Indonesia Packaged Water Market Outlook to 2035

By Product Type, By Packaging Format, By Distribution Channel, By End-User Segment, and By Region

- Product Code: TDR0436

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “Indonesia Packaged Water Market Outlook to 2035 – By Product Type, By Packaging Format, By Distribution Channel, By End-User Segment, and By Region” provides a comprehensive analysis of the packaged drinking water industry in Indonesia. The report covers an overview and genesis of the market, overall market size in terms of volume and value, detailed market segmentation; trends and developments, regulatory and quality compliance landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Indonesia packaged water market.

The report concludes with future market projections based on population growth and urbanization trends, changes in consumer health and hydration behavior, expansion of modern retail and e-commerce channels, regional income growth patterns, climate-driven water availability concerns, cause-and-effect relationships across pricing and packaging shifts, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

Indonesia Packaged Water Market Overview and Size

The Indonesia packaged water market is valued at approximately ~USD ~ billion, representing the production and sale of bottled and packaged drinking water across multiple formats, including large refillable gallons, single-serve bottles, multi-pack PET bottles, cups, and on-the-go packs. Packaged water in Indonesia includes both mineral water sourced from natural springs and treated drinking water produced through purification, filtration, and disinfection processes, catering to a wide spectrum of income groups and consumption occasions.

The market is anchored by Indonesia’s large and growing population base, uneven access to safe tap water across urban and semi-urban areas, rising health awareness, and the entrenched cultural acceptance of bottled water as a daily necessity rather than a discretionary product. In many regions, packaged water serves as a primary drinking water source for households, offices, schools, hospitality establishments, and informal foodservice outlets.

Java represents the largest demand center due to population density, urbanization, industrial activity, and retail penetration, followed by Sumatra and Bali–Nusa Tenggara. Major metropolitan areas such as Jakarta, Surabaya, Bandung, and Medan drive high-volume consumption through offices, modern trade, and foodservice, while secondary cities and peri-urban areas contribute steady growth via gallon water and economy bottled formats. Eastern Indonesia shows lower per-capita consumption but higher long-term growth potential as infrastructure, income levels, and distribution reach improve.

What Factors are Leading to the Growth of the Indonesia Packaged Water Market

Limited access to safe and reliable piped drinking water sustains structural demand: Despite progress in water infrastructure, a significant share of Indonesian households continues to face inconsistent or unsafe tap water quality. Concerns around contamination, salinity, and supply interruptions reinforce dependence on packaged water for daily drinking needs. Large refillable gallon bottles, in particular, function as a household staple across urban and semi-urban regions, ensuring a steady baseline demand independent of short-term economic cycles. This structural reliance creates a resilient consumption floor for packaged water producers.

Rising health awareness and preference for hygienic, sealed beverages increase per-capita consumption: Consumers across income groups increasingly associate packaged water with safety, hygiene, and health, especially in comparison to boiled or untreated water sources. Younger demographics, working professionals, and urban families show higher willingness to pay for branded water products that communicate purity, mineral balance, and quality assurance. This behavioral shift supports volume growth in single-serve bottles and premium mineral water variants, particularly in modern retail, foodservice, and on-the-go consumption occasions.

Urbanization, mobility, and lifestyle changes expand out-of-home consumption: Indonesia’s expanding urban workforce, rising commuter populations, and growth in travel, tourism, and organized foodservice drive demand for convenient hydration solutions. Packaged water is a default accompaniment in offices, retail malls, transport hubs, restaurants, and delivery platforms. As eating-out and takeaway consumption increase, packaged water volumes rise in parallel, benefiting manufacturers with strong distribution and foodservice partnerships.

Which Industry Challenges Have Impacted the Growth of the Indonesia Packaged Water Market:

Rising packaging material costs and logistics complexity pressure margins across price-sensitive segments: The Indonesia packaged water market is highly volume-driven and price-sensitive, particularly in refillable gallon and mass-market PET bottle segments. Volatility in PET resin prices, packaging inputs, and secondary materials such as caps, labels, and cartons directly impacts cost structures. Given intense competition and limited pricing flexibility in economy segments, manufacturers often absorb cost increases rather than passing them fully to consumers. Additionally, Indonesia’s archipelagic geography increases logistics complexity, with inter-island transportation, fuel costs, and last-mile distribution adding variability to delivery timelines and operating margins, particularly for players with nationwide reach.

Environmental concerns and plastic waste scrutiny create regulatory and reputational challenges: Single-use plastic waste has emerged as a major public concern in Indonesia, placing bottled water producers under increasing scrutiny from regulators, municipalities, and consumers. Local bans, levies, or restrictions on certain plastic formats in select cities and provinces create uncertainty around packaging strategies. While refillable gallon formats mitigate some environmental pressure, smaller PET bottles—critical for on-the-go and foodservice consumption—remain exposed to sustainability criticism. Managing recycling partnerships, lightweighting initiatives, and compliance with evolving environmental expectations adds cost and operational complexity, particularly for mid-sized and regional players.

Water source sustainability and licensing constraints affect long-term capacity planning: Packaged water producers rely on licensed water sources, including springs and groundwater, which are subject to environmental assessments, extraction limits, and periodic renewal requirements. In regions facing water stress, community concerns, or regulatory tightening, securing new sources or expanding existing capacity can become challenging. Public opposition to perceived over-extraction by commercial bottlers may delay approvals or trigger stricter oversight. These dynamics introduce long-term supply-side risks, particularly for companies pursuing aggressive capacity expansion or operating in ecologically sensitive areas.

What are the Regulations and Initiatives which have Governed the Market:

Food safety, quality, and labeling regulations governing packaged drinking water production: Packaged water in Indonesia is regulated under national food safety and quality standards that define permissible water sources, treatment processes, microbiological limits, mineral content thresholds, and hygiene requirements. Manufacturers must comply with licensing, periodic inspections, and quality testing to ensure consumer safety. Labeling regulations require clear disclosure of product type (mineral vs treated water), volume, production details, and certification markings. Compliance with these standards is essential for brand credibility, access to modern trade, and participation in institutional and foodservice supply contracts.

Environmental regulations and initiatives targeting plastic waste reduction and recycling: Government-led initiatives aimed at reducing plastic waste influence packaging choices and producer responsibility frameworks. Policies encouraging recycled content, reduced material usage, and waste collection partnerships are gradually shaping industry practices. While enforcement intensity varies by region, long-term regulatory direction signals increasing accountability for packaging lifecycle management. Leading packaged water companies are responding through lightweight bottle designs, recycled PET adoption, refillable formats, and collaborations with waste management and recycling ecosystems.

Local government oversight on water extraction, source protection, and community engagement: Water extraction permits and source utilization are governed by regional authorities, with requirements linked to environmental impact assessments, sustainability commitments, and community considerations. In some regions, local governments impose conditions related to water conservation, recharge initiatives, or community development contributions. These regulatory dynamics influence site selection, capacity expansion decisions, and long-term operating stability. Producers with strong compliance frameworks and stakeholder engagement capabilities are better positioned to navigate evolving local governance expectations.

Indonesia Packaged Water Market Segmentation

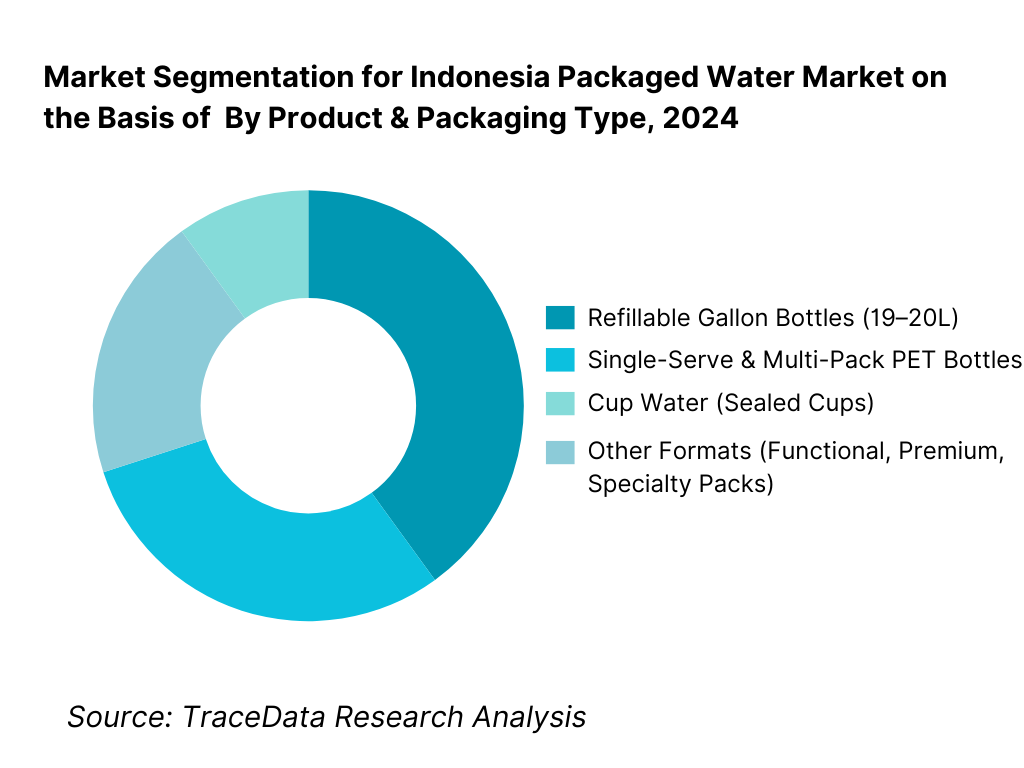

By Product & Packaging Type: Refillable gallon water holds structural dominance The refillable gallon water segment holds dominance in the Indonesia packaged water market. This is because large-format gallons serve as a primary drinking water source for households, offices, and institutions across urban and semi-urban regions. These formats offer lower per-liter cost, reliable supply, and strong alignment with daily consumption habits. Single-serve PET bottles and cups continue to grow steadily, supported by out-of-home consumption, foodservice demand, and modern retail expansion, but remain more price-sensitive and exposed to environmental scrutiny compared to gallon formats.

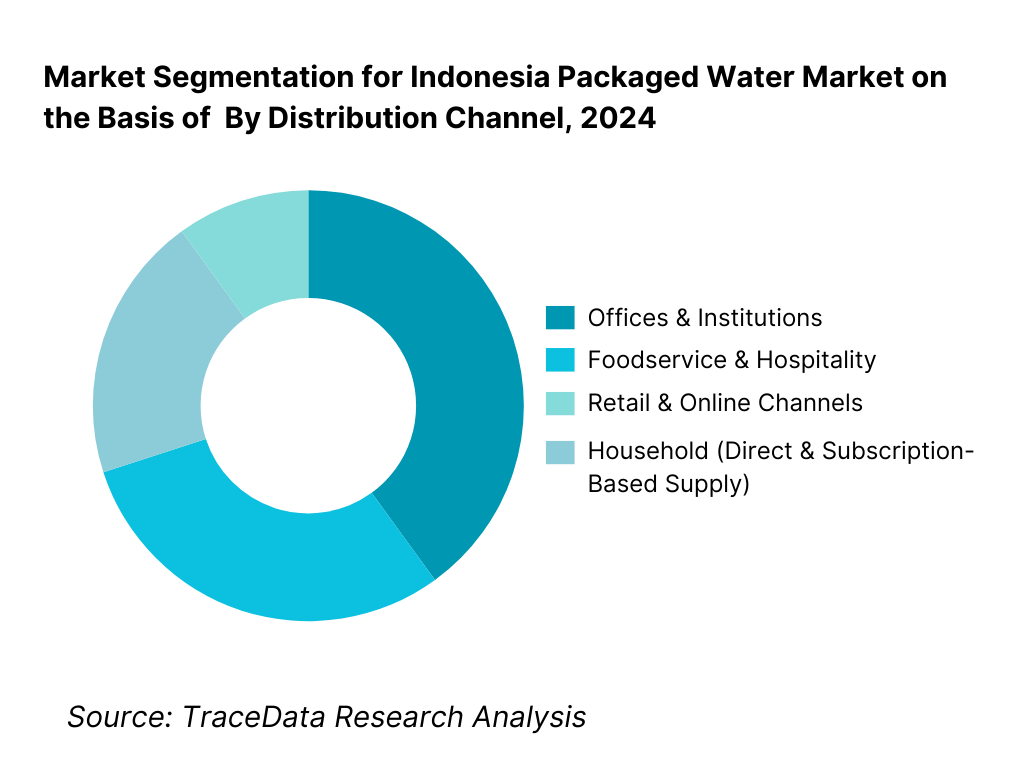

By Distribution Channel: Household and institutional supply dominates volume demand Household and institutional consumption dominates the Indonesia packaged water market due to reliance on bottled water for daily hydration. Residential users drive repeat gallon purchases, while offices, factories, schools, and commercial establishments provide stable bulk demand. Foodservice and hospitality segments contribute higher per-unit value but remain more cyclical, while modern retail and online channels increasingly influence brand choice, premiumization, and urban growth.

Competitive Landscape in Indonesia Packaged Water Market

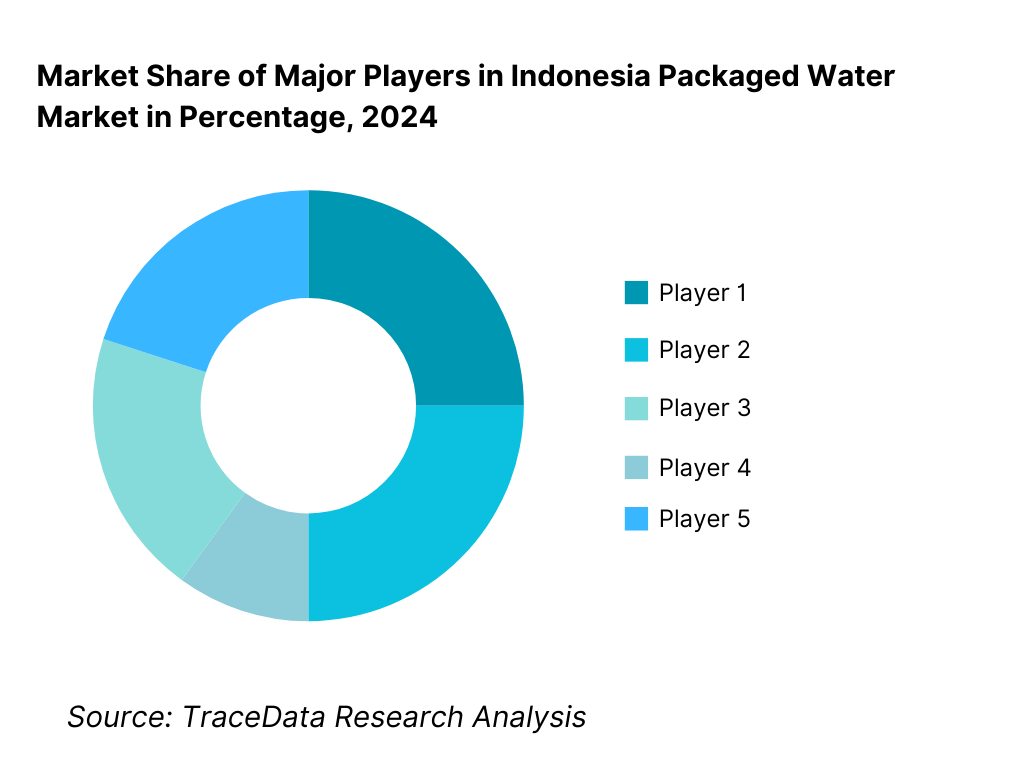

The Indonesia packaged water market exhibits moderate-to-high concentration, characterized by the dominance of a few large national brands with extensive source ownership, bottling infrastructure, and distribution networks, alongside a long tail of regional and local players. Market leadership is driven by brand trust, water source credibility, nationwide logistics reach, pricing discipline, and strong penetration in refillable gallon formats.

While leading brands dominate modern trade, institutional supply, and urban households, regional players remain competitive in local markets by leveraging proximity, lower logistics costs, and price-based positioning. Informal and small-scale refill operators coexist at the bottom end of the market, primarily serving highly price-sensitive consumers.

Key Players in Indonesia Packaged Water Market

Name | Founding Year | Original Headquarters |

AQUA (Danone Indonesia) | 1973 | Jakarta, Indonesia |

Le Minerale (Mayora Group) | 2015 | Jakarta, Indonesia |

Cleo Water (Tanobel Group) | 2004 | Surabaya, Indonesia |

Ades (Coca-Cola Indonesia) | 1985 | Jakarta, Indonesia |

Club | 1986 | Jakarta, Indonesia |

Nestlé Pure Life Indonesia | 2005 | Jakarta, Indonesia |

Various Regional & Local Bottlers | — | Regional |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

AQUA (Danone Indonesia): AQUA remains the clear market leader and category benchmark, with unmatched brand recognition and trust across income segments. Its competitive advantage is reinforced by extensive spring ownership, large-scale bottling capacity, and deep penetration in refillable gallon distribution. The company continues to invest in sustainability initiatives, recycling partnerships, and community engagement to protect its long-term license to operate amid increasing environmental scrutiny.

Le Minerale (Mayora Group): Le Minerale has rapidly scaled as a strong challenger brand, leveraging Mayora’s national distribution strength and aggressive pricing strategy. The brand positions itself around sealed gallon caps, mineral content messaging, and competitive pricing, enabling fast household penetration. Its growth reflects rising competition in the mainstream mineral water segment, particularly in urban and peri-urban markets.

Cleo Water (Tanobel Group): Cleo differentiates through purified and low-mineral water positioning, targeting health-conscious consumers and specific dietary preferences. The brand has steadily expanded its footprint in modern trade and institutional channels, with a focus on quality consistency and controlled processing rather than natural spring sourcing.

Ades (Coca-Cola Indonesia): Ades benefits from Coca-Cola’s route-to-market strength and retail relationships, particularly in single-serve PET bottles for on-the-go consumption. While its share is smaller compared to leading mineral water brands, Ades plays a strategic role in foodservice, convenience retail, and impulse-driven channels.

Nestlé Pure Life Indonesia: Nestlé Pure Life competes in the treated water segment with an emphasis on international quality standards and brand credibility. Its positioning appeals to middle-income urban consumers and institutional buyers seeking consistency and safety assurance, though it faces pricing pressure from domestic brands with lower cost structures.

What Lies Ahead for Indonesia Packaged Water Market?

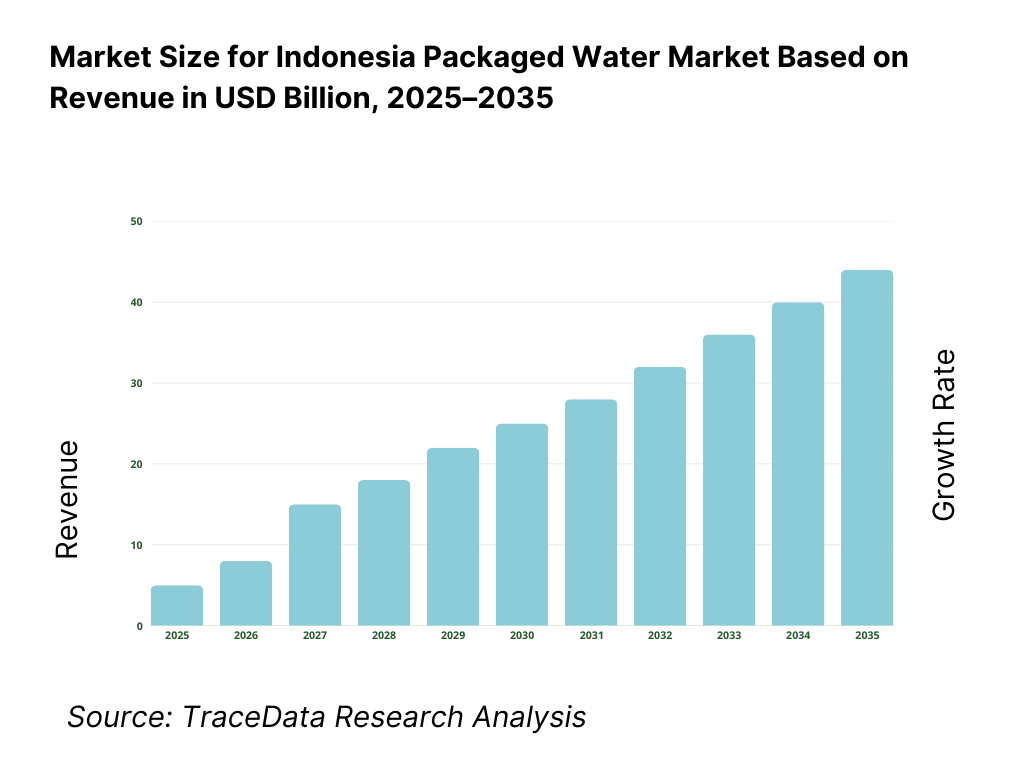

The Indonesia packaged water market is expected to expand steadily through 2035, supported by long-term population growth, continued urbanization, uneven access to reliable piped drinking water, and the entrenched role of packaged water as a daily consumption necessity. Growth momentum will be reinforced by rising health awareness, increasing out-of-home consumption, expansion of modern retail and e-commerce distribution, and sustained household dependence on refillable gallon formats. As consumers across income groups continue to prioritize safety, hygiene, and convenience in drinking water choices, packaged water will remain a core component of Indonesia’s consumer staples landscape.

Continued Dominance of Refillable Gallon Water with Gradual Premiumization: The future of the Indonesia packaged water market will continue to be anchored by refillable gallon water, which functions as a household utility rather than a discretionary beverage. This segment will benefit from repeat purchase behavior, subscription-based delivery models, and institutional demand from offices and commercial establishments. At the same time, gradual premiumization is expected within the category, driven by branding, mineral composition claims, sealed-cap innovations, and improved service reliability. Leading players that balance affordability with trust and quality assurance will retain strong consumer loyalty over the long term.

Expansion of Single-Serve and On-the-Go Formats Driven by Urban Lifestyles: Single-serve PET bottles and cup water formats are expected to grow steadily as Indonesia’s urban workforce expands and mobility increases. Rising commuter populations, growth in foodservice and delivery platforms, tourism recovery, and increased time spent outside the home will support demand for convenient hydration solutions. While these formats face greater pricing sensitivity and environmental scrutiny, they will remain critical for volume growth in modern trade, convenience retail, transportation hubs, and hospitality channels.

Increasing Focus on Sustainability, Recycling, and Packaging Innovation: Environmental considerations will play a more central role in shaping industry strategies through 2035. Government initiatives, consumer awareness, and corporate sustainability commitments will accelerate investments in lightweight packaging, recycled PET content, refillable systems, and waste collection partnerships. Brands that proactively align with plastic reduction narratives and circular economy initiatives will strengthen reputation and regulatory resilience. Sustainability will increasingly influence brand preference, particularly among urban and younger consumers.

Indonesia Packaged Water Market Segmentation

By Product Type

- Natural Mineral Water

- Treated / Purified Drinking Water

- Functional & Enhanced Water (Low Mineral, Added Minerals, Oxygenated, etc.)

By Packaging Format

- Refillable Gallon Bottles (19–20 Liters)

- Single-Serve PET Bottles

- Multi-Pack PET Bottles

- Cup Water (Sealed Cups)

- Other Specialty & On-the-Go Formats

By Distribution & Delivery Model

- Direct Household Delivery & Subscription Model

- Traditional Trade (Kirana Stores, Small Retailers)

- Modern Trade (Supermarkets, Minimarkets, Convenience Stores)

- Foodservice & Hospitality Supply

- Online Grocery, Quick Commerce & E-commerce Platforms

By End-Use Segment

- Household Consumption

- Offices, Factories & Institutions

- Food service & Hospitality

- Travel, Tourism & Mobility Hubs

By Region

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Bali & Nusa Tenggara

- Eastern Indonesia

Players Mentioned in the Report:

- AQUA (Danone Indonesia)

- Le Minerale (Mayora Group)

- Cleo Water (Tanobel Group)

- Ades (Coca-Cola Indonesia)

- Nestlé Pure Life Indonesia

- Regional packaged water manufacturers and local refillable gallon operators

Key Target Audience

- Packaged water manufacturers and bottling companies

- Water source owners and treatment technology providers

- Packaging material suppliers (PET, caps, labels, cartons)

- Distributors, wholesalers, and last-mile delivery partners

- Modern retail chains and e-commerce grocery platforms

- Foodservice operators, hotels, and institutional buyers

- Municipal bodies and regulators involved in water and plastic waste management

- Private equity firms and consumer-focused investors

Time Period:

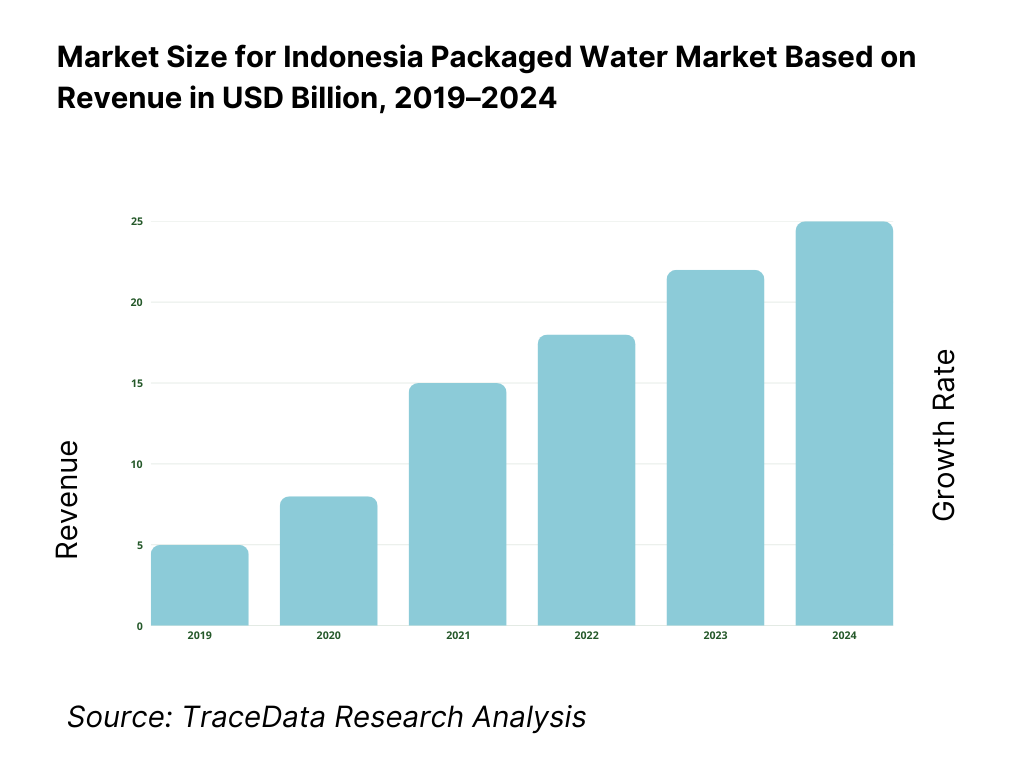

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in Indonesia Packaged Water Market

Value Chain Analysis

4.1 Delivery Model Analysis for Packaged Water-Refillable Gallon, Single-Serve Bottles, Cups, Bulk Supply [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for Indonesia Packaged Water Market [Household Sales, Institutional Supply, Retail Sales, Foodservice, Subscription & Direct Delivery]

4.3 Business Model Canvas for Indonesia Packaged Water Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Players vs Global Brands [AQUA vs Nestlé Pure Life etc.]

5.2 Investment Model in Indonesia Packaged Water Market [Capacity Expansion, Bottling Plants, Distribution Infrastructure, Sustainability Investments]

5.3 Comparative Analysis of Packaged Water Consumption in Household vs Out-of-Home Segments [Purchase Drivers, Price Sensitivity, Volume Patterns]

5.4 Packaged Water Spend Allocation by Consumer Type [Households, Offices & Institutions, Foodservice, Travel & Tourism]Market Attractiveness for Indonesia Packaged Water Market

Supply-Demand Gap Analysis

Market Size for Indonesia Packaged Water Market Basis

8.1 Revenues (Historical Trend)

Market Breakdown for Indonesia Packaged Water Market Basis

9.1 By Market Structure (Branded Packaged Water vs Local/Unbranded Supply)

9.2 By Product Type (Mineral Water, Treated/Purified Water, Functional & Enhanced Water)

9.3 By End-Use Segment (Household, Institutional, Foodservice, Travel & Tourism)

9.4 By Consumer Type (Urban vs Semi-Urban vs Rural)

9.5 By Packaging Format (Refillable Gallon, PET Bottles, Cups, Others)

9.6 By Distribution Channel (Direct Delivery, Traditional Trade, Modern Trade, Online)

9.7 By Premium vs Mass-Market Products

9.8 By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali & Nusa Tenggara, Eastern Indonesia)Demand-Side Analysis for Indonesia Packaged Water Market

10.1 Household & Institutional Consumer Landscape and Cohort Analysis

10.2 Packaged Water Adoption Drivers & Purchase Decision Process

10.3 Consumption Effectiveness & Value Perception Analysis

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in Indonesia Packaged Water Market

11.2 Growth Drivers for Indonesia Packaged Water Market

11.3 SWOT Analysis for Indonesia Packaged Water Market

11.4 Issues & Challenges for Indonesia Packaged Water Market

11.5 Government Regulations for Indonesia Packaged Water MarketSnapshot on Refillable Gallon & Bulk Packaged Water Market in Indonesia

12.1 Market Size and Future Potential for Refillable & Bulk Water in Indonesia

12.2 Business Models & Revenue Streams [Subscription Delivery, Institutional Contracts, Retail Sales]

12.3 Delivery Models & Packaged Water Offerings [Home Delivery, Retail Packs, Institutional Supply]Opportunity Matrix for Indonesia Packaged Water Market

PEAK Matrix Analysis for Indonesia Packaged Water Market

Competitor Analysis for Indonesia Packaged Water Market

15.1 Market Share of Key Players in Indonesia Packaged Water Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Bottling Capacity, Revenues, Pricing Strategy, Packaging Formats, Key Regions, Distribution Network, Sustainability Initiatives, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Competitive Positioning Matrix for Packaged Water Brands

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for Indonesia Packaged Water Market Basis

16.1 Revenues (Projections)

Market Breakdown for Indonesia Packaged Water Market Basis

17.1 By Market Structure (Branded vs Local Supply)

17.2 By Product Type (Mineral, Treated, Functional Water)

17.3 By End-Use Segment (Household, Institutional, Foodservice, Travel)

17.4 By Consumer Type (Urban, Semi-Urban, Rural)

17.5 By Packaging Format (Gallon, Bottles, Cups, Others)

17.6 By Distribution Channel (Direct Delivery, Retail, Online)

17.7 By Premium vs Mass-Market Products

17.8 By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali & Nusa Tenggara, Eastern Indonesia)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Indonesia Packaged Water Market across demand-side and supply-side entities. On the demand side, entities include households, offices and corporate facilities, factories, educational institutions, healthcare facilities, hospitality establishments, foodservice operators, retail consumers, and travel and mobility hubs. Demand is further segmented by consumption pattern (daily household use vs out-of-home consumption), packaging preference (refillable gallon vs single-serve formats), price sensitivity, and distribution model (direct delivery, retail purchase, institutional supply).

On the supply side, the ecosystem includes natural spring owners, groundwater license holders, water treatment and purification operators, national packaged water brands, regional bottlers, contract bottling partners, packaging material suppliers (PET preforms, caps, labels, cartons), logistics and last-mile delivery providers, distributors, wholesalers, retail chains, and recycling and waste management partners. Regulatory bodies overseeing food safety, water extraction, and environmental compliance form an integral part of the ecosystem.

From this mapped ecosystem, we shortlist 6–10 leading packaged water brands and a representative set of regional and local players based on production capacity, geographic coverage, product portfolio, brand trust, distribution reach, and strength in refillable gallon and mainstream bottled water segments. This step establishes how value is created and captured across water sourcing, treatment, bottling, distribution, and after-sales delivery.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the Indonesia packaged water market structure, consumption behavior, and segment dynamics. This includes reviewing population and urbanization trends, household water access levels, per-capita bottled water consumption patterns, retail and foodservice expansion, and regional income distribution. We assess consumer preferences around price, brand trust, mineral content perception, packaging convenience, and delivery reliability.

Company-level analysis includes review of bottling capacities, water source portfolios, packaging formats, distribution models, pricing strategies, and geographic footprint. We also examine regulatory and compliance dynamics shaping the market, including food safety standards, labeling requirements, water extraction permits, and plastic waste management initiatives. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and creates the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with packaged water manufacturers, regional bottlers, distributors, retail partners, institutional buyers, foodservice operators, and logistics providers. The objectives are threefold:

(a) validate assumptions around demand concentration by packaging format and end-use segment,

(b) authenticate segment splits across household, institutional, and out-of-home consumption, and

(c) gather qualitative insights on pricing behavior, margin structures, distribution costs, water source constraints, and brand selection criteria.

A bottom-to-top approach is applied by estimating household penetration, repeat purchase frequency, average consumption volumes, and institutional demand across key regions, which are aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with distributors and delivery operators to validate field-level realities such as refill frequency, delivery economics, competitive substitution, and service expectations.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market estimates, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as population growth, urban household formation, retail expansion, and foodservice recovery trends. Assumptions around packaging cost volatility, logistics intensity, environmental compliance costs, and water source sustainability are stress-tested to understand their impact on pricing and consumption growth.

Sensitivity analysis is conducted across key variables including per-capita consumption growth, premiumization rates, sustainability-driven packaging shifts, and regional penetration expansion. Market models are refined until alignment is achieved between production capacity, distribution throughput, and end-user consumption patterns, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the Indonesia Packaged Water Market?

The Indonesia packaged water market holds strong long-term potential, supported by a large and growing population, uneven access to safe piped drinking water, rising health awareness, and the entrenched role of bottled water as a daily consumption necessity. Refillable gallon formats provide a stable demand base, while single-serve and premium segments offer incremental value growth. As urbanization and modern retail penetration increase, packaged water consumption is expected to expand steadily through 2035.

02 Who are the Key Players in the Indonesia Packaged Water Market?

The market features a combination of large national brands with extensive bottling networks and distribution reach, alongside regional and local players serving price-sensitive and localized demand. Competition is shaped by brand trust, water source credibility, packaging economics, and last-mile delivery capability. Leading players benefit from strong refillable gallon penetration and nationwide logistics, while regional brands compete on proximity and pricing.

03 What are the Growth Drivers for the Indonesia Packaged Water Market?

Key growth drivers include population growth, urbanization, limited reliability of tap water, increasing health and hygiene awareness, and expansion of foodservice and out-of-home consumption. Additional momentum comes from digital ordering, subscription-based delivery models, and wider availability through modern trade and e-commerce platforms. Sustainability-focused packaging innovation and premium mineral water positioning also contribute to value growth.

04 What are the Challenges in the Indonesia Packaged Water Market?

Challenges include pressure on margins from packaging and logistics costs, environmental scrutiny related to plastic waste, regulatory oversight on water extraction and source sustainability, and intense price competition in mass-market segments. Regional infrastructure gaps and inter-island logistics complexity can also impact delivery efficiency and cost structures, particularly for players operating at a national scale.