Iraq Cold Chain Market Outlook to 2029

By Market Structure, By Product Type (Perishables, Pharmaceuticals), By Transport Mode, By Temperature Type, By End-Use Industry, and By Region

- Product Code: TDR0202

- Region: Middle East

- Published on: June 2025

- Total Pages: 80

Report Summary

The report titled “Iraq Cold Chain Market Outlook to 2029 - By Market Structure, By Product Type (Perishables, Pharmaceuticals), By Transport Mode, By Temperature Type, By End-Use Industry, and By Region” provides a comprehensive analysis of the cold chain market in Iraq. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the cold chain logistics space. The report concludes with future market projections based on revenue, end-user demand, infrastructure developments, key drivers and restraints, and case studies highlighting major opportunities and risks.

Iraq Cold Chain Market Overview and Size

The Iraq cold chain market was valued at USD 630 Million in 2023, supported by increased demand for temperature-sensitive food products, pharmaceuticals, and vaccines. Iraq’s growing urbanization, improvements in infrastructure, and expansion of organized retail are accelerating the need for reliable cold chain logistics. Major players such as Agility Logistics, Al-Rashed International, DHL Iraq, and Al-Hilal Logistics are expanding operations to meet growing needs for cold storage and transportation in key cities like Baghdad, Basra, and Erbil.

In 2023, the Iraqi Ministry of Health launched a nationwide vaccine distribution drive, requiring end-to-end temperature-controlled logistics for COVID-19 and polio vaccines, which significantly drove cold chain development. International NGOs and private players invested in cold room facilities and refrigerated vehicles to support this national initiative.

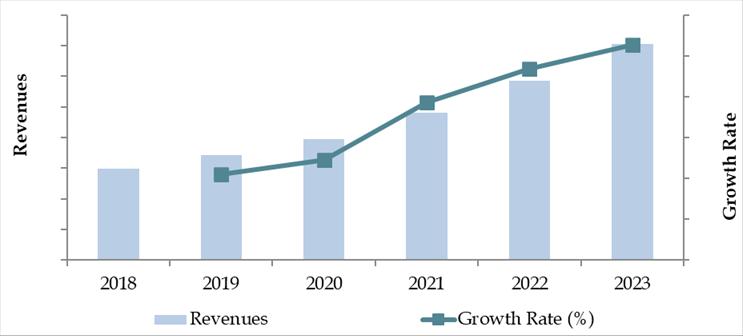

Market Size for Iraq Cold Chain Industry on the Basis of Revenues in USD Million, 2018-2024

What Factors are Leading to the Growth of Iraq Cold Chain Market:

Rising Healthcare Needs: With increasing demand for biologics, vaccines, and temperature-sensitive pharmaceuticals, Iraq’s cold chain infrastructure is becoming critical. The pharmaceutical sector grew by 8.5% in 2023, fueling investment in temperature-controlled logistics.

Food & Perishables Industry Growth: The expansion of Iraq’s food retail and hospitality sector has increased demand for cold storage of dairy, meat, seafood, and fresh produce. Imports of perishable food grew by 12% in 2023, directly boosting cold chain requirements.

Public and NGO Support: International development agencies and government support are improving Iraq’s logistics infrastructure. For instance, UNICEF and WHO projects have contributed cold storage units and capacity building in provinces with low infrastructure.

Which Industry Challenges Have Impacted the Growth for Iraq Cold Chain Market

Power Supply and Infrastructure Limitations: Iraq faces chronic electricity shortages and infrastructure deficiencies that severely impact the efficiency of cold storage facilities. According to industry estimates, nearly 35% of cold storage operators face regular disruptions due to inconsistent power supply, leading to higher operating costs and product spoilage risks. This discourages smaller businesses from investing in cold chain operations.

High Capital Investment Requirements: Cold chain logistics demand substantial upfront investment in specialized vehicles, temperature-controlled warehouses, and monitoring systems. For many Iraqi businesses, especially SMEs, the initial capital requirement is a key barrier, limiting market entry and expansion. Industry data indicates that over 40% of potential cold chain startups are unable to secure financing or investor interest.

Lack of Skilled Workforce and Training: The cold chain industry in Iraq lacks adequately trained personnel to manage and operate temperature-controlled logistics. From facility technicians to fleet handlers, skill shortages affect operational efficiency and safety compliance. In a 2023 logistics sector survey, 46% of cold chain operators reported difficulty in finding qualified staff for technical roles.

What are the Regulations and Initiatives which have Governed the Market

Ministry of Health and WHO Cold Chain Guidelines: The Iraqi Ministry of Health, in collaboration with WHO, has established mandatory cold chain protocols for vaccine storage and transportation. These include temperature validation, data logging, and insulation standards. As of 2023, over 60% of public sector cold storage units were upgraded to meet these guidelines, especially in the wake of the COVID-19 vaccination drive.

Customs and Import Controls on Cold Chain Equipment: Import of refrigerated vehicles and cold room equipment requires pre-clearance from the General Authority of Customs and the Ministry of Planning. In 2022, delays in import approvals contributed to a 7% increase in lead time for cold chain projects, causing uncertainty for logistics providers and warehouse operators.

Public-Private Partnership Initiatives: To overcome logistics infrastructure gaps, the Iraqi government has begun offering PPP models for building cold storage clusters near food processing zones and health distribution hubs. One such pilot project in Erbil, supported by the UNDP, added 3,000 metric tons of cold storage capacity in 2023 alone.

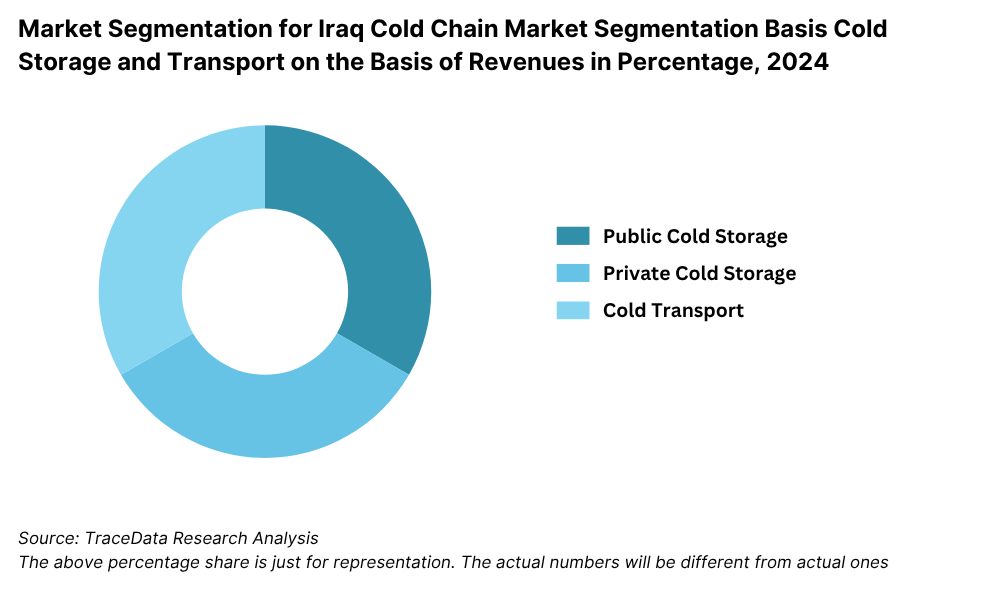

Iraq Cold Chain Market Segmentation

By Market Structure: The unorganized sector currently dominates Iraq’s cold chain market due to the prevalence of small-scale, region-specific operators offering basic refrigerated transport and storage. These players often operate without modern tracking systems or regulatory compliance but fill essential gaps in underserved regions. The organized sector is gradually gaining traction, driven by foreign investment, multinational logistics providers, and large Iraqi conglomerates entering the market with standardized cold chain solutions, temperature monitoring systems, and international compliance protocols.

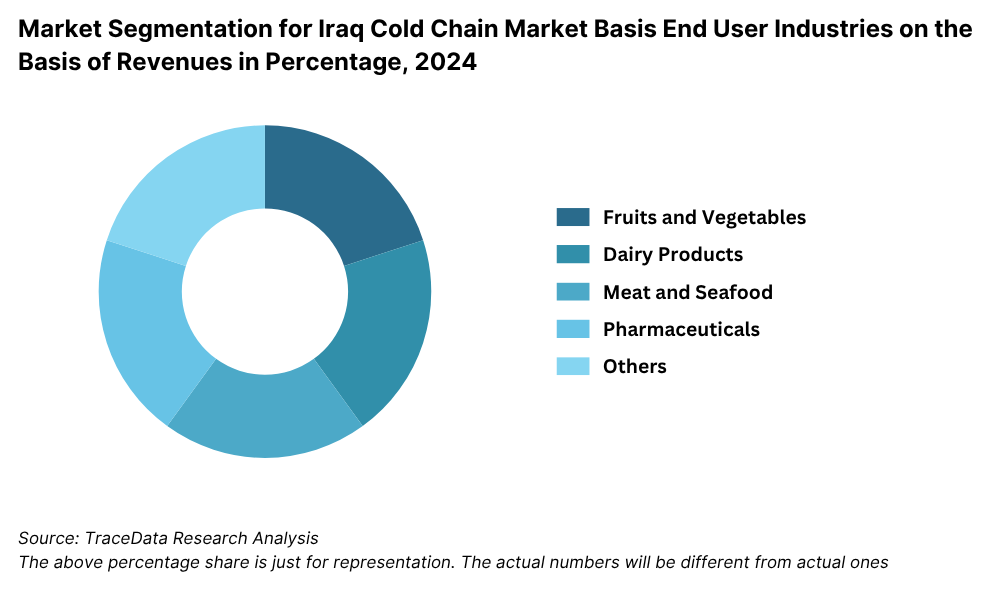

By Product Type: The perishable food category holds the largest share, led by the increasing demand for meat, dairy, fruits, and vegetables that require temperature-controlled storage and transport. Iraq’s reliance on food imports, particularly from Turkey, Iran, and the UAE, has made cold chain logistics vital. The pharmaceutical segment is growing rapidly due to rising demand for vaccines, insulin, biologics, and temperature-sensitive medicines, with major emphasis on maintaining WHO-compliant cold chain standards.

By Temperature Type: The chilled segment (0°C to 8°C) dominates the market due to the high volume of dairy, fresh produce, and ready-to-eat food transportation. The frozen segment (-18°C and below) is gaining momentum, primarily driven by imports of frozen meat, seafood, and processed foods. Recent investments in freezer-equipped vehicles and storage facilities are improving service levels in this category.

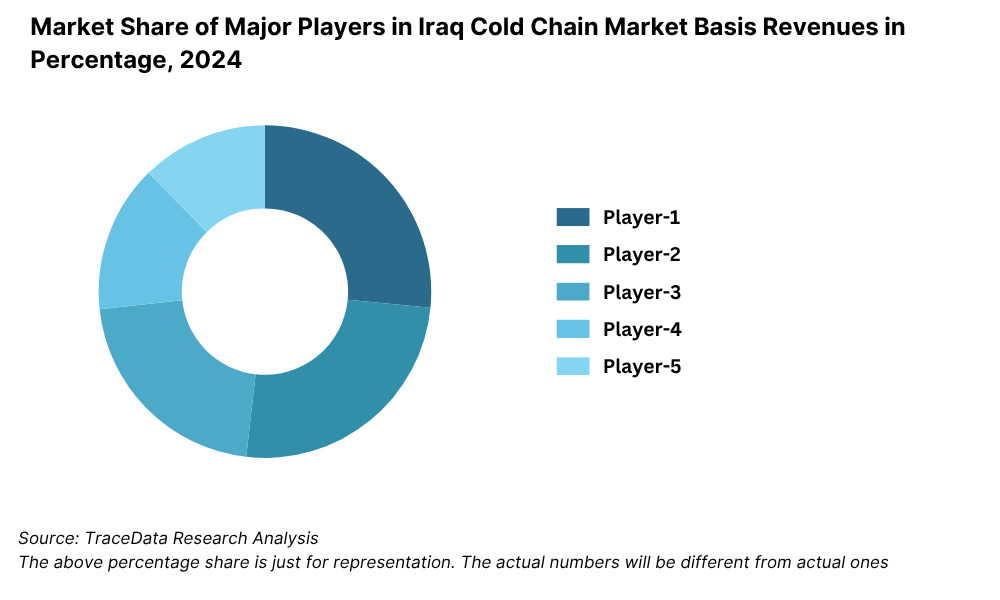

Competitive Landscape in Iraq Cold Chain Market

The Iraq cold chain market is moderately fragmented, with both local logistics providers and international companies operating in the space. While domestic players often rely on basic infrastructure and regional networks, global and regional firms are introducing advanced cold chain technologies, compliance protocols, and temperature-monitoring solutions. The presence of NGOs and development organizations has further facilitated partnerships to improve Iraq’s cold chain logistics ecosystem.

Company Name | Founding Year | Original Headquarters |

Almco Group (Cold Chain Division) | 2003 | Baghdad, Iraq |

Agility Logistics Iraq | 1979 (Iraq: ~2005) | Kuwait City, Kuwait |

Qafila Logistics (Iraq Operations) | 2017 | Dubai, UAE |

Al-Mansour International Distribution Co. | 2007 | Baghdad, Iraq |

Nimr Al Iraq General Trading & Transport | 2004 | Baghdad, Iraq |

Zain Cold Chain Logistics | 2011 | Erbil, Iraq |

Modern Iraq Company for General Trading (Cold Transport) | 2005 | Baghdad, Iraq |

Rasan Pharmaceutical Logistics (Cold Chain Focus) | 2014 | Baghdad, Iraq |

Al Hilal Cold Stores and Transport | 2010 | Basra, Iraq |

Maersk Iraq (Cold Chain Container Services) | 1904 (Iraq: ~2000s) | Copenhagen, Denmark |

DHL Global Forwarding Iraq | 1969 (Iraq: ~2003) | Bonn, Germany |

DB Schenker Iraq (Cold Chain Services) | 1872 (Iraq: ~2010s) | Essen, Germany |

Kuehne + Nagel Iraq (Cold Chain & Pharma) | 1890 (Iraq: ~2010s) | Schindellegi, Switzerland |

CEVA Logistics Iraq | 2006 (Iraq: ~2010s) | Marseille, France |

UPS Iraq (via authorized agent) | 1907 (Iraq: ~2000s) | Atlanta, USA |

FedEx Iraq (via local partner) | 1971 (Iraq: ~2000s) | Memphis, USA |

Some of the recent competitor trends and key information about players include:

Agility Logistics: A regional leader in cold chain solutions, Agility expanded its Iraq operations in 2023 by opening a new temperature-controlled warehouse facility in Baghdad. The site supports food imports and pharmaceutical distribution, significantly enhancing Agility’s role in high-value logistics in Iraq.

Al-Rashed International: One of Iraq’s oldest logistics providers, Al-Rashed has steadily modernized its fleet of refrigerated trucks. In 2023, the company added 40+ cold transport units to support perishable imports through Umm Qasr port and domestic distribution to major cities.

DHL Express Iraq: DHL introduced a dedicated cold chain division for healthcare logistics in Iraq in late 2022, focusing on time-critical and temperature-sensitive shipments. In 2023, DHL saw a 17% YoY increase in pharmaceutical cold shipments due to vaccine delivery contracts.

Al-Hilal Logistics: A rising local player, Al-Hilal operates refrigerated trucking and warehousing in southern Iraq. In 2023, it expanded its frozen storage capacity by 30% to cater to increased demand from seafood and meat importers in Basra and Nasiriyah.

CEVA Logistics (via Joint Venture): CEVA entered Iraq through strategic partnerships with local operators to deliver end-to-end supply chain solutions, including pharmaceutical cold storage. Its focus in 2023 was on establishing compliance with GDP (Good Distribution Practice) protocols for healthcare logistics.

What Lies Ahead for Iraq Cold Chain Market?

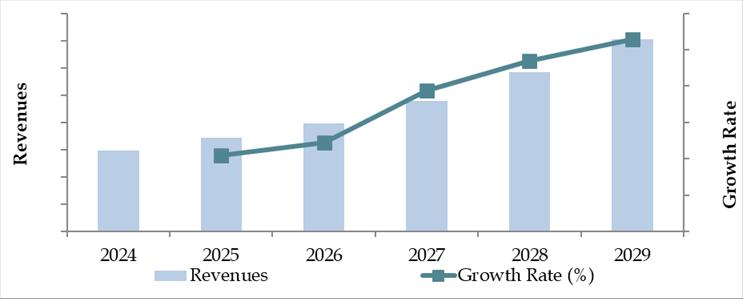

The Iraq cold chain market is projected to grow steadily through 2029, registering a respectable CAGR driven by the expansion of organized retail, growing pharmaceutical needs, and increased focus on food safety and import efficiency. Strategic investments, government support, and public-private partnerships are expected to further accelerate the development of cold logistics infrastructure across Iraq’s key regions.

Rising Role of Pharmaceuticals and Healthcare Logistics: With Iraq’s increasing demand for vaccines, biologics, and chronic disease treatments, the pharmaceutical cold chain segment is expected to see double-digit growth. New healthcare reforms and partnerships with global health organizations will contribute to the expansion of Good Distribution Practice (GDP)-compliant storage and transport systems.

Expansion of Modern Food Retail and Quick Commerce: The growth of supermarkets, hypermarkets, and e-commerce grocery platforms in cities like Baghdad, Erbil, and Sulaymaniyah is expected to increase demand for cold storage of perishables such as dairy, fresh produce, and frozen foods. Quick-commerce players are also exploring temperature-controlled last-mile delivery solutions.

Technology Integration and Real-Time Monitoring: Iraq’s cold chain is expected to adopt IoT sensors, GPS fleet tracking, and real-time temperature monitoring to improve supply chain integrity and minimize spoilage. Such technologies will become more common as Iraq aligns with international compliance norms for food and pharma logistics.

Increased Investment in Cold Chain Infrastructure: With support from development agencies and foreign investors, Iraq is likely to witness significant infrastructure investments in cold rooms, refrigerated trucks, and cross-docking hubs over the next five years. The focus will be on strategic logistics corridors connecting ports (e.g., Umm Qasr) to inland demand centers.

Future Outlook and Projections for Iraq Cold Chain Market on the Basis of Revenues in USD Million, 2024-2029

Iraq Cold Chain Market Segmentation

By Market Structure:

Local Logistics Operators

International Cold Chain Providers

Public-Private Partnership Facilities

NGO-supported Cold Chain Projects

Organized Sector

Unorganized Sector

Government-Supported Infrastructure

By Product Type:

Perishable Food (Fruits, Vegetables, Dairy, Meat, Seafood)

Pharmaceuticals (Vaccines, Biologics, Medicines)

Processed & Frozen Foods

Chemicals & Industrial Goods

By Temperature Type:

Chilled (0°C to 8°C)

Frozen (-18°C and below)

Ambient Controlled (15°C to 25°C)

Ultra Cold (< -70°C, mainly for vaccines)

By Transport Mode:

Refrigerated Trucks (Large & Small)

Refrigerated Containers

Air Freight with Cold Chain Capabilities

Rail Logistics (Limited)

By End-Use Industry:

Food & Beverage

Pharmaceuticals & Healthcare

Retail & Supermarkets

Quick-Commerce & E-Grocery

Government & Relief Organizations

By Region:

Baghdad & Central Iraq

Northern Iraq (Erbil, Dohuk)

Southern Iraq (Basra, Nasiriyah)

Western Iraq (Anbar Region)

Kurdistan Region

Players Mentioned in the Report:

Move One

Maersk Cold Chain Services

Americold [international network]

Agility Logistics

Almas Group Logistics

DSV Iraq

SEKO Logistics (through partners)

Ruzave-listed cold storage providers

Arch Star Global Logistics

National Aviation Services (NAS) – cold storage services

Key Target Audience:

Cold Chain Logistics Providers

Food & Pharmaceutical Importers

Retail Chains & Supermarkets

Government Bodies (e.g., Ministry of Health, Ministry of Trade)

NGOs and International Development Agencies

Infrastructure Investors

Technology Providers (IoT, Telematics)

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

6.1. Revenues, 2018-2024P

7.1. By Cold Storage and Cold Transport, 2023-2024P

7.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

7.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2023-2024P

10.1. Iraq Cold Storage Market Size

10.1.1. By Revenue, 2018-2024P

10.1.2. By Number of Pallets, 2018-2024P

10.2. Iraq Cold Storage Market Segmentation

10.2.1. By Temperature Range (Ambient, Chilled and Frozen), 2023-2024P

10.2.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

10.2.3. By Major Cities, 2023-2024P

10.3. Iraq Cold Storage Market Future Outlook and Projections, 2025-2029

10.3.1. By Temperature Range (Ambient, Chilled and Frozen), 2025-2029

10.3.2. By Major Cities, 2025-2029

11.1. Iraq Cold Transport Market Size (By Revenue and Number of Reefer Trucks), 2018-2024P

11.2. Iraq Cold Transport Market Segmentation

11.2.1. By Mode of Transportation (Land, Sea and Air), 2023-2024P

11.2.2. By Location (Domestic and International), 2023-2024P

11.3. Iraq Cold Transport Market Future Outlook and Projections, 2025-2029

11.3.1. By Mode of Transport (Land, Sea and Air), 2025-2029

11.3.2. By Location (Domestic and International), 2025-2029

12.1. Trends and Developments in Iraq Cold Chain Market

12.2. Issues and Challenges in Iraq Cold Chain Market

12.3. Decision Making Parameters for End Users in Iraq Cold Chain Market

12.4. SWOT Analysis of Iraq Cold Chain Industry

12.5. Government Regulations and Associations in Iraq Cold Chain Market

12.6. Macroeconomic Factors Impacting Iraq Cold Chain Market

13.1. Parameters to be covered for Each End Users to Determine Business Potential:

13.1.1. Production Clusters

13.1.2. Market Demand, Major Products Stored, Cold Storage Companies in Guwahati catering to End Users

13.1.3. Location Preference for Each End User and their Production Plants, Preferences for Outsourcing and Captive Facility, Services Required, Facility Preferences, Decision Making Parameters

13.1.4. Cross comparison of leading end users/companies based on Headquarters, Manufacturing Plants, Products Stored, Major Products, Total Production, Cold Chain Partner, Facility Outsourced/Captive, Pallets Owned/Hired, Contact Person, Address and others

16.1. Competitive Landscape in Iraq Cold Chain Market

16.2. Competition Scenario in Iraq Cold Chain Market (Competition Stage, Major Players, Competing Parameters)

16.3. Key Metrics (Temperature Range, Pallet Position, Prices Charged, Occupancy Rate, Revenue (2023) and Employee Base) for Major Players in Iraq Cold Chain Market

16.4. Company Profiles of Major Companies in Iraq Cold Chain Market (Year of Establishment, Company Overview, Service Offered, USP, Warehousing Facilities, Warehousing Price, Cold Storage by location, Occupancy Rate, Major Clientele, Industries Catered, Employee Base, Temperature Range, Topline OPEX*, Revenue, Recent Developments, Future Strategies)

16.5. Strength and Weakness

16.6. Operating Model Analysis Framework

16.7. Gartner Magic Quadrant

16.8. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

18.1. By Cold Storage and Cold Transport, 2025-2029

18.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2025-2029

18.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2025-2029

18.4. Recommendation

18.5. Opportunity Analysis

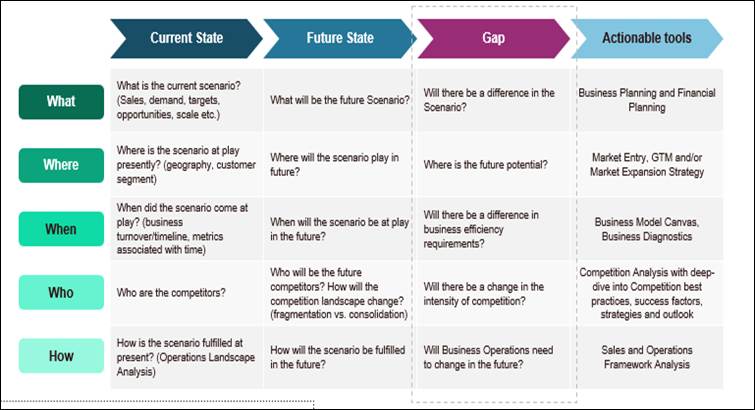

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Iraq Cold Chain Market. This includes cold storage operators, cold transport companies, retail chains, food importers, pharmaceutical distributors, government bodies, and NGOs.

Basis this mapping, we shortlist 5–6 key players and stakeholders in the Iraqi cold chain ecosystem using parameters such as fleet size, warehouse capacity, service region, revenue contribution, and compliance with cold chain standards.

Sourcing is made through industry articles, NGO reports, local business directories, trade publications, and proprietary databases to perform desk research and collate ecosystem-level information.

Step 2: Desk Research

A comprehensive secondary research process is undertaken referencing industry reports, news articles, white papers, and proprietary sources to gather key data points.

We analyze cold chain demand drivers including food import volumes, pharmaceutical market size, urbanization trends, and logistics capacity across Iraq.

We examine financial and operational details of major companies by reviewing press releases, international aid project documentation, donor databases, annual reports, government procurement tenders, and trade data (import/export of perishables and medical supplies).

Step 3: Primary Research

In-depth interviews are conducted with key stakeholders, including cold chain logistics providers, F&B distributors, pharmaceutical suppliers, port and customs officials, retail heads, and development agency representatives.

The primary objective is to validate market size estimates, understand regional demand clusters, identify infrastructure and capacity gaps, and validate business models and pricing structures.

Bottom-up evaluation is conducted to estimate warehouse capacity and refrigerated vehicle availability by region. These inputs are then aggregated to derive market size and segmentation.

Disguised interviews are also conducted with operators to validate service pricing, temperature management practices, and utilization levels, enabling cross-verification with secondary sources.

Step 4: Sanity Check

A comprehensive top-down and bottom-up triangulation process is undertaken using volume estimates, revenue models, and regional penetration rates to validate findings.

All assumptions and figures undergo internal review, and outliers are eliminated through iterative validation with multiple data points, ensuring robust and reliable market modeling.

FAQs

1. What is the potential for the Iraq Cold Chain Market?

The Iraq cold chain market is expected to witness robust growth through 2029, reaching an estimated valuation of USD 1.1 Billion by the end of the forecast period. This growth is being driven by the rising demand for temperature-controlled logistics in food and pharmaceuticals, increased government and donor investment in healthcare logistics, and the expansion of modern retail infrastructure. Iraq’s strategic location and heavy reliance on imports further amplify the need for reliable cold chain systems.

2. Who are the Key Players in the Iraq Cold Chain Market?

Major players operating in the Iraq Cold Chain Market include Agility Logistics, Al-Rashed International, DHL Express Iraq, Al-Hilal Logistics, and CEVA Logistics. These companies are known for their growing infrastructure footprint, expertise in handling temperature-sensitive goods, and partnerships with healthcare and food distributors. NGOs like UNICEF and WHO also play critical roles in supporting cold chain logistics, especially in the healthcare segment.

3. What are the Growth Drivers for the Iraq Cold Chain Market?

Key growth drivers include the rising demand for pharmaceuticals, particularly vaccines and biologics, which require strict temperature control. The expansion of food retail and supermarket chains, increasing import volumes of perishable goods, and public health initiatives supported by international aid organizations also contribute to market expansion. Additionally, urbanization and infrastructure development in regions like Baghdad, Erbil, and Basra are creating localized demand for cold storage and refrigerated transport.

4. What are the Challenges in the Iraq Cold Chain Market?

The Iraq Cold Chain Market faces several challenges, including frequent power outages, limited cold storage infrastructure, and a shortage of skilled labor in cold chain management. High capital investment requirements and low awareness of compliance standards (like GDP for pharmaceuticals) hinder rapid expansion. Furthermore, geopolitical instability and logistical bottlenecks at ports and checkpoints often disrupt supply chain continuity, especially in remote regions.