Ireland Auto Finance Market Outlook to 2029

By Market Structure, By Lenders (Banks, Non-Banking Financial Companies), By Vehicle Type (New vs Used), By Tenure, By Interest Rates, and By Region

- Product Code: TDR0146

- Region: Europe

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Ireland Auto Finance Market Outlook to 2029 – By Market Structure, By Lenders (Banks, Non-Banking Financial Companies), By Vehicle Type (New vs Used), By Tenure, By Interest Rates, and By Region” provides a comprehensive analysis of the auto finance market in Ireland. The report covers an overview and genesis of the industry, overall market size in terms of credit disbursed, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on credit volume disbursed, by market segment, vehicle types, regions, cause and effect relationship, and success case studies highlighting the major opportunities and caution points.

Ireland Auto Finance Market Overview and Size

The Ireland auto finance market reached a valuation of EUR 6.4 Billion in 2023, driven by rising vehicle demand, improving consumer credit conditions, and growing partnerships between auto dealers and financial institutions. The market is characterized by key players such as Bank of Ireland, AIB, Volkswagen Financial Services, Bluestone Motor Finance, and CapitalFlow. These companies are recognized for their robust credit underwriting systems, diverse loan offerings, and tech-driven service platforms.

In 2023, Bluestone Motor Finance announced a new AI-powered credit decisioning system aimed at accelerating loan approvals and reducing risk. This move highlights the increasing role of technology in enhancing consumer experience and operational efficiency. Major urban centers such as Dublin and Cork remain strongholds due to high vehicle ownership rates and urban mobility demands.

Market Size for Ireland Auto Finance Industry on the Basis of Credit Disbursed (EUR Billion), 2018-2024

What Factors are Leading to the Growth of Ireland Auto Finance Market:

Economic Recovery and Consumer Sentiment: Ireland’s post-COVID economic rebound has fueled consumer confidence, resulting in higher demand for vehicle financing. In 2023, auto loans grew by 11.5% YoY, signaling strong credit appetite, especially for personal vehicles. The re-opening of supply chains and rebound in employment levels also contributed to this surge.

Digitization of Loan Processes: With approximately 35% of auto loan applications initiated through online portals in 2023, the role of digital platforms has expanded significantly. Fintech lenders and traditional banks have developed mobile-friendly applications, pre-approved offers, and instant approval features, thereby making the borrowing process quicker and more transparent.

Rising Preference for Used Vehicles: The high cost of new vehicles and global supply chain constraints have led many Irish consumers to finance used cars instead. Used vehicle financing constituted nearly 42% of total disbursed auto loans in 2023, up from 30% in 2020. Financial institutions are adjusting their products to support this rising demand, offering competitive interest rates and flexible repayment options.

Which Industry Challenges Have Impacted the Growth for Ireland Auto Finance Market

High Interest Rates and Inflation Pressures: The European Central Bank’s tightening cycle has led to elevated interest rates, directly impacting borrowing costs for consumers. In 2023, the average auto loan interest rate in Ireland rose to 6.9%, compared to 5.2% in 2021. This increase has led to a decline in loan affordability, with approximately 28% of potential borrowers reconsidering or delaying vehicle purchases due to high monthly payments.

Credit Access for Subprime Borrowers: A significant portion of consumers, especially younger buyers and gig economy workers, face challenges in accessing credit due to low or non-traditional credit scores. It is estimated that 35% of declined auto finance applications in 2023 were from consumers with subprime or thin credit files. This limits the addressable market for lenders and leaves a large demographic underserved.

Regulatory Complexity and Compliance Burden: Compliance with EU-wide financial and consumer protection regulations continues to be a challenge for lenders. Rules related to GDPR, Know Your Customer (KYC), and Anti-Money Laundering (AML) require continuous investment in compliance infrastructure. Smaller non-bank lenders often struggle to meet these requirements efficiently, affecting their market competitiveness.

What are the Regulations and Initiatives which have Governed the Market

Consumer Protection Code (CPC) and Credit Contracts: The Central Bank of Ireland mandates strict adherence to the CPC for all lenders offering consumer loans, including auto finance. These rules ensure transparency in loan agreements, advertising, and customer disclosures. In 2023, over 92% of lenders were found to be compliant in a regulatory audit, showing strong market alignment with consumer rights initiatives.

Electric Vehicle Financing Incentives: As part of Ireland’s Climate Action Plan, financial products that support the purchase of electric vehicles receive government-backed incentives. These include interest rate subsidies and extended repayment terms. In 2023, the Sustainable Energy Authority of Ireland (SEAI) reported a 19% increase in EV finance applications due to these supportive measures.

Open Banking Implementation: With the rollout of PSD2 regulations, open banking has started to reshape auto finance. Lenders can now access real-time financial data from applicants (with consent), enabling more accurate credit assessments. This has led to a 15% improvement in loan approval rates for customers with previously borderline credit profiles.

Ireland Auto Finance Market Segmentation

By Market Structure: The organized sector leads the Ireland auto finance market, driven by banks and large non-banking financial institutions that offer transparent terms, standardized loan products, and digital platforms. These institutions also benefit from regulatory compliance and established customer trust. The unorganized sector, which includes small local financiers and dealer-tied credit providers, serves niche and subprime borrowers. While often more flexible, this segment lacks uniform standards and is perceived to carry higher interest rates and risks.

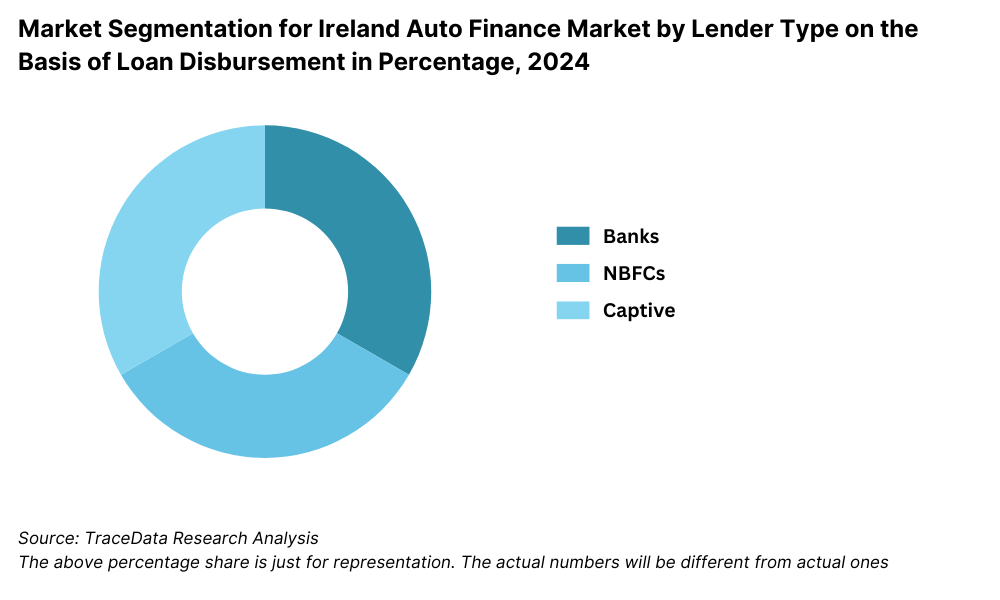

By Lender Type: Banks dominate the lending landscape due to their wide branch networks, strong customer base, and competitive interest rates. Institutions like Bank of Ireland and AIB offer attractive auto loan schemes with digital onboarding. Non-Banking Financial Companies (NBFCs) such as Bluestone and CapitalFlow have expanded their market share by catering to customers with thin credit files and offering faster loan processing.

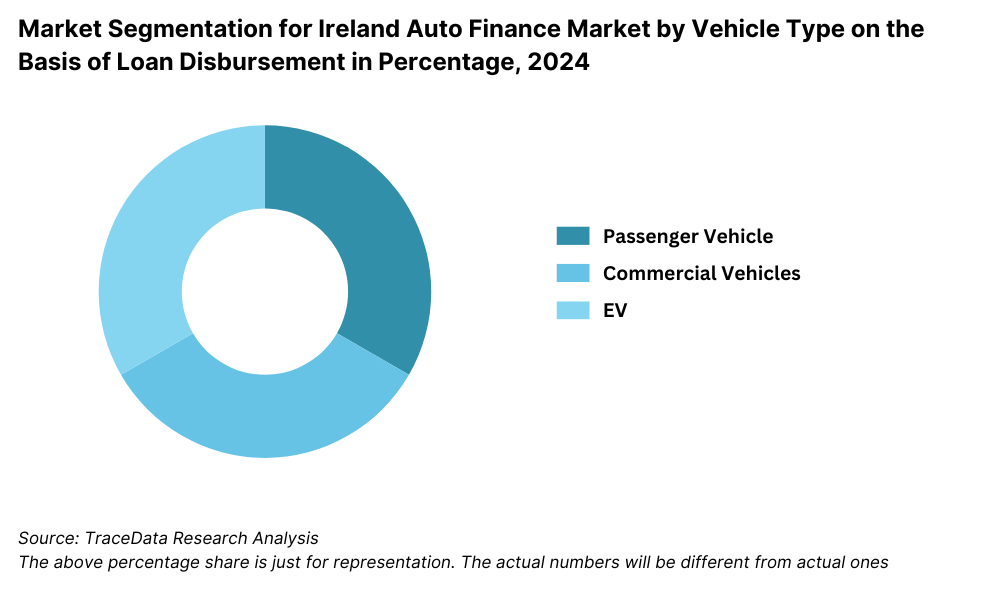

By Vehicle Type: Financing for new vehicles remains dominant due to manufacturer-dealer financing tie-ups and promotional interest rates. However, the used vehicle finance segment has seen rapid growth, particularly among budget-conscious buyers and first-time vehicle owners. In 2023, used car financing made up over 40% of all auto finance transactions, driven by supply chain delays in new vehicle production and affordability concerns.

Competitive Landscape in Ireland Auto Finance Market

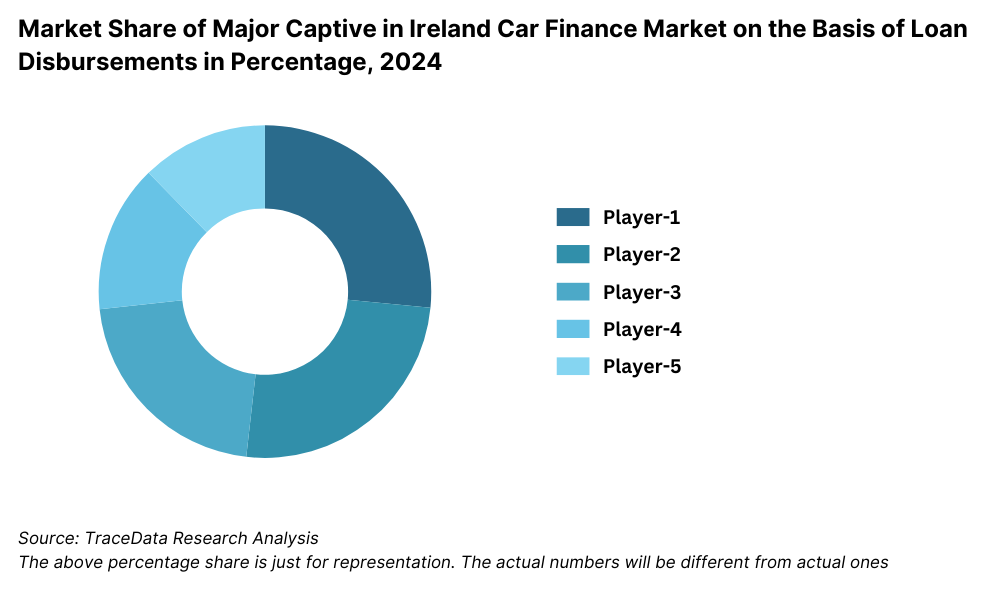

The Ireland auto finance market is moderately consolidated, with a mix of traditional banks, non-banking financial institutions, and new-age fintech lenders competing for market share. The growing adoption of digital platforms and embedded finance within car dealerships has further diversified the ecosystem, offering consumers a range of choices in terms of loan products, tenures, and interest rates. Key players include Bank of Ireland, AIB, Volkswagen Financial Services, Bluestone Motor Finance, CapitalFlow, and Avant Money.

| Name | Founding Year | Original Headquarters |

| AIB (Allied Irish Banks) Car Finance | 1966 | Dublin, Ireland |

| Bank of Ireland Auto Finance | 1783 | Dublin, Ireland |

| Permanent TSB Car Loan | 1884 | Dublin, Ireland |

| Volkswagen Financial Services Ireland | 1949 | Braunschweig, Germany |

| BMW Financial Services Ireland | 1993 | Munich, Germany |

| Toyota Financial Services Ireland | 1982 | Toyota City, Japan |

| Renault Bank Ireland (RCI Banque) | 2011 | Paris, France |

| Bluestone Motor Finance Ireland | 2014 | Dublin, Ireland |

| Close Brothers Motor Finance Ireland | 1878 | London, UK |

| First Auto Finance | 2008 | Dublin, Ireland |

| Capitalflow (Auto Finance Division) | 2016 | Dublin, Ireland |

Some of the recent competitor trends and key information about competitors include:

Bank of Ireland: As a market leader in personal lending, the bank reported a 12% YoY growth in auto loan disbursements in 2023. Their digital loan application process and pre-approved offers for account holders have strengthened customer retention and increased loan volumes.

AIB: Known for its competitive APRs and flexible loan tenures, AIB enhanced its mobile banking interface in 2023 to streamline auto loan approvals. The bank also introduced a green car loan segment with interest rebates for EV purchases, seeing a 21% increase in applications for EV-related financing.

Volkswagen Financial Services: This captive lender expanded its operations in Ireland through partnerships with multiple dealerships under the VW Group umbrella, including Audi and Skoda. In 2023, they launched a promotional 0% finance scheme for selected new models, boosting their market share in the new vehicle finance category.

Bluestone Motor Finance: A leader in financing for non-prime and near-prime borrowers, Bluestone implemented an AI-driven risk assessment tool in 2023. The firm saw a 17% rise in loan approvals, primarily driven by used car financing demand.

CapitalFlow: Focused on fast-tracked auto loans for SMEs and commercial fleets, CapitalFlow gained popularity for their 48-hour disbursement model. In 2023, the company expanded its dealer financing partnerships by 30%, enabling more embedded lending at point-of-sale.

Avant Money: Offering fixed-rate personal loans that can be used for auto purchases, Avant Money reported a 13% increase in auto-related loan usage. Their integration with online comparison tools has helped attract digitally savvy customers seeking competitive interest rates.

What Lies Ahead for Ireland Auto Finance Market?

The Ireland auto finance market is projected to grow steadily through 2029, with a moderate CAGR driven by digital transformation, increased vehicle ownership, and the rising affordability of credit. Enhanced competition, evolving consumer expectations, and supportive government policies are expected to shape the market landscape in the coming years.

Expansion of Green Auto Financing: Ireland’s strong national focus on sustainability will likely drive increased financing for electric and hybrid vehicles. By 2029, green auto finance products are expected to account for over 30% of new vehicle loan applications. Lenders are anticipated to offer preferential interest rates, longer tenures, and government-backed guarantees to support EV adoption.

Rise of Digital-First Lending Platforms: Auto loan providers will continue to invest in mobile-first platforms and instant loan approval systems. AI-powered credit scoring and biometric authentication are expected to become standard in the lending process, reducing application processing times and improving customer satisfaction across age demographics.

Increased Penetration of Used Car Financing: As used vehicle purchases become more mainstream due to affordability and supply chain issues, financial institutions are expected to increase their focus on used car loan products. More flexible underwriting criteria bundled insurance packages, and warranty-backed financing options will emerge to support this growth.

Embedded Finance and Dealer Partnerships: The integration of auto finance directly into car dealerships and online car sales platforms will become more prominent. By 2029, embedded lending solutions are expected to capture a significant portion of point-of-sale financing, offering real-time loan approvals within dealership CRM systems.

Future Outlook and Projections for Ireland Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Ireland Auto Finance Market Segmentation

By Market Structure:

Banks

Non-Banking Financial Companies (NBFCs)

Captive Finance Arms (OEM Finance Companies)

Online Lending Platforms

Dealer-Integrated Financing

Organized Sector

Unorganized Sector

By Vehicle Type:

New Vehicles

Used Vehicles

Electric Vehicles

Commercial Vehicles

By Loan Tenure:

12–24 Months

25–36 Months

37–60 Months

60+ Months

By Interest Rate Range:

<5% APR

5–6% APR

6–7% APR

7% APR

By Age of Consumer:

18–30

31–45

46–60

60+

By Region:

Dublin

Cork

Galway

Limerick

Waterford

Rest of Ireland

Players Mentioned in the Report (Banks):

- Allied Irish Banks (AIB)

- Bank of Ireland

- Permanent TSB (PTSB)

Players Mentioned in the Report (NBFCs):

- Finance Ireland Motor & Leasing

- Close Brothers Motor Finance

- Capitalflow

- BNP Paribas Personal Finance (Creation)

Players Mentioned in the Report (Captive):

- CA Auto Bank Ireland

- Volkswagen Financial Services Ireland

- Polestar Financial Services

Key Target Audience:

Auto Finance Providers

Commercial Banks and NBFCs

Online Lending Startups

Vehicle Dealership Networks

Regulatory Bodies (e.g., Central Bank of Ireland)

Fintech Developers

Consumer Credit Bureaus

Market Research Institutions

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Ireland by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Ireland Car Finance Market

11.2. Growth Drivers for Ireland Car Finance Market

11.3. SWOT Analysis for Ireland Car Finance Market

11.4. Issues and Challenges for Ireland Car Finance Market

11.5. Government Regulations for Ireland Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Ireland Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Ireland Car Finance Market, 2024

17.3. Market Share of Key Captive in Ireland Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Ireland Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities relevant to the Ireland Auto Finance Market. Based on this mapping, we shortlist 5–6 key players in the industry using criteria such as credit disbursed, borrower base, product offerings, and market penetration.

Sourcing is conducted through credible industry publications, regulatory filings, financial databases, and proprietary sources to build a foundational understanding of the market dynamics.

Step 2: Desk Research

We then conduct extensive desk research leveraging a combination of secondary and proprietary data sources. This allows us to analyze the auto finance landscape in terms of lending volumes, interest rate trends, number of active lenders, borrower behavior, regional trends, and product segmentation.

We cross-reference company-level data using annual reports, investor presentations, Central Bank reports, and publicly available datasets to validate financial and operational metrics.

Step 3: Primary Research

A series of in-depth interviews is carried out with stakeholders across the Ireland Auto Finance ecosystem. These include C-level executives at leading banks and NBFCs, auto dealership owners, fintech lending platforms, and regulatory officials.

Interviews are structured to validate preliminary market hypotheses, fine-tune segmentation variables, and gather detailed insights into interest rate structures, loan tenure preferences, consumer financing patterns, and digital lending innovations.

Our team also conducts disguised interviews by posing as prospective customers, allowing us to test pricing transparency, customer service standards, application approval processes, and product terms firsthand.

Step 4: Sanity Check

A dual-pronged top-down and bottom-up analysis is employed to validate market size projections and ensure data consistency. Market modeling techniques are used to project credit disbursed, forecast CAGR, and segment performance through 2029. These figures are cross-verified using triangulation methods and expert validations from industry stakeholders.

FAQs

1. What is the potential for the Ireland Auto Finance Market?

The Ireland auto finance market is positioned for steady growth, with a market valuation of EUR 6.4 Billion in 2023. This growth is expected to continue through 2029, supported by increasing vehicle ownership, improved credit availability, and the rise of digital lending platforms. Government incentives for electric vehicles and the expansion of online and embedded finance options are expected to further unlock market potential.

2. Who are the Key Players in the Ireland Auto Finance Market?

Key players in the Ireland auto finance market include Bank of Ireland, AIB, Volkswagen Financial Services, Bluestone Motor Finance, CapitalFlow, and Avant Money. These institutions hold a strong market presence due to their wide financial product portfolios, advanced credit risk assessment systems, and partnerships with car dealerships and digital platforms.

3. What are the Growth Drivers for the Ireland Auto Finance Market?

Major growth drivers include the increasing demand for both new and used vehicles, rising consumer credit accessibility, and the integration of AI and digital technologies into the loan approval process. Additionally, Ireland’s focus on sustainable transportation and government-backed EV financing incentives are accelerating the shift toward green vehicle lending, further fueling the market's growth.

4. What are the Challenges in the Ireland Auto Finance Market?

Challenges in the market include high interest rates influenced by broader European monetary policy, limited access to credit for subprime borrowers, and complex regulatory compliance requirements. Additionally, many small lenders face difficulties in digitizing their services and meeting the rising expectations of tech-savvy consumers, potentially hindering their competitive edge.