Ireland Logistics and Warehousing Market Outlook to 2029

By Freight Mode, By Type of Warehousing, By End Users, By Ownership Structure, and By Region

- Product Code: TDR0209

- Region: Europe

- Published on: July 2025

- Total Pages: 80

Report Summary

The report titled “Ireland Logistics and Warehousing Market Outlook to 2029 – By Freight Mode, By Type of Warehousing, By End Users, By Ownership Structure, and By Region” provides a comprehensive analysis of the logistics and warehousing industry in Ireland. The report covers an overview and evolution of the sector, overall market size in terms of revenue, market segmentation; key trends and developments, regulatory landscape, customer and service provider profiling, major challenges, and a competitive landscape including benchmarking, SWOT analysis, opportunities, and company profiling of major players in the Ireland Logistics and Warehousing Market. The report concludes with future market projections based on revenue, segmented by freight modes, warehousing types, industries served, and region, along with case studies showcasing major market success factors and risks.

Ireland Logistics and Warehousing Market Overview and Size

The Ireland logistics and warehousing market was valued at approximately EUR 7.2 Billion in 2023, driven by the growing e-commerce sector, increasing trade activity within the EU, and government initiatives to improve transportation infrastructure. The market is supported by major players such as DB Schenker, DHL Supply Chain, Primeline Logistics, An Post, and DPD Ireland, who offer integrated logistics solutions including last-mile delivery, inventory management, and value-added services.

In 2023, Primeline Logistics expanded its automated warehousing facility in Dublin, catering to growing demand in the retail and healthcare sectors. This reflects the broader trend of warehouse modernization and adoption of digital technologies such as WMS and RFID. Dublin, Cork, and Galway are considered key logistics hubs due to their proximity to ports and high consumer density.

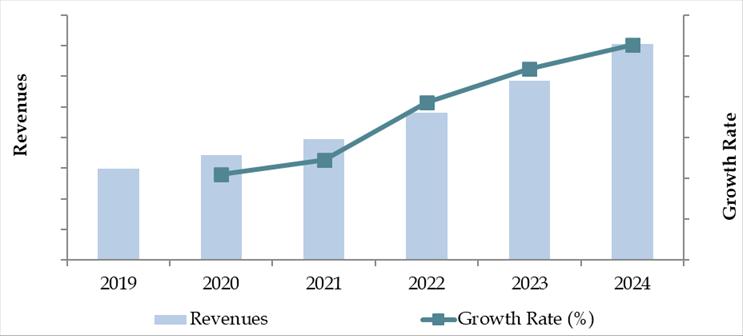

Market Size for Ireland Logistics and Warehousing Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors are Leading to the Growth of Ireland Logistics and Warehousing Market

E-Commerce Boom: Ireland’s e-commerce market has witnessed rapid expansion, with online retail sales growing by over 17% in 2023. This has significantly boosted demand for warehousing and last-mile delivery services. 3PL providers are expanding storage capacities and optimizing delivery routes to serve both B2B and B2C segments.

Strategic Location within EU: Ireland’s position as a gateway between Europe and North America makes it a key logistics corridor. Post-Brexit, several multinational firms have chosen Ireland as their EU distribution base to maintain access to the European Single Market. This has increased demand for customs clearance, bonded warehousing, and multimodal logistics services.

Government Infrastructure Push: The National Development Plan 2021–2030 has allocated over EUR 35 billion towards transport and logistics infrastructure. Improvements in road networks, port modernization (e.g., Dublin and Rosslare), and rail freight revitalization are expected to streamline goods movement and reduce logistics costs.

Which Industry Challenges Have Impacted the Growth for Ireland Logistics and Warehousing Market

Infrastructure Bottlenecks: Despite ongoing infrastructure investments, congestion and connectivity issues remain significant challenges. According to a 2023 industry report, approximately 32% of logistics delays in Ireland were due to urban traffic congestion, especially in the Greater Dublin Area. These limitations have impacted supply chain efficiency, particularly for last-mile delivery services.

Rising Operating Costs: The logistics sector has experienced rising fuel costs, increased labor wages, and higher rental rates for warehousing. In 2023, logistics service providers reported an average cost increase of 11% year-on-year, with warehousing rental rates alone climbing by 9%. These rising costs are straining profit margins, especially for small and medium enterprises.

Labor Availability and Skill Gaps: A shortage of skilled drivers, warehouse workers, and logistics planners is affecting industry growth. A recent survey indicated that 44% of logistics companies in Ireland are struggling to meet service demand due to labor shortages. Post-Brexit restrictions have further reduced the pool of available foreign workers, intensifying the challenge.

What are the Regulations and Initiatives which have Governed the Market

National Logistics and Supply Chain Strategy (2022–2031): The Irish government has introduced a long-term logistics strategy focused on improving freight corridors, reducing emissions, and promoting regional logistics hubs. In 2023, EUR 280 million was allocated to develop road-rail interchanges and optimize port logistics.

Green Logistics and Carbon Targets: Ireland’s Climate Action Plan mandates a 35% reduction in logistics-related carbon emissions by 2030. As a result, logistics companies are increasingly adopting electric vehicles, energy-efficient warehouses, and sustainable packaging. In 2023, 16% of last-mile delivery vehicles were either electric or hybrid.

EU Mobility Package Compliance: Irish logistics firms are now required to adhere to the EU Mobility Package, which includes driver rest regulations, wage equalization, and transport licensing norms. While it ensures regulatory consistency across borders, it has increased compliance burdens for Irish operators engaged in cross-border freight.

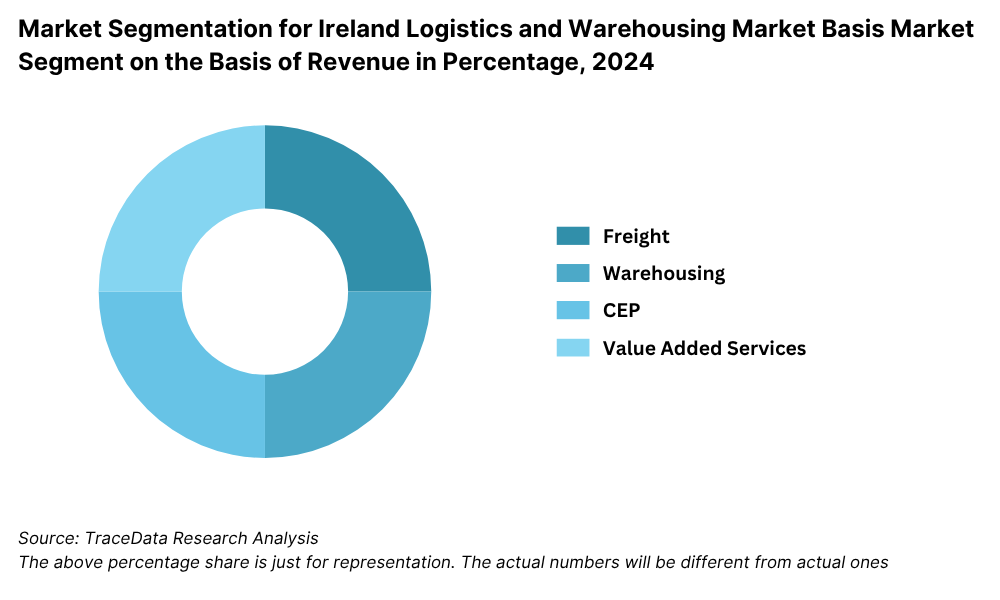

Ireland Logistics and Warehousing Market Segmentation

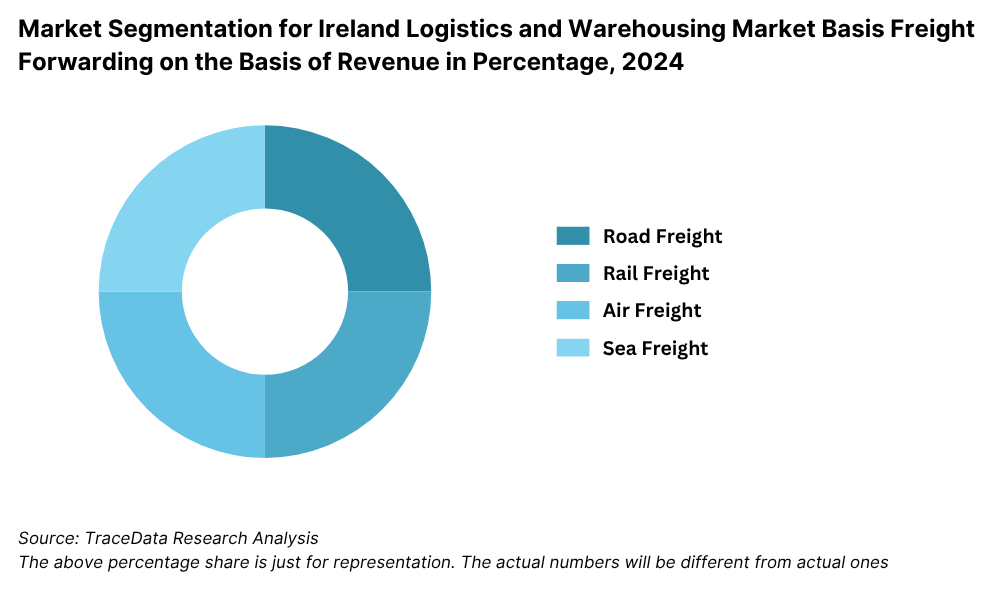

By Freight Mode: Road freight dominates the logistics market in Ireland due to the country’s extensive road network and flexibility in reaching urban and rural destinations. Road transportation is preferred for both domestic and cross-border deliveries within the EU. Sea freight holds a significant share owing to Ireland’s strong export-import dependency and the presence of major ports like Dublin Port and Port of Cork. Air freight is primarily used for high-value or time-sensitive goods, especially in the pharmaceutical and tech sectors. Rail freight, although growing, remains underutilized due to limited infrastructure and modal integration.

By Type of Warehousing: General warehousing dominates the sector, catering to FMCG, retail, and consumer electronics industries. These facilities typically store ambient goods and support high turnover rates. Cold storage warehousing is growing steadily, driven by demand from pharmaceuticals, biotechnology, and agri-food sectors. In 2023, cold chain logistics experienced a notable surge due to Ireland’s export-oriented biopharma industry. E-commerce fulfillment centers are also gaining ground, offering specialized solutions for rapid order processing and last-mile distribution.

By End-User Industry: Retail and e-commerce are the leading end-user segments, driven by rising consumer demand for fast delivery and inventory availability. Pharmaceutical and healthcare follow closely, benefiting from Ireland’s position as a global manufacturing hub for biopharmaceuticals. The food and beverage industry is also a key contributor, particularly in cold storage logistics. Other sectors include automotive, chemicals, and construction materials.

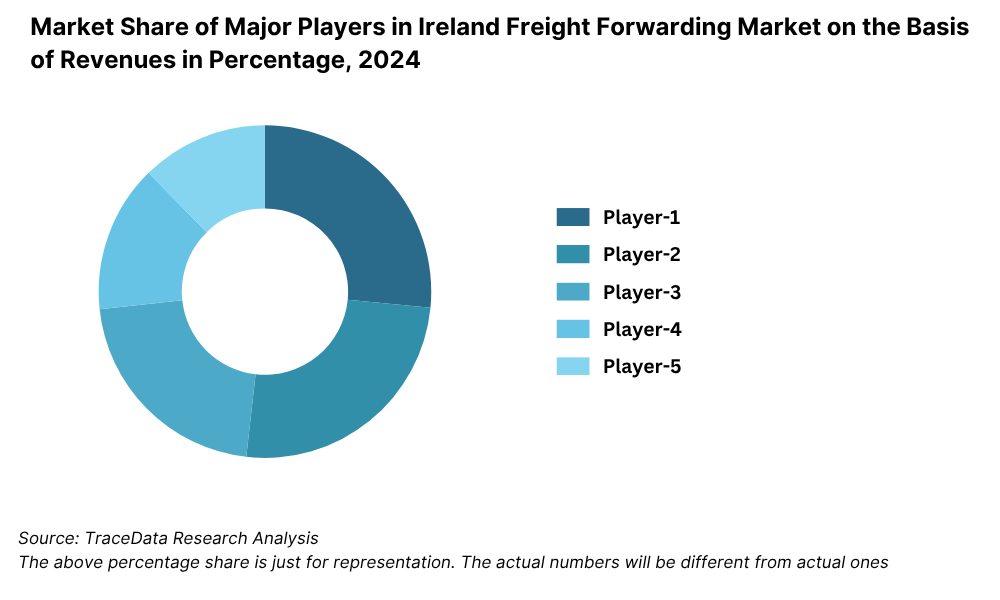

Competitive Landscape in Ireland Logistics and Warehousing Market

The Ireland logistics and warehousing market is moderately fragmented, with a mix of multinational logistics companies and strong local players. The presence of global 3PLs like DB Schenker, DHL, and DSV alongside regional specialists such as Primeline Logistics, An Post, and Nightline has resulted in a dynamic and competitive environment. The sector is witnessing increased investments in automation, cold chain infrastructure, and green logistics, particularly from firms adapting to post-Brexit and sustainability challenges.

Company Name | Founding Year | Original Headquarters |

Musgrave Group Logistics | 1876 | Cork, Ireland |

Primeline Logistics | 1988 | Ashbourne, County Meath, Ireland |

Wards Transport Ltd. | 1972 | Dublin, Ireland |

Dixon Transport | 1979 | Dublin, Ireland |

Allied Logistics Ltd. | 1990 | Limerick, Ireland |

Kuehne + Nagel Ireland Ltd. | 1890 (IE: ~1970s) | Schindellegi, Switzerland |

DB Schenker Ireland Ltd. | 1872 (IE: ~1990s) | Essen, Germany |

DHL Supply Chain Ireland | 1969 (IE: ~1980s) | Bonn, Germany |

UPS Ireland | 1907 (IE: ~1988) | Atlanta, USA |

FedEx Express Ireland | 1971 (IE: ~2000s) | Memphis, USA |

Maersk Line Ireland | 1904 (IE: ~2000s) | Copenhagen, Denmark |

CEVA Logistics Ireland | 2006 (IE: ~2010s) | Marseille, France |

Rhenus Logistics Ireland | 1912 (IE: ~2000s) | Holzwickede, Germany |

Yusen Logistics Ireland | 1955 (IE: ~2000s) | Tokyo, Japan |

Expeditors Ireland Ltd. | 1979 (IE: ~2000s) | Seattle, USA |

Dachser Ireland | 1930 (IE: ~2005) | Kempten, Germany |

Some of the recent competitor trends and key information about competitors include:

DB Schenker: DB Schenker Ireland expanded its Dublin operations in 2023 by adding over 15,000 sq.m of new warehousing space, integrated with advanced inventory management systems. The expansion targets the life sciences and electronics sectors, aiming to strengthen the company’s contract logistics offerings.

DHL Supply Chain: In 2023, DHL announced the rollout of its GoGreen strategy in Ireland, incorporating electric delivery vehicles and solar-powered warehouses. The company aims to reduce its logistics-related emissions by 50% by 2025 and has already electrified over 30% of its last-mile fleet in urban centers.

Primeline Logistics: A leading Irish-owned provider, Primeline expanded its fulfillment and cold chain capabilities in 2023 to serve growing demand from e-commerce and the pharmaceutical sector. The firm has also partnered with major retailers for omnichannel distribution.

An Post: The national postal service has aggressively expanded into logistics and parcel delivery, with over 20% YoY growth in e-commerce deliveries in 2023. An Post has modernized several of its regional distribution centers and integrated route optimization software to improve delivery timelines.

DSV Ireland: DSV continues to serve as a major logistics partner for Irish exporters. In 2023, it launched a new cross-dock facility in Naas to streamline freight flows post-Brexit and reduce customs bottlenecks. The firm has also invested in digital freight management tools for enhanced transparency.

Nightline Logistics: Now part of UPS, Nightline remains a significant player in express parcel delivery. In 2023, it enhanced its returns management services for major online retailers and introduced flexible warehousing solutions to meet peak season demands.

What Lies Ahead for Ireland Logistics and Warehousing Market?

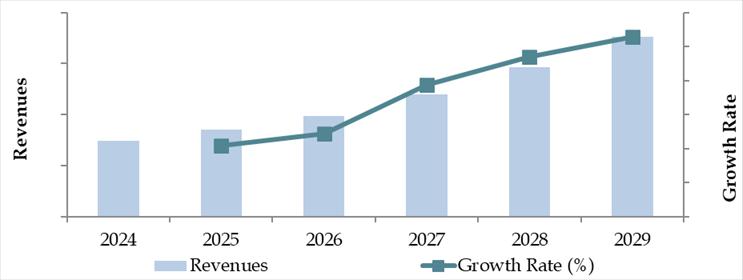

The Ireland logistics and warehousing market is projected to witness steady growth by 2029, recording a healthy CAGR during the forecast period. This growth will be driven by e-commerce expansion, infrastructure investments, and increasing adoption of digital and green logistics solutions.

Expansion of E-commerce Fulfillment Infrastructure: With online retail continuing to grow, logistics providers are expected to invest heavily in e-commerce-specific warehousing and last-mile capabilities. Demand for urban micro-fulfillment centers and automated pick-pack solutions is anticipated to rise, especially in densely populated areas such as Dublin and Cork.

Digital Transformation of Logistics Operations: The integration of digital tools such as AI-powered route optimization, real-time tracking, and predictive inventory management is likely to accelerate. These innovations will enhance supply chain visibility, improve operational efficiency, and enable logistics companies to offer more responsive and customized services to clients.

Growth of Cold Chain Logistics: The need for temperature-controlled storage and transportation will increase, driven by Ireland’s booming pharmaceutical and food export sectors. With growing regulatory scrutiny and consumer demand for safety and quality, companies are expected to invest in state-of-the-art cold storage and monitoring systems.

Green and Sustainable Logistics Practices: As Ireland moves towards its 2030 climate targets, logistics providers will prioritize environmentally sustainable operations. This includes a transition to electric vehicles, use of renewable energy in warehouses, carbon offset programs, and packaging waste reduction. These initiatives will not only comply with regulations but also enhance brand reputation and customer loyalty.

Future Outlook and Projections for Ireland Logistics and Warehousing Market on the Basis of Revenues in USD Billion, 2024-2029

Ireland Logistics and Warehousing Market Segmentation

• By Freight Mode:

o Road Freight

o Sea Freight

o Air Freight

o Rail Freight

• By Type of Warehousing:

o General Warehousing

o Cold Storage Warehousing

o E-commerce Fulfillment Centers

o Bonded Warehousing

o Automated Warehouses

• By End-User Industry:

o E-commerce and Retail

o Pharmaceuticals and Healthcare

o Food and Beverage

o Automotive

o Industrial Manufacturing

o Chemicals

• By Ownership Structure:

o Third-Party Logistics (3PL)

o Fourth-Party Logistics (4PL)

o Own Account (In-house Logistics)

• By Region:

o Dublin

o Cork

o Galway

o Limerick

o Shannon

o Rest of Ireland

Players Mentioned in the Report:

Freight Forwarding Companies

- Emerald Freight

- Quinn Freight Forwarding

- Ace Express Freight

- NRS Logistics

- AIT Worldwide Logistics

- Kintetsu World Express

- DHL Global Forwarding

- DB Schenker

- Röhlig Logistics

Warehousing Companies

- Emerald Freight

- AIT Worldwide Logistics

- DB Schenker

- Kuehne + Nagel

- Rhenus Logistics

E‑Commerce Logistics Companies

- Autofulfil

- ShipBob** (note: partner-based)

- Amazon Fulfillment

- SHIPHYPE Fulfillment

- AMZ Prep

Express Logistics Companies

- DHL Express

- FedEx

- UPS

- Fastway Couriers

- Parcel Direct Ireland

Key Target Audience:

• Third-Party Logistics Providers

• Warehousing and Distribution Companies

• E-commerce and Retail Companies

• Pharmaceutical and Cold Chain Operators

• Government and Regulatory Agencies (e.g., Department of Transport, Enterprise Ireland)

• Research and Policy Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Macroeconomic framework for Ireland Including GDP (2018-2024), GDP Growth (2018-2024), GDP Contribution by Sector

4.2. Logistics Sector Contribution to GDP and how the contribution has been changing in the historical assessment

4.3. Ease of Doing Business in Ireland

4.4. LPI Index of Ireland and Improvements in the last 10-15 Years

4.5. Custom Procedure and Custom Charges in Ireland Logistics market

5.1. Landscape of Investment Parks and Free Trade Zones in Ireland

5.2. Current Scenario for Logistics Infrastructure in Ireland

5.3. Road Infrastructure in Ireland including Road Network, Toll Charges and Toll Network, Major Goods Traded through Road, Major Flow Corridors for Road (Inbound and Outbound)

5.4. Air Infrastructure in Ireland including Total Volume Handled, FTK for Air Freight, Major Inbound and Outbound Flow Corridors, Major Goods traded through Air, Number of Commercial and passenger Airports, Air Freight Volume by Ports and other Parameters

5.5. Sea Infrastructure in Ireland including Total Volume Handled, FTK for Sea Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Sea, Number of Ports for Coastal and Ocean Freight, Number of Vessels, Sea Freight Volume by Ports and other Parameters

5.6. Rail Infrastructure in Ireland including Total Volume Handled, FTK for Rail Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Rail and others

6.1. Basis Revenues, 2018-2024P

7.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2018-2024P

7.2. By End User Industries, 2018-2024P

8.1. Market Overview and Genesis

8.2. Ireland Freight Forwarding Market Size by Revenues, 2018-2024P

8.3. Ireland 3PL Freight Forwarding Market Segmentation, 2018-2024P

8.3.1. By Mode of Freight Transport (Road, Sea, Air and Rail), 2018-2024P

8.3.1.1. Price per FTK for Road/Air/Sea and Rail in Ireland

8.3.1.2. Road Freight (Domestic and International Volume, FTK and Revenue; Number of Registered Vehicles)

8.3.1.3. Road Freight Domestic and International Corridors

8.3.1.4. Ocean Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity; Sea Ports Key Statistics)

8.3.1.5. Air Freight (Domestic and International Volume, FTK and Revenue)

8.3.1.6. Rail Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity and Region)

8.3.1.7. Export-Import Scenario (Value by Mode of Transport, Commodity and Country; Volume by Principal Commodities)

8.3.2. By Intercity Road Freight Corridors, 2018-2024P

8.3.3. By International Road Freight Corridors, 2018-2024P

8.3.4. By End User (Industrial, FMCG, F&B, Retail and Others), 2018-2024P

8.4. Snapshot of Freight Truck Aggregators in Ireland Including Company Overview, USP. Business Strategies, Future Plans, Business Model, Number of Fleets, Margins/Commission, Number of Booking, Major Clients, Average Booking Amount, Major Routes and others

8.5. Competitive Landscape in Ireland Freight Forwarding Market, 2021

8.5.1. Heat Map of Major Players in Ireland Freight Forwarding on the Basis of Service offering

8.5.2. Market Share of Maior Players in Ireland Freight Forwarding Market, 2023

8.5.3. Cross Comparison of Major Players in Freight Forwarding Companies on the Basis of Parameters including Volume of Road Freight, Inception Year, Number of Fleets (Owned and Subcontracted), Fleets by Type, Occupancy Rate, Number of Employees, Major Route Network, Major Clients, Revenues, Volume of Sea Freight, Volume of Air Freight, USP, Business Strategy, Technology, (2023)

8.6. Ireland 3PL Freight Forwarding Future Market Size by Revenues, 2025-2029

8.7. Ireland Freight Forwarding Market Segmentation, 2025-2029

8.7.1. Future Market Segmentation by Mode of Freight Transport (Road, Sea, Air and Rail), 2025-2029

8.7.2. Future Market Segmentation by International Road Freight Corridors (China, Ireland and Ireland), 2025-2029

8.7.3. Future Market Segmentation by End User (Industrial, FMCG, F&B, Retail and Others), 2025-2029

9.1. Market Overview and Genesis

9.2. Value Chain Analysis in Ireland Warehousing Market including entities, margins, role of each entity, process flow, challenges and other aspects

9.3. Ireland Warehousing Market Size on the Basis of Revenues and Warehousing Space, 2018-2024P

9.4. Ireland 3PL Warehousing Segmentation

9.4.1. Ireland Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2018-2024P

9.4.2. Ireland Warehousing By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2018-2024P

9.4.3. Ireland Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2018-2024P

9.4.4. 3PL Warehousing Space by Region, 2024P

9.5. Competitive Landscape in Ireland 3PL Warehousing Market

9.5.1. Market share of Top 10 Companies in Ireland Warehousing Market, 2023

9.5.2. Cross Comparison of Top 10 3PL Warehousing Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Revenues from Warehousing, Number of Warehouses, Warehousing Space, Location of Warehouses, Type of Warehouses, Occupancy Rate, Rental Rates, Clients and others, (2023)

9.6. Ireland Warehousing Future Market Size on the Basis of Revenues, 2025-2029

9.7. Ireland Warehousing Market Future Segmentation

9.7.1. Ireland Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2025-2029

9.7.2. Ireland Warehousing Revenue By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2025-2029

9.7.3. Ireland Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2025-2029

10.1. Market Overview and Genesis

10.2. Value Chain Analysis in Ireland CEP Market including entities, margins, role of each entity, process flow, challenges and other aspects

10.3. Revenue Composition and Contribution Between First Mile/Mid Mile and Last Mile Delivery-Analysis for Domestic and International Shipments

10.4. Ireland CEP Market Size on the Basis of Revenues and Shipments, 2018-2024P

10.5. Ireland CEP Market Segmentation, 2021

10.5.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2023-2024P

10.5.2. Segmentation by International and Domestic Express, 2023-2024P

10.5.3. Segmentation by B2B, B2C and C2C, 2023-2024P

10.5.4. Segmentation by Period of Delivery, 2023-2024P

10.6. Competitive Landscape in 3PL Market, 2021

10.6.1. Overview and Genesis, Market Nature, Market Stage and Major Competing Parameters

10.6.2. Market Share of Companies in Ireland CEP Market on the Basis of Revenues/Number of Shipments, 2023

10.6.3. Market Share of Top 5 Companies in Ireland E-Commerce Shipment Market on the Basis of Revenues/Number of Shipments, 2023

10.6.4. Cross Comparison of Top 10 Ireland CEP Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Number of last Mile Delivery Shipments, Revenues, Major Clients, Number of Fleets, Number of Employees, Number of Riders, Number of Pin Code Served, Major Service Offering and others

10.7. Ireland CEP Market Size on the Basis of Revenues and Shipments, 2025-2029

10.8. Ireland CEP Market Segmentation

10.8.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2025-2029

10.8.2. Segmentation by International and Domestic Express, 2025-2029

10.8.3. Segmentation by B2B, B2C and C2C, 2025-2029

10.8.4. Segmentation by Period of Delivery, 2025-2029

11.1. Customer Cohort Analysis and End User Paradigm for Different Industry Verticals under Logistics Sector (Telecommunications, FMCG, Automotive, Apparel, F&B, Construction and Pharmaceuticals)

11.2. Understanding on Logistics Spend by End User, 2023-2024P

11.3. End User Preferences in terms of In-House or Outsourcing Logistics Services and Reason for Selection; Segregate this by Size of Company on the Basis of Revenues

11.4. Major Logistics Company who are Specialized in Serving Each Type of End User (Telecommunications, FMCG, Apparel, F&B, Construction and Pharmaceuticals)

11.5. Detailed Landscape of Each End Users across Parameters including Major Products Manufactured and Traded, Emerging Products, Type of Services Required, and Type of Services Outsourced, Major Companies, Contract Duration, Likelihood to Recommend, Market Orientation, Major Clusters, Type of Sourcing Preference, Pain Points, Facilities/Services Required, Future Outlook. Market Size for End User Industry Vertical with Growth Rate, 2018-2024P

12.1. Basis Revenues, 2025-2029

13. Ireland Logistics and Warehousing Future Market Segmentation

13.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2025-2029

13.2. By End User Industries, 2025-2029

13.3. Recommendation

13.4. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Ireland Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5–6 logistics and warehousing service providers in the country based upon their financial performance, service portfolio, infrastructure capabilities, and geographic reach.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like total market revenues, freight volume, warehousing capacity, rental trends, pricing, and regional performance.

We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and market intelligence reports. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, operational managers, warehouse heads, and supply chain specialists representing various logistics companies, warehouse operators, and end-user industries such as retail, pharmaceuticals, and FMCG. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients or service users. This approach enables us to validate operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of cost structures, capacity utilization, value chain processes, pricing strategies, and logistics technologies in use.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process. Revenue triangulation, freight tonnage analysis, warehousing square footage estimates, and growth benchmarking are used to ensure consistency and accuracy of final market projections.

FAQs

1. What is the potential for the Ireland Logistics and Warehousing Market?

The Ireland logistics and warehousing market is expected to experience steady growth, reaching a valuation of approximately EUR 9.8 Billion by 2029. This growth is driven by increasing demand for e-commerce fulfillment, Ireland’s strategic role in EU trade post-Brexit, and rising investments in cold chain and automated warehousing infrastructure. The country’s growing exports, especially in pharmaceuticals and food products, also provide a strong foundation for market expansion.

2. Who are the Key Players in the Ireland Logistics and Warehousing Market?

Key players in the Ireland Logistics and Warehousing Market include DB Schenker, DHL Supply Chain, Primeline Logistics, An Post, DSV Ireland, and Nightline Logistics. These companies lead the market due to their extensive infrastructure, multimodal capabilities, advanced digital solutions, and focus on sustainability and customer-centric services.

3. What are the Growth Drivers for the Ireland Logistics and Warehousing Market?

The main growth drivers include the continued rise of e-commerce, expansion of the pharmaceutical and food export sectors, and increased investment in green and automated logistics solutions. Government-backed infrastructure development, including road-rail integration and port upgrades, further supports industry growth. Additionally, Ireland’s strategic position as an EU logistics hub enhances its long-term potential.

4. What are the Challenges in the Ireland Logistics and Warehousing Market?

The market faces several challenges such as high operating costs, limited availability of Grade A warehouse space, labor shortages in skilled logistics roles, and compliance with evolving EU mobility and sustainability regulations. Infrastructure bottlenecks and congestion in urban centers also pose significant operational difficulties for logistics providers.