Italy Auto Finance Market Outlook to 2029

By Loan Provider Type, By Vehicle Type (New vs. Used), By Type of Loan, By Tenure, By Consumer Age and By Region

- Product Code: TDR0167

- Region: Europe

- Published on: May 2025

- Total Pages: 80

Report Summary

The report titled “Italy Auto Finance Market Outlook to 2029 - By Loan Provider Type, By Vehicle Type (New vs. Used), By Type of Loan, By Tenure, By Consumer Age and By Region” provides a comprehensive analysis of the auto finance industry in Italy. The report covers an overview and genesis of the industry, overall market size in terms of loan disbursals, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and a comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on loan disbursals, loan providers, vehicle types, regions, cause-and-effect relationships, and success case studies highlighting major opportunities and market risks.

Italy Auto Finance Market Overview and Size

The Italy auto finance market was valued at EUR 22.5 Billion in 2023, driven by increasing car ownership, digital transformation in lending processes, and favorable interest rates. Key players in the market include FCA Bank, Santander Consumer Bank, Findomestic Banca, Unicredit, and BNP Paribas Personal Finance. These players are recognized for their wide network of dealerships, customizable loan offerings, and strong consumer trust.

In 2023, FCA Bank introduced a fully digital loan approval system, streamlining the application process and reducing approval time to under 24 hours. Urban regions such as Milan, Rome, and Turin are leading markets, owing to higher income levels and dense vehicle ownership.

Market Size for Italy Auto Finance Industry on the Basis of Loan Disbursed, 2018–2023

What Factors are Leading to the Growth of Italy Auto Finance Market:

Affordable Financing Options: Competitive interest rates and flexible loan terms have made vehicle ownership more accessible to a wider population. In 2023, nearly 65% of all vehicle purchases in Italy were financed through structured loans, enabling consumers to own vehicles without large upfront payments. These financing solutions cater especially to middle-income and first-time buyers.

Rise in Used Car Financing: The growing acceptance of used cars has significantly contributed to the demand for auto loans. In 2023, used vehicles accounted for approximately 55% of total financed vehicle sales in Italy. With certified pre-owned programs and improved vehicle quality, buyers are increasingly opting for used cars with financing as a cost-effective option.

Digital Transformation in Loan Processing: The digitization of auto finance has streamlined loan applications, approvals, and disbursements. In 2023, about 48% of auto loan applications were processed through digital platforms. This shift towards online channels has reduced processing times and improved accessibility, especially for tech-savvy consumers and those in urban centers.

Which Industry Challenges Have Impacted the Growth for Italy Auto Finance Market:

High Default Risk Among Subprime Borrowers: A major concern for lenders is the rising rate of loan defaults, particularly in subprime lending segments. In 2023, non-performing auto loans accounted for approximately 6.5% of total auto finance portfolios. This trend has made lenders more cautious, resulting in tighter credit checks and reduced loan disbursal to high-risk customers.

Stringent Regulatory Compliance: Compliance with evolving EU consumer credit laws and privacy regulations, such as GDPR and the revised Consumer Credit Directive, has imposed additional operational burdens. Smaller and mid-sized lenders often struggle to keep up with these complex regulatory requirements, impacting their competitiveness in the market.

Credit Access for Young and Low-Income Consumers: Many young buyers and those without a strong credit history face challenges in securing auto loans. In 2023, less than 18% of approved loans were issued to consumers under 25, limiting the participation of a key demographic in vehicle ownership through financing.

What are the Regulations and Initiatives which have Governed the Market:

EU Consumer Credit Directive (CCD): Italy follows the updated EU CCD guidelines which emphasize transparency in loan terms, mandatory creditworthiness assessments, and standardized disclosures. These measures have enhanced consumer protection but increased compliance costs for lenders.

Government Subsidies for Low-Emission Vehicles: The Italian government provides financial incentives for the purchase and financing of electric and hybrid vehicles. These include tax credits, reduced VAT, and eco-bonuses. In 2023, these incentives led to a 28% increase in loans for electric vehicles, signaling a shift towards sustainable mobility financing.

Open Banking under PSD2: The implementation of PSD2 has enabled banks and fintechs to access consumer financial data (with consent) through APIs, improving credit risk assessment. By 2023, more than 35% of auto loan approvals used open banking data to make informed lending decisions.

Italy Auto Finance Market Segmentation

By Loan Provider Type: Bank-backed lenders dominate the auto finance market in Italy due to their extensive branch networks, long-standing customer relationships, and access to low-cost capital. These institutions offer a wide variety of loan products with flexible terms. Captive finance companies, such as FCA Bank and Toyota Financial Services, also hold a significant market share by offering brand-specific benefits, promotional interest rates, and in-house financing options at the point of sale. Fintech lenders are rapidly gaining traction, especially among younger consumers, due to their fully digital processes and quick loan disbursal.

By Vehicle Type: Used vehicles account for a higher share of financed purchases in Italy, driven by affordability, longer vehicle lifespans, and rising consumer confidence in certified pre-owned programs. New vehicle financing remains strong due to incentives from automakers and government support for EVs. In 2023, the financing split was approximately 55% used cars and 45% new cars.

By Loan Tenure: The most common loan tenures in Italy fall within the 36 to 60-month range, as this allows a manageable monthly payment without incurring excessive interest. Shorter tenures (12–24 months) are preferred by high-income individuals or those financing used vehicles with smaller loan amounts.

Competitive Landscape in Italy Auto Finance Market

The Italy auto finance market is moderately concentrated, with a mix of traditional banks, OEM-captive finance companies, and emerging fintech lenders shaping the competitive landscape. Major players such as FCA Bank, Santander Consumer Bank, Findomestic Banca, Unicredit, and BNP Paribas Personal Finance dominate the space. However, digital platforms and neo-lenders are gaining traction by offering faster, more user-friendly loan processing and innovative financial products.

| Company Name | Founding Year | Original Headquarters |

| CA Auto Bank | 1925 | Turin, Italy |

| Mobilize Financial Services Italy | 2022 | Paris, France |

| Santander Consumer Finance | 1987 | Madrid, Spain |

| Deutsche Leasing Italia | 1962 | Bad Homburg, Germany |

| Toyota Financial Services Italy | 2000 | Nagoya, Japan |

| Ferrari Financial Services | 2006 | Maranello, Italy |

| Lamborghini Financial Services | 2007 | Sant'Agata Bolognese, Italy |

| Fiat Professional Financial Services | 2007 | Turin, Italy |

| DLL Group | 1969 | Eindhoven, Netherlands |

| Leasys S.p.A. | 2001 | Rome, Italy |

Some of the recent competitor trends and key information about competitors include:

FCA Bank: As the financial arm of Stellantis, FCA Bank is a leader in the auto finance space. In 2023, it rolled out a fully digital loan processing system that cut average approval time to under 24 hours. The bank also saw a 20% increase in electric vehicle loan applications due to its green financing programs.

Santander Consumer Bank: Known for its strong dealer network, Santander expanded its presence in the used vehicle loan segment, with a 22% YoY increase in disbursals. It has also launched AI-based credit scoring tools to better evaluate risk and offer customized loan packages.

Findomestic Banca: A specialist in consumer credit, Findomestic introduced mobile-first lending options in 2023, targeting millennials and Gen Z buyers. Its focus on instant pre-approval and flexible repayment options has led to a 15% rise in loan origination through digital channels.

Unicredit: One of Italy’s largest banks, Unicredit reported a 34% increase in financing for electric and hybrid vehicles, driven by its eco-loan initiatives and partnerships with green dealerships. It also integrated open banking APIs to streamline credit assessments.

BNP Paribas Personal Finance: The company focused on southern Italy in 2023, where it launched deferred repayment schemes to support economic recovery. This helped boost its customer base in regions historically underserved by traditional lenders.

What Lies Ahead for Italy Auto Finance Market?

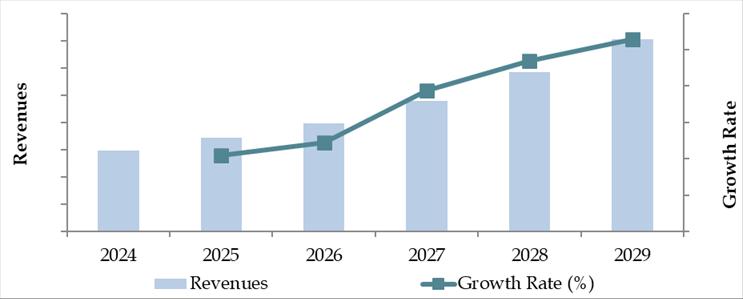

The Italy auto finance market is projected to grow steadily through 2029, demonstrating a healthy CAGR driven by increased vehicle demand, digital innovation, and government support for green mobility. The market’s evolution will be shaped by technological transformation, evolving consumer preferences, and stronger regulatory frameworks.

Acceleration of Electric Vehicle Financing: With Italy’s continued push toward environmental sustainability and the EU's climate goals, there will be a significant increase in auto loans for electric and hybrid vehicles. Financial institutions are expected to expand green financing portfolios, supported by subsidies, tax incentives, and specialized loan products tailored for EVs.

Expansion of Digital Lending Ecosystems: The future of auto financing in Italy lies in fully digitized platforms. Lenders will increasingly leverage AI, machine learning, and open banking to automate approvals, personalize loan offers, and enhance credit assessment accuracy. By 2029, it is expected that over 70% of auto loan applications will be initiated and processed online.

Rising Demand for Flexible Loan Structures: Consumers are seeking greater flexibility in repayment options, including balloon payments, leasing with buyout options, and deferred installment plans. Lenders will respond with innovative products catering to gig workers, freelancers, and those with irregular incomes—segments that are currently underserved.

Growing Penetration of Fintech and Neobanks: Fintech lenders are poised to gain market share by offering seamless digital experiences, competitive rates, and faster disbursal times. These platforms are expected to especially attract younger consumers and those in metropolitan areas seeking convenience and speed.

Future Outlook and Projections for Italy Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Italy Auto Finance Market Segmentation

• By Loan Provider Type:

o Bank-backed Auto Finance Institutions

o Captive Finance Companies (OEM-backed)

o Digital-only Fintech Lenders

o Credit Unions and Cooperative Banks

o Leasing Companies

o Peer-to-Peer Lending Platforms

• By Vehicle Type:

o New Cars

o Used Cars

o Electric Vehicles

o Hybrid Vehicles

o Luxury Vehicles

o Commercial Vehicles

• By Type of Loan:

o Standard Auto Loans

o Balloon Payment Loans

o Leasing with Option to Buy

o Operating Leases

o Subscription-Based Models

• By Loan Tenure:

o Less than 24 months

o 24–36 months

o 36–60 months

o Above 60 months

• By Consumer Age Group:

o 18–24

o 25–34

o 35–44

o 45–54

o 55+

• By Region:

o Northern Italy (Lombardy, Veneto, Emilia-Romagna)

o Central Italy (Tuscany, Lazio, Umbria)

o Southern Italy (Campania, Calabria, Sicily, Puglia)

o Islands (Sardinia, Sicily)

Players Mentioned in the Report (Banks):

- Intesa Sanpaolo

- UniCredit

- Banco BPM

- BPER Banca

- Banca Monte dei Paschi di Siena

- Banca Nazionale del Lavoro (BNL)

- Crédit Agricole Italia

- UBI Banca

- Banca Carige

- Banca Popolare di Sondrio

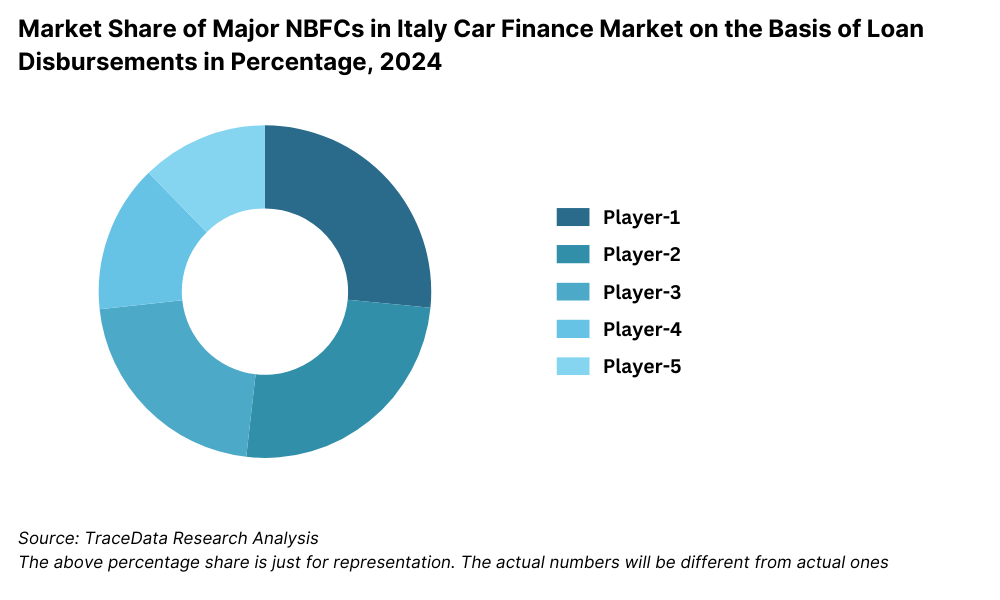

Players Mentioned in the Report (NBFCs):

- Scalapay

- AideXa

- Credimi

- Viceversa

- Prestiamoci

- SLC Auto

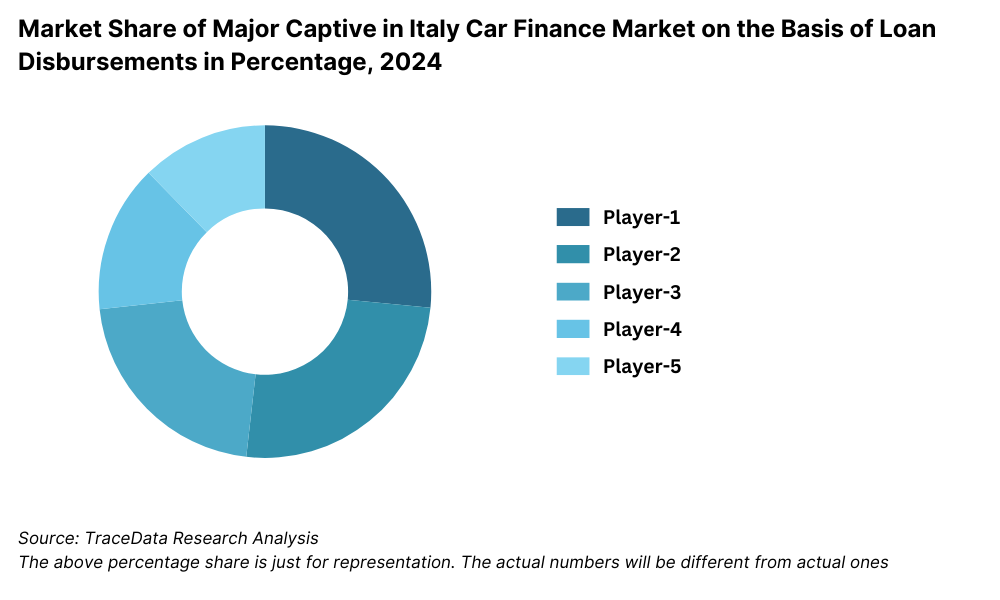

Players Mentioned in the Report (Captive):

- CA Auto Bank

- Volkswagen Financial Services Italy

- BMW Financial Services Italy

- Mercedes-Benz Financial Services Italy

- Toyota Financial Services Italy

- Ford Credit Italy

- RCI Banque (Renault and Nissan)

- Stellantis Financial Services

Key Target Audience:

• Auto Finance Companies

• Commercial Banks and Captive Finance Arms

• Online Loan Aggregators and Marketplaces

• Automotive OEMs and Dealerships

• Regulatory Bodies (e.g., Bank of Italy, EU Consumer Credit Authority)

• Fintech and Lending Startups

• Research and Policy Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Italy by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

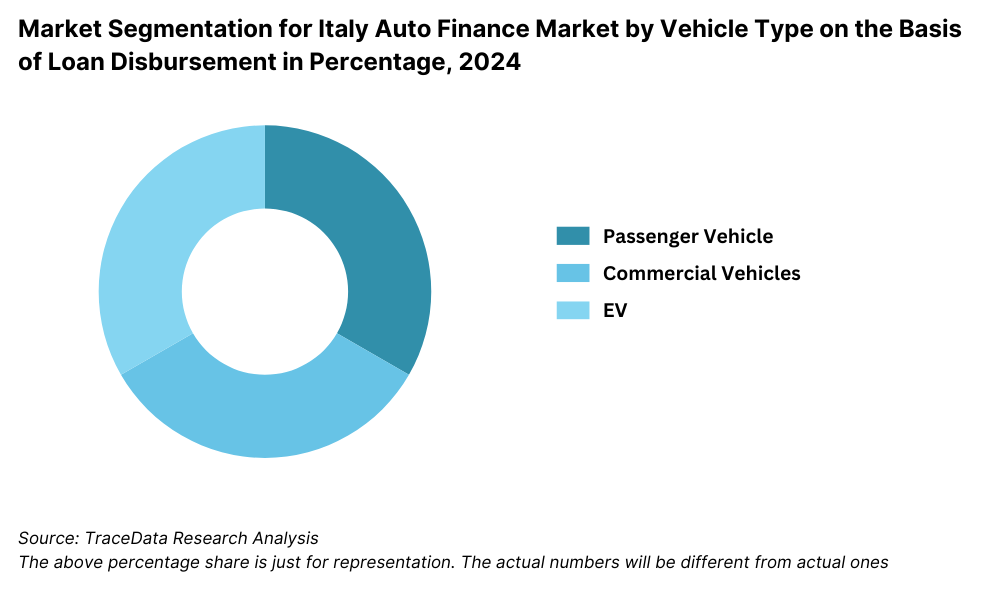

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Italy Car Finance Market

11.2. Growth Drivers for Italy Car Finance Market

11.3. SWOT Analysis for Italy Car Finance Market

11.4. Issues and Challenges for Italy Car Finance Market

11.5. Government Regulations for Italy Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Italy Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Italy Car Finance Market, 2024

17.3. Market Share of Key Captive in Italy Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Italy Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities relevant to the Italy Auto Finance Market. This includes banks, captive finance companies, fintech lenders, dealerships, and auto buyers. Based on this ecosystem, we shortlist the leading 5–6 auto finance providers in the country, using financial metrics, market share, and loan disbursal volumes.

Sourcing is carried out through industry reports, market intelligence platforms, government publications, financial filings, and multiple secondary and proprietary databases to perform desk research and compile industry-level insights.

Step 2: Desk Research

We conduct exhaustive desk research by referencing diverse sources such as central bank data, automotive and finance publications, investment reports, and company websites. This helps us analyze core market variables such as total loan disbursals, average ticket sizes, interest rates, consumer behavior, and vehicle sales data.

This also involves gathering and evaluating company-level data from press releases, financial statements, investor presentations, and regulatory disclosures to build a detailed picture of the leading players and market structure.

Step 3: Primary Research

A series of structured interviews are conducted with C-level executives, senior managers, sales directors, and auto dealers across the Italian auto finance ecosystem. These interactions aim to validate hypotheses, confirm data points, and uncover practical insights related to product offerings, loan approval processes, and emerging trends.

As part of the validation process, our team also performs mystery shopping by contacting companies as potential customers. This technique allows us to cross-check information related to pricing, approval criteria, consumer experience, and product differentiation. These findings are used to benchmark operational and financial indicators across the industry.

Step 4: Sanity Check

- Bottom-up and top-down modeling is used to validate the market sizing and segment-level analysis. Cross-verification through triangulation, trend projections, and expert feedback ensures the accuracy and credibility of the final data sets used in the report.

FAQs

1. What is the potential for the Italy Auto Finance Market?

The Italy Auto Finance Market holds significant growth potential, reaching an estimated valuation of EUR 22.5 Billion in 2023. Growth is fueled by rising vehicle ownership, the digital transformation of lending services, and supportive government policies for electric and hybrid vehicle financing. The increasing preference for flexible financing solutions and the expansion of fintech players further enhance the market’s future outlook.

2. Who are the Key Players in the Italy Auto Finance Market?

Key players in the Italy Auto Finance Market include FCA Bank, Santander Consumer Bank, Findomestic Banca, Unicredit, and BNP Paribas Personal Finance. These institutions are dominant due to their strong dealer relationships, digital lending capabilities, and diversified financing products. Emerging fintech lenders and leasing companies are also gaining traction, particularly among younger, tech-savvy consumers.

3. What are the Growth Drivers for the Italy Auto Finance Market?

Growth is driven by several factors, including increased demand for both new and used vehicles, the rapid adoption of digital loan platforms, and rising interest in electric vehicles supported by government incentives. Additionally, the introduction of personalized and flexible loan offerings has made auto financing more accessible across various income groups.

4. What are the Challenges in the Italy Auto Finance Market?

The Italy Auto Finance Market faces several challenges, such as high default risks in the subprime segment, regulatory burdens from EU lending directives, and limited financing access for young and low-income consumers. Regional disparities in credit availability and the need for greater financial literacy among borrowers also present ongoing obstacles to market expansion.