Italy Logistics and warehousing Market Outlook to 2029

By Market Segments (Freight Forwarding, Warehousing, Courier & Parcel), By End User (Retail, Manufacturing, Automotive, Pharma, FMCG), By Region (North, Central, South Italy)

- Product Code: TDR0285

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Italy Logistics and Warehousing Market Outlook to 2029 - By Market Segments (Freight Forwarding, Warehousing, Courier & Parcel), By End User (Retail, Manufacturing, Automotive, Pharma, FMCG), By Region (North, Central, South Italy)” provides a comprehensive analysis of the logistics and warehousing market in Italy. It covers the genesis of the industry, market size in terms of revenue, detailed market segmentation, major trends and developments, regulatory framework, consumer profiles, key challenges, and a competitive landscape of major companies. The report concludes with future market projections based on revenue, market segments, end users, and region-wise growth trends along with case studies highlighting key success factors and barriers.

Italy Logistics and Warehousing Market Overview and Size

The Italy logistics and warehousing market reached a valuation of EUR 115 Billion in 2023, fueled by Italy’s central position in Europe, its growing e-commerce ecosystem, and government initiatives to modernize transport infrastructure. Major players such as SDA Express Courier (Poste Italiane), DB Schenker, DHL, Kuehne + Nagel, BRT (Bartolini), and Fercam dominate the landscape, offering multimodal logistics, temperature-controlled warehousing, last-mile delivery, and integrated logistics solutions.

In 2023, Poste Italiane invested in AI-based route optimization systems and electric delivery fleets to enhance urban logistics in cities such as Milan and Rome. The northern region of Italy, home to industrial hubs such as Milan, Turin, and Bologna, remains the most active in terms of warehousing and freight movement, followed by the central region.

%2C%202019-2024.png)

What Factors are Leading to the Growth of Italy Logistics and Warehousing Market

Strategic Geographic Location: Italy acts as a gateway to both Europe and the Mediterranean region. Ports such as Genoa, Trieste, and Naples play critical roles in international freight movement. Over 35% of Italy’s exports to non-EU countries pass through these ports, enhancing the demand for warehousing and distribution centers nearby.

Rise of E-commerce and Omnichannel Retail: With over 45 million internet users and 39 million active online shoppers, Italy's e-commerce market continues to rise. In 2023, e-commerce logistics accounted for ~20% of total logistics revenue, driven by demand for fast delivery, reverse logistics, and real-time tracking.

Infrastructure Modernization and Digitalization: Italy’s Piano Nazionale di Ripresa e Resilienza (PNRR) allocates significant funding to upgrade rail and road freight corridors. Around EUR 25 billion is set aside for transport and logistics digitization by 2026, enabling automation in warehousing, tracking, and cross-border freight documentation.

Which Industry Challenges Have Impacted the Growth of the Italy Logistics and Warehousing Market

Infrastructure Bottlenecks in Southern Italy: While Northern Italy boasts modern infrastructure and integrated transport networks, the southern regions face significant logistical bottlenecks. In 2023, nearly 28% of shipment delays were reported in Southern Italy due to underdeveloped road and rail networks. This infrastructure disparity limits the efficient flow of goods and increases costs for operators serving nationwide distribution.

Labor Shortages and Rising Costs: The sector is facing acute labor shortages, particularly for warehouse staff and last-mile delivery personnel. In 2023, over 34% of logistics firms reported difficulty in hiring and retaining skilled labor, leading to higher wage costs and productivity concerns. Automation adoption is on the rise but remains financially unviable for small and medium operators.

Environmental Compliance and Carbon Emission Targets: As part of Italy’s commitment to the EU Green Deal, logistics companies face stringent sustainability requirements. Meeting carbon reduction targets, transitioning to electric fleets, and upgrading warehouses to energy-efficient standards have increased operational costs. About 45% of SMEs in the sector flagged sustainability compliance as a financial burden in 2023.

What are the Regulations and Initiatives Which Have Governed the Market

Sustainable Logistics Mandates under EU Green Deal: Italy is aligning with the European Union’s 2030 climate goals, which require logistics companies to lower emissions and adopt green transportation methods. In 2023, emission standards compliance checks increased by 40% across key logistics corridors, prompting major players to invest in electric and hybrid delivery fleets.

National Recovery and Resilience Plan (PNRR): The Italian government allocated over EUR 25 billion under the PNRR to modernize logistics infrastructure, especially rail freight and intermodal terminals. This includes investment in digital freight corridors, smart warehouses, and AI-based route planning tools. Initial rollouts in Northern Italy have already reduced shipment transit times by up to 12%.

Simplified Customs Procedures for Exporters: To boost trade competitiveness, Italy introduced fast-track customs clearance programs for certified logistics operators under the EU Authorized Economic Operator (AEO) scheme. By 2023, nearly 60% of cross-border freight volume was processed via expedited AEO channels, cutting customs processing time by 30–50%.

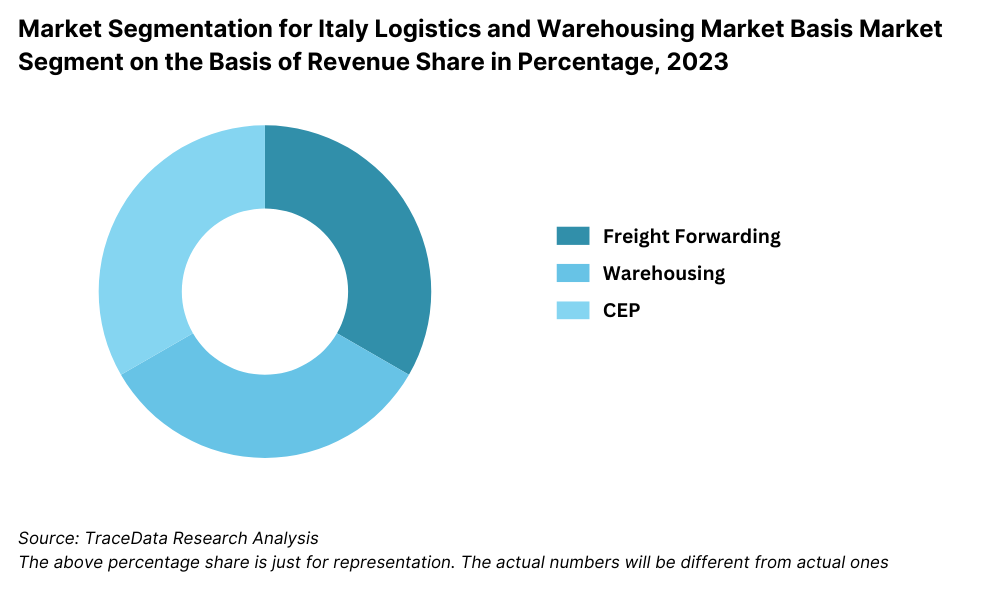

Italy Logistics and Warehousing Market Segmentation

By Market Segment: Freight forwarding dominates the Italian logistics market due to the country’s strategic geographic position, facilitating trade across Europe, the Middle East, and Africa. Italy’s major seaports like Genoa and Trieste, along with its integration into the European road and rail network, make freight forwarding highly efficient and cost-effective. Warehousing contributes significantly as well, with a strong presence in Northern Italy. It supports a variety of industries including automotive, pharma, and FMCG. Courier and parcel services have gained traction rapidly, driven by the surge in e-commerce and demand for same-day or next-day deliveries in urban areas.

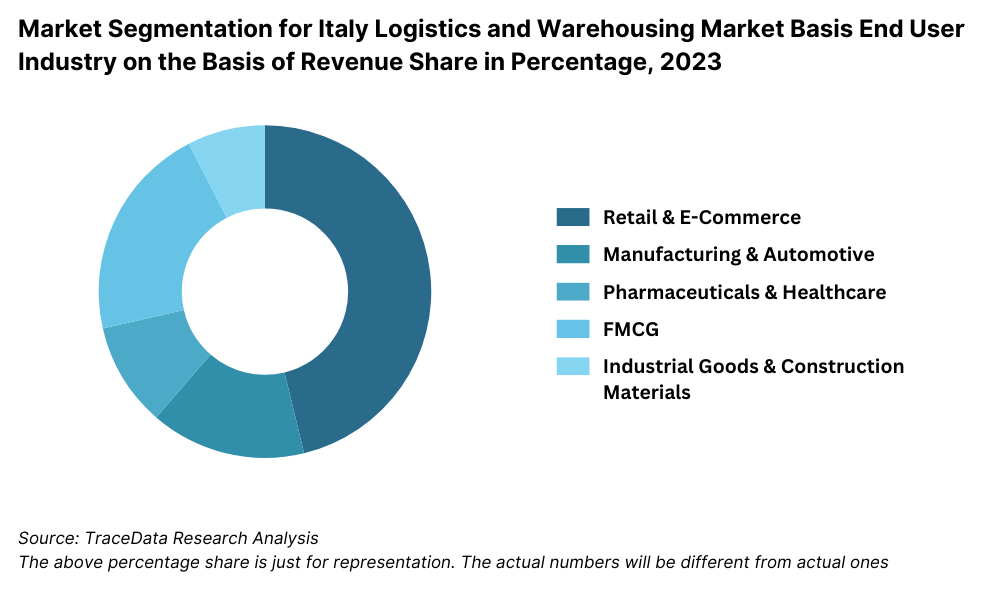

By End User Industry: Retail and e-commerce are the leading end users in the Italian logistics market, benefiting from urban fulfillment centers and last-mile delivery services. Manufacturing and automotive industries, particularly in Lombardy and Emilia-Romagna, depend on integrated warehousing and JIT (just-in-time) logistics to support production schedules. The pharmaceutical sector relies on cold chain logistics and GDP-compliant warehouses to ensure the safety and efficacy of temperature-sensitive products. FMCG is another major segment requiring fast-moving, high-volume logistics with a focus on distribution efficiency.

By Region: Northern Italy holds the largest market share due to its strong industrial base and access to international trade corridors. Cities like Milan, Bologna, and Turin act as central hubs for warehousing and multimodal transport. Central Italy, including Rome and Florence, plays a supportive role, particularly in national distribution. Southern Italy, although less developed logistically, is witnessing increased investment through the government’s recovery and infrastructure plans, aimed at reducing regional disparities and promoting economic growth.

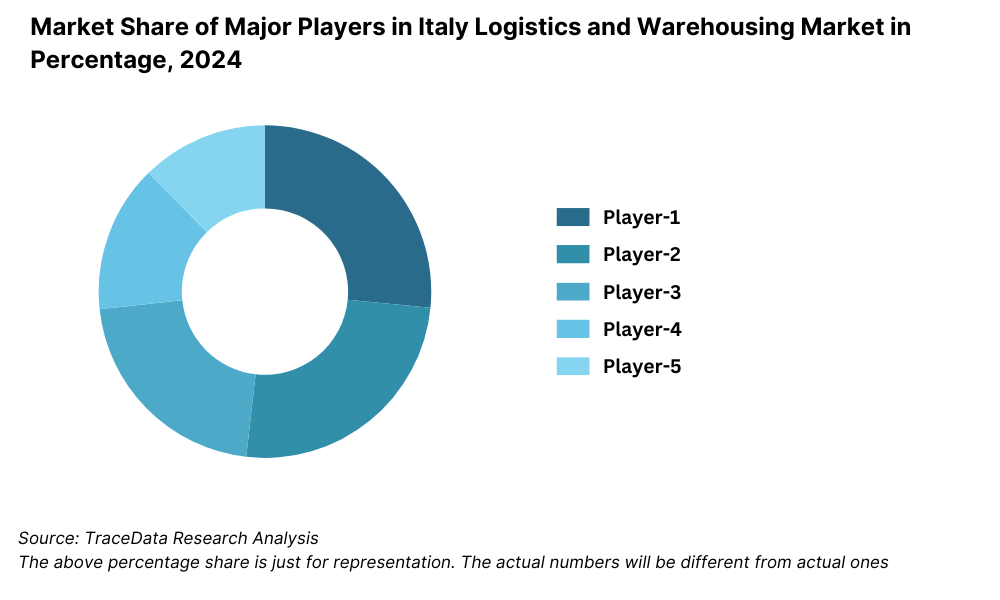

Competitive Landscape in Italy Logistics and Warehousing Market

The Italy logistics and warehousing market is moderately consolidated, with a few major global and regional players accounting for a significant share. However, the rise of e-commerce, regional logistics hubs, and specialized logistics providers has created space for mid-sized and niche players. Leading companies such as DHL Supply Chain, DB Schenker, SDA Express Courier, BRT (Bartolini), Fercam, Kuehne + Nagel, and GLS Italy dominate the market through extensive networks, multimodal capabilities, and innovative service offerings.

Company | Establishment Year | Headquarters |

DHL Supply Chain | 1969 | Bonn, Germany (Italy HQ: Milan) |

DB Schenker | 1872 | Essen, Germany (Italy HQ: Verona) |

SDA Express Courier | 1984 | Rome, Italy |

BRT (Bartolini) | 1928 | Bologna, Italy |

Fercam | 1949 | Bolzano, Italy |

Kuehne + Nagel | 1890 | Schindellegi, Switzerland (Italy HQ: Milan) |

GLS Italy | 1999 | San Giuliano Milanese, Italy |

Some of the recent competitor trends and key information about competitors include:

DHL Supply Chain: A global leader in contract logistics, DHL has significantly expanded its footprint in Italy with new automated fulfillment centers in Milan and Turin. In 2023, DHL reported a 12% increase in warehousing revenue, driven by growth in e-commerce, pharma, and industrial sectors. Their green fleet initiative in Rome has also contributed to improved sustainability metrics.

DB Schenker: Operating an extensive intermodal network across Italy, DB Schenker opened new rail freight hubs in Verona and Naples, optimizing long-haul cargo distribution. In 2023, the company achieved a 10% year-on-year growth in freight forwarding volume, with key accounts in the automotive and manufacturing industries.

SDA Express Courier: A subsidiary of Poste Italiane, SDA handles a large portion of domestic parcel delivery and B2C e-commerce shipments. In 2023, SDA processed over 120 million parcels, marking an 18% increase from the previous year. Their AI-based route optimization tool has helped reduce last-mile delivery time by 22%.

BRT (Bartolini): Known for its fast and reliable parcel delivery, BRT expanded its urban delivery network in 2023, opening 50+ new micro-hubs across metropolitan cities. The company has also launched flexible delivery windows and pick-up points, enhancing convenience for e-commerce consumers.

Fercam: Specializing in integrated and temperature-sensitive logistics, Fercam experienced a 14% growth in cold chain logistics services in 2023, especially for pharmaceuticals and food products. The company also invested in solar-powered warehouses in Northern Italy to reduce its carbon footprint.

Kuehne + Nagel: This global logistics player launched its “KN PharmaChain” solutions in Italy, offering end-to-end GDP-compliant logistics for high-value medical products. In 2023, Kuehne + Nagel saw a 9% growth in contract logistics, with a focus on automated distribution centers and predictive inventory management.

GLS Italy: Focused on express parcel services, GLS Italy has strengthened its position through cross-border integration with European GLS networks. In 2023, GLS handled over 75 million parcels and implemented real-time parcel tracking enhancements, improving customer satisfaction and delivery transparency.

What Lies Ahead for Italy Logistics and Warehousing Market?

The Italy logistics and warehousing market is projected to grow steadily through 2029, exhibiting a healthy CAGR during the forecast period. This growth will be driven by the expansion of e-commerce, modernization of transport infrastructure, and Italy’s strategic position within European trade corridors.

Digital Transformation of Supply Chains: The integration of technologies such as artificial intelligence, Internet of Things (IoT), and predictive analytics in logistics operations is expected to significantly improve route optimization, inventory tracking, and warehouse automation. These advancements will enhance efficiency, reduce operational costs, and offer real-time insights, benefiting both logistics providers and end users.

Expansion of Cold Chain and Pharma Logistics: With increasing global demand for temperature-sensitive goods—particularly pharmaceuticals and perishable foods—Italy is likely to witness a significant rise in investment in cold chain infrastructure. The growth of this segment will be further supported by stringent compliance requirements and a strong export orientation in pharma and food processing sectors.

Sustainable and Green Logistics Initiatives: Italy’s logistics players are expected to increasingly adopt electric delivery vehicles, energy-efficient warehouses, and carbon-neutral shipping methods. These efforts align with the EU Green Deal targets and growing consumer expectations for environmentally responsible practices, making sustainability a competitive differentiator.

Development of Southern Logistics Corridors: Under the National Recovery and Resilience Plan (PNRR), significant investment is anticipated in the logistics corridors of Southern Italy. These efforts aim to reduce regional disparities, improve multimodal connectivity, and make southern ports more competitive. By 2029, this development could open up new markets and improve last-mile access in previously underserved areas.

%2C%202024-2030.png)

Italy Logistics and Warehousing Market Segmentation

• By Market Segment:

o Freight Forwarding

o Warehousing Services

o Courier & Parcel Services

o Cold Chain Logistics

o Contract Logistics

o Last-Mile Delivery

o Value-Added Services (Packaging, Labeling, Customs Clearance)

• By End User Industry:

o Retail & E-commerce

o Manufacturing

o Automotive

o Pharmaceutical & Healthcare

o FMCG (Fast-Moving Consumer Goods)

o Food & Beverage

o Chemicals

• By Mode of Transport:

o Road Transport

o Rail Freight

o Air Cargo

o Sea Freight

o Intermodal Transport

• By Ownership Type:

o Third-Party Logistics (3PL)

o In-House Logistics

o Fourth-Party Logistics (4PL)

• By Region:

o Northern Italy

o Central Italy

o Southern Italy

o Islands (Sicily, Sardinia)

Players Mentioned in the Report:

• DHL Supply Chain

• DB Schenker

• SDA Express Courier

• BRT (Bartolini)

• Fercam

• Kuehne + Nagel

• GLS Italy

• Amazon Logistics Italy

• Poste Italiane

• CEVA Logistics

Key Target Audience:

• Logistics and Freight Forwarding Companies

• E-commerce and Retail Companies

• Manufacturing and Automotive Firms

• Cold Chain Operators and Pharma Distributors

• Italian Ministry of Infrastructure and Transport

• Regional Development Authorities

• Trade and Customs Agencies

• Logistics Real Estate Developers

• Research and Policy Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Italy Logistics and Warehousing Market

4.3. Business Model Canvas for Italy Logistics and Warehousing Market

4.4. Freight and Delivery Decision-Making Process

4.5. Warehouse and Facility Setup Decision-Making Process

5.1. Freight Volume Movement in Italy, 2018-2024

5.2. Warehousing Space Occupancy and Rental Trends, 2018-2024

5.3. Public Infrastructure Investment in Logistics and Transport, 2024

5.4. Number of Logistics Companies and Warehouses in Italy by Region

8.1. Revenues, 2018-2024

8.2. Volume Handled, 2018-2024

9.1. By Market Segment (Freight Forwarding, Warehousing, Courier & Parcel), 2023-2024P

9.2. By Transport Mode (Road, Rail, Sea, Air), 2023-2024P

9.3. By End User Industry (Retail, Automotive, Pharma, FMCG, Manufacturing), 2023-2024P

9.4. By Region (Northern, Central, Southern Italy, Islands), 2023-2024P

9.5. By Logistics Model (3PL, 4PL, In-House), 2023-2024P

10.1. End-User Logistics Requirements and Cohort Analysis

10.2. Customer Journey and Logistics Partner Selection

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Italy Logistics and Warehousing Market

11.2. Growth Drivers for Italy Logistics and Warehousing Market

11.3. SWOT Analysis for Italy Logistics and Warehousing Market

11.4. Issues and Challenges for Italy Logistics and Warehousing Market

11.5. Government Regulations and EU Mandates for Italy Logistics and Warehousing Market

12.1. Market Size and Future Potential for E-commerce and Parcel Logistics, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Logistics Companies Based on Service Type, Network, Technology, Fulfillment Capabilities

13.1. Warehouse Absorption Trends and Land Availability, 2018-2029

13.2. Rental Yields and Occupancy Rates

13.3. Tier 1 vs Tier 2 Region Analysis

13.4. Key Players in Logistics Real Estate and Industrial Parks

16.1. Benchmark of Key Competitors Including Company Overview, Network Size, Service Offerings, Fleet Size, Warehouse Infrastructure, Technology Use, and Sector Specialization

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Volume Handled, 2025-2029

18.1. By Market Segment (Freight Forwarding, Warehousing, Courier & Parcel), 2025-2029

18.2. By Transport Mode (Road, Rail, Sea, Air), 2025-2029

18.3. By End User Industry (Retail, Automotive, Pharma, FMCG, Manufacturing), 2025-2029

18.4. By Region (Northern, Central, Southern Italy, Islands), 2025-2029

18.5. By Logistics Model (3PL, 4PL, In-House), 2025-2029

18.6. Recommendations

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Italy Logistics and Warehousing Market. Based on this ecosystem, we shortlist 5–6 leading logistics providers in the country based on their financial information, warehousing footprint, modal capabilities (road, rail, sea), and operational scale.

Sourcing is done through industry articles, government publications (e.g., Ministry of Infrastructure and Transport), and a combination of secondary and proprietary databases to perform desk research and collate industry-level insights.

Step 2: Desk Research

We conduct an exhaustive desk research process by leveraging diverse secondary and proprietary sources. This includes data from trade associations, Eurostat, company websites, press releases, investor presentations, and logistic-specific databases.

We examine variables such as market revenue, freight volumes, regional distribution, warehouse capacity, infrastructure investments, and pricing levels. This is supported by a detailed review of company-specific metrics, including annual reports and published financials. The desk research phase aims to establish a robust understanding of market structure and participant dynamics.

Step 3: Primary Research

A series of in-depth interviews are conducted with C-level executives, warehouse operators, freight forwarders, third-party logistics providers (3PLs), and key end-users from retail, pharma, and automotive sectors. These discussions are designed to validate market estimates, triangulate statistical assumptions, and derive qualitative insights about growth drivers and bottlenecks.

As part of validation, our team also conducts disguised interviews by approaching companies as potential clients. This covert approach helps us cross-check operational and financial inputs shared during direct interviews, offering greater transparency around pricing models, service offerings, value chain activities, and regional coverage.

Step 4: Sanity Check

- A combination of top-down and bottom-up market sizing techniques are applied to ensure robustness and accuracy. Modeling exercises are performed to reconcile overall market size with segment-level data (e.g., freight forwarding, warehousing, parcel services). This triangulation process serves as the final sanity check prior to forecasting and analysis.

FAQs

1. What is the potential for the Italy Logistics and Warehousing Market?

The Italy logistics and warehousing market is poised for consistent growth, projected to reach a valuation of EUR 158 Billion by 2029. This growth is driven by Italy’s strategic location in the heart of Europe, increasing demand from e-commerce, expanding cold chain requirements, and government investments in transport infrastructure under the National Recovery and Resilience Plan (PNRR).

2. Who are the Key Players in the Italy Logistics and Warehousing Market?

Key players in the Italy logistics and warehousing market include DHL Supply Chain, DB Schenker, SDA Express Courier, BRT (Bartolini), Fercam, and Kuehne + Nagel. These companies lead due to their extensive networks, multimodal capabilities, and specialized offerings across various sectors like e-commerce, pharma, and automotive logistics.

3. What are the Growth Drivers for the Italy Logistics and Warehousing Market?

Primary growth drivers include the rise in online shopping, which has led to increased demand for last-mile delivery and fulfillment centers. Investments in cold chain logistics for pharmaceuticals and food, regulatory incentives for green logistics, and infrastructure upgrades through the EU-backed PNRR program also contribute significantly to market expansion.

4. What are the Challenges in the Italy Logistics and Warehousing Market?

The market faces several challenges including regional infrastructure disparities, particularly in Southern Italy, labor shortages in warehousing and delivery roles, and rising costs associated with sustainability compliance. Additionally, increasing pressure from environmental regulations and the need for digital transformation pose significant hurdles for small and mid-sized operators.