Italy Smart Wearables Market Outlook to 2030

By Device Type, By Application, By Connectivity, By Sales Channel, and By Region

- Product Code: TDR0378

- Region: Europe

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “Italy Smart Wearables Market Outlook to 2030 - By Device Type, By Application, By Connectivity, By Sales Channel, and By Region” provides a comprehensive analysis of the smart wearables market in Italy. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the smart wearables market. The report concludes with future market projections based on device volumes, connectivity evolution, applications, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

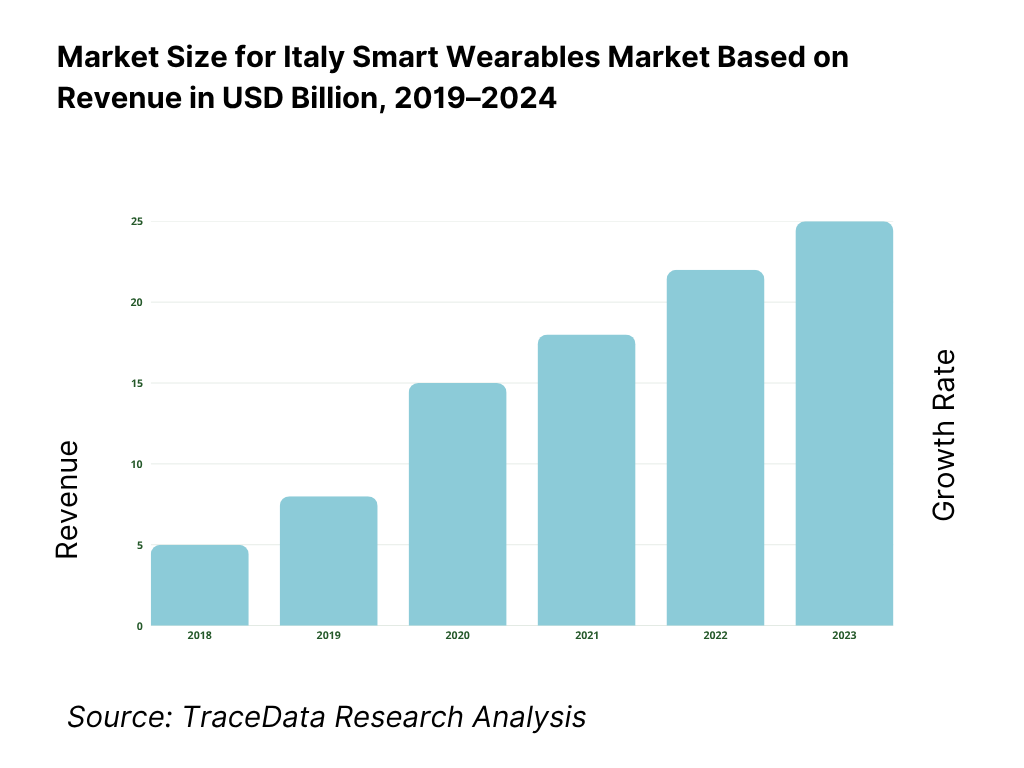

Italy Smart Wearables Market Overview and Size

The Italy smart wearables market is valued at USD 1.33 billion, based on a five-year historical analysis of the country’s wearable-technology revenue series. Momentum continued into the next cycle, with Italy’s broader connected-health and consumer wearables lines together reported at USD 1.74 billion the following year. Growth is underpinned by wrist-wear leadership (notably smartwatches), expanding health features, and rising attach via retail/e-commerce and operator bundles. Source: Market Research Future — Italy Wearable Technology & Italy Smart Watch market country dashboards.

Adoption concentrates around Milan, Rome, Turin and Bologna, where higher disposable incomes, dense premium retail (e.g., Apple Store, MediaWorld/Unieuro footprints), and telco eSIM provisioning by TIM, Vodafone and Wind Tre accelerate uptake; Milan’s role as the payments/retail innovation hub also helps (e.g., Tap to Pay on iPhone rollout with Nexi, Adyen, Stripe, launched across Italian merchants starting with Prada’s Milan stores). National volume is further pulled by sports/outdoor culture in the North and strong online marketplaces.

What Factors are Leading to the Growth of the Italy Smart Wearables Market:

Ageing population and clinical workload driving medical-grade and wellness wearables adoption: Italy’s demographic structure is skewing older, creating sustained demand for continuous health monitoring. The resident population is 58,986,023, with people aged 65+ reaching 14,573,000 and life expectancy at 83.4 years. Hospitals processed 7,646,540 inpatient discharge records in the most recent full year available, generating 52,428,952 bed-days and day-hospital accesses. This combination of high longevity and heavy inpatient throughput is a direct pull for remote patient monitoring, cardiometabolic screening, and fall-detection wearables to reduce hospital load and enable home-based follow-up.

Deep connectivity base and fluid mobile market enable always-on smart wearables: The device addressable base is underpinned by dense mobile access: Italy posted 132 mobile cellular subscriptions per 100 people, implying multiple active SIMs per user—crucial for LTE/eSIM/BT-tethered wearables. Market fluidity is high: AGCOM recorded 7.7 million mobile number portability (MNP) operations in one year, reflecting competitive switching that benefits vendors bundling watches/bands with plans. A population of 58,986,023 plus multi-SIM penetration increases the reachable base for connected health and fitness devices, companion apps, and subscription services.

Digitized payments and NFC acceptance support wrist-based pay and transit use-cases: Wearable payments rely on a vibrant card infrastructure. Italy’s domestic BANCOMAT network processes around 2,000,000,000 transactions worth over €160,000,000,000 annually, while the ECB reports 25.8 billion contactless card payments in the euro area in the first half of the latest year alone—an NFC environment that smartwatches tap into for retail, transit, and venue access. The Bank of Italy’s Payments Statistics confirm ongoing monitoring and expansion of POS infrastructure, reinforcing a national environment conducive to wrist-based payment adoption.

Which Industry Challenges Have Impacted the Growth of the Italy Smart Wearables Market:

Demographic headwinds: shrinking births and an older dependency profile: Italy faces record-low births and a shrinking working-age base, which can temper discretionary device purchases and shift demand toward elder-care features. There were 370,000 births and a total resident population of 58,930,000, alongside an over-65 cohort of 14,573,000. Life expectancy rose to 83.4 years, lifting health-care demand but straining payers and family caregivers. This demographic mix can elongate replacement cycles for fitness wearables while increasing requirements for clinical-grade functions and reimbursement alignment.

Data protection enforcement raises compliance stakes for health-grade wearables: GDPR compliance is non-negotiable for devices collecting biometric and location data. Italy’s Data Protection Authority (Garante) reported more than €24,000,000 in fines collected and 130 inspections during the latest reporting year, with 2,204 notified data breaches. For wearable vendors, this means rigorous consent, minimization, and DPIAs for special-category data, along with robust security for companion apps and cloud systems. Non-compliance risks disruption of Italian sales channels and app distribution, especially for ECG/SpO₂ devices processing sensitive health data.

Integration burden with hospital flows and regional health systems: Italy’s hospital activity and inter-regional patient mobility complicate interoperability for clinical wearables. The Ministry of Health’s SDO database logged 7,358,727 coded discharge records (excluding non-censused institutions and healthy newborns), of which 5,413,992 were acute ordinary discharges and 1,588,792 day-hospital events. Cross-region flows add complexity for data exchange and follow-up. Vendors must map device data to regional electronic health records and clinician workflows to realize RPM benefits at scale, a non-trivial task across Italy’s decentralized health governance.

What are the Regulations and Initiatives which have Governed the Market:

EU Medical Device Regulation (MDR) governs health-grade wearables: If a wearable makes medical claims (e.g., ECG), it falls under MDR 2017/745, requiring CE marking via a Notified Body for most risk classes. Italy hosts designated MDR NBs such as ECM NB 1282 and Certiquality NB 0546, and certifications are published in EUDAMED’s Notified Bodies & Certificates module. MDR’s consolidated framework mandates clinical evaluation, PMS/PMCF, and UDI—critical for any vendor transitioning from consumer “wellness” status to certified “medical” classification.

GDPR frames data collection, biometrics, and international transfers: Regulation 2016/679 applies to all processing of personal and special-category data (health/biometrics) from Italian users. Enforcement is active: the Garante collected over €24,000,000 in fines, handled 2,204 breach notifications, and carried out 130 inspections in the latest reporting cycle. Wearable providers must implement explicit consent, DPIAs, DPA contracts, and safeguard cross-border transfers to ensure lawful processing for continuous monitoring, geolocation, and payments.

Radio Equipment Directive (RED) & telecom oversight for connectivity and safety: All Bluetooth/Wi-Fi/LTE wearables must comply with RED 2014/53/EU requirements on RF safety, EMC, and spectrum use to be placed on the EU market, with CE marking and supporting technical documentation. The directive also includes cybersecurity and privacy provisions for certain device classes. Market dynamics under AGCOM oversight remain fluid, evidenced by 7.7 million MNP operations in a year—relevant for telco-bundled wearables using eSIM, VoLTE, and advanced connectivity features.

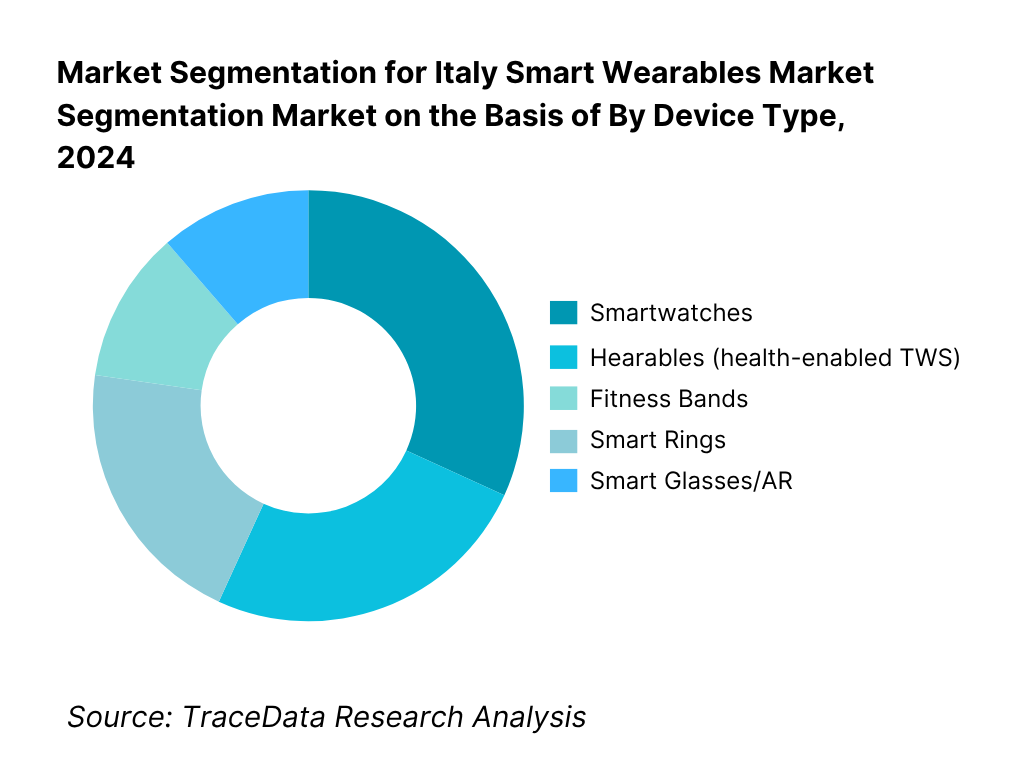

Italy Smart Wearables Market Segmentation

By Device Type: Italy Smart Wearables market is segmented by device type into smartwatches, fitness bands, hearables, smart rings and smart glasses. Recently, smartwatches have a dominant market share in Italy under the segmentation device type; it is due to their deep integration with iOS/Android ecosystems, ECG/AFib, SpO₂, skin temperature and women’s-health features, plus NFC wallet acceptance and eSIM/LTE options supporting standalone calling. Strong brand gravity (Apple, Samsung, Garmin) and wide door coverage at MediaWorld, Unieuro, Euronics and telco shops keep smartwatch sell-out and upgrade cadence higher than other categories.

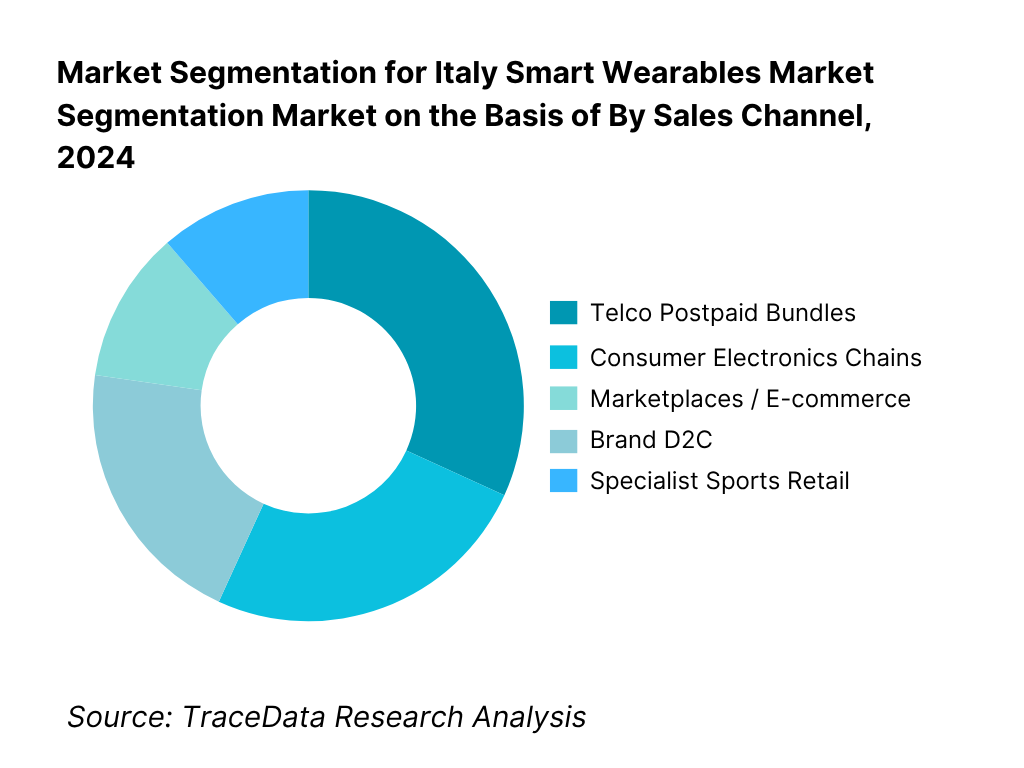

By Sales Channel: Italy Smart Wearables market is segmented by sales channel into telco postpaid bundles, CE chains, marketplaces/e-commerce, brand D2C, and specialist sports retail. Recently, telco postpaid bundles have a dominant market share in Italy under the segmentation sales channel; it is due to instalment financing, device-plus-plan bundles, eSIM activation in-store, and insurance/extended-service attach, which reduce up-front cost friction. Operator promotions synced with smartphone refresh waves and wallet integrations raise conversion, while CE chains and Amazon.it remain strong for mid-price segments and seasonal events.

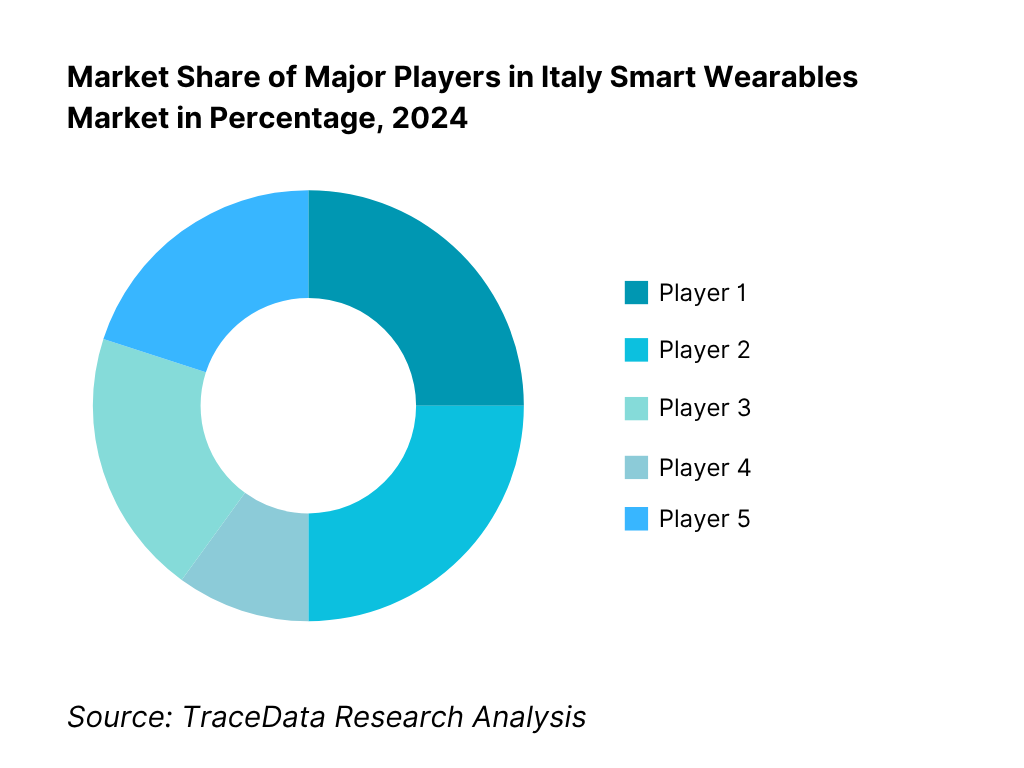

Competitive Landscape in Italy Smart Wearables Market

The Italy Smart Wearables market is shaped by a concentrated set of global platforms with select domestic health-wearable specialists. Consolidation around Apple, Samsung, Garmin and Google (Fitbit) sets the software/services pace (health dashboards, AI coaching, payments), while Withings, Polar, Suunto, Amazfit/Zepp sustain multi-price coverage. Italian champions Empatica (medical-grade wearables) and ComfTech (smart textiles) anchor clinical and textile-integrated niches, respectively—broadening hospital, research, and eldercare pathways.

Name | Founding Year | Original Headquarters |

Apple | 1976 | Cupertino, USA |

Samsung Electronics | 1938 | Seoul, South Korea |

Garmin Ltd. | 1989 | Olathe, USA |

Fitbit (Google LLC) | 2007 | Mountain View, USA |

Huawei Technologies Co., Ltd. | 1987 | Shenzhen, China |

Xiaomi Corporation | 2010 | Beijing, China |

Amazfit (Zepp Health Corporation) | 2013 | Hefei, China |

Withings | 2008 | Issy-les-Moulineaux, France |

Polar Electro Oy | 1977 | Kempele, Finland |

Suunto Oy | 1936 | Vantaa, Finland |

OPPO Electronics Corp. | 2004 | Dongguan, China |

Fossil Group, Inc. | 1984 | Richardson, USA |

Empatica Inc. | 2013 | Milan, Italy |

ComfTech Srl | 2010 | Monza, Italy |

Mobvoi Information Technology Co., Ltd. (TicWatch) | 2012 | Beijing, China |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Apple: Apple continues to lead Italy’s smartwatch segment, driven by the launch of advanced health sensors and deeper ecosystem integration. The company expanded its Apple Watch Ultra and Series 9 lines with enhanced blood oxygen, temperature, and ECG monitoring features, while Italy became part of the Tap to Pay on iPhone rollout, strengthening its payments ecosystem. Partnerships with TIM, Vodafone, and Wind Tre further boosted eSIM watch activations across major Italian cities.

Samsung Electronics: Samsung consolidated its position with the Galaxy Watch6 range, emphasizing personalized health tracking through its BioActive Sensor and new sleep-scoring algorithms. The company also advanced Google Wallet compatibility and collaborated with leading retailers such as MediaWorld and Unieuro to expand its presence in the premium wearables segment.

Garmin Ltd.: Garmin expanded its sports and outdoor wearables line-up in Italy, focusing on endurance athletes and adventure travelers. The company introduced new Forerunner and Fenix series models equipped with solar charging and multi-band GPS. Its partnership with major Italian sports retailers, including Decathlon and Cisalfa, has strengthened brand accessibility among performance-driven consumers.

Fitbit (Google): Fitbit continued to integrate deeper with Google’s ecosystem following its full transition under Google Health. In Italy, the Fitbit Charge 6 launch emphasized AI-driven wellness analytics and integration with YouTube Music and Google Wallet. The brand focused heavily on stress management and sleep health, targeting wellness-conscious professionals and urban users.

Huawei Technologies: Huawei maintained strong traction in the mid-price smartwatch and band categories with the Watch GT 4 and Band 8, offering long battery life and fitness features at accessible price points. Its focus on HarmonyOS integration and AI-powered health algorithms resonated well with Italian consumers seeking affordability without compromising on design or performance.

What Lies Ahead for Italy Smart Wearables Market?

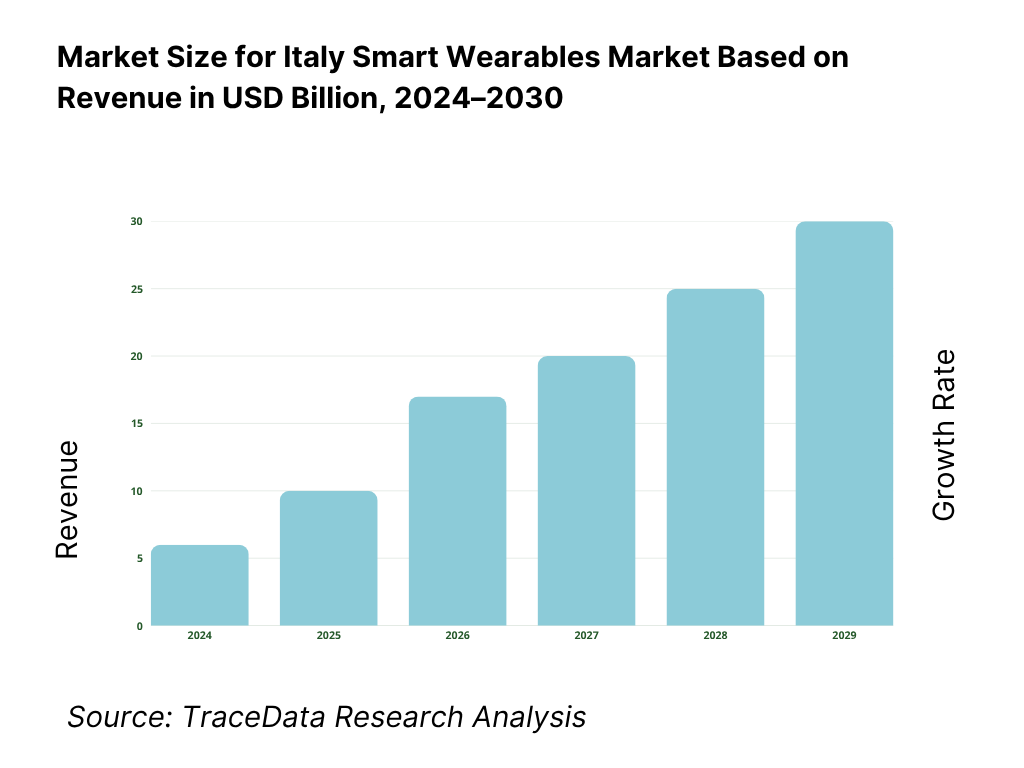

The Italy Smart Wearables Market is projected to grow steadily through 2030, supported by Italy’s strong health-tech digitization, expanding telemedicine ecosystem, and maturing payment and connectivity infrastructure. Growth will continue to be fueled by the increasing integration of smartwatches into digital health frameworks, rising consumer awareness of wellness technologies, and the expansion of NFC-enabled payments and eSIM-based wearables across Italy’s major mobile operators.

Rise of Health-Centric and Medical-Grade Wearables: The future of Italy’s wearables market will see a strong transition from fitness-only devices to clinical-grade monitoring solutions. With 14.57 million residents aged 65 years and above (ISTAT) and hospitals recording over 7.6 million inpatient discharges annually (Ministero della Salute), continuous remote monitoring through ECG, blood-oxygen, and temperature-tracking devices is becoming integral to care delivery. Partnerships between hospitals and medical-certified vendors like Empatica and Withings are expected to expand remote-patient monitoring and post-discharge management solutions across regions.

Expansion of eSIM-Enabled and Telco-Bundled Smartwatches: Italy’s highly competitive telecom market—hosting 132 mobile subscriptions per 100 people (World Bank/ITU) and over 7.7 million annual number-portability operations (AGCOM)—is expected to fuel the next growth wave. Telco bundles with Apple, Samsung, and Huawei wearables are becoming mainstream, with carriers such as TIM, Vodafone Italia, and Wind Tre offering multi-device data plans and instalment financing. This structure reduces upfront cost barriers and will drive higher adoption of LTE-connected wearables that operate independently from smartphones.

AI, Analytics, and Personalization in Wellness Ecosystems: Artificial intelligence and analytics are set to redefine user engagement in the Italy smart wearables landscape. With national broadband coverage exceeding 99% of the population (AGCOM Osservatorio), Italian consumers increasingly expect real-time insights into activity, sleep, and stress metrics. Wearables will evolve into predictive wellness companions, powered by machine-learning algorithms that enable early-warning systems for cardiovascular anomalies and fatigue prediction. Local integration with Italy’s Fascicolo Sanitario Elettronico 2.0 and EU-wide health data spaces will further align device data with personalized digital-care pathways.

Italy Smart Wearables Market Segmentation

By Device Type

Smartwatches

Fitness Bands

Hearables (Health-Enabled TWS)

Smart Rings

Smart Glasses / AR Wearables

By Application

Health & Wellness Monitoring

Fitness & Sports Tracking

Communication & Connectivity

Payments & Access Control

Safety & Emergency Services

By Connectivity

Bluetooth-Only Devices

Wi-Fi Enabled Devices

LTE / eSIM Cellular Devices

Dual-Band GPS / GNSS Devices

UWB / Short-Range RF Devices

By Sales Channel

Telecom Operator Bundles

Consumer Electronics Chains

Online Marketplaces / E-Commerce

Direct-to-Consumer (D2C) Brand Stores

Sports & Specialty Retailers

By Region

Nord-Ovest

Nord-Est

Centro

Sud

Isole

Players Mentioned in the Report:

Apple

Samsung

Garmin

Google (Fitbit)

Xiaomi

Huawei

Amazfit (Zepp Health)

Withings

Polar

Suunto

OPPO

Fossil Group

Empatica

ComfTech

Mobvoi (TicWatch)

Key Target Audience

Consumer electronics chains (MediaWorld, Unieuro, Euronics)

Mobile network operators (TIM, Vodafone Italia, Wind Tre)

Hospitals & regional health authorities (Regione Lombardia; Regione Lazio; Regione Emilia-Romagna)

Remote patient-monitoring platforms & digital health ISVs

Payments processors & acquirers (Nexi, Adyen, Stripe)

Investments and venture capitalist firms (growth equity, health-tech & device funds)

Government & regulatory bodies (Ministero della Salute; Garante per la Protezione dei Dati Personali; Agenzia per l’Italia Digitale)

Sports federations and performance centres

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Smart Wearables-(Retail, Telco Bundles, E-commerce, D2C, Subscription-Based, B2B Health Contracts)

4.2. Revenue Streams for Italy Smart Wearables Market-(Device Sales, Subscription Services, Health Data Analytics, App Monetization, Pay-per-Use, Insurance Integration, and After-Sales Revenue)

4.3. Business Model Canvas for Italy Smart Wearables Market-(Key Partners, Key Activities, Value Proposition, Customer Segments, Channels, Cost Structure, Revenue Streams)

5.1. Freelance Fitness Coaches and Health Tech Startups vs. Full-Time OEM Training Ecosystems

5.2. Investment Model in Italy Smart Wearables Market-(Venture Capital, Corporate Investment, PNRR Digital Health Funds, EU Horizon Funding)

5.3. Comparative Analysis of Product Funneling by Telcos, OEMs, and Health Institutions

5.4. Consumer Spending on Wearable Devices by Age and Income Group

8.1. Revenues (In EUR Mn), 2019-2024

8.2. Unit Shipments and ASP Analysis

8.3. Contribution of Premium vs. Mid-tier vs. Budget Segments

9.1. By Market Structure-(In-House Brand Ecosystem vs. Third-Party Platforms)

9.2. By Device Type-(Smartwatch, Fitness Band, Hearables, Smart Glasses, Smart Rings)

9.3. By Application-(Health Monitoring, Fitness Tracking, Communication, Payments, Safety & Emergency)

9.4. By Industry Verticals-(Healthcare, Sports & Fitness, Consumer Electronics, Industrial Safety, Fashion Tech)

9.5. By Company Size-(Large Enterprises, SMEs, Startups/Tech Hubs)

9.6. By Consumer Demographics-(Age, Gender, Income, Occupation)

9.7. By Connectivity-(Bluetooth, LTE/eSIM, Wi-Fi, UWB, NFC)

9.8. By Region-(Nord-Ovest, Nord-Est, Centro, Sud, Isole)

10.1. Consumer Cohort Analysis (Athletes, Professionals, Seniors, Youth)

10.2. Buying Behavior and Decision-Making Process

10.3. Product Retention, Upgrade, and Subscription Renewal Rates

10.4. Return on Investment and Device Replacement Cycles

10.5. Gap Analysis Framework for Demand Latency

11.1. Trends and Developments in Italy Smart Wearables Market

11.2. Growth Drivers

11.3. SWOT Analysis

11.4. Issues and Challenges

11.5. Government Regulations and Policy Framework

12.1. Market Size and Future Potential for Connected Wearable Apps (2018-2029)

12.2. Business Model and Revenue Streams for App Integrators and Health Platforms

12.3. Integration of Cloud Analytics and AI-Driven Coaching

15.1. Market Share of Key Players (By Revenue & Units)

15.2. Benchmark of Key Competitors-(Company Overview, USP, Product Line, Revenue, Distribution Reach, Technology Stack, Pricing Model, AI/ML Features, Payment Integration, Partnerships, App Ecosystem, Marketing Strategies, Recent Developments)

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant Mapping for Smart Wearables (Italy Context)

15.5. Bowman’s Strategic Clock-Competitive Advantage Assessment

16.1. Revenues (In EUR Mn), 2025-2030

16.2. Forecast by Installed Base and New Sales

17.1. By Market Structure-(In-House Ecosystem vs. Third-Party Platforms)

17.2. By Device Type-(Smartwatch, Fitness Band, Hearables, Smart Rings, Smart Glasses)

17.3. By Application-(Health Monitoring, Fitness Tracking, Communication, Payments, Safety & Emergency)

17.4. By Industry Verticals-(Healthcare, Sports & Fitness, Industrial, Fashion, Consumer Electronics)

17.5. By Company Size-(Large Enterprises, SMEs, Startups)

17.6. By Consumer Demographics-(Age, Gender, Income)

17.7. By Connectivity-(Bluetooth, LTE/eSIM, Wi-Fi, NFC)

17.8. By Region-(Nord-Ovest, Nord-Est, Centro, Sud, Isole)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities in the Italy Smart Wearables Market. On the supply side, this includes device OEMs (Apple, Samsung, Garmin, Fitbit, Huawei, Amazfit, Empatica, ComfTech), component manufacturers, telco operators (TIM, Vodafone Italia, Wind Tre), retail chains (MediaWorld, Unieuro, Euronics), distributors, and digital payment enablers (Nexi, Adyen). On the demand side, the focus extends to healthcare institutions, corporate wellness programs, insurance providers, and individual consumers across fitness and clinical use-cases. Based on this mapped ecosystem, we shortlist the five to six leading wearable players in Italy using criteria such as financial disclosures, installed base estimates, market reach, distribution partnerships, and user engagement metrics. Sourcing is conducted through industry publications, EU trade statistics, AGCOM communications reports, ISTAT data, and proprietary device tracker databases to consolidate industry-level insights and establish a validated ecosystem baseline.

Step 2: Desk Research

We conduct an extensive desk research process by referencing diverse secondary and proprietary databases. This includes review of data from ISTAT, AGCOM, Ministry of Health (SDO reports), Bank of Italy, Eurostat, World Bank, and corporate filings from wearable manufacturers and telco partners. This enables us to analyze market structure, annual device shipments, operator bundle penetration, NFC and payment ecosystem coverage, eSIM activations, and channel pricing dynamics. Company-level data are cross-verified using press releases, sustainability and financial reports, regulatory filings under MDR, and vendor compliance records (CE/EUDAMED). This phase establishes a granular understanding of both the operating environment and value chain participants, providing a reliable foundation for quantitative modeling.

Step 3: Primary Research

We conduct a series of in-depth interviews with senior executives, product managers, and regulatory specialists from smartwatch OEMs, component suppliers, telecom operators, retail channel partners, and health-technology integrators. This step is designed to validate market hypotheses, confirm operational metrics, and extract insights on pricing, consumer behavior, device mix, regulatory challenges, and integration with healthcare systems. A bottom-up approach is adopted to quantify revenue contributions by each major participant, which is then aggregated to the national market estimate. As part of our validation strategy, we perform disguised interviews simulating B2B partnership inquiries with retailers, telcos, and healthcare buyers to cross-verify sales data, channel margins, and warranty policies. These discussions help triangulate primary responses with secondary datasets, ensuring a fully verified view of Italy’s smart wearables revenue composition, service models, and adoption barriers.

Step 4: Sanity Check

Finally, a comprehensive top-down and bottom-up triangulation process is executed to verify all numerical outcomes. Market size modeling is supported by macroeconomic indicators such as Italy’s total population (58.9 million, ISTAT), internet and mobile subscription base (132 per 100 inhabitants, World Bank/ITU), and healthcare throughput (7.6 million inpatient discharges, Ministry of Health). Cross-validation is performed between device shipment data, retail sell-through analysis, and telco eSIM activation reports to confirm overall market coherence. This sanity check ensures consistency, accuracy, and integrity of the Italy Smart Wearables Market model prior to finalization and reporting.

FAQs

01 What is the potential for the Italy Smart Wearables Market?

The Italy Smart Wearables Market holds strong potential, valued at USD 1.33 billion based on consolidated country data from Italy’s wearable technology sector. The market’s expansion is propelled by digital health integration, the rapid adoption of eSIM-based smartwatches, and the increasing focus on preventive healthcare among Italy’s 58.9 million residents (ISTAT). With 14.57 million individuals aged 65 and above, the nation’s aging population underpins sustained demand for continuous monitoring, fall detection, and chronic care wearables. Additionally, growth in NFC payments and telemedicine networks under FSE 2.0 further enhances the market’s adoption landscape.

02 Who are the Key Players in the Italy Smart Wearables Market?

The Italy Smart Wearables Market features a blend of global consumer technology brands and specialized Italian innovators. Key players include Apple, Samsung, Garmin, Fitbit (Google), Huawei, and Amazfit (Zepp Health), which dominate through strong ecosystems, premium retail presence, and carrier partnerships with TIM, Vodafone Italia, and Wind Tre. Local leaders such as Empatica (clinical-grade wearables) and ComfTech (smart textiles) strengthen Italy’s footprint in healthcare and research applications. Other important participants include Withings, Polar, Suunto, OPPO, Fossil Group, Xiaomi, and Mobvoi, collectively shaping the market’s diverse product landscape.

03 What are the Growth Drivers for the Italy Smart Wearables Market?

The primary growth drivers include Italy’s advanced digital connectivity, with 132 mobile subscriptions per 100 people (World Bank/ITU), and a mature healthcare system managing over 7.6 million inpatient discharges annually (Ministero della Salute). This infrastructure supports adoption of connected health devices for remote monitoring and telemedicine. Furthermore, the expansion of NFC-enabled payments, supported by 2 billion annual transactions via BANCOMAT and over €160 billion in digital payment value (Bank of Italy, Reuters), promotes smartwatch usage beyond fitness into retail and transit applications. Combined with Italy’s tech-savvy urban base, these factors create a strong platform for sustained wearable adoption.

04 What are the Challenges in the Italy Smart Wearables Market?

The Italy Smart Wearables Market faces structural and regulatory challenges. Compliance with EU Medical Device Regulation (MDR 2017/745) and GDPR (Reg. 2016/679) increases product certification and data-handling costs, particularly for health-grade wearables. Italy’s Garante Privacy Authority reported 2,204 data breaches and €24 million in penalties during its latest cycle, highlighting heightened scrutiny over biometric data. Additionally, the decentralized healthcare system complicates integration of wearable data with regional electronic health records, while high dependency on imported components (sensors, batteries, SoCs) from Asia constrains local supply resilience and cost optimization.