Italy Telemedicine Market Outlook to 2030

By Market Structure, By Service Type, By Medical Specialty, By Mode of Delivery, By End User, and By Region

- Product Code: TDR0316

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Italy Telemedicine Market Outlook to 2030 – By Market Structure, By Service Type, By Medical Specialty, By Mode of Delivery, By End User, and By Region” provides a comprehensive analysis of the telemedicine industry in Italy. The report covers the industry’s overview and genesis, overall market size in terms of revenue, detailed market segmentation; trends and developments, policy and regulatory landscape (SSN guidelines, PNRR/telemedicine investments), stakeholder and patient profiling, key issues and operational challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the telemedicine ecosystem. The report concludes with future market projections based on consultation volumes, remote-monitoring device penetration, specialty lines, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

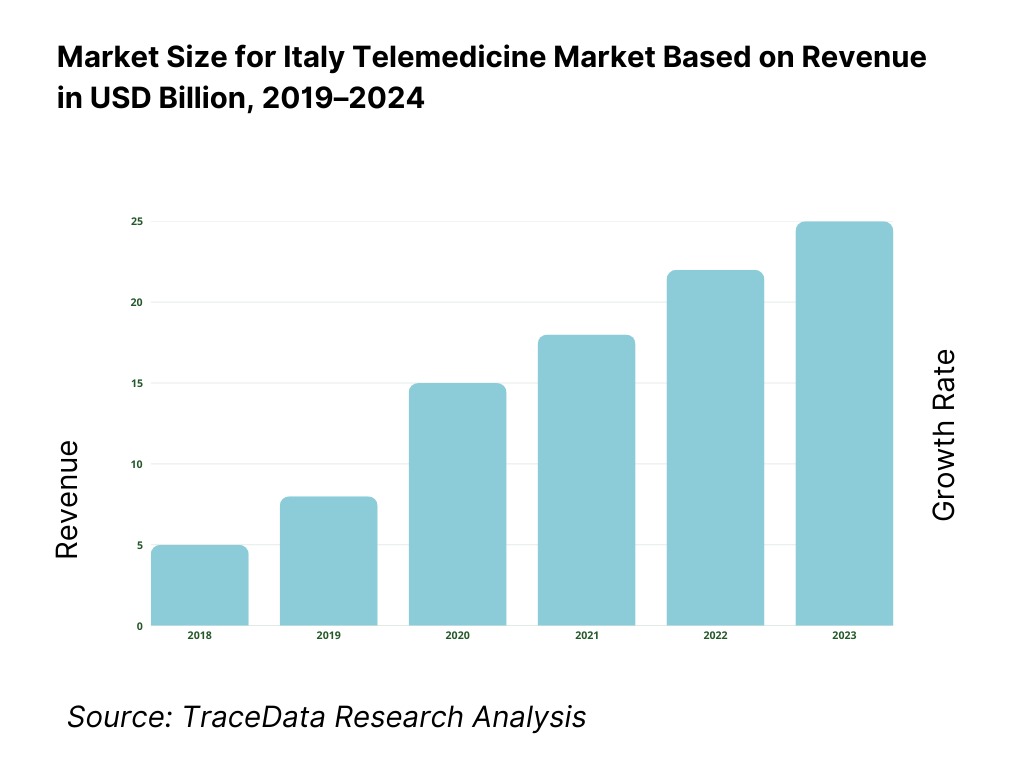

Italy Telemedicine Market Overview and Size

The Italy telemedicine market is valued at USD 2,981.0 million, based on a five-year historical analysis grounded in verified industry data. This substantial figure reflects rapid adoption across healthcare delivery models, supported by evolving reimbursement policies, expanded digital health infrastructure, and growing patient acceptance of virtual care.

Leading cities and regions—such as Rome, Milan, and Turin—dominate the market due to their advanced healthcare facilities, robust digital infrastructure, and proactive regional healthcare authorities promoting telemedicine integration. These hubs benefit from high concentrations of specialist providers, extensive SSN (Servizio Sanitario Nazionale) participation, and increased venture funding for tele-health innovation.

What Factors are Leading to the Growth of the Italy Telemedicine Market:

Rapid ageing and chronic-care need amplified by population structure: Italy’s population base creates sustained telemedicine demand. The resident population stands at 58,934,000 people, establishing the addressable base for remote care delivery. Within it, older adults—who are the highest users of healthcare—are large in absolute terms: 14,573,000 people are aged 65+, a cohort requiring frequent monitoring and multi-specialty follow-ups ISTAT Demographic Indicators. Longevity compounds this need: life expectancy is 83.4 years, extending the period in which chronic conditions must be managed at home or in community settings with digital support. These combined figures underpin recurring use cases for tele-cardiology, tele-oncology, and remote patient monitoring, as providers must serve millions of older residents efficiently without expanding physical infrastructure at the same pace.

Digital rails: fixed broadband, national e-ID and online access to services: Telemedicine uptake depends on households’ ability to connect and authenticate. Italy counted 18,945,300 fixed broadband subscriptions, supplying the throughput needed for video consultations and device telemetry. Identity and access are enabled by SPID, which logged 33,500,000 issued digital identities and 1,000,000,000+ online accesses in the latest full year reported, facilitating secure login to public and private e-health services. This digital backbone sits atop a national population of 59,499,453, indicating very large volumes of potential authenticated health interactions across portals, e-prescriptions and tele-consult platforms. The hard counts of connections and identities materially lower onboarding friction and make at-scale telemedicine operations feasible.

Public investment and service digitisation anchoring long-term adoption: National policy is actively financing rollout. Under PNRR Mission 6, Investment 1.2.3 “Telemedicina” carries a €1,500,000,000 allocation for national platform and services, with decrees specifying selection and diffusion procedures. Residual resources of €172,898,380 were recently repartitioned to complete telemedicine services, evidencing continued disbursement momentum. Parallel dematerialisation of medical prescriptions makes electronic prescribing the default, standardising digital clinical flows that dovetail with remote care. These concrete euro amounts and national legal measures hard-wire availability, interoperability and reimburseable usage, turning pilot projects into routine service lines.

Which Industry Challenges Have Impacted the Growth of the Italy Telemedicine Market:

Health-workforce pressure: GP contraction, nurse scarcity, capacity squeeze: Telemedicine scales best when clinicians are available to operate hybrid models; Italy’s workforce signals stress. General practitioners fell from 45,382 to 35,398 over 2013–2024, cutting the front line that triages and follows chronic patients. Nurse availability is structurally low at 6.2 practising nurses per 1,000 population, well under the OECD average, while hospital beds sit at 3.1 per 1,000—numbers that limit in-person buffer capacity and push more activity online OECD/WHO Observatory summary. With 58,934,000 residents needing care continuity, staffing ratios constrain throughput and can slow provider onboarding to remote services if not paired with workflow automation and task-shifting.

Demographic headwinds and mobility patterns complicate planning: System demand is rising amid shrinking births and outward migration. Births totaled 370,000, a historic low that alters age pyramids and concentrates need in older cohorts ISTAT communication via press/Reuters digest. Net emigration involved 191,000 residents moving abroad, challenging regional workforce stability and continuity of care strategies that telemedicine must cover. The country’s resident population is 58,934,000, while those 65+ number 14,573,000. These absolute figures shape load planning for remote monitoring, home-based follow-ups and caregiver support, yet they also raise cross-regional demand variability that complicates uniform rollout timetables.

Uneven digitalisation and execution gaps despite national funds: While allocations exist, execution remains a hurdle. Against a PNRR telemedicine endowment of €1,500,000,000, projects registered in the government’s ReGiS system accounted for “a little over €800,000,000,” indicating uncommitted capacity that delays service uniformity. Even as 18,945,300 fixed broadband lines provide national connectivity, regional digital maturity still varies in practice, requiring integration funding and technical assistance to reach remote clinics. In the interim, providers juggle legacy processes with new national platforms, slowing clinical pathway redesign and increasing integration costs—frictions that telemedicine vendors must navigate with deployment and training models tailored to local readiness.

What are the Regulations and Initiatives which have Governed the Market:

Ministerial Guidelines defining service, quality and functional requirements: The Ministero della Salute – Decreto 21 settembre 2022 formally approved “Linee guida per i servizi di telemedicina – Requisiti funzionali e livelli di servizio,” creating the reference rulebook for providers and technology suppliers. This decree sits alongside national demographics that expand its scope—14,573,000 residents aged 65+ and 58,934,000 total residents are potential users of regulated tele-services. The guidelines specify service definitions (tele-consultation, tele-monitoring, tele-assistance) and operational/quality levels to be met for SSN integration, ensuring that digital pathways are licensed against national standards rather than ad-hoc vendor protocols—essential for scale across thousands of facilities.

PNRR Investment 1.2.3 (Platform + Services) with tracked disbursements: Regulatory scaffolding is paired with earmarked financing and implementing decrees. The PNRR allocates €1,500,000,000 to telemedicine (Investment 1.2.3), split between a Piattaforma nazionale and Servizi di telemedicina, with implementation targets publicly monitored Agenas project note. Additional decrees operationalise selections and territorial diffusion, and a subsequent repartition assigned €172,898,380 in residual funds to complete service coverage. These exact euro totals, published in the official journal, underpin licensing and procurement frameworks for regions and providers, ensuring compliant onboarding to the national platform across Italy’s 59,499,453-person health system.

Full dematerialisation of prescriptions enabling end-to-end digital journeys: National law has extended electronic prescriptions to all prescription types, making dematerialised issuing the default and enabling digital front doors for care and pharmacy fulfilment. This sits on top of proven authentication rails: SPID recorded 33,500,000 issued identities and 1,000,000,000+ accesses, and broadband lines number 18,945,300, removing key bottlenecks to licensed telemedicine workflows from consultation to e-prescription and follow-up. The regulatory shift creates enforceable, machine-readable transaction trails, which are prerequisites for auditing reimbursed tele-services within SSN governance and for safely scaling remote care.

Italy Telemedicine Market Segmentation

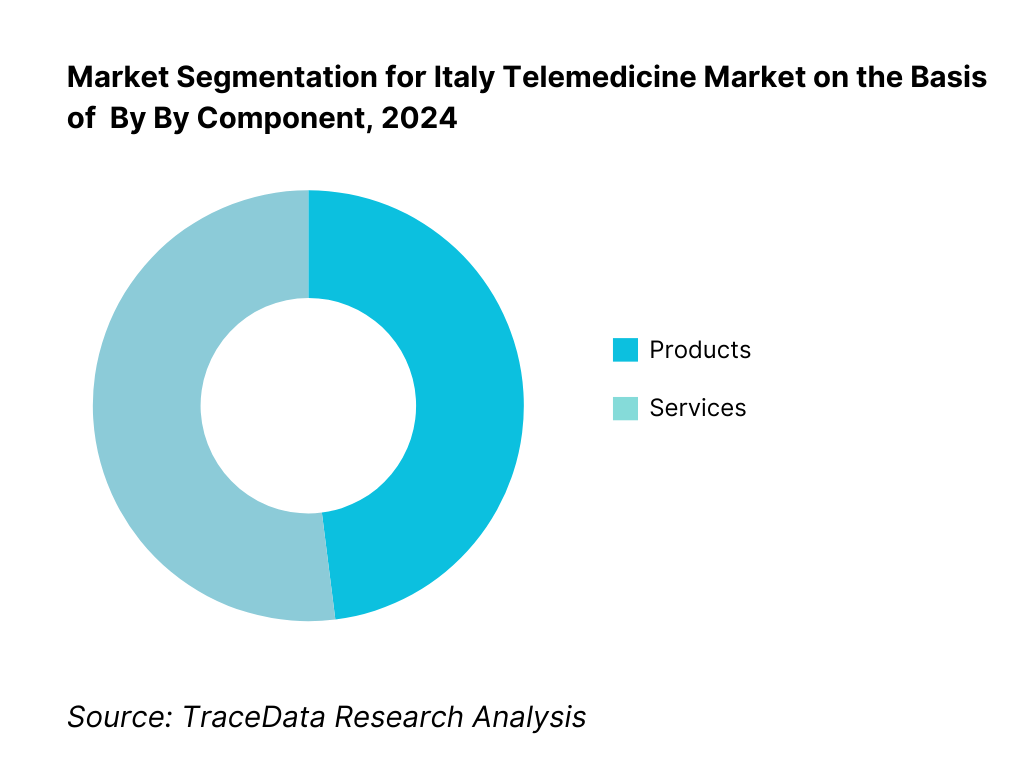

By Component: Italy’s telemedicine market is segmented into products and services. Products (including hardware and software platforms) hold the dominant share, driven by rising deployment of remote-monitoring devices, diagnostic tools, and integrated platforms for virtual consultations. Growing demand from hospitals and clinics for scalable infrastructure underpins products’ leadership. Services—such as virtual consultations and tele‐monitoring—follow closely, bolstered by increasing patient acceptance and SSN-aligned reimbursements.

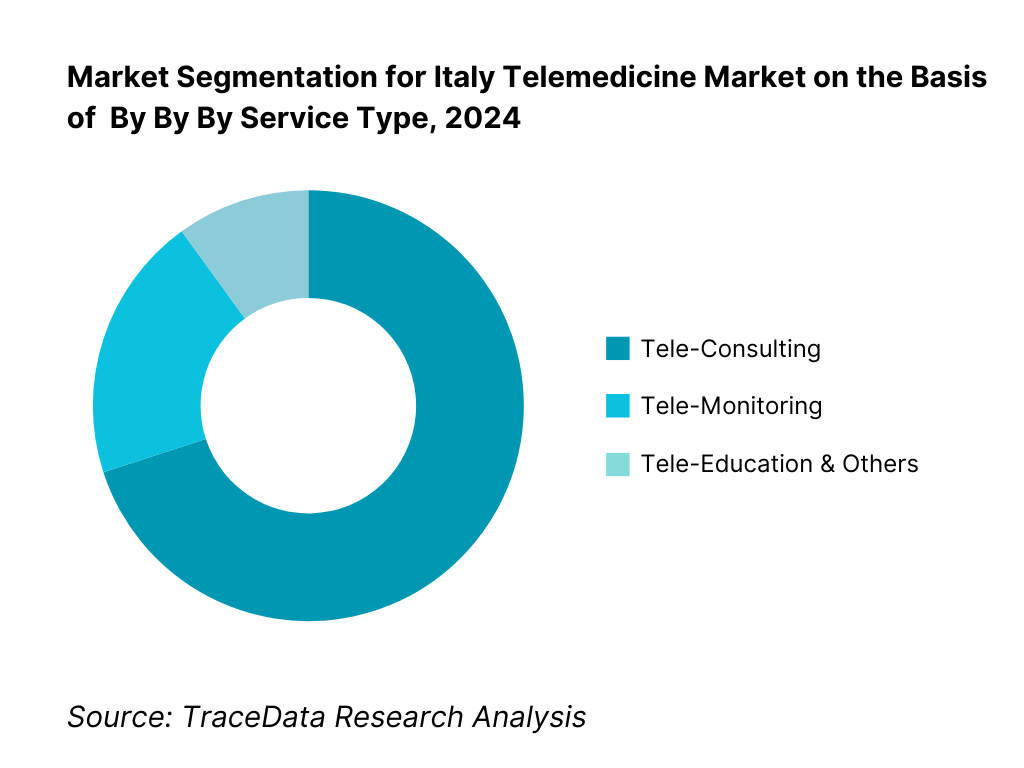

By Service Type: Within Italy’s telemedicine services, tele-consulting commands market leadership, as healthcare systems and private providers focus on scaling virtual visits for routine and specialist care. Enhanced patient trust, improved broadband access, and structured SSN reimbursement encourage tele-consultation uptake. Tele-monitoring and tele-education remain growth areas but are emerging from smaller bases, reflecting incremental adoption in chronic disease management and provider training.

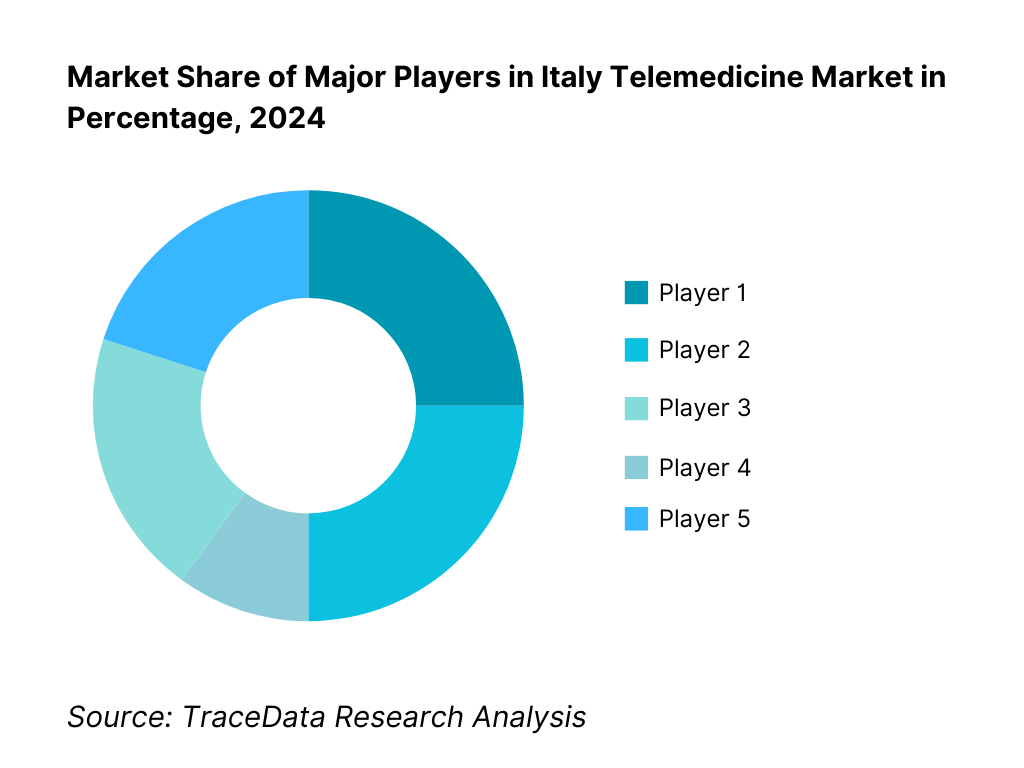

Competitive Landscape in Italy Telemedicine Market

Italy’s telemedicine market showcases a concentrated competitive environment with several key players spanning digital platform providers, device manufacturers, and SSN-integrated solutions. This reflects a strategic consolidation of market power and innovation capacity.

Name | Founding Year | Original Headquarters |

DocPlanner | 2012 | Warsaw, Poland (Italy ops) |

TeleDoc Health | 2009 | Rome, Italy |

MyDoctor | 2015 | Milan, Italy |

D-Heart | 2016 | Genoa, Italy |

Doctolib (Italy ops) | 2013 | Paris, France |

Babylon Health | 2013 | London, UK |

AmWell | 2006 | Boston, USA |

MDLIVE | 2009 | Florida, USA |

Siemens Healthineers | 1847 | Erlangen, Germany |

Philips Healthcare | 1891 | Eindhoven, Netherlands |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

DocPlanner: As one of the largest digital health platforms operating in Italy, DocPlanner expanded its teleconsultation services in 2024, integrating electronic prescriptions and specialist booking into its platform to improve patient experience and provider efficiency.

TeleDoc Health: A domestic leader in Italy’s telemedicine ecosystem, TeleDoc Health has increased its partnerships with SSN regional authorities, adding remote patient monitoring solutions for chronic disease management and elderly care services.

D-Heart: Known for its portable ECG device designed for home use, D-Heart secured new collaborations with cardiology clinics in 2024, enhancing accessibility to cardiac monitoring and positioning itself as a leader in tele-cardiology solutions.

Doctolib (Italy operations): Strengthening its foothold in Italy, Doctolib has invested in AI-driven scheduling and digital triage tools, expanding beyond appointment booking into more integrated digital health services for both public and private providers.

Philips Healthcare: Leveraging its strong diagnostic equipment portfolio, Philips has rolled out connected telehealth monitoring systems across several Italian hospitals, focusing on integration with existing SSN infrastructure and supporting remote care for high-risk patients.

What Lies Ahead for Italy Telemedicine Market?

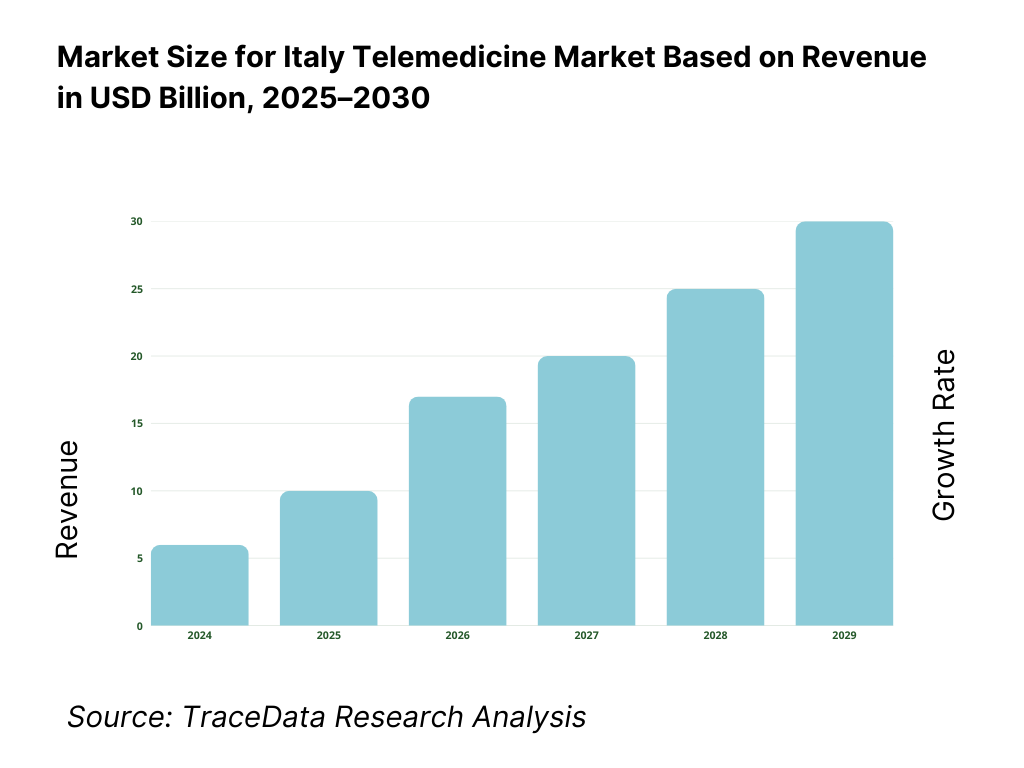

The Italy telemedicine market is expected to continue its steady expansion over the next five years, supported by sustained government funding under the National Recovery and Resilience Plan (PNRR), increasing demand from Italy’s ageing population, and the structural shift towards digital health integration within the Servizio Sanitario Nazionale (SSN). This growth will also be accelerated by investments in digital infrastructure, rising chronic disease prevalence, and patient acceptance of hybrid healthcare delivery.

Rise of Hybrid Care Models: The future of telemedicine in Italy will be increasingly shaped by hybrid healthcare systems, where in-person consultations are complemented by remote monitoring and digital follow-ups. Hospitals and regional healthcare authorities are integrating virtual care into traditional pathways to manage high patient loads efficiently.

Focus on Chronic Disease and Elderly Care: With more than 14 million Italians aged above 65, telemedicine solutions will focus strongly on managing chronic illnesses such as cardiovascular diseases, diabetes, and cancer. Specialized platforms for tele-cardiology, tele-oncology, and elderly home care are set to gain prominence as providers adapt to demographic realities.

Expansion of Specialty-Specific Platforms: Demand will rise for telemedicine solutions tailored to specific specialties, including dermatology, mental health, and rehabilitation. These niche platforms will provide sector-specific tools that integrate diagnostics, treatment, and continuous monitoring.

Leveraging AI, Wearables, and Analytics: Artificial intelligence, connected medical devices, and advanced analytics will drive personalized patient care in Italy’s telemedicine future. From AI-based triage systems to wearable-enabled remote monitoring, these technologies will improve accuracy, reduce system strain, and deliver measurable outcomes for both providers and patients.

Italy Telemedicine Market Segmentation

By Component

Products

Services

By Service Type

Tele-Consulting

Tele-Monitoring

Tele-Radiology

Tele-Dermatology

Tele-Psychiatry

By Medical Specialty

Cardiology

Oncology

Dermatology

Psychiatry & Mental Health

Primary Care

By Mode of Delivery

Web-based Platforms

Cloud-based Solutions

Mobile Applications

Device-Integrated Platforms

By End User

Hospitals & Clinics

Home Care Settings

Insurance Providers & Employers

Pharmacies

Government & Public Health Agencies (SSN)

Players Mentioned in the Report:

DocPlanner

TeleDoc Health

MyDoctor

D-Heart

Siemens Healthineers

Teladoc Health (via partnerships)

Doctor On Demand

HealthTap

MediBubble

Babylon Health

Doctolib (Italy operations)

AmWell

Zocdoc (Italian collaborations)

MDLIVE

Philips Healthcare

Key Target Audience

SSN regional healthcare authorities (e.g., Regione Lombardia Health Department)

National Ministry of Health – Digital Health Division

Large private hospital groups (e.g., Humanitas, San Donato Group)

Insurance companies offering health plans (e.g., Generali, UnipolSai)

Employers with large workforce requiring health benefits (e.g., Enel, Eni)

Technology investors and venture capital firms focused on digital health

Telemedicine platform developers and device manufacturers

Professional medical associations (e.g., Italian Society of Telemedicine and eHealth)

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Telemedicine in Italy (Virtual Consultations, Remote Patient Monitoring, Hybrid Care, AI-enabled Triage, Mental Health Tele-therapy-Margins, Patient Preference, Strengths & Weaknesses)

4.2. Revenue Streams for Italy Telemedicine Market (Reimbursement by SSN, Out-of-Pocket, Employer/Insurance Coverage, Subscription-Based Platforms, Device-Linked Services)

4.3. Business Model Canvas for Italy Telemedicine Market (Platform-Centric, Hospital-Integrated, Device-Linked, Public-Private Partnerships)

5.1. Public SSN-Integrated Platforms vs. Private Telehealth Providers

5.2. Investment Model in Italy Telemedicine (Venture Capital, EU PNRR Funds, Insurer-backed Investments)

5.3. Comparative Analysis of Patient Onboarding & Funnel Process (SSN vs. Private Platforms)

5.4. Telemedicine Budget Allocation by Provider Type (Hospitals, Primary Care Clinics, Specialists, Insurers)

8.1. Revenues, Historic

9.1. By Market Structure (SSN Integrated, Private Platforms, Hybrid Models)

9.2. By Service Type (Tele-Consulting, Tele-Monitoring, Tele-Psychiatry, Tele-Dermatology, Tele-Cardiology)

9.3. By Medical Specialties (Cardiology, Oncology, Dermatology, Radiology, Psychiatry, Primary Care)

9.4. By User Type (Hospitals, Clinics, Home Care, Insurers, Employers)

9.5. By Patient Demographic (Elderly, Chronic Disease Patients, Preventive Care Users, Mental Health Patients)

9.6. By Mode of Delivery (Video, Mobile Apps, AI-enabled Chatbots, Device-Integrated Monitoring)

9.7. By Open vs. Customized Programs (General Public vs. Employer/Insurance-tailored Programs)

9.8. By Region (Northern Italy, Central Italy, Southern Italy, Islands)

10.1. Corporate & Insurance Client Landscape (Insurer partnerships, Employer adoption)

10.2. Patient Adoption Drivers & Decision-Making Process (Convenience, Cost, Trust in Digital)

10.3. Telemedicine Effectiveness & ROI Analysis (Reduced Hospitalizations, Efficiency Gains, Patient Outcomes)

10.4. Gap Analysis Framework (Infrastructure Gaps, Skill Gaps, Awareness Gaps)

11.1. Trends and Developments (Hybrid Care Models, AI-enabled RPM, Cloud Interoperability, Mental Health Tele-therapy)

11.2. Growth Drivers (Aging Demographics, PNRR Funding, Chronic Disease Burden, COVID-19 Shift)

11.3. SWOT Analysis for Italy Telemedicine Market

11.4. Issues and Challenges (Reimbursement Complexity, Low Digital Literacy, Regional Disparities)

11.5. Government Regulations (SSN Guidelines, PNT National Platform, GDPR & Data Governance)

12.1. Market Size and Future Potential of Online Platforms (B2C apps, insurer platforms, SSN integrations)

12.2. Business Models & Revenue Streams (Subscription, Pay-per-Consult, Employer Packages)

12.3. Delivery Models and Service Mix (On-Demand Consults, Scheduled Visits, Chronic Care)

12.4. Cross Comparison of Leading Italian Telemedicine Companies (Company Overview, Investment, Revenues, Subscribers, Specialty Focus, Pricing, Partnerships, Innovations)

15.1. Market Share of Key Players (by revenues, consultations, subscribers)

15.2. Benchmark of Key Competitors (Company Overview, USP, Strategies, Business Model, Tech Infrastructure, Specialty Focus, Major Clients, Tie-ups, Marketing, Innovations)

15.3. Operating Model Analysis Framework (Integrated vs. Standalone vs. Hybrid)

15.4. Gartner-like Positioning Quadrant (Innovation vs. Market Reach)

15.5. Strategic Advantage Models (Bowman’s Clock Adaptation)

16.1. Revenues, Forecast

17.1. By Market Structure (SSN, Private, Hybrid)

17.2. By Service Type (Tele-Consulting, Tele-Monitoring, Mental Health, etc.)

17.3. By Medical Specialties (Cardiology, Oncology, Dermatology, Radiology, Psychiatry, Primary Care)

17.4. By User Type (Hospitals, Clinics, Insurers, Employers, Homecare)

17.5. By Patient Demographic (Elderly, Chronic Patients, Preventive, Mental Health)

17.6. By Mode of Delivery (Video, Mobile, Device-Linked)

17.7. By Open vs. Customized Programs (General vs. Insurer/Employer Custom)

17.8. By Region (North, Central, South, Islands)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire ecosystem of the Italy Telemedicine Market to identify both demand-side and supply-side entities. On the demand side, this includes patients, hospitals, primary care providers, elderly care facilities, insurers, and regional health authorities within the SSN. On the supply side, we consider telemedicine platform developers, device manufacturers, connectivity providers, and public–private consortia. Based on this ecosystem mapping, we shortlist 5–6 leading telemedicine solution providers in Italy by evaluating their financial performance, regional coverage, number of affiliated providers, and integration with national health services. Sourcing is conducted through policy documents, healthcare authority portals, and proprietary healthcare databases to collate detailed industry-level information.

Step 2: Desk Research

We then engage in an exhaustive desk research process, referencing diverse secondary and proprietary healthcare databases. This enables us to conduct a thorough analysis of Italy’s telemedicine industry by aggregating insights on revenues, platform adoption volumes, patient access levels, regulatory frameworks, and technology adoption. We also examine company-level data in depth, drawing on official press releases, annual reports, policy updates from the Ministry of Health, Gazzetta Ufficiale decrees, and SSN statistics. These data points help us to establish a comprehensive baseline for the market’s structure, growth drivers, and operational frameworks.

Step 3: Primary Research

In this stage, we conduct structured interviews with C-level executives, medical directors, policymakers, and technology vendors active in Italy’s telemedicine market. The objective is to validate hypotheses regarding adoption patterns, service delivery models, and regulatory influence. Disguised interviews are also undertaken, where our team approaches providers under the guise of prospective clients. This approach allows us to corroborate operational and financial details against secondary sources and gain nuanced insights into revenue streams, reimbursement mechanisms, integration processes, and value chain dynamics. A bottom-up approach is employed to assess individual company revenues and aggregate them to arrive at a holistic market estimate.

Step 4: Sanity Check

Finally, we perform a dual sanity check using both bottom-to-top and top-to-bottom methodologies. This includes market size modeling exercises, triangulating revenues with adoption rates and patient demand indicators, and validating our results against official healthcare datasets. This step ensures the robustness and accuracy of the market model and confirms alignment with macroeconomic indicators and policy-driven healthcare expansion in Italy002E

FAQs

01 What is the potential for the Italy Telemedicine Market?

The Italy Telemedicine Market is poised for substantial growth, reaching a valuation of USD 2,981 million in 2024. This potential is driven by demographic shifts, with over 14.5 million residents aged above 65, alongside rising chronic disease prevalence and increased demand for remote healthcare delivery. The market’s potential is further bolstered by strong government funding through the National Recovery and Resilience Plan (PNRR) and nationwide digital health initiatives integrating telemedicine into the Servizio Sanitario Nazionale (SSN).

02 Who are the Key Players in the Italy Telemedicine Market?

The Italy Telemedicine Market features several key players, including DocPlanner, TeleDoc Health, and D-Heart, which dominate due to their patient reach, innovative platforms, and integration with Italian healthcare providers. International players such as Philips Healthcare, Siemens Healthineers, Doctolib, Babylon Health, and AmWell also hold a strong presence, leveraging their global expertise and technological capabilities. Other notable contributors include MyDoctor, MediBubble, and MDLIVE, which have expanded digital consultation, device-linked services, and specialty telemedicine offerings.

03 What are the Growth Drivers for the Italy Telemedicine Market?

The primary growth drivers include demographic and healthcare system factors, such as Italy’s 14.5 million citizens aged 65+, which creates consistent demand for chronic disease and elderly care solutions. Digital infrastructure expansion, supported by 18.9 million fixed broadband subscriptions and 33.5 million SPID e-IDs, enables nationwide access to secure telemedicine platforms. Additionally, the government’s €1.5 billion PNRR telemedicine allocation is accelerating platform adoption, integration, and service standardization, making telemedicine an embedded part of Italy’s healthcare future.

04 What are the Challenges in the Italy Telemedicine Market?

The Italy Telemedicine Market faces several challenges, including healthcare workforce shortages, with the number of general practitioners falling from 45,382 to 35,398 between 2013 and 2024. Regional disparities in digital readiness also hinder uniform rollout despite 18.9 million broadband lines nationally. Additionally, execution delays exist within the PNRR framework, with only about €800 million out of €1.5 billion fully committed to telemedicine projects. These issues limit scalability and highlight the need for efficient integration, workforce support, and consistent reimbursement mechanisms.