Italy Used Car Market Outlook to 2030

By Fuel Type, By Vehicle Age, By Price Band, By Sales Channel, and By Region

- Product Code: TDR0317

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Italy Used Car Market Outlook to 2030 – By Fuel Type, By Vehicle Age, By Price Band, By Sales Channel, and By Region” provides a comprehensive analysis of the used car industry in Italy. The report covers an overview and genesis of the industry, overall market size in terms of transaction volumes and value, market segmentation; trends and developments, regulatory and licensing landscape, consumer profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Italy used car market. The report concludes with future market projections based on transfer volumes, vehicle age cohorts, regional dynamics, fuel mix evolution, and digital adoption. It highlights cause-and-effect relationships between macroeconomic factors, consumer behavior, financing availability, and regulatory changes, while also presenting success case studies that emphasize the major opportunities and cautions for stakeholders operating in the Italy used car ecosystem.

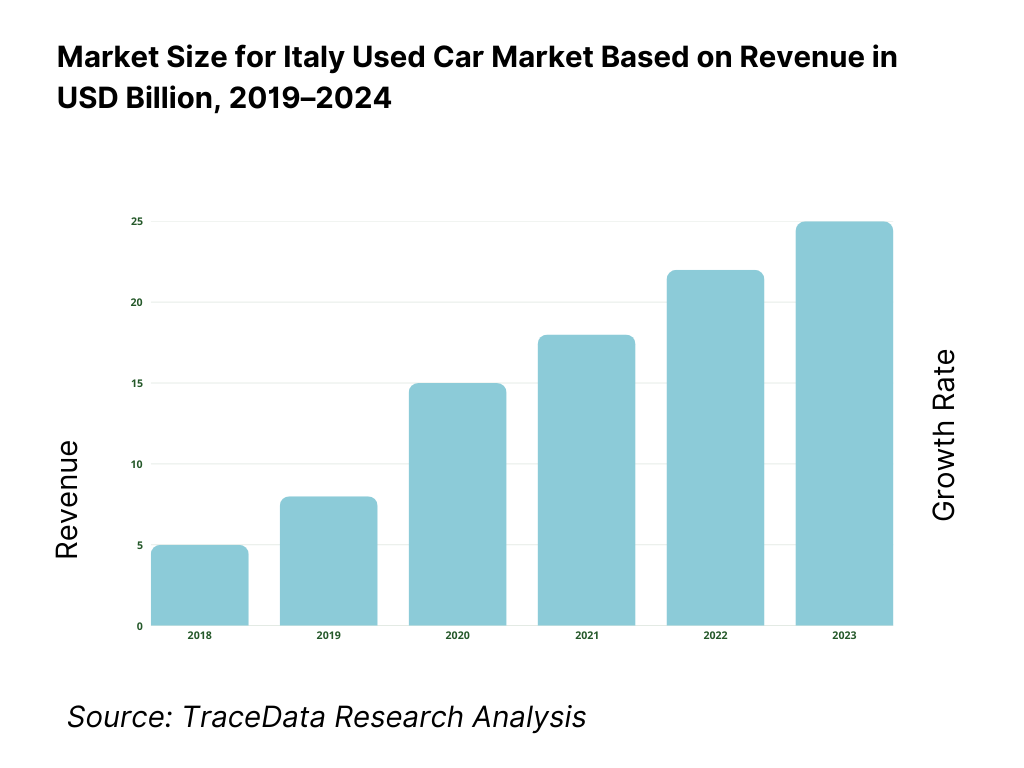

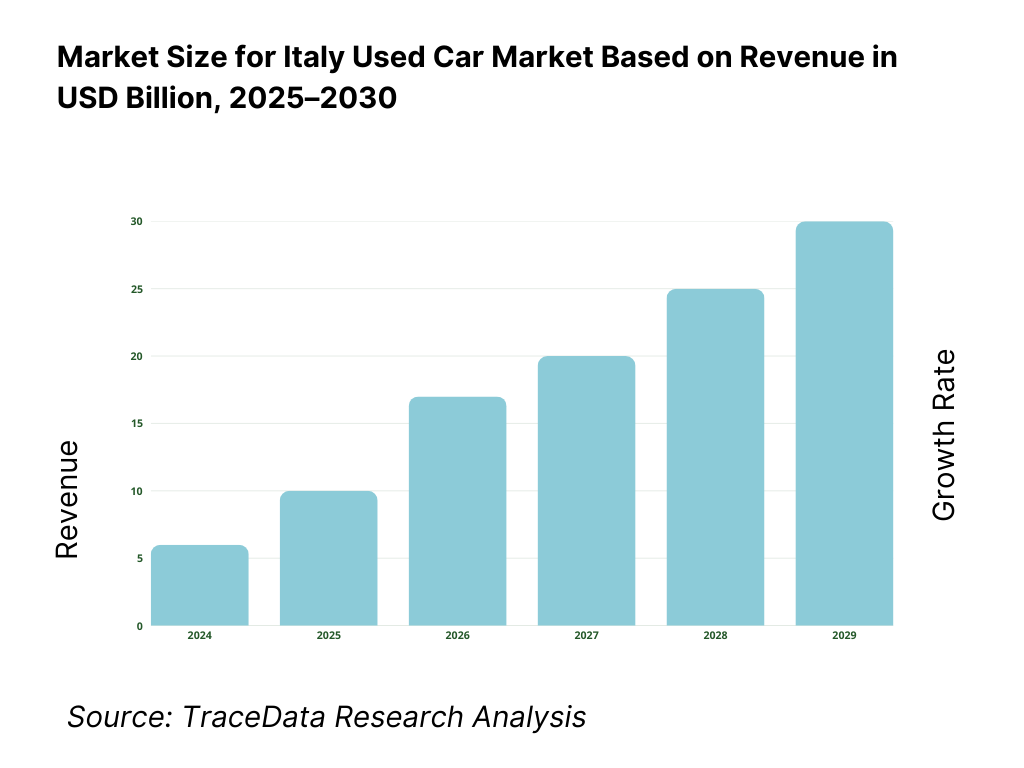

Italy Used Car Market Overview and Size

The Italy used car market is valued at EUR 9.8 billion (most recent full-year), rising to EUR 10.8 billion in the following period as online channels deepen liquidity and affordability gaps with new cars widen. Transaction intensity remained high with ~5.01 million ownership transfers in the latest complete cycle and climbed to ~5.41 million thereafter. Volumes are documented by UNRAE/ACI, while value is reported by the BVA Doxa–Subito Second Hand Economy observatory.

Lombardy, Lazio, and Campania dominate by activity because they combine the largest parc density, strong household purchasing power, deep dealer networks and corporate-fleet churn, plus highly liquid online demand hubs around Milan, Rome, and Naples. In the last complete cycle, Lombardy alone accounted for the highest share of transfers, with Lazio and Campania following—an effect of bigger urban fleets, higher commuting needs, and abundant sourcing from lease/rental returns.

What Factors are Leading to the Growth of the Italy Used Car Market:

Deep vehicle parc & high motorisation sustain replacement and liquidity: Italy’s circulating passenger-car parc reached 41.3 million units, with 701 cars per 1,000 residents and 942 total vehicles per 1,000 residents. This density translates into steady ownership changes: in a single month, 281,547 car transfers were recorded (net of dealer “minivolture”). Monthly PRA updates also show peaks above 414,263 total formalities in busy periods. A large parc, high car-to-population ratios, and frequent transfers create constant inflows of trade-ins and private sales—key oxygen for used-car retailers, auctions, and platforms across the North-West, North-East, Centre, South and Islands.

Household consumption and employment underpin used-car demand: Household final consumption is a core macro spine: World Bank records US$ 1,342,801,449,857 of household consumption, while ISTAT reports mean monthly household outlays at € 2,728. Labor-market momentum adds support: ISTAT notes +352,000 more employed people on average across the year. These macro tailwinds raise the probability of households funding mobility needs, enabling trade-up from older vehicles and smoother clearance of dealer inventory. They also sustain service, insurance and accessory spending attached to used-car purchases—critical to dealer contribution margins and marketplace take-rates.

Credit transmission improves affordability at the point of sale: Banca d’Italia indicates easing financing conditions: the APRC on new consumer loans printed 10.18 (previous 10.29), while its Annual Report notes a decline in risk-free and bank lending rates. With consumer credit directly used to finance second-hand purchases, even small rate moves unlock thousands of incremental approvals each month across dealers and online checkouts. Combined with employment gains, this credit channel lowers monthly instalments, supports demand for younger stock, and helps move aging inventory more quickly between regional markets.

Which Industry Challenges Have Impacted the Growth of the Italy Used Car Market:

Aging parc stresses compliance, maintenance, and remarketing: ACI highlights a swelling fleet of 41.3 million cars and a low scrappage pulse: in its yearbook cycle, “prime iscrizioni” were just under 1.6 million, far below historical peaks of over 2.0 million. The annuario also reports a median age at scrappage of 18 years and 6 months, signalling longevity of older propulsion and higher future reconditioning/inspection needs. Older stock complicates emissions compliance inside ZTL/LEZ areas and raises warranty exposure for retailers, while demand concentrates on vehicles with verifiable service histories and recent “revisione” certificates.

Admin frictions around transfers and documentation: A buyer must file a change-of-ownership at a Motorist’s Telematic Counter (STA) and the PRA; the single application process connects the Vehicle Licensing Agency office with the PRA title registry. After signing, registration must be completed within 60 days. Transfer charges comprise three components—IPT, stamp duty and ACI fees—which vary by province and vehicle class. These steps, deadlines and multi-agency filings create operational drag for C2C sellers and dealer back-offices, especially with high monthly volumes such as 281,547 transfers recorded in one month.

Tight pipeline of younger stock limits choice and slows electrified uptake: ACI’s yearbook notes new-car “prime iscrizioni” at just under 1.6 million, well short of the 1.9 million–2.0 million seen pre-pandemic. The thinner inflow of near-new returns constrains ≤3-year supply in the secondary market, pushing buyers toward older age bands even as households spend € 2,728 per month on average. Monthly transfer prints remain high—e.g., 281,547—but the model/fuel mix lags recent new-car cohorts, slowing the natural diffusion of hybrid/BEV options across dealer forecourts and online listings.

What are the Regulations and Initiatives which have Governed the Market:

Ownership transfer (PRA/STA) and 60-day filing rule: After a sale, the buyer files a single application to the provincial Vehicle Licensing Agency and local PRA office; this can be done at an STA desk. The filing must be completed within 60 days, and the PRA issues the updated digital ownership certificate (CdP digitale). Transfer cost elements are enumerated by ACI—IPT, stamp duty, ACI fees—with amounts varying by province and vehicle. This framework standardises title integrity for dealers and platforms executing thousands of monthly transfers.

Periodic roadworthiness inspection (“Revisione”) cadence: The Ministry of Infrastructure and Transport mandates the first inspection after 4 years from first registration and then every 2 years thereafter (art. 80 CdS). The government portal reiterates the same schedule for passenger cars and light vehicles. Dealers and marketplaces rely on up-to-date inspection documentation during intake and disclosure. With a parc of 41.3 million cars, this cadence governs a vast stream of compliance events relevant to warranty decisions and retail readiness.

Distance-selling consumer rights for online used-car transactions: EU consumer law grants a 14-day cooling-off period for distance and off-premises contracts, implemented in Italy via the Consumer Code; official guidance clarifies scope and trader duties (14-day FAQ; EUR-Lex summary). For professional-to-consumer sales conducted online—common in used-car e-commerce—dealers must honour withdrawal rights, shaping logistics, refund workflows and reconditioning standards to re-retail returned vehicles efficiently.

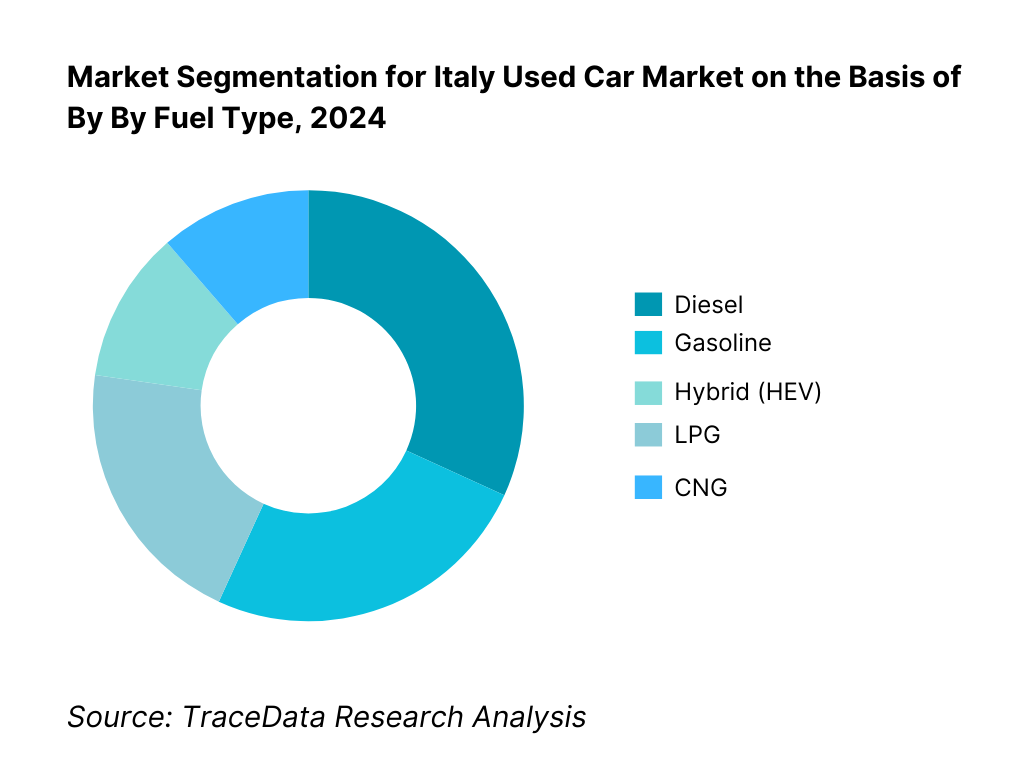

Italy Used Car Market Segmentation

By Fuel Type: Italy used car market is segmented by fuel type into diesel, gasoline, hybrid (HEV), LPG, CNG, BEV and PHEV. Recently, diesel has a dominant market share in Italy under the segmentation fuel type, due to the deep installed base, robust long-distance efficiency, and abundant supply of ex-fleet vehicles filtering into the secondary market. Consumers seeking value, torque for intercity travel, and wide availability across price bands continue to prioritize diesel listings, even as hybrids expand and BEVs remain a small but rising niche.

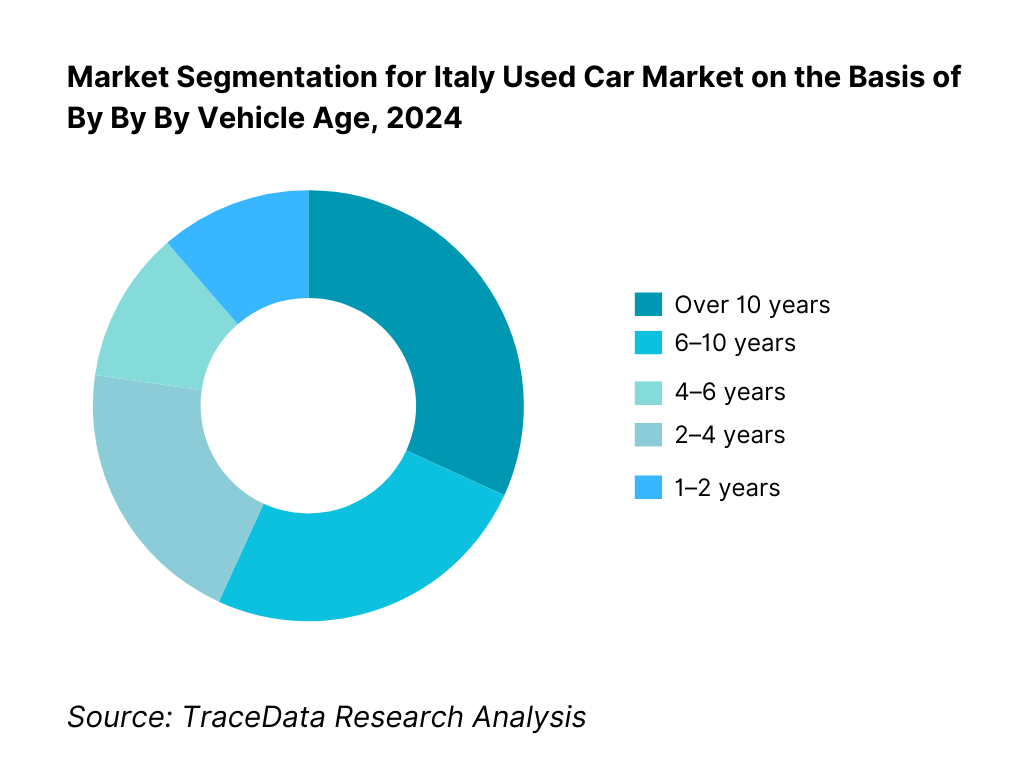

By Vehicle Age: Italy used car market is segmented by vehicle age into 0–1 year, 1–2 years, 2–4 years, 4–6 years, 6–10 years, and over 10 years. Recently, over 10 years has a dominant market share in Italy under the segmentation by vehicle age, due to the country’s older parc and a strong value-for-money bias among households. Abundant supply of high-mileage but serviceable units, higher IPT and insurance sensitivity, and tighter budgets channel buyers toward older vehicles, while near-new stock remains constrained by earlier new-car shortages.

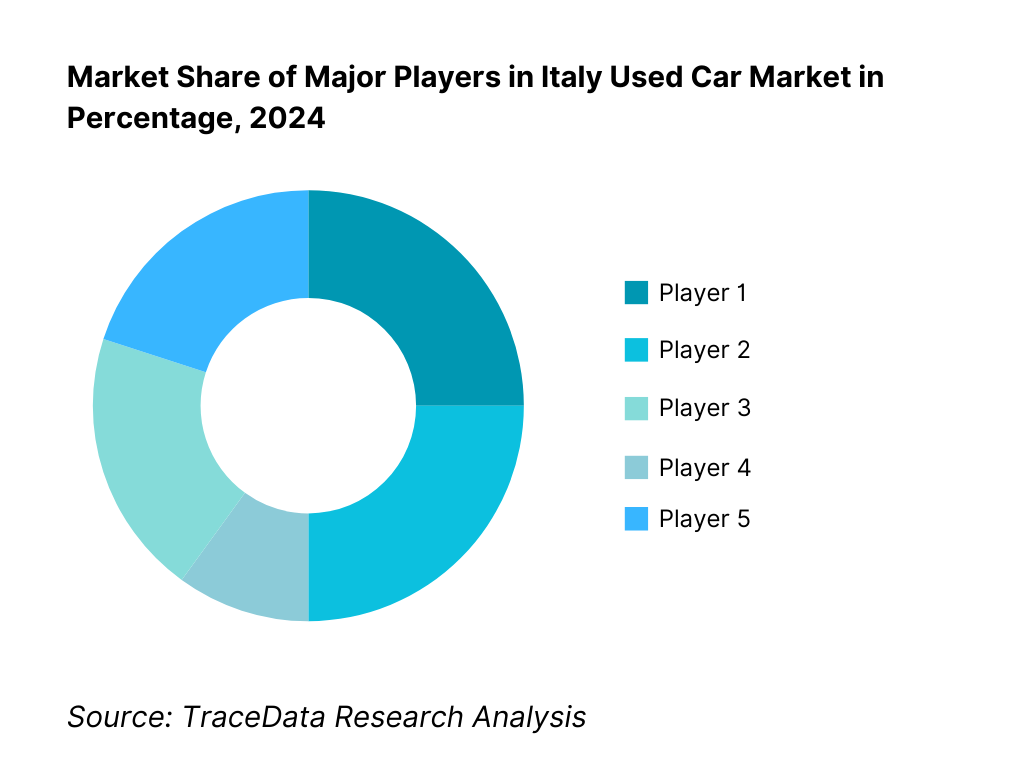

Competitive Landscape in Italy Used Car Market

The Italy used car market skews toward multi-channel platforms and OEM-backed certified programs. AutoScout24 and Subito aggregate the widest online demand; AUTO1 Group’s retail (Autohero) and buying (Noicompriamoauto.it) nodes provide cross-border sourcing scale; while brumbrum (Aramis Group) pursues vertically integrated online retail. OEM certified labels (e.g., Spoticar, Das WeltAuto) leverage captive finance, reconditioning standards, and dealer networks to defend gross margins and residual-value confidence.

Name | Founding Year | Original Headquarters |

AutoScout24 | 1998 | Munich, Germany |

Subito (Motori) | 2007 | Milan, Italy |

brumbrum (Aramis Group) | 2016 | Milan, Italy |

Autohero (AUTO1 Group) | 2017 | Berlin, Germany |

Noicompriamoauto.it (AUTO1/WKDA) | 2014 | Milan, Italy |

Spoticar (Stellantis) | 2019 | Rueil-Malmaison, France |

Das WeltAuto (Volkswagen Group) | 2010 | Wolfsburg, Germany |

CarGurus (Italy operations) | 2006 | Cambridge, USA |

AutoXY | 2012 | Bergamo, Italy |

AUTO1.com (B2B wholesale) | 2012 | Berlin, Germany |

CarNext | 2018 | Amsterdam, Netherlands |

Carvago | 2018 | Prague, Czech Republic |

Clickar (Leasys) | 2018 | Turin, Italy |

BCA | 1946 | Farnham, United Kingdom |

Arval AutoSelect (Arval remarketing) | 1989 | Rueil-Malmaison, France |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

AutoScout24: As one of the largest online automotive marketplaces in Italy, AutoScout24 introduced enhanced AI-driven pricing tools and personalized recommendation engines in 2024, helping both dealers and consumers improve transparency and speed in vehicle transactions.

Subito (Motori): Known for its dominance in the C2C and classifieds segment, Subito expanded its trust and safety features in 2024, including integrated digital contracts and fraud detection systems, making peer-to-peer used car sales more secure.

brumbrum (Aramis Group): Specializing in online-only used car retailing, brumbrum opened a new refurbishment hub in Northern Italy in 2024, enabling faster reconditioning cycles and consistent CPO-standard delivery across its inventory.

Autohero (AUTO1 Group): With a focus on cross-border sourcing and direct-to-consumer online sales, Autohero expanded its logistics and delivery capacity in Italy in 2024, offering customers flexible home delivery and extended return policies.

Spoticar (Stellantis): Stellantis’ certified pre-owned brand expanded its dealer network presence across Southern Italy in 2024, reinforcing its omnichannel sales model and strengthening residual-value confidence with OEM-backed warranties.

What Lies Ahead for Italy Used Car Market?

The Italy used car market is anticipated to remain robust through the end of the decade, supported by strong household demand, a large and aging vehicle parc, and the increasing role of digital platforms in facilitating transactions. The steady flow of fleet returns, trade-ins, and cross-border sourcing will further contribute to the resilience of the sector, while government environmental regulations will shape the composition of vehicles traded, favoring newer and lower-emission models.

Digital and Hybrid Retail Models: The future of the Italy used car market will increasingly rely on hybrid retail channels, blending online transactions with physical dealership experiences. Buyers are demanding convenience through online search and financing options, while still valuing in-person inspections and after-sales services, pushing platforms and dealers toward omnichannel strategies.

Certified and Outcome-Oriented Programs: Certified Pre-Owned (CPO) initiatives will see accelerated adoption, as consumers place a premium on transparency, warranty coverage, and verified vehicle condition. This shift will align dealer programs with measurable outcomes such as reduced return rates and improved resale values, strengthening consumer confidence in the used car ecosystem.

Shift Toward Electrified and Younger Stock: Demand for hybrid and electric vehicles in the secondary market will rise as recent new car cohorts enter the resale cycle. Younger vehicles (0–5 years) will gain traction due to better compliance with emission zones and lower maintenance risk, gradually reshaping the traditional dominance of older stock.

Leveraging AI, Data, and Analytics: Digital platforms and dealer networks will increasingly leverage AI-driven pricing tools, predictive demand analytics, and vehicle-history algorithms. These tools will enable more accurate valuations, personalized recommendations, and improved fraud detection, ultimately driving efficiency in dealer margins and enhancing trust among buyers.

Italy Used Car Market Segmentation

By Fuel Type

Diesel

Gasoline

Hybrid (HEV)

LPG & CNG

BEV & PHEV

By Vehicle Age

0–2 Years

2–4 Years

4–6 Years

6–10 Years

Over 10 Years

By Price Band

Entry (<€5,000)

Budget (€5,000–€10,000)

Mid (€10,000–€20,000)

Premium (€20,000–€40,000)

Luxury (>€40,000)

By Sales Channel

Franchised Dealers (incl. OEM CPO)

Independent Dealers

Online-Only Retailers

B2B Auctions

C2C (Private Sales)

By Region

North-West (Lombardy, Piedmont, Liguria, Aosta Valley)

North-East (Veneto, Emilia-Romagna, Friuli Venezia Giulia, Trentino-Alto Adige)

Centre (Lazio, Tuscany, Marche, Umbria, Abruzzo)

South (Campania, Puglia, Calabria, Basilicata, Molise)

Islands (Sicily, Sardinia)

Players Mentioned in the Report:

AutoScout24

Subito (Motori)

brumbrum (Aramis Group)

Autohero (AUTO1 Group)

Noicompriamoauto.it (wkda/AUTO1 Group)

Spoticar (Stellantis)

Das WeltAuto (Volkswagen Group)

Audi Prima Scelta :plus

BMW Premium Selection

Mercedes-Benz Certified

Toyota Approved Used

Renault Selection

BCA Italia

Arval AutoSelect

Ayvens (ALD | LeasePlan) Remarketing.

Key Target Audience

Automotive dealer groups (franchised and independents)

OEM captive finance and banks

Leasing and rental companies

Online marketplaces and auction platforms

Aftermarket refurbishers and inspection/certification providers

Investments and venture capitalist firms

Government and regulatory bodies (Ministero delle Infrastrutture e dei Trasporti, ACI/PRA, MIMS–Motorizzazione Civile, regional IPT authorities)

Logistics and vehicle transport providers

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Sourcing Model Analysis for Used Cars (trade-ins, ex-lease, ex-rental, imports, km0 stock)-Margins, Preference, Strengths & Weaknesses

4.2. Revenue Streams for Used Car Market (vehicle margin, F&I, warranty & service packages, logistics fees, subscription/rental of used cars)

4.3. Business Model Canvas for Italy Used Car Market (dealer model, marketplace aggregator, OEM CPO, online-only retailer, B2B auctions)

5.1. Independent Dealers vs Franchise/OEM Networks

5.2. Investment Model in Italy Used Car Market (reconditioning hubs, digital platforms, inventory financing, regional dealership networks)

5.3. Comparative Analysis of Acquisition Funnel-Private Seller, Dealer Trade-in, Auction, and OEM Buyback Programs

5.4. Used Car Budget Allocation by Household Income Levels

8.1. Revenues-Historical Growth

9.1. By Market Structure (Franchised Dealers, Independent Dealers, Online Platforms, Auctions, C2C)

9.2. By Fuel Type (Gasoline, Diesel, Hybrid, Plug-in Hybrid, BEV)

9.3. By Vehicle Age (≤2 years, >2-5 years, >5-8 years, >8-12 years, >12 years)

9.4. By Price Band (Entry, Budget, Mid, Premium, Luxury)

9.5. By Ownership Type (Private, Corporate/Fleet, Rental Disposals)

9.6. By Sales Channel (Dealer, Online-Only, Auction, C2C)

9.7. By Mileage Band (≤40k, 40-80k, 80-120k, 120-160k, >160k)

9.8. By Region (North-West, North-East, Centre, South, Islands)

10.1. Consumer Cohort Analysis (first-time buyers, family upgraders, commuters, prestige seekers, SMEs/fleet buyers)

10.2. Used Car Purchase Decision Framework (channel choice, financing decision, warranty importance, online vs offline)

10.3. Ownership Cost & ROI Analysis (fuel, insurance, maintenance, depreciation by age/fuel type)

10.4. Gap Analysis Framework (mismatch between consumer needs & available stock)

11.1. Trends & Developments (digital retail, shift from diesel to hybrid/EV, CPO expansion, dealer consolidation, instant online offers)

11.2. Growth Drivers (affordability vs new, high new car prices, digital marketplaces, increased financing penetration, residual value resilience)

11.3. SWOT Analysis for Italy Used Car Market

11.4. Issues & Challenges (aging fleet, Euro emission restrictions, odometer fraud, fragmented dealer landscape, high IPT/fees)

11.5. Government Regulations (PRA transfers, IPT, bollo auto, revisione, warranty requirements, emission bans in ZTL/LEZ)

12.1. Market Size & Future Potential for Online Used Car Market

12.2. Business Model & Revenue Streams (classifieds, transaction-fee based, hybrid dealer-integrator models)

12.3. Delivery Models & Service Offerings (home delivery, buy-online return policies, CPO certification, subscription offers)

15.1. Market Share of Key Players in Italy Used Car Market Basis Revenues/Volumes

15.2. Benchmark of Key Competitors (Company Overview, USP, Business Strategies, Business Model, Number of Dealerships/Inventory, Revenues, Pricing Basis, Technology Used, Warranty Programs, Financing Tie-ups, Major Clients, Strategic Alliances, Marketing Strategy, Recent Developments)

15.3. Operating Model Analysis Framework (inventory acquisition, reconditioning, sales model, post-sale engagement)

15.4. Gartner Magic Quadrant for Competitive Positioning

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues-Forecast

17.1. By Market Structure (Franchised, Independent, Online, Auctions, C2C)

17.2. By Fuel Type (Gasoline, Diesel, Hybrid, Plug-in Hybrid, BEV)

17.3. By Vehicle Age (≤2 years, >2-5 years, >5-8 years, >8-12 years, >12 years)

17.4. By Price Band (Entry to Luxury)

17.5. By Ownership Type (Private, Corporate, Rental)

17.6. By Sales Channel (Dealer, Online, Auction, C2C)

17.7. By Mileage Band (≤40k to >160k)

17.8. By Region (North-West, North-East, Centre, South, Islands)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Italy Used Car Market. Based on this ecosystem, we will shortlist 5–6 leading players in the country based on their financial information, market reach, sourcing mix, and customer base. Sourcing is conducted through industry articles, PRA/ACI statistics, UNRAE reports, government data portals, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like transfer volumes, parc size, vehicle age/fuel segmentation, sourcing flows, and dealer network structures. We supplement this with detailed examinations of company-level data, relying on sources such as annual reports, investor presentations, press releases, and registry filings. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Italy Used Car Market companies and demand-side participants. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach companies and dealers under the guise of potential clients. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, sourcing channels, reconditioning processes, pricing strategies, and customer journey factors.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process. Cross-verification is conducted between PRA/ACI transfer data, UNRAE segmentation reports, and player-level volumes to ensure internal consistency. This triangulation strengthens the accuracy of the final market estimates and ensures a comprehensive, validated analysis of the Italy Used Car Market.

FAQs

01 What is the Potential for the Italy Used Car Market?

The Italy Used Car Market is poised for sustained momentum, recording 5.01 million ownership transfers in 2023 and growing further to 5.41 million in the following cycle, as per ACI/PRA statistics. The market’s potential is underpinned by Italy’s high motorization rate of 701 cars per 1,000 residents and a circulating parc of over 41.3 million vehicles, among the largest in Europe. This deep stock combined with affordability gaps versus new vehicles and rising digital adoption ensures the used car sector remains a cornerstone of Italian mobility.

02 Who are the Key Players in the Italy Used Car Market?

The Italy Used Car Market features several major players, including AutoScout24, Subito (Motori), and brumbrum (Aramis Group). These platforms dominate the market with their extensive online reach, dealer integration, and consumer-friendly features. Other notable competitors include Autohero (AUTO1 Group), Noicompriamoauto.it, and OEM-backed certified programs such as Spoticar (Stellantis) and Das WeltAuto (Volkswagen Group). Premium OEM CPO labels like Audi Prima Scelta :plus, BMW Premium Selection, and Mercedes-Benz Certified further strengthen the competitive landscape, offering buyers enhanced trust and warranty-backed vehicles.

03 What are the Growth Drivers for the Italy Used Car Market?

The primary growth drivers include macroeconomic and structural factors such as Italy’s large and aging vehicle parc of 41.3 million cars, which naturally creates high replacement and resale activity. Strong household consumption levels, with average monthly expenditure of €2,728 (ISTAT), support demand for affordable used mobility. Additionally, the expansion of digital platforms has transformed discovery and transaction processes, enabling faster liquidity across regions. Improved access to consumer credit, with lending rates easing to 10.18% APRC (Bank of Italy), also drives demand for younger stock and fuels the growth of certified pre-owned programs.

04 What are the Challenges in the Italy Used Car Market?

The Italy Used Car Market faces significant challenges, including an aging parc with a median scrappage age of 18 years and 6 months, raising compliance and maintenance issues. Administrative complexities such as the 60-day PRA transfer filing requirement and varying provincial IPT charges create frictions in high-volume months, where over 280,000 transfers may be processed. Additionally, supply constraints of newer vehicles, with new registrations still below 1.6 million units, limit availability of younger and electrified stock, slowing the transition toward hybrids and EVs in the secondary market and restraining choice for buyers.