Japan AI in Healthcare Market Outlook to 2030

By Solution, By Clinical Application, By Technology, By Deployment Model, By End User, and By Region

- Product Code: TDR0318

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Japan AI in Healthcare Market Outlook to 2030 – By Solution, By Clinical Application, By Technology, By Deployment Model, By End User, and By Region” provides a comprehensive analysis of Japan’s AI-enabled healthcare ecosystem. The study covers the market’s overview and genesis within Japan’s universal coverage system, overall market size in terms of revenue, and granular segmentation. It examines trends and developments, the regulatory landscape, customer-level profiling of provider cohorts and procurement playbooks, issues and challenges, and a competitive landscape including competition scenario, cross-comparison matrices, opportunity zones and bottlenecks, and detailed company profiling of major domestic and global players. The report concludes with future market projections by solution and region, scenario-based adoption curves linked to regulatory/reimbursement milestones, cause-and-effect relationships across hospital digital maturity and evidence thresholds, and success case studies highlighting the principal opportunities and cautions for stakeholders entering or scaling within Japan’s AI in healthcare market.

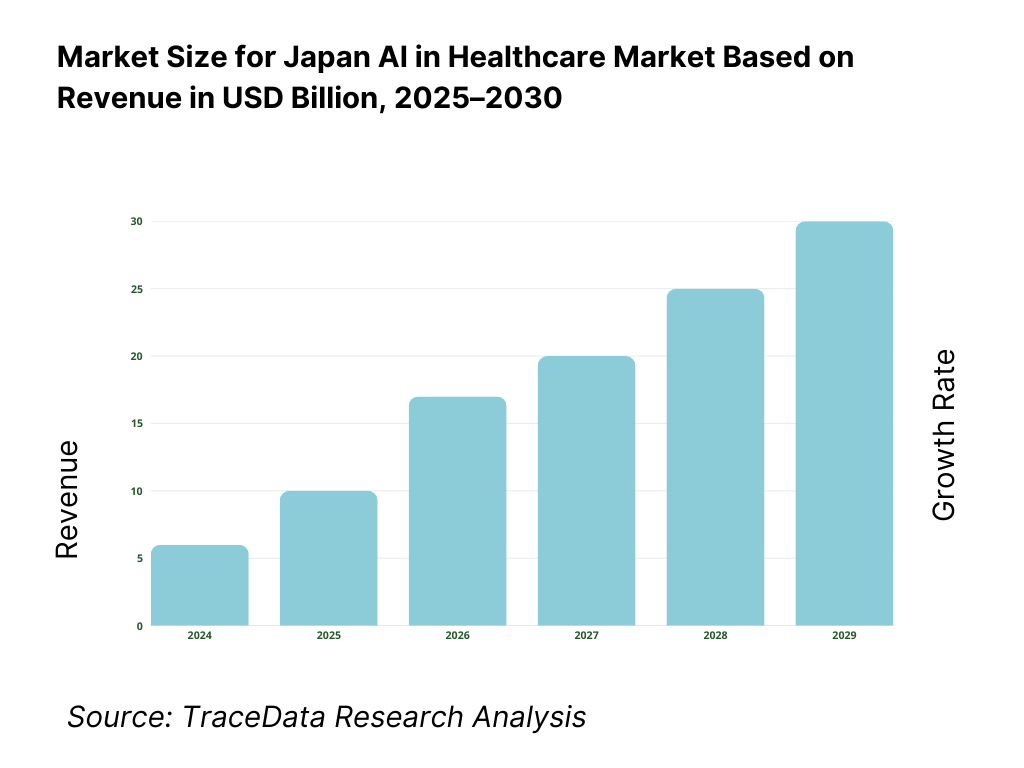

Japan AI in Healthcare Market Overview and Size

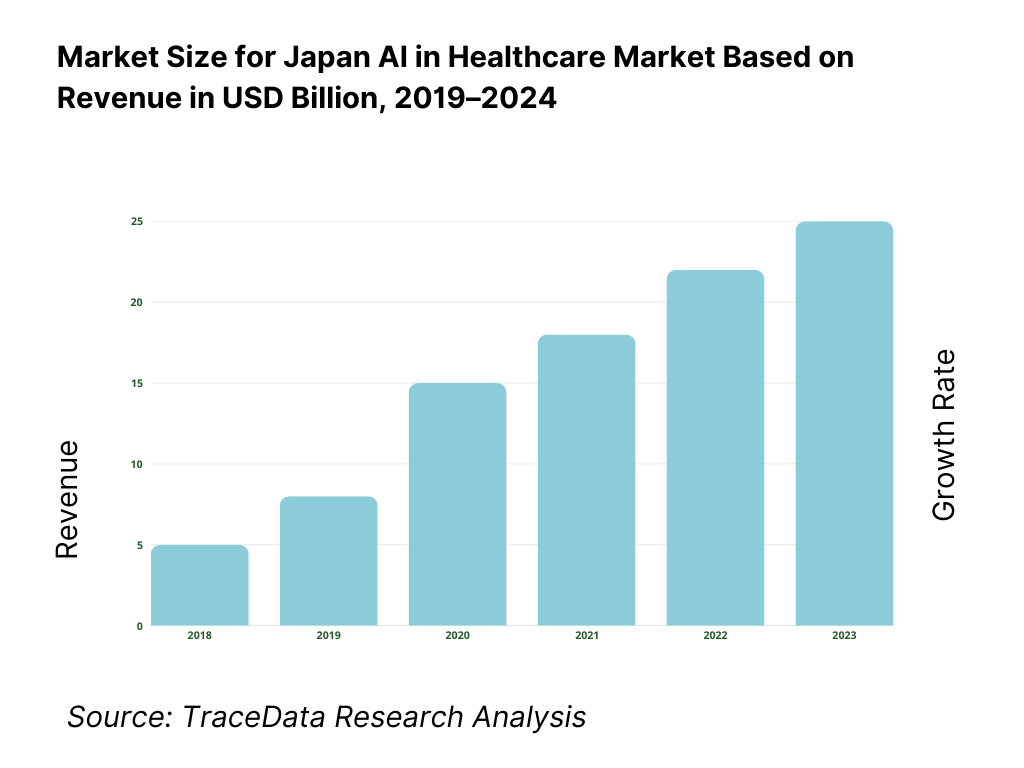

Japan’s AI in healthcare market is valued at USD 917.3 million, based on a five-year historical analysis, with traction concentrated in imaging AI, clinical decision support, and digital therapeutics. Momentum in the adjacent period is evidenced by USD 1.42 billion, indicating rapid enterprise adoption as hospitals chase throughput gains and evidence-backed SaMDs scale beyond pilots. Key drivers include high diagnostic workloads, universal coverage–linked efficiency mandates, and the maturation of domestic vendors bringing PMDA-cleared products to market.

The market’s operational gravity centers on Kantō (Tokyo) and Kansai (Osaka/Kyoto), followed by Tokai (Nagoya) and Fukuoka clusters. These hubs host dense networks of university/DPC hospitals, large research biobanks, and OEM headquarters or major offices, enabling rich data pipelines (SS-MIX2/FHIR), faster clinical validation, and OEM–provider co-creation. National statistics show 1,786 acute DPC hospitals and 82 university hospitals, with distribution skewed to large prefectures; imaging OEMs such as Canon Medical and Fujifilm maintain headquarters and plants across Greater Tokyo–Tochigi–Shizuoka, anchoring commercialization.

What Factors are Leading to the Growth of the Japan AI in Healthcare Market:

Super-aged demand & hospital throughput pressure: Japan’s elderly population totals 36,243,000 people and accounts for nearly a third of residents, concentrating complex, imaging-heavy care needs in large urban hospital systems. Hospitals handled an average of 1,123,654 inpatients per day, of which 921,894 were in general hospitals, underscoring sustained diagnostic and care workloads that favor AI for triage, reading-room efficiency and care coordination. All 82 university hospitals operate as DPC facilities within a national network of roughly 8,000 hospitals, creating dense sites for AI deployment and validation at scale. These demographics and throughput realities directly raise the payoff from radiology, endoscopy and documentation-automation AI.

Structured payment & data rails that enable AI: The Diagnosis Procedure Combination network includes 1,786 acute-care DPC hospitals, standardizing activity-based data capture that AI can learn from and optimize against. National handbooks provide machine-readable hospital and bed statistics by prefecture, making integration targets explicit for vendors building SS-MIX2/FHIR pipelines. National expenditure tables and patient-flow surveys released by the ministry give site-level utilization baselines that support AI business cases in imaging, endoscopy and operations. Together these rails—codified DPC data, published hospital capacity files, and routine patient-volume reporting—shorten validation cycles and support outcomes monitoring required in post-market surveillance.

Deep diagnostic capacity and clinical workforce scale: Japan operates one of the world’s densest diagnostic infrastructures, with OECD noting the country has the highest availability of CT and MRI units per capita among member states, which translates to massive image flows suited to computer vision and workflow AI. Clinical workforce pipelines are substantial: nursing education reached 280 universities with 25,673 enrolled students, feeding AI-augmented workflows such as documentation, staffing and bed-flow. Physician statistics compiled by the ministry detail specialty distribution (e.g., 11,030 hospital-based pediatricians), enabling targeted AI deployment to bottleneck services. These system-level inputs make AI a practical lever rather than a speculative add-on.

Which Industry Challenges Have Impacted the Growth of the Japan AI in Healthcare Market:

Workforce shortages, distribution and work-style constraints: The ministry’s physician census shows uneven physician distribution by prefecture (e.g., Saitama 180.2 physicians per 100k vs. Tokushima 335.7), complicating equitable AI rollout without robust change management and clinical governance. Specialty staffing remains tight: hospital-based pediatricians number 11,030, with survey evidence of workload pressures that AI alone cannot absorb without workflow redesign. Nursing workforce aging is visible despite pipeline growth, with studies noting multi-decade shifts in staff age composition. These human-capital frictions necessitate AI that demonstrably saves time per case and integrates with existing rota and duty-hour reforms.

Data fragmentation and security obligations across thousands of sites: Japan’s healthcare system spans roughly 8,000 hospitals plus over 100,000 clinics, creating heterogeneous SS-MIX2 repositories and PACS/VNA estates that demand robust interoperability, identity management and on-premises options. The 2023 Hospital Report logged 1,123,654 average inpatients per day, generating continuous streams of PHI that must meet strict cybersecurity notices and auditability—particularly for SaMD updates. Post-Approval Change Management Protocols (PACMP) and AI/ML device expectations formalize lifecycle changes, raising vendor costs for safe model iteration at scale.

Demography-driven utilization with shrinking birth cohort: Japan’s population stands at 124.35 million with 36.23 million aged 65+, intensifying chronic-care and screening workloads that can outpace staffing if AI does not deliver measurable throughput gains. Births fell to 720,988, deepening the long-term dependency ratio and tightening future clinical labor supply while raising per-capita care needs among older adults. In this context, AI projects must prove time saved per study, fewer repeat exams, and reduced length-of-stay to justify scarce IT and clinical resources.

What are the Regulations and Initiatives which have Governed the Market:

PMDA/MHLW SaMD approval and lifecycle controls: Software as a Medical Device that requires “Approval of the MHLW” undergoes PMDA product review, with structured fee-based consultations before filing. Science Board materials set expectations for AI/ML SaMD, including performance evidence and post-market monitoring; lifecycle updates follow Post-Approval Change Management Protocols, formalizing verification when models change. For providers, this means AI used in diagnostic pathways must be traceable and validated; for vendors, it mandates operational capacity to sustain compliant updates across hundreds of DPC sites (1,786 facilities) without disrupting care.

Data access under the Next-Generation Medical Infrastructure Law (NGMIL): NGMIL enables certified operators to create and provide pseudonymized medical data for secondary use, balancing public health benefits and privacy. The 2023 amendment established a formal system for pseudonymized data utilization by nationally authorized users, allowing access to unaltered fields such as specific test values or disease names when justified. For AI developers, this clarifies lawful pipelines for training/validation datasets sourced from provider partners and certified hubs, accelerating evidence generation without compromising identifiability rules.

Reimbursement decision-making via Chuikyo and HTA use: Coverage and coding decisions for devices and DTx are determined by the Central Social Insurance Medical Council (Chuikyo) after MHLW evaluation, with nationally applied reimbursement prices. Japan has formal cost-effectiveness evaluation guidelines for drugs and devices; these processes are increasingly consulted for digital interventions as evidence matures. The existence of a single payer framework, codified pricing and a central decision body creates a clear commercialization route for AI SaMD and DTx once clinical utility is demonstrated, enabling scaled uptake across 1,123,654 daily inpatient encounters and broader outpatient flows.

Japan AI in Healthcare Market Segmentation

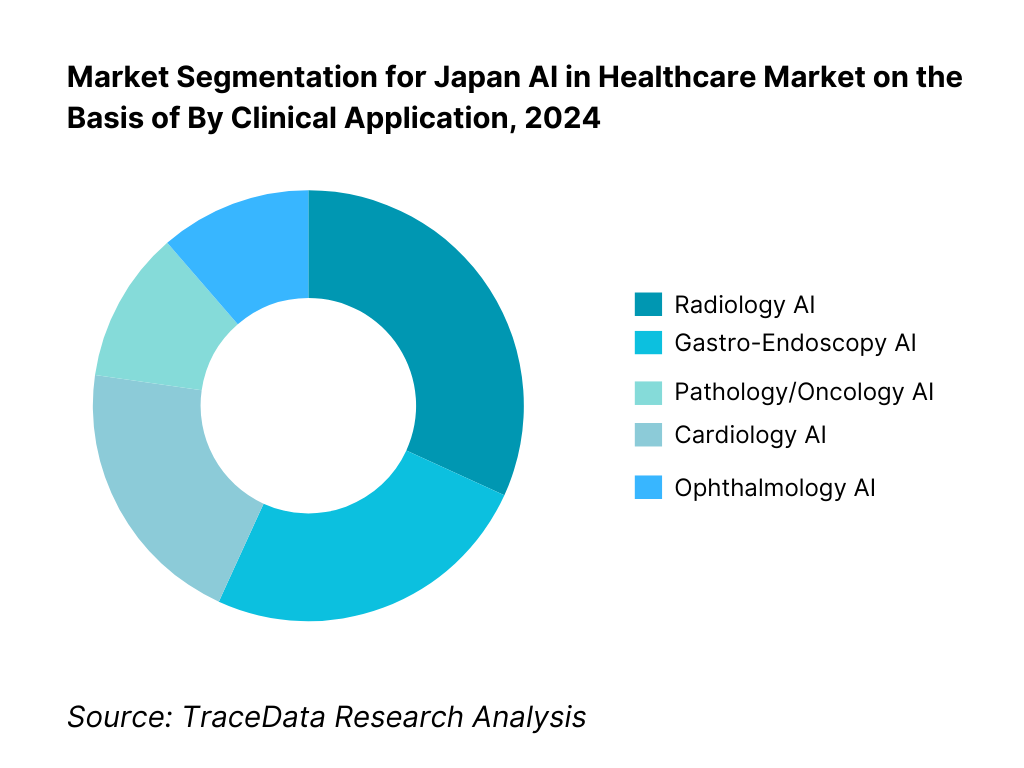

By Clinical Application: Japan AI in Healthcare market is segmented by clinical application into radiology AI, gastro-endoscopy AI, cardiology AI, pathology/oncology AI, and ophthalmology AI. Radiology AI currently holds a dominant share because of Japan’s exceptionally high imaging volumes and the near-universal presence of PACS across DPC hospitals. Concurrently, endoscopy AI has advanced quickly given Japan’s screening culture and the availability of commercial systems like CAD EYE and gastroAI-model G, which have undergone regulatory review and in-market deployment, strengthening clinician trust. Radiology retains the lead, however, due to multi-modality breadth (X-ray, CT, MRI, ultrasound), OEM bundling across large installed bases, and measurable reading-room KPIs (turnaround time, prioritized worklists) that map cleanly to hospital ROI and procurement scorecards.

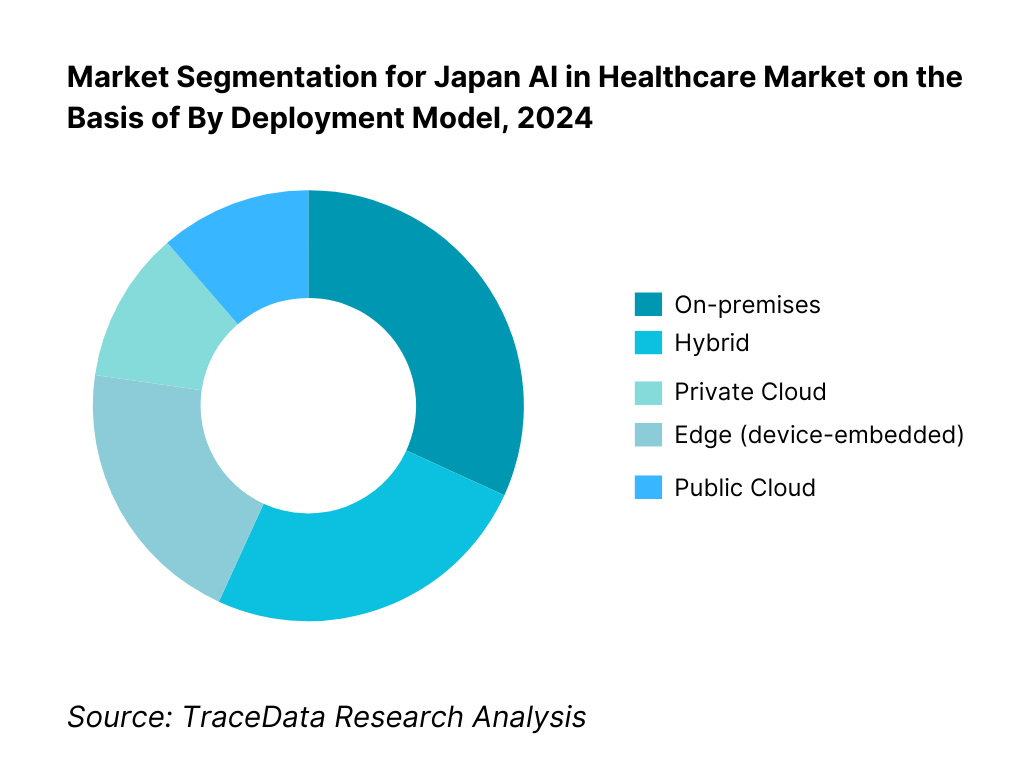

By Deployment Model: Japan AI in Healthcare market is segmented by deployment into on-premises, private cloud, public cloud, hybrid, and edge. On-premises currently dominates as many university and public hospitals prioritize data residency, SS-MIX2 archives, and controlled model updates under established medical IT governance. Ties to existing VNA/PACS, network segmentation policies, and strict audit requirements under hospital security guidelines favor local inference for diagnostic workloads. That said, hybrid is expanding rapidly as vendors introduce cloud-based model lifecycle management while keeping PHI processing in-hospital, and edge grows with modality-embedded AI. Public cloud uptake, while rising, is often led by secondary workflows (report generation, NLP scribing) rather than primary diagnosis in larger centers—with private cloud preferred by chains seeking unified governance.

Competitive Landscape in Japan AI in Healthcare Market

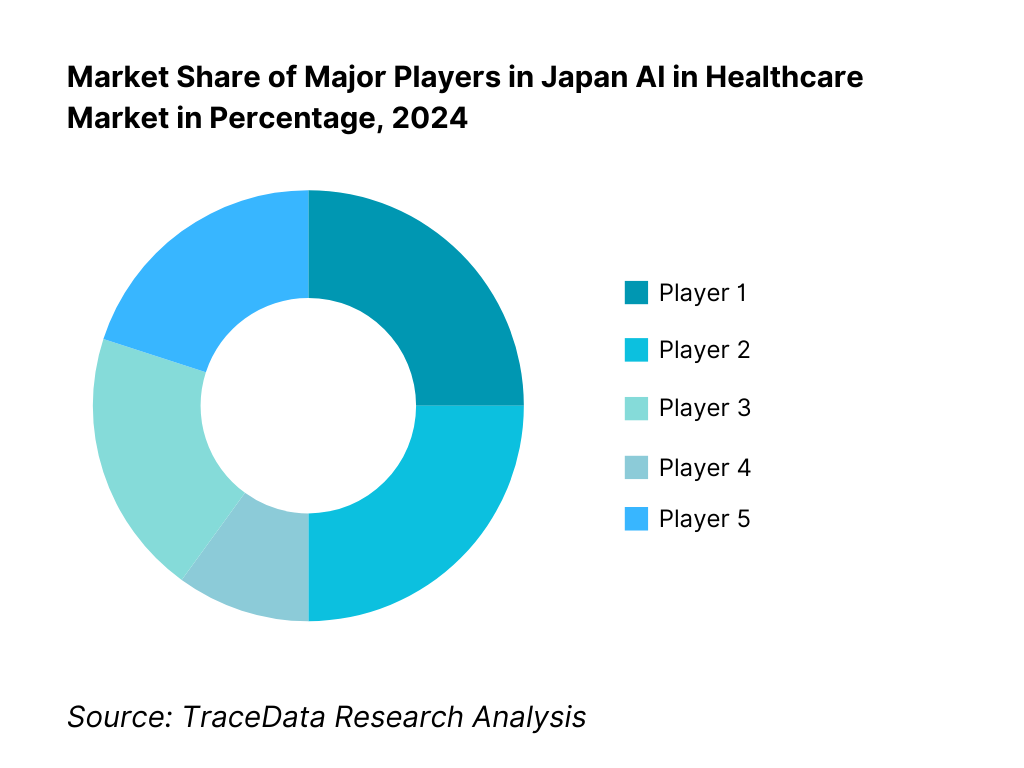

The Japan AI in Healthcare market coalesces around imaging OEMs with embedded AI, domestic SaMD innovators, and DTx pioneers. Notable players include Fujifilm (endoscopy AI), Canon Medical Systems (imaging AI platformization), global OEMs (Siemens Healthineers, GE HealthCare) leveraging large installed bases, and digital-native firms like AI Medical Service (gastro AI) and CureApp (reimbursed DTx for nicotine dependence and hypertension). This concentration underscores the influence of hardware-software bundling, PMDA-cleared SaMDs, and university hospital collaborations that accelerate validation and adoption.

Name | Founding Year | Original Headquarters |

Fujifilm Healthcare | 1934 | Tokyo, Japan |

Canon Medical Systems | 1930 | Ōtawara, Tochigi, Japan |

Siemens Healthineers | 1847 | Erlangen, Germany |

GE HealthCare | 1892 | Chicago, USA |

Philips Healthcare | 1891 | Eindhoven, Netherlands |

NVIDIA Healthcare | 1993 | Santa Clara, USA |

Microsoft (Azure AI Healthcare) | 1975 | Redmond, USA |

Google Cloud Healthcare | 1998 | Mountain View, USA |

LPIXEL | 2014 | Tokyo, Japan |

Preferred Networks | 2014 | Tokyo, Japan |

AI Medical Service | 2017 | Tokyo, Japan |

MICIN | 2015 | Tokyo, Japan |

Ubie | 2017 | Tokyo, Japan |

CureApp | 2014 | Tokyo, Japan |

Medmain | 2018 | Fukuoka, Japan |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Fujifilm Healthcare: As a leading innovator in medical imaging, Fujifilm expanded its CAD EYE endoscopy AI platform in 2024, with new clinical trials validating its effectiveness in real-time polyp detection. The company also deepened its collaborations with university hospitals to accelerate deployment of AI-assisted colonoscopy.

Canon Medical Systems: Strengthening its position in radiology AI, Canon Medical launched upgrades to its AI-based CT reconstruction and workflow optimization tools in 2024. With a strong domestic manufacturing base, the company continues to focus on integrating AI directly into imaging modalities to ensure seamless adoption in Japanese hospitals.

AI Medical Service: A Tokyo-based startup, AI Medical Service gained significant traction in 2024 by receiving MHLW approval for gastroAI-model G, the first AI for gastric lesion detection. Its clinical partnerships with major endoscopy centers highlight its leadership in gastrointestinal AI and Japan’s innovation edge in this field.

CureApp: A pioneer in digital therapeutics (DTx), CureApp secured expanded reimbursement for its hypertension DTx app in 2024, building on its earlier nicotine cessation success. The company continues to work closely with insurers and the Chuikyo council to make DTx a mainstream treatment option within Japan’s universal healthcare system.

LPIXEL: Focused on AI-powered pathology and imaging solutions, LPIXEL announced multiple collaborations with pharmaceutical companies in 2024 for real-world evidence and drug development applications. Its emphasis on explainable AI and regulatory compliance positions it strongly in precision medicine and drug discovery support.

What Lies Ahead for Japan AI in Healthcare Market?

The Japan AI in Healthcare market is expected to continue its steady expansion through 2030, driven by the country’s super-aged demographics, the rising pressure on hospitals to improve throughput, and supportive regulatory frameworks for Software as a Medical Device (SaMD) and digital therapeutics (DTx). National initiatives such as the Next-Generation Medical Infrastructure Law and Chuikyo’s structured reimbursement pathways are creating an enabling environment for adoption across radiology, endoscopy, pathology, and chronic disease management.

Rise of Hybrid AI Deployment Models: The future of Japan’s healthcare AI will be shaped by hybrid deployment models, where on-premises processing ensures data security while cloud systems handle model management and analytics. This is particularly critical in university and DPC hospitals that manage large volumes of SS-MIX2/FHIR data. Hybrid architectures will offer scalability while respecting Japan’s strict data residency and cybersecurity requirements.

Focus on Outcome-Based AI Integration: Hospitals and payers will increasingly demand outcome-based validation before adopting AI solutions. Metrics such as reduced radiology turnaround times, improved adenoma detection rates in colonoscopy, shorter length of stay, and enhanced documentation efficiency will become benchmarks for procurement. Vendors that can tie AI performance directly to clinical and operational ROI will gain significant traction.

Expansion of Clinical Domain-Specific AI: Demand is expected to rise for domain-specific AI solutions, particularly in gastroenterology, oncology, and ophthalmology. Japan’s strong culture of endoscopic screening, rising cancer burden, and diabetic eye disease prevalence will drive adoption of AI systems tailored to these high-volume specialties. The precision medicine push will further strengthen pathology and oncology AI solutions.

Leveraging GenAI, NLP, and Real-World Evidence: The next phase will witness deeper use of generative AI and natural language processing in EHR summarization, clinical documentation, and patient engagement. In parallel, the vast national datasets from the NDB and DPC networks will be leveraged for real-world evidence generation, feeding back into AI training and post-market validation. This dual approach will enhance personalization of care and accelerate the feedback loop for regulatory approvals and reimbursement.

Japan AI in Healthcare Market Segmentation

By Solution

Diagnostic Imaging AI (CT, MRI, X-ray, Ultrasound)

Clinical Decision Support Systems (CDSS)

Digital Therapeutics (DTx) (e.g., hypertension, nicotine cessation, diabetes)

Hospital Operations AI (bed management, scheduling, revenue cycle)

Population Health & Real-World Evidence Analytics

By Clinical Application

Radiology

Gastro-Endoscopy

Cardiology

Pathology & Oncology

Ophthalmology

By Technology

Computer Vision

Natural Language Processing (NLP) & Large Language Models

Traditional Machine Learning

Deep Learning

Generative AI

By Deployment Model

On-Premises

Private Cloud

Public Cloud

Hybrid

Edge (device-embedded AI)

By End User

University Hospitals (82 in total)

Prefectural & Community DPC Hospitals

Private Clinics

Imaging & Diagnostic Centers

Pharma & CROs (for RWE & clinical trials)

By Region

Kantō (Tokyo & surrounding prefectures)

Kansai (Osaka, Kyoto, Hyōgo)

Tokai (Aichi/Nagoya region)

Kyushu (Fukuoka and southern hubs)

Hokkaido & Tohoku

Players Mentioned in the Report:

Fujifilm Healthcare

Canon Medical Systems

Siemens Healthineers

GE HealthCare

Philips

NVIDIA

Microsoft (Azure for Healthcare)

Google Cloud

LPIXEL

Preferred Networks;

AI Medical Service

MICIN

Ubie

CureApp

Medmain.

Key Target Audience

University hospital executive boards (CIO, CMIO, radiology/endoscopy chairs)

Prefectural & community DPC hospitals’ procurement teams

Private clinic chains and imaging center networks

Medical device OEMs & distributors (imaging, endoscopy, pathology)

Pharma/Biotech & CRO digital units (RWE/HEOR, trial operations)

Investments and venture capitalist firms (healthtech growth equity & corporate VC)

Government and regulatory bodies (MHLW, PMDA, Chuikyo, AMED, NEDO)

EHR/HIS/PACS vendors and cloud service providers (SS-MIX2/FHIR/DICOM enablement)

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Japan AI in Healthcare Market

4. Value Chain Analysis

4.1. Delivery Model Analysis for AI in Healthcare-On-Premises, Private Cloud, Public Cloud, Hybrid, and Edge Deployments-Margins, Adoption Preferences, Strengths, and Weaknesses

4.2. Revenue Streams for Japan AI in Healthcare Market-SaaS Subscriptions, Per-Study Usage, OEM Bundling, Outcome-Based Models, Validation Services

4.3. Business Model Canvas for AI in Healthcare-Key Partners, Key Activities, Value Propositions, Cost Structure, Revenue Streams, Customer Segments

5. Market Structure

5.1. Domestic Vendors vs Global Vendors (Local Startups vs MNCs)

5.2. Investment Model in Japan AI in Healthcare Market-Venture Capital, Corporate Venture, Government Grants (AMED/NEDO), JV Models

5.3. Comparative Analysis of the AI Deployment Process by Public vs Private Hospitals

5.4. AI Budget Allocation by Hospital Size (University, Community, Clinics)

6. Market Attractiveness for Japan AI in Healthcare Market

(Evaluated through TAM/SAM/SOM, adoption barriers, reimbursement accessibility, dataset richness, health burden alignment, competitive intensity, hospital digitalization index, policy favorability)

7. Supply-Demand Gap Analysis (Radiologist Shortages vs Imaging Volume; Endoscopy Caseload vs Specialist Availability; AI-enabled DTx Demand vs Coverage Approvals; Hospital IT Maturity vs AI Readiness)

8. Market Size for Japan AI in Healthcare Market Basis

8.1. Revenues (Historical to Present)

9. Market Breakdown for Japan AI in Healthcare Market Basis

9.1. By Market Structure (In-House vs Outsourced AI Deployment)

9.2. By Solution (Diagnostic Imaging AI, Clinical Decision Support, Digital Therapeutics, Hospital Operations AI, RWE/Population Health Analytics)

9.3. By Clinical Applications (Radiology, Gastro-Endoscopy, Cardiology, Oncology/Pathology, Ophthalmology)

9.4. By Hospital Size (University Hospitals, Prefectural Hospitals, Private Clinics, Imaging Centers, Pharma/CROs)

9.5. By Clinician Type (Radiologists, Gastroenterologists, Cardiologists, Pathologists, Ophthalmologists, General Practitioners)

9.6. By Mode of Deployment (On-Premises, Cloud, Edge)

9.7. By Procurement Model (Enterprise Subscription, Per-Study, OEM Bundled, Outcome-Based Contracts)

9.8. By Region (Kanto, Kansai, Tokai, Kyushu, Hokkaido/Tohoku)

10. Demand Side Analysis for Japan AI in Healthcare Market

10.1. Hospital Client Landscape and Cohort Analysis

10.2. AI Adoption Decision-Making Process in Hospitals

10.3. ROI and Effectiveness of AI-Based Clinical Workflows

10.4. Gap Analysis Framework-Workflow Integration, Data Quality, Clinician Training, Procurement Delays

11. Industry Analysis

11.1. Trends and Developments for Japan AI in Healthcare Market

11.2. Growth Drivers-Aging Population, Clinician Shortage, Digital Hospital Mandates, Reimbursement Inclusion, GenAI in EHRs

11.3. SWOT Analysis for Japan AI in Healthcare Market

11.4. Issues and Challenges-Privacy Culture, Data Fragmentation, Regulatory Approval Times, Cybersecurity Risks, Hospital Legacy IT

11.5. Government Regulations-PMDA AI SaMD Approvals, NDB/NGMIL Access, Chuikyo Reimbursement Codes, SS-MIX2/FHIR Interoperability

12. Snapshot on AI-Enabled Digital Therapeutics (DTx) Market in Japan

12.1. Market Size and Future Potential for DTx in Japan

12.2. Business Model and Revenue Streams-Reimbursement-Approved DTx vs Self-Pay Apps

12.3. Delivery Models and Type of Therapeutic Areas Covered

13. Opportunity Matrix for Japan AI in Healthcare Market-Presented with Radar Chart

14. PEAK Matrix Analysis for Japan AI in Healthcare Market

15. Competitor Analysis for Japan AI in Healthcare Market

15.1. Market Share of Key Players in Japan AI in Healthcare Market (Revenue Basis)

15.2. Benchmark of Key Competitors including-Company Overview, USP, Business Strategies, Business Model, Revenues, Pricing, Technology Used, Approved Products, Clinical Evidence Strength, Strategic Tie-Ups, Marketing, Recent Developments

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant

15.5. Bowman’s Strategic Clock for Competitive Advantage

16. Future Market Size for Japan AI in Healthcare Market Basis

16.1. Revenues (Forecast Period)

17. Market Breakdown for Japan AI in Healthcare Market Basis (Future)

17.1. By Market Structure (In-House vs Outsourced AI Deployment)

17.2. By Solution (Diagnostic Imaging AI, Clinical Decision Support, DTx, Operations AI, Population Analytics)

17.3. By Clinical Applications (Radiology, Gastro-Endoscopy, Cardiology, Oncology/Pathology, Ophthalmology)

17.4. By Hospital Size

17.5. By Clinician Type

17.6. By Mode of Deployment

17.7. By Procurement Model

17.8. By Region (Kanto, Kansai, Tokai, Kyushu, Hokkaido/Tohoku)

18. Recommendations

19. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the Japan AI in Healthcare ecosystem, capturing both demand-side entities (university hospitals, prefectural DPC hospitals, private clinics, imaging centers, and payers under the NHI system) and supply-side entities (OEMs such as Fujifilm and Canon, global imaging leaders, domestic AI startups like AI Medical Service, CureApp, LPIXEL, and infrastructure providers such as Microsoft Azure and Google Cloud). Based on this mapping, we shortlist 5–6 leading AI healthcare providers in Japan by evaluating their regulatory approvals, clinical partnerships, revenue streams, and installed base within DPC/university hospitals. Sourcing is conducted through MHLW/PMDA publications, industry articles, proprietary databases, and public financial disclosures to collate industry-level information.

Step 2: Desk Research

Our team conducts exhaustive desk research, referencing a wide range of secondary and proprietary sources including MHLW Hospital Reports, OECD health statistics, and company-level filings. This process allows us to analyze critical market aspects such as number of hospitals (8,000+ facilities including 1,786 DPC hospitals), physician and patient volumes, adoption barriers, and deployment models (on-premises, cloud, hybrid). Company-level analysis includes regulatory announcements (PMDA SaMD approvals), product press releases, financial statements, and partnership disclosures. This desk research establishes a baseline view of market structure, value chain, pricing strategies, and clinical adoption patterns in Japan.

Step 3: Primary Research

We conduct structured interviews with C-level executives, department heads, and senior clinicians across the Japan AI in Healthcare market, including radiology, gastroenterology, and digital therapeutics stakeholders. The primary goal is to validate hypotheses around adoption rates, operational bottlenecks, and regulatory readiness. We also execute disguised interviews under the guise of potential clients, enabling us to confirm details on deployment models, AI procurement processes, and pricing negotiations. These conversations provide clarity on revenue contributions per vendor, clinical validation practices, and integration hurdles, supplementing our desk research findings. This ensures a bottom-up revenue aggregation approach, cross-verified with secondary data.

Step 4: Sanity Check

Finally, we perform a sanity check using top-to-bottom and bottom-to-top approaches. Market size modeling integrates hospital volume data (inpatients per day: 1,123,654), physician density, diagnostic infrastructure availability, and number of SaMD/DTx approvals. This is validated against both desk and primary research. By triangulating across ecosystem mapping, industry statistics, and executive interviews, we ensure that the findings are accurate, consistent, and aligned with Japan’s unique regulatory and healthcare delivery framework.

FAQs

01 What is the Potential for the Japan AI in Healthcare Market?

The Japan AI in Healthcare Market is poised for strong expansion, valued at USD 917.3 million in 2023 and supported by a five-year historical growth trajectory. Its potential stems from the country’s super-aged population of 36.2 million elderly citizens, rising demand for efficiency in 1,786 DPC hospitals, and rapid adoption of digital health infrastructure. The market is further reinforced by the government’s focus on SaMD approvals and the integration of AI into radiology, endoscopy, and digital therapeutics, making it one of the most dynamic health technology sectors in Asia.

02 Who are the Key Players in the Japan AI in Healthcare Market?

The Japan AI in Healthcare Market features several leading players, including Fujifilm Healthcare, Canon Medical Systems, and AI Medical Service, which are front-runners due to their strong presence in imaging and endoscopy AI. Other notable participants include CureApp in the digital therapeutics space, LPIXEL in pathology AI, and Preferred Networks with its deep learning applications. Global leaders such as Siemens Healthineers, GE HealthCare, Philips, NVIDIA, Microsoft, and Google Cloud are also influential, leveraging partnerships with Japanese hospitals and OEMs to expand their clinical AI portfolios.

03 What are the Growth Drivers for the Japan AI in Healthcare Market?

The primary growth drivers include demographic and systemic factors such as Japan’s 124.3 million population with one of the world’s highest life expectancies, creating sustained demand for chronic disease care and diagnostics. The government’s regulatory reforms, including the Next-Generation Medical Infrastructure Law for pseudonymized data sharing and Chuikyo’s structured reimbursement pathway for digital therapeutics, are enabling adoption. Additionally, Japan’s healthcare system, with over 8,000 hospitals and widespread PACS and SS-MIX2 integration, provides the technological backbone needed for large-scale AI deployment in diagnostics and workflow automation.

04 What are the Challenges in the Japan AI in Healthcare Market?

The Japan AI in Healthcare Market faces several challenges, including workforce shortages and uneven physician distribution—ranging from 180 physicians per 100,000 in Saitama to 335 in Tokushima—which strain deployment and adoption. Regulatory demands for continuous post-market surveillance and PACMP compliance increase costs for vendors, especially for adaptive AI systems. Data fragmentation across 8,000+ hospitals and 100,000 clinics also complicates interoperability, with cybersecurity requirements adding further integration hurdles. These constraints necessitate significant investments in validation, governance, and secure deployment to ensure widespread scalability.