Japan Domestic Tourism Market Outlook to 2029

By Market Structure, By Regions, By Age Groups, By Purpose of Travel, By Transportation Mode, and By Accommodation Type

- Product Code: TDR0116

- Region: Asia

- Published on: February 2025

- Total Pages: 80

Report Summary

The report titled “Japan Domestic Tourism Market Outlook to 2029 - By Market Structure, By Regions, By Age Groups, By Purpose of Travel, By Transportation Mode, and By Accommodation Type” provides a comprehensive analysis of the domestic tourism market in Japan. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the domestic tourism market. The report concludes with future market projections based on tourism spending, by purpose of travel, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Japan Domestic Tourism Market Overview and Size

The Japan domestic tourism market reached a valuation of JPY 25 trillion in 2023, driven by the resurgence of travel after the COVID-19 pandemic, government initiatives such as the "Go To Travel" campaign, and the increasing emphasis on local cultural and nature-based tourism. The market is characterized by major players such as JTB Corporation, HIS Co., Ltd., Rakuten Travel, and Nippon Travel Agency. These companies are recognized for their extensive networks, tailored travel packages, and customer-focused services.

In 2023, JTB Corporation introduced a new digital platform offering curated travel experiences to meet the rising demand for unique and sustainable tourism. Popular destinations include Tokyo, Kyoto, Hokkaido, and Okinawa, which continue to attract significant domestic travel due to their cultural, culinary, and recreational appeal.

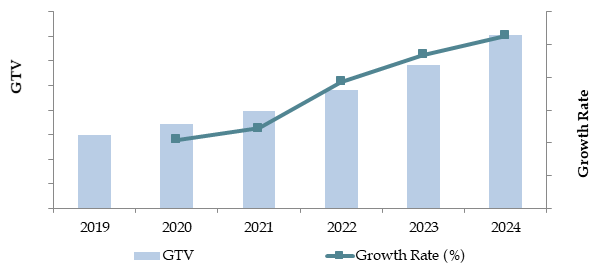

Market Size for Japan Domestic Tourism Industry on the Basis of GTV in USD Billion, 2018-2024

What Factors are Leading to the Growth of the Japan Domestic Tourism Market

Economic Factors: The weak Japanese yen and the rising cost of international travel have driven consumers to explore domestic alternatives. In 2023, domestic travel accounted for approximately 80% of total tourism activity in Japan. Affordability and convenience have become key drivers, particularly among families and retirees looking for budget-friendly travel options.

Cultural Appeal: Japan's rich cultural heritage, diverse regional cuisines, and seasonal attractions have bolstered domestic tourism. Events like cherry blossom festivals, snow festivals, and local cultural fairs continue to draw significant domestic travelers, with an estimated 30% increase in domestic cultural tourism from 2018 to 2023.

Government Initiatives: The "Go To Travel" campaign, introduced to stimulate the domestic tourism industry post-pandemic, provided subsidies and discounts for accommodations and transportation. This initiative contributed to a 20% increase in domestic travel spending in 2023 compared to 2022.

Which Industry Challenges Have Impacted the Growth for Japan Domestic Tourism Market?

Seasonality and Overcrowding: Japan’s domestic tourism is highly seasonal, with significant peaks during cherry blossom season, Golden Week, and New Year's holidays. This leads to overcrowding at major destinations, reducing the quality of travel experiences and straining local infrastructure. Approximately 35% of domestic travelers cited overcrowding as a factor that deterred them from revisiting popular destinations in 2023.

Aging Population: Japan's aging population poses challenges for the domestic tourism market. Many senior travelers prefer short trips with minimal physical strain, reducing the demand for adventurous or long-haul domestic travel. In 2023, senior citizens accounted for 40% of domestic travelers, but their per-trip expenditure was 25% lower than that of younger demographics.

Limited Regional Connectivity: While major cities like Tokyo and Osaka are well-connected, rural and remote areas lack adequate transportation and accommodation infrastructure. This hampers the potential for promoting lesser-known destinations. In 2023, over 60% of domestic tourism spending was concentrated in urban areas, leaving rural regions underdeveloped and underfunded.

Impact of Natural Disasters: Japan is prone to natural disasters such as earthquakes, typhoons, and volcanic eruptions, which can disrupt travel plans and affect tourism flows. In 2023, typhoons in Kyushu led to a 12% decline in regional domestic tourism revenue compared to the previous year.

What Are the Regulations and Initiatives Which Have Governed the Market?

Travel Subsidy Programs: The Japanese government launched the "Go To Travel" campaign in 2020 to stimulate domestic tourism. By 2023, the program had provided over JPY 2 trillion in subsidies, covering discounts on accommodation, transportation, and attractions. This initiative has significantly boosted travel to less-visited prefectures, leading to a 15% increase in regional tourism spending.

Regional Development Grants: To promote tourism in rural areas, the government allocates grants for developing local attractions and improving infrastructure. In 2023, JPY 300 billion was invested in building transportation links and enhancing accommodation options in underexplored regions like Tohoku and Shikoku.

Environmental Sustainability Policies: The government has implemented sustainability guidelines for tourism operators, focusing on reducing carbon emissions and preserving cultural heritage sites. For instance, Kyoto introduced a cap on the number of visitors to certain historic landmarks to prevent over-tourism. In 2023, 20% of domestic travelers opted for eco-friendly travel packages.

Japan Domestic Tourism Market Segmentation

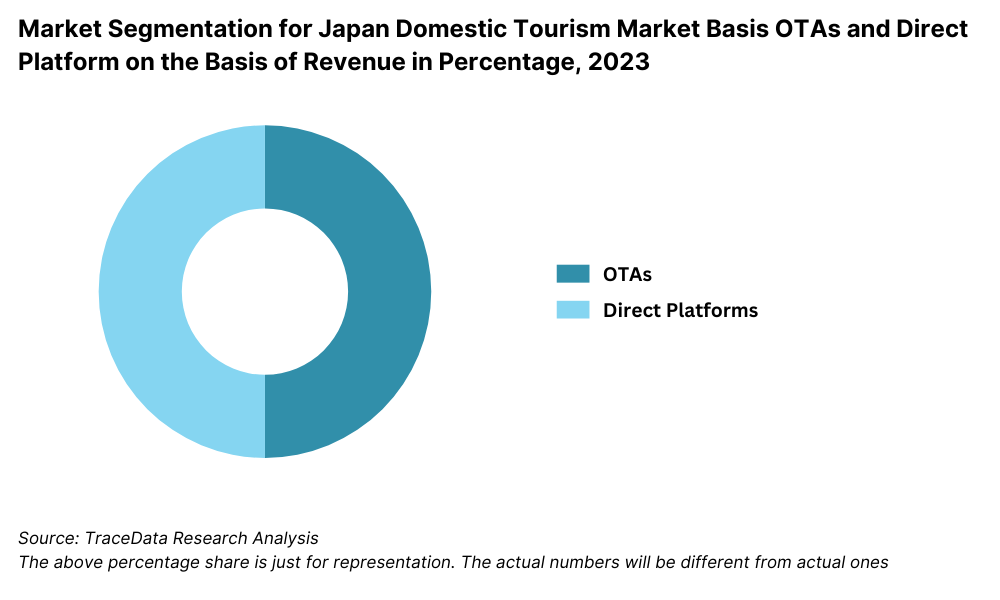

By Market Structure: Local travel agencies dominate the market due to their extensive knowledge of regional destinations, personalized services, and strong community connections. These agencies often cater to niche travel needs such as cultural or nature-based tours. Online Travel Agencies (OTAs) also hold a significant share, driven by their convenience, wide range of offerings, and competitive pricing. OTAs have gained prominence due to the increasing preference for digital platforms among younger demographics.

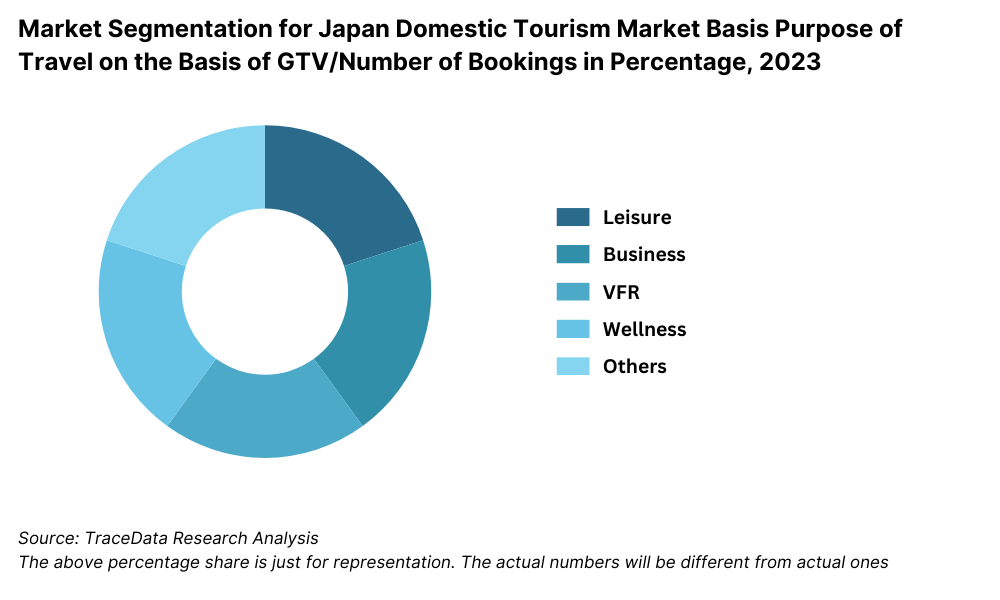

By Purpose of Travel: Leisure travel is the largest segment, driven by the popularity of Japan’s seasonal attractions like cherry blossoms, hot springs, and regional festivals. Business travel follows, supported by Japan’s economic hubs such as Tokyo and Osaka hosting a steady flow of conferences and corporate events. Visiting friends and relatives (VFR) constitutes another significant segment, particularly during national holidays like Obon and New Year.

By Age Group: Travelers aged 30-49 dominate the market, driven by their financial stability and interest in family vacations or cultural experiences. Seniors (aged 60+) form the second-largest group, showing a preference for shorter trips and wellness-oriented travel. Younger travelers (aged 18-29) are increasingly opting for budget-friendly travel packages and adventure tourism.

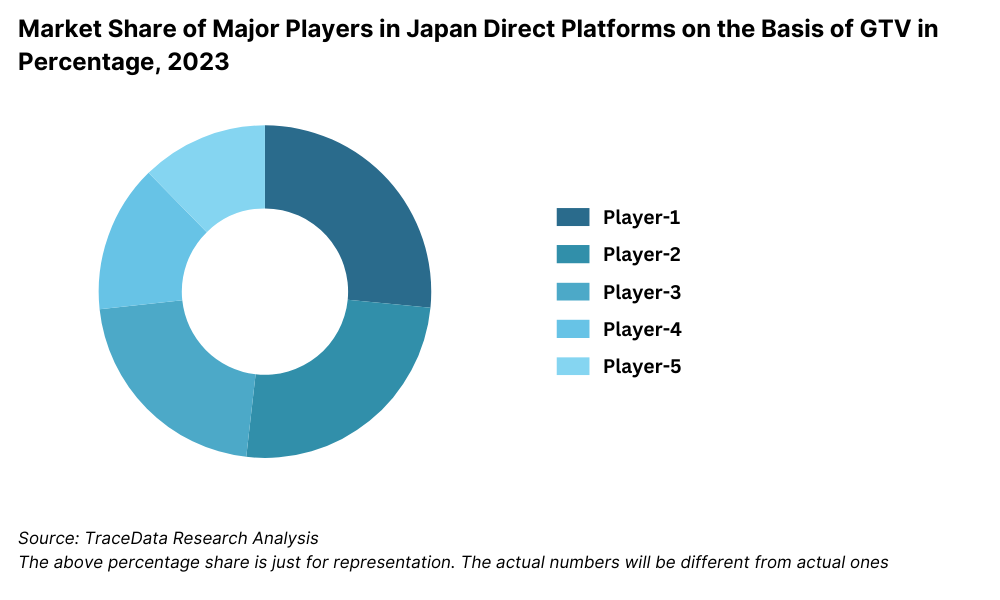

Competitive Landscape in Japan Domestic Tourism Market

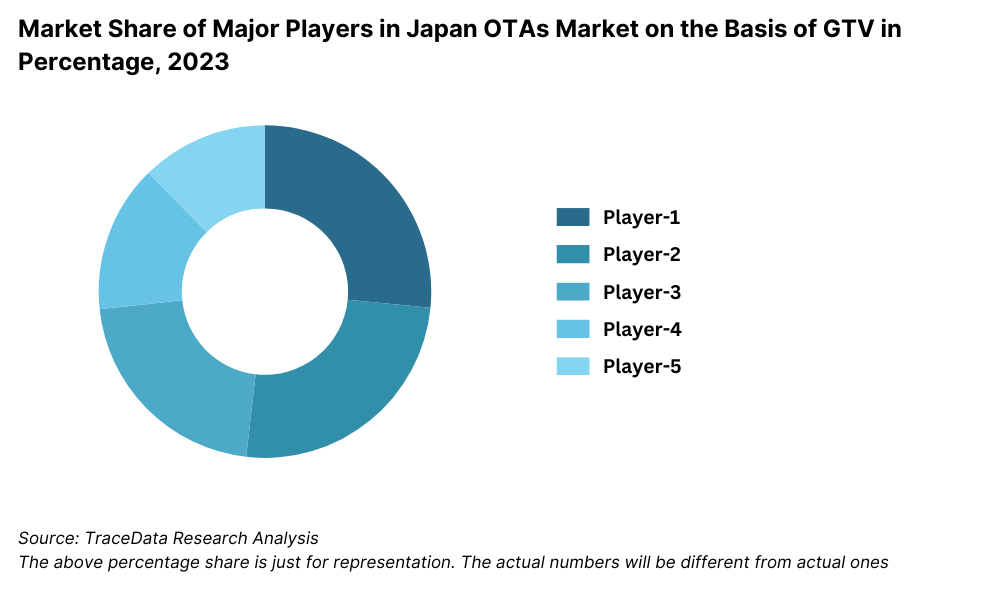

The Japan domestic tourism market is moderately fragmented, with a mix of traditional travel agencies, online travel platforms, and niche service providers. Major players like JTB Corporation, HIS Co., Ltd., Rakuten Travel, Nippon Travel Agency, and Jalan.net dominate the space, leveraging extensive networks, digital transformation, and customer-centric offerings. The emergence of smaller, region-specific agencies and eco-tourism operators has further diversified the market, providing consumers with a variety of tailored travel options.

OTAs:

Company Name | Establishment Year | Headquarters |

|---|---|---|

Rakuten Travel | 2001 | Tokyo, Japan |

JAPANiCAN (JTB Corp.) | 2005 | Tokyo, Japan |

Jalan.net (Recruit Holdings) | 2000 | Tokyo, Japan |

Ikyu Corporation | 2000 | Tokyo, Japan |

Yahoo! Travel (Yahoo Japan) | 1996 | Tokyo, Japan |

Rurubu Travel (JTB Publishing) | 2001 | Tokyo, Japan |

Travelko | 2003 | Tokyo, Japan |

Expedia Japan | 1996 | Tokyo, Japan |

Booking.com Japan | 1996 | Amsterdam, Netherlands |

Agoda Japan | 2005 | Singapore |

Direct Platforms:

Company Name | Establishment Year | Headquarters |

|---|---|---|

Japan Airlines (JAL) | 1951 | Tokyo, Japan |

All Nippon Airways (ANA) | 1952 | Tokyo, Japan |

JR East (East Japan Railway Company) | 1987 | Tokyo, Japan |

JR West (West Japan Railway Company) | 1987 | Osaka, Japan |

JR Central (Central Japan Railway Company) | 1987 | Nagoya, Japan |

Odakyu Electric Railway | 1948 | Tokyo, Japan |

Tobu Railway | 1897 | Tokyo, Japan |

Keio Corporation | 1948 | Tokyo, Japan |

Kintetsu Railway | 1944 | Osaka, Japan |

Nishitetsu (Nishi-Nippon Railroad) | 1908 | Fukuoka, Japan |

Recent Competitor Trends and Key Information About Competitors:

JTB Corporation: The largest travel agency in Japan, JTB launched a new digital platform in 2023, offering customized domestic travel packages and eco-tourism options. The company reported a 15% increase in domestic travel bookings, with a significant focus on promoting lesser-known destinations.

HIS Co., Ltd.: Known for its budget-friendly packages, HIS recorded a 20% rise in family travel bookings in 2023. The company's emphasis on seasonal campaigns and special discounts has strengthened its market position, particularly in urban areas.

Rakuten Travel: Leveraging the parent company's e-commerce ecosystem, Rakuten Travel saw a 30% increase in bookings through its app in 2023. Its loyalty points integration and personalized recommendations have made it a favorite among tech-savvy travelers.

Nippon Travel Agency: With a strong focus on senior travelers, Nippon Travel introduced wellness and cultural tour packages in 2023, driving a 12% growth in this segment. The company’s partnerships with local governments to promote regional tourism have been a key differentiator.

Jalan.net: A leading online travel platform, Jalan.net reported a 25% increase in rural accommodation bookings in 2023. Its extensive reviews, local attraction guides, and exclusive discounts have positioned it as a go-to platform for younger travelers seeking authentic experiences.

What Lies Ahead for Japan Domestic Tourism Market?

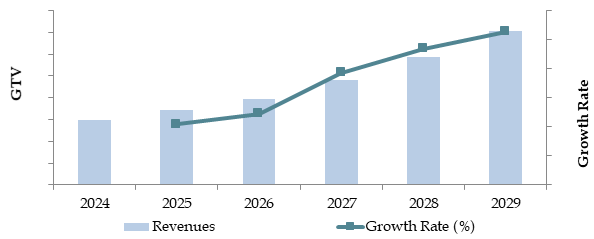

The Japan domestic tourism market is expected to witness steady growth by 2029, with a promising CAGR driven by favorable government policies, increasing consumer interest in regional tourism, and advancements in digital platforms for travel planning.

Growth in Regional Tourism: With ongoing investments in rural infrastructure and the promotion of off-the-beaten-path destinations, regional tourism is anticipated to grow significantly. Areas like Tohoku and Kyushu are expected to gain more prominence, driven by government grants and marketing campaigns.

Increased Focus on Sustainable Tourism: Sustainability will play a central role in shaping the future of domestic tourism. Initiatives such as eco-friendly accommodations, carbon-neutral travel packages, and the preservation of natural and cultural heritage are expected to attract environmentally conscious travelers.

Digital Innovation in Travel Planning: The adoption of advanced digital tools such as AI-driven itinerary recommendations, virtual reality previews of destinations, and streamlined online booking systems will enhance the travel planning experience. This trend is expected to boost the number of bookings through online travel agencies and mobile apps.

Rising Popularity of Wellness Tourism: Wellness tourism, including hot spring (onsen) retreats, yoga getaways, and nature therapy trips, is projected to grow as more travelers prioritize health and well-being. Japan’s aging population is likely to contribute significantly to this trend, with a focus on relaxing and restorative travel experiences.

Future Outlook and Projections for Japan Domestic Tourism Market on the Basis of GTV in USD Billion, 2024-2029

Japan Domestic Tourism Market Segmentation

- By Type of Travel

- Local

- Interstate Travel

- By Tour Type

- Conferences/Meeting

- Weekend Getaways

- Adventures Tours

- Organized Tours

- Holidays Trip

- Others

- By Market Structure:

- Traditional Travel Agencies

- Online Travel Agencies (OTAs)

- Regional Tourism Operators

- Niche and Specialty Travel Providers

- Wellness Tourism Operators

- Adventure Tourism Operators

- By Purpose of Travel:

- Leisure

- Business

- Visiting Friends and Relatives (VFR)

- Cultural and Heritage Tourism

- Wellness and Recreational Travel

- By Age Group:

- 18-29

- 30-49

- 50-59

- 60+

- By Accommodation Type:

- Hotels

- Ryokans (Traditional Japanese Inns)

- Guesthouses and Hostels

- Vacation Rentals

- Eco-Lodges

- By Region:

- Kanto (Tokyo, Yokohama)

- Kansai (Osaka, Kyoto)

- Hokkaido

- Kyushu

- Okinawa

- Tohoku

- Chugoku-Shikoku

- By Booking:

- Hotel

- Trains

- Buses

- Cars

- Airline

- Packages and others

Players Mentioned in the Report:

OTAs

- Rakuten Travel

- JAPANiCAN (JTB Corp.)

- Jalan.net (Recruit Holdings)

- Ikyu Corporation

- Yahoo! Travel (Yahoo Japan)

- Rurubu Travel (JTB Publishing)

- Travelko

- Expedia Japan

- Booking.com Japan

- Agoda Japan.

Direct Platforms

- Japan Airlines (JAL)

- All Nippon Airways (ANA)

- JR East (East Japan Railway Company)

- JR West (West Japan Railway Company)

- JR Central (Central Japan Railway Company)

- Odakyu Electric Railway

- Tobu Railway

- Keio Corporation

- Kintetsu Railway

- Nishitetsu (Nishi-Nippon Railroad)

Key Target Audience:

- Travel Agencies

- Online Travel Platforms

- Regional Tourism Boards

- Hospitality Service Providers

- Regulatory Bodies (e.g., Japan Tourism Agency)

- Sustainability and Eco-Tourism Organizations

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Revenue Streams for OTAs and Travel Agents in Japan Domestic Tourism Market

4.2. Business Model Canvas for OTAs and Travel Agents in Japan Domestic Tourism Market

4.3. Relationship between OTAs, Travel Agents and Hotels/Airline and other Stakeholders-Discuss about Commission and other revenue structure

5.1. Domestic Tourism Spending in Japan, 2018-2024

5.2. Tourism Contribution to Japans GDP, 2018-2024

5.3. Ratio of Domestic to International Tourism in Japan, 2018-2024

5.4. Number of Travel Agencies in Japan

5.5. Number of Domestic Tourists in Japan, 2018-2024

8.1. GTV, 2018-2024

8.2. Number of Bookings, 2018-2024

9.1. By Local or Interstate Travel, 2023-2024P

9.2. By Mode of Booking, (OTA Platform and Direct Booking), 2023-2024P

9.3. By Purpose of Travel (Leisure, Business, VFR, Wellness), 2023-2024P

9.4. By Tour Type (Conferences/Meeting, Weekend Getaways, Adventures Tours, Organized Tours, Holidays Trip and Others), 2023-2024P

9.5. By Age Group (18-29, 30-49, 50-59, 60+), 2023-2024P

9.6. By Region (Kanto, Kansai, Hokkaido, Kyushu, Okinawa, and Others), 2023-2024P

9.7. By Type of Accommodation (Hotels, Ryokans, Guesthouses, Vacation Rentals), 2023-2024P

9.8. By Type of Bookings (Hotel, Trains, Buses, Cars, Airline, Packages and others), 2023-2024P

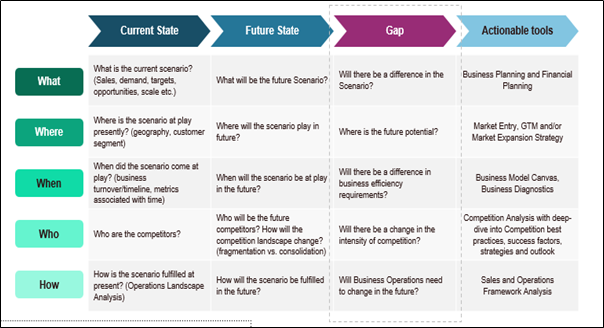

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Needs, Desires, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments in Japan Domestic Tourism Market

11.2. Growth Drivers for Japan Domestic Tourism Market

11.3. SWOT Analysis for Japan Domestic Tourism Market

11.4. Issues and Challenges for Japan Domestic Tourism Market

11.5. Government Regulations for Japan Domestic Tourism Market

12.1. Market Size and Future Potential for OTAs Domestic Tourism Market, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Travel Platforms Basis Operational and Financial Variables

13.1. Financing Penetration for Travel Expenses, 2018-2029

13.2. Changing Trends in Financing for Tourism, with Reasons

13.3. Financing Patterns for Different Tourism Segments

13.4. Tourism Financing Split by Banks, NBFCs, and Other Entities, 2023-2024P

16.1. Market Share of Key OTAs in Japan Domestic Tourism Market Basis GTV, 2023

16.2. Market Share of Key Players in Japan Domestic Tourism Market Basis GTV, 2023

16.3. Benchmark of Key Players in Japan Domestic Tourism Market Basis Operational and Financial Performance

16.4. Strength and Weakness Analysis

16.5. Operating Model Analysis Framework

16.6. Competitive Positioning Matrix

16.7. Gartner Magic Quadrant

16.8. Bowmans Strategic Clock for Competitive Advantage

17.1. GTV, 2025-2029

17.2. Number of Bookings, 2025-2029

18.1. By Local or Interstate Travel, 2025-2029

18.2. By Mode of Booking, (OTA Platform and Direct Booking), 2025-2029

18.3. By Purpose of Travel (Leisure, Business, VFR, Wellness), 2025-2029

18.4. By Tour Type (Conferences/Meeting, Weekend Getaways, Adventures Tours, Organized Tours, Holidays Trip and Others), 2025-2029

18.5. By Age Group (18-29, 30-49, 50-59, 60+), 2025-2029

18.6. By Region (Kanto, Kansai, Hokkaido, Kyushu, Okinawa, and Others), 2025-2029

18.7. By Type of Accommodation (Hotels, Ryokans, Guesthouses, Vacation Rentals), 2025-2029

18.8. By Type of Bookings (Hotel, Trains, Buses, Cars, Airline, Packages and others), 2025-2029

19.1. Strategic Recommendations for Stakeholders

19.2. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Japan Domestic Tourism Market. Based on this ecosystem, we shortlist the leading 5-6 players in the industry, including travel agencies, online platforms, and regional operators, based on their financial performance, customer reach, and service portfolio.

Utilize industry reports, government publications, and secondary data sources to gather initial insights and identify market dynamics.

Step 2: Desk Research

Conduct comprehensive desk research using secondary data sources, including proprietary databases, industry articles, press releases, and government reports. This step focuses on analyzing the market structure, segmentation, pricing trends, and key performance indicators.

Examine company-level data, including financial statements, service portfolios, and strategic initiatives, to gain a deeper understanding of the competitive landscape.

Step 3: Primary Research

Engage in in-depth interviews with executives, stakeholders, and regional tourism operators to validate secondary data and gain additional insights. These interviews focus on market trends, growth drivers, and operational challenges.

Adopt a bottom-up approach to estimate regional tourism spending and aggregate data to derive overall market size.

Conduct disguised interviews with service providers to corroborate the insights gathered and verify the financial and operational data shared during the research process.

Step 4: Sanity Check

Perform top-down and bottom-up market size modeling to validate data accuracy and ensure alignment with industry trends.

- Use cross-verification techniques to assess data reliability, combining secondary insights with primary research findings.

FAQs

1. What is the potential for the Japan Domestic Tourism Market?

The Japan domestic tourism market is set to grow steadily by 2029, driven by government initiatives, increasing consumer interest in regional destinations, and advancements in travel technology. The market is expected to expand further as Japan continues to promote cultural and sustainable tourism.

2. Who are the Key Players in the Japan Domestic Tourism Market?

Key players include JTB Corporation, HIS Co., Ltd., Rakuten Travel, Nippon Travel Agency, and Jalan.net. These companies dominate the market with their strong distribution networks, tailored travel packages, and customer-centric approaches.

3. What are the Growth Drivers for the Japan Domestic Tourism Market?

Growth drivers include government subsidies such as the "Go To Travel" campaign, the rising popularity of rural tourism, and increasing digitalization of the travel industry. Additionally, consumer demand for wellness and cultural tourism continues to boost market growth.

4. What are the Challenges in the Japan Domestic Tourism Market?

Challenges include seasonality, overcrowding at major destinations, and limited infrastructure in rural areas. Other barriers include the aging population’s preference for shorter, less strenuous trips and the disruption caused by natural disasters like typhoons and earthquakes.