Japan Fintech Blockchain Market Outlook to 2029

By Market Structure, By Application, By Deployment Mode, By End-User Industries, and By Region

- Product Code: TDR0119

- Region: Asia

- Published on: February 2025

- Total Pages: 80

Report Summary

The report titled “Japan Fintech Blockchain Market Outlook to 2029 - By Market Structure, By Application, By Deployment Mode, By End-User Industries, and By Region” provides a comprehensive analysis of the fintech blockchain market in Japan. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the fintech blockchain market. The report concludes with future market projections based on revenue, application adoption, regional distribution, cause-and-effect relationships, and success case studies highlighting the major opportunities and challenges.

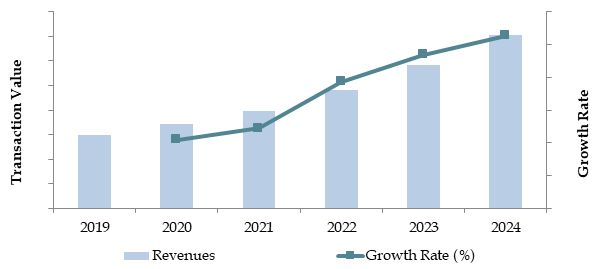

Japan Fintech Blockchain Market Overview and Size

The Japan fintech blockchain market reached a valuation of JPY 1.2 trillion in 2023, driven by increasing demand for secure, transparent, and efficient financial transactions. Factors such as government support for blockchain technology, a highly tech-savvy population, and the need for enhanced financial infrastructure have significantly contributed to market growth. The market is characterized by major players such as BitFlyer Blockchain, Tech Bureau, Soramitsu, LayerX, and MUFG Bank. These companies are recognized for their innovative blockchain solutions, extensive partnerships, and customer-centric services.

In 2023, MUFG Bank launched Progmat Coin, a blockchain-based platform aimed at enhancing the efficiency of digital asset issuance and settlement. This initiative underscores the growing adoption of blockchain in Japan’s financial ecosystem. Major regions such as Tokyo, Osaka, and Yokohama are key hubs for blockchain innovation, given their robust infrastructure and concentration of financial institutions.

Market Size for Japan Fintech Blockchain Industry on the Basis of Transaction Value in USD Billion, 2018-2023

What Factors are Leading to the Growth of Japan Fintech Blockchain Market?

Technological Advancements: Rapid advancements in blockchain technology, including scalability solutions and interoperability protocols, have driven adoption in Japan’s fintech sector. These developments enhance blockchain's utility in financial transactions, cross-border payments, and digital asset management.

Government Support: Japan’s government has introduced favorable policies and frameworks to promote blockchain innovation. Regulatory clarity regarding the use of blockchain in financial services has encouraged both startups and established financial institutions to invest in the technology.

Increased Demand for Transparency: The need for secure and transparent transaction systems has boosted blockchain adoption in fintech. Blockchain’s ability to provide immutable and auditable transaction records is particularly appealing to the financial sector, which prioritizes trust and compliance.

Which Industry Challenges Have Impacted the Growth for Japan Fintech Blockchain Market?

Regulatory Ambiguity: Despite Japan’s proactive stance on blockchain, certain aspects of regulation remain unclear, particularly concerning decentralized finance (DeFi) and cryptocurrency integration in fintech solutions. This lack of clarity discourages potential adopters and slows down innovation. In 2023, over 25% of blockchain projects faced delays due to compliance uncertainties.

Scalability Issues: The fintech sector’s demand for high transaction throughput often surpasses the capabilities of many blockchain platforms. Current scalability limitations hinder adoption for high-frequency use cases such as payment processing and real-time settlements, constraining the technology's full potential.

Cybersecurity Concerns: Blockchain’s immutability makes it appealing for fintech, but the technology is not immune to cyberattacks, especially in cases of poor implementation. In 2023, Japan reported an increase in blockchain-related fraud, accounting for approximately JPY 4 billion in financial losses, which raised concerns among financial institutions.

What Are the Regulations and Initiatives Which Have Governed the Market?

Japan’s Payment Services Act: Amended in 2020, this act provides a regulatory framework for blockchain-based payment services, including cryptocurrency exchanges. It ensures consumer protection and legal clarity, encouraging the adoption of blockchain in the fintech space.

Financial Services Agency (FSA) Oversight: Japan’s FSA monitors blockchain projects within the fintech sector to ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. In 2023, over 90% of blockchain-related fintech companies in Japan were compliant with FSA guidelines.

Smart Contract Legislation: Japan is working on creating legal frameworks to recognize smart contracts as enforceable agreements. These efforts aim to encourage broader adoption of blockchain technology for use cases such as automated loan processing and digital asset trading.

Japan Fintech Blockchain Market Segmentation

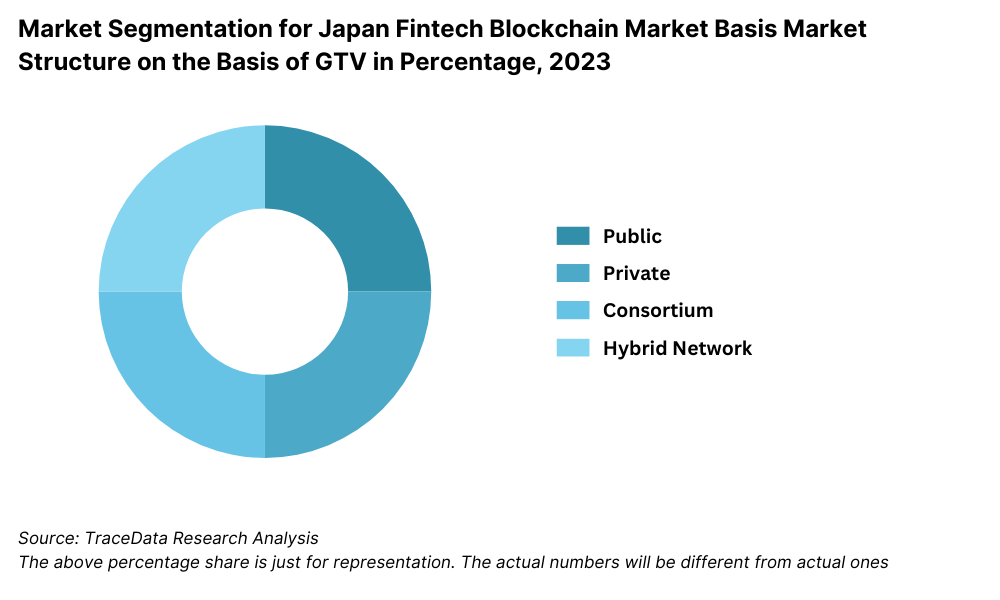

By Market Structure: Public blockchain networks dominate due to their decentralized nature, offering transparency and security for financial applications. These networks are popular for cross-border payments and decentralized finance (DeFi) solutions. Private blockchain networks hold a significant share, primarily used by financial institutions for internal operations, such as secure transaction settlements and fraud prevention. Consortium blockchains are growing steadily, driven by collaborative projects among banks and fintech firms to streamline interbank operations.

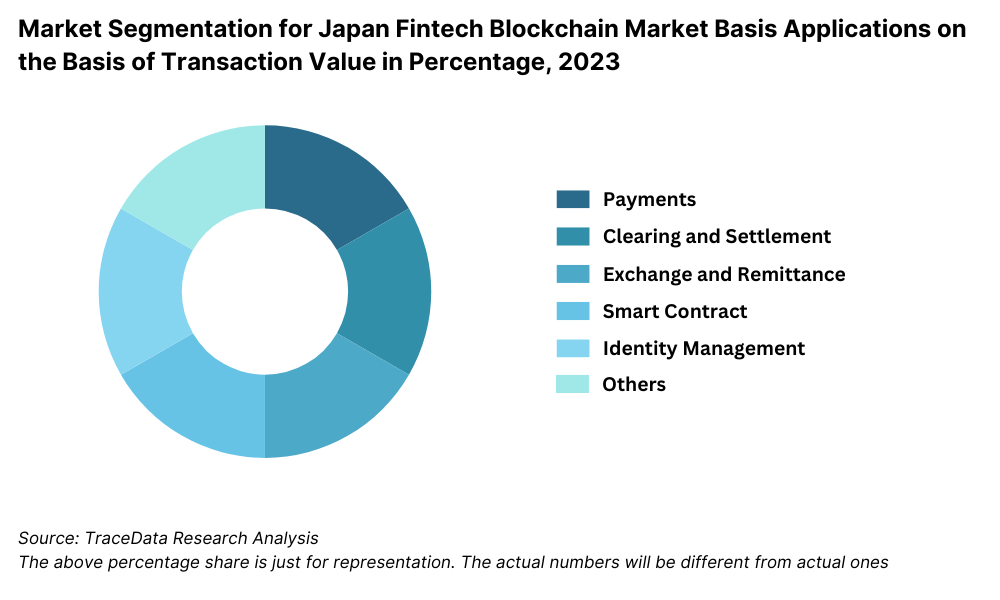

By Application: Payments and remittances dominate the application segment, leveraging blockchain’s ability to facilitate secure, low-cost, and real-time transactions. Digital identity management follows closely, as blockchain ensures robust security and eliminates identity fraud. Other notable applications include smart contracts, used for automating complex financial agreements, and asset tokenization, which enables the digitization of financial instruments such as bonds and real estate.

By Deployment Mode: Cloud-based blockchain solutions are the most widely adopted due to their scalability and ease of integration with existing fintech systems. On-premises solutions remain relevant for institutions prioritizing data control and security, particularly for high-value transactions and sensitive financial data.

Competitive Landscape in Japan Fintech Blockchain Market

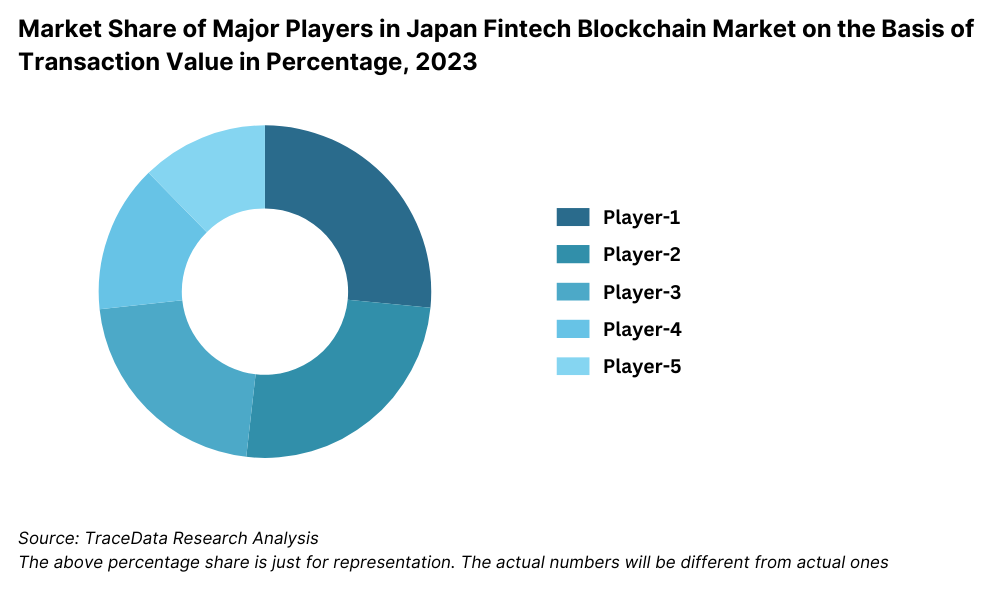

The Japan fintech blockchain market is moderately concentrated, with key players leading the market through innovative solutions, robust partnerships, and industry-specific applications. However, the market is also witnessing the emergence of smaller firms and niche players focusing on specialized use cases, further diversifying the competitive landscape.

Company Name | Establishment Year | Headquarters |

|---|---|---|

SBI Holdings | 1999 | Tokyo, Japan |

bitFlyer | 2014 | Tokyo, Japan |

Tech Bureau | 2014 | Osaka, Japan |

Chaintope Inc. | 2016 | Fukuoka, Japan |

LayerX Inc. | 2018 | Tokyo, Japan |

Orb Inc. | 2014 | Tokyo, Japan |

GVE Ltd. | 2018 | Tokyo, Japan |

Keychain | 2016 | Tokyo, Japan |

Smart Trade Inc. | 2018 | Tokyo, Japan |

xenodata lab. | 2016 | Tokyo, Japan |

Recent Competitor Trends and Key Information About Competitors:

BitFlyer Blockchain: A pioneer in the Japanese blockchain space, BitFlyer Blockchain expanded its enterprise blockchain offerings in 2023, focusing on payment systems and supply chain finance. The company reported a 20% increase in blockchain transactions on its platform, driven by partnerships with financial institutions.

Tech Bureau: Known for its private blockchain platform "mijin," Tech Bureau has collaborated with banks and insurance companies to streamline their operational processes. In 2023, the company launched a blockchain-based claims management system for the insurance industry, resulting in a 15% reduction in processing times.

Soramitsu: Specializing in decentralized finance (DeFi) and digital identity solutions, Soramitsu introduced a blockchain-based digital currency for local governments in 2023. This initiative has enhanced the efficiency of public funds distribution, attracting significant interest from regional municipalities.

LayerX: A key player in blockchain adoption for corporate governance, LayerX developed a voting platform for shareholder meetings, which saw a 30% increase in usage in 2023. The platform’s success reflects the growing demand for secure and transparent corporate decision-making processes.

MUFG Bank: Japan’s largest financial group, MUFG, has been at the forefront of blockchain innovation with its Progmat Coin initiative. Launched in 2023, this blockchain-based digital asset platform has facilitated over JPY 1 trillion in digital asset transactions, highlighting its significant impact on Japan’s financial ecosystem.

What Lies Ahead for Japan Fintech Blockchain Market?

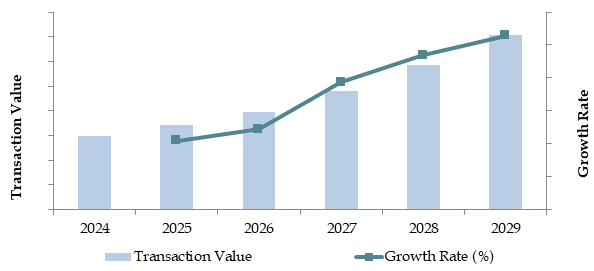

The Japan fintech blockchain market is projected to grow significantly by 2029, exhibiting a robust CAGR during the forecast period. This growth is expected to be fueled by technological advancements, supportive government policies, and increasing adoption across various financial applications.

Expansion of Decentralized Finance (DeFi): The adoption of DeFi solutions is anticipated to grow, driven by the demand for transparent and efficient financial services. DeFi platforms are expected to gain traction among individual users and small businesses seeking alternative lending and investment opportunities.

Integration of Blockchain with AI and IoT: The convergence of blockchain with artificial intelligence (AI) and the Internet of Things (IoT) is likely to revolutionize the fintech landscape in Japan. These integrations will enhance decision-making, improve transaction security, and enable real-time data sharing, opening new opportunities for blockchain applications in financial services.

Development of Central Bank Digital Currency (CBDC): Japan’s ongoing research and pilot programs for a digital yen are expected to drive blockchain adoption in the financial sector. The introduction of a CBDC will enhance cross-border payment efficiency and promote digital financial inclusion.

Growth of Smart Contracts: The increasing use of blockchain-based smart contracts in automating financial processes, such as loan agreements and insurance claims, is expected to expand. Smart contracts offer greater efficiency, reduce errors, and improve trust between parties.

Future Outlook and Projections for Japan Fintech Blockchain Market on the Basis of Transaction Value in USD Billion, 2024-2029

Japan Fintech Blockchain Market Segmentation

- By Market Structure:

- Public Blockchain Networks

- Private Blockchain Networks

- Consortium Blockchain Networks

- Hybrid Blockchain Solutions

- By Application:

- Payments

- Clearing and Settlement

- Exchanges and Remittance

- Smart Contract

- Identity Management

- Compliance Management/KYC

- By Deployment Mode:

- Cloud-Based Solutions

- On-Premises Solutions

- By End-User Industries:

- Banking

- Insurance

- Asset Management

- Payment Processing Companies

- Government and Regulatory Bodies

- By Region:

- Kanto (Tokyo, Yokohama)

- Kansai (Osaka, Kyoto)

- Chubu (Nagoya)

- Hokkaido

- Kyushu

- Okinawa

Players Mentioned in the Report:

- SBI Holdings

- bitFlyer

- Tech Bureau

- Chaintope Inc.

- LayerX Inc.

- Orb Inc.

- GVE Ltd.

- Keychain

- Smart Trade Inc.

- xenodata lab.

Key Target Audience:

- Blockchain Technology Providers

- Financial Institutions (Banks and Insurance Companies)

- Payment Processing Companies

- Government and Regulatory Bodies (e.g., Financial Services Agency - FSA)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Revenue Streams for Japan Fintech Blockchain Market

4.2. Business Model Canvas for Japan Fintech Blockchain Market

4.3. Adoption Decision-Making Process

4.4. Technology Deployment Decision-Making Process

5.1. Blockchain Adoption in Japans Fintech Sector, 2018-2024

5.2. Adoption Rate of Blockchain by Financial Institutions, 2018-2024

5.3. Spending on Blockchain Technology in Japans Fintech Industry, 2024

5.4. Distribution of Blockchain Service Providers in Japan by Region

8.1. Transaction Value, 2018-2024

8.2. Number of Blockchain-Based Transactions, 2018-2024

9.1. By Market Structure (Public, Private, Consortium, and Hybrid Networks), 2023-2024P

9.2. By Deployment Mode (Cloud-Based and On-Premises Solutions), 2023-2024P

9.3. By Application (Payments, Clearing, and Settlement, Exchanges and Remittance, Smart Contract, Identity Management, and Compliance Management/KYC), 2023-2024P

9.4. By Region (Kanto, Kansai, Hokkaido, Kyushu, Okinawa, and Others), 2023-2024P

9.5. By Large, Small and Medium Enterprises, 2023-2024P

9.6. By Banking, Non-Banking and Insurance, 2023-2024P

10.1. User Landscape and Cohort Analysis

10.2. Blockchain Integration Journey and Decision-Making

10.3. Needs, Challenges, and Pain Points Analysis

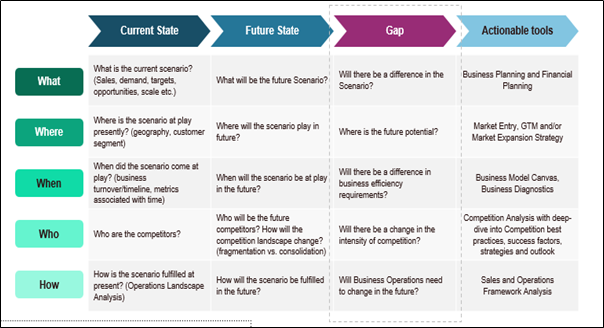

10.4. Gap Analysis Framework

11.1. Trends and Developments for Japan Fintech Blockchain Market

11.2. Growth Drivers for Japan Fintech Blockchain Market

11.3. SWOT Analysis for Japan Fintech Blockchain Market

11.4. Issues and Challenges for Japan Fintech Blockchain Market

11.5. Regulatory Landscape for Japan Fintech Blockchain Market

14.1. Market Share of Major Players in Japan Fintech Blockchain Market Basis Revenues, 2023

14.2. Benchmark of Key Competitors in Japan Fintech Blockchain Market Basis Operational and Financial Variables, 2023

14.3. Strength and Weakness Analysis

14.4. Operating Model Analysis Framework

14.5. Competitive Positioning Matrix

14.6. Gartner Magic Quadrant

14.7. Bowmans Strategic Clock for Competitive Advantage

15.1. Transaction Value, 2025-2029

15.2. Number of Blockchain-Based Transactions, 2025-2029

16.1. By Market Structure (Public, Private, Consortium, and Hybrid Networks), 2025-2029

16.2. By Deployment Mode (Cloud-Based and On-Premises Solutions), 2025-2029

16.3. By Application (Payments, Clearing, and Settlement, Exchanges and Remittance, Smart Contract, Identity Management, and Compliance Management/KYC), 2025-2029

16.4. By Region (Kanto, Kansai, Hokkaido, Kyushu, Okinawa, and Others), 2025-2029

16.5. By Large, Small and Medium Enterprises, 2025-2029

16.6. By Banking, Non-Banking and Insurance, 2025-2029

16.7. Recommendation and Conclusion

16.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Japan Fintech Blockchain Market. Based on this ecosystem, we will shortlist the leading 5-6 players in the market, including blockchain solution providers, fintech companies, and financial institutions, using criteria such as financial performance, technological capabilities, and market reach.

Data is sourced through industry reports, government publications, secondary research, and proprietary databases to gather market-level insights.

Step 2: Desk Research

Conduct comprehensive desk research using diverse secondary and proprietary databases. This step involves aggregating industry-level insights, including market revenues, technology adoption rates, the number of active players, and the application areas of blockchain in fintech.

Supplement this with company-level analysis using press releases, annual reports, financial statements, and related documents to build a foundational understanding of the market and its participants.

Step 3: Primary Research

Engage in a series of detailed interviews with C-level executives, blockchain solution developers, and fintech stakeholders. These interviews are conducted to validate hypotheses, authenticate statistical data, and gather insights into operational and financial strategies.

A bottom-to-top approach is undertaken to estimate market size, starting with individual company contributions and aggregating them to form the overall market landscape.

Disguised interviews are conducted to cross-verify insights, ensuring the reliability of shared operational and financial data while gaining a deeper understanding of revenue streams, pricing strategies, and technology adoption trends.

Step 4: Sanity Check

- A comprehensive sanity check is performed through bottom-to-top and top-to-bottom analyses. Market size modeling is used to validate findings and ensure consistency across all data points.

FAQs

1. What is the potential for the Japan Fintech Blockchain Market?

The Japan fintech blockchain market is poised for substantial growth, reaching a projected valuation of JPY 2.5 trillion by 2029. This growth is driven by factors such as increased demand for secure financial transactions, regulatory support, and the growing adoption of blockchain across various financial applications.

2. Who are the Key Players in the Japan Fintech Blockchain Market?

The Japan fintech blockchain market features prominent players such as BitFlyer Blockchain, Tech Bureau, Soramitsu, and LayerX. These companies lead the market with their innovative solutions, extensive partnerships, and strong presence in key applications like payments, digital identity, and asset tokenization.

3. What are the Growth Drivers for the Japan Fintech Blockchain Market?

Key growth drivers include technological advancements such as scalability improvements and interoperability solutions, government initiatives promoting blockchain adoption, and the growing need for transparency and efficiency in financial transactions.

4. What are the Challenges in the Japan Fintech Blockchain Market?

The market faces challenges such as regulatory ambiguity regarding decentralized finance, scalability limitations for high-frequency financial applications, and high implementation costs for blockchain solutions. Cybersecurity risks associated with blockchain deployment also pose significant hurdles.