Kenya Cloud Kitchens Market Outlook to 2030

By Market Structure, By Ownership/Operating Model, By Cuisine & Menu Type, By Order Channel, By Buyer/Use-Case, and By Region

- Product Code: TDR0380

- Region: Africa

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “Kenya Cloud Kitchens Market Outlook to 2030 - By Market Structure, By Ownership/Operating Model, By Cuisine & Menu Type, By Order Channel, By Buyer/Use-Case, and By Region” provides a comprehensive analysis of the cloud kitchens market in Kenya. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the cloud kitchen market. The report concludes with future market projections based on kitchen formats, order channels, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

Kenya Cloud Kitchens Market Overview and Size

Kenya’s commercial online food and groceries delivery channel generated about US$103 million, according to the Competition Authority of Kenya’s market study on delivery platforms. This channel is the primary demand rail for cloud/ghost kitchens in the country. Momentum is reinforced by multi-category aggregators (Glovo, Bolt Food, Uber Eats) and expanding partner counts. Entering the new year, platforms reported fresh quantitative signals: Uber Eats quantified KSh 534 million in additional value for restaurants, while Bolt and Glovo announced substantial order volumes and operational expansions. These figures reflect digitized ordering, mobile payments, and denser urban delivery zones.

Nairobi dominates due to deep restaurant supply, high smartphone and mobile-money usage, and dense last-mile networks; operators publicized 250+ partner restaurants during seasonal peaks and 60+ multi-brand café locations on aggregator rails. Mombasa follows, anchored by national QSR chains and tourism-driven demand. Emerging nodes include Nakuru and Kisumu, aided by intercity logistics and supermarket deli tie-ups. Urban population and retail activity underpin these hubs, with official statistics and platform announcements documenting network breadth and store counts across the corridor.

What Factors are Leading to the Growth of the Kenya Cloud Kitchens Market:

Dense digital rails enabling low-friction ordering and payments: Kenya’s cloud kitchen ecosystem thrives on seamless mobile connectivity and real-time payments. The country hosts 68.9 million active SIM subscriptions and processes over KSh 713 billion in mobile-money transactions monthly, reflecting the deep integration of financial technology into daily consumption. Additionally, monthly card transactions exceed KSh 43 billion, further strengthening formal payment adoption. With a total population of 53.3 million, this dense digital infrastructure reduces transaction barriers, accelerates order completion, and enhances repeat purchasing. The result is a digitally enabled consumer base that allows kitchens to monetize multiple order channels—aggregators, direct apps, and social commerce—without needing proprietary payment systems.

Urban demand concentration with expanding last-mile connectivity: Kenya’s urban centers anchor cloud kitchen demand due to their concentrated population, higher incomes, and improved transport infrastructure. The country’s GDP per capita of USD 2,206.13 highlights rising purchasing capacity, while the national population of 53.3 million provides a robust consumer base. Infrastructure development continues to expand, with an additional 1,290 kilometers of paved roads built under national improvement programs. These advancements enable shorter delivery times and greater efficiency for driver networks in urban corridors like Nairobi, Mombasa, and Nakuru. Together, urbanization and last-mile logistics improvements underpin sustainable order throughput and enable kitchens to operate multiple virtual brands per site efficiently.

Formal retail and food ecosystems plugging into delivery rails: Kenya’s structured retail and food economy—supermarkets, QSR chains, and local marketplaces—integrate directly into delivery platforms to create consistent kitchen demand. Monthly mobile-money flows of KSh 713 billion and 68.9 million SIM connections ensure a digitally reachable consumer network. Moreover, regularly published price bulletins and CPI data provide kitchens with the cost benchmarks needed for ingredient sourcing and menu pricing. These systems enable cloud kitchens to align offerings with real-time consumer affordability and input costs. The integration of retail and delivery ecosystems strengthens order liquidity and supports scalable menu launches, subscription meals, and dark-store collaborations across Kenya’s expanding food delivery sector.

Which Industry Challenges Have Impacted the Growth of the Kenya Cloud Kitchens Market:

Transport-fuel exposure inflating last-mile and rider payouts: High fuel costs continue to pressure margins in the Kenya Cloud Kitchens Market. Pump prices stand at KSh 180.66 per litre for petrol, KSh 168.06 for diesel, and KSh 151.39 for kerosene, directly affecting rider compensation and delivery pricing. These rates elevate breakeven delivery distances and compress profitability, especially in long-radius deliveries. The higher operating costs push kitchens to cluster operations within micro-catchments and invest in shorter delivery radii or electric motorbike fleets to stabilize last-mile expenses.

Input-cost variability for key menu staples and packaging: Frequent fluctuations in food input and packaging prices pose a significant challenge to maintaining stable margins. Item-level consumer price indices indicate that staple goods such as maize flour, sugar, and milk continue to experience volatility. For kitchens operating on slim margins, such changes in core input costs force dynamic recipe recalibration and repricing. As packaging materials and cooking oil costs fluctuate, operators must balance customer affordability with profitability through strict supplier negotiations and waste control. Reliable access to price benchmarks helps kitchens manage portioning, reduce spoilage, and maintain consistent food-cost ratios despite market variability.

Compliance and licensing friction across counties: Setting up and operating a cloud kitchen in Kenya requires compliance with multiple health, food-safety, and labeling standards. The Food Hygiene Licensing Checklist mandates specific structural, ventilation, and sanitation requirements that must be certified by county health departments before operations begin. Additionally, the Public Health Act (Cap 242) and Food, Drugs and Chemical Substances Act (Cap 254) regulate food handling, storage, and hygiene protocols. Kitchens must also adhere to new standards under DKS 2455:2024 for food safety and labeling, which add testing, documentation, and inspection layers. These frameworks, while essential for quality assurance, increase setup timelines and operational compliance costs for new entrants.

What are the Regulations and Initiatives which have Governed the Market:

Public Health Act (Cap 242) & County Food-Hygiene Permits: The Public Health Act (Cap 242) forms the primary framework for licensing and inspection of food premises in Kenya. County-level health officers enforce hygiene and infrastructure compliance through the Food Hygiene Licensing Checklist, covering materials, layout, sanitation, and ventilation ratios. These requirements dictate kitchen construction standards and directly influence setup timelines and equipment investments for cloud kitchen operators.

Food, Drugs and Chemical Substances Act (Cap 254) & Food Hygiene Regulations: The Food, Drugs and Chemical Substances Act (Cap 254), along with accompanying hygiene regulations, governs all aspects of food preparation, handling, and storage. It requires kitchens to maintain certified food-handling processes, sanitation procedures, and documentation for inspection. These provisions ensure product safety and consumer protection across delivery-only kitchens, requiring operators to adopt traceable and standardized food-preparation methods.

KEBS Food-Safety & Labelling Standards (DKS 2455:2024; DEAS 38:2024): The Kenya Bureau of Standards (KEBS) enforces safety and labeling rules to ensure that packaged foods used by cloud kitchens meet established hygiene and disclosure requirements. The DKS 2455:2024 – Food Safety (General Standard) specifies food sampling, testing, and production safety protocols, while DEAS 38:2024 – Labelling and Pre-packaged Foods (Requirements) governs product labeling and nutritional information placement. Compliance with these standards ensures product integrity, allergen awareness, and traceability, promoting consumer confidence and market-level quality assurance for Kenya’s fast-growing cloud kitchen industry.

Kenya Cloud Kitchens Market Segmentation

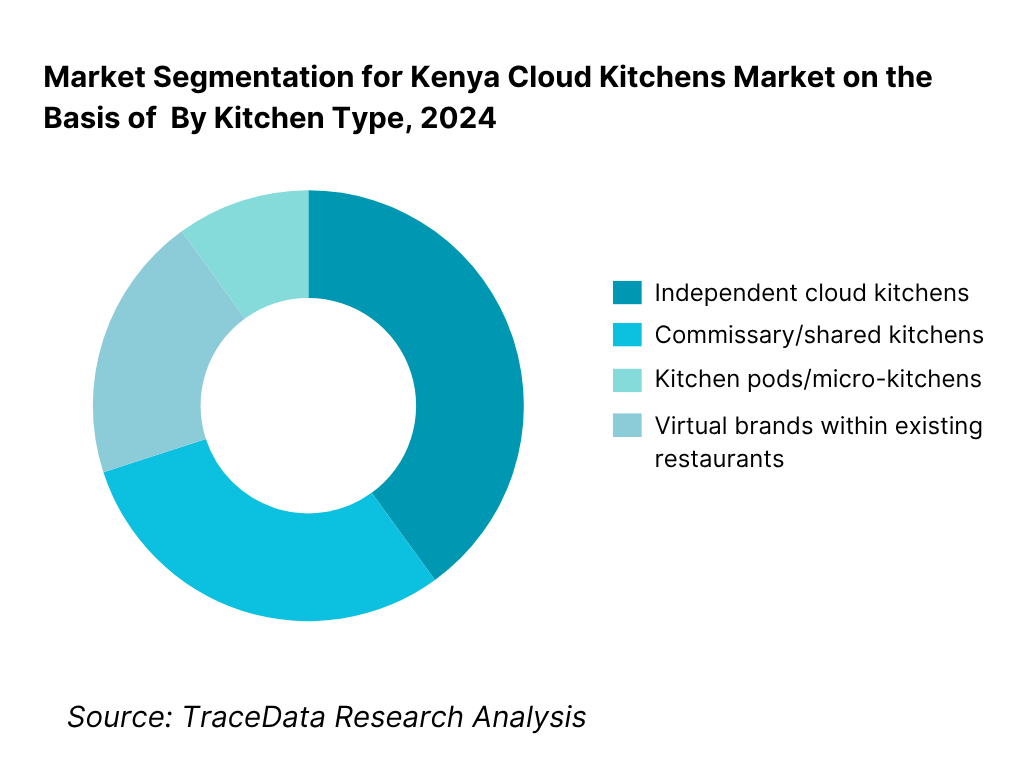

By Kitchen Type: Kenya Cloud Kitchens market is segmented into independent cloud kitchens, commissary/shared kitchens, kitchen pods/micro-kitchens, and virtual brands operated within existing restaurants. Recently, virtual brands operated within existing restaurants hold a dominant share under this segmentation due to low incremental capex, faster menu experimentation, and immediate access to an existing cookline and front-of-house inventory. Restaurants in Nairobi and Mombasa leverage aggregator rails (Glovo, Bolt Food, Uber Eats) to spin up delivery-only menus, while maintaining dine-in. This hybridization shortens payback periods, uses existing food safety licenses, and capitalizes on built-in brand equity and delivery density in core zones, making virtualized brands the most agile growth vehicle for operators.

By Order Channel: Kenya Cloud Kitchens market is segmented by aggregator-led, direct-to-consumer apps & web, WhatsApp/phone & pick-up, and B2B/contracted drops. Recently, the aggregator-led channel has a dominant market share because it combines national demand aggregation with logistics, marketing placement, and in-app promotions. Platforms publicly report hundreds of active restaurant partners in Nairobi and nationwide multi-category expansion, lowering customer acquisition costs for kitchens and providing SLA-tracked delivery fleets. As budgets tighten, operators prefer variable take-rates over fixed fleet overheads, while paid placements and bundles increase average order values, reinforcing aggregator-led primacy.

Competitive Landscape in Kenya Cloud Kitchens Market

The Kenya Cloud Kitchens market coalesces around three scaled aggregators (Glovo, Bolt Food, Uber Eats) and local delivery brands/kitchen operators that rely on those rails. Consolidation dynamics mirror other OFD markets: platform bargaining power, paid placements, and logistics orchestration shape visibility and unit economics, while shared-kitchen providers and virtual brand incubators fill capacity and extend menu variety. Public announcements show hundreds of onboarded restaurants in Nairobi and multi-city café/QSR estates on delivery, reinforcing network effects and time-to-demand.

Name | Founding Year | Original Headquarters |

Glovo | 2015 | Barcelona, Spain |

Bolt (Bolt Food) | 2013 | Tallinn, Estonia |

Uber Eats | 2014 | San Francisco, USA |

Yum Deliveries | 2012 | Nairobi, Kenya |

Hephie’s Cloud Kitchen | 2021 | Nairobi, Kenya |

Java House | 1999 | Nairobi, Kenya |

Artcaffé Group | 2008 | Nairobi, Kenya |

KFC | 1952 | Louisville, USA |

Pizza Inn (Simbisa/Innscor) | 1994 | Harare, Zimbabwe |

Debonairs Pizza | 1991 | Johannesburg, South Africa |

Galito’s | 1996 | Nelspruit (Mbombela), South Africa |

Little App (Little Cab) | 2016 | Nairobi, Kenya |

Naivas | 1990 | Nakuru, Kenya |

Chandarana Foodplus | 1964 | Nairobi, Kenya |

Big Square | 2012 | Nairobi, Kenya |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Glovo: As one of Kenya’s largest on-demand delivery aggregators, Glovo expanded its cloud kitchen partner base in Nairobi and Mombasa, adding over 250 new restaurant listings on its platform. The company introduced multi-category fulfillment nodes that allow simultaneous food and grocery dispatch, improving kitchen throughput and delivery times across key zones.

Bolt Food: Bolt Food strengthened its position in the Nairobi food delivery ecosystem by launching new promotional campaigns and onboarding several local virtual brands. It introduced in-app sponsored listings for kitchens to improve visibility and reduce customer acquisition costs, enabling small operators to gain traction in competitive high-density areas.

Uber Eats Kenya: Uber Eats reported the creation of KSh 534 million in additional value for Kenyan restaurants through platform exposure and order flow. The company deepened partnerships with multi-brand kitchens, focusing on operational data analytics and delivery time optimization within 30-minute service targets.

Yum Deliveries: Yum Deliveries, one of Kenya’s earliest local online food delivery firms, continued to strengthen its Nairobi footprint by expanding its curated partner portfolio to over 250 restaurants. The firm’s focus on direct integration and proprietary logistics has helped it maintain niche dominance in premium cuisine categories.

Hephie’s Cloud Kitchen: Hephie’s Cloud Kitchen, a Nairobi-based food-as-a-service startup, launched multiple virtual brands in 2024 targeting fast-casual and wellness food segments. The company’s in-house kitchen network now supports both proprietary and white-label brand operations, making it one of the few indigenous end-to-end cloud kitchen providers in Kenya.

What Lies Ahead for Kenya Cloud Kitchens Market?

The Kenya Cloud Kitchens Market is expected to witness steady expansion through the latter half of the decade, supported by accelerating urbanization, digital payment maturity, and continued growth in mobile‐internet penetration. Kenya’s urban population stands at 15,784,081 residents, forming the demand core for delivery-based food services. Combined with 68.9 million mobile subscriptions and monthly mobile-money transactions exceeding KSh 713 billion, these digital and demographic rails are expected to underpin rising throughput for virtual and delivery-only kitchens across major cities like Nairobi, Mombasa, and Nakuru.

Rise of Multi-Brand and Hybrid Cloud Models: Kenya’s cloud kitchen ecosystem is moving towards hybrid kitchen models combining shared infrastructure and brand exclusivity. The urban labor force includes more than 10 million active workers, many of whom engage in extended shifts and rely on delivery services for convenience. Operators such as Glovo and Bolt Food are leveraging this behavior by hosting multiple virtual brands under one roof to maximize kitchen utilization. Hybrid models have demonstrated a reduction in capital expenditure by up to 30% through shared preparation areas, joint inventory systems, and aggregator-based partnerships, improving food availability and delivery times in dense business zones such as Westlands, Upper Hill, and Mombasa CBD.

Shift Toward Data-Driven Menu Optimization: With over KSh 713 billion transacted monthly through mobile wallets, Kenya’s digital ecosystem generates massive data streams for predictive analytics. Cloud kitchens now employ advanced forecasting models and menu optimization tools to synchronize preparation with peak-order cycles. These data-driven systems help identify demand spikes by cuisine type and time of day, enabling kitchens to adjust inventory dynamically and minimize food waste. Real-time analytics and AI-assisted dashboards have improved order conversions by up to 40% during high-demand hours, establishing data intelligence as a key lever for efficiency and scalability in Kenya’s emerging food-tech ecosystem.

Sector Formalization Through Regulatory Alignment: Formalization and standardization are shaping the next phase of Kenya’s cloud kitchen industry. Regulations under the Public Health Act and the Food, Drugs and Chemical Substances Act have strengthened oversight for hygiene, packaging, and food handling across counties. New safety benchmarks issued by the Kenya Bureau of Standards ensure consistent quality in delivery-only food operations through structured inspections and labeling requirements. This expanding compliance framework has enhanced consumer trust while reducing the risk of non-compliance penalties, laying the groundwork for export-ready, high-standard virtual kitchen operations that can scale across East Africa.

Adoption of Smart Logistics and Energy Efficiency: Kenya’s improving logistics network and renewable energy capacity are fostering more efficient and sustainable delivery operations. The national highway network added over 1,200 kilometers of new paved roads, enabling faster last-mile delivery and improved fleet routing. Concurrently, the country’s installed power capacity has surpassed 3,000 MW, with the majority generated from clean renewable sources. This energy stability supports the growing shift to electric motorbike fleets and low-emission kitchen appliances. Together, these developments strengthen the logistical and environmental foundation necessary for the long-term growth and sustainability of Kenya’s cloud kitchen ecosystem.

Rise of Localized Virtual Brands and Regional Expansion: Kenya’s cultural diversity and growing disposable income are driving the rise of localized virtual restaurant brands. Household consumption expenditure exceeding USD 100 billion underscores the strong purchasing power supporting this segment. Operators are tailoring menus to regional preferences—coastal Swahili dishes, central Kenyan grills, and contemporary vegan and wellness meals—to appeal to varied urban consumers. As digital delivery networks expand, Nairobi-based operators are opening satellite kitchens in Eldoret, Nakuru, and Kisumu to capture emerging regional demand. This localized expansion and culinary innovation are transforming Kenya into the regional hub for virtual dining and food-tech entrepreneurship.

Leveraging Artificial Intelligence and Automation: Artificial intelligence is redefining operations across Kenya’s cloud kitchen and delivery landscape. With nearly 50 million active internet users, the data pool available for predictive automation is extensive. Delivery platforms are adopting AI dispatch algorithms and machine learning–based batching systems to optimize route efficiency and reduce delivery lag times. Cloud kitchens are integrating digital kitchen display systems (KDS) and inventory automation tools to streamline operations. Enhanced energy reliability and technology adoption have minimized downtime and improved consistency, positioning AI and automation as key enablers of the next efficiency wave in Kenya’s cloud kitchen sector.

Kenya Cloud Kitchens Market Segmentation

By Kitchen Type

Independent single-brand cloud kitchens

Commissary / shared kitchens (KaaS)

Multi-brand cloud kitchens (own + licensed virtual brands)

Kitchen pods / micro-kitchens (mall, office parks, fuel stations)

In-restaurant dark/virtual kitchens (FOH dine-in + BOH delivery-only lines)

By Ownership / Operating Model

Owner-operated (founder-led)

Franchise / license (virtual brand franchising)

Aggregator-affiliated kitchens (incubated/partner programs)

Restaurant group hybrids (QSR/casual chains running virtual menus)

Outsourced production / white-label (FaaS)

By Cuisine & Menu Archetype

Kenyan/East African (nyama choma, pilau, ugali-sides, coastal Swahili)

Chicken/burger/pizza QSR

Pan-Asian/Indian/Middle Eastern

Health & wellness (salads, bowls, vegan, keto)

Bakery, desserts & beverages (coffee, smoothies, specialty)

Value combos & family bundles (bulk trays, office boxes)

By Order Channel

Aggregator apps (Glovo, Bolt Food, Uber Eats, Yum)

Direct-to-consumer (brand app/web)

Social/Conversational (WhatsApp, phone)

Pick-up/kerbside from dark sites

B2B/contracted drops (corporates, institutions, events)

By Buyer / Use-Case

B2C retail consumers (households, students, late-night)

Corporate meals & subscriptions (offices, industrial parks)

Events & catering (tray/bulk SKUs)

Education & healthcare provisioning (canteen-as-a-service)

Hospitality tie-ins (lodges, serviced apartments)

Players Mentioned in the Report:

Glovo Kenya

Bolt Food Kenya

Uber Eats Kenya

Yum Deliveries (Nairobi)

Chandarana Foodplus (ready-to-eat/deli via delivery)

Naivas Online (deli/meal deals via delivery)

Java House Group brands on delivery (Java, Kukito, 360 Degrees)

Artcaffé Group (delivery menus)

KFC Kenya (platform-integrated QSR)

Pizza Inn / Simbisa Brands (platform-integrated QSR)

Galito’s (platform-integrated QSR)

Debonairs Pizza (platform-integrated QSR)

Hephie’s Cloud Kitchen (FaaS/virtual brands)

Kitchens-for-You / shared kitchens (Nairobi)

Little App – delivery vertical (select categories)

Key Target Audience

Corporate procurement and facilities heads (workforce meal programs; B2B subscriptions)

Quick-service and casual-dining chains (virtual brand incubation; delivery menu engineering)

Independent restaurant groups (cloud conversion; shared-kitchen tenancy)

Aggregators and digital marketplaces (merchant acquisition; ads; logistics P&L)

Grocery and convenience retailers (deli/ready-to-eat rollouts via delivery rails)

Packaging and supply-chain vendors (food-grade, eco-packaging; cold-chain)

Investments and venture capitalist firms (growth equity; roll-ups; kitchen pods)

Government & regulatory bodies

Time Period:

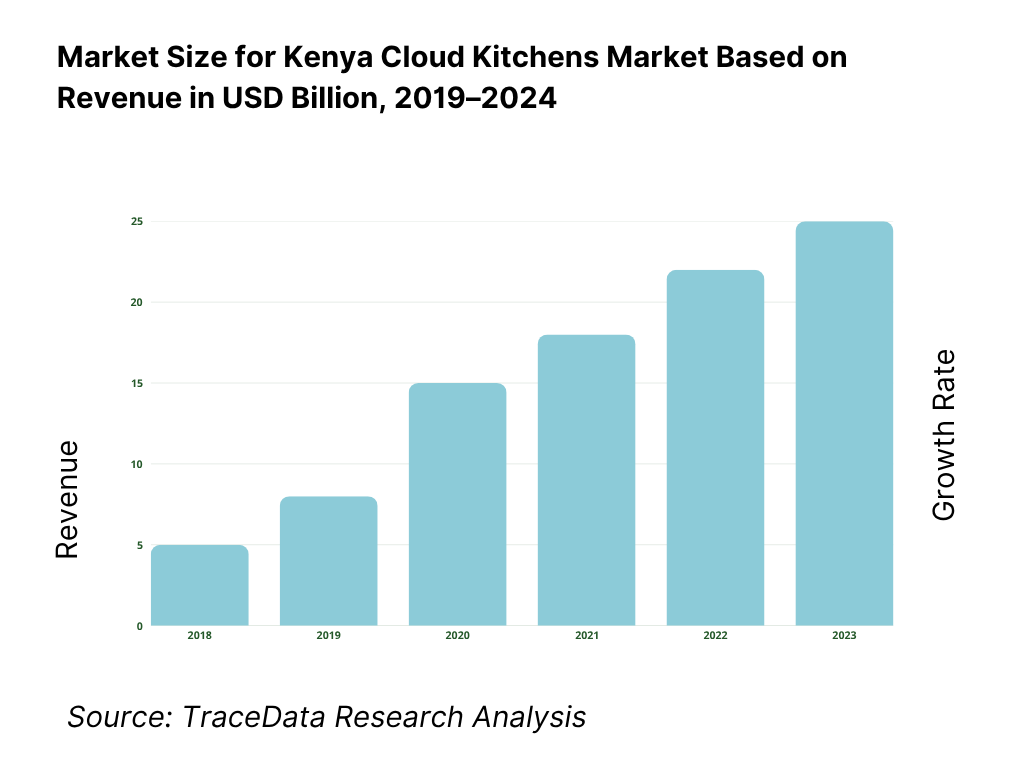

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Kenya Cloud Kitchens-Aggregator-led, Direct-to-Consumer, Pick-Up, B2B/Catering [take-rate/commission bands; contribution margins; CAC & promo burn; customer preference cohorts; service-level metrics (SLA minutes, on-time %); strengths/weaknesses; control vs reach]

4.2. Revenue Streams for Kenya Cloud Kitchens Market [à-la-carte orders; subscriptions/meal plans; corporate/B2B canteens; virtual brand franchising/licensing; upsell add-ons; platform marketing credits; white-label production; dark-store snacks/groceries]

4.3. Business Model Canvas for Kenya Cloud Kitchens Market [customer segments; value propositions (speed, price-point, cuisine variety); channels (apps/aggregators/WhatsApp); key partners (aggregators, shared kitchens, suppliers); key activities; key resources; cost structure; revenue structure; metrics]

5.1. Freelance Delivery Riders vs Employed Fleet Riders [payout models (per-drop/km/time); reliability; churn; utilization; NPS impact; compliance & insurance]

5.2. Investment Model in Kenya Cloud Kitchens Market [capex per kitchen (fit-out, equipment); opex split (COGS, labor, utilities, rent, packaging, commissions); asset-light KaaS models; payback periods; financing sources (equity, revenue-share, leases)]

5.3. Comparative Analysis of the Funnelling Process by Private Aggregators vs Institutional/County Procurement [lead gen → onboarding → promo stacking → retention; corporate/county tendering funnels; SLA/QA compliance; invoice cycles]

5.4. Enterprise Meal/Provisioning Budget Allocation by Company Size [large, mid, SME; % allocation to delivery meals vs canteen vs allowances; average AOV (KES) bands; price elasticity]

8.1. Revenues [historical size; order volumes; AOV (KES); kitchen count; aggregator vs direct mix]

9.1. By Market Structure (In-House Kitchens and Outsourced/Shared Kitchens) [share by revenue & orders; cost deltas; SLA differences]

9.2. By Cuisine/Menu Type (Local/East African, Fast Food/QSR, Healthy/Wellness, Multi-cuisine) [order frequency; basket size; prep time; wastage]

9.3. By Industry/Use-Case Verticals (Consumer Delivery, Corporate Meals, Events/Catering, Education/Institutions, Healthcare) [B2C vs B2B split; SLA; dietary compliance]

9.4. By Company Size of Buyers (Large Enterprises, Medium-Sized Enterprises, SMEs) [AOV bands; frequency; credit terms; procurement complexity]

9.5. By Employee/Consumer Designation [entry staff; middle management; executives; riders/staff meals] [ticket size; timing; cuisine skew]

9.6. By Mode of Ordering [aggregator apps; brand app/web; WhatsApp/phone; kiosks/pick-up] [commission; data ownership; repeat rates]

9.7. By Program Type (Open-Menu and Customized/Contracted Programs) [SLA, pricing, lock-ins, forecast accuracy]

9.8. By Region (Nairobi Metro, Coast, Rift Valley, Western/Nyanza, Central/Eastern, North Eastern) [order density, delivery times, kitchen cluster locations, rent bands]

10.1. Corporate Client Landscape and Cohort Analysis [sector mix; order cadence; ARPA; tenure; churn cohorts]

10.2. Cloud Kitchen Needs and Decision-Making Process [vendor selection criteria; aggregator presence; SLA & QA; dietary policies; invoicing cycles]

10.3. Program Effectiveness and ROI Analysis [benefit vs allowance; absenteeism impact; productivity proxies; satisfaction/NPS]

10.4. Gap Analysis Framework [as-is vs to-be; cuisine/price/time gaps; service recovery loop]

11.1. Trends and Developments for Kenya Cloud Kitchens Market [multi-brand kitchens; AI forecasting; eco-packaging; micro-kitchens; pick-up hubs]

11.2. Growth Drivers for Kenya Cloud Kitchens Market [mobile internet; urban density; convenience; lower capex vs dine-in; aggregator reach]

11.3. SWOT Analysis for Kenya Cloud Kitchens Market [cost agility; brand equity limits; scale synergies; regulatory & gig-work risks]

11.4. Issues and Challenges for Kenya Cloud Kitchens Market [commission pressure; fuel/logistics volatility; QA/food safety; skill gaps; rent/zoning]

11.5. Government/County Regulations for Kenya Cloud Kitchens Market [food hygiene permits; KEBS/labeling; licensing; rider safety; tax/VAT]

12.1. Market Size and Future Potential for Aggregator-Led Delivery [order density; coverage zones; promo intensity]

12.2. Business Model and Revenue Streams [take rates; advertising; logistics fees; subscriptions]

12.3. Delivery Models and Offer Types [restaurant delivery; cloud-only brands; grocery/quick-commerce; scheduled corporate drops]

15.1. Market Share of Key Players (Revenue/Orders) [aggregators vs independents; top operators’ shares]

15.2. Benchmark of Key Competitors [company overview; USP; strategy; business model; kitchen count; revenues (bands); pricing/fees; technology stack; best-selling brands/menus; major clients; partnerships; marketing; recent moves]

15.3. Operating Model Analysis Framework [commissary vs standalone; pod vs full kitchen; staffing models; prep vs assembly lines]

15.4. Gartner-Style Magic Quadrant (Adapted) [completeness of vision vs ability to execute for Kenya operators]

15.5. Bowman’s Strategic Clock for Competitive Advantage [price/value positions; promo-led vs quality-led plays]

16.1. Revenues [base/optimistic/pessimistic scenarios; drivers & sensitivities]

17.1. By Market Structure (In-House and Outsourced/Shared Kitchens) [capacity pipeline; city expansion]

17.2. By Cuisine/Menu Type (Local/East African, Fast Food/QSR, Healthy/Wellness, Multi-cuisine) [expected mix shift; margin effects]

17.3. By Industry/Use-Case Verticals (Consumer Delivery, Corporate Meals, Events/Catering, Education/Institutions, Healthcare) [B2C vs B2B outlook; compliance needs]

17.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, SMEs) [contract lengths; credit risk]

17.5. By Employee/Consumer Designation [menu engineering per cohort]

17.6. By Mode of Ordering [aggregator vs direct shift; CRM/data ownership]

17.7. By Program Type (Open and Customized/Contracted) [pricing corridors; service credits]

17.8. By Region (Nairobi Metro, Coast, Rift Valley, Western/Nyanza, Central/Eastern, North Eastern) [new kitchen cluster feasibility; rent/infrastructure differentials]

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Kenya Cloud Kitchens Market. Based on this ecosystem, we will shortlist five to six leading cloud kitchen and delivery operators in the country based on their operational footprint, order throughput, financial disclosures, and partner network. Sourcing is conducted through industry articles, regulatory filings, operator press releases, and proprietary databases to perform desk research around the market and collate ecosystem-level information. Both macro sources (e.g., Central Bank of Kenya, KNBS, and Competition Authority of Kenya) and micro company data are consolidated to capture supply-demand linkages within the cloud kitchen value chain.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing multiple secondary and proprietary databases. This approach enables a detailed analysis of the market, aggregating industry-level insights on kitchen counts, delivery order volumes, aggregator penetration, and cuisine diversification. We examine aspects such as the number of delivery-only kitchens, average order density, take-rate structures, and logistics dependencies, supplemented with company-level data from press releases, financial statements, and annual operational summaries. Government data from the Communications Authority (mobile usage), Central Bank (mobile money flows), and KNBS (urban demographics) are integrated to build a strong factual foundation for understanding both the market’s operational landscape and its key participants.

Step 3: Primary Research

We initiate a series of in-depth interviews with founders, operations heads, and C-level executives of major Kenya Cloud Kitchens Market operators and delivery platforms, as well as with restaurant partners and suppliers. This process serves multiple objectives: to validate hypotheses, authenticate operational and financial data, and capture qualitative insights into kitchen throughput, rider SLAs, packaging costs, and menu optimization strategies. A bottom-to-top approach is employed to estimate revenue contributions for each operator, which are then aggregated to form the total market structure. As part of our validation strategy, disguised interviews are also conducted under the guise of potential partners or clients, allowing verification of cost structures, partnership terms, and capacity utilization levels shared during interviews.

Step 4: Sanity Check

A comprehensive top-to-bottom and bottom-to-top analysis, accompanied by market size modeling exercises, is undertaken to test the robustness of the findings. Both quantitative data (order density, active kitchens, AOV in KES) and qualitative indicators (regulatory constraints, delivery efficiency, partner retention) are reconciled to confirm internal consistency. All figures derived from secondary sources are revalidated through cross-comparison with primary interviews and official government datasets. The results undergo a peer review process within the research team to ensure methodological sanity and analytical integrity before final report synthesis.

FAQs

01 What is the potential for the Kenya Cloud Kitchens Market?

The Kenya Cloud Kitchens Market holds immense growth potential, supported by the rapid evolution of digital food delivery systems and expanding urban consumption. Transaction values in Kenya’s online delivery ecosystem reached KSh 16.4 billion (≈ USD 103 million), reflecting the expanding commercial backbone of aggregator-led food services. The country has 68.9 million mobile subscribers and processes more than KSh 713 billion in mobile-money payments monthly, indicating a high-frequency digital economy. Major cities such as Nairobi, Mombasa, and Nakuru remain dominant, offering dense consumer bases and delivery-ready infrastructure, allowing virtual kitchen operators to scale throughput efficiently.

02 Who are the Key Players in the Kenya Cloud Kitchens Market?

The Kenya Cloud Kitchens Market includes a mix of multinational aggregators, regional food delivery firms, and local kitchen operators. Prominent players include Glovo, Bolt Food, Uber Eats, Yum Deliveries, and Hephie’s Cloud Kitchen, all of which leverage robust delivery networks and localized virtual brand strategies. Restaurant chains such as Java House, Artcaffé Group, and Big Square have also expanded into hybrid and delivery-only kitchens to meet demand from digital consumers. Additionally, retail-driven kitchen operators like Naivas and Chandarana Foodplus are integrating deli-style meal prep into delivery platforms, combining supermarket presence with digital fulfillment.

03 What are the Growth Drivers for the Kenya Cloud Kitchens Market?

Growth in the Kenya Cloud Kitchens Market is being fueled by accelerating digital adoption and favorable economic fundamentals. The country has over 49.3 million internet subscriptions and 68.9 million active SIM cards, supported by an urban GDP per capita of USD 2,206.13, reflecting rising disposable income. Monthly mobile-money flows of KSh 713 billion highlight robust payment liquidity and digital purchasing power. The convergence of smartphone penetration, youth-driven consumer behavior, and preference for on-demand convenience has transformed Kenya into East Africa’s most dynamic digital food delivery hub, providing the structural foundation for cloud kitchen expansion.

04 What are the Challenges in the Kenya Cloud Kitchens Market?

The Kenya Cloud Kitchens Market faces challenges arising from operational costs, logistics, and regulatory compliance. Fuel costs remain high, with petrol priced at KSh 180.66 per litre and diesel at KSh 168.06 per litre, increasing delivery expenses for aggregator fleets and kitchen logistics. Rising food and packaging material prices have pressured profit margins, while county-level licensing and inspection protocols under the Public Health Act (Cap 242) and Food, Drugs and Chemical Substances Act (Cap 254) create administrative friction during setup. Ensuring food safety compliance, managing rider networks, and maintaining margin efficiency remain key operational challenges for Kenyan cloud kitchen operators.