Kenya Cold Chain Market Outlook to 2029

By Market Structure, By Temperature Type (Chilled & Frozen), By End-User Applications (Fruits & Vegetables, Dairy, Meat & Seafood, Pharmaceuticals), By Ownership (3PL & Captive), and By Region

- Product Code: TDR0287

- Region: Africa

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Kenya Cold Chain Market Outlook to 2029 – By Market Structure, By Temperature Type (Chilled & Frozen), By End-User Applications (Fruits & Vegetables, Dairy, Meat & Seafood, Pharmaceuticals), By Ownership (3PL & Captive), and By Region” provides a comprehensive analysis of the cold chain industry in Kenya. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on revenue, by market structure, end-user segment, and region, along with cause and effect relationship and success case studies highlighting the major opportunities and cautions.

Kenya Cold Chain Market Overview and Size

The Kenya cold chain market reached a valuation of KES 40 Billion in 2023, driven by rising demand for temperature-sensitive food and pharmaceutical products, increasing urbanization, and the expansion of modern retail and foodservice sectors. The market is dominated by key players such as Cold Solutions Kenya, Logistics Solutions Africa, Ice Clean Care Group, and BigCold Kenya. These companies have gained prominence due to their strong logistics capabilities, temperature-controlled warehouse infrastructure, and focus on service quality.

In 2023, BigCold Kenya commissioned a new multi-temperature facility in Nairobi to cater to increasing demand from food processors and pharmaceutical clients. Nairobi and Mombasa serve as the central cold chain hubs due to their port access, urban consumption base, and growing FMCG and healthcare distribution networks.

%2C%202024-2030.png)

What Factors are Leading to the Growth of Kenya Cold Chain Market:

Food Safety & Regulatory Push: With increasing government regulation around food safety and pharmaceutical integrity, companies are investing in certified cold storage and distribution systems. The Kenya Bureau of Standards (KEBS) and the Pharmacy and Poisons Board (PPB) have increased compliance checks in 2023, driving formal cold chain adoption.

Agricultural Exports & Perishables Trade: Kenya's fresh produce and flower export industry heavily depends on cold chain logistics. In 2023, over 60% of horticultural exports required chilled supply chains. Growth in EU-bound fresh produce exports continues to boost the need for quality cold storage and air freight services.

Urbanization & Supermarket Retail: Kenya’s expanding urban population and modern retail penetration (with chains like Naivas, Quickmart, Carrefour) have increased demand for refrigerated food distribution. In Nairobi alone, over 200 retail outlets now require regular replenishment of cold items such as dairy, frozen foods, and fresh meats.

Which Industry Challenges Have Impacted the Growth of the Kenya Cold Chain Market

Infrastructure Gaps in Rural Areas: One of the key challenges is the underdeveloped cold chain infrastructure outside of major cities. According to industry estimates, over 65% of Kenya’s rural regions lack access to temperature-controlled storage facilities. This restricts cold chain penetration into remote agricultural zones, resulting in significant post-harvest losses — estimated at over 30% for perishable produce such as mangoes, avocados, and dairy.

High Operational Costs: The cost of maintaining cold storage and refrigerated transportation remains prohibitively high due to elevated electricity prices, fuel costs, and maintenance expenses. Industry stakeholders report that cold chain service providers in Kenya incur operating costs up to 40% higher than room-temperature logistics, making it difficult to offer competitive pricing. This affects affordability for small farmers, SMEs, and independent pharmacies.

Skill and Technology Shortage: There is a limited pool of trained professionals and technicians specialized in cold chain logistics, refrigeration systems, and temperature monitoring technologies. As per 2023 data from Kenya’s National Industrial Training Authority, only 15% of cold chain workers received formal training in cold storage maintenance or pharmaceutical handling. This gap leads to inefficient operations and occasional product spoilage.

What are the Regulations and Initiatives which have Governed the Market

KEBS Cold Chain Standards for Food and Pharma: The Kenya Bureau of Standards (KEBS) has implemented detailed guidelines for temperature-controlled storage and transportation of perishables and pharmaceuticals. These standards specify mandatory cold storage temperature ranges (e.g., 2°C–8°C for vaccines) and require all logistics firms to maintain calibrated thermometers and data loggers. In 2023, KEBS increased surprise audits and revoked 9% of cold chain licenses for non-compliance.

Pharmacy and Poisons Board (PPB) Oversight: All pharmaceutical cold chain logistics are regulated by the PPB under the Good Distribution Practice (GDP) framework. In 2022–2023, PPB introduced stricter requirements for warehousing, including contingency backup power systems and 24/7 temperature tracking for life-saving drugs and vaccines. These rules are enforced particularly for importers and major distributors operating out of Nairobi and Mombasa.

Public-Private Initiatives for Post-Harvest Loss Reduction: The government, in collaboration with international donors like USAID and FAO, has launched capacity-building programs and grants to encourage investment in cold storage facilities near farm clusters. In 2023, under the Kenya Climate Smart Agriculture Project (KCSAP), over 20 farmer cooperatives received funding to set up solar-powered cold rooms in counties like Meru, Machakos, and Nakuru.

Kenya Cold Chain Market Segmentation

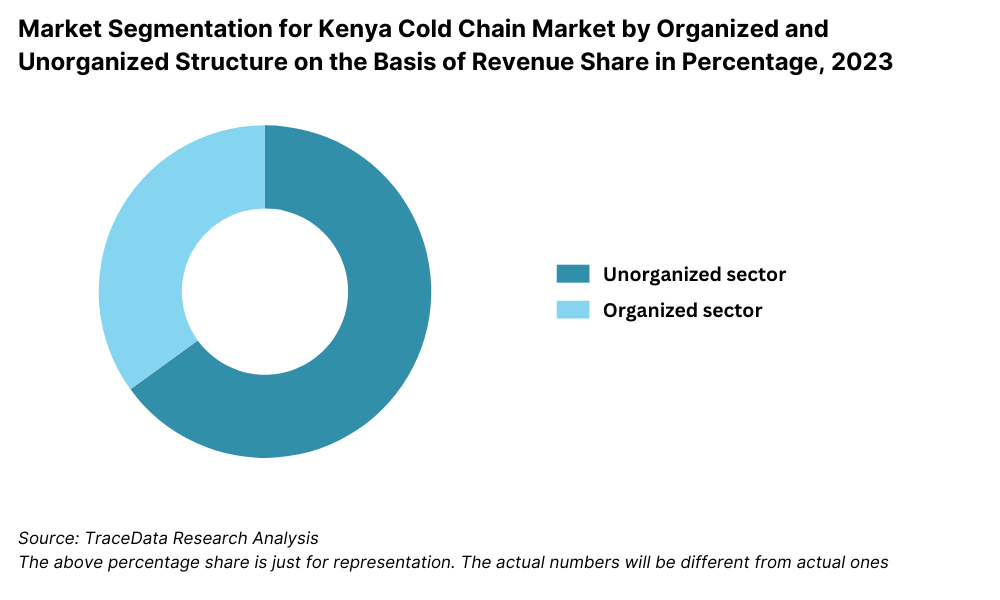

By Market Structure: The market is largely dominated by unorganized players, especially in rural and peri-urban regions, where informal cold storage and ad-hoc transportation methods are common due to lack of investment and infrastructure. However, the organized segment is rapidly growing in urban centers like Nairobi and Mombasa, driven by rising demand from supermarkets, QSR chains, and pharmaceutical distributors. Organized players such as BigCold and Cold Solutions are gaining share by offering reliable, GDP-compliant services, real-time tracking, and better temperature integrity.

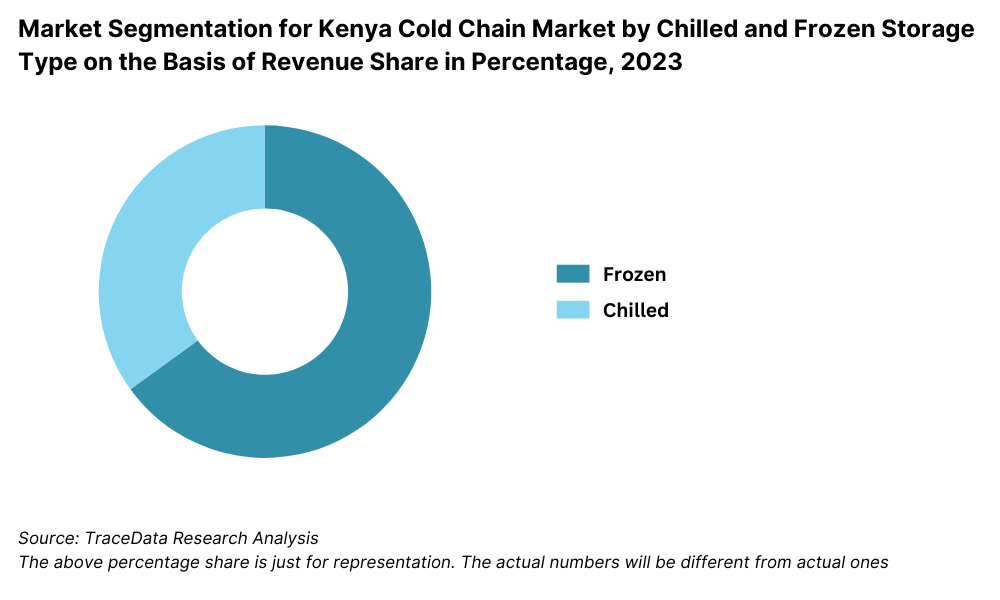

By Temperature Type: The frozen segment holds a significant share due to strong demand from meat, seafood, and frozen food exporters. However, the chilled segment is gaining momentum, especially for fresh produce, dairy, and pharmaceutical products. In 2023, chilled storage witnessed higher growth owing to increased supply of fresh-cut fruits, ready-to-eat meals, and vaccines, all requiring storage between 2°C to 8°C.

By End-User Application: The food industry dominates cold chain usage in Kenya, with fruits & vegetables and meat & seafood being the top contributors. The pharmaceutical segment is witnessing strong growth, backed by expanding vaccine distribution, diagnostic logistics, and temperature-sensitive medication. The dairy industry also represents a consistent demand source, especially for milk processors and yogurt manufacturers needing daily distribution.

Competitive Landscape in Kenya Cold Chain Market

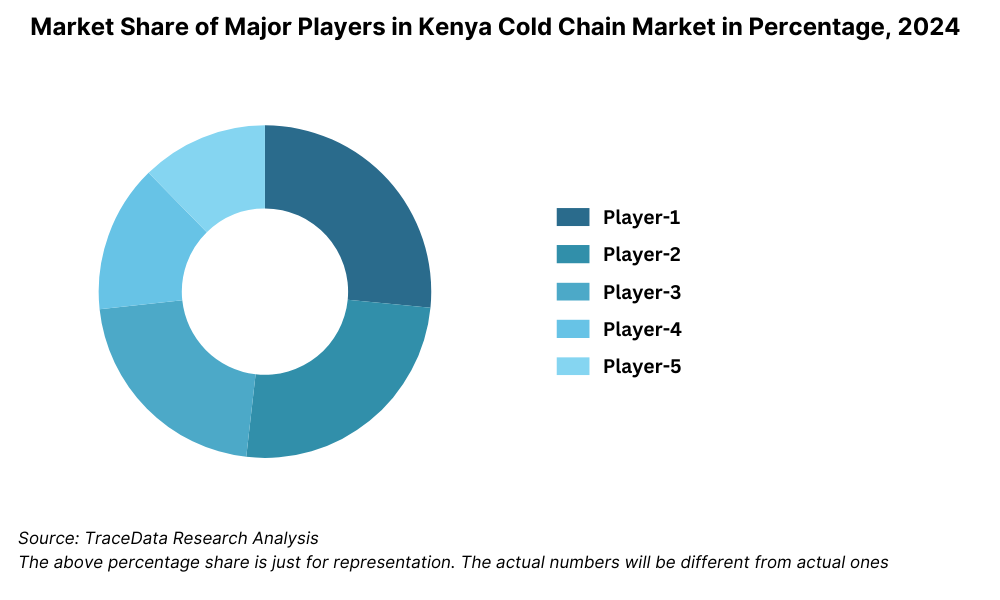

The Kenya cold chain market is moderately consolidated, with a few dominant players leading in infrastructure, service offerings, and regional reach. The sector is witnessing rapid expansion with the entry of specialized logistics companies, increased donor funding, and digital innovation. Key players such as BigCold Kenya, Cold Solutions, Ice Clean Care Group, and Logistics Solutions Africa are shaping the market, especially in Nairobi, Mombasa, and key agricultural counties.

Company | Establishment Year | Headquarters |

BigCold Kenya | 2015 | Nairobi, Kenya |

Cold Solutions | 2020 | Nairobi, Kenya |

Ice Clean Care Group | 2013 | Mombasa, Kenya |

Logistics Solutions Africa | 2010 | Nairobi, Kenya |

Twiga Cold Chain Services | 2017 | Nairobi, Kenya |

Some of the recent competitor trends and key information about competitors include:

BigCold Kenya: A market leader in multi-temperature warehousing and distribution, BigCold operates a 12,000-pallet facility in Nairobi. In 2023, it expanded its pharma cold chain services and signed long-term distribution contracts with two leading FMCG brands. The company is known for its ISO-certified operations and real-time tracking solutions.

Cold Solutions: Backed by private equity, Cold Solutions began operations in 2020 and has quickly scaled up. In 2023, it announced the development of a state-of-the-art cold storage complex near Nairobi Industrial Area with a 15,000-pallet capacity. It aims to serve exporters and supermarket chains with advanced automation and temperature monitoring.

Ice Clean Care Group: A long-standing player in the Mombasa region, Ice Clean Care Group provides temperature-controlled transport and blast freezing for seafood exporters. In 2023, the firm upgraded its fleet with solar-assisted reefer trucks to reduce fuel dependency and improve cold chain continuity for long-haul routes.

Logistics Solutions Africa (LSA): LSA offers integrated cold chain solutions including warehousing, transport, and last-mile delivery. In 2023, LSA entered the pharmaceutical cold chain segment, achieving GDP certification and securing contracts with top-tier pharmacy chains and distributors.

Twiga Cold Chain Services: Originally a food supply chain platform, Twiga expanded into cold chain logistics in 2020. In 2023, it scaled its cold distribution network to cover over 25 counties, enabling temperature-sensitive delivery for both food and health products to retail kiosks and clinics in underserved areas.

What Lies Ahead for Kenya Cold Chain Market?

The Kenya cold chain market is projected to witness strong growth through 2029, exhibiting a healthy CAGR driven by evolving consumption patterns, increased healthcare logistics demand, and the continued modernization of agricultural value chains. Rising investments in cold storage infrastructure and regulatory reforms are expected to reshape the competitive landscape over the next few years.

Expansion of Pharmaceutical Cold Chain: With the continued rollout of essential vaccines, biologics, and specialty medicines, the pharmaceutical cold chain is expected to expand rapidly. By 2029, the segment is projected to grow by over 2x compared to 2023, supported by regulatory enforcement from the Pharmacy and Poisons Board and investment from private players and donor-funded programs.

Adoption of Solar-Powered Cold Storage: Given Kenya’s abundant solar potential and high electricity costs, solar-powered cold rooms are gaining traction—particularly in rural areas. Between 2025 and 2029, adoption of off-grid solar cold storage is anticipated to rise sharply, driven by donor programs like USAID KCDMS and local agri-tech innovations that cater to smallholder farmers and cooperatives.

Growth of Integrated Cold Chain Logistics: An increasing number of companies are expected to shift towards end-to-end cold chain solutions, integrating storage, transportation, and last-mile delivery. This transition will be driven by demand from modern retailers, QSR chains, and e-commerce grocery platforms seeking consistent temperature control and digital tracking.

Digital Monitoring and IoT Integration: The future of the Kenyan cold chain market will be shaped by the integration of real-time temperature monitoring, IoT sensors, and cloud-based inventory management systems. These technologies will enhance transparency, reduce spoilage, and allow better forecasting and fleet optimization, particularly in the high-value pharmaceutical and export sectors.

%2C%202019-2024.png)

Kenya Cold Chain Market Segmentation

• By Market Structure:

o Organized Cold Chain Providers

o Unorganized Cold Chain Operators

o Captive Cold Chain Infrastructure

o Third-Party Logistics (3PL) Providers

o End-to-End Integrated Cold Chain Services

o Standalone Cold Storage Warehouses

o Refrigerated Transportation Fleets

• By Temperature Type:

o Chilled (0°C to 8°C)

o Frozen (-18°C and below)

• By End-User Application:

o Fruits & Vegetables

o Meat & Seafood

o Dairy Products

o Pharmaceuticals

o Bakery & Confectionery

o Quick Service Restaurants (QSRs)

o Retail and Supermarkets

• By Ownership Model:

o Captive (Owned by Food/FMCG/Pharma Companies)

o 3PL (Third Party Logistics Service Providers)

• By Region:

o Nairobi Metropolitan

o Mombasa & Coastal Region

o Western Kenya (Kisumu, Kakamega)

o Rift Valley (Nakuru, Eldoret)

o Central Kenya (Nyeri, Murang’a)

o Eastern Kenya (Meru, Embu)

Players Mentioned in the Report:

• BigCold Kenya

• Cold Solutions

• Ice Clean Care Group

• Logistics Solutions Africa

• Twiga Cold Chain Services

• Sendy Logistics (Cold Chain Division)

• Freight Forwarders Kenya (FFK)

• Alpha Logistics Services

• Farm to Market Alliance Cold Chain Partners

Key Target Audience:

• Cold Storage Infrastructure Providers

• Food Exporters and Agro-Processors

• Pharmaceutical Manufacturers and Distributors

• Supermarkets and QSR Chains

• Third-Party Logistics Providers

• Regulatory Bodies (e.g., KEBS, PPB, MoH)

• Development Agencies (e.g., USAID, FAO, Gavi)

• Investment Funds and Agritech Innovators

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Kenya Cold Chain Market

4.3. Business Model Canvas for Kenya Cold Chain Market

4.4. Cold Chain Service Decision-Making Process

4.5. Cold Chain Infrastructure Investment Decision-Making Process

5.1. Cold Chain Capacity in Kenya, 2018-2024

5.2. Demand vs Cold Chain Capacity Gap by Sector (Food vs Pharma), 2018-2024

5.3. Per Capita Cold Storage Capacity in Kenya, 2024

5.4. Number of Cold Chain Operators by Region in Kenya, 2024

8.1. Revenues, 2018-2024

8.2. Pallet Capacity & Volume Handled, 2018-2024

9.1. By Market Structure (Organized vs Unorganized), 2023-2024P

9.2. By Ownership Model (Captive vs 3PL), 2023-2024P

9.3. By Temperature Type (Chilled vs Frozen), 2023-2024P

9.4. By Region (Nairobi, Mombasa, Western, Rift Valley, Central, Eastern), 2023-2024P

9.5. By End-Use Sector (Fruits & Vegetables, Meat & Seafood, Dairy, Pharmaceuticals), 2023-2024P

10.1. End-User Landscape and Cohort Analysis

10.2. Service Selection and Logistics Outsourcing Decision Process

10.3. Need, Preference, and Pain Point Analysis

10.4. Cold Chain Penetration Gap by Sector

11.1. Trends and Developments in Kenya Cold Chain Market

11.2. Growth Drivers for Kenya Cold Chain Market

11.3. SWOT Analysis for Kenya Cold Chain Market

11.4. Issues and Challenges in Kenya Cold Chain Market

11.5. Government Regulations and Compliance Guidelines

12.1. Adoption of IoT, GPS Tracking, and Temperature Monitoring

12.2. Use of Solar-Powered Cold Storage and Refrigerated Transport

12.3. Cold Chain Management Software Adoption

13.1. Financing Models and Lease Options for Cold Storage Facilities

13.2. Public-Private Partnerships and Donor Funding Initiatives

13.3. ROI Analysis and Investment Trends, 2018-2024

16.1. Benchmark of Key Competitors including Company Overview, Facility Locations, Pallet Capacity, Sectors Served, Technology Adoption, and Key Clients

16.2. Strength and Weakness Assessment

16.3. Operating Model Analysis Framework

16.4. Competitive Positioning Matrix

16.5. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Pallet Capacity & Volume Handled, 2025-2029

18.1. By Market Structure (Organized vs Unorganized), 2025-2029

18.2. By Ownership Model (Captive vs 3PL), 2025-2029

18.3. By Temperature Type (Chilled vs Frozen), 2025-2029

18.4. By Region, 2025-2029

18.5. By End-Use Sector (Fruits & Vegetables, Meat & Seafood, Dairy, Pharmaceuticals), 2025-2029

18.6. By User Type (Exporters, Supermarkets, Hospitals, Agro-Cooperatives), 2025-2029

18.7. By Facility Size (Small <500 Pallets, Medium 500-5000 Pallets, Large >5000 Pallets), 2025-2029

18.8. Recommendation

18.9. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities relevant to the Kenya Cold Chain Market. This includes cold storage facility operators, refrigerated transporters, agro-exporters, pharmaceutical distributors, supermarket chains, and government/regulatory bodies.

Sourcing is conducted through government publications (e.g., Kenya National Bureau of Statistics, Ministry of Agriculture), industry whitepapers, news articles, and proprietary market databases to form an initial landscape view and shortlist 5–6 key organized players based on infrastructure footprint, sectoral focus (food vs. pharma), and financial performance.

Step 2: Desk Research

An exhaustive secondary research process is undertaken using a combination of public domain sources and proprietary databases. We analyze sector-specific reports, trade publications, regulatory filings, press releases, annual reports, investor presentations, and government data.

This phase aims to build a foundational market view, covering aspects such as capacity of cold storage facilities, transportation networks, temperature types handled, sector-wise demand (e.g., agriculture, healthcare), pricing trends, and regional distribution. Detailed company profiles and operating metrics are extracted for leading cold chain service providers.

Step 3: Primary Research

A series of in-depth interviews are conducted with CXOs, operations heads, and logistics managers across key cold chain companies and major end-user organizations (including exporters, supermarkets, and pharmaceutical firms). These conversations help validate assumptions, understand market trends, and triangulate volume and revenue figures.

Bottom-up estimation is performed by capturing the individual capacity, utilization rate, and revenue estimates from multiple players, which is then aggregated to model the overall market size.

Disguised interviews are conducted as a cross-validation mechanism — researchers pose as potential clients or supply chain partners to assess actual service levels, pricing benchmarks, operating practices, and capacity utilization. This method supplements top-down data derived from industry-wide indicators.

Step 4: Sanity Check

- A combination of bottom-to-top and top-to-bottom analysis is applied to validate the final market size and projections. Growth modeling is cross-checked against macroeconomic drivers (agricultural exports, pharma growth, urban consumption patterns), while internal consistency of segment-level data is tested against independent secondary sources and expert consultations.

FAQs

1. What is the potential for the Kenya Cold Chain Market?

The Kenya cold chain market holds significant potential, with the market valued at approximately KES 40 Billion in 2023. Growth is being driven by increasing demand for temperature-sensitive logistics in food and pharmaceuticals, expansion of modern retail, and government-backed post-harvest loss reduction programs. Rising urbanization and Kenya’s strategic position as an agricultural exporter further support future market expansion through 2029.

2. Who are the Key Players in the Kenya Cold Chain Market?

Key players in the Kenya cold chain market include BigCold Kenya, Cold Solutions, Ice Clean Care Group, Logistics Solutions Africa, and Twiga Cold Chain Services. These companies are recognized for their advanced cold storage facilities, refrigerated transport networks, and sector specialization in perishable foods and pharmaceuticals. Several emerging players and international donors are also entering the market through partnerships and infrastructure investments.

3. What are the Growth Drivers for the Kenya Cold Chain Market?

Major growth drivers include the increasing need for food safety and traceability, rising demand from supermarkets and fast food chains, expansion of pharmaceutical distribution, and the growth in horticultural exports. Regulatory enforcement around temperature compliance and the adoption of solar-powered cold storage in rural areas are also stimulating investments and innovation in the sector.

4. What are the Challenges in the Kenya Cold Chain Market?

The market faces several challenges, including high infrastructure and energy costs, limited cold chain penetration in rural areas, and a shortage of skilled technicians and cold chain professionals. Additionally, compliance with regulatory standards from bodies like KEBS and the Pharmacy and Poisons Board requires significant investment, which can be difficult for small and informal players. Lack of integrated logistics and fragmented service models also hinder efficiency and scalability.