KSA Cryogenic Equipment Market Outlook to 2035

By Equipment Type, By Cryogenic Fluid, By End-Use Industry, By Application, and By Region

- Product Code: TDR0460

- Region: Middle East

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “KSA Cryogenic Equipment Market Outlook to 2035 – By Equipment Type, By Cryogenic Fluid, By End-Use Industry, By Application, and By Region” provides a comprehensive analysis of the cryogenic equipment industry in the Kingdom of Saudi Arabia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and safety landscape, buyer-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players operating in the KSA cryogenic equipment market. The report concludes with future market projections based on industrial gas demand growth, LNG and hydrogen infrastructure development, healthcare and life-sciences expansion, petrochemical and refining investments, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

KSA Cryogenic Equipment Market Overview and Size

The KSA cryogenic equipment market is valued at approximately ~USD ~ billion, representing the supply of engineered systems designed for the storage, transportation, liquefaction, regasification, and controlling handling of cryogenic fluids such as liquid nitrogen, oxygen, argon, hydrogen, LNG, and specialty gases at extremely low temperatures. Cryogenic equipment typically includes storage tanks, vaporizers, pumps, valves, piping systems, tankers, and integrated cold-handling solutions engineered for high safety, thermal efficiency, and regulatory compliance.

The market is anchored by Saudi Arabia’s large-scale industrial base, including oil & gas, petrochemicals, refining, and metals, alongside rising demand from industrial gases, healthcare infrastructure, food processing, electronics manufacturing, and emerging hydrogen and clean-energy applications. Cryogenic systems are critical enablers for both traditional hydrocarbon value chains and future-oriented energy and industrial transitions under Vision 2030.

Demand is further supported by the Kingdom’s focus on industrial localization, expansion of industrial gas production capacity, investments in LNG handling and import/export infrastructure, and growing adoption of cryogenic technologies in medical oxygen, pharmaceutical cold chains, and specialty industrial processes. Large industrial clusters in the Eastern Province and Western Region continue to dominate demand, while new industrial cities and giga-projects are creating incremental requirements for cryogenic storage and distribution systems.

The Eastern Province represents the largest demand center due to its concentration of oil & gas fields, refineries, petrochemical complexes, and industrial gas plants. The Western Region follows, supported by healthcare infrastructure expansion, food and beverage processing, logistics hubs, and energy-intensive industrial projects linked to port-based development. Central Saudi Arabia shows growing demand driven by manufacturing diversification, medical infrastructure, and institutional facilities, while Northern and Southern regions represent emerging demand pockets linked to mining, energy transition projects, and regional industrial development initiatives.

What Factors are Leading to the Growth of the KSA Cryogenic Equipment Market

Expansion of industrial gas production and downstream consumption strengthens core demand: Saudi Arabia continues to expand its industrial gas ecosystem to support steel, chemicals, electronics, healthcare, food processing, and energy sectors. Oxygen, nitrogen, argon, and specialty gases are critical inputs across these industries, necessitating reliable cryogenic storage, on-site generation, and distribution infrastructure. Cryogenic tanks, vaporizers, and transfer systems are increasingly deployed at production plants, industrial customer sites, and distribution terminals to ensure uninterrupted supply and process stability. As industrial clusters scale and diversify, demand for both standardized and customized cryogenic equipment increases proportionally.

Oil, gas, petrochemical, and LNG infrastructure investments sustain large-scale equipment requirements: The Kingdom’s upstream, midstream, and downstream energy sectors rely heavily on cryogenic technologies for gas processing, liquefaction, separation, and storage. Investments in LNG handling facilities, gas processing plants, and hydrogen-ready infrastructure drive demand for large-capacity cryogenic tanks, pumps, heat exchangers, and insulated piping systems. These projects often require engineered-to-order equipment designed to meet stringent safety, temperature, and pressure specifications, reinforcing the role of experienced cryogenic equipment suppliers and EPC-aligned vendors.

Emergence of hydrogen, clean energy, and advanced industrial applications creates new growth avenues: Saudi Arabia’s ambitions in clean hydrogen, ammonia, and energy transition technologies are creating a new layer of demand for advanced cryogenic equipment. Liquid hydrogen and ammonia handling require highly specialized storage and transfer systems with superior insulation performance, leak prevention, and safety controls. Pilot projects, export-oriented energy hubs, and research-driven industrial initiatives are accelerating adoption of next-generation cryogenic solutions, positioning the market for structural growth beyond traditional industrial gas and hydrocarbon applications.

Which Industry Challenges Have Impacted the Growth of the KSA Cryogenic Equipment Market:

High capital cost and long procurement cycles for engineered cryogenic systems impact project timing and buyer commitment: Cryogenic equipment such as large storage tanks, vaporizers, pumps, and integrated handling systems involve high upfront capital expenditure due to specialized materials, insulation requirements, precision engineering, and stringent safety standards. For industrial, energy, and healthcare buyers in Saudi Arabia, these costs can delay investment decisions, particularly for non-core or phased expansion projects. Long engineering, manufacturing, and delivery lead times—especially for imported or customized equipment—can further extend project schedules and make buyers cautious about committing early, particularly in environments where downstream demand visibility is still evolving.

Dependence on imported equipment and specialized components exposes projects to supply chain and logistics risks: While Saudi Arabia is advancing localization initiatives, a significant share of cryogenic equipment and critical components—such as vacuum-insulated vessels, advanced valves, instrumentation, and control systems—continues to be sourced from international suppliers. This reliance exposes projects to risks related to global manufacturing capacity constraints, shipping delays, customs clearance timelines, and currency fluctuations. During periods of strong global demand for cryogenic systems—such as LNG and hydrogen-related buildouts—lead times can stretch further, impacting commissioning schedules and increasing total installed costs for projects in the Kingdom.

Technical complexity and stringent safety requirements increase engineering and installation challenges: Cryogenic systems operate at extremely low temperatures and involve handling of hazardous or high-value gases, requiring meticulous design, fabrication, installation, and commissioning. Inadequate integration between equipment suppliers, EPC contractors, and site operators can lead to design mismatches, safety review delays, or rework during installation. Limited availability of locally experienced cryogenic specialists for installation, commissioning, and maintenance can further increase execution risk, particularly for advanced applications such as liquid hydrogen, LNG, and specialty gas systems.

What are the Regulations and Initiatives which have Governed the Market:

Industrial safety, pressure vessel, and hazardous materials regulations governing cryogenic equipment design and operation: Cryogenic equipment deployed in Saudi Arabia must comply with national and site-specific safety regulations covering pressure vessels, hazardous materials handling, and industrial operations. Requirements related to vessel integrity, insulation performance, pressure relief systems, leak detection, and emergency shutdown protocols directly influence equipment design and certification. Compliance with Saudi standards and internationally recognized codes is critical for approval by plant owners, regulators, and insurance providers, shaping specification requirements and supplier qualification processes.

Standards and conformity requirements under SASO and related authorities shaping product approval and market entry: The Saudi Standards, Metrology and Quality Organization (SASO) plays a central role in defining conformity assessment, certification, and quality requirements for industrial equipment, including cryogenic systems. Imported cryogenic equipment must meet applicable technical regulations, testing, and documentation requirements before market entry. These processes influence supplier timelines, documentation burden, and cost structures, particularly for international manufacturers entering the Saudi market or supplying project-specific engineered systems.

Vision 2030, industrial localization, and energy transition initiatives influencing demand patterns and supplier strategies: Saudi Arabia’s Vision 2030 agenda emphasizes industrial diversification, localization of manufacturing, healthcare expansion, and leadership in clean energy and hydrogen. These initiatives indirectly support growth in cryogenic equipment demand across industrial gases, medical oxygen, LNG, hydrogen, and advanced manufacturing applications. At the same time, localization and local-content preferences increasingly influence procurement strategies, encouraging international suppliers to partner with local manufacturers, service providers, or EPC firms to strengthen competitiveness and align with national development objectives.

KSA Cryogenic Equipment Market Segmentation

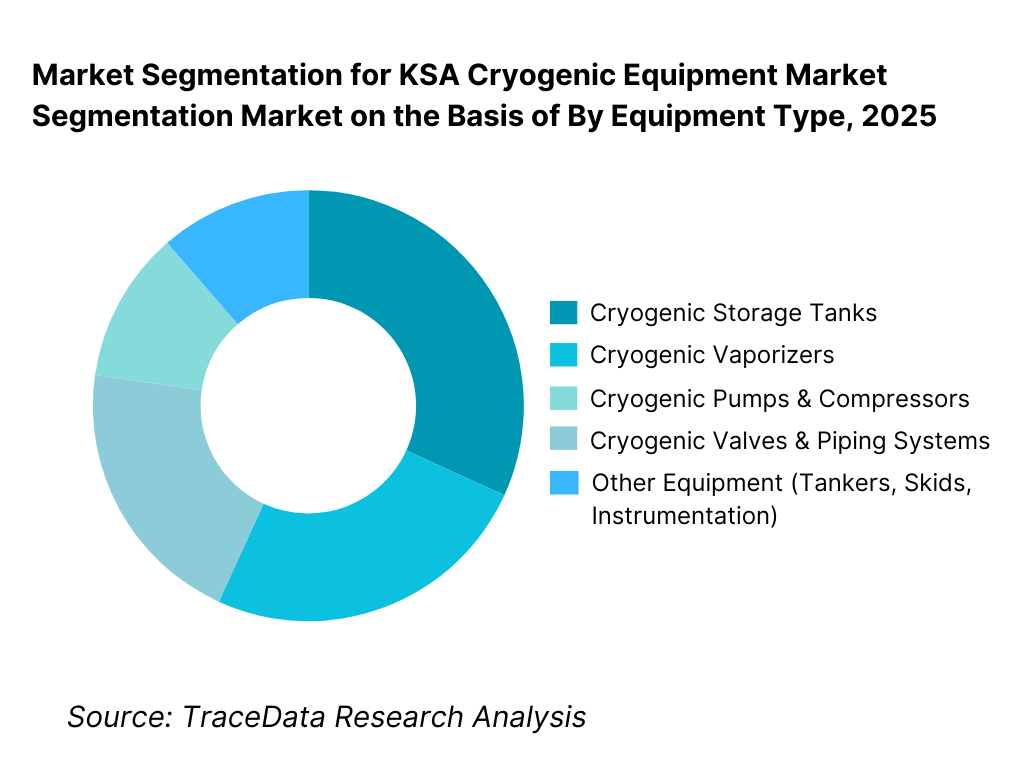

By Equipment Type: The cryogenic storage tanks segment holds dominance in the KSA cryogenic equipment market. This is because large-volume storage of liquid oxygen, nitrogen, argon, LNG, and emerging hydrogen applications forms the backbone of industrial gas supply chains, oil & gas processing, healthcare oxygen systems, and energy infrastructure projects in Saudi Arabia. Storage tanks—both stationary and transportable—are critical for ensuring supply continuity, operational safety, and thermal efficiency. While vaporizers, pumps, valves, and transfer systems are essential supporting components, storage tanks account for the highest capital value per installation and are typically specified early in project planning, driving their dominant share.

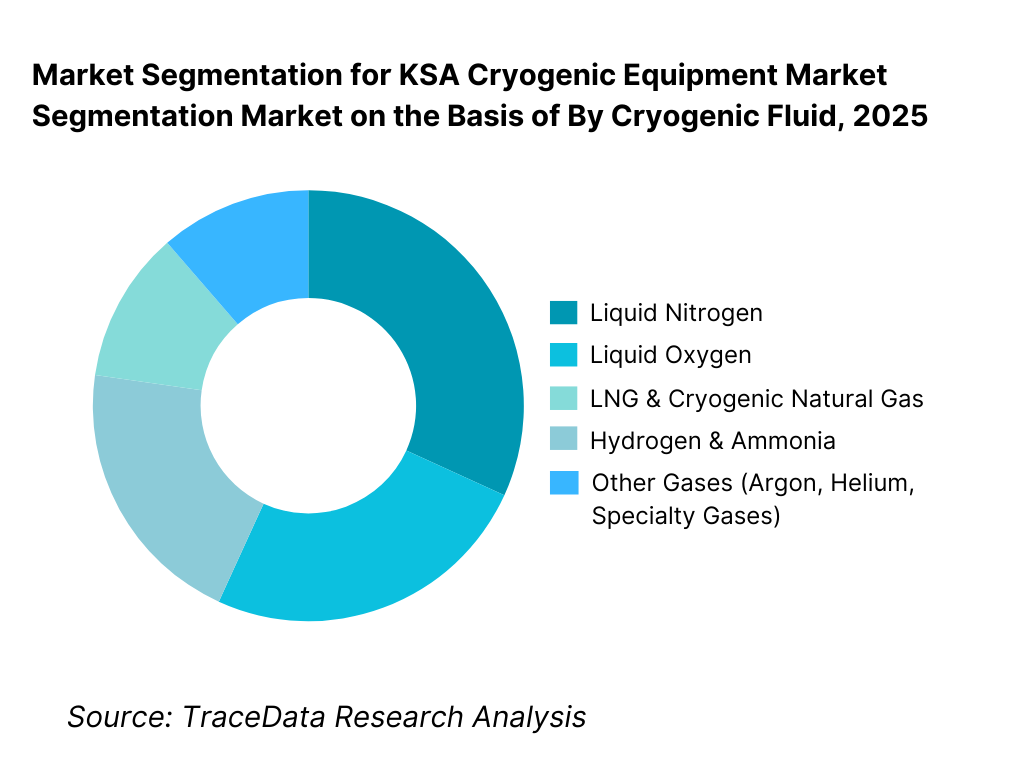

By Cryogenic Fluid: Liquid nitrogen and liquid oxygen dominate cryogenic fluid demand in Saudi Arabia due to their widespread use across industrial manufacturing, petrochemicals, steel, healthcare, and food processing. LNG and hydrogen-related fluids represent a fast-growing segment, driven by gas processing, energy transition initiatives, and export-oriented infrastructure development. Specialty gases such as argon and helium contribute a smaller but high-value share, particularly in electronics, welding, and advanced industrial applications.

Competitive Landscape in KSA Cryogenic Equipment Market

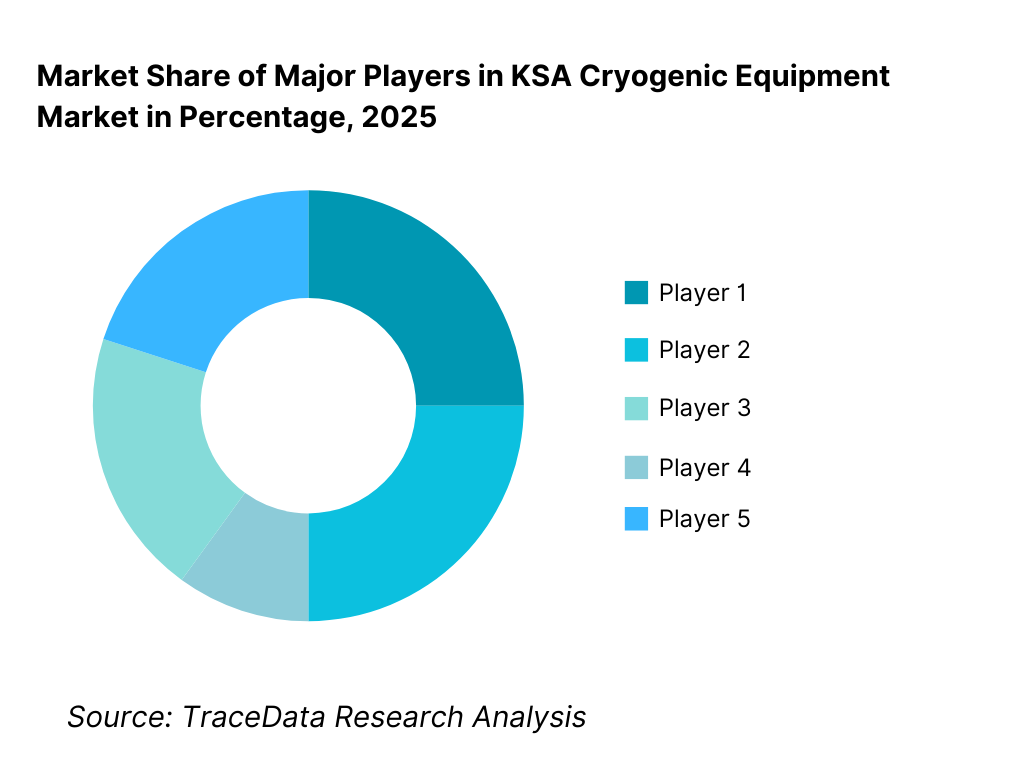

The KSA cryogenic equipment market exhibits moderate concentration, characterized by a mix of global cryogenic equipment manufacturers, international industrial gas technology providers, and regional EPC-aligned suppliers. Market leadership is driven by engineering expertise, compliance with stringent safety and quality standards, ability to deliver large-capacity customized systems, after-sales service capability, and alignment with major oil & gas, industrial gas, and healthcare buyers. While global players dominate large-scale energy and industrial projects, regional suppliers and local partners play a critical role in installation, commissioning, servicing, and localization-driven procurement.

Name | Founding Year | Original Headquarters |

Air Liquide Engineering & Construction | 1902 | Paris, France |

Linde Engineering | 1879 | Munich, Germany |

Air Products | 1940 | Allentown, Pennsylvania, USA |

Chart Industries | 1859 | Ball Ground, Georgia, USA |

Messer Group | 1898 | Bad Soden, Germany |

Cryostar (Linde Group Company) | 1966 | Hesingue, France |

INOX India | 1993 | Gujarat, India |

Taylor-Wharton (Subsidiary of Air Water) | 1936 | Alabama, USA |

Fives Group (Cryogenic Technologies) | 1812 | Paris, France |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Linde Engineering: Linde remains a dominant technology provider for large-scale cryogenic and gas processing systems in Saudi Arabia, particularly in oil & gas, LNG, and hydrogen-linked projects. Its competitive strength lies in deep process engineering expertise, ability to deliver complex integrated systems, and long-standing relationships with major Saudi industrial and energy stakeholders.

Air Liquide Engineering & Construction: Air Liquide continues to strengthen its position through turnkey cryogenic plant solutions, industrial gas infrastructure, and on-site gas generation systems. The company benefits from strong alignment with healthcare oxygen supply, industrial gas networks, and energy transition initiatives, making it a preferred partner for long-term supply-linked projects.

Air Products: With a strong footprint in Saudi Arabia, Air Products plays a dual role as both an industrial gas supplier and cryogenic technology provider. Its involvement in mega hydrogen and clean energy projects reinforces its competitive position, particularly for large-capacity liquid hydrogen and ammonia-related cryogenic systems.

Chart Industries: Chart Industries competes strongly in storage tanks, LNG-related equipment, and modular cryogenic systems. Its strength lies in standardized yet scalable equipment platforms that are well-suited for LNG terminals, industrial gas distribution, and mid-scale energy infrastructure projects.

INOX India: INOX India has expanded its presence through competitively priced cryogenic tanks and transport equipment, particularly for industrial gases and healthcare applications. The company benefits from cost competitiveness, manufacturing scale, and growing acceptance among EPC contractors and industrial gas distributors in the Kingdom.

What Lies Ahead for KSA Cryogenic Equipment Market?

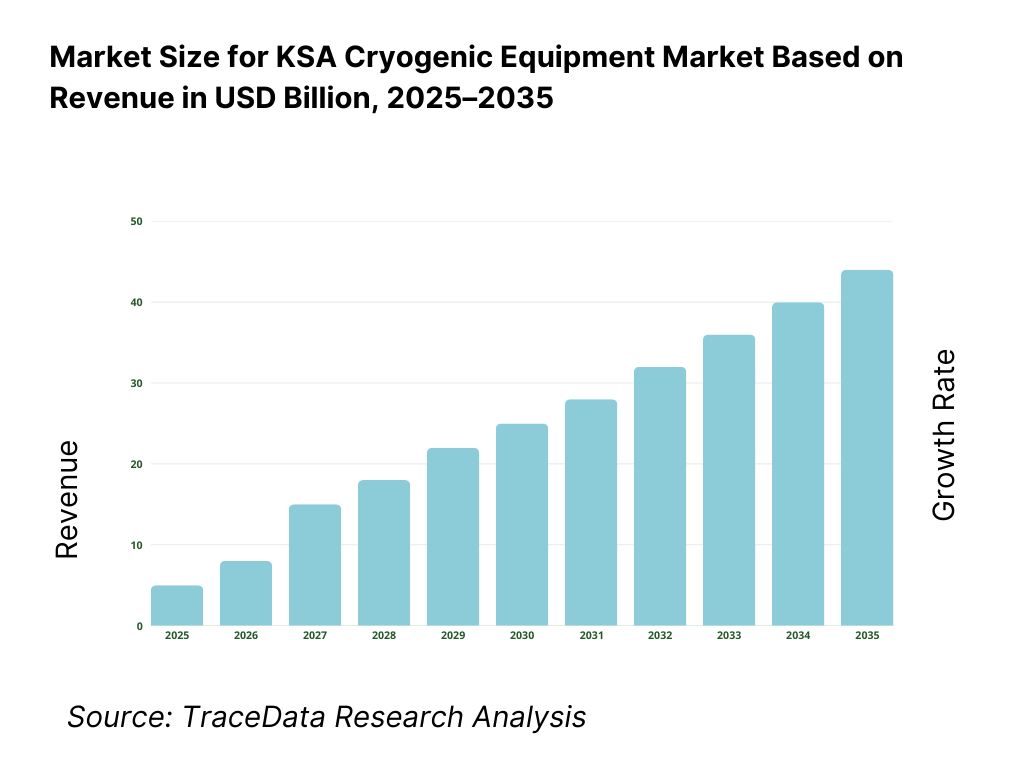

The KSA cryogenic equipment market is expected to expand steadily through 2035, supported by long-term growth in industrial gas demand, oil & gas and petrochemical investments, healthcare infrastructure expansion, and the Kingdom’s strategic push toward hydrogen and clean energy under Vision 2030. Cryogenic systems will remain a critical enabling infrastructure across both traditional hydrocarbon value chains and emerging energy-transition applications. As industrial operators, EPC contractors, and public-sector stakeholders increasingly prioritize safety, reliability, and lifecycle efficiency, demand for engineered cryogenic solutions is expected to remain structurally resilient.

Shift Toward Large-Scale, Engineered, and Application-Specific Cryogenic Systems: The future of the KSA cryogenic equipment market will see a continued shift from basic storage solutions toward large-capacity, engineered, and application-specific systems. Demand is increasing for equipment designed around complex operational requirements such as LNG handling, hydrogen liquefaction, ammonia export, specialty gas processing, and integrated industrial gas supply networks. These applications require advanced insulation systems, precise thermal control, high-integrity pressure management, and seamless integration with downstream processes. Suppliers capable of delivering customized, project-specific solutions will capture higher-value contracts and deepen long-term client relationships.

Rising Importance of Hydrogen, LNG, and Energy Transition Infrastructure: Hydrogen, ammonia, and LNG-related investments will play an increasingly influential role in shaping cryogenic equipment demand through 2035. Export-oriented clean energy projects, gas processing facilities, and hydrogen hubs will require advanced cryogenic tanks, transfer systems, and liquefaction-related equipment. Early-stage pilot projects are expected to evolve into larger commercial deployments over the forecast period, creating sustained demand for high-specification cryogenic technologies and positioning Saudi Arabia as a regional hub for cryogenic-enabled energy infrastructure.

Expansion of Distributed Medical and Industrial Oxygen Infrastructure: Healthcare sector expansion and emergency preparedness initiatives will continue to drive demand for medical oxygen infrastructure across Saudi Arabia. Hospitals, specialty medical centers, and regional healthcare facilities are increasingly adopting bulk liquid oxygen storage and vaporization systems for supply reliability and safety. This trend supports steady demand for small-to-mid-scale cryogenic equipment installations, complementing the large industrial and energy-driven projects that dominate overall market value.

Greater Emphasis on Localization, Service Capability, and Lifecycle Support: Procurement strategies in Saudi Arabia are increasingly influenced by localization objectives, after-sales service capability, and long-term operational support. Through 2035, cryogenic equipment suppliers will be expected to demonstrate not only technical excellence but also local assembly, servicing, inspection, and maintenance capabilities. Partnerships with local EPCs, service providers, and industrial operators will become more critical, particularly for safety-sensitive and mission-critical installations.

KSA Cryogenic Equipment Market Segmentation

By Equipment Type

• Cryogenic Storage Tanks

• Cryogenic Vaporizers

• Cryogenic Pumps & Compressors

• Cryogenic Valves & Piping Systems

• Cryogenic Transport Equipment (Tankers, ISO Containers, Skids)

By Cryogenic Fluid

• Liquid Nitrogen

• Liquid Oxygen

• LNG / Cryogenic Natural Gas

• Hydrogen & Ammonia

• Other Cryogenic Gases (Argon, Helium, Specialty Gases)

By End-Use Industry

• Oil & Gas & Petrochemicals

• Industrial Gases & Manufacturing

• Healthcare & Life Sciences

• Energy Transition & Hydrogen Projects

• Food Processing & Other Industries

By Application

• Industrial Gas Production & Distribution

• LNG Processing, Storage & Transfer

• Medical Oxygen Infrastructure

• Hydrogen & Clean Energy Systems

• Research, Specialty Manufacturing & Laboratories

By Region

• Eastern Province

• Western Region

• Central Region

• Northern & Southern Regions

Players Mentioned in the Report:

• Linde Engineering

• Air Liquide Engineering & Construction

• Air Products

• Chart Industries

• Messer Group

• Cryostar

• INOX India

• Taylor-Wharton

• Fives Group

• Regional EPC contractors, cryogenic system integrators, and local service providers

Key Target Audience

• Cryogenic equipment manufacturers and system integrators

• Industrial gas producers and distributors

• Oil & gas, petrochemical, and LNG operators

• Hydrogen and clean energy project developers

• EPC contractors and industrial engineering firms

• Hospitals, healthcare networks, and medical infrastructure planners

• Government agencies and regulatory bodies

• Private equity, infrastructure, and energy-transition investors

Time Period:

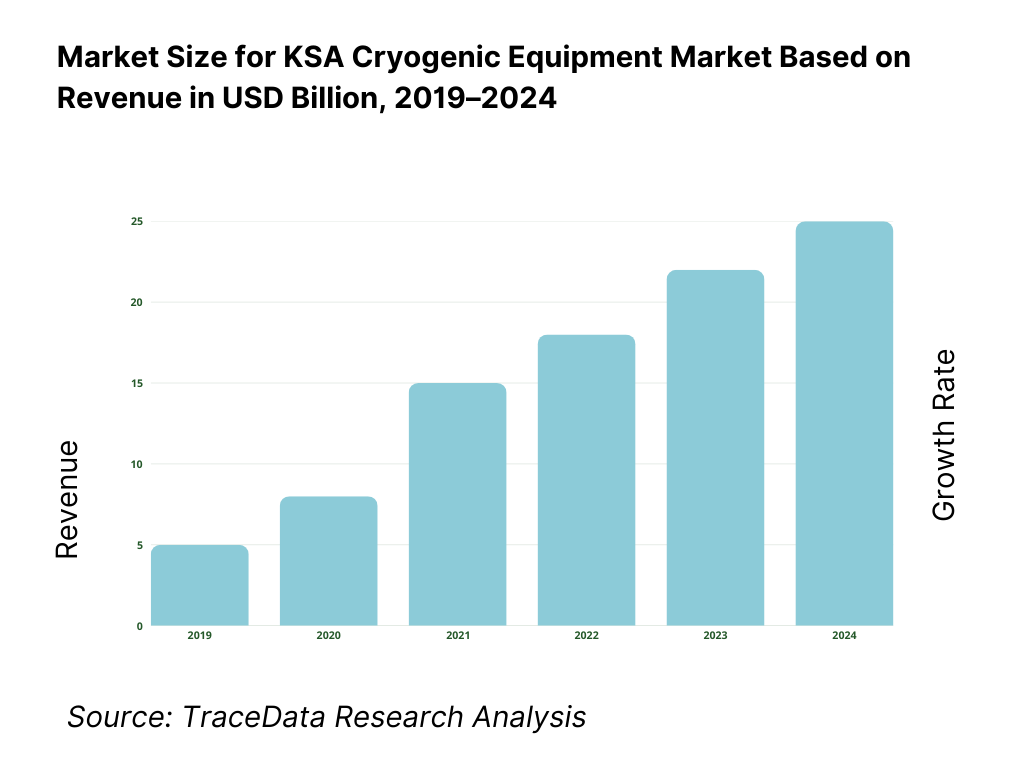

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Cryogenic Equipment-EPC Turnkey, OEM Direct Supply, Lease & Operate, Build-Own-Operate (BOO) [Margins, Preference, Strength & Weakness]

4. 2 Revenue Streams for KSA Cryogenic Equipment Market [Equipment Sales, EPC Contracts, Leasing, After-Sales Services, Maintenance & Spares]

4. 3 Business Model Canvas for KSA Cryogenic Equipment Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]

5. 1 Local Players vs Global Vendors [Regional EPCs vs Linde/Air Liquide/Chart Industries etc.]

5. 2 Investment Model in KSA Cryogenic Equipment Market [Government Projects, Energy Majors, EPC Investments, Foreign Direct Investment]

5. 3 Comparative Analysis of Cryogenic Equipment Adoption in Industrial vs Healthcare Sectors [Procurement Models, Use Cases, ROI Benchmarks]

5. 4 Cryogenic Equipment Budget Allocation by End-User Type [Oil & Gas, Industrial Gases, Healthcare, Energy Transition Projects]

8. 1 Revenues (Historical Trend)

9. 1 By Market Structure (EPC-Based Projects vs Direct OEM Procurement)

9. 2 By Equipment Type (Storage Tanks, Vaporizers, Pumps, Valves, Transport Equipment)

9. 3 By End-Use Industry (Oil & Gas, Industrial Gases, Healthcare, Energy Transition, Manufacturing)

9. 4 By Application (LNG Handling, Industrial Gas Supply, Medical Oxygen, Hydrogen Systems, Specialty Applications)

9. 5 By Cryogenic Fluid (Liquid Nitrogen, Liquid Oxygen, LNG, Hydrogen, Other Gases)

9. 6 By Installation Type (On-Site Fixed Systems, Modular Systems, Mobile & Transport Systems)

9. 7 By Standard vs Customized Cryogenic Systems

9. 8 By Region (Eastern Province, Western Region, Central Region, Northern & Southern Regions)

10. 1 Industrial & Institutional Buyer Landscape and Cohort Analysis

10. 2 Cryogenic Equipment Adoption Drivers & Decision-Making Process

10. 3 Equipment Performance, Safety & ROI Analysis

10. 4 Gap Analysis Framework

11. 1 Trends & Developments in KSA Cryogenic Equipment Market

11. 2 Growth Drivers for KSA Cryogenic Equipment Market

11. 3 SWOT Analysis for KSA Cryogenic Equipment Market

11. 4 Issues & Challenges for KSA Cryogenic Equipment Market

11. 5 Government Regulations for KSA Cryogenic Equipment Market

12. 1 Market Size and Future Potential for LNG & Hydrogen Cryogenic Infrastructure in KSA

12. 2 Business Models & Revenue Streams [Turnkey EPC, Lease Models, Long-Term Supply Contracts]

12. 3 Delivery Models & Cryogenic Applications Offered [LNG Terminals, Hydrogen Storage, Industrial Gas Plants, Medical Oxygen Systems]

15. 1 Market Share of Key Players in KSA Cryogenic Equipment Market (By Revenues)

15. 2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Manufacturing Footprint, Revenues, Pricing Models, Technology Used, Key Cryogenic Solutions, Major Clients, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15. 3 Operating Model Analysis Framework

15. 4 Gartner Magic Quadrant for Cryogenic & Industrial Gas Technology Providers

15. 5 Bowman’s Strategic Clock for Competitive Advantage

16. 1 Revenues (Projections)

17. 1 By Market Structure (EPC vs Direct OEM Supply)

17. 2 By Equipment Type (Storage Tanks, Vaporizers, Pumps, Valves, Transport Equipment)

17. 3 By End-Use Industry (Oil & Gas, Industrial Gases, Healthcare, Energy Transition, Manufacturing)

17. 4 By Application (LNG, Industrial Gas, Medical Oxygen, Hydrogen, Specialty Applications)

17. 5 By Cryogenic Fluid (Nitrogen, Oxygen, LNG, Hydrogen, Others)

17. 6 By Installation Type (Fixed, Modular, Mobile Systems)

17. 7 By Standard vs Customized Systems

17. 8 By Region (Eastern, Western, Central, Northern & Southern Regions)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the KSA Cryogenic Equipment Market across demand-side and supply-side entities. On the demand side, entities include oil & gas operators, petrochemical producers, industrial gas companies, LNG and gas processing facilities, hydrogen and clean energy project developers, hospitals and healthcare networks, food processing companies, and research and industrial manufacturing facilities. Demand is further segmented by application type (industrial gas production, LNG handling, medical oxygen infrastructure, hydrogen systems), project scale (large-scale integrated plants vs distributed installations), and procurement model (EPC-led turnkey projects, direct OEM procurement, long-term gas supply-linked contracts, and public-sector tenders).

On the supply side, the ecosystem includes global cryogenic equipment manufacturers, industrial gas technology providers, regional equipment suppliers, EPC contractors, insulation and materials specialists, valve and instrumentation providers, transport equipment manufacturers, installation and commissioning specialists, and local inspection and certification bodies. From this mapped ecosystem, we shortlist 6–10 leading cryogenic equipment suppliers and system integrators based on engineering capability, project execution track record in Saudi Arabia, safety and compliance credentials, service footprint, and relevance across oil & gas, industrial gases, and healthcare segments. This step establishes how value is created and captured across engineering, fabrication, installation, commissioning, and long-term service support.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the KSA cryogenic equipment market structure, demand drivers, and segment behavior. This includes reviewing oil & gas and petrochemical investment pipelines, industrial gas capacity expansion, LNG and hydrogen project announcements, healthcare infrastructure development, and Vision 2030-linked industrial diversification initiatives. We assess buyer priorities around safety, reliability, localization, lifecycle cost, and compliance with Saudi and international standards.

Company-level analysis includes review of supplier product portfolios, project references in the Kingdom, manufacturing and localization strategies, service and maintenance offerings, and typical contract structures. We also examine regulatory and compliance dynamics shaping demand, including SASO conformity requirements, industrial safety standards, pressure vessel regulations, and site-specific approval processes. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market estimation and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with cryogenic equipment manufacturers, industrial gas producers, EPC contractors, oil & gas operators, healthcare infrastructure planners, and facility engineers. The objectives are threefold: (a) validate assumptions around demand concentration by industry and region, procurement models, and supplier positioning; (b) authenticate segmentation splits by equipment type, cryogenic fluid, end-use industry, and application; and (c) gather qualitative insights on pricing structures, delivery timelines, installation complexity, localization expectations, and after-sales service requirements.

A bottom-to-top approach is applied by estimating the number of projects and average equipment value across key end-use segments and regions, which are aggregated to develop the overall market view. In selected cases, EPC- and buyer-style discussions are used to validate field-level realities such as specification rigidity, approval timelines, commissioning risks, and the role of service support in supplier selection.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market size, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as energy investment cycles, industrial output growth, healthcare capacity expansion, and clean energy project timelines. Assumptions related to equipment lead times, localization intensity, and safety compliance costs are stress-tested to understand their impact on adoption and project execution. Sensitivity analysis is conducted across key variables including hydrogen project acceleration, LNG infrastructure expansion, regulatory stringency, and service capability availability. Market models are refined until alignment is achieved between supplier capacity, EPC execution capability, and buyer project pipelines, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the KSA Cryogenic Equipment Market?

The KSA cryogenic equipment market holds strong long-term potential, supported by sustained investment in oil & gas and petrochemicals, expanding industrial gas demand, healthcare infrastructure growth, and the Kingdom’s strategic push into hydrogen and clean energy. Cryogenic systems are critical enablers across both traditional and emerging applications, ensuring stable demand through 2035. As project scale and technical complexity increase, higher-spec engineered systems are expected to capture a growing share of market value.

02 Who are the Key Players in the KSA Cryogenic Equipment Market?

The market features a combination of global cryogenic technology leaders, industrial gas majors, and regional equipment suppliers working closely with EPC contractors. Competition is shaped by engineering depth, safety and compliance credentials, ability to deliver customized large-scale systems, localization strategy, and long-term service capability. Established international players dominate complex energy and industrial projects, while regional suppliers are gaining ground in industrial gas distribution and healthcare-related installations.

03 What are the Growth Drivers for the KSA Cryogenic Equipment Market?

Key growth drivers include expansion of industrial gas production, oil & gas and petrochemical capacity additions, LNG and hydrogen infrastructure development, and increasing adoption of bulk medical oxygen systems. Vision 2030-driven industrial diversification, clean energy initiatives, and localization policies further reinforce demand for cryogenic technologies. The need for safe, reliable, and lifecycle-efficient cryogenic systems continues to support adoption across sectors.

04 What are the Challenges in the KSA Cryogenic Equipment Market?

Challenges include high capital costs, long engineering and procurement cycles, dependence on imported specialized equipment, and stringent safety and compliance requirements. Limited availability of locally experienced cryogenic installation and maintenance specialists can increase execution risk for complex projects. Additionally, evolving localization expectations and regulatory approval processes can extend project timelines if not addressed early in the procurement and design stages.