KSA Edible Oil Market Outlook to 2035

By Oil Type, By Source, By Application, By Distribution Channel, and By Region

- Product Code: TDR0428

- Region: Middle East

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “KSA Edible Oil Market Outlook to 2035 – By Oil Type, By Source, By Application, By Distribution Channel, and By Region” provides a comprehensive analysis of the edible oil industry in the Kingdom of Saudi Arabia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and food safety landscape, buyer-level consumption profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players operating in the KSA edible oil market. The report concludes with future market projections based on population growth, dietary transition trends, food service and hospitality expansion, import dependency dynamics, government food security initiatives, regional demand drivers, cause-and-effect relationships, and scenario-based illustrations highlighting the major opportunities and risks shaping the market through 2035.

KSA Edible Oil Market Overview and Size

The KSA edible oil market is valued at approximately ~USD ~ billion, representing the consumption of vegetable-based and specialty edible oils used across household cooking, foodservice preparation, industrial food processing, and institutional catering applications. Edible oils are a core component of Saudi Arabia’s food consumption basket due to the prevalence of oil-intensive cooking methods, high consumption of fried and processed foods, and strong demand from commercial kitchens and food manufacturers.

The market is anchored by Saudi Arabia’s structurally high dependence on edible oil imports, supported by large-scale refining, blending, and packaging infrastructure within the country. Due to limited domestic oilseed cultivation, the market relies heavily on imported crude and refined palm oil, soybean oil, sunflower oil, corn oil, and olive oil, which are then processed and distributed through organized wholesale, retail, and foodservice channels. Palm oil and blended oils dominate volume consumption due to their cost efficiency and functional suitability, while sunflower oil and olive oil command higher value shares in retail segments.

Central and Western regions represent the largest edible oil demand centers in Saudi Arabia. The Central region leads due to population concentration, high household consumption, and strong institutional catering demand. The Western region shows elevated foodservice-driven consumption supported by hospitality, tourism, and religious travel activities. The Eastern region benefits from port-linked imports, industrial food processing clusters, and refinery proximity, while Southern and Northern regions represent smaller but steadily formalizing consumption markets with rising modern retail penetration.

What Factors are Leading to the Growth of the KSA Edible Oil Market:

Expansion of foodservice, hospitality, and institutional catering strengthens structural demand: Saudi Arabia continues to witness rapid expansion of organized foodservice formats, including quick-service restaurants, casual dining chains, cloud kitchens, hotels, and large-scale institutional caterers serving corporate campuses, hospitals, schools, and religious gatherings. These segments are among the most edible-oil-intensive consumers due to high frying volumes, batch cooking processes, and standardized menu formats. Palm oil, soybean oil, and blended oils are widely used in these applications because they offer thermal stability, longer frying life, and predictable cost structures. The growth of entertainment districts, tourism infrastructure, and large mixed-use developments further increases commercial kitchen density and operating hours, directly strengthening edible oil demand.

Population growth, urbanization, and evolving dietary habits support sustained consumption: Saudi Arabia’s growing population, combined with increasing urbanization and lifestyle changes, continues to drive higher consumption of packaged foods, ready-to-eat meals, and restaurant-prepared foods. Younger demographics exhibit strong preference for convenience-oriented diets, indirectly increasing edible oil usage across food manufacturing and preparation stages. In parallel, the large expatriate population brings diverse culinary practices that support demand for multiple oil types and blends. While per-capita household cooking volumes have stabilized in mature urban households, overall edible oil demand continues to expand due to higher frequency of out-of-home consumption and increasing penetration of processed food products.

Import-led supply chains and domestic refining capacity enhance market scalability: The KSA edible oil market benefits from well-established import infrastructure, port connectivity, and large-scale refining and blending facilities operated by leading regional and multinational players. Bulk imports of crude edible oils enable refiners to optimize cost structures, blend oils for specific performance requirements, and serve multiple customer segments from centralized facilities. This model ensures supply continuity despite global commodity price fluctuations. Government-led food security initiatives, strategic reserves, and diversified sourcing strategies further strengthen supply resilience.

Which Industry Challenges Have Impacted the Growth of the KSA Edible Oil Market:

Exposure to global commodity price volatility impacts pricing stability and margin visibility: The KSA edible oil market is highly exposed to fluctuations in global vegetable oil prices, particularly palm oil, soybean oil, and sunflower oil, which are influenced by weather patterns, geopolitical developments, export restrictions, and biofuel policies in major producing countries. Sudden increases in crude oil prices can disrupt procurement planning, compress refiner and distributor margins, and lead to frequent retail price revisions. This volatility creates uncertainty for foodservice operators and food manufacturers that rely on stable input costs, occasionally delaying contract renewals or encouraging short-term sourcing strategies rather than long-term supply commitments.

High import dependence creates supply chain sensitivity and logistical risk: Saudi Arabia’s limited domestic oilseed production means the edible oil market remains structurally dependent on imports of crude and refined oils. Disruptions related to port congestion, freight rate volatility, shipping delays, or supplier-side policy changes can impact supply continuity. While large refiners typically mitigate these risks through diversified sourcing and inventory buffers, smaller importers and regional distributors are more vulnerable to supply shocks. These dynamics can result in temporary shortages, uneven regional availability, and price dispersion across channels during periods of global supply stress.

Health perceptions and sustainability concerns challenge volume-driven oil categories: Growing consumer awareness around nutrition, trans fats, and saturated fat content has created perception-related challenges for certain high-volume edible oils, particularly palm oil. While palm oil remains functionally important and cost-efficient, negative health perceptions can limit its acceptance in premium retail segments and among health-conscious consumers. In addition, sustainability and traceability concerns—especially among multinational foodservice chains and institutional buyers—add pressure on suppliers to demonstrate responsible sourcing, increasing compliance and documentation requirements without always enabling proportional price premiums.

What are the Regulations and Initiatives which have Governed the Market:

Food safety, quality standards, and compositional requirements enforced by SFDA: The Saudi edible oil market operates under a comprehensive food safety and quality framework governed by the Saudi Food and Drug Authority (SFDA). Imported and locally refined edible oils must comply with standards related to fatty acid composition, permissible additives, contaminants, shelf life, and labeling requirements. Oils are subject to inspection and testing at ports of entry and within domestic distribution channels to ensure consumer safety. Compliance with these standards influences refining practices, blending formulations, and quality assurance systems across the value chain.

Mandatory labeling, fortification, and consumer information regulations shaping product specifications: Regulatory requirements related to nutritional labeling, ingredient disclosure, and country-of-origin information directly affect packaging design and product positioning in the edible oil market. Certain edible oil categories are subject to fortification standards, particularly for vitamins such as A and D, which requires refiners to incorporate controlled dosing and verification processes. These regulations increase operational complexity but also support public health objectives and enhance consumer trust in packaged edible oil products.

Import controls, customs procedures, and food security initiatives influencing sourcing strategies: Edible oil imports into Saudi Arabia are governed by customs procedures, documentation requirements, and compliance checks designed to ensure supply security and quality consistency. Government-led food security initiatives encourage diversified sourcing and adequate inventory holding to reduce exposure to global supply disruptions. While these policies strengthen market resilience, they also influence working capital requirements, supplier selection decisions, and long-term sourcing contracts, particularly for large refiners and institutional buyers.

KSA Edible Oil Market Segmentation

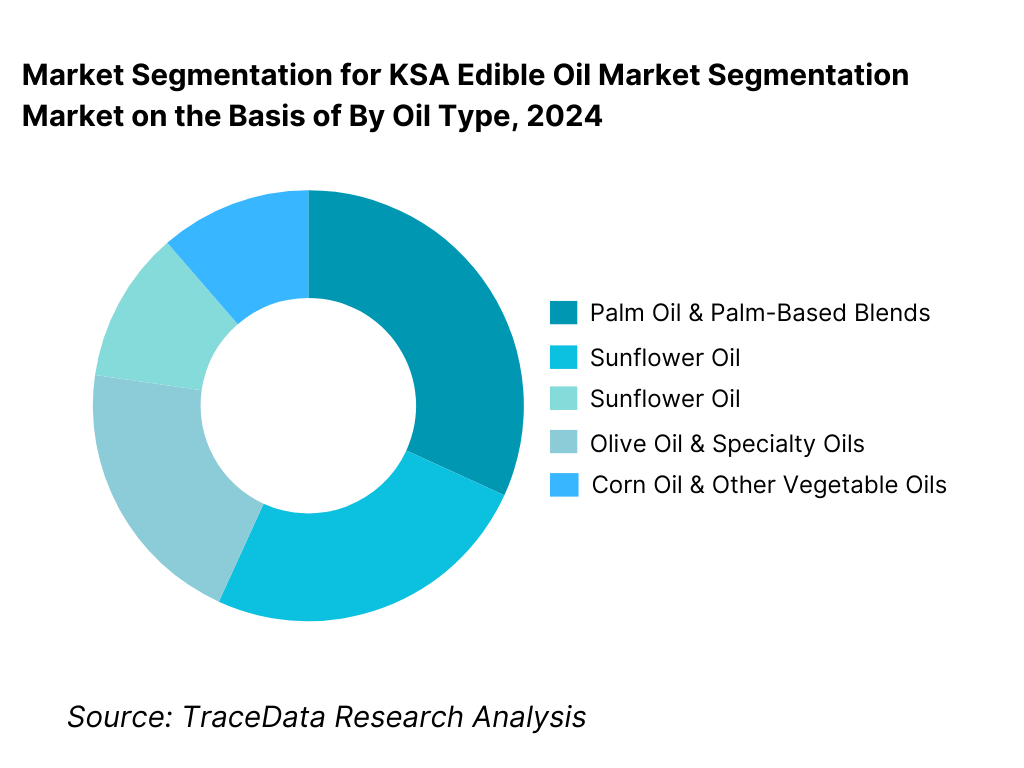

By Oil Type: Palm oil and blended edible oils hold dominance in the KSA edible oil market. This is because these oils offer superior cost efficiency, high thermal stability, and long frying life, making them particularly suitable for foodservice operations, institutional catering, and industrial food processing. Palm oil is widely used in bulk cooking, baking, and frying applications, while blended oils allow refiners to balance cost, functionality, and nutritional positioning. Sunflower oil and soybean oil represent significant mid-tier segments, especially in household consumption, while olive oil and specialty oils cater to premium and health-conscious consumers. Despite growing health awareness, volume demand remains concentrated in price-sensitive and performance-driven oil categories.

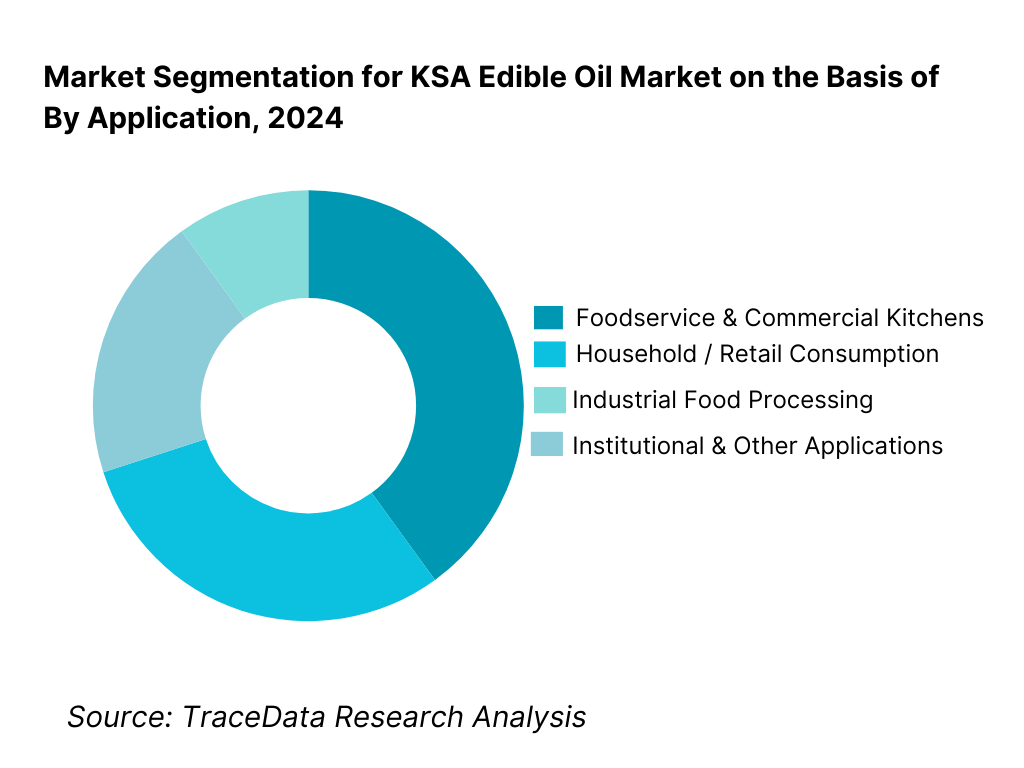

By Application: Foodservice and commercial cooking dominate edible oil consumption in Saudi Arabia. Large-scale kitchens, quick-service restaurants, hotels, catering companies, and institutional food providers account for a disproportionate share of total oil volumes due to continuous, high-frequency usage. Household cooking remains a stable and significant segment, driven by population growth and cultural cooking practices, while industrial food processing contributes steadily through packaged foods, snacks, bakery, and ready-to-eat product manufacturing. The foodservice segment benefits from relatively lower sensitivity to short-term price fluctuations, reinforcing its dominance in overall demand.

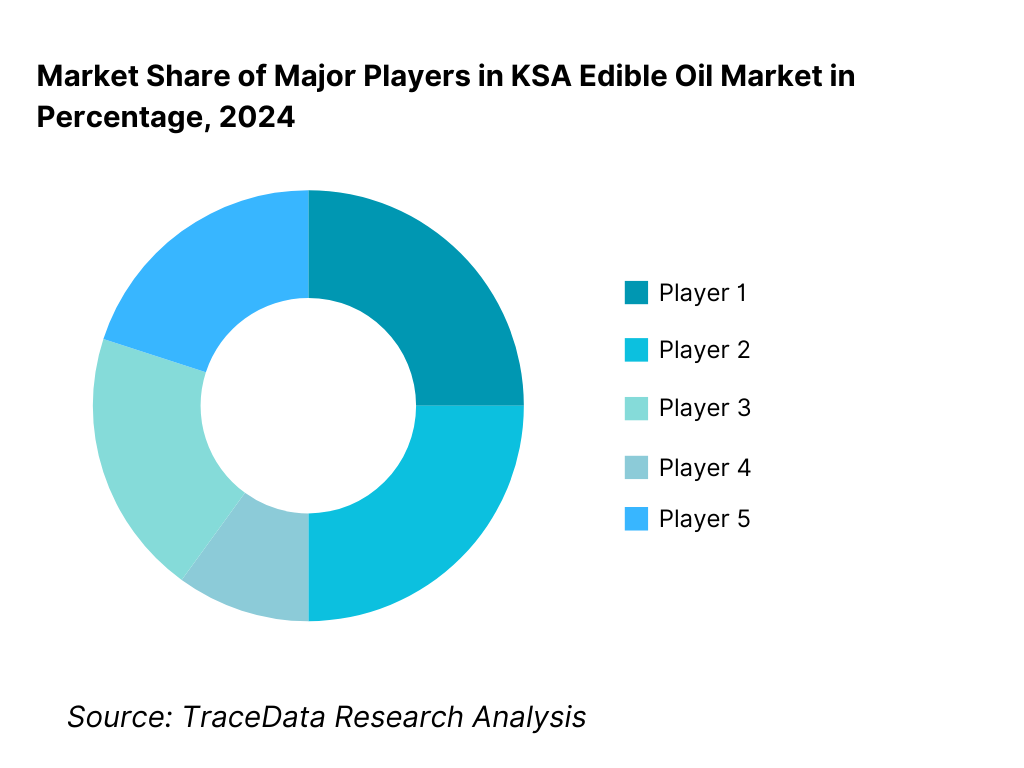

Competitive Landscape in KSA Edible Oil Market

The KSA edible oil market exhibits moderate concentration, characterized by a mix of large regional refiners, multinational agribusiness-linked suppliers, and established local brands with strong distribution networks. Market leadership is driven by access to bulk crude oil sourcing, refining and blending capacity, pricing competitiveness, supply reliability, and long-standing relationships with foodservice operators and modern retail chains. While large players dominate bulk and foodservice channels through scale and procurement efficiency, smaller and niche brands remain competitive in premium retail segments such as olive oil and specialty health-positioned products.

Name | Founding Year | Original Headquarters |

Savola Group | 1979 | Jeddah, Saudi Arabia |

Abdul Hadi Al-Qahtani & Sons | 1948 | Dammam, Saudi Arabia |

Cargill | 1865 | Minneapolis, Minnesota, USA |

Wilmar International | 1991 | Singapore |

Olam Group | 1989 | Singapore |

IFFCO Group | 1975 | Sharjah, UAE |

United Foods Company | 1993 | Jeddah, Saudi Arabia |

Al Alami Foods | 1980 | Riyadh, Saudi Arabia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Savola Group: Savola remains the dominant branded edible oil player in Saudi Arabia, with strong positioning across household, foodservice, and institutional segments. The company’s competitive strength is anchored in scale, extensive refining and packaging capacity, deep retail penetration, and long-term supply relationships with commercial buyers. Savola continues to focus on portfolio optimization, cost efficiency, and selective premiumization through health-positioned oil variants.

Cargill: Cargill operates as a key upstream and bulk supplier in the Saudi edible oil ecosystem, leveraging its global sourcing network and commodity risk management capabilities. The company plays a critical role in supplying crude and refined oils to large food manufacturers and institutional buyers, where supply reliability, pricing transparency, and volume consistency are primary decision drivers.

Wilmar International: Wilmar’s presence in the KSA market is linked to its global leadership in palm oil processing and trading. The company benefits from integrated sourcing, refining expertise, and strong capabilities in bulk edible oil supply, particularly for foodservice and industrial applications where cost efficiency and functional performance are prioritized.

IFFCO Group: IFFCO competes strongly in the branded and semi-branded edible oil space, supported by a diversified food portfolio and regional manufacturing footprint. The company’s edible oil offerings benefit from broad distribution reach, competitive pricing, and established relationships with modern trade retailers across Saudi Arabia.

United Foods Company: United Foods maintains a steady presence in the Saudi edible oil market through localized production, flexible packaging formats, and targeted positioning in value and mid-tier segments. The company benefits from responsiveness to local market requirements and the ability to serve both retail and foodservice customers efficiently.

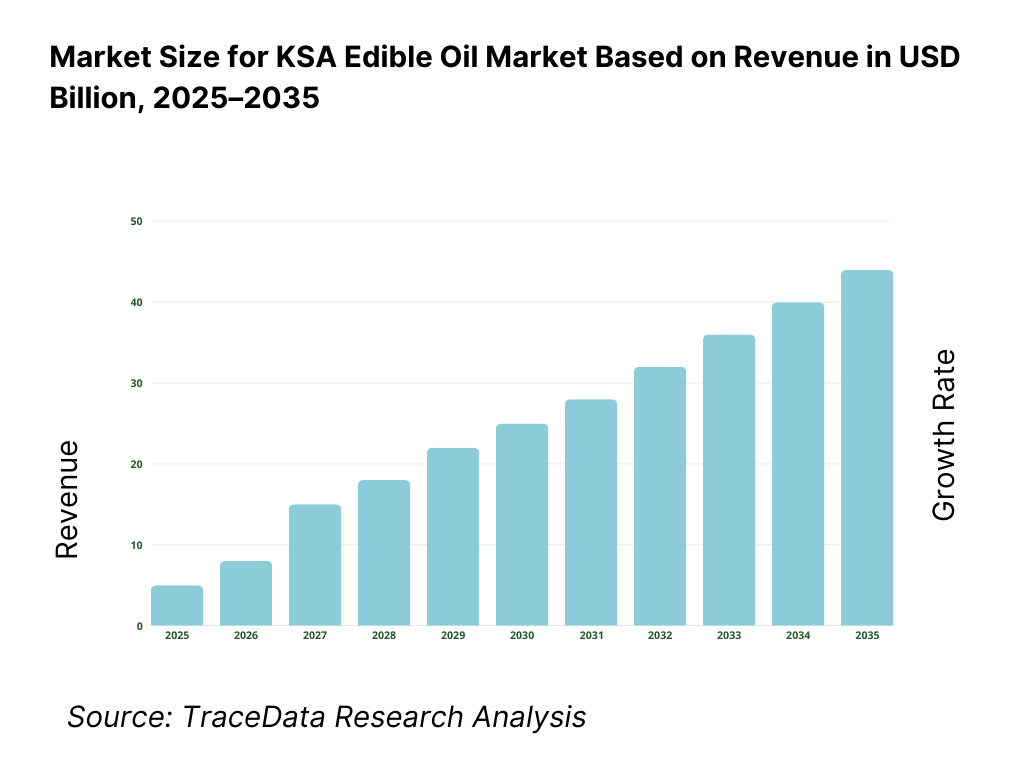

What Lies Ahead for KSA Edible Oil Market?

The KSA edible oil market is expected to expand steadily by 2035, supported by population growth, rising foodservice penetration, and structurally high dependence on edible oils across household, commercial, and industrial food consumption. Growth momentum is further reinforced by expanding hospitality and tourism infrastructure, increasing participation of women and youth in the workforce (driving out-of-home dining), and continued reliance on imported edible oils supported by large-scale domestic refining and blending capacity. As Saudi Arabia advances its Vision 2030 objectives, edible oils will remain a core input for the food ecosystem, with demand anchored in volume-driven consumption rather than cyclical volatility.

Transition Toward Higher-Value and Health-Positioned Edible Oil Consumption: The future of the KSA edible oil market will see a gradual shift from purely price-driven consumption toward higher-value and health-positioned oil categories, particularly in urban household segments and premium foodservice. Demand is increasing for sunflower oil, olive oil, and blended oils positioned around lower saturated fat content and nutritional benefits. While palm oil will continue to dominate volumes due to cost efficiency and functional performance, refiners and brands that can balance affordability with health-oriented messaging and fortification will capture incremental value growth. This transition will be evolutionary rather than disruptive, given the market’s strong price sensitivity.

Sustained Growth in Foodservice, Hospitality, and Institutional Demand Channels: Large-scale foodservice operators, quick-service restaurants, hotels, and institutional caterers will continue to drive a disproportionate share of edible oil demand through 2035. These buyers prioritize supply reliability, consistent quality, frying performance, and contract-based pricing over brand differentiation. As tourism, entertainment districts, and mega-project developments expand, commercial kitchens will increase throughput and operating intensity, reinforcing steady bulk oil demand. This trend favors large refiners and suppliers with robust logistics, inventory management capabilities, and long-term sourcing arrangements.

Greater Emphasis on Import Diversification, Supply Security, and Risk Management: Given Saudi Arabia’s structural dependence on imported edible oils, future market development will place increasing emphasis on diversified sourcing strategies, inventory buffering, and commodity risk management. Refiners and large buyers are expected to strengthen long-term supplier relationships across multiple origin countries to mitigate exposure to geopolitical disruptions, weather-driven supply shocks, and export restrictions. Government food security initiatives and strategic reserves will continue to play a stabilizing role, supporting confidence in market continuity even during periods of global volatility.

KSA Edible Oil Market Segmentation

By Oil Type

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Corn Oil

- Olive Oil

- Blended & Specialty Edible Oils

By Source

- Palm-Based Oils

- Soybean-Based Oils

- Sunflower-Based Oils

- Corn-Based Oils

- Olive-Based Oils

- Other

- Vegetable Sources

By Application

- Household Cooking & Retail Consumption

- Food service & Commercial Kitchens

- Industrial Food Processing (Bakery, Snacks, Ready-to-Eat)

- Institutional Catering (Hospitals, Schools, Religious Gatherings)

By Distribution Channel

- Modern Trade (Hypermarkets, Supermarkets)

- Traditional Trade (Grocery Stores, Wholesalers)

- Foodservice & HoReCa Supply

- Industrial & B2B Direct Supply

By Region

- Central Region

- Western Region

- Eastern Region

- Southern Region

- Northern Region

Players Mentioned in the Report:

- Savola Group

- United Foods Company

- Abdul Hadi Al-Qahtani & Sons Group

- IFFCO Group

- Cargill

- Wilmar International

- Olam Group

- Al Alami Foods

- Regional edible oil refiners, importers, packers, and distributors

Key Target Audience

- Edible oil refiners and blenders

- Bulk edible oil importers and traders

- Foodservice operators and institutional caterers

- Packaged food and snack manufacturers

- Modern retail chains and private-label buyers

- Hospitality and tourism-linked foodservice providers

- Government agencies focused on food security and regulation

- Private equity and strategic investors in food and agribusiness

Time Period:

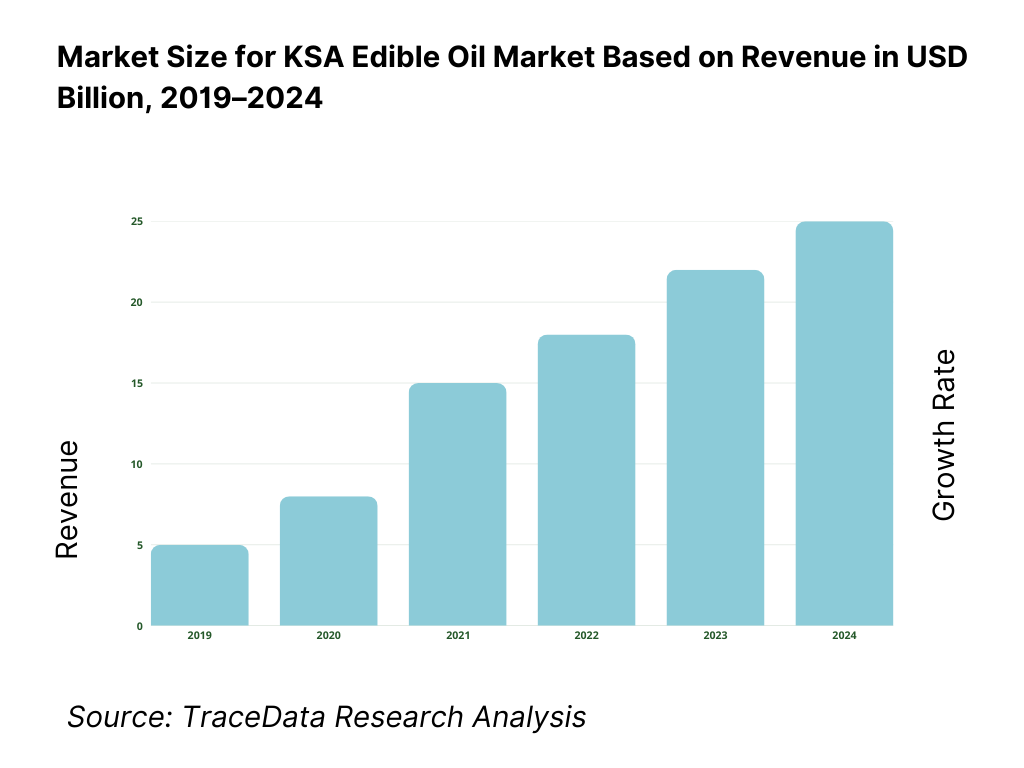

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in KSA Edible Oil Market

Value Chain Analysis

4.1 Delivery Model Analysis for Edible Oil Market-Import-Based Supply, Local Refining, Blending & Packaging, Distribution & Retail [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for KSA Edible Oil Market [Bulk Oil Sales, Branded Retail Packs, Private Label Manufacturing, Foodservice Supply]

4.3 Business Model Canvas for KSA Edible Oil Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Players vs Global Vendors [Domestic Refineries & Packers vs Global Edible Oil Brands]

5.2 Investment Model in KSA Edible Oil Market [Government Food Security Initiatives, Private Investments, JV Models, Corporate Expansion]

5.3 Comparative Analysis of Edible Oil Consumption in Household vs Institutional Segments [Procurement Models, Usage Patterns, Price Sensitivity, Margin Benchmarks]

5.4 Edible Oil Procurement & Budget Allocation by Buyer Type [Households, Foodservice Operators, Food Manufacturers]Market Attractiveness for KSA Edible Oil Market

Supply-Demand Gap Analysis

Market Size for KSA Edible Oil Market Basis

8.1 Revenues (Historical Trend)

Market Breakdown for KSA Edible Oil Market Basis

9.1 By Market Structure (Imported Finished Oils vs Locally Refined & Packed Oils)

9.2 By Oil Type (Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Olive Oil, Others)

9.3 By End-Use Segment (Household Consumption, Foodservice, Food Processing & Manufacturing)

9.4 By Pack Size (Small Packs, Medium Packs, Bulk Packs)

9.5 By Application (Cooking, Frying, Baking, Food Processing)

9.6 By Distribution Channel (Modern Trade, Traditional Trade, HoReCa Supply, Online)

9.7 By Branded vs Private Label Edible Oils

9.8 By Region (Central Region, Western Region, Eastern Region, Southern Region, Northern Region)Demand-Side Analysis for KSA Edible Oil Market

10.1 Consumer, Foodservice & Industrial Buyer Landscape and Cohort Analysis

10.2 Consumption Drivers & Purchase Decision-Making Process

10.3 Price Sensitivity, Health Perception & Value-for-Money Analysis

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in KSA Edible Oil Market

11.2 Growth Drivers for KSA Edible Oil Market

11.3 SWOT Analysis for KSA Edible Oil Market

11.4 Issues & Challenges for KSA Edible Oil Market

11.5 Government Regulations & Food Safety Standards for KSA Edible Oil MarketSnapshot on Branded & Packaged Edible Oil Market in KSA

12.1 Market Size and Future Potential for Packaged & Value-Added Edible Oils in KSA

12.2 Business Models & Revenue Streams [Branded Sales, Private Label Supply, Institutional Contracts]

12.3 Delivery Models & Product Offerings [Retail Packs, Bulk Supply, Premium & Health-Focused Oils]Opportunity Matrix for KSA Edible Oil Market

PEAK Matrix Analysis for KSA Edible Oil Market

Competitor Analysis for KSA Edible Oil Market

15.1 Market Share of Key Players in KSA Edible Oil Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Refining & Packaging Capacity, Revenues, Pricing Strategy, Product Portfolio, Key Customers, Distribution Reach, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Competitive Positioning Matrix for Edible Oil Brands

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for KSA Edible Oil Market Basis

16.1 Revenues (Projections)

Market Breakdown for KSA Edible Oil Market Basis

17.1 By Market Structure (Imported vs Locally Refined & Packed Oils)

17.2 By Oil Type (Palm, Soybean, Sunflower, Canola, Olive, Others)

17.3 By End-Use Segment (Household, Foodservice, Food Processing)

17.4 By Pack Size (Small, Medium, Bulk)

17.5 By Application (Cooking, Frying, Baking, Processing)

17.6 By Distribution Channel (Retail, HoReCa, Online, Institutional)

17.7 By Branded vs Private Label Oils

17.8 By Region (Central, Western, Eastern, Southern, Northern)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the KSA Edible Oil Market across demand-side and supply-side entities. On the demand side, entities include household consumers, foodservice operators (quick-service restaurants, hotels, cloud kitchens), industrial food processors (bakery, snacks, ready-to-eat foods), and institutional caterers serving hospitals, schools, labor camps, and religious gatherings. Demand is further segmented by application (household, foodservice, industrial), oil usage type (frying, cooking, baking, blending), and procurement model (spot purchasing, annual contracts, private-label sourcing, institutional tenders).

On the supply side, the ecosystem includes crude edible oil importers, domestic refiners and blenders, packaging and bottling companies, wholesalers, distributors, modern retail chains, foodservice supply distributors, logistics providers, and regulatory authorities responsible for food safety and customs compliance. From this mapped ecosystem, we shortlist 6–10 leading edible oil players based on refining capacity, sourcing strength, distribution reach, portfolio breadth, and penetration across retail and foodservice channels. This step establishes how value is created and captured across import sourcing, refining, packaging, distribution, and end-market consumption.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the KSA edible oil market structure, consumption drivers, and segment behavior. This includes reviewing population trends, household consumption patterns, foodservice and hospitality expansion, institutional catering demand, and industrial food processing growth. We analyze import volumes by oil type, refining and storage capacity, packaging formats, and channel-wise distribution dynamics.

Company-level analysis includes review of product portfolios, brand positioning, pricing tiers, distribution strategies, and channel focus across retail, foodservice, and B2B supply. We also examine regulatory and compliance dynamics shaping the market, including food safety standards, fortification requirements, labeling norms, and customs procedures. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes the assumptions required for market sizing and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with edible oil refiners, importers, distributors, foodservice procurement heads, industrial food manufacturers, retail category managers, and institutional catering operators. The objectives are threefold: (a) validate assumptions around demand concentration, channel mix, and oil-type preferences, (b) authenticate segment splits by oil type, application, distribution channel, and region, and (c) gather qualitative insights on pricing behavior, contract structures, supply reliability, inventory practices, and buyer expectations around quality, performance, and compliance.

A bottom-to-top approach is applied by estimating consumption volumes across key demand segments and regions, which are aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with distributors and foodservice suppliers to validate field-level realities such as price negotiation practices, delivery lead times, packaging preferences, and supply continuity challenges.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market size estimates, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as population growth, foodservice outlet expansion, tourism-linked consumption, and packaged food production trends. Assumptions around import dependency, global commodity price sensitivity, freight costs, and inventory buffering are stress-tested to understand their impact on pricing and availability.

Sensitivity analysis is conducted across key variables including oil price volatility, foodservice growth intensity, health-driven substitution trends, and regulatory changes related to fortification or labeling. Market models are refined until alignment is achieved between import volumes, domestic refining capacity, distribution throughput, and end-user consumption, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the KSA Edible Oil Market?

The KSA Edible Oil Market holds strong long-term potential, supported by population growth, expanding foodservice and hospitality infrastructure, and structurally high reliance on edible oils across household and commercial food consumption. The market benefits from stable import-led supply chains, large-scale domestic refining capacity, and consistent demand from institutional and industrial food users. While price sensitivity remains high, volume growth is expected to remain steady through 2035, with incremental value upside from health-positioned and specialty oil segments.

02 Who are the Key Players in the KSA Edible Oil Market?

The market features a mix of large domestic refiners, regional food conglomerates, and multinational agribusiness-linked suppliers. Competition is shaped by access to crude oil sourcing, refining and blending scale, pricing competitiveness, distribution reach, and long-term relationships with foodservice and retail buyers. Large players dominate bulk and foodservice channels, while smaller and niche brands remain competitive in premium retail and specialty oil segments.

03 What are the Growth Drivers for the KSA Edible Oil Market?

Key growth drivers include expansion of foodservice and institutional catering, population growth and urbanization, increasing consumption of packaged and ready-to-eat foods, and continued government focus on food security. Additional momentum comes from tourism and hospitality development, private-label growth in modern retail, and steady demand from industrial food processing. Import diversification and refining capacity investments further support supply continuity and market scalability.

04 What are the Challenges in the KSA Edible Oil Market?

Challenges include exposure to global edible oil price volatility, high dependence on imports, and margin pressure during periods of rapid commodity cost escalation. Health perceptions around certain oil types, particularly palm oil, can influence retail demand mix and brand positioning. In addition, compliance with food safety, fortification, and labeling regulations increases operational complexity, particularly for smaller importers and packers.