KSA Movie Market Outlook to 2035

By Content Type, By Distribution Channel, By Language, By Audience Segment, and By Region

- Product Code: TDR0459

- Region: Middle East

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “KSA Movie Market Outlook to 2035 – By Content Type, By Distribution Channel, By Language, By Audience Segment, and By Region” provides a comprehensive analysis of the movie and theatrical exhibition industry in the Kingdom of Saudi Arabia. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and policy landscape, audience-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the KSA movie market. The report concludes with future market projections based on cinema infrastructure expansion, content localization, entertainment spending growth, digital–physical convergence, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

KSA Movie Market Overview and Size

The KSA movie market is valued at approximately ~USD ~ billion, representing revenues generated across theatrical exhibition, film distribution, box office collections, premium cinema formats, advertising, and associated concessions. The market reflects the rapid transformation of Saudi Arabia’s entertainment ecosystem following the reintroduction of cinemas, supported by large-scale investments in cinema infrastructure, international studio partnerships, and the localization of film content aligned with cultural preferences.

The market is anchored by rising discretionary spending, a young and digitally engaged population, increasing female workforce participation, and government-led initiatives to diversify the economy under Vision 2030. Movie theaters in Saudi Arabia have evolved from basic exhibition venues into integrated entertainment destinations featuring luxury seating, IMAX and 4DX formats, dine-in cinemas, and mixed-use retail integration. This evolution has significantly increased average ticket values and per-capita cinema spending compared to early reopening years.

Riyadh and Makkah Province represent the largest demand centers for movie consumption in Saudi Arabia. Riyadh leads due to its population scale, concentration of premium malls, higher disposable incomes, and strong appetite for international and local entertainment experiences. Makkah Province benefits from dense urban centers such as Jeddah and sustained tourism inflows, supporting consistent cinema footfall. The Eastern Province contributes stable demand driven by urban households and family-oriented leisure spending. Emerging regions, including secondary cities and giga-project zones, are expected to drive incremental market expansion as cinema infrastructure penetrates underserved locations and new entertainment clusters come online.

What Factors are Leading to the Growth of the KSA Movie Market:

Rapid expansion of cinema infrastructure and premium theater formats strengthens market penetration: Saudi Arabia has witnessed an accelerated rollout of multiplex cinemas across malls, lifestyle centers, and mixed-use developments. The shift toward premium formats—such as IMAX, Dolby Cinema, VIP lounges, and experiential seating—has elevated the theatrical value proposition beyond basic movie viewing. These formats increase revenue per screen and per visitor while attracting repeat visits from high-spending urban audiences. The growing availability of cinemas in non-metro cities further expands the addressable audience base and normalizes moviegoing as a mainstream leisure activity.

Strong demographic fundamentals and changing social norms drive sustained audience growth: Saudi Arabia’s population is young, urbanizing, and highly engaged with visual media content. The normalization of cinemas as family-friendly and socially acceptable entertainment venues has expanded participation across age groups and genders. Weekend leisure spending, group outings, and event-based movie releases now form a recurring part of urban lifestyles. This demographic momentum supports consistent footfall growth, particularly for blockbuster international releases, regional Arabic films, and locally produced content.

Localization of content and rising domestic film production enhance market depth: The Saudi film ecosystem is increasingly supported by local production incentives, talent development programs, and partnerships with regional and global studios. Arabic-language films, culturally relevant narratives, and locally produced features have improved audience resonance and diversified box office revenues beyond Hollywood-centric releases. Over time, this localization strengthens release pipelines, reduces dependence on imported content cycles, and builds a sustainable domestic movie economy with export potential to regional markets.

Which Industry Challenges Have Impacted the Growth of the KSA Movie Market:

High capital intensity of cinema development and long payback periods impact expansion pace and screen economics: While demand for movie-going has expanded rapidly in Saudi Arabia, cinema development remains a capital-intensive investment involving high upfront costs for real estate integration, fit-outs, projection systems, sound engineering, premium seating, and digital infrastructure. In many locations, especially outside Tier-1 cities, screen utilization rates can vary significantly by season and content slate, elongating payback periods. These economics make operators cautious in committing to aggressive rollouts, particularly in secondary cities where footfall predictability is still evolving. As a result, screen additions may lag headline demand growth during periods of cost inflation or retail development slowdown.

Content availability constraints and release window dependencies affect consistency of audience footfall: The Saudi movie market remains partially dependent on international content pipelines and global release schedules, particularly for blockbuster titles that drive peak attendance. Delays in international releases, regional censorship reviews, or limited availability of locally produced films can create uneven box office performance across quarters. While domestic film production is growing, the current slate volume is not yet sufficient to fully smooth demand volatility. This reliance on episodic tentpole releases can result in fluctuating occupancy levels, complicating revenue forecasting and operational planning for cinema operators.

Audience price sensitivity and balancing premium formats with mass-market accessibility create pricing challenges: Premium cinema formats such as IMAX, VIP lounges, and dine-in experiences command higher ticket prices and generate strong margins, but broad-based market growth still depends on affordability for family audiences and younger consumers. In periods of macroeconomic pressure or rising living costs, discretionary entertainment spending can soften, especially for repeat visits. Operators must balance premiumization strategies with promotional pricing, bundled offers, and off-peak discounts to sustain volume, which can pressure average revenue per ticket if not carefully managed.

What are the Regulations and Initiatives which have Governed the Market:

Licensing frameworks and content classification regulations governing exhibition and film approval: The KSA movie market operates under a structured regulatory environment that governs cinema licensing, film classification, content approvals, and exhibition standards. All films must undergo review and classification to ensure alignment with cultural norms and regulatory guidelines. These processes influence release timelines, content availability, and marketing strategies. While regulatory clarity has improved significantly over recent years, compliance requirements still necessitate close coordination between distributors, exhibitors, and authorities to avoid scheduling disruptions.

Government-led entertainment sector initiatives supporting infrastructure development and local content creation: Saudi Arabia’s broader entertainment and cultural development initiatives under Vision 2030 actively support the growth of cinemas, film festivals, and local production capabilities. Incentives related to entertainment licensing, facilitation of international partnerships, and funding support for domestic filmmakers contribute to ecosystem development. These initiatives have lowered entry barriers for global exhibitors and studios while encouraging the emergence of Saudi-produced films, gradually strengthening supply-side depth and long-term market sustainability.

Urban planning, mall development policies, and giga-project integration shaping cinema location strategy: Cinema expansion in Saudi Arabia is closely linked to retail zoning policies, mixed-use development regulations, and large-scale urban projects. Many new cinemas are embedded within malls, lifestyle destinations, and giga-projects that follow master-planned development frameworks. While this integration enhances visibility and footfall potential, it also ties cinema rollout timelines to broader real estate development cycles, permitting processes, and infrastructure readiness. As a result, cinema growth trajectories are influenced not only by consumer demand but also by the pace of urban development execution.

KSA Movie Market Segmentation

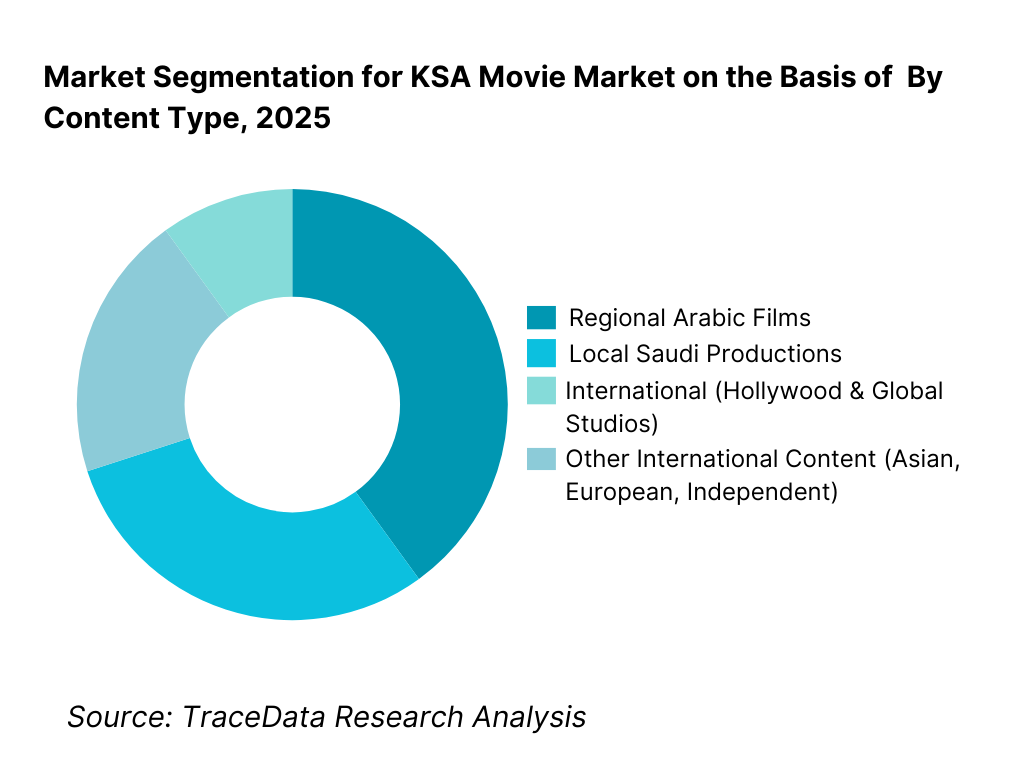

By Content Type: International blockbuster films hold dominance. This is because Hollywood and major international studio releases continue to drive the highest footfall, peak occupancy rates, and premium-format utilization across Saudi cinemas. Big-budget action, animation, and franchise films benefit from strong brand recognition, family appeal, and synchronized global marketing campaigns. While Arabic-language and locally produced films are gaining traction, especially during holiday periods and cultural seasons, international content remains the primary volume driver of box office revenues.

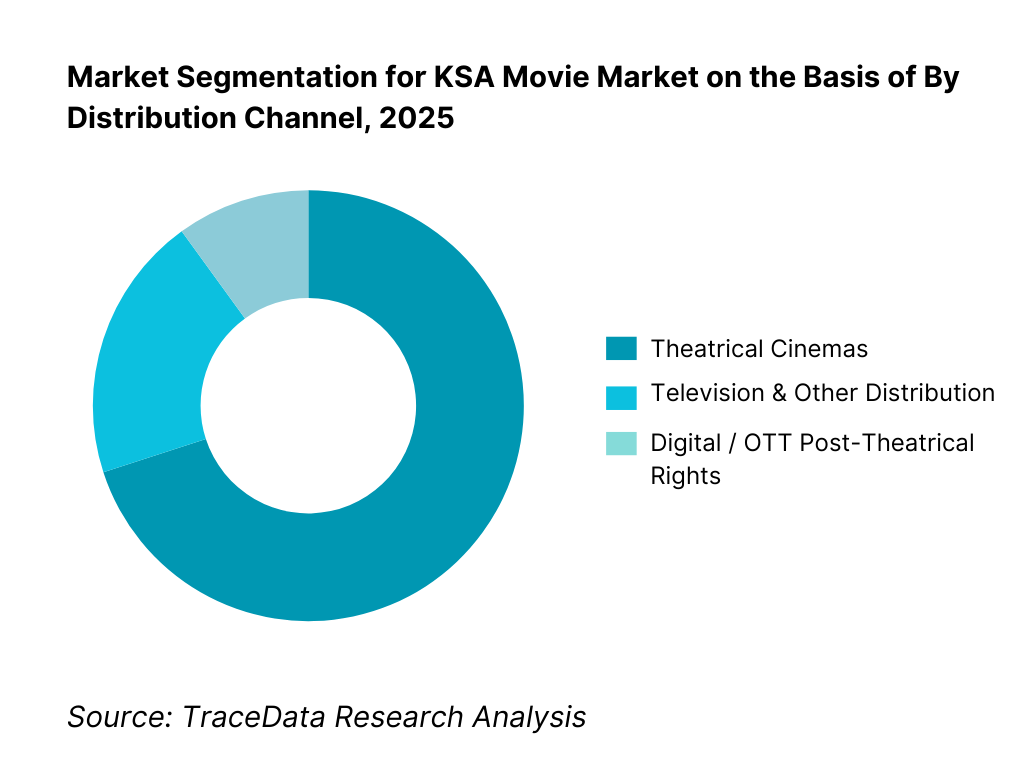

By Distribution Channel: Theatrical exhibition dominates the KSA movie market. Cinema halls remain the primary revenue-generating channel for movie consumption in Saudi Arabia, supported by premium viewing formats, eventized releases, and mall-integrated leisure destinations. While digital streaming platforms are widely consumed, theatrical releases retain cultural significance and monetization strength due to social viewing preferences, family outings, and experiential differentiation. Non-theatrical channels, including in-flight entertainment and institutional screenings, remain marginal contributors.

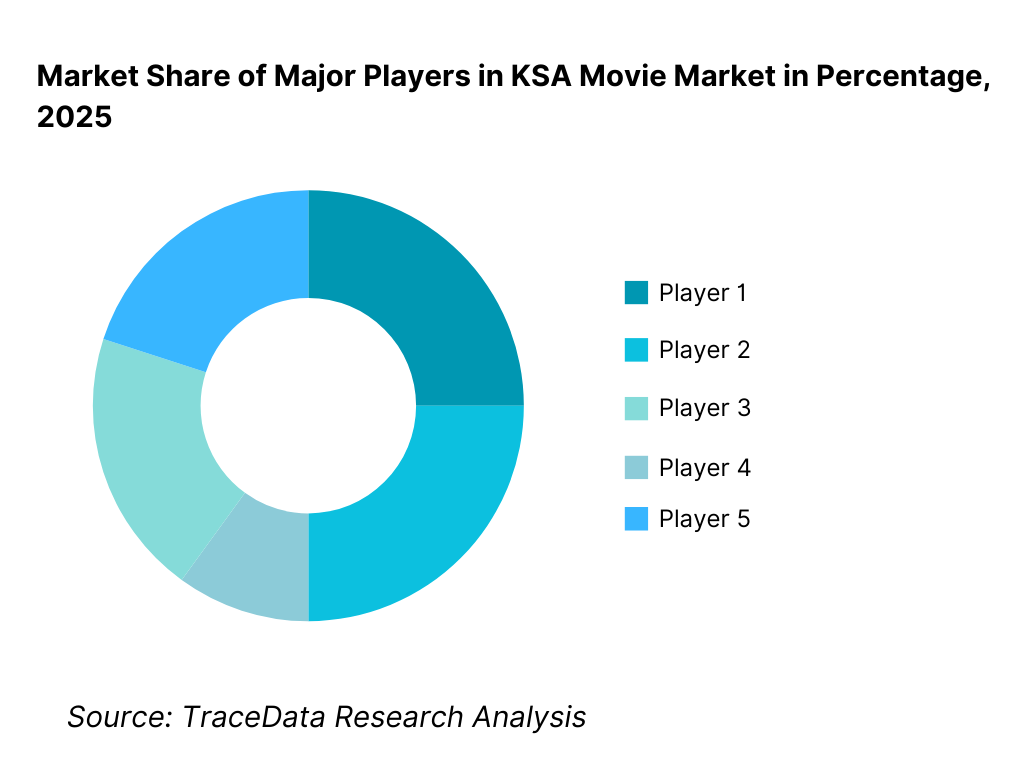

Competitive Landscape in KSA Movie Market

The KSA movie market exhibits moderate concentration, characterized by a small number of large cinema operators with nationwide footprints, strong mall partnerships, and access to premium screening technologies. Competitive positioning is driven by screen count, geographic coverage, premium format availability, content partnerships, loyalty programs, and integration with food, retail, and lifestyle offerings. While leading operators dominate Tier-1 cities, regional expansion into secondary locations remains a key battleground as new entertainment zones and mixed-use developments come online.

Name | Founding Year | Original Headquarters |

VOX Cinemas (Majid Al Futtaim) | 2000 | Dubai, UAE |

AMC Cinemas Saudi Arabia | 1920 | Kansas City, USA |

Muvi Cinemas | 2019 | Riyadh, Saudi Arabia |

Reel Cinemas | 2013 | Dubai, UAE |

Empire Cinemas | 1919 | Beirut, Lebanon |

Novo Cinemas | 2014 | Dubai, UAE |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

VOX Cinemas: VOX Cinemas is the market leader in Saudi Arabia, leveraging early entry, rapid screen rollout, and strong mall integration. The operator has emphasized premium formats such as IMAX, THEATRE, and luxury seating, positioning itself strongly among urban and high-spending audiences. Its scale, programming flexibility, and brand familiarity support consistent occupancy across major cities.

AMC Cinemas Saudi Arabia: AMC entered the Saudi market as a symbolic first mover and continues to focus on flagship locations in key urban centers. The brand benefits from global studio relationships and standardized operational processes. While its expansion pace has been more selective, AMC maintains relevance through premium screens and strong international content alignment.

Muvi Cinemas: As a Saudi-origin operator, Muvi Cinemas has expanded aggressively across both major and secondary cities. The company positions itself as a family-friendly, culturally aligned brand with competitive pricing and broad geographic reach. Muvi’s strategy focuses on rapid localization, regional penetration, and alignment with domestic entertainment initiatives.

Reel Cinemas: Reel Cinemas maintains a selective presence, focusing on premium mall locations and high-quality viewing experiences. The operator emphasizes service quality, curated content, and experiential differentiation rather than scale-driven expansion.

Empire Cinemas and Novo Cinemas: These operators contribute to competitive diversity through targeted expansions, regional content programming, and partnerships with specific mall developers. While smaller in scale, they remain relevant in selected markets and support competitive pricing and programming variety.

What Lies Ahead for KSA Movie Market?

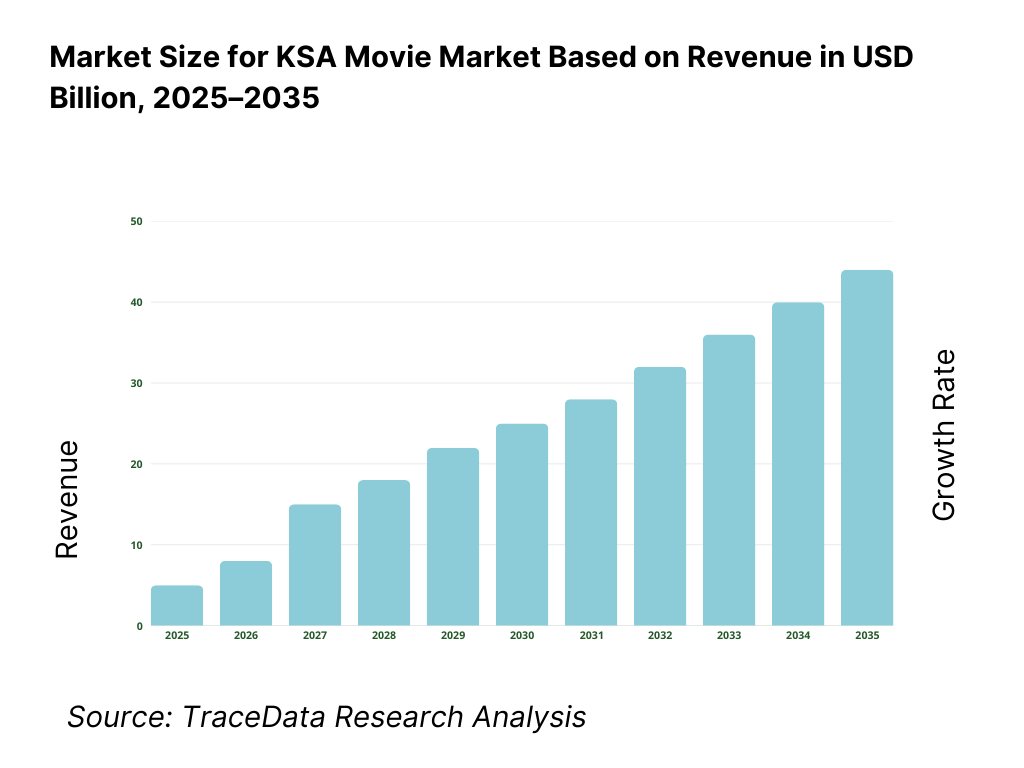

The KSA movie market is expected to expand steadily through 2035, supported by sustained growth in entertainment spending, continued rollout of cinema infrastructure, and the normalization of movie-going as a mainstream leisure activity under Vision 2030. Growth momentum will be reinforced by population expansion, rising urban lifestyles, increasing participation by families and women, and the integration of cinemas into mixed-use developments, giga-projects, and tourism-focused destinations. As Saudi Arabia continues to position entertainment as a core pillar of economic diversification, the movie market will remain a structurally important component of the broader leisure and cultural ecosystem.

Transition Toward Premium, Experiential, and Destination-Led Cinema Formats: The future of the KSA movie market will see a gradual shift from basic multiplex formats toward more experiential and destination-led cinema offerings. Demand is increasing for IMAX, Dolby Cinema, VIP lounges, dine-in concepts, and boutique screening experiences that elevate theatrical viewing beyond home-based alternatives. These formats support higher ticket pricing, stronger margins, and differentiated positioning, particularly in Tier-1 cities and tourism-driven locations. Operators that successfully balance premium experiences with scalable standard screens will capture both value-driven and volume-driven demand.

Growing Emphasis on Local Content, Arabic Films, and Saudi-Led Productions: Domestic film production and Arabic-language content will play a progressively larger role in shaping box office stability and cultural resonance. Government-backed initiatives, talent development programs, and production incentives are expected to increase the volume and quality of Saudi-produced films over the next decade. As local storytelling improves and audience affinity deepens, locally produced films will reduce reliance on international release cycles and create more predictable year-round content pipelines. This transition will strengthen ecosystem depth and support the emergence of Saudi Arabia as a regional content hub.

Expansion into Secondary Cities and Underserved Regions: While major cities currently dominate screen count and revenues, future growth will increasingly come from secondary cities and emerging urban clusters. Cinema penetration in these regions remains relatively low, presenting long-term expansion opportunities as retail infrastructure, lifestyle centers, and residential developments mature. Operators with flexible formats, disciplined capex strategies, and localized programming will be better positioned to unlock demand outside Tier-1 metros without diluting returns.

Integration of Cinemas with Tourism, Events, and Broader Entertainment Ecosystems: Cinemas will increasingly function as part of a wider entertainment mix that includes festivals, live events, cultural programming, and seasonal tourism peaks. Integration with giga-projects and entertainment districts will drive episodic demand spikes linked to holidays, international events, and tourist inflows. This convergence strengthens cinemas’ role as anchor attractions rather than standalone venues, improving footfall resilience and cross-spend potential.

KSA Movie Market Segmentation

By Content Type

• International (Hollywood & Global Studios)

• Regional Arabic Films

• Local Saudi Productions

• Other International Content (Asian, European, Independent)

By Distribution Channel

• Theatrical Cinemas

• Digital / OTT Post-Theatrical Rights

• Television & Other Distribution

By Language

• English

• Arabic

• Other Languages (Hindi, Asian, European)

By Audience Segment

• Families & Group Audiences

• Youth / Young Adults

• Premium / High-Income Viewers

• Tourists & Others

By Region

• Riyadh Region

• Makkah Province

• Eastern Province

• Other Regions

Players Mentioned in the Report:

• VOX Cinemas (Majid Al Futtaim)

• AMC Cinemas Saudi Arabia

• Muvi Cinemas

• Reel Cinemas

• Empire Cinemas

• Novo Cinemas

• Regional and emerging cinema operators and entertainment developers

Key Target Audience

• Cinema operators and entertainment venue developers

• Film distributors and international studios

• Saudi and regional film producers

• Mall developers and mixed-use real estate owners

• Tourism and entertainment authorities

• Advertising agencies and brand partners

• Private equity and strategic investors in entertainment assets

• Cultural institutions and policy stakeholders

Time Period:

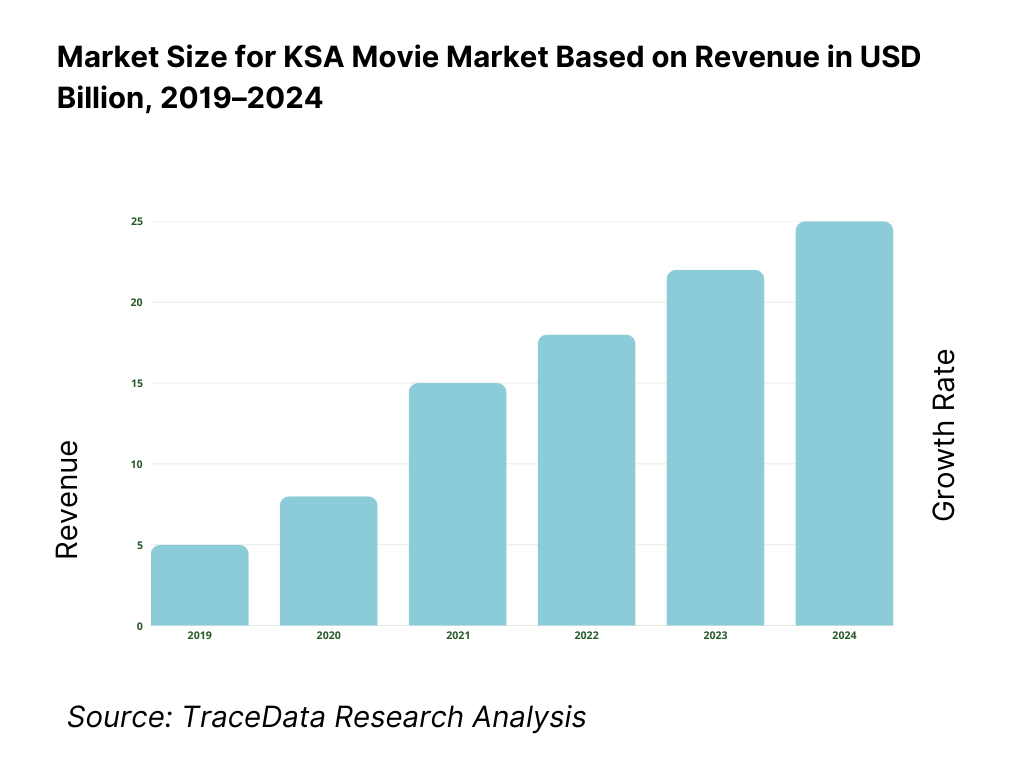

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Movie Content & Exhibition-Theatrical, OTT Post-Theatrical, Television, In-Flight & Institutional [Margins, Preference, Strength & Weakness]

4. 2 Revenue Streams for KSA Movie Market [Box Office, Premium Formats, Advertising, Concessions, Distribution Rights]

4. 3 Business Model Canvas for KSA Movie Market [Key Partners, Key Activities, Value Propositions, Audience Segments, Cost Structure, Revenue Streams]

5. 1 Local Operators vs International Cinema Chains [Muvi vs VOX/AMC etc.]

5. 2 Investment Model in KSA Movie Market [Government Initiatives, Private Investments, Strategic Partnerships, Real Estate-Linked Investments]

5. 3 Comparative Analysis of Movie Consumption in Theatrical vs Digital Platforms [Viewing Behavior, Monetization Models, ROI Benchmarks]

5. 4 Budget Allocation by Cinema Operators & Distributors [Premium Formats, Content Acquisition, Marketing, Operations]

8. 1 Revenues (Historical Trend)

9. 1 By Market Structure (Theatrical Exhibition vs Digital & Non-Theatrical Distribution)

9. 2 By Content Type (International, Regional Arabic, Local Saudi, Other International)

9. 3 By Genre (Action, Drama, Comedy, Animation, Thriller, Others)

9. 4 By Language (Arabic, English, Other Languages)

9. 5 By Audience Segment (Families, Youth, Premium Viewers, Tourists)

9. 6 By Viewing Format (Standard, IMAX, Dolby, VIP, Experiential)

9. 7 By Premium vs Mass-Market Offerings

9. 8 By Region (Riyadh Region, Makkah Province, Eastern Province, Other Regions)

10. 1 Audience Landscape and Cohort Analysis

10. 2 Movie Consumption Drivers & Decision-Making Process

10. 3 Viewing Effectiveness & Value Per Visit Analysis

10. 4 Gap Analysis Framework

11. 1 Trends & Developments in KSA Movie Market

11. 2 Growth Drivers for KSA Movie Market

11. 3 SWOT Analysis for KSA Movie Market

11. 4 Issues & Challenges for KSA Movie Market

11. 5 Government Regulations for KSA Movie Market

12. 1 Market Size and Future Potential for OTT-Based Movie Consumption in KSA

12. 2 Business Models & Revenue Streams [Subscription, Transactional VOD, Advertising-Supported]

12. 3 Delivery Models & Content Offerings [SVOD Platforms, TVOD Releases, Hybrid Release Windows]

15. 1 Market Share of Key Players in KSA Movie Market (By Revenues)

15. 2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Screen Count, Revenues, Pricing Models, Formats Offered, Key Locations, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15. 3 Operating Model Analysis Framework

15. 4 Competitive Positioning Matrix for Cinema Operators

15. 5 Bowman’s Strategic Clock for Competitive Advantage

16. 1 Revenues (Projections)

17. 1 By Market Structure (Theatrical and Digital Distribution)

17. 2 By Content Type (International, Regional Arabic, Local Saudi, Other International)

17. 3 By Genre (Action, Drama, Comedy, Animation, Thriller, Others)

17. 4 By Language (Arabic, English, Other Languages)

17. 5 By Audience Segment (Families, Youth, Premium Viewers, Tourists)

17. 6 By Viewing Format (Standard, Premium, Experiential)

17. 7 By Premium vs Mass-Market Offerings

17. 8 By Region (Riyadh, Makkah, Eastern Province, Other Regions)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the KSA Movie Market across demand-side and supply-side entities. On the demand side, entities include cinema operators, mall and mixed-use developers, entertainment destination owners, film distributors, advertisers, families and youth audiences, tourists, and institutional or event-based exhibitors. Demand is further segmented by content type (international, regional Arabic, local Saudi productions), viewing format (standard, premium, experiential), audience segment (families, youth, premium viewers, tourists), and consumption occasion (weekend leisure, holidays, events, seasonal releases).

On the supply side, the ecosystem includes cinema operators, projection and sound technology providers, seating and fit-out suppliers, film distributors, international studios, local production houses, marketing agencies, ticketing and loyalty platform providers, and regulatory authorities overseeing licensing and content classification. From this mapped ecosystem, we shortlist leading cinema operators and distributors based on screen count, geographic footprint, format mix, mall partnerships, and role in driving box office volumes. This step establishes how value is created and captured across content acquisition, exhibition, audience engagement, and ancillary revenue streams.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the structure, demand drivers, and segment behavior of the KSA movie market. This includes review of cinema rollout trends, entertainment spending patterns, demographic shifts, mall and mixed-use development pipelines, and tourism-linked entertainment initiatives. We assess audience preferences related to content mix, language, pricing sensitivity, premium format adoption, and frequency of movie-going.

Company-level analysis includes review of operator expansion strategies, screen formats, pricing tiers, loyalty programs, and content partnerships. Regulatory and policy review focuses on cinema licensing frameworks, content classification processes, and government initiatives supporting entertainment and local film production. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes assumptions for market estimation and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with cinema operators, film distributors, mall developers, content producers, marketing partners, and industry stakeholders. The objectives are threefold: (a) validate assumptions around audience behavior, content performance, and regional demand concentration, (b) authenticate segmentation splits by content type, language, audience segment, and viewing format, and (c) gather qualitative insights on pricing strategies, occupancy dynamics, release timing sensitivity, and operational challenges.

A bottom-to-top approach is applied by estimating screen counts, average ticket prices, occupancy rates, and ancillary revenues across regions and formats, which are aggregated to develop the overall market view. In selected cases, audience-facing assessments and operator interactions are used to validate real-world dynamics such as peak vs off-peak utilization, promotional effectiveness, and premium format uptake.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market sizing, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as population growth, entertainment spending trends, mall development activity, and tourism expansion. Assumptions around content supply, pricing elasticity, and screen rollout pace are stress-tested to assess their impact on revenue growth and market stability.

Sensitivity analysis is conducted across variables including premium format penetration, local content growth, secondary city expansion, and seasonal demand volatility. Market models are refined until alignment is achieved between operator capacity, content availability, and audience demand, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the KSA Movie Market?

The KSA Movie Market holds strong long-term potential, supported by a young population, rising entertainment participation, continued cinema infrastructure expansion, and government-backed initiatives under Vision 2030. The normalization of movie-going as a mainstream leisure activity, combined with premiumization of cinema formats and increasing local content production, positions the market for sustained growth through 2035.

02 Who are the Key Players in the KSA Movie Market?

The market features a concentrated set of large cinema operators with nationwide footprints, complemented by regional and emerging players. Competition is shaped by screen count, geographic coverage, premium format availability, mall partnerships, and content programming capability. Leading operators play a central role in shaping audience habits, driving premium adoption, and anchoring entertainment destinations.

03 What are the Growth Drivers for the KSA Movie Market?

Key growth drivers include rapid cinema rollout across major and secondary cities, rising discretionary spending, increasing family and female participation, and integration of cinemas within mixed-use developments and tourism projects. Additional momentum comes from the expansion of premium formats, improved local film production, and event-led entertainment consumption tied to festivals and holidays.

04 What are the Challenges in the KSA Movie Market?

Challenges include high capital requirements for cinema development, variability in content release pipelines, demand seasonality, and balancing premium pricing with mass-market affordability. Dependence on international releases can create uneven box office performance, while expansion into secondary cities requires careful alignment of capex with footfall predictability and local demand maturity.