KSA Smart Wearables Market Outlook to 2030

By Device Type, By Connectivity, By Use Case, By Distribution Channel, By User Segment, and By Region

- Product Code: TDR0323

- Region: Middle East

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “KSA Smart Wearables Market Outlook to 2030 – By Device Type, By Connectivity, By Use Case, By Distribution Channel, By User Segment, and By Region” provides a comprehensive analysis of the smart wearables market in Saudi Arabia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the smart wearables market. The report concludes with future market projections based on device shipments, connectivity adoption, use-case expansion, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

KSA Smart Wearables Market Overview and Size

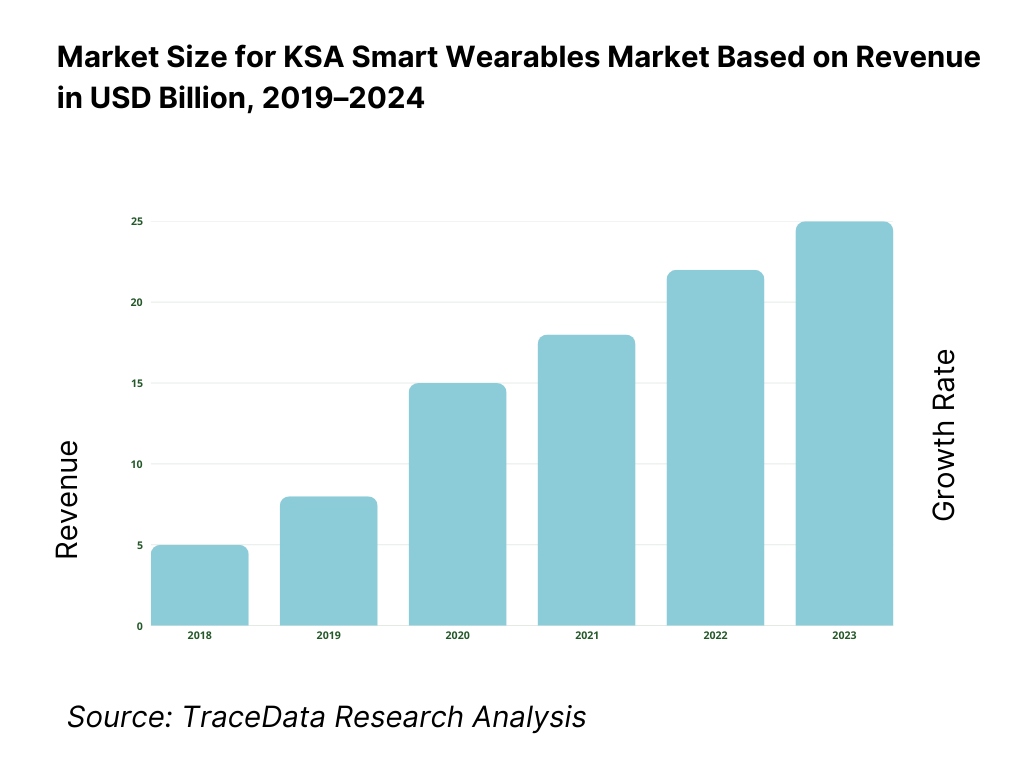

Saudi Arabia’s smart wearables market is valued at USD 626.0 million, based on a five-year historical analysis of the wearable computing category. Recent momentum reflects premium smartwatch uptake, health-centric devices, and connected features bundled by telcos. Fresh signals from adjacent coverage show consumer wearables revenue at USD 672.9 million (2024) as connected services deepen and fitness/health use cases expand, underscoring the market’s shift to recurring app and coaching layers.

Riyadh, Jeddah–Makkah, and the Eastern Province dominate due to high urban concentration, dense specialty retail (e.g., Jarir >60 KSA showrooms), and telco footprints (stc/Mobily/Zain) that enable eSIM watch activation and device financing. Pilgrim flows in Makkah/Medinah (over 18.5 million pilgrims in 2024) further catalyze safety/wayfinding and health-monitoring use cases. Robust digital infrastructure and retail scale makes these hubs the launchpads for premium wearables and connected services.

What Factors are Leading to the Growth of the KSA Smart Wearables Market:

Ubiquitous connectivity and a large, connected consumer base: Saudi Arabia’s digital fabric now supports wearables at national scale. The Kingdom counted 35.3 million residents at mid-year, creating a broad addressable base for connected devices. Connectivity depth is exceptional: 68.2 million mobile lines were active and median mobile speeds reached 129 Mbps, underpinning streaming health and location services. Internet availability is near-universal, with the national Internet report showing essentially full access and rapid growth in Saudi domains. In this environment, LTE/eSIM-enabled watches, always-connected rings, and sensor-rich hearables can deliver continuous telemetry, phone-free calling, and emergency features that depend on reliable nationwide networks.

High urban incomes and spending power concentrated in major cities: Household purchasing power is reinforced by national income levels—GDP per capita of USD 35,057.2—and dense urbanization that channels demand through organized retail and operator stores. Urban concentration translates to efficient distribution, merchandising and after-sales coverage in Riyadh, Jeddah–Makkah and the Eastern Province—prime launchpads for premium watches and performance wearables. The combination of diversified retail footprints and strong telco financing in these cities directly supports upgrades into eSIM models and multi-device ecosystems, while higher-income cohorts drive attach into subscription coaching and health dashboards.

Mass mobility and safety/health management during pilgrim seasons: Religious mobility creates distinct, large-scale use cases for wearables. During the peak ritual in the latest cycle, authorities recorded over 1.83 million pilgrims at Arafat—an enormous concentration requiring navigation, heat vigilance and emergency response capabilities. Government meteorological bulletins during the season reported 41°C conditions in Makkah/Mina, validating the role for on-wrist alerts, SOS and hydration prompts. As the Ministry of Hajj and Umrah continues to expand organized flows year-round via Umrah, that constant inbound traffic sustains recurring demand for location-aware devices, long-battery modes, and multilingual interfaces aligned with pilgrim safety operations.

Which Industry Challenges Have Impacted the Growth of the KSA Smart Wearables Market:

Multi-agency approvals and compliance workload for connected health devices: Commercializing a medical-adjacent wearable in Saudi Arabia typically spans three authorities and multiple filings: medical models require SFDA classification and post-market vigilance; all radio-equipped devices need CST type approval and spectrum conformity; and any product processing personal data must align with SDAIA/PDPL controller registration rules. The sequencing, document translations, local representative duties and vigilance reporting create a tangible time-to-market hurdle for OEMs shipping multi-SKU portfolios each season.

Heat stress and durability constraints during peak seasons: Wearables used outdoors must withstand extreme local conditions. During the most recent Hajj period, national advisories cited 41°C readings in sacred sites, while international coverage logged crowds of over 1.83 million at Arafat under extreme heat—conditions that can challenge device batteries, adhesives, displays and sensor accuracy. Engineering for high thermal loads, reliable GNSS in urban canyons and sustained heart-rate/SpO₂ sampling without thermal drift becomes non-negotiable. OEMs must validate materials and firmware under Saudi-specific heat cycles to avoid failure spikes during mass events.

Clinical-grade adoption limited by care-delivery bandwidth: At national level, the health workforce counted 113,300 physicians and 235,461 nurses across public and private sectors in the latest reporting year. While these absolute numbers are substantial, integrating continuous wearable streams for chronic-care requires physician hours for triage and protocol-driven follow-up, alongside trained nursing capacity for remote monitoring kits. Until provider dashboards, delegation models and payer reimbursement align with this real-world staffing base, hospital-grade use cases may scale slower than consumer wellness, constraining clinical deployments despite strong device availability.

What are the Regulations and Initiatives which have Governed the Market:

Medical Device Classification and Marketing Authorization (SFDA): Medical-grade wearables and companion software are regulated by the Saudi Food & Drug Authority under formal classification and marketing authorization pathways. SFDA’s MDS-G008 guidance codifies risk-based classes and documentation; additional guidance covers SaMD, UDI/labeling and vigilance—obligating local economic operators to maintain complaint, incident and recall processes. For OEMs, meeting these filings is prerequisite to claiming medical functions (e.g., ECG) on-pack or in local app stores.

Type Approval for Radio Equipment and Spectrum Use (CST): Any wearable with Bluetooth, Wi-Fi, LTE/eSIM, UWB or GNSS must secure type approval from the Communications, Space & Technology Commission before marketing, aligning with national spectrum and device standards. The regulator maintains official regulations and licensing frameworks for radio services; recent spectrum outlooks also opened the full 6 GHz band for Wi-Fi 6E, underpinning high-throughput accessories and gateways. Type approval sits alongside SASO/SABER product conformity at import, so program management must sequence certificates correctly to avoid customs delays.

Personal Data Protection Law (PDPL) & National Register of Controllers (SDAIA): Wearables capturing health signals, location and identifiers fall squarely under the Personal Data Protection Law administered by SDAIA. Rules governing the National Register of Controllers require qualifying entities to register as data controllers on the National Data Governance Platform, creating an auditable record of processing activities and accountability for cross-border transfers, retention and security controls SDAIA—Rules Governing the National Register of Controllers. For vendors and integrators, controller registration and PDPL-aligned consent flows are table stakes for launching data-rich features, dashboards and cross-border analytics.

KSA Smart Wearables Market Segmentation

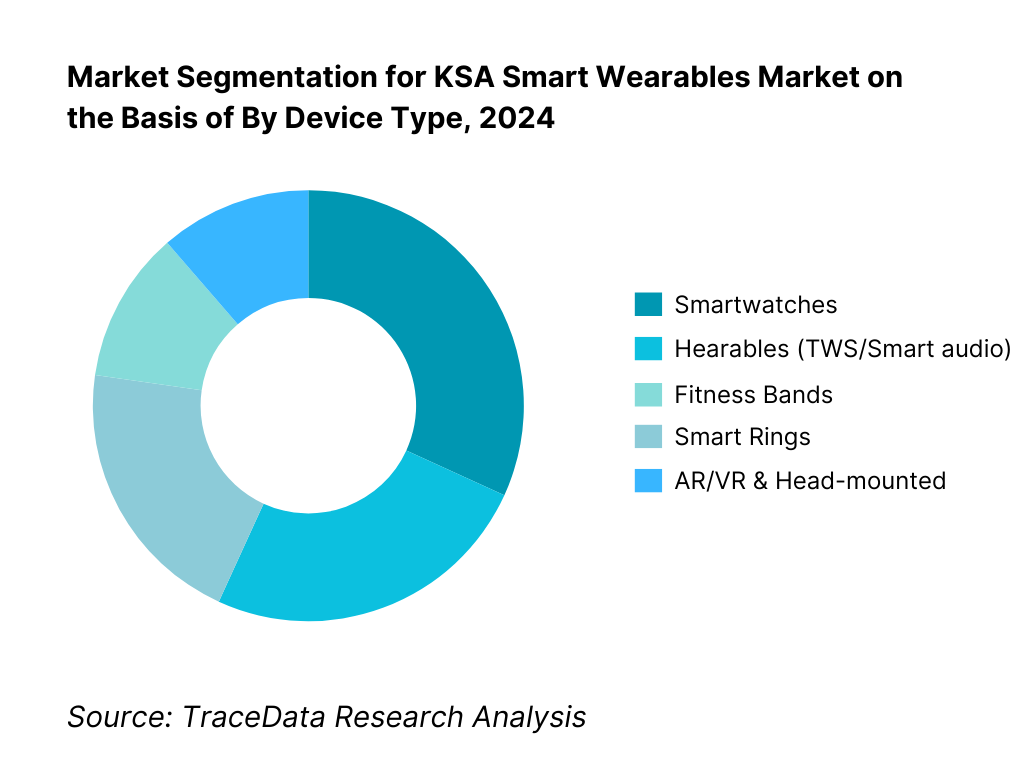

By Device Type: KSA smart wearables market is segmented by device type into smartwatches, fitness bands, hearables, smart rings, and AR/VR/head-mounted. Smartwatches currently command the dominant share under device type, owing to their rich sensor stack (PPG/HRV, SpO₂, skin temperature), native eSIM support through stc/Mobily/Zain, and strong brand ecosystems (Apple, Samsung, Huawei, Garmin) with Arabic-localized UX and warranty/service presence. Telco financing and retail shop-in-shop formats at leading chains (e.g., Jarir/eXtra) keep upgrade cycles brisk, while regulated medical features (ECG) and Workplace/insurance wellness challenges increase watch stickiness for both consumer and employee wellness programs.

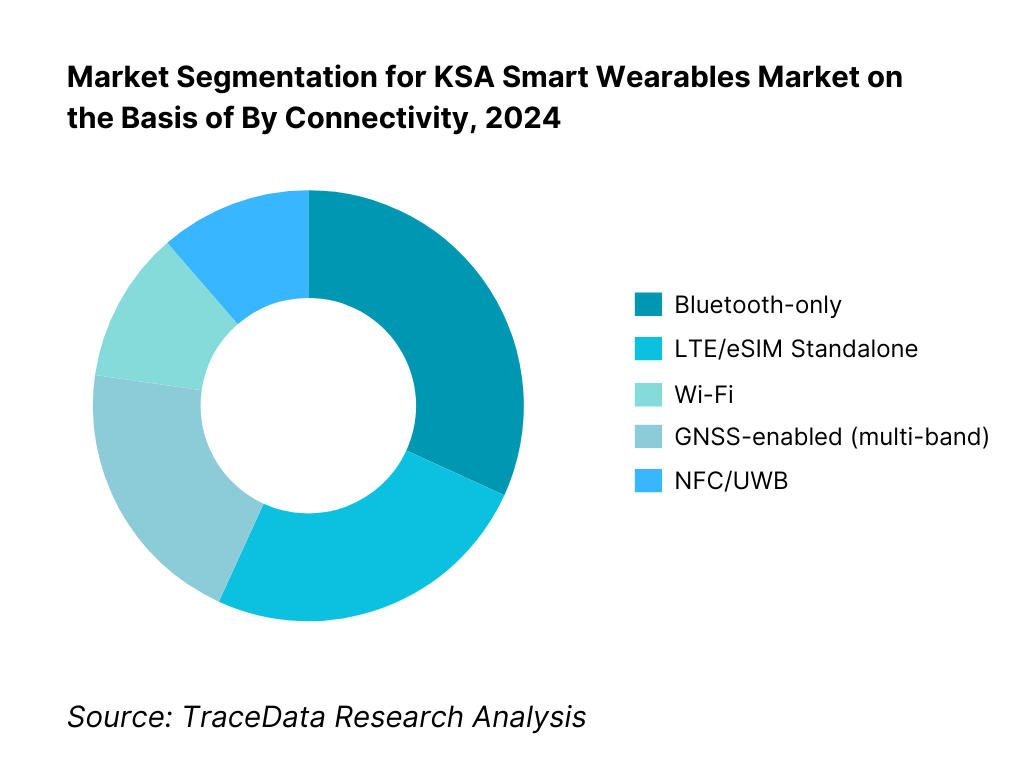

By Connectivity: KSA smart wearables market is segmented by connectivity into Bluetooth-only, LTE/eSIM standalone, Wi-Fi, GNSS-enabled, and NFC/UWB. Bluetooth-only remains the largest due to broad availability across hearables and entry-to-mid fitness devices at accessible price points. However, LTE/eSIM watches are expanding rapidly as operators push bundled lines and family-setup offerings; the ability to leave phones behind for calls/triangulation during outdoor activities resonates in Riyadh and Jeddah. GNSS layers are now standard in performance watches (desert trails/off-road), while NFC/UWB grows with local wallet adoption.

Competitive Landscape in KSA Smart Wearables Market

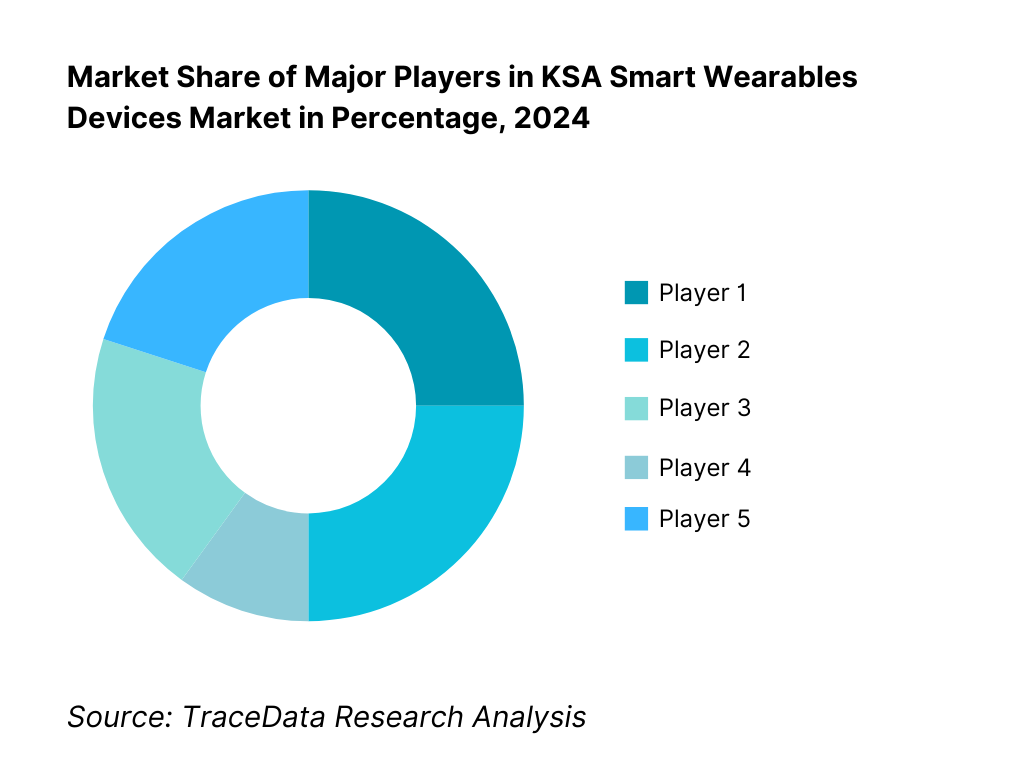

The KSA smart wearables market is shaped by a tight cohort of global platforms and performance specialists working through operators and organized retail. Apple, Samsung, Huawei, and Garmin dominate premium and upper-mid tiers via deep ecosystems, service networks, and eSIM readiness; Xiaomi and Amazfit sustain value momentum online and in mass retail. This consolidation underscores the influence of a few platforms in dictating feature roadmaps (ECG/SpO₂), Arabic UX quality, and subscription layers that lift lifetime value.

Name | Founding Year | Original Headquarters |

Apple | 1976 | Cupertino, USA |

Samsung | 1938 | Daegu, South Korea |

Huawei | 1987 | Shenzhen, China |

Garmin | 1989 | Lenexa, Kansas, USA |

Fitbit (Google) | 2007 | San Francisco, USA |

Xiaomi | 2010 | Beijing, China |

Amazfit (Zepp Health) | 2013 | Hefei, China |

OPPO | 2004 | Dongguan, China |

HONOR | 2013 | Shenzhen, China |

Realme | 2018 | Shenzhen, China |

Withings | 2008 | Issy-les-Moulineaux, France |

Polar | 1977 | Kempele, Finland |

Suunto | 1936 | Helsinki, Finland |

Oura | 2013 | Oulu, Finland |

Noise | 2014 | Gurugram, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Apple: A leading brand in the premium smartwatch segment, Apple has deepened its presence in Saudi Arabia through expanded eSIM support with stc, Mobily, and Zain. In 2024, the company strengthened health features such as ECG and AFib alerts, positioning the Apple Watch as both a lifestyle and medical-adjacent device. Its partnerships with retailers like Jarir and eXtra ensure broad availability across urban centers.

Samsung: Samsung has enhanced its Galaxy Watch line with regional ECG rollout and strong integration with Android ecosystems. The company continues to focus on affordability relative to Apple while offering Arabic-ready user interfaces. Expansion into fitness tracking and integration with Samsung Health has helped capture young, tech-savvy users in Riyadh and Jeddah.

Huawei: Huawei consolidated its wearables footprint by pushing its Watch GT series with long battery life tailored for desert environments. In 2024, it launched new models with improved SpO₂ and heart rate tracking, and bundled offers through its Experience Stores and e-commerce partners. Its competitive pricing strategy appeals strongly to students and young professionals.

Garmin: Garmin remains the leader in sports and performance tracking devices, particularly popular among professional athletes and outdoor enthusiasts in the Kingdom. The brand has strengthened distribution partnerships in KSA and introduced multi-band GNSS devices, targeting desert off-road users and endurance athletes who demand accuracy.

Fitbit (Google): Fitbit, now part of Google, continues to emphasize subscription-based health insights through Fitbit Premium. In 2024, the company upgraded its sensors for sleep and stress monitoring, aligning with Saudi Arabia’s growing interest in wellness and preventive health. Its competitive mid-tier pricing ensures widespread adoption via e-commerce channels like Noon and Amazon.sa.

What Lies Ahead for KSA Smart Wearables Market?

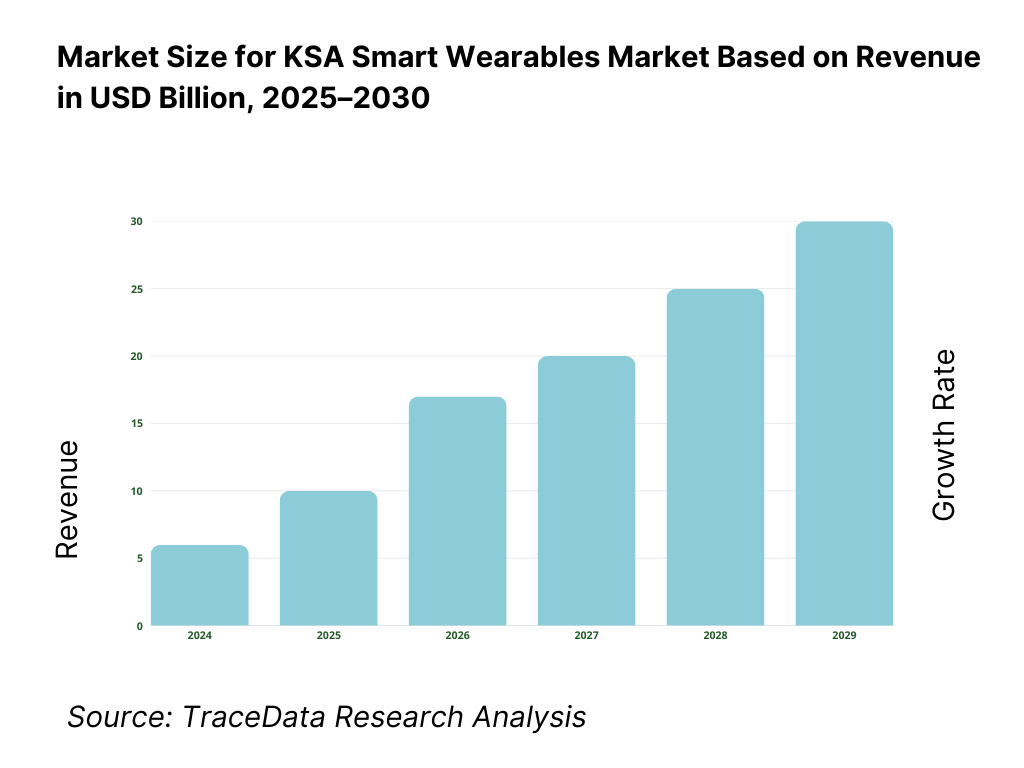

The KSA smart wearables market is anticipated to expand robustly toward the end of the decade, supported by Vision 2030’s focus on digital health, rising consumer health consciousness, and rapid 5G/IoT adoption. With a connected population exceeding 35.3 million residents and strong telco integration, the market is well positioned to see sustained momentum in premium smartwatches, discreet form factors like rings, and medical-grade devices that complement national health and wellness programs.

Rise of eSIM and Always-Connected Wearables: Future adoption will be strongly shaped by eSIM-only wearables tied to stc, Mobily, and Zain. These devices allow consumers to remain connected without smartphones, appealing particularly during large gatherings like Hajj and Umrah where safety and navigation are critical. Always-connected wearables will gain traction among both youth and enterprise wellness programs.

Shift Toward Preventive and Outcome-Based Health Monitoring: Wearables will evolve from simple fitness trackers to tools aligned with Saudi Arabia’s preventive healthcare goals. Clinical-grade metrics such as ECG, SpO₂, and temperature will be used to monitor chronic conditions, with hospitals and insurers integrating wearable dashboards. This outcome-driven use of wearables ensures measurable improvements in patient health and corporate wellness productivity.

Growth of Sector-Specific Wearables: Demand will rise for wearables tailored to specific sectors—pilgrim safety monitoring, sports performance tracking, and enterprise worker safety in industrial zones. For example, location-aware devices with SOS alerts can enhance crowd management during pilgrimages, while GNSS-heavy watches will be essential for desert endurance sports. Corporate clients will increasingly adopt ruggedized wearables for employee safety in construction and oil & gas.

Integration of AI and Arabic-Language Coaching: Artificial intelligence will become central in enhancing wearable ecosystems. Personalized coaching in Arabic, AI-driven health insights, and predictive alerts will improve user engagement and retention. This localization—combined with SDAIA’s data governance framework—will help position AI-powered wearables as indispensable in daily wellness, further bridging consumer health and government digital health platforms.

KSA Smart Wearables Market Segmentation

By Device Type

Smartwatches

Fitness Bands/Trackers

Hearables (Smart Audio/TWS with health features)

Smart Rings

AR/VR & Head-Mounted Wearables

By Connectivity

Bluetooth-only Devices

LTE/eSIM Standalone Wearables

Wi-Fi Enabled Devices

GNSS-enabled Devices (GPS, GLONASS, BeiDou)

NFC/UWB Wearables

By Use Case/Application

Health & Wellness Tracking

Clinical Remote Patient Monitoring (RPM)

Sports & Performance Coaching

Pilgrim Safety & Navigation

Enterprise & Worker Safety

By Distribution Channel

Specialty Electronics Retail (Jarir, eXtra, etc.)

Telco Operator Stores (stc, Mobily, Zain)

E-commerce Platforms (Noon, Amazon.sa)

Pharmacies & Wellness Chains (e.g., Nahdi)

Branded Stores/Experience Centers

By Price Band

Entry-Level (< USD 100)

Value Segment (USD 100–199)

Mid-Premium (USD 200–399)

Premium (USD 400–699)

Luxury (> USD 700)

By User Segment

Youth & Students

Working Professionals & Executives

Women’s Wellness Users

Expatriates

Seniors/Chronic-care Patients

Pilgrims & Travelers

By Region

Riyadh Region

Makkah & Jeddah

Eastern Province (Dammam, Khobar, Dhahran)

Madinah & Tabuk

Southern Provinces

Players Mentioned in the Report:

Apple

Samsung

Huawei

Garmin

Fitbit (Google)

Xiaomi

Amazfit (Zepp Health)

OPPO

HONOR

Realme

Withings

Polar

Suunto

Oura

Noise.

Key Target Audience

Consumer electronics retailers (Jarir, eXtra)

Mobile network operators (stc, Mobily, Zain)

Hospitals & virtual-care providers (Seha Virtual Hospital, leading private hospital groups)

Health insurers & corporate wellness buyers (Bupa Arabia, Tawuniya)

Sports federations & clubs (Saudi Sports for All Federation; professional clubs)

Pilgrim services & public-safety authorities (Ministry of Hajj & Umrah; Civil Defense)

Government & regulatory bodies (SFDA, CST, SDAIA, SASO)

Investments and venture capitalist firms (health-tech/wearables funds; regional growth equity)

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for Smart Wearables-Direct Import, Local Distribution, Telco Bundling, Pharmacy Channel (Margins, Preferences, Strengths, Weaknesses)

4.2 Revenue Streams for KSA Smart Wearables Market-Device Sales, Subscriptions (Health Apps, AI Coaching), Telco EMI Bundles, Insurance Rebates, Corporate Wellness Contracts

4.3 Business Model Canvas for KSA Smart Wearables Market-Key Partners, Value Propositions, Customer Segments, Revenue Streams, Cost Structures

5.1 Grey Market Imports vs. Organized Retail and Telco Distribution

5.2 Investment Model in KSA Smart Wearables Market (OEM Retail Stores, Telco Co-Brands, Health-Tech Startups)

5.3 Comparative Analysis of Wearables Funnel: Consumer Retail vs. Clinical RPM Programs (Private vs. Government Pilots)

5.4 Budget Allocation for Wearables by Corporate Wellness Programs, Insurance Incentives, and Household Spend

8.1 Revenues (Historical to Current)

8.2 Growth Milestones (e.g., eSIM launches, RPM adoption, pilgrim-focused rollouts)

9.1 By Market Structure (Consumer-Grade vs. Medical-Grade Devices)

9.2 By Device Type (Smartwatches, Fitness Bands, Hearables, Smart Rings, AR/VR Wearables)

9.3 By Connectivity (Bluetooth-only, LTE/eSIM, Wi-Fi, GNSS, NFC/UWB)

9.4 By Industry Verticals (Healthcare, Fitness/Sports, Corporate Wellness, Retail Consumers, Pilgrimage Safety & Monitoring)

9.5 By Company Size (Enterprise Wellness Contracts-Large Corporates, Medium Enterprises, SMEs)

9.6 By User Segment (Youth, Professionals, Women, Seniors, Pilgrims)

9.7 By Mode of Purchase (Retail Stores, Telco Bundles, E-Commerce, Pharmacies)

9.8 By Region (Riyadh, Makkah/Jeddah, Eastern Province, Madinah/Tabuk, Southern Provinces)

10.1 Consumer & Corporate Cohort Analysis

10.2 Decision-Making Process (Device Selection, Telco EMI Bundles, Clinical Referrals)

10.3 Effectiveness of Wearable Programs & ROI Analysis (Health Outcomes, Corporate Productivity Gains)

10.4 Gap Analysis Framework (Unmet Needs in Women’s Wellness, Senior Care, Pilgrim Tracking)

11.1 Trends and Developments (eSIM-Only Devices, Arabic UX, Smart Rings, Insurance-Backed Wellness)

11.2 Growth Drivers (Vision 2030 Health Digitalization, 5G/Wi-Fi 6 Penetration, Pilgrim Safety)

11.3 SWOT Analysis for KSA Smart Wearables Market

11.4 Issues and Challenges (PDPL Compliance, SFDA Approvals, Battery Life in Desert Climates)

11.5 Government Regulations (SFDA Medical Device, CST Radio Type Approvals, PDPL Data Localization, SASO Conformity)

12.1 Market Size and Future Potential for Online/Connected Wearables Subscriptions (Coaching Apps, Remote Monitoring Dashboards)

12.2 Business Models and Revenue Streams (Subscription Tiers, Insurer Incentives, App In-App Purchases)

12.3 Delivery Models and Features Offered (Telehealth Integration, Corporate Dashboards, Pilgrim Apps)

15.1 Market Share of Key Players (By Device Type, Price Band, Channel)

15.2 Benchmark of 15 Key Competitors-Company Overview, USP, Device Portfolio, Pricing, Medical Certifications, Arabic UX, Partnerships (Telcos/Hospitals/Insurers), Strategic Tie-Ups, Technology Used, Recent Developments

15.3 Operating Model Analysis Framework (Retail, Telco Bundling, Subscription Tie-Ins)

15.4 Gartner Magic Quadrant (Global Wearables Players Adapted to KSA)

15.5 Bowman’s Strategic Clock (Competitive Positioning in KSA Context)

16.1 Revenues (Forecast Horizon)

17.1 By Market Structure (Consumer vs. Medical-Grade Devices)

17.2 By Device Type (Smartwatches, Fitness Bands, Hearables, Smart Rings, AR/VR Wearables)

17.3 By Connectivity (Bluetooth-only, LTE/eSIM, Wi-Fi, GNSS, NFC/UWB)

17.4 By Industry Verticals (Healthcare, Fitness/Sports, Corporate Wellness, Retail Consumers, Pilgrimage Safety & Monitoring)

17.5 By Company Size (Large Corporates, Medium Enterprises, SMEs)

17.6 By User Segment (Youth, Professionals, Women, Seniors, Pilgrims)

17.7 By Mode of Purchase (Retail, Telco Bundles, E-Commerce, Pharmacies)

17.8 By Region (Riyadh, Makkah/Jeddah, Eastern Province, Madinah/Tabuk, Southern Provinces)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the ecosystem for the KSA Smart Wearables Market, identifying all demand-side and supply-side entities. On the demand side, this includes consumers, corporate wellness programs, healthcare providers, insurers, and government bodies such as the Ministry of Health, SFDA, CST, and SDAIA. On the supply side, we map OEMs (Apple, Samsung, Huawei, Garmin, Fitbit, Xiaomi, etc.), telcos (stc, Mobily, Zain), retailers (Jarir, eXtra), pharmacies, and e-commerce platforms (Noon, Amazon.sa). From this ecosystem, we shortlist the top 5–6 brands by distribution depth, financial performance, and active user base in the Kingdom. Sourcing relies on regulator releases, telco/retail listings, and secondary industry articles.

Step 2: Desk Research

An exhaustive desk research process follows, referencing secondary and proprietary databases. We analyze market revenues at the country level, the number of active wearable OEMs, price band ranges, and demand drivers (fitness adoption, pilgrim safety, chronic-care monitoring). Company-level insights are compiled through official press releases, regulatory filings, financial statements, telco partnership announcements, and distribution agreements. This desk research creates a baseline understanding of the market structure, including SKU segmentation (smartwatches, hearables, fitness bands), channel economics, and evolving regulatory frameworks.

Step 3: Primary Research

We conduct structured interviews with executives from OEMs, telcos, and retail partners as well as healthcare stakeholders and insurers. These discussions validate hypotheses built during desk research, confirm shipment splits, and shed light on revenue streams from device sales, subscriptions, and insurance/telco tie-ups. A bottom-to-top approach evaluates revenue contributions by individual players, later aggregated to model the national market. As part of validation, we run disguised client interviews with distributors and retailers, enabling triangulation of sell-out volumes, service costs, and pricing strategies against secondary data. These interactions further clarify value chain dynamics, Arabic UX adoption, eSIM readiness, and battery performance concerns under desert conditions.

Step 4: Sanity Check

Finally, we undertake top-to-bottom and bottom-to-top reconciliation to ensure coherence across datasets. Market size modeling exercises align channel sell-out data with shipment imports, telco eSIM activations, and regulatory approvals. This triangulation validates both demand- and supply-side estimates, ensuring a credible and balanced view of the KSA Smart Wearables Market.

FAQs

01 What is the potential for the KSA Smart Wearables Market?

The KSA Smart Wearables Market holds strong potential, with revenues from wearable computing valued at USD 626.0 million in 2024. Growth is being fueled by Vision 2030’s emphasis on digital health, rising urban incomes, and the Kingdom’s connected population of 35.3 million residents. The market’s potential is further bolstered by the integration of wearables into remote patient monitoring, corporate wellness programs, and pilgrim safety initiatives, creating both consumer and institutional demand streams.

02 Who are the Key Players in the KSA Smart Wearables Market?

The KSA Smart Wearables Market features several leading global players, including Apple, Samsung, Huawei, Garmin, and Fitbit (Google). These companies dominate due to their premium ecosystems, strong telco/eSIM partnerships, and Arabic UX readiness. Other notable players shaping the market include Xiaomi, Amazfit (Zepp Health), OPPO, HONOR, Realme, Withings, Polar, Suunto, Oura, and Noise. Their competitive edge comes from a mix of affordability, performance metrics, battery endurance, and localized distribution partnerships with operators, retailers, and e-commerce platforms.

03 What are the Growth Drivers for the KSA Smart Wearables Market?

Key growth drivers include connectivity and digital infrastructure, with 68.2 million mobile lines and median mobile Internet speeds of 129 Mbps enabling seamless wearable usage. Rising incomes ensure strong spending power in Riyadh, Jeddah, and the Eastern Province. Large-scale mobility events like Hajj and Umrah—with 1.83 million pilgrims recorded in Arafat—create unique safety and health-monitoring use cases for connected wearables, reinforcing adoption beyond individual wellness into crowd management and emergency services.

04 What are the Challenges in the KSA Smart Wearables Market?

Challenges include regulatory complexity, as wearable OEMs must navigate SFDA medical-device registration, CST radio approvals, and PDPL compliance with SDAIA. Environmental conditions present another barrier: summer pilgrim seasons have recorded 41°C in Makkah, testing device durability and sensor reliability. On the clinical side, workforce capacity limits adoption, with 113,300 physicians and 235,461 nurses supporting national healthcare delivery. Integrating wearable streams into provider workflows requires dashboards, reimbursement models, and staffing bandwidth—factors still catching up to consumer-level adoption.