KSA Streaming Media Market Outlook to 2035

By Content Type, By Platform Model, By Monetization Model, By Device Type, and By User Segment

- Product Code: TDR0468

- Region: Middle East

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “KSA Streaming Media Market Outlook to 2035 – By Content Type, By Platform Model, By Monetization Model, By Device Type, and By User Segment” provides a comprehensive analysis of the streaming media industry in the Kingdom of Saudi Arabia (KSA). The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and content governance landscape, user-level demand profiling, key issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the KSA streaming media market. The report concludes with future market projections based on digital infrastructure expansion, 5G penetration, local content production initiatives, youth demographics, changing media consumption behavior, regulatory evolution, and cause-and-effect relationships, along with case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

KSA Streaming Media Market Overview and Size

The KSA streaming media market is valued at approximately ~USD ~ billion, representing revenues generated from subscription-based, advertising-supported, and transactional digital media services, including video-on-demand (VoD), live streaming, music streaming, and short-form digital content delivered via internet-connected platforms. Streaming media services encompass content hosting, distribution, and consumption across smart TVs, smartphones, tablets, PCs, and connected devices, supported by broadband and mobile data networks.

The market is underpinned by Saudi Arabia’s high smartphone penetration, a digitally native and youthful population, widespread adoption of high-speed mobile internet, and increasing household access to smart TVs and connected home ecosystems. Streaming platforms have become a primary source of entertainment consumption, complementing and, in some segments, substituting traditional broadcast television and physical media formats. The rise of on-demand viewing, personalized recommendations, and multi-language content libraries has significantly reshaped consumer expectations around media accessibility and convenience.

Urban centers such as Riyadh, Jeddah, and Dammam represent the largest demand hubs for streaming media in KSA due to higher disposable incomes, stronger broadband infrastructure, and early adoption of digital services. Secondary cities and smaller towns are witnessing accelerating uptake as network quality improves and affordable data plans expand access. Nationally, demand growth is further reinforced by increasing local and regional content availability, Arabic-language programming, and content aligned with cultural preferences and family viewing norms.

What Factors are Leading to the Growth of the KSA Streaming Media Market:

Rapid digital infrastructure expansion and high mobile internet penetration drive usage growth: Saudi Arabia has invested heavily in telecommunications infrastructure, including nationwide 4G coverage and rapid 5G rollout across major urban and semi-urban areas. High mobile internet speeds and declining data costs have made video and audio streaming more accessible and reliable, enabling consumers to stream high-definition and ultra-high-definition content without significant buffering constraints. This infrastructure readiness directly supports longer viewing times, higher-quality content consumption, and greater willingness to subscribe to premium streaming services.

Young demographics and changing entertainment consumption preferences strengthen demand: KSA has a relatively young population with strong affinity for digital platforms, social media, and on-demand entertainment. Younger users increasingly prefer personalized, on-demand, and mobile-first content experiences over scheduled linear television. Streaming media platforms align closely with these preferences by offering flexible viewing, localized and international content, and multi-device accessibility. The growing role of streaming in daily leisure time, social interaction, and family entertainment continues to expand the overall addressable user base.

Government support for digital transformation and local content creation boosts market depth: National digital transformation initiatives and broader economic diversification goals have encouraged investment in media, entertainment, and creative industries. Support for local content production, licensing of new entertainment formats, and development of domestic studios and talent ecosystems has expanded the supply of Arabic and regionally relevant content. This not only increases user engagement but also reduces reliance on imported content, strengthening the long-term sustainability and cultural alignment of streaming media platforms operating in KSA.

Which Industry Challenges Have Impacted the Growth of the KSA Streaming Media Market:

Content regulation, censorship standards, and approval timelines impact catalog depth and speed-to-market: Streaming media platforms operating in Saudi Arabia must comply with content classification, cultural norms, and regulatory review processes that govern what can be distributed locally. Requirements related to age ratings, content edits, and approval clearances can delay the launch of global titles or require localized versions, increasing operational complexity and costs. For international platforms, these processes can slow content refresh cycles and limit the availability of certain genres, while local platforms must balance creative expression with regulatory alignment. These dynamics can affect user satisfaction, perceived content variety, and competitive parity with global catalogs.

High competition and rising content acquisition costs pressure profitability and differentiation: The KSA streaming media market is characterized by intense competition among global platforms, regional players, and telecom-backed services, all competing for user attention and subscription share. As competition intensifies, the cost of acquiring premium international content, exclusive sports rights, and high-quality local productions continues to rise. Smaller or newer platforms face challenges in matching the scale, marketing budgets, and content libraries of established players, which can compress margins and make long-term profitability more difficult without sustained subscriber growth or strong advertising monetization.

User churn sensitivity driven by price, content overlap, and subscription fatigue: As households increasingly subscribe to multiple streaming services, user sensitivity to pricing, content overlap, and perceived value has increased. Promotional pricing and short-term subscriptions are common, leading to higher churn rates when flagship content cycles end or prices increase. In a market where users can easily switch between platforms, maintaining long-term subscriber loyalty requires continuous investment in fresh content, user experience enhancements, and localized programming, which raises operating costs and increases revenue volatility.

What are the Regulations and Initiatives which have Governed the Market:

Content classification frameworks and media governance regulations shaping platform operations: Streaming media services in KSA operate under regulatory frameworks that define content classification, age ratings, and permissible themes. These regulations aim to ensure cultural alignment, protect younger audiences, and maintain consistency with national media standards. Platforms must implement content moderation systems, parental controls, and transparent rating disclosures, which influence platform design, content acquisition strategies, and user interface configurations. Compliance is essential for licensing and continued market access.

Digital infrastructure and telecommunications initiatives supporting streaming adoption: National initiatives focused on broadband expansion, 5G deployment, and digital transformation have indirectly governed the growth of the streaming media market by improving network reliability and access. Policies encouraging investment in high-speed mobile and fixed-line connectivity have enabled higher-quality video streaming, reduced latency, and expanded access beyond major urban centers. These infrastructure-driven initiatives form a foundational enabler for sustained growth in video-on-demand, live streaming, and interactive media services.

Media localization, creative economy support, and entertainment sector development programs: Government-led initiatives to support the creative economy, local media production, and entertainment sector development have influenced the structure of the streaming market. Incentives for local content creation, support for domestic studios, and encouragement of Arabic-language programming have increased the availability of culturally relevant content on streaming platforms. These initiatives help build local intellectual property, support talent development, and strengthen the long-term viability of domestic and regional streaming media ecosystems.

KSA Streaming Media Market Segmentation

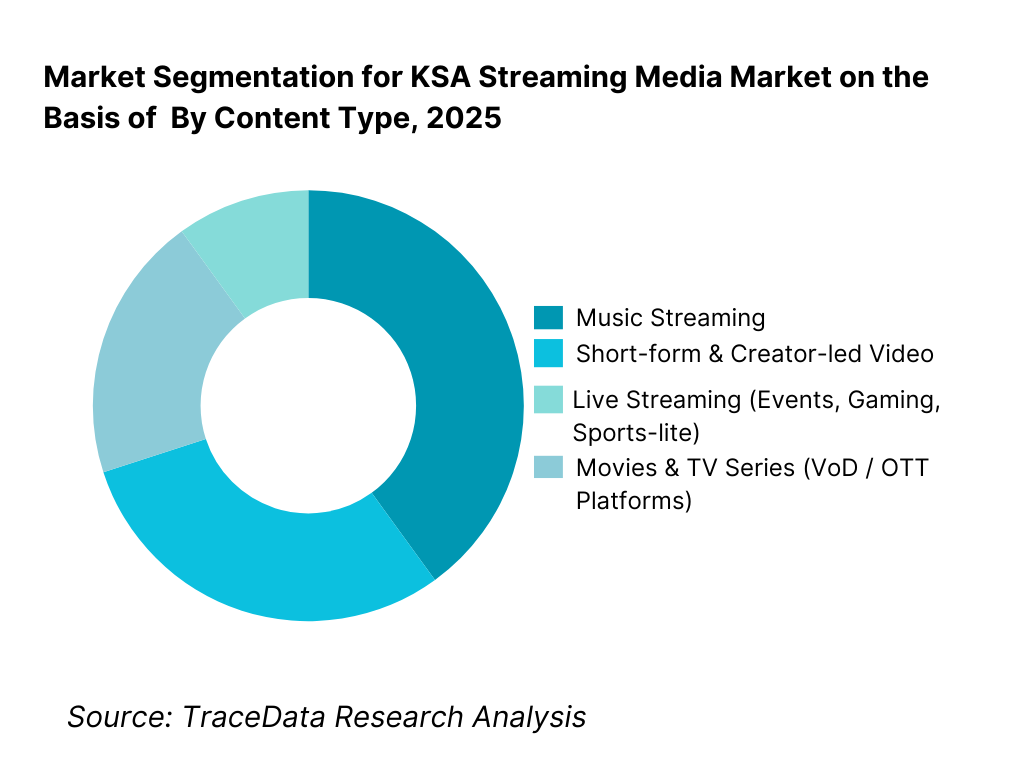

By Content Type: Video-on-demand (VoD) and series-led entertainment holds dominance. Long-form video content—including movies, scripted series, reality shows, and exclusive originals—accounts for the largest share of streaming consumption in Saudi Arabia. This dominance is driven by strong household adoption of smart TVs, family-oriented viewing behavior, and rising demand for premium Arabic and international series. While music streaming and short-form video continue to grow rapidly—especially among younger users—VoD remains the primary revenue and engagement driver due to higher subscription pricing and longer viewing hours.

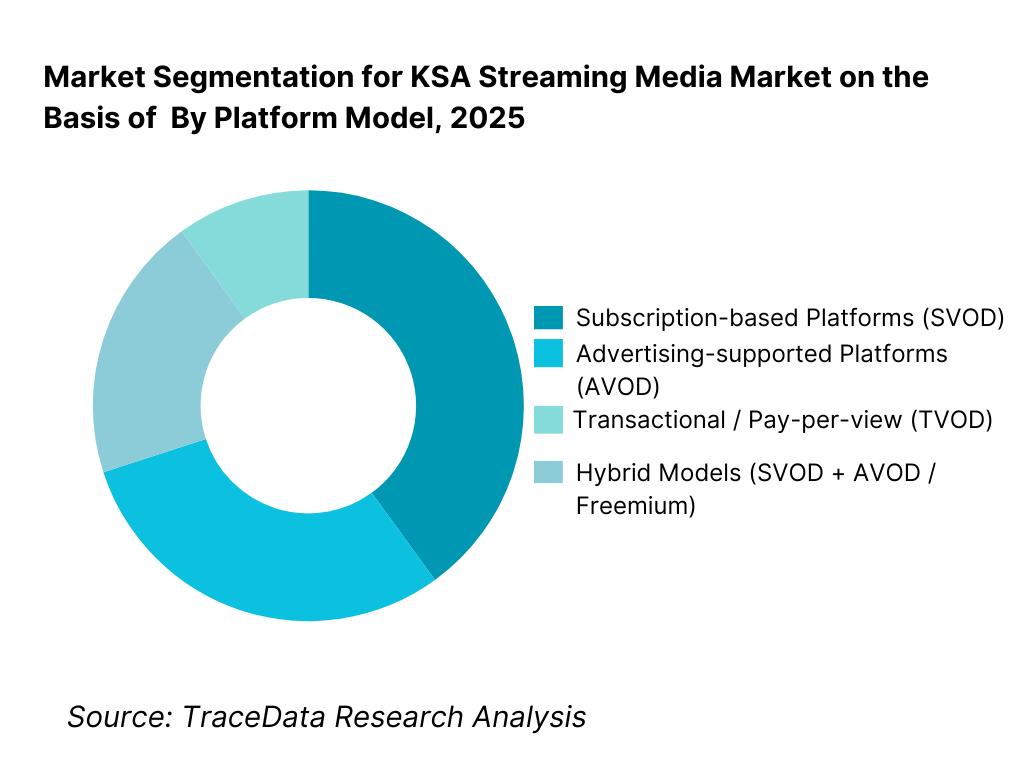

By Platform Model: Subscription-based platforms dominate, with hybrid models gaining traction. Subscription Video-on-Demand (SVOD) platforms lead the KSA streaming market as users increasingly value ad-free experiences, exclusive content libraries, and premium originals. However, advertising-supported (AVOD) and hybrid freemium models are gaining relevance as platforms seek to expand reach among price-sensitive users and casual viewers. Telecom-bundled platforms also play an important role by lowering effective subscription costs and driving mass adoption.

Competitive Landscape in KSA Streaming Media Market

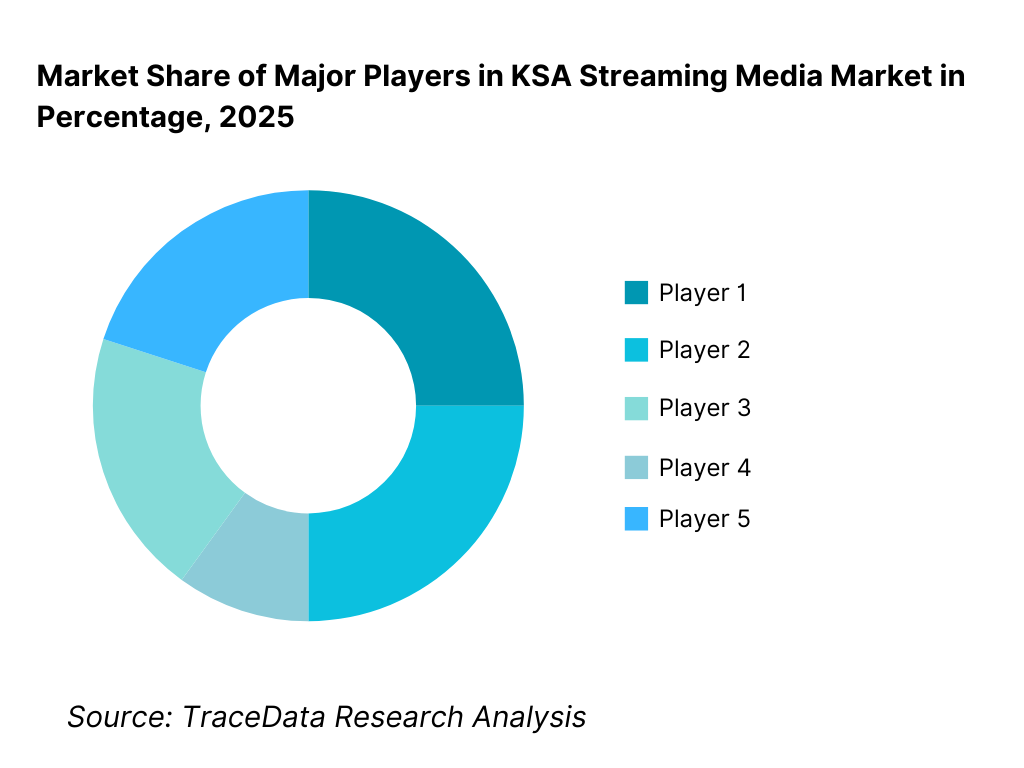

The KSA streaming media market exhibits moderate-to-high competitive intensity, characterized by the presence of global streaming giants, strong regional Arabic-content platforms, and telecom-backed services. Market leadership is shaped by content library depth, localization quality, exclusive originals, pricing flexibility, and bundling partnerships with telecom operators. Global platforms dominate premium international content and technology capabilities, while regional players compete effectively through Arabic programming, regional storytelling, and cultural alignment. Telecom-backed platforms benefit from embedded distribution, billing integration, and bundled pricing strategies.

Name | Launch Year | Original Headquarters |

Netflix | 2007 | Los Gatos, California, USA |

Shahid | 2011 | Dubai, UAE |

Amazon Prime Video | 2016 | Seattle, Washington, USA |

Disney+ | 2019 | Burbank, California, USA |

STARZPLAY | 2014 | Abu Dhabi, UAE |

Anghami | 2012 | Beirut, Lebanon |

Spotify | 2008 | Stockholm, Sweden |

Jawwy TV | 2018 | Riyadh, Saudi Arabia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Netflix: Netflix continues to lead in premium international and original content, with increasing emphasis on Middle East–relevant productions and selective Arabic-language originals. Its competitive strength lies in recommendation algorithms, global-scale production budgets, and strong brand association with high-quality scripted content. However, premium pricing positions it toward higher-income households and bundled subscribers.

Shahid: Shahid remains the dominant Arabic-content platform in Saudi Arabia, benefiting from deep regional catalogs, Ramadan-centric programming, and exclusive Arabic originals. Its hybrid monetization model allows it to address both mass-market and premium segments, making it highly competitive in terms of reach and cultural relevance.

Amazon Prime Video: Amazon Prime Video leverages bundled value through its broader Prime ecosystem, positioning streaming as part of a multi-service offering rather than a standalone product. This pricing logic supports steady adoption among price-conscious users while its international catalog and growing regional content slate strengthen engagement.

Disney+: Disney+ competes strongly in family and franchise-led segments, driven by global IP such as animation, Marvel, and Star Wars content. Its appeal is particularly strong among households with children, though reliance on a narrower content portfolio compared to broader platforms can limit total viewing hours.

Telecom-backed platforms (e.g., Jawwy TV): Local telecom-linked platforms benefit from direct access to subscriber bases, simplified billing, and bundled data or entertainment plans. While content depth may be narrower than global platforms, these services play a strategic role in user acquisition, retention, and ecosystem integration within Saudi Arabia’s digital economy.

What Lies Ahead for KSA Streaming Media Market?

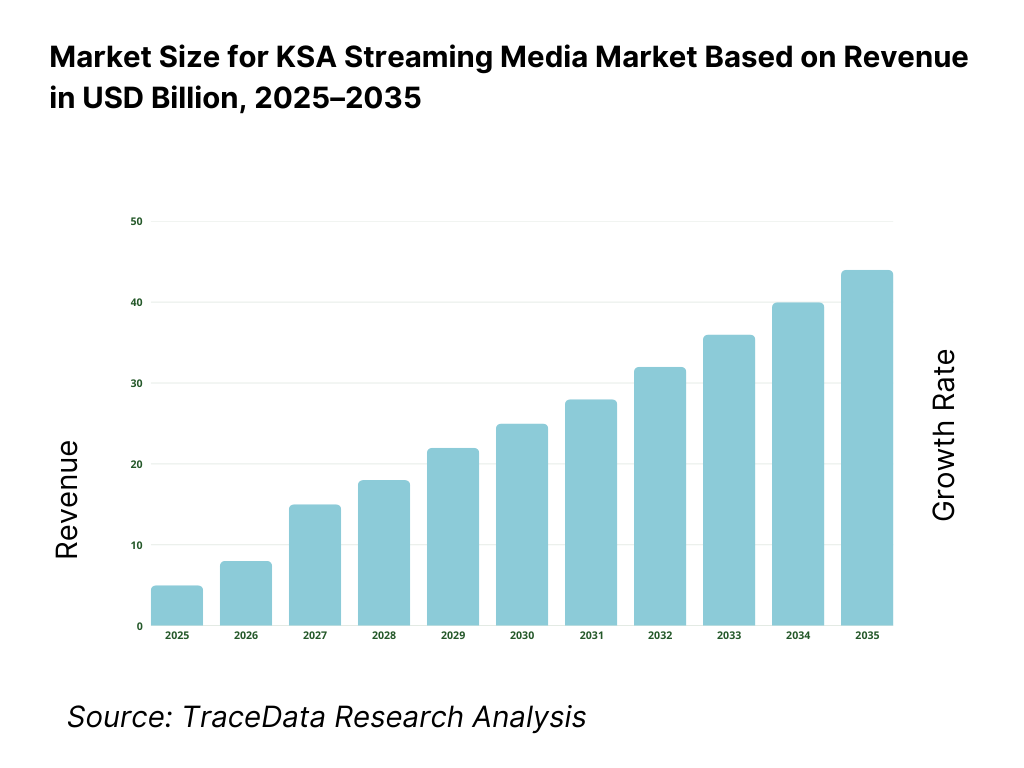

The KSA streaming media market is expected to expand strongly through 2035, supported by sustained growth in digital infrastructure, high smartphone and smart TV penetration, favorable demographics, and continued shifts in entertainment consumption away from linear television toward on-demand platforms. Streaming services are becoming a core component of household entertainment, driven by convenience, personalization, and expanding Arabic and regional content libraries. Growth momentum is further reinforced by national digital transformation priorities, rising disposable incomes, and increasing acceptance of subscription-based digital services across urban and semi-urban populations.

Continued Shift Toward Localized and Arabic-Language Content Ecosystems: The next phase of growth in the KSA streaming media market will be defined by deeper localization. Platforms are increasingly investing in Arabic originals, Saudi-produced series, culturally aligned reality formats, and family-friendly programming that resonates with local audiences. Ramadan-centric content cycles, regional storytelling, and Saudi talent development will become central competitive differentiators. Platforms that successfully balance global franchises with strong local narratives are expected to capture higher engagement and reduce subscriber churn over the long term.

Evolution of Monetization Models to Balance Reach and Profitability: Through 2035, the market will see greater diversification of monetization strategies, moving beyond pure subscription models. Hybrid approaches combining subscription tiers with advertising, telecom bundling, and mobile-only plans will expand addressable reach while managing affordability constraints. Advertising-supported video-on-demand (AVOD) is expected to grow steadily as advertisers follow audiences to digital platforms and demand measurable, targeted media inventory. Platforms that optimize pricing flexibility and ad integration without degrading user experience will be better positioned to sustain margins.

Rising Importance of Telecom Partnerships and Ecosystem Bundling: Telecom operators will continue to play a pivotal role in shaping streaming adoption in KSA. Bundled data plans, integrated billing, and zero-rating or discounted access lower barriers for mass adoption and support user retention. As competition intensifies, streaming platforms that secure strong telecom alliances will benefit from distribution scale, reduced customer acquisition costs, and more predictable subscriber pipelines. This dynamic favors both global platforms with strong negotiation power and regional players embedded within local telecom ecosystems.

Increased Focus on Platform Experience, Personalization, and Household Engagement: As content libraries expand and competition increases, user experience will become a key battleground. Improvements in personalization algorithms, Arabic user interfaces, parental controls, multi-profile management, and cross-device continuity will directly influence viewing time and loyalty. Household-level engagement—particularly family viewing on smart TVs—will remain critical, pushing platforms to curate content portfolios that address multiple age groups and preferences within the same subscription.

KSA Streaming Media Market Segmentation

By Content Type

- Movies & TV Series (Video-on-Demand / OTT)

- Music Streaming

- Short-form & Creator-Led Video

- Live Streaming (Events, Gaming, Sports-Lite)

By Platform Model

- Subscription Video-on-Demand (SVOD)

- Hybrid Models (SVOD + AVOD / Freemium)

- Advertising-Supported Platforms (AVOD)

- Transactional / Pay-Per-View (TVOD)

By Monetization Model

- Monthly / Annual Subscriptions

- Advertising Revenue

- Bundled Telecom Plans

- One-Time Content Purchases or Rentals

By Device Type

- Smart TVs

- Smartphones

- Laptops & Tablets

- Gaming Consoles and Other Connected Devices

By User Segment

- Individual Users

- Family / Household Subscribers

- Youth and Students

- Price-Sensitive / Ad-Supported Users

Players Mentioned in the Report:

- Netflix

- Shahid

- Amazon Prime Video

- Disney+

- STARZPLAY

- Jawwy TV

- Spotify

- Anghami

- Regional and local content platforms and telecom-backed streaming services

Key Target Audience

- Global and regional streaming media platforms

- Local content producers and studios

- Telecom operators and digital service providers

- Advertising agencies and brand marketers

- Media rights owners and distributors

- Smart TV, device, and connected-ecosystem providers

- Investors focused on media, entertainment, and digital platforms

- Government and regulatory stakeholders in media and digital economy

Time Period:

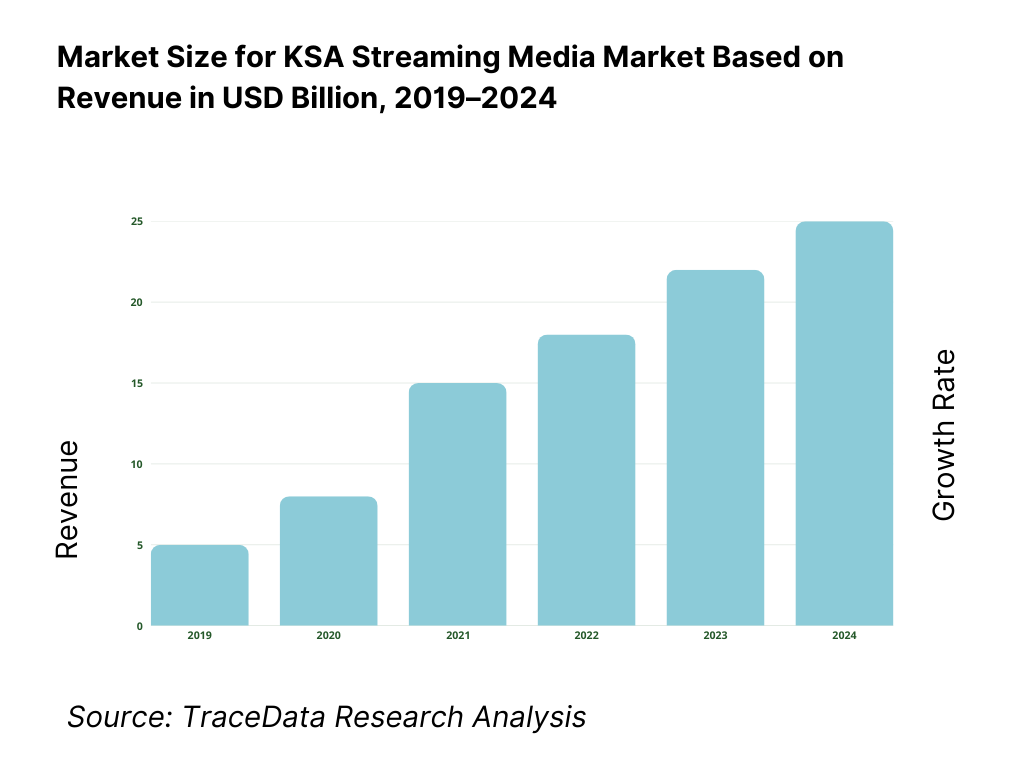

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Streaming Media including subscription-based platforms, ad-supported platforms, transactional VOD, telecom-bundled services, and smart TV ecosystems with margins, preferences, strengths, and weaknesses

4. 2 Revenue Streams for Streaming Media Market including subscription revenues, advertising revenues, transactional rentals and purchases, content licensing, and bundled telecom offerings

4. 3 Business Model Canvas for Streaming Media Market covering content creators, platform operators, aggregators, telecom partners, device OEMs, and payment gateways

5. 1 Global Streaming Platforms vs Regional and Local Players including Netflix, Amazon Prime Video, Disney+, Shahid, StarzPlay, and other domestic or regional platforms

5. 2 Investment Model in Streaming Media Market including original content investments, licensing-based models, co-productions, and platform technology investments

5. 3 Comparative Analysis of Streaming Media Distribution by Direct-to-Consumer and Telecom or Device Bundled Channels including telco partnerships and smart TV integrations

5. 4 Consumer Entertainment Budget Allocation comparing streaming subscriptions versus traditional TV, cinema, and gaming with average spend per household per month

8. 1 Revenues from historical to present period

8. 2 Growth Analysis by content type and by monetization model

8. 3 Key Market Developments and Milestones including OTT regulation updates, launch of local platforms, major content investments, and exclusive sports or entertainment rights

9. 1 By Market Structure including global platforms, regional platforms, and local players

9. 2 By Content Type including movies, TV series, originals, live sports, and kids or infotainment content

9. 3 By Monetization Model including subscription-based, advertising-supported, and transactional models

9. 4 By User Segment including individual users, family households, and youth-centric consumers

9. 5 By Consumer Demographics including age groups, income levels, and urban versus semi-urban users

9. 6 By Device Type including smartphones, smart TVs, laptops or tablets, and connected devices

9. 7 By Subscription Type including monthly plans, annual plans, and bundled plans

9. 8 By Region including Central, Western, Eastern, Northern, and Southern regions of KSA

10. 1 Consumer Landscape and Cohort Analysis highlighting youth dominance and family viewing clusters

10. 2 Streaming Platform Selection and Purchase Decision Making influenced by content exclusivity, pricing, language preference, and bundled offers

10. 3 Engagement and ROI Analysis measuring viewing hours, churn rates, and customer lifetime value

10. 4 Gap Analysis Framework addressing content localization gaps, pricing affordability, and platform differentiation

11. 1 Trends and Developments including rise of Arabic originals, sports streaming, short-form content, and AI-driven personalization

11. 2 Growth Drivers including high internet penetration, 5G rollout, young population, and government support for media and entertainment

11. 3 SWOT Analysis comparing global platform scale versus regional content strength and regulatory alignment

11. 4 Issues and Challenges including content regulation, piracy, rising content costs, and subscriber churn

11. 5 Government Regulations covering media licensing, content censorship guidelines, and digital media governance in KSA

12. 1 Market Size and Future Potential of ad-supported streaming platforms and digital video advertising

12. 2 Business Models including free ad-supported streaming and hybrid subscription plus advertising models

12. 3 Delivery Models and Type of Solutions including programmatic advertising, targeted ads, and brand integrations

15. 1 Market Share of Key Players by revenues and by subscriber base

15. 2 Benchmark of 15 Key Competitors including Netflix, Amazon Prime Video, Disney+, Apple TV+, Shahid, StarzPlay, OSN+, YouTube Premium, beIN CONNECT, Jawwy TV, Roku Channel, Tencent-backed platforms, regional niche platforms, and local OTT players

15. 3 Operating Model Analysis Framework comparing global OTT models, regional content-led models, and telecom-integrated platforms

15. 4 Gartner Magic Quadrant positioning global leaders and regional challengers in streaming media

15. 5 Bowman’s Strategic Clock analyzing competitive advantage through differentiation via content versus price-led mass strategies

16. 1 Revenues with projections

17. 1 By Market Structure including global platforms, regional platforms, and local players

17. 2 By Content Type including movies, series, originals, and sports

17. 3 By Monetization Model including subscription, advertising-supported, and transactional

17. 4 By User Segment including individuals, families, and youth users

17. 5 By Consumer Demographics including age and income groups

17. 6 By Device Type including smartphones, smart TVs, and connected devices

17. 7 By Subscription Type including standalone and bundled plans

17. 8 By Region including Central, Western, Eastern, Northern, and Southern KSA

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the KSA Streaming Media Market across demand-side and supply-side entities. On the demand side, entities include individual users, family households, youth and student audiences, expatriate populations, advertisers, and brand marketers consuming or funding streaming content. Demand is further segmented by usage behavior (long-form vs short-form consumption), device preference (smart TV vs mobile-first), content preference (Arabic, international, family-oriented, youth-led), and payment behavior (subscription, ad-supported, bundled).

On the supply side, the ecosystem includes global streaming platforms, regional Arabic-content platforms, music streaming services, telecom-backed streaming services, content studios and production houses, rights owners and distributors, advertising agencies, data and analytics providers, device manufacturers, and telecom operators enabling distribution and billing. From this mapped ecosystem, we shortlist 8–12 leading platforms and ecosystem participants based on subscriber base, content library depth, localization focus, monetization model, and strategic relevance in Saudi Arabia. This step establishes how value is created and captured across content creation, aggregation, distribution, monetization, and user engagement.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the KSA streaming media market structure, consumption trends, and segment behavior. This includes reviewing digital media adoption trends, smartphone and smart TV penetration, broadband and 5G rollout, media consumption time allocation, and shifts from linear TV to on-demand platforms. We assess user preferences around content language, genre, pricing sensitivity, and platform loyalty.

Company-level analysis includes review of platform content strategies, pricing tiers, monetization approaches, telecom partnerships, and localization initiatives. We also examine regulatory and governance frameworks influencing content availability, classification, and platform operations. The outcome of this stage is a comprehensive industry foundation that defines segmentation logic and establishes assumptions for market sizing, competitive positioning, and long-term outlook modeling.

Step 3: Primary Research

We conduct structured interviews with streaming platform executives, regional content producers, telecom operators, advertising buyers, media planners, and digital marketing stakeholders. The objectives are threefold:

(a) validate assumptions around user behavior, subscription penetration, and platform differentiation,

(b) authenticate segment splits by content type, monetization model, and device usage, and

(c) gather qualitative insights on churn behavior, pricing thresholds, advertising effectiveness, and content localization impact.

A bottom-to-top approach is applied by estimating user base size, average revenue per user (ARPU), and advertising yield across key segments, which are aggregated to develop the overall market view. In selected cases, platform-level and advertiser-level discussions are used to validate real-world dynamics such as promotional pricing impact, seasonal demand spikes (e.g., Ramadan), and effectiveness of bundled offerings.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate market estimates, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as population demographics, income growth, digital infrastructure investment, and advertising spend migration toward digital channels. Assumptions around content investment intensity, pricing evolution, and user churn are stress-tested to understand their impact on long-term growth. Sensitivity analysis is conducted across variables including regulatory changes, telecom bundling penetration, and local content production scale-up. Market models are refined until alignment is achieved between platform capacity, content supply, advertiser demand, and user consumption behavior, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the KSA Streaming Media Market?

The KSA Streaming Media Market holds strong long-term potential, supported by a young and digitally engaged population, high mobile and smart TV penetration, and sustained migration from traditional broadcast media to on-demand platforms. Growth is reinforced by increasing local Arabic content production, flexible monetization models, and strong telecom ecosystem support. Through 2035, streaming media is expected to remain a central pillar of Saudi Arabia’s entertainment and digital economy.

02 Who are the Key Players in the KSA Streaming Media Market?

The market features a mix of global streaming platforms, strong regional Arabic-content services, music streaming providers, and telecom-backed platforms. Competition is shaped by content exclusivity, localization depth, pricing flexibility, platform experience, and bundling partnerships. Regional players remain highly competitive due to cultural alignment and language relevance, while global platforms lead in scale, technology, and international content libraries.

03 What are the Growth Drivers for the KSA Streaming Media Market?

Key growth drivers include expanding high-speed internet coverage, favorable demographics, rising acceptance of subscription-based digital services, and increasing investment in local and regional content. Additional momentum comes from telecom bundling, hybrid ad-supported models, and growing advertiser interest in targeted digital video and audio inventory.

04 What are the Challenges in the KSA Streaming Media Market?

Challenges include content regulation and approval requirements, rising competition and content acquisition costs, and increasing user churn driven by subscription fatigue and price sensitivity. Platforms must continuously balance localization, affordability, and content freshness to sustain engagement and profitability in an increasingly competitive landscape.