Kuwait Auto Finance Market Outlook to 2029

By Market Structure, By Loan Providers, By Type of Vehicles Financed, By Loan Tenure, By Interest Rates, By Age Group of Consumers, and By Region.

- Product Code: TDR0138

- Region: Middle East

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Kuwait Auto Finance Market Outlook to 2029 - By Market Structure, By Loan Providers, By Type of Vehicles Financed, By Loan Tenure, By Interest Rates, By Age Group of Consumers, and By Region.” provides a comprehensive analysis of the auto finance market in Kuwait. The report covers an overview and genesis of the industry, overall market size in terms of total financing value, market segmentation, trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape, including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Kuwait Auto Finance Market. The report concludes with future market projections based on total loans disbursed, market penetration, consumer demographics, and success case studies highlighting the major opportunities and risks in the industry.

Kuwait Auto Finance Market Overview and Size

The Kuwait auto finance market reached a valuation of KWD 1.8 billion in 2023, driven by the rising demand for vehicle ownership, increasing penetration of banking and financial services, and the emergence of digital loan processing solutions. The market is characterized by key players, including National Bank of Kuwait (NBK), Gulf Bank, Boubyan Bank, Ahli United Bank, KFH Auto, and Al Mulla Finance. These financial institutions and lenders are recognized for their competitive interest rates, flexible repayment options, and customer-oriented financing services.

In 2023, KFH Auto launched a digital auto finance platform, enabling customers to apply for loans online and get instant approvals. This initiative was aimed at capturing the growing demand for digital financial services and enhancing the car-buying experience. Kuwait City and Al Ahmadi are the leading regions for auto financing due to their high population density and greater access to financial institutions.

Market Size for Kuwait Auto Finance Industry on the Basis of Credit Disbursed in USD Billion, 2018-2024

What Factors are Leading to the Growth of Kuwait Auto Finance Market?

Economic Factors: The rising cost of living and the increasing prices of new vehicles have made auto financing a necessity for consumers in Kuwait. In 2023, approximately 72% of car purchases were financed through loans, allowing consumers to afford vehicles without immediate large payments. This trend is particularly evident among mid-income earners who rely on structured repayment plans to manage their finances efficiently.

Growing Middle Class: The expanding middle class in Kuwait has contributed to the increasing demand for auto loans. Over the past five years, the middle-income population has grown by 10%, creating a higher demand for vehicle ownership. Auto finance solutions provide a pathway for these consumers to afford personal vehicles, particularly given the limited availability of public transportation options in the country.

Digitalization: The digitization of financial services has transformed the auto finance market, making loan applications more accessible and transparent. In 2023, nearly 45% of auto loan applications were submitted online, reflecting a strong shift toward digital banking and online financial transactions. Banks and lenders have introduced AI-powered credit assessments, reducing loan approval times and enhancing customer convenience.

Which Industry Challenges Have Impacted the Growth of Kuwait Auto Finance Market?

High Default Rates and Credit Risk: The rising number of borrowers defaulting on loan repayments has increased the risk exposure for financial institutions. In 2023, approximately 6.5% of auto loans were classified as non-performing, prompting banks to impose stricter lending criteria. This has made it difficult for individuals with lower credit scores to access financing.

Regulatory Compliance and Lending Restrictions: The Central Bank of Kuwait (CBK) has enforced strict lending regulations to minimize financial risk. Regulations such as capping loan amounts to 50% of an applicant’s annual income have limited access to auto financing, particularly for lower-income individuals. In 2023, around 18% of auto loan applications were rejected due to failure to meet creditworthiness and income criteria.

Limited Access to Auto Loans for Expatriates: Expatriates, who make up a significant portion of Kuwait’s workforce, face stricter eligibility requirements for auto loans. Many banks require higher down payments or charge higher interest rates for non-Kuwaiti borrowers, making it challenging for expatriates to finance vehicle purchases. In 2023, expatriates accounted for only 35% of total auto loan approvals, highlighting a disparity in loan accessibility.

What are the Regulations and Initiatives that Have Governed the Market?

Loan Approval and Credit Score Regulations: The Credit Information Network (Ci-Net) plays a crucial role in evaluating borrowers' financial histories before approving loans. Since 2023, all auto loan applicants have been required to undergo a comprehensive credit check, leading to a 10% decrease in loan approvals for high-risk borrowers.

Interest Rate and Loan Tenure Restrictions: The Central Bank of Kuwait (CBK) has implemented a maximum loan tenure of 5 years for new vehicles and 3 years for used vehicles, ensuring borrowers do not accumulate excessive long-term debt. Additionally, interest rates on auto loans are regulated, preventing excessive lending costs for consumers.

Government Incentives for Electric Vehicles (EVs): To promote sustainable transportation, the Kuwaiti government has introduced subsidized auto loans for EV purchases, offering reduced interest rates and longer repayment periods. In 2023, EV auto financing grew by 12%, with Tesla and Nissan Leaf being the most financed electric vehicle models.

Kuwait Auto Finance Market Segmentation

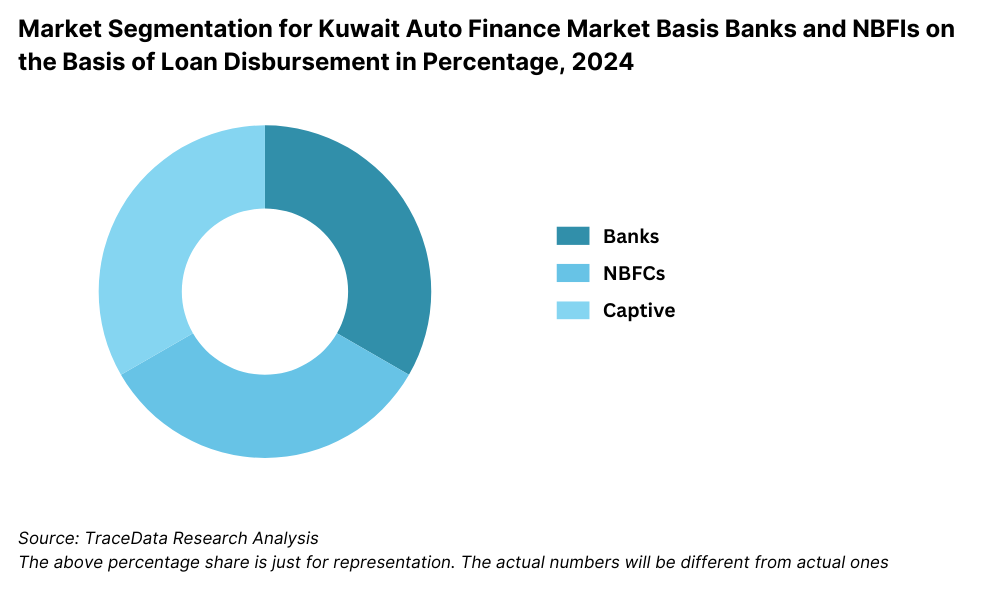

By Market Structure: Banks and financial institutions dominate the auto finance market in Kuwait due to their extensive reach, competitive interest rates, and structured loan offerings. These entities provide secure financing solutions with transparent terms and conditions, making them a preferred choice for consumers. Non-banking financial institutions (NBFIs) and digital lenders have started gaining traction due to their flexible eligibility criteria and faster loan disbursal process, catering particularly to younger consumers and expatriates.

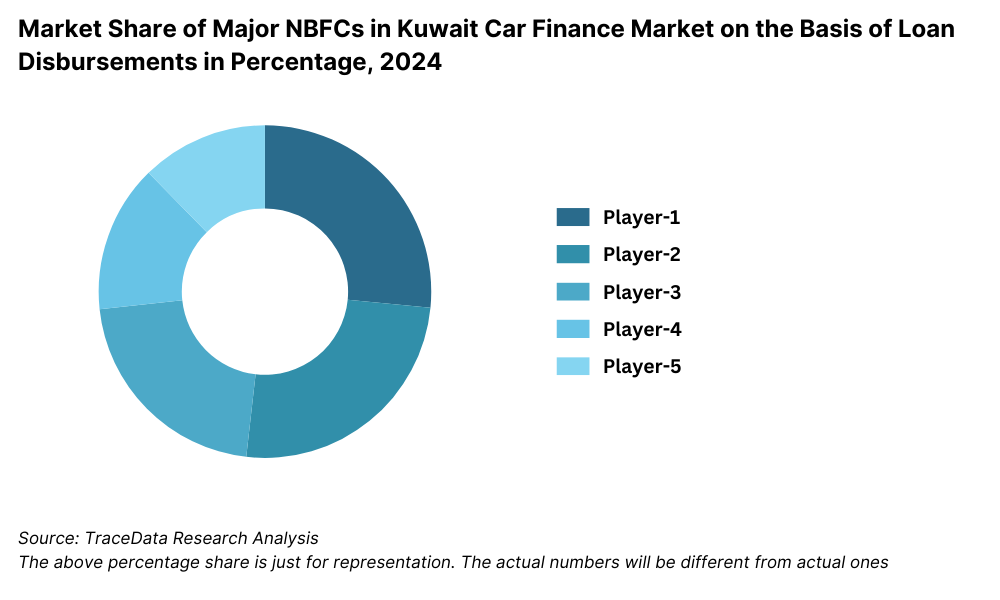

By Financial Institutions: Kuwait Finance House (KFH) leads the market due to its strong presence and Islamic banking-based financing solutions, which appeal to a large portion of the population. National Bank of Kuwait (NBK) follows closely, offering a variety of loan products with competitive interest rates and flexible repayment options. Gulf Bank, Boubyan Bank, and Burgan Bank also hold significant shares in the auto finance sector due to their customer-friendly policies and widespread branch networks.

By Types of Vehicles Financed: New car financing dominates the market as consumers prefer financing for brand-new vehicles due to attractive dealership financing programs, lower interest rates, and better resale value. Used car financing, while growing, still remains secondary as many consumers prefer outright purchases for pre-owned vehicles. Luxury car financing is also on the rise, particularly among high-income individuals and expatriates who seek premium automobile brands.

Competitive Landscape in Kuwait Auto Finance Market

The Kuwait auto finance market is moderately concentrated, with several banks, financial institutions, and Islamic lenders competing for market share. The presence of international banks, dealership financing options, and digital lending platforms has intensified competition, offering customers a diverse range of financing solutions.

Name | Founding Year | Original Headquarters |

|---|---|---|

National Bank of Kuwait (NBK) Auto Loan | 1952 | Kuwait City, Kuwait |

Gulf Bank Auto Finance | 1960 | Kuwait City, Kuwait |

Kuwait Finance House (KFH) Auto Finance | 1977 | Kuwait City, Kuwait |

Commercial Bank of Kuwait Auto Loan | 1960 | Kuwait City, Kuwait |

Burgan Bank Auto Loan | 1977 | Kuwait City, Kuwait |

Al Ahli Bank of Kuwait (ABK) Auto Finance | 1967 | Kuwait City, Kuwait |

Boubyan Bank Auto Finance | 2004 | Kuwait City, Kuwait |

Ahli United Bank Kuwait (AUBK) Auto Loan | 2000 | Kuwait City, Kuwait |

Toyota Financial Services Kuwait | 1982 | Toyota City, Japan |

Warba Bank Auto Financing | 2010 | Kuwait City, Kuwait |

Recent Market Developments and Competitor Trends

National Bank of Kuwait (NBK): As one of the leading financial institutions, NBK launched an AI-driven auto loan approval system in 2023, reducing loan processing time by 40%. This innovation has strengthened its position in the digital auto finance market.

Kuwait Finance House (KFH): KFH introduced a Shariah-compliant auto loan program in 2023 that witnessed a 25% increase in applications from customers seeking Islamic financing solutions.

Gulf Bank: Gulf Bank expanded its online loan application platform, allowing customers to apply for auto loans remotely, leading to a 30% rise in digital loan approvals in 2023.

Boubyan Bank: Specializing in Islamic banking, Boubyan Bank saw a 15% growth in Murabaha auto loans in 2023, as more consumers opted for interest-free financing options.

Ahli United Bank: Ahli United Bank partnered with automobile dealerships to offer exclusive financing deals, resulting in a 20% increase in new car loan disbursements in 2023.

Al Mulla Finance: The company focused on financing used vehicles, seeing a 10% growth in second-hand car loan approvals as more consumers opted for cost-effective vehicle ownership.

What Lies Ahead for Kuwait Auto Finance Market?

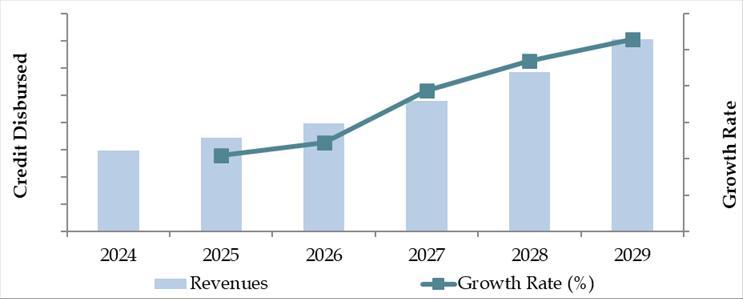

The Kuwait auto finance market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be driven by increasing vehicle ownership, digital transformation in financial services, and rising demand for flexible auto loan options.

Rise in Islamic Auto Financing: As Kuwait has a strong preference for Sharia-compliant financial products, the demand for Islamic auto financing is expected to increase. Financial institutions are likely to introduce new Murabaha-based auto loan schemes to cater to this growing segment.

Expansion of Digital Auto Financing Solutions: The auto finance industry is witnessing a shift towards digitalization, with banks and non-banking financial institutions (NBFIs) offering online loan applications, AI-based credit assessment, and digital documentation processing. This will enhance loan approval speeds and customer convenience, making auto loans more accessible.

Increased Preference for Electric Vehicle (EV) Financing: With Kuwait’s focus on sustainability and reducing carbon emissions, financial institutions are expected to offer specialized auto financing programs for electric and hybrid vehicles. These programs may include lower interest rates, extended loan tenures, and government-backed incentives.

Growth of Non-Banking Financial Institutions (NBFIs) in Auto Loans: While traditional banks dominate the market, NBFIs and fintech lenders are gaining traction due to their more flexible eligibility criteria and quick loan disbursement processes. This is particularly beneficial for expatriates and young professionals who may face challenges in obtaining bank loans.

Future Outlook and Projections for Kuwait Car Finance Market on the Basis of Loan Disbursements in USD Billion, 2024-2029

Kuwait Auto Finance Market Segmentation

By Market Structure:

- Banks

- Non-Banking Financial Institutions (NBFIs)

- Captive Finance Companies (Bank-Owned Auto Finance Divisions)

- Islamic Auto Financing Institutions

- Digital Lending Platforms

By Type of Vehicles Financed:

- New Cars

- Used Cars

- Luxury Cars

- Commercial Vehicles

- Electric Vehicles (EVs)

By Loan Tenure:

- 1-3 Years

- 3-5 Years

- 5-7 Years

By Age of Consumer:

- 21-30 Years

- 31-45 Years

- 46+ Years

By Region:

- Kuwait City

- Al Jahra

- Hawalli

- Farwaniya

- Mubarak Al-Kabeer

- Ahmadi

Players Mentioned in the Report (Banks):

- National Bank of Kuwait (NBK)

- Kuwait Finance House (KFH)

- Gulf Bank

- Commercial Bank of Kuwait (CBK)

- Al Ahli Bank of Kuwait (ABK)

- Boubyan Bank

- Warba Bank

- Kuwait International Bank (KIB)

Players Mentioned in the Report (NBFCs):

- Al Mulla Finance

- Al Amanah Finance

- National Leasing and Financing Company

- WARED Lease & Finance Company

Players Mentioned in the Report (Captive):

- Mercedes-Benz Finance (Al Mulla Automobiles Co.)

- Mitsubishi Motors Finance (Maseelah Trading Company)

- Toyota Finance (Al Sayer Group)

- Ford Credit (Alghanim Auto)

- Nissan Finance (Abdulmohsen Abdulaziz Al Babtain Co.)

- Honda Finance (Alghanim Auto)

- Hyundai Finance (Northern Gulf Trading Co.)

- Kia Finance (Al Mulla & Behbehani Motor Company)

Key Target Audience:

- Banks & Financial Institutions

- Non-Banking Financial Institutions (NBFIs)

- Car Dealerships & Auto Manufacturers

- Government Regulatory Bodies (e.g., Central Bank of Kuwait)

- Digital Auto Lending Platforms

- Research & Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Kuwait by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024P

9.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By Type of Vehicle (New, Used, Electric), 2023-2024P

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Kuwait Car Finance Market

11.2. Growth Drivers for Kuwait Car Finance Market

11.3. SWOT Analysis for Kuwait Car Finance Market

11.4. Issues and Challenges for Kuwait Car Finance Market

11.5. Government Regulations for Kuwait Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Kuwait Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Kuwait Car Finance Market, 2024

17.3. Market Share of Key Captive in Kuwait Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Kuwait Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New, Used, Electric), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, Above 8 years), 2025-2029

19.6. Recommendation

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities in the Kuwait Auto Finance Market. Based on this ecosystem, we shortlist the top financial institutions and non-banking financial entities operating in the country based on their loan disbursement volumes, financial performance, and market presence.

The initial data collection is conducted through industry reports, government publications, financial records, and proprietary databases to create a comprehensive overview of the auto finance market.

Step 2: Desk Research

We engage in extensive desk research, leveraging secondary data sources, industry articles, regulatory filings, and company financial reports. This process helps in understanding the total market size, loan disbursement trends, interest rate variations, and financing options offered by key market players.

Our analysis covers auto loan pricing trends, interest rate fluctuations, consumer preferences, key competitors, and growth drivers. Additionally, we conduct detailed examinations of annual reports, financial disclosures, press releases, and investor presentations of major financial institutions to assess their market strategies and performance.

Step 3: Primary Research

We conduct in-depth interviews with industry stakeholders, including C-level executives from banks, non-banking financial institutions (NBFIs), auto dealerships, digital lenders, and regulatory authorities.

As part of our validation strategy, we also conduct disguised interviews, posing as potential customers, to verify interest rates, loan terms, approval conditions, and other key parameters shared by institutions.

Step 4: Sanity Check

- We employ bottom-to-top and top-to-bottom market size modeling techniques to cross-check the accuracy of our findings. Data is validated using multiple triangulation methods, ensuring that loan disbursement figures, market segmentation, and growth projections align with industry trends.

FAQs

1. What is the potential for the Kuwait Auto Finance Market?

The Kuwait auto finance market is expected to witness steady growth in the coming years, driven by increasing vehicle ownership, rising disposable incomes, and the expansion of Sharia-compliant financing solutions. The growing demand for flexible auto loan options and the integration of digital lending platforms are further boosting market accessibility. By 2029, the market is projected to see significant growth in loan disbursements, making auto financing a key driver of vehicle sales in Kuwait.

2. Who are the Key Players in the Kuwait Auto Finance Market?

The Kuwait Auto Finance Market includes major financial institutions, with leading players such as Kuwait Finance House (KFH), National Bank of Kuwait (NBK), Gulf Bank, Boubyan Bank, Burgan Bank, and Ahli United Bank. Additionally, non-banking financial institutions (NBFIs) like Al Mulla Finance and Warba Bank are gaining market presence. Digital lending platforms and captive finance companies are also playing a growing role in offering innovative financing solutions.

3. What are the Growth Drivers for the Kuwait Auto Finance Market?

The primary growth drivers include economic factors such as rising vehicle demand and increasing disposable income, which are making auto loans a preferred financing solution. The expansion of digital lending platforms and AI-based loan approvals is further enhancing accessibility and ease of loan disbursement. Additionally, government incentives and regulations supporting Islamic auto finance solutions are contributing to market growth. The increasing adoption of electric vehicle (EV) financing programs is also expected to boost auto loan demand in the coming years.

4. What are the Challenges in the Kuwait Auto Finance Market?

The Kuwait Auto Finance Market faces several challenges, including stringent loan approval processes that make it difficult for expatriates and young borrowers to secure financing. Fluctuations in interest rates due to economic conditions and Central Bank regulations can impact loan affordability.