Kuwait Microscopes Market Outlook to 2030

By Market Structure, By Modality, By Application, By End-User, By Price Tier, By Sales Channel, and By Region

- Product Code: TDR0344

- Region: Middle East

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Kuwait Microscopes Market Outlook to 2030 – By Market Structure, By Modality, By Application, By End-User, By Price Tier, By Sales Channel, and By Region” provides a comprehensive analysis of the microscopes market in Kuwait. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the microscopes market. The report concludes with future market projections based on modality adoption, application demand, procurement cycles, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

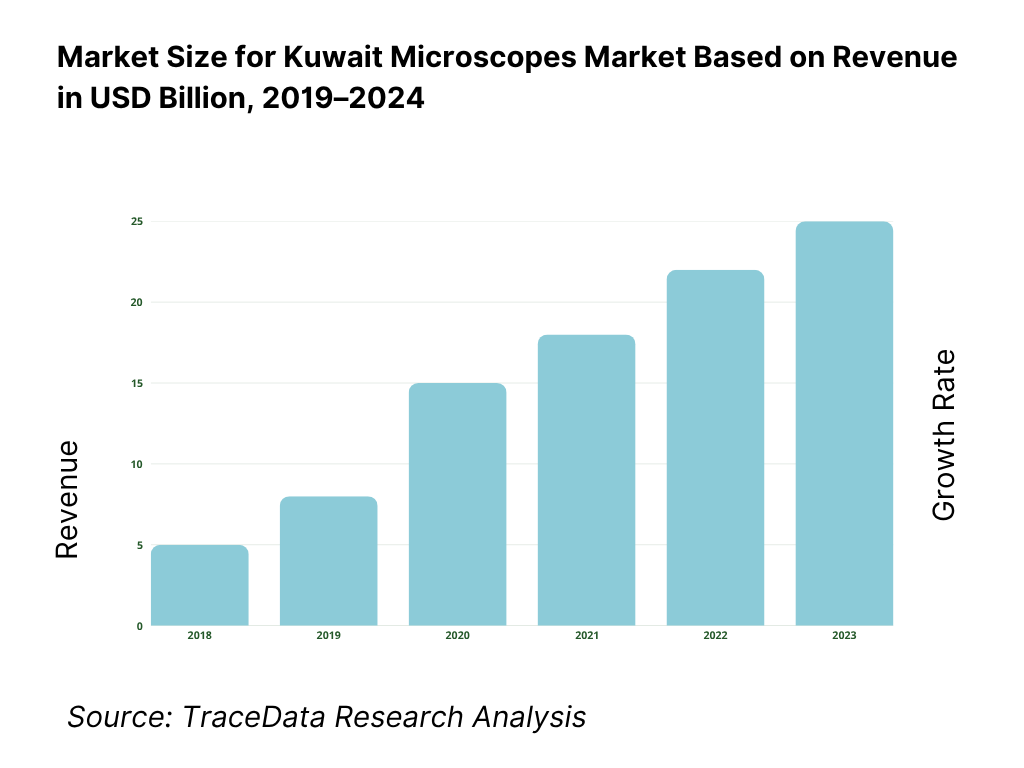

Kuwait Microscopes Market Overview and Size

The Kuwait microscopes market is valued at USD 12.3 million (optical microscopes), based on a five-year historical analysis by Grand View Research. Device demand is underpinned by steady public and private capital expenditure, with trade flows indicating active replacement cycles; Kuwait imported USD 7.73 million of microscopes across HS 9011/9012, reflecting robust procurement for hospitals, research, and industrial QA/QC. Cross-border supply capacity remained healthy as logistics normalized, reinforcing availability and upgrade activity.

Kuwait City and adjoining Hawalli dominate due to the concentration of Ministry of Health tertiary hospitals, Kuwait University schools, and private reference labs located in the capital corridor—sites that house most core imaging facilities and tender-led installations. On the supply side, Germany and the European Union lead supply into Kuwait, evidenced by USD 3.98 million of stereoscopic microscopes exported from Germany and USD 412,530 in EU microscope parts shipped to Kuwait; the dominance reflects established OEM portfolios and authorized distribution footprints. The United States maintained strong trade linkages at USD 2.4 billion in goods exports to Kuwait, facilitating OEM support and training pathways for imaging technologies.

What Factors are Leading to the Growth of the Kuwait Microscopes Market:

Clinical and research demand anchored by Kuwait’s health system scale-up: Kuwait’s population stands at 4,838,782 and is served by a Ministry of Health network that includes large tertiary complexes listed on the government portal, such as Mubarak Al-Kabir Hospital and the Al-Sabah Specialized Medical District. This patient load underpins routine clinical microscopy across pathology, hematology and infection control. Academic demand is reinforced by 42,697 enrolled students and 1,691 academic staff at Kuwait University, which explicitly points to expanding laboratory teaching and research footprints. Macroeconomic headroom further sustains capital equipment cycles: the IMF places Kuwait’s economy at USD 153.1 billion in current prices, while OPEC’s official tracker shows steady upstream capacity that funds public healthcare capex and tenders. In OPEC’s Monthly Oil Market Report, Kuwait’s crude output registered 2,408 tb/d in a recent month within 2024 time series tables, illustrating a revenue base that historically correlates to state procurement of clinical technologies.

Industrial and materials labs supported by hydrocarbons and manufacturing throughput: Beyond hospitals, microscopes—especially stereo, metallurgical and benchtop SEM—serve QA/QC in energy and downstream industries. OPEC’s own accounting shows Kuwait averaging ~2,421–2,430 tb/d across quarters in 2024, with a point reading of 2,431 tb/d in September and 2,408 tb/d in November, underscoring stable feedstock for refinery, petrochemicals and metals testing where microscopy is embedded in standards. Macroeconomic strength adds resilience: the IMF places Kuwait’s GDP (current prices) at USD 153.1 billion with PPP GDP at USD 260.5 billion, giving public and private buyers fiscal capacity for instrument replacement and lab expansion. On the talent side, Kuwait University reports 6,138 graduates in the latest cohort, feeding industrial labs with trained operators who sustain utilization of optical and electron platforms. These quantitative drivers—hydrocarbon throughput, macro headroom and skilled graduates—translate into durable demand for microscopes, accessories and service contracts in Kuwait’s industrial ecology.

Education and healthcare ecosystem density improves utilization rates: Microscope demand correlates with the density of teaching labs, residency programs, and national health workforce. Kuwait University’s 42,697 students and 101 graduate programs symbolize a large learner base that cycles through practical courses requiring compound and fluorescence units. On the clinical side, WHO notes Kuwait’s population at 4,838,782, informing slide volumes and routine smear workloads across district hospitals and specialized centers listed by government. Logistics performance shapes uptime and spare parts flow; the World Bank’s Logistics Performance Index records Kuwait with a 2023 international ranking of 51, positioning it mid-table and enabling reasonable instrument import lead times and service part replenishment. Together, a sizeable tertiary student body, a national clinical network and a workable logistics backbone—quantified by these indicators—raise installed-base utilization and accelerate refresh cycles for optical, digital and electron microscopy in Kuwait’s market.

Which Industry Challenges Have Impacted the Growth of the Kuwait Microscopes Market:

Import compliance and pre-clearance steps add time and documentation load: Microscopes and accessories are regulated products requiring conformity under the Kuwait Conformity Assessment Scheme (KUCAS). The Public Authority for Industry’s TABEK portal specifies issuance of a Technical Inspection Report (TIR) and a Clearance Certificate before customs release, with documented inputs like customs declaration numbers and product technical details enumerated in the service flow. The KUCAS listing of Regulated Products is maintained by PAI and drives pre-shipment and destination checks that vendors must allocate staff to manage. For public buyers, competitive tendering under national procurement law adds formal thresholds; for example, the statute cites a five-million Kuwaiti dinar cut-off for certain KPC contracts, highlighting governance around larger buys that often include microscopy suites and service lots. These quantified compliance elements translate to longer bid-to-install cycles and higher pre-award admin costs.

Logistics performance constraints can stretch lead times for high-value optics: Precision optics and SEM columns are sensitive to transit delays and storage conditions. The World Bank’s LPI assigns Kuwait a global rank of 51 in 2023, placing it behind the region’s top performers, which implies room for improvement in customs, infrastructure and timeliness sub-scores that directly influence delivery and service SLAs for microscopes and cryo-prep equipment. While Kuwait’s macro capacity is strong—IMF cites USD 153.1 billion GDP in current prices and USD 260.5 billion on a PPP basis—the LPI signals operational friction that vendors must price into buffer stocks and multi-ship schedules. The combination of high-value, fragile imports with a mid-tier logistics ranking elevates the risk of installation slippage, spare-parts backlogs, and warranty clock disputes—especially for complex imaging cores being commissioned under public grants and hospital expansions.

Skills depth and R&D intensity limit advanced modality adoption without training bundles: Transitioning from routine optical to confocal, super-resolution, and SEM requires operators and imaging scientists. Kuwait University’s 6,138 annual graduates form a pipeline, yet the broader R&D ecosystem shows modest researcher density in international statistics, necessitating vendor-led applications training to fully utilize advanced systems. UNESCO/World Bank time series on researchers per million people show Kuwait’s reported values within recent years at the lower end versus high-intensity research economies, underscoring the need for sustained skill development to unlock instrument performance. This skills-to-instrument gap manifests in longer ramp-up times, under-utilization of advanced features, and heavier reliance on OEM/partner applications scientists—costs buyers must plan for in Kuwait’s microscopy market.

What are the Regulations and Initiatives which have Governed the Market:

Medical device registration and vigilance under MOH decrees: Kuwait’s Ministry of Health has issued formal decrees covering medical device registration, product release, and vigilance. The MOH “Decrees and Circulars” page lists Ministerial Decree (13)/2022 for “Registration and Release of Medical Devices,” setting dossier, local-agent, and post-market reporting expectations for devices that include microscopes and accessories. MOH also hosts a Medical Device Incident Reporting form for end-users and HCPs, making device surveillance explicit for imaging systems in clinical settings. In practice, microscope OEMs and distributors must align device classes with MOH guidance, maintain local authorized representation, and log adverse incidents through MOH channels—requirements that are quantifiable at the document level and directly affect go-to-market timelines in Kuwait’s healthcare sector.

KUCAS conformity and TABEK e-processing for regulated products: The Kuwait Conformity Assessment Scheme (KUCAS), run by the Public Authority for Industry, mandates verification that regulated products meet Kuwaiti/GSO technical regulations before clearance. The PAI site details KUCAS objectives and the TABEK e-platform that issues a Technical Inspection Report (TIR) and subsequent Clearance Certificate against a defined document set, including customs declaration IDs and product details. These numbered steps—and the presence of a distinct TIR requirement—structure every microscope import into Kuwait, from clinical optics to SEM columns, and should be built into lead-time and compliance budgets by vendors and buyers.

Public tendering thresholds and oversight for equipment procurement: Large public-sector acquisitions of microscopes typically route through Kuwait’s Central Agency for Public Tenders (CAPT) framework. The official law text specifies thresholds, including a five-million Kuwaiti dinar ceiling for certain Kuwait Petroleum Corporation contracts before CAPT competence is triggered, clarifying when centralized oversight applies to high-value instrument buys. PAI separately notes its role in monitoring application of Kuwaiti, Gulf and international standards on imported and local products—linking standards enforcement with public procurement compliance for regulated technical goods. For suppliers, these numeric thresholds and standards-monitoring mandates define bid packaging, contract governance, and post-award acceptance testing in Kuwait’s microscopes market.

Kuwait Microscopes Market Segmentation

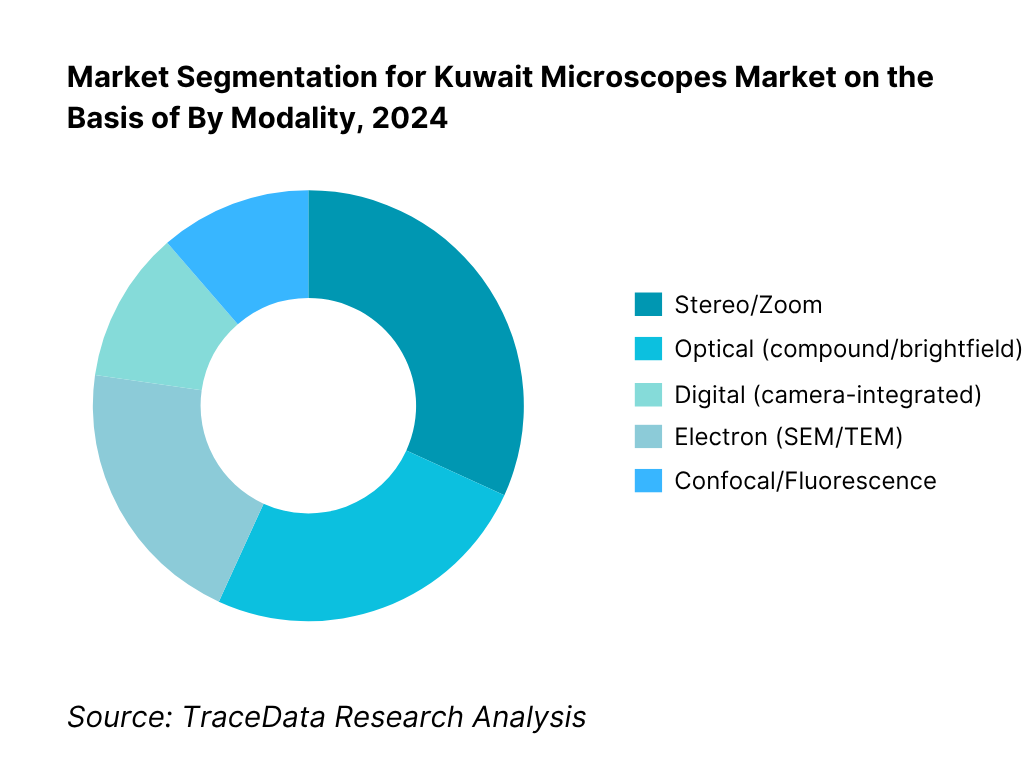

By Modality: Kuwait Microscopes market is segmented by modality into optical, stereo/zoom, digital, electron, confocal/fluorescence, and scanning probe. Stereo/zoom holds the dominant share in Kuwait under the modality segmentation. This is due to large purchases by public hospitals and teaching laboratories for routine dissection, grossing, and QC—mirrored in inbound trade where stereoscopic microscopes form the single largest HS-level flow (USD 4.50m) and Germany’s high-end stereo units account for the bulk of value (USD 3.98m), aligning with distributor portfolios and tender specifications favoring robust, serviceable platforms for routine workloads.

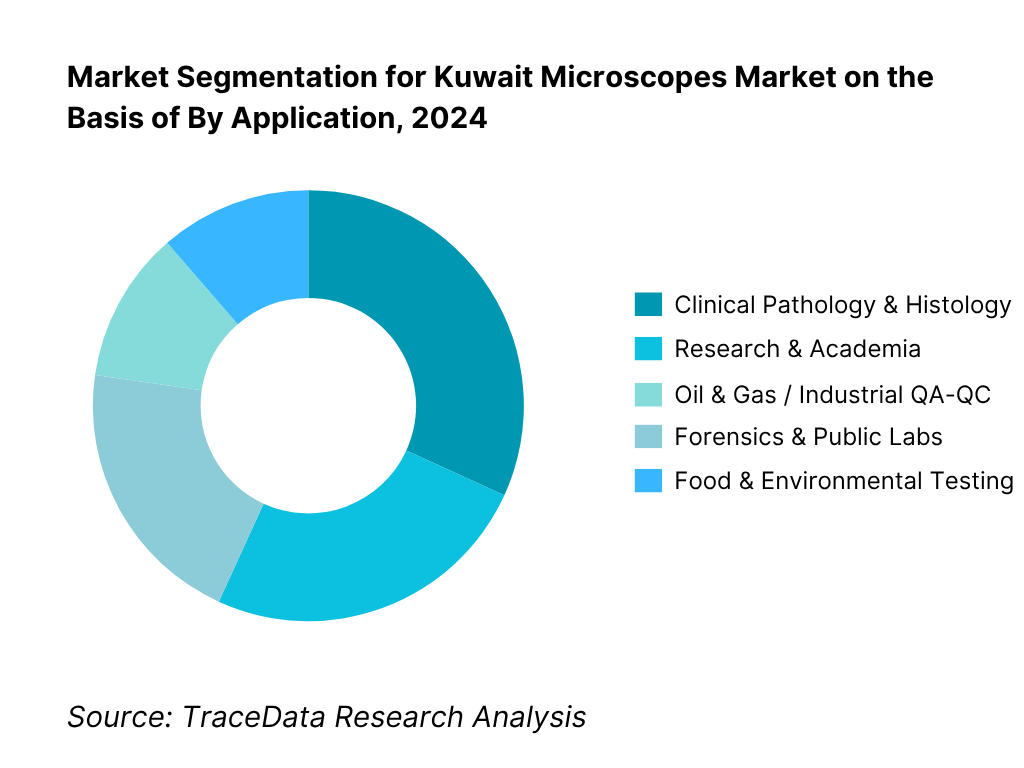

By Application: Kuwait Microscopes market is segmented by application into clinical pathology & histology, research & academia, oil & gas/industrial QA-QC, forensics & public labs, and food & environmental testing. Clinical pathology & histology currently dominates in Kuwait under the application segmentation because MOH tertiary hospitals and private diagnostic centers have the highest fixed installed base and turnover in slide-based workflows, with expanding digital pathology pilots and steady consumables pull-through. Procurement records and trade patterns show consistent imports of optical bodies and parts—both necessary to keep clinical imaging fleets operational and compliant—underpinning this segment’s primacy.

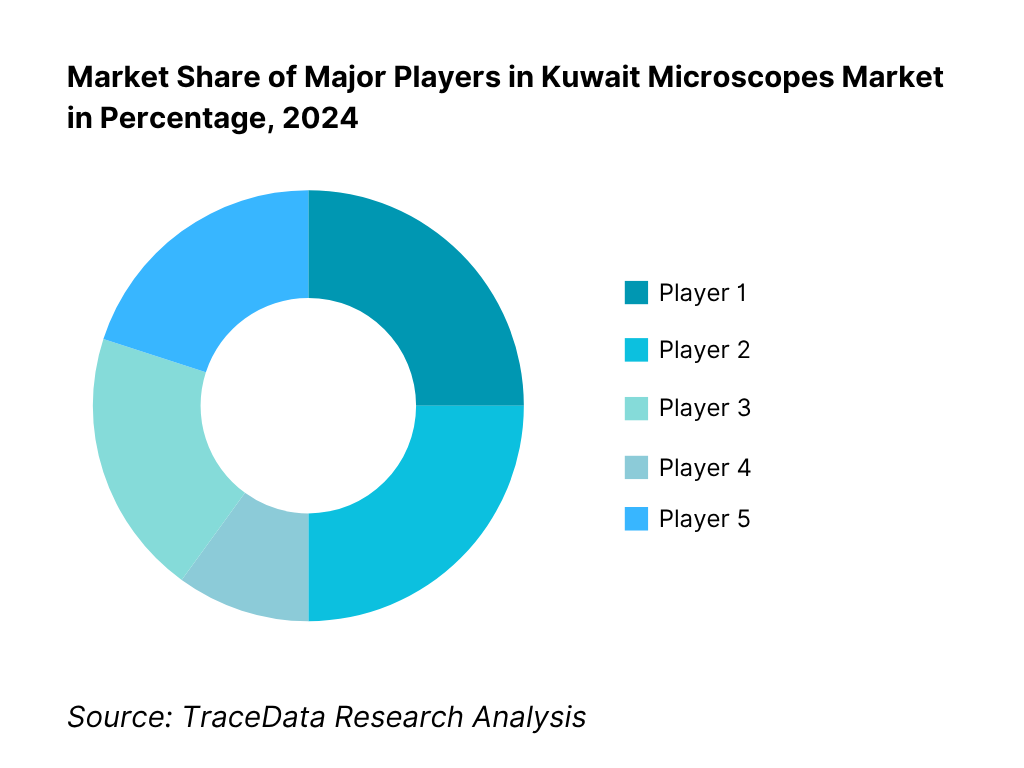

Competitive Landscape in Kuwait Microscopes Market

The Kuwait microscopes market features a concentrated set of global OEMs supplying via authorized distributors. Optical categories are led by German and Japanese brands, with strong pipeline into public-sector tenders and university cores. Electron and scanning probe systems are fewer in number but high in value, typically supported from regional hubs in the UAE and KSA. This concentration gives leading OEMs leverage in specifications, bundled service, and training ecosystem design.

Name | Founding Year | Original Headquarters |

Thermo Fisher Scientific | 2006 | Waltham, USA |

ZEISS (Carl Zeiss Microscopy) | 1846 | Jena, Germany |

Leica Microsystems | 1869 | Wetzlar, Germany |

Nikon Instruments (Nikon Corp.) | 1917 | Tokyo, Japan |

Evident (Olympus spin-off) | 2021 | Tokyo, Japan |

JEOL Ltd. | 1949 | Tokyo, Japan |

Hitachi High-Tech | 2001 | Tokyo, Japan |

Bruker | 1960 | Karlsruhe, Germany |

TESCAN | 1991 | Brno, Czech Republic |

Keyence | 1974 | Osaka, Japan |

Meiji Techno | 1964 | Saitama, Japan |

Motic | 1988 | Xiamen, China |

Labomed (Labo America) | 1976 | Fremont, USA |

Vision Engineering | 1958 | Woking, UK |

Dino-Lite (AnMo Electronics) | 2000 | Hsinchu, Taiwan |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

ZEISS (Carl Zeiss Microscopy): A global leader in optics, ZEISS strengthened its presence in Kuwait by supplying advanced stereo and confocal microscopes through CAPT tenders. In 2024, ZEISS expanded partnerships with Kuwait University and KISR, focusing on digital imaging platforms that support both pathology and nanotechnology research.

Leica Microsystems: Known for its dominance in histopathology workflows, Leica Microsystems has enhanced its Kuwait portfolio with new digital slide scanners. In 2024, the company collaborated with MOH hospitals to pilot digital pathology solutions, targeting efficiency in high-volume diagnostic centers.

Evident (Olympus): Evident reinforced its role in clinical microscopy by launching upgraded digital microscopy systems in Kuwait’s private hospital sector. In 2024, Evident also introduced bundled service and training packages for pathology labs, helping facilities address workforce gaps in advanced imaging.

Nikon Instruments: Nikon has been actively targeting the academic and research market in Kuwait, particularly at Kuwait University. In 2024, Nikon introduced high-resolution fluorescence platforms to biology labs and emphasized its software ecosystem (NIS-Elements) for advanced life sciences research.

Thermo Fisher Scientific (Phenom SEM): Thermo Fisher focused on benchtop SEM adoption in Kuwait’s oil & gas QA/QC labs. In 2024, Phenom systems were positioned as compact and cost-effective alternatives to full-scale SEMs, driving uptake among industrial players needing rapid materials analysis.

What Lies Ahead for Kuwait Microscopes Market?

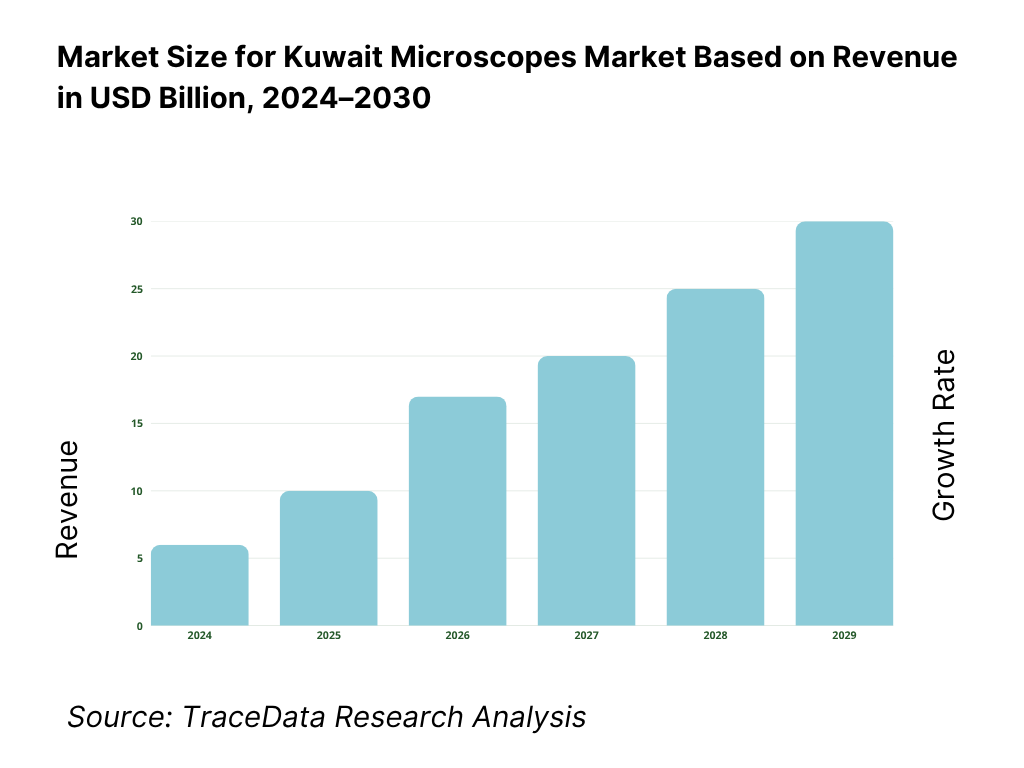

The Kuwait microscopes market is expected to advance steadily through the end of the decade, supported by consistent healthcare expenditure, investments in research and academia, and modernization across oil & gas quality assurance labs. Growth will be underpinned by Kuwait’s strong fiscal base, continued procurement through CAPT tenders, and rising adoption of advanced imaging solutions in both clinical and industrial applications.

Rise of Digital & Automated Microscopy: The future of the Kuwait microscopes market will be shaped by the increasing demand for digital imaging and automated workflows. Hospitals are piloting digital pathology systems, while universities are adopting motorized and software-integrated microscopes to improve precision, speed, and data sharing across labs.

Focus on Clinical Pathology & Diagnostics: Clinical pathology is set to remain the dominant application segment, with MOH tertiary hospitals and private diagnostic chains investing in optical, confocal, and slide scanning systems. This reflects Kuwait’s growing healthcare needs and the shift toward efficient diagnostic workflows.

Expansion of Industrial & Oil & Gas Applications: Kuwait’s petroleum-driven economy ensures sustained demand for microscopes in QA/QC labs for materials testing, corrosion studies, and failure analysis. Benchtop SEM and metallurgical microscopes are gaining traction as cost-effective solutions to support industrial and petrochemical applications.

Integration of AI & Image Analytics: The deployment of AI-enabled image analysis and software platforms will increase in Kuwait’s labs, enabling automated classification, quantitative image analysis, and better integration with LIS/LIMS systems. This evolution will enhance workflow efficiency and help laboratories optimize resource utilization.

Kuwait Microscopes Market Segmentation

By Modality

Optical (Compound/Brightfield)

Stereo/Zoom

Digital (Camera-Integrated)

Confocal & Fluorescence

Electron (SEM/TEM)

Scanning Probe (AFM)

By Application

Clinical Pathology & Histology

Research & Academia

Oil & Gas / Industrial QA-QC

Forensics & Public Labs

Food & Environmental Testing

By End-User

MOH & Public Hospitals

Private Hospitals & Diagnostic Centers

Universities & Research Institutes (Kuwait University, KISR)

Oil & Gas Sector Labs (KOC, KNPC, KIPIC)

Forensics & Public Reference Labs (MOI, PAFN)

By Sales Channel

CAPT/GCC Tenders

Direct Institutional Procurement

Distributor-Led Projects

Educational Retail & Training Suppliers

By Region

Kuwait City

Hawalli

Ahmadi

Farwaniya

Jahra

Players Mentioned in the Report:

Thermo Fisher Scientific

ZEISS (Carl Zeiss Microscopy)

Leica Microsystems

Nikon Instruments

Evident (Olympus)

JEOL Ltd

Hitachi High-Tech

Bruker

TESCAN

Keyence

Meiji Techno

Motic

Labomed (Labo America)

Vision Engineering

Dino-Lite (AnMo)

Key Target Audience

Hospital procurement & biomedical engineering heads (MOH tertiary hospitals; Mubarak Al-Kabeer, Jaber, Al-Sabah networks)

Private diagnostics & reference lab directors (Al Borg, Dar Al Shifa-affiliated labs, leading chains)

University & research core facility managers (Kuwait University; KISR centers)

Oil & gas QA/QC laboratory managers (KOC, KNPC, KIPIC, PIC)

Forensics & public laboratory administrators (Ministry of Interior Forensics; Public Authority for Food & Nutrition)

Industrial manufacturing QA leaders (metallography/failure analysis units in fabrication and utilities)

Investments and venture capitalist firms (healthcare/industrial technology portfolios)

Government and regulatory bodies

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for Microscopes in Kuwait (Direct OEM supply, Authorized Distributor, GCC Joint Tendering, Education Retail, Refurbished Imports-Margins, Preference, Strength, Weakness)

4.2 Revenue Streams for Kuwait Microscopes Market (Capex sales, Service contracts, Consumables, Software licenses, Training & Applications Support, Refurb/Lease programs)

4.3 Business Model Canvas for Kuwait Microscopes Market (Customer Segments, Value Proposition, Key Activities, Key Resources, Channels, Partnerships, Cost Structure, Revenue Streams)

5.1 Public Procurement (CAPT/GCC Tenders) vs Private Institutional Procurement (share, dynamics, lead times)

5.2 Investment Model in Kuwait Microscopes Market (Capex vs Opex, Trade-in programs, OEM financing)

5.3 Comparative Analysis of Procurement Funnel by Government vs Private Institutions (Tender specs, evaluation criteria, purchase approval cycles)

5.4 Microscopy Budget Allocation by Institution Type (MOH hospitals, Universities, Oil & Gas labs, Private Diagnostics)

8.1 Revenues, Historical & Current

9.1 By Market Structure (Public Procurement vs Private Procurement)

9.2 By Modality (Optical, Digital, Electron SEM/TEM, Confocal/Fluorescence, Scanning Probe/AFM)

9.3 By Application (Clinical Pathology, Research & Academia, Oil & Gas Materials Testing, Forensics, Food & Environmental Testing, Semiconductor/Electronics)

9.4 By End-User (MOH & Public Hospitals, Private Hospitals & Diagnostics, Universities & Research Institutes, Oil & Gas Sector Labs, Central Reference & Forensic Labs)

9.5 By Price Tier (Entry/Education, Mid-Range Clinical, High-End Research, Benchtop e-beam, Floor-standing e-beam)

9.6 By Sales Channel (CAPT/GCC tenders, Direct institutional sales, Distributor projects, Education retail)

9.7 By Region (Kuwait City, Hawalli, Ahmadi, Farwaniya, Jahra)

10.1 Institutional Client Landscape and Cohort Analysis (MOH, KISR, Oil & Gas, Universities, Forensics)

10.2 Microscopy Procurement Needs and Decision-Making Process (budget drivers, technical committees, tender requirements)

10.3 Utilization & ROI Analysis (lab throughput, uptime, service cost vs acquisition, digital workflow efficiency)

10.4 Gap Analysis Framework (unmet needs in digital pathology, advanced AFM, education sector)

11.1 Trends and Developments (Digital pathology, Portable digital microscopes, AI-based imaging, Benchtop SEM, Automation & Integration with LIS/LIMS)

11.2 Growth Drivers (Government healthcare spend, Research funding, Oil & Gas QA/QC needs, Digital transformation in pathology)

11.3 SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

11.4 Issues and Challenges (Tender delays, Service workforce scarcity, Import compliance, High TCO for e-beam systems)

11.5 Government Regulations (MOH device registration, KUCAS conformity, CAPT procurement laws, GCC joint procurement)

12.1 Market Size and Future Potential (Digital microscopy & slide scanning)

12.2 Business Models and Revenue Streams (Software, Cloud storage, Subscription, AI analytics)

12.3 Delivery Models and Types (Digital pathology, Remote teaching, Virtual microscopy)

15.1 Market Share of Key Players (basis revenues and installed base in Kuwait)

15.2 Benchmark of Key Competitors (Company Overview, Kuwait presence, USP, Business Model, Revenues, Distributor/Agent, Installed base, Pricing, Technology, Applications, Major Clients, Strategic Tie-ups, Recent Developments)

15.3 Operating Model Analysis Framework (direct vs distributor-led, demo labs, service centers)

15.4 Gartner Magic Quadrant (adapted for microscopy in Kuwait)

15.5 Bowman’s Strategic Clock (competitive advantage positioning)

16.1 Revenues (Forecast)

17.1 By Market Structure (Public vs Private)

17.2 By Modality (Optical, Digital, Electron, Confocal, AFM)

17.3 By Application (Clinical, Research, Industrial, Forensics, Education)

17.4 By End-User (Public Hospitals, Private Diagnostics, Research Institutes, Oil & Gas, Forensics)

17.5 By Price Tier (Entry, Mid, High-End)

17.6 By Sales Channel (Tenders, Direct, Distributor, Education)

17.7 By Region (Kuwait City, Hawalli, Ahmadi, Farwaniya, Jahra)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side entities (MOH tertiary hospitals, private diagnostic chains, Kuwait University, Kuwait Institute for Scientific Research, oil & gas QA/QC labs under KOC/KNPC, forensic laboratories, and the Public Authority for Food & Nutrition) as well as the supply-side entities (global OEMs such as ZEISS, Leica, Nikon, Thermo Fisher, Olympus/Evident, JEOL, Hitachi, and their authorized distributors in Kuwait). Based on this ecosystem, we shortlist 5–6 leading OEMs and distributors active in Kuwait using their tender participation records, channel strength, and installed base visibility. Sourcing is conducted through government tender databases (CAPT, MOH portals), OEC/Comtrade import statistics, OEM press releases, and proprietary subscription databases to collate industry-level information.

Step 2: Desk Research

We conduct exhaustive desk research by referencing diverse secondary and proprietary databases. This enables a thorough analysis of the Kuwait microscopes market, aggregating insights on trade inflows, procurement structures, and regulatory frameworks (KUCAS/PAI conformity and MOH registration). We evaluate aspects like import volumes, tender frequency, distributor presence, and demand concentration in Kuwait City and Hawalli. This is supplemented with company-level information, including OEM annual reports, distributor partnership announcements, and tender-winning records. Together, these sources provide a foundational understanding of market size dynamics, channel strength, and entity-level operations.

Step 3: Primary Research

We initiate in-depth interviews with C-level executives, distributor managers, hospital biomedical engineering heads, and research facility directors. This process serves to validate trade-based market hypotheses, authenticate data points, and extract operational and financial insights. A bottom-up approach is applied to estimate revenues by modality and application, which is then aggregated to form the Kuwait market view. As part of validation, our team also conducts disguised interviews with distributors and hospital purchasing committees, approaching as potential clients. This enables cross-checking of pricing, service levels, and procurement cycles against secondary datasets. These interviews clarify revenue streams (device sales, service contracts, consumables), value chains, pricing structures, and warranty/service frameworks unique to Kuwait.

Step 4: Sanity Check

A bottom-up and top-down reconciliation exercise is carried out, using HS 9011/9012 import values as a baseline cross-check against OEM shipment announcements, distributor records, and public tender data. This dual approach ensures that the Kuwait microscopes market size is both statistically valid and operationally consistent. The modeling outputs undergo sensitivity testing to align with macroeconomic indicators such as Kuwait’s USD 153.1 billion GDP and public health expenditure commitments.

FAQs

01 What is the Potential for the Kuwait Microscopes Market?

The Kuwait Microscopes Market holds strong potential, valued at USD 12.3 million in 2024 for optical devices, according to industry analysis. This momentum is supported by the country’s extensive healthcare infrastructure, including over 4.8 million residents served by MOH tertiary hospitals, as well as active research centers like Kuwait University and KISR. Continuous investment from Kuwait’s oil & gas sector further expands demand for advanced imaging in materials testing. Together, these factors ensure a steady growth trajectory for the microscopes market in Kuwait.

02 Who are the Key Players in the Kuwait Microscopes Market?

The Kuwait Microscopes Market features leading global OEMs such as ZEISS, Leica Microsystems, Nikon Instruments, Evident (Olympus), and Thermo Fisher Scientific. These companies dominate due to their extensive product portfolios in clinical and research imaging, strong distributor partnerships, and active participation in CAPT tenders. Other notable players with growing footprints include JEOL, Hitachi High-Tech, Bruker, TESCAN, and Keyence, alongside mid-tier suppliers like Meiji Techno, Motic, Labomed, Vision Engineering, and Dino-Lite, which serve education and industrial segments.

03 What are the Growth Drivers for the Kuwait Microscopes Market?

Key growth drivers include healthcare expansion, with Kuwait’s MOH hospitals and private diagnostic labs modernizing pathology infrastructure to serve a population of over 4.8 million. A second driver is the oil & gas sector, where Kuwait produced 2,408 thousand barrels per day in late 2024, underpinning QA/QC demand in petrochemicals and metallurgy. The third driver is the academic ecosystem, with 42,697 students and 1,691 faculty at Kuwait University fueling training and research use-cases. These macroeconomic and institutional pillars directly sustain procurement of microscopes.

04 What are the Challenges in the Kuwait Microscopes Market?

Challenges include import compliance, with microscopes falling under Kuwait’s Conformity Assessment Scheme (KUCAS), requiring Technical Inspection Reports and clearance certificates for customs release. A second barrier is logistics performance: the World Bank ranks Kuwait 51st globally in its 2023 Logistics Performance Index, which can delay instrument clearance and spares. Finally, there is a skills gap, as UNESCO data shows Kuwait reporting fewer researchers per million compared with global R&D leaders, limiting adoption of advanced systems like SEM and AFM without heavy OEM training.