Laos Auto Finance Market Outlook to 2029

By Market Structure, By Financial Institutions, By Vehicle Type, By Loan Tenure, By Consumer Age Group, and By Region

- Product Code: TDR0123

- Region: Asia

- Published on: February 2025

- Total Pages: 80

Report Summary

The report titled “Laos Auto Finance Market Outlook to 2029 – By Market Structure, By Financial Institutions, By Vehicle Type, By Loan Tenure, By Consumer Age Group, and By Region” provides a comprehensive analysis of the auto finance market in Laos. The report covers an overview and genesis of the industry, the overall market size in terms of loan disbursement value, market segmentation, trends and developments, regulatory landscape, customer profiling, issues and challenges, and competitive landscape, including the competition scenario, cross-comparison, opportunities, bottlenecks, and profiling of major financial institutions. The report concludes with future market projections based on loan disbursement value, market trends, regional demand, key drivers, and success case studies highlighting major opportunities and potential risks.

Laos Auto Finance Market Overview and Size

The Laos auto finance market reached an estimated valuation of LAK 6.5 Trillion in 2023, driven by the increasing demand for vehicle ownership, expanding banking and financial services, and a growing middle-class population seeking convenient financing options. The market is characterized by major players, including BCEL Leasing, Lao Development Bank, ACLEDA Bank Lao, and Maruhan Japan Bank, among others, which offer financing solutions catering to diverse consumer needs.

In 2023, BCEL Leasing introduced new flexible repayment options and reduced interest rates to attract more borrowers. This initiative aligns with the growing demand for affordable financing solutions in Laos and aims to enhance vehicle ownership accessibility. Key markets such as Vientiane, Luang Prabang, and Pakse have witnessed a rise in auto financing due to urbanization and increasing vehicle demand.

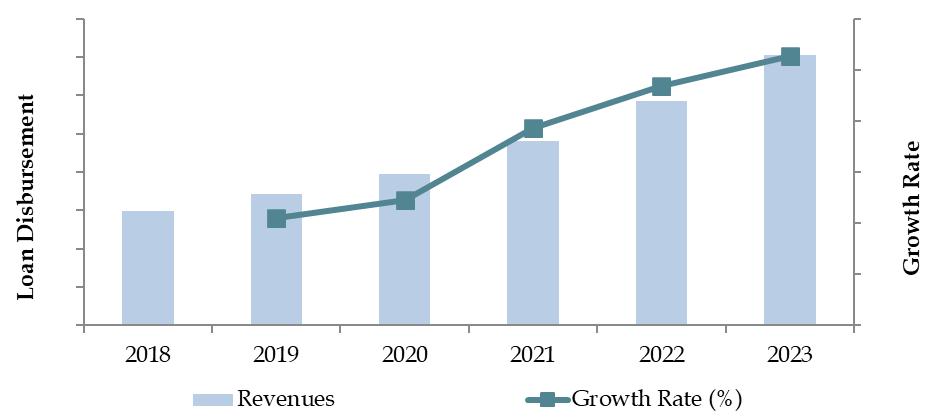

Market Size for Laos Auto Finance Industry Based on Loan Disbursement Value (USD Billion), 2018-2023

What Factors are Driving the Growth of the Laos Auto Finance Market?

Economic Factors: Laos’ economic expansion and infrastructure development have led to increased disposable incomes, contributing to a higher demand for auto financing. The rising cost of vehicles has made auto loans a preferred choice for consumers, particularly for middle-income buyers who rely on financing for car purchases. In 2023, approximately 70% of new vehicle purchases in Laos were financed through loans, highlighting the critical role of auto finance in car ownership.

Increasing Vehicle Ownership Aspirations: Laos has witnessed a shift in consumer preferences towards personal vehicles due to inadequate public transport infrastructure. The auto loan penetration rate in Laos is expected to reach 80% by 2029, as more consumers opt for financing solutions to afford vehicles.

Growth of Financial Institutions and Digital Lending: The expansion of commercial banks and non-banking financial institutions (NBFIs) has led to increased loan availability and competitive interest rates. The digitalization of banking services has streamlined auto loan applications, making financing more accessible. In 2023, over 35% of auto loan applications in Laos were processed online, reflecting a shift towards digital finance solutions.

Which Industry Challenges Have Impacted the Growth of the Laos Auto Finance Market?

Limited Financial Awareness and Credit Access: Concerns about financial literacy and access to formal banking services pose significant challenges to the auto finance market in Laos. Approximately 40% of potential borrowers struggle to secure auto loans due to a lack of credit history or collateral requirements. Many consumers, especially in rural areas, rely on informal lending sources, which often come with higher interest rates and less favorable terms, further restricting market growth.

High Interest Rates and Loan Repayment Challenges: Auto loan interest rates in Laos remain relatively high compared to regional markets, impacting affordability for many consumers. Interest rates for auto loans range between 8% and 12% in 2023, depending on loan tenure and financial institutions. Additionally, inconsistent income levels and economic uncertainties have contributed to a rise in non-performing auto loans, which accounted for approximately 6% of total loan portfolios in 2023. This challenge discourages financial institutions from expanding their auto lo

Regulatory Barriers and Policy Uncertainties: Stringent regulations and frequent policy changes create barriers to auto loan approvals and disbursements. In 2023, it was reported that 25% of auto loan applications were delayed or rejected due to complex documentation and compliance requirements. Additionally, strict rules on used vehicle imports have restricted the financing options available for second-hand cars, further limiting choices for budget-conscious consumers.

What Are the Regulations and Initiatives Governing the Laos Auto Finance Market?

Loan Eligibility and Credit Assessment Policies: The Bank of the Lao PDR mandates strict credit assessment procedures for auto loan approvals. In 2023, around 70% of auto loans required a minimum credit score and income proof, making it challenging for informal sector workers to access financing. Financial institutions are required to assess repayment capacity based on verifiable income sources before approving loans.

Interest Rate Regulations and Consumer Protection Laws: To prevent predatory lending practices, Laos has introduced maximum interest rate caps for auto loans, ensuring consumer protection. Additionally, financial institutions must disclose all loan terms, including fees and penalties, to borrowers before finalizing contracts. In 2023, regulatory bodies fined three financial institutions for non-compliance with transparency requirements.

Restrictions on Used Vehicle Financing: To regulate emissions and vehicle safety, the Lao government has imposed restrictions on financing used vehicles older than 10 years. This policy, enforced since 2022, has resulted in a 15% decline in used car loan approvals. While this initiative aims to modernize the vehicle fleet and reduce environmental impact, it limits financing options for budget-conscious consumers.

Laos Auto Finance Market Segmentation

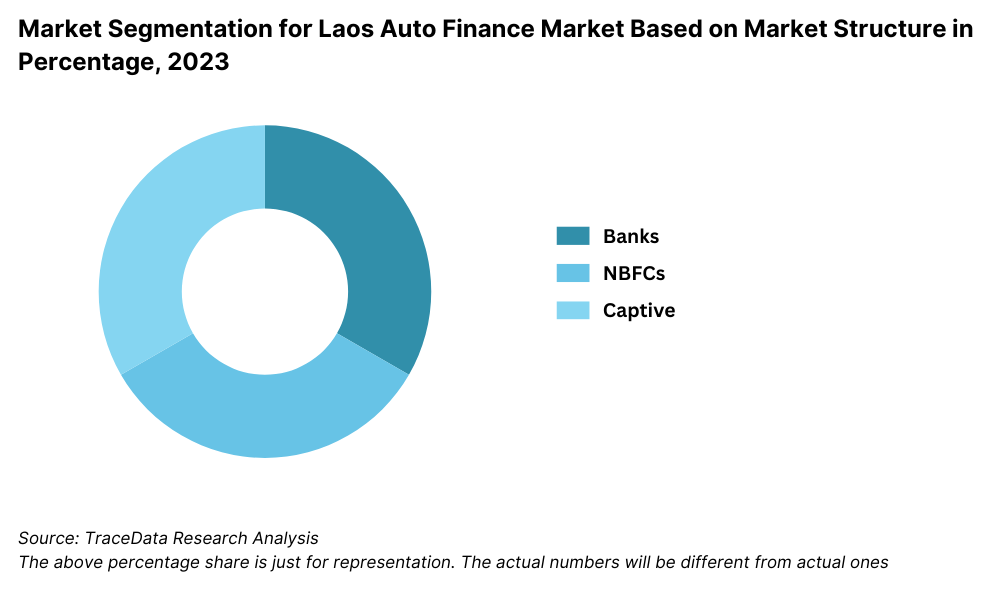

By Market Structure: The banking sector dominates the auto finance market due to its extensive branch networks, established trust, and competitive interest rates. Major banks such as BCEL, Lao Development Bank, and ACLEDA Bank Lao play a crucial role in vehicle financing. They offer structured loan products with defined terms and conditions, making them the preferred choice for salaried professionals and businesses. Non-banking financial institutions (NBFIs) also hold a growing share of the market, catering to consumers who may not meet traditional banking requirements.

Market Segmentation for Laos Auto Finance Market Based on Market Structure in Percentage, 2023

By Financial Institution: Commercial Banks lead the market as they provide structured financing solutions with lower interest rates and longer repayment periods. In 2023, around 65% of auto loans in Laos were issued by commercial banks, including BCEL and Lao Development Bank. Microfinance Institutions (MFIs) cater to consumers with lower credit scores or those without formal income documentation. These institutions offer auto loans at higher interest rates but with more flexible eligibility criteria, making them a crucial segment for informal sector workers.

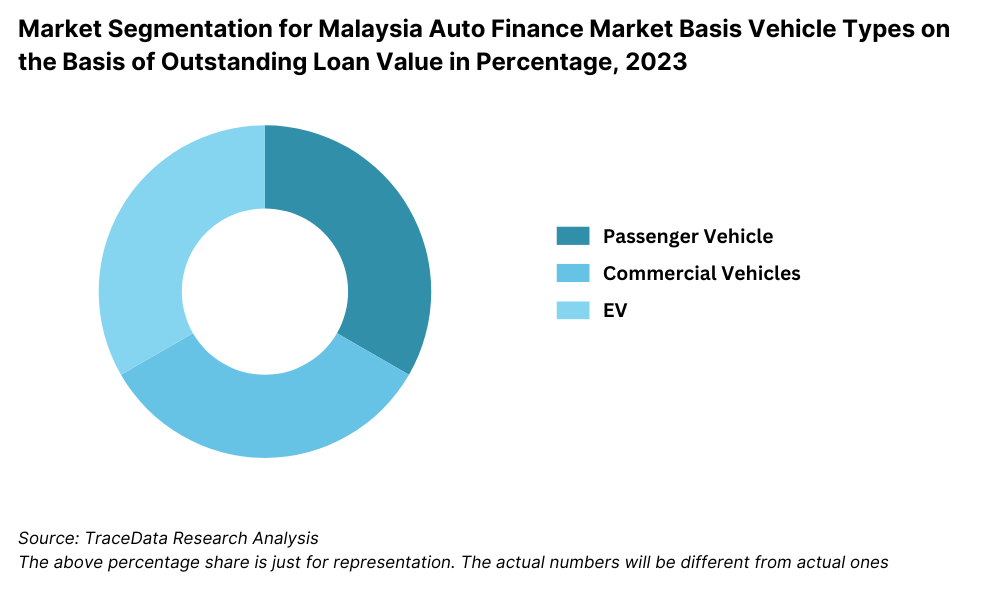

By Vehicle Type: New vehicles dominate the auto finance market, accounting for approximately 75% of financed vehicles in 2023. Consumers prefer new cars due to better fuel efficiency, warranty coverage, and financing incentives offered by manufacturers and banks. Used car financing remains limited, as many banks and financial institutions impose age restrictions on vehicles eligible for loans. However, this segment is projected to grow as digital lending platforms simplify the loan approval process.

Market Segmentation for Malaysia Auto Finance Market Basis Vehicle Types on the Basis of Outstanding Loan Value in Percentage, 2023

Competitive Landscape in Laos Auto Finance Market

The Laos auto finance market is relatively concentrated, with a few major banks and financial institutions dominating the space. However, the increasing presence of microfinance institutions (MFIs), leasing companies, and digital lending platforms has diversified the market, offering consumers more financing options and flexible repayment structures.

| Name | Founding Year | Original Headquarters |

|---|---|---|

| BCEL (Banque Pour Le Commerce Extérieur Lao) | 1975 | Vientiane, Laos |

| Maruhan Japan Bank Laos | 2007 | Tokyo, Japan |

| JDB Bank (Joint Development Bank) | 1989 | Vientiane, Laos |

| ACLEDA Bank Lao Ltd. | 2008 | Phnom Penh, Cambodia |

| Phongsavanh Bank | 2007 | Vientiane, Laos |

| Kasikornbank (Laos) | 1945 | Bangkok, Thailand |

| SACOM Bank Laos (Sacombank Laos) | 2010 | Ho Chi Minh City, Vietnam |

| Lao Development Bank | 2003 | Vientiane, Laos |

| Toyota Leasing (Lao) Co., Ltd. | 2016 | Vientiane, Laos |

| ANZ Laos (Australia & New Zealand Banking Group Limited) | 2007 | Melbourne, Australia |

Some of the Recent Competitor Trends and Key Information about Competitors Include:

BCEL Leasing: As one of the leading auto finance providers in Laos, BCEL Leasing has maintained a strong market presence. In 2023, the company recorded a 15% increase in auto loan approvals, driven by the introduction of flexible repayment plans and digital loan processing services. Its strategic partnerships with automobile dealerships have further strengthened its loan disbursement growth.

Lao Development Bank: Known for its extensive branch network across Laos, Lao Development Bank saw a 12% rise in auto loan disbursements in 2023, particularly among middle-income borrowers. The bank introduced a specialized financing program for first-time car buyers, making vehicle ownership more accessible.

ACLEDA Bank Lao: A dominant player in the microfinance sector, ACLEDA Bank Lao has expanded its presence in the auto loan market, particularly in rural and semi-urban areas. In 2023, approximately 30% of its total loan portfolio was allocated to auto financing, emphasizing affordable loan options for low-income consumers.

Maruhan Japan Bank: Maruhan Japan Bank has gained market share due to its competitive interest rates and quick loan processing times. The bank reported a 20% increase in auto loan approvals in 2023, fueled by the introduction of digital loan applications and an AI-based credit assessment model.

Lao-China Bank: With a growing focus on corporate and expatriate customers, Lao-China Bank has positioned itself as a key player in high-value auto financing and leasing services. In 2023, the bank recorded a 10% growth in vehicle leasing contracts, with a particular focus on fleet financing for businesses.

What Lies Ahead for the Laos Auto Finance Market?

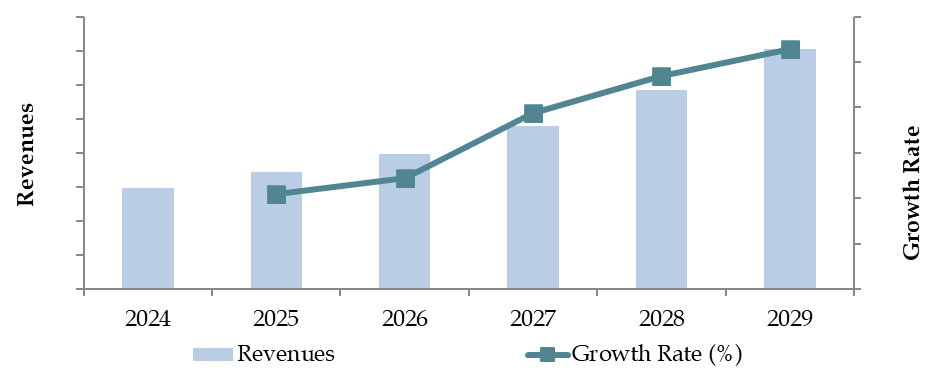

The Laos auto finance market is projected to expand steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be driven by increasing vehicle demand, financial inclusion initiatives, and the rising adoption of digital lending solutions.

Expansion of Digital Auto Financing: The adoption of online loan application platforms, AI-driven credit scoring, and mobile banking solutions is expected to streamline auto loan approvals and enhance accessibility for consumers. By 2029, over 50% of auto loan applications in Laos are anticipated to be processed digitally, reducing paperwork and improving loan approval turnaround times.

Growth in Used Vehicle Financing: With rising vehicle prices and limited disposable income, the demand for used car financing is expected to increase. Financial institutions are likely to introduce flexible loan schemes for second-hand vehicles, overcoming current regulatory challenges and expanding credit availability for budget-conscious buyers.

Increasing Role of Microfinance Institutions (MFIs): MFIs are expected to play a crucial role in making auto loans more accessible to low-income and rural consumers. By 2029, MFIs are projected to account for over 40% of total auto loans, offering small-ticket financing solutions with lower entry barriers compared to commercial banks.

Introduction of Green Auto Finance and Electric Vehicle (EV) Loans: As part of Laos' commitment to environmental sustainability, financial institutions are expected to roll out low-interest financing options for electric and hybrid vehicles. Government-backed initiatives such as reduced taxes on EV loans and incentives for eco-friendly vehicle ownership will boost green auto financing adoption in the coming years.

Future Outlook and Projections for Laos Car Finance Market on the Basis of Loan Disbursements in USD Billion, 2024-2029

Laos Auto Finance Market Segmentation

• By Market Structure:

- Commercial Banks

- Microfinance Institutions (MFIs)

- Leasing Companies

- Non-Banking Financial Institutions (NBFIs)

- Digital Auto Loan Providers

- Government-Backed Financial Institutions

• By Vehicle Type:

- New Vehicles

- Used Vehicles

- Electric Vehicles (EVs) and Hybrid Cars

- Commercial Vehicles

• By Loan Tenure:

- 1-3 Years

- 3-5 Years

- 5+ Years

• By Consumer Age Group:

- 18-25

- 25-40

- 40-55

- 55+

• By Region:

- Vientiane

- Central Laos

- Northern Laos

- Southern Laos

- Western Laos

Players Mentioned in the Report (Banks):

- Lao-Viet Bank

- Maruhan Japan Bank Laos

- Indochina Bank

- BFL Bred Group

- Sai Gon Ha Noi Bank Lao Limited

- ACLEDA Bank Lao

- Krungsri Bank (Bank of Ayudhya)

- Krungthai Bank

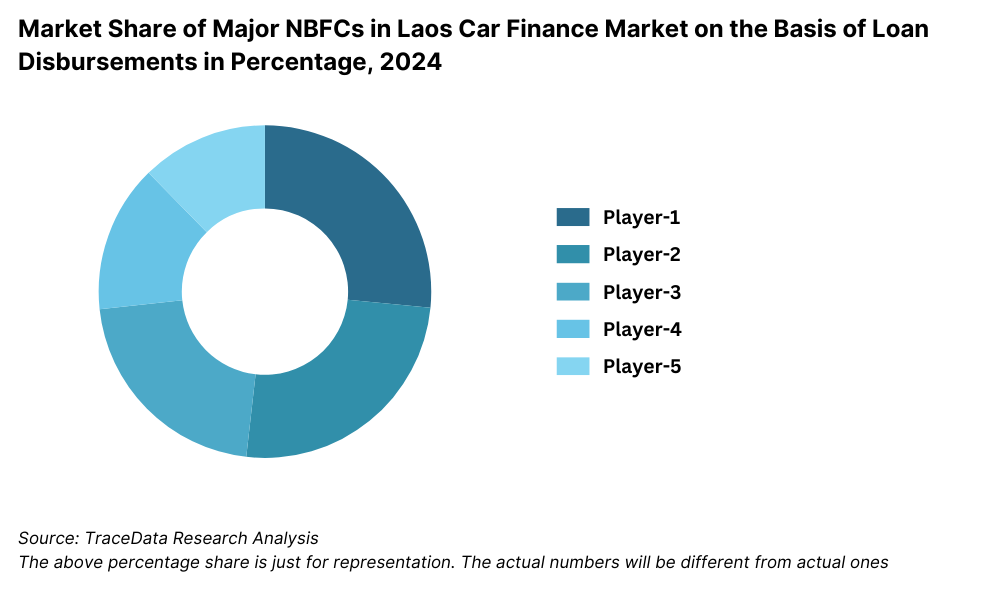

Players Mentioned in the Report (NBFCs):

- BSP Finance Lao

- Sabaidee Leasing Co., Ltd.

- KB KOLAO Leasing Co., Ltd.

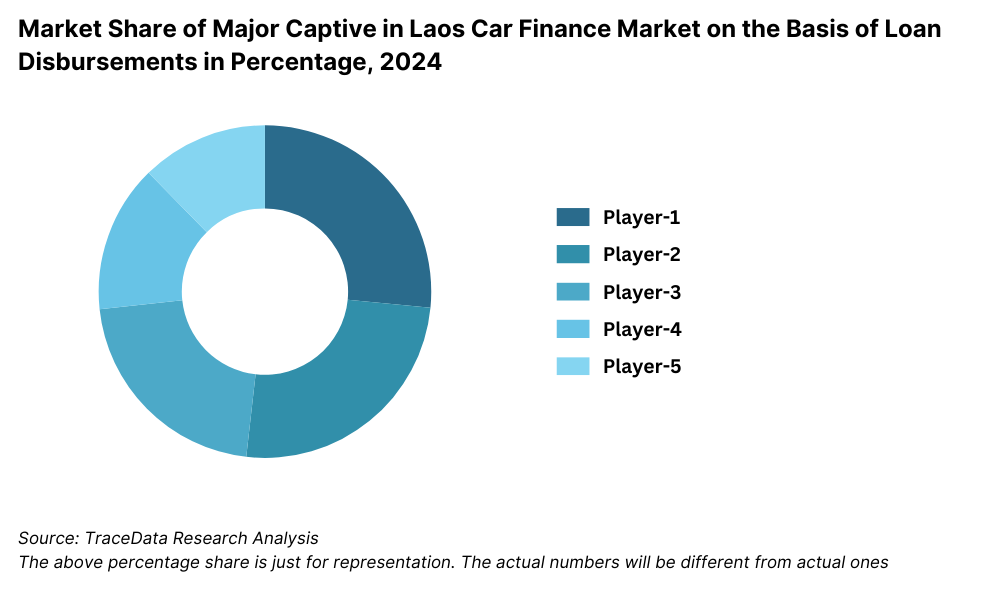

Players Mentioned in the Report (Captive):

- Toyota Tsusho Leasing (Lao) Co., Ltd.

- Lao Ford City (partnered with multiple finance companies)

Key Target Audience:

- Commercial Banks

- Microfinance Institutions (MFIs)

- Automobile Leasing Companies

- Regulatory Bodies (e.g., Bank of the Lao PDR)

- Automotive Dealerships

- Digital Lending Platforms

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Laos by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024P

9.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By Type of Vehicle (New, Used, Electric), 2023-2024P

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Laos Car Finance Market

11.2. Growth Drivers for Laos Car Finance Market

11.3. SWOT Analysis for Laos Car Finance Market

11.4. Issues and Challenges for Laos Car Finance Market

11.5. Government Regulations for Laos Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

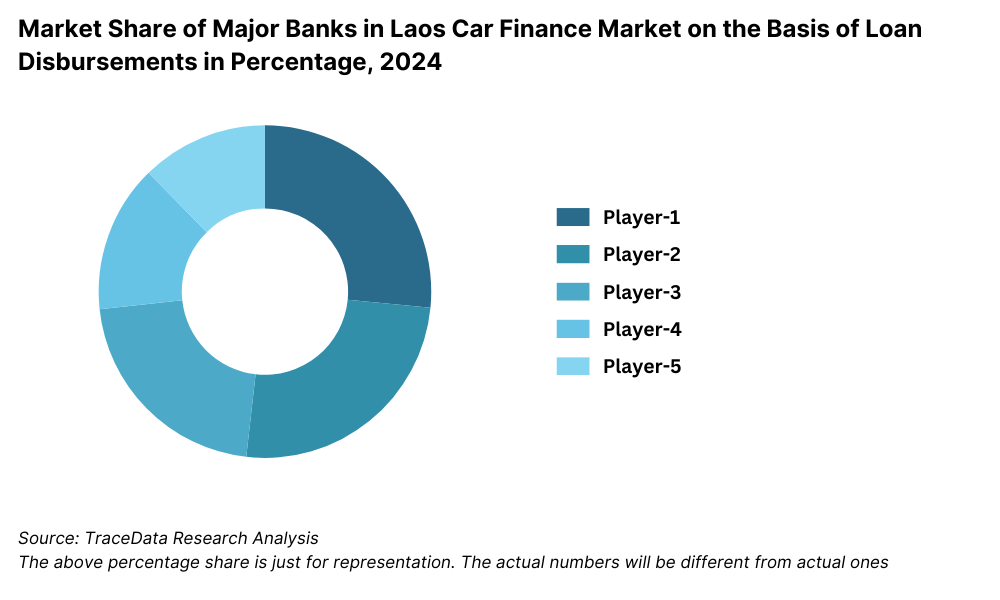

17.1. Market Share of Key Banks in Laos Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Laos Car Finance Market, 2024

17.3. Market Share of Key Captive in Laos Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Laos Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New, Used, Electric), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, Above 8 years), 2025-2029

19.6. Recommendation

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Laos Auto Finance Market. Based on this ecosystem, we will shortlist leading 5-6 financial institutions in the country based on their financial performance, loan disbursement volume, and market share.

Sourcing is conducted through industry articles, financial reports, regulatory filings, and multiple secondary and proprietary databases to gather market-level data and insights.

Step 2: Desk Research

An exhaustive desk research process is undertaken by referencing diverse secondary and proprietary databases to analyze the Laos auto finance industry comprehensively.

The research covers aspects such as loan disbursement value, market structure, interest rate trends, major players, regulatory environment, and consumer preferences.

Additionally, company-level data is examined through sources like press releases, financial statements, and annual reports to understand financial institutions' performance in the auto loan sector.

Step 3: Primary Research

Conduct a series of in-depth interviews with C-level executives, industry experts, and financial institution representatives in the Laos auto finance market.

The primary research is used to validate market hypotheses, confirm statistical data, and gain deeper operational and financial insights from key stakeholders.

A bottom-to-top approach is utilized to evaluate loan volumes for each institution, which is then aggregated to determine the total market size.

As part of our validation strategy, our team executes disguised interviews, approaching financial institutions as potential customers to verify loan offerings, interest rates, and financial models.

Step 4: Sanity Check

Bottom-to-top and top-to-bottom analysis along with market size modeling exercises are conducted to ensure data accuracy and consistency.

Cross-verification of findings with historical trends, expert opinions, and regulatory data ensures the sanity check process is robust and reliable.

FAQs

1. What is the potential for the Laos Auto Finance Market?

The Laos Auto Finance Market is poised for substantial growth, reaching a valuation of LAK 12 Trillion by 2029. This growth is driven by factors such as the increasing demand for vehicle ownership, expansion of financial services, and rising accessibility of digital lending platforms. The market’s potential is further bolstered by government policies supporting financial inclusion and the introduction of electric vehicle (EV) financing programs.

2. Who are the Key Players in the Laos Auto Finance Market?

The Laos Auto Finance Market features several key players, including BCEL Leasing, Lao Development Bank, ACLEDA Bank Lao, Maruhan Japan Bank, Lao-China Bank, and Phongsavanh Bank. These institutions dominate the market due to their wide-reaching networks, competitive loan products, and strong brand presence. Other notable players include leasing companies and microfinance institutions (MFIs), which provide flexible financing solutions for different consumer segments.

3. What are the Growth Drivers for the Laos Auto Finance Market?

The primary growth drivers include rising vehicle ownership demand, as urbanization and limited public transportation options make personal vehicles a necessity for many consumers. The expansion of financial services, including commercial banks, microfinance institutions (MFIs), and digital lending platforms, has improved access to auto financing. Additionally, government incentives for electric vehicle (EV) financing, such as lower interest rates and tax exemptions, are encouraging more consumers to opt for green vehicle financing. The adoption of technology-driven loan processing, including AI-based credit scoring and digital applications, is making auto loans more accessible and efficient.

4. What are the Challenges in the Laos Auto Finance Market?

The Laos Auto Finance Market faces several challenges, including limited access to credit, as approximately 40% of potential borrowers struggle to secure auto loans due to a lack of credit history or collateral. High interest rates, ranging from 8% to 12%, make financing less affordable for many consumers. Regulatory constraints on used car financing, including strict documentation requirements and restrictions on financing older vehicles, limit options for budget-conscious buyers. Additionally, the slow adoption of digital lending solutions remains a barrier, as only 30% of auto loans were processed digitally in 2023, indicating the need for further technological advancements in the sector.