Laos Cold Chain Market Outlook to 2029

By Service Type (Cold Storage and Cold Transportation), By End Users (Dairy, Fruits & Vegetables, Meat & Seafood, Pharmaceuticals), By Region, and By Temperature Range

- Product Code: TDR0289

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Laos Cold Chain Market Outlook to 2029 – By Service Type (Cold Storage and Cold Transportation), By End Users (Dairy, Fruits & Vegetables, Meat & Seafood, Pharmaceuticals), By Region, and By Temperature Range” provides a comprehensive assessment of the cold chain industry in Laos. It covers an overview and genesis of the market, overall industry size in terms of revenue, market segmentation, key drivers, trends and developments, regulatory scenario, customer profile, challenges, and comparative landscape. The report concludes with forward-looking projections based on market revenue, services, regional share, end-use sectors, and includes success case studies, opportunities, and market constraints.

Laos Cold Chain Market Overview and Size

The Laos cold chain market was valued at LAK 850 Billion in 2023, propelled by the expansion of the food retail sector, increasing demand for temperature-sensitive pharmaceuticals, and rising export opportunities in agri-produce and meat products. The market is served by both domestic and regional logistics players, with a focus on building cold storage warehouses near major urban centers like Vientiane, Savannakhet, and Pakse.

Major players include Lao Logistics Group, Savan Logistics, and regional operators like DHL Laos, who offer cold storage and last-mile temperature-controlled logistics for food and healthcare products. Foreign aid-funded infrastructure developments and private investments in logistics parks have also supported sector growth.

In 2023, Lao Logistics Group launched a multi-temperature storage facility in Vientiane to cater to increasing demand from food exporters and pharma companies. This marked a significant milestone in the modernization of Laos’ temperature-controlled supply chain infrastructure.

%2C%202019-2024.png)

What Factors are Leading to the Growth of Laos Cold Chain Market:

Food & Agriculture Exports: Laos’ agriculture exports, particularly fresh fruits, vegetables, and chilled meat to China, Thailand, and Vietnam, require efficient cold chain support. Export volumes for perishables have grown by 18% CAGR between 2019 and 2023, necessitating expanded temperature-controlled logistics.

Healthcare & Pharma Distribution: The pharmaceutical segment has seen a surge in demand for vaccines, insulin, and temperature-sensitive diagnostics. In 2023, healthcare logistics accounted for approximately 22% of total cold chain revenue, driven by the need for cold storage compliance in rural and cross-border distribution.

Retail & Supermarket Expansion: The entry and growth of modern retail formats such as Mini Big C and local supermarket chains in Vientiane and Luang Prabang has increased the need for organized storage and timely delivery of frozen and chilled foods.

Which Industry Challenges Have Impacted the Growth for Laos Cold Chain Market

Limited Infrastructure and Equipment: One of the most pressing challenges is the underdeveloped cold chain infrastructure. According to sector estimates, over 60% of food producers in Laos lack access to reliable cold storage facilities. This leads to high spoilage rates, especially for perishable goods such as fruits and seafood, with post-harvest losses estimated at 25–30%. The limited availability of temperature-controlled vehicles further complicates last-mile delivery.

High Operating Costs: The cost of setting up and maintaining cold storage and refrigerated transportation is high due to unreliable electricity supply and dependency on diesel-based backup systems. These costs are often passed on to end consumers or absorbed by SMEs, making cold chain services unaffordable for many small producers and exporters.

Lack of Technical Expertise: There is a significant shortage of trained personnel in temperature-sensitive logistics operations. Industry stakeholders report that nearly 40% of cold storage facilities in Laos face periodic issues related to improper temperature monitoring, maintenance, and non-compliance with safety standards. This limits the capacity of the sector to handle sensitive categories like pharmaceuticals or biologics.

What are the Regulations and Initiatives Which Have Governed the Market

Food Safety and Quality Control Regulations: The Ministry of Health and Ministry of Agriculture and Forestry in Laos have introduced food handling standards and cold chain guidelines for processed and perishable products. These regulations, though still evolving, require proper temperature tracking and certified transport for high-risk food categories. In 2023, compliance enforcement increased, particularly for export-oriented agribusinesses.

ASEAN Harmonization Initiatives: As a member of ASEAN, Laos is working toward harmonizing its cold chain and logistics standards with regional guidelines. This includes adopting Good Distribution Practices (GDP) for pharmaceuticals and aligning with ASEAN Food Safety Policy frameworks. These measures are expected to increase regional trade compatibility and attract foreign logistics players into the market.

Public-Private Partnerships (PPPs) and Donor Funding: Development partners such as ADB, JICA, and the World Bank are supporting cold chain modernization through infrastructure development, capacity building, and concessional loans. A recent ADB-backed logistics corridor project in central Laos includes plans for temperature-controlled warehouses along key agri-export routes. In 2023, over LAK 120 billion in investment was committed to PPP projects aimed at reducing cold chain gaps.

Laos Cold Chain Market Segmentation

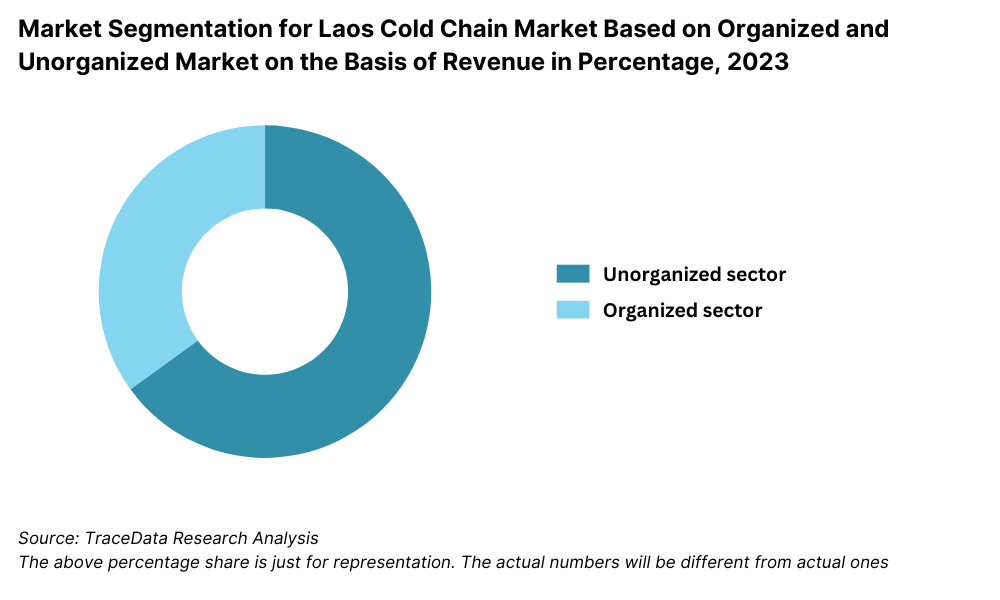

By Market Structure: Unorganized players dominate the market due to their affordability, flexible operations, and presence in local supply chains, especially for agri-produce and meat in peri-urban and rural regions. These operators often provide ad-hoc cold storage solutions and short-haul refrigerated transport. However, organized service providers are gaining ground, particularly in urban areas, due to rising demand from supermarkets, pharmaceutical companies, and exporters. Organized players offer standardized services, temperature tracking, and better hygiene compliance, attracting clients seeking reliability and consistency.

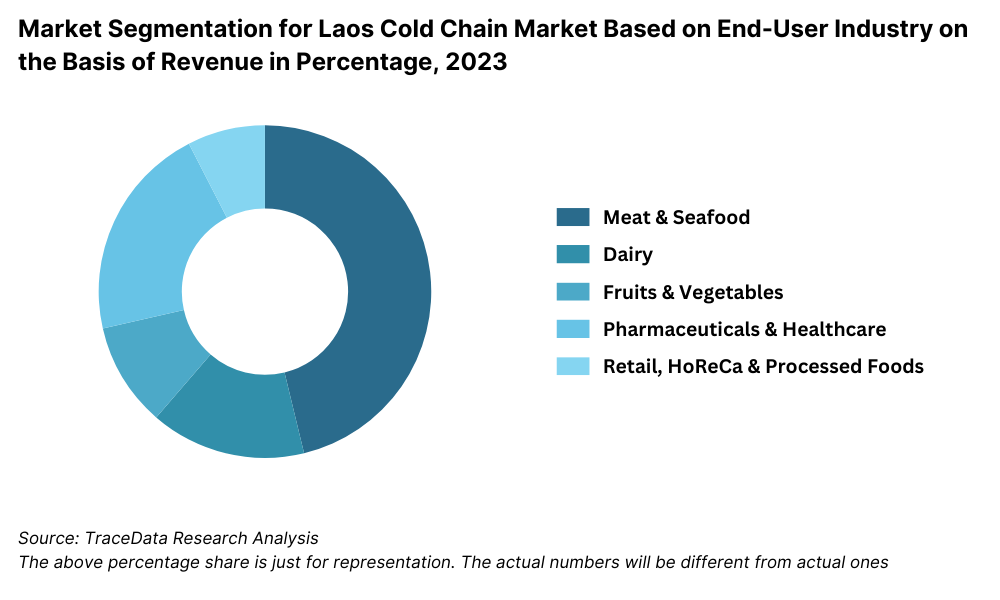

By End-User Industry: Meat & seafood is the leading end-user segment in the Laos cold chain market due to strong domestic consumption and growth in cross-border exports, especially to Thailand and Vietnam. Dairy follows as the second major contributor, driven by increasing imports and government-supported school milk distribution programs. Fruits & vegetables and pharmaceuticals are emerging segments due to rising modern retail demand and health sector developments. Pharma is particularly reliant on temperature-sensitive distribution for vaccines and essential medicines.

By Temperature Range: Chilled storage (0°C to 10°C) dominates the market as most perishable products like dairy, vegetables, and meat require this range. Chilled infrastructure is more prevalent across logistics parks and wholesale markets. Frozen storage (below -18°C) has a smaller but growing share, used primarily for seafood and processed foods. Demand for frozen logistics is expected to rise with increasing frozen food imports and exports.

Competitive Landscape in Laos Cold Chain Market

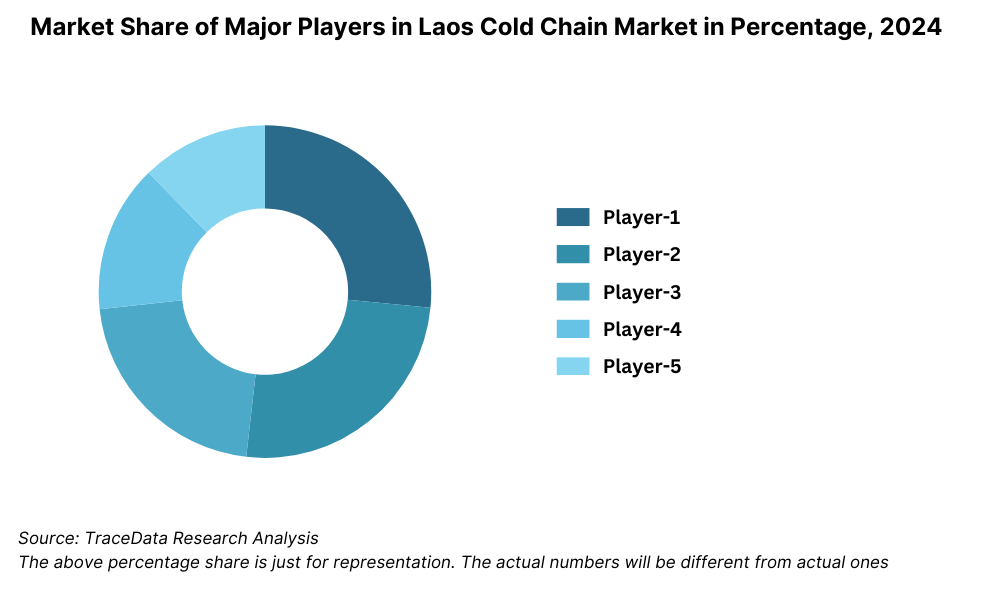

The Laos cold chain market is moderately fragmented, with a mix of local logistics providers and regional players catering to different industries. However, the sector is evolving as international logistics companies and donor-funded infrastructure initiatives promote organized cold chain expansion. Key players in the market include Lao Logistics Group, Savan Logistics, Lao Freight Forwarder, Vientiane Cold Storage, and DHL Laos.

Company Name | Establishment Year | Headquarters |

Lao Logistics Group | 2011 | Vientiane, Laos |

Savan Logistics | 2009 | Savannakhet, Laos |

Lao Freight Forwarder | 1996 | Vientiane, Laos |

Vientiane Cold Storage | 2018 | Vientiane, Laos |

DHL Laos | 2002 | Vientiane, Laos |

Some of the recent competitor trends and key information about competitors include:

Lao Logistics Group: One of the leading state-backed logistics providers in Laos, the company recently opened a new multi-temperature cold storage warehouse near the Vientiane Logistics Park in 2023. The facility is aimed at improving the agri-export cold chain and attracting foreign investors in the processed food sector.

Savan Logistics: Strategically located near the East-West Economic Corridor, Savan Logistics has expanded its refrigerated cross-border transport services to Thailand and Vietnam. In 2023, the company reported a 20% increase in frozen goods volumes, especially seafood and processed meat.

Lao Freight Forwarder: A pioneer in freight and warehouse services, the company has introduced temperature-controlled containers for pharma distribution across central and southern Laos. In 2023, their cold chain division grew by 12%, largely driven by seasonal vaccine storage contracts.

Vientiane Cold Storage: A relatively new entrant, the firm focuses on short-haul chilled storage services for fresh produce and dairy suppliers in the Vientiane region. In 2023, it reported a 30% increase in cold room rentals, driven by growing supermarket chains.

DHL Laos: Leveraging global expertise, DHL offers cold chain logistics for pharmaceuticals and high-value perishables. The company has expanded its GDP-compliant pharma transport network across hospitals and pharmacies in 2023, targeting private healthcare providers and NGO partners.

What Lies Ahead for Laos Cold Chain Market?

The Laos cold chain market is projected to grow steadily by 2029, exhibiting a strong CAGR during the forecast period. This growth is expected to be fueled by infrastructure investments, rising demand for perishable goods, and increased focus on food and pharmaceutical safety.

Expansion of Agricultural Exports: With government and international support, Laos is set to enhance its agri-export capabilities, especially in fruits, vegetables, and meat. This will require robust cold chain networks for maintaining freshness and meeting international quality standards, driving demand for both cold storage and transportation services.

Rising Role of Pharmaceuticals: As Laos’ healthcare sector expands and demand for temperature-sensitive products like vaccines and biologics grows, cold chain providers are likely to invest more in GDP-compliant pharma logistics. Partnerships with private hospitals, NGOs, and global health initiatives will further push growth in this segment.

Technology Integration in Cold Chain: The adoption of IoT, GPS tracking, and temperature monitoring systems is expected to rise. These technologies will enable real-time visibility, reduce spoilage, and improve operational efficiency. Small and medium operators are also expected to benefit from government and donor-backed digitalization initiatives.

Cross-Border Trade and Regional Integration: Laos’ strategic location in the ASEAN corridor positions it well for cross-border cold chain trade. Projects like the Laos-China Railway and East-West Economic Corridor are expected to increase the movement of temperature-sensitive goods across borders, making cold chain services more vital than ever.

%2C%202024-2030.png)

Laos Cold Chain Market Segmentation

• By Market Structure:

o Organized Cold Chain Operators

o Unorganized/Informal Cold Storage Providers

o Public Cold Storage Facilities

o Private Logistic Parks with Cold Chain Facilities

o Cross-Border Cold Chain Service Providers

o Food Retail and FMCG-Based Cold Chain

o Pharma & Medical Cold Chain Providers

• By End-User Industry:

o Meat & Seafood

o Dairy Products

o Fruits & Vegetables

o Pharmaceuticals & Vaccines

o Frozen Processed Foods

o Foodservice (Hotels, Restaurants, and Catering)

o Agro-Exporters

• By Temperature Range:

o Chilled (0°C to 10°C)

o Frozen (< -18°C)

o Controlled Ambient (15°C to 25°C)

• By Type of Service:

o Cold Storage Warehousing

o Refrigerated Transportation

o End-to-End Cold Chain Logistics

o Temperature Monitoring & Tracking Services

o Third-Party Cold Chain Logistics

• By Region:

o Vientiane

o Savannakhet

o Luang Prabang

o Champasak

o Bokeo

o Oudomxay

Players Mentioned in the Report:

• Lao Logistics Group

• Savan Logistics

• Lao Freight Forwarder

• Vientiane Cold Storage

• DHL Laos

• CEFL Logistics

• Mekong Cold Storage Initiative

Key Target Audience:

• Cold Chain Logistics Providers

• Food and Beverage Exporters

• Pharmaceutical Distributors

• Government and Regulatory Authorities

• Retail Chains and Supermarkets

• Development Agencies and Donor Organizations

• Infrastructure Investors

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges that they Face

4.2. Revenue Streams for Laos Cold Chain Market

4.3. Business Model Canvas for Laos Cold Chain Market

4.4. Buying Decision Making Process

4.5. Supply Decision Making Process

5.1. Cold Chain Infrastructure Overview in Laos, 2018-2024

5.2. Cold Storage Capacity vs Demand in Laos, 2018-2024

5.3. Public vs Private Cold Chain Facilities, 2024

5.4. Number of Cold Chain Providers in Laos by Region

8.1. Revenues, 2018-2024

8.2. Volume Handled (Tons), 2018-2024

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Type of Service (Storage, Transportation, End-to-End), 2023-2024P

9.3. By Temperature Range (Chilled, Frozen, Controlled Ambient), 2023-2024P

9.4. By Region (Vientiane, Savannakhet, Luang Prabang, Others), 2023-2024P

9.5. By End-User Industry (Dairy, Meat & Seafood, Fruits & Vegetables, Pharmaceuticals, Others), 2023-2024P

10.1. Customer Landscape and Usage Patterns

10.2. Customer Journey and Vendor Selection Process

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Laos Cold Chain Market

11.2. Growth Drivers for Laos Cold Chain Market

11.3. SWOT Analysis for Laos Cold Chain Market

11.4. Issues and Challenges for Laos Cold Chain Market

11.5. Government Regulations for Laos Cold Chain Market

12.1. Cold Chain Trade Flows with ASEAN Neighbors

12.2. Role of Special Economic Zones and Logistics Parks

12.3. Comparison of Laos vs Thailand and Vietnam Cold Chain Ecosystem

13.1. Investment by Development Agencies and PPPs, 2018-2029

13.2. Cost of Operation and Subsidy Landscape

13.3. Cold Chain Financing Instruments Used in Laos

13.4. Infrastructure Gap and Future Investment Requirements

13.5. Role of Foreign Aid in Cold Chain Expansion

16.1. Benchmark of Key Competitors in Laos Cold Chain Market including Company Overview, Capacity, Service Offering, Region Presence, Technology Used, and Growth Strategies

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Cold Chain Capability Quadrant

16.5. Porters Five Forces for Market Competitiveness

17.1. Revenues, 2025-2029

17.2. Volume Handled (Tons), 2025-2029

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Type of Service (Storage, Transportation, End-to-End), 2025-2029

18.3. By Temperature Range (Chilled, Frozen, Controlled Ambient), 2025-2029

18.4. By Region (Vientiane, Savannakhet, Luang Prabang, Others), 2025-2029

18.5. By End-User Industry (Dairy, Meat & Seafood, Fruits & Vegetables, Pharmaceuticals, Others), 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Laos Cold Chain Market. Basis this ecosystem, we will shortlist leading 5–6 service providers in the country based upon their financial information, operational capacity/volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the revenue generated, number of players, storage capacity, freight movement, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, development agency reports, project documentation, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Laos Cold Chain Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate revenue contribution and capacity for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of cold chain services, infrastructure utilization, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Laos Cold Chain Market?

The Laos cold chain market is expected to witness consistent growth, reaching an estimated valuation of LAK 1,350 Billion by 2029. This potential is driven by increasing demand for safe and efficient storage and transportation of perishable goods, rising exports of agri-products, growth in modern retail, and government-backed infrastructure development. Enhanced integration with ASEAN trade corridors further strengthens the long-term outlook for the market.

2. Who are the Key Players in the Laos Cold Chain Market?

The Laos Cold Chain Market includes several key players such as Lao Logistics Group, Savan Logistics, and Lao Freight Forwarder, who provide warehousing and cold transportation services. International players like DHL Laos and emerging local companies such as Vientiane Cold Storage also play a significant role in expanding capacity and technological capabilities across the cold chain segment.

3. What are the Growth Drivers for the Laos Cold Chain Market?

Major growth drivers include the expansion of the agriculture and food processing industry, rising demand for temperature-sensitive pharmaceuticals, and regional trade integration under ASEAN. Government partnerships with international development agencies and investment in logistics infrastructure have also significantly improved cold chain coverage across key provinces.

4. What are the Challenges in the Laos Cold Chain Market?

The Laos Cold Chain Market faces challenges such as limited cold storage capacity, high electricity and operating costs, and a shortage of trained personnel in cold chain management. Additionally, fragmented infrastructure in rural areas and lack of real-time monitoring systems hinder efficiency and service reliability. These factors need to be addressed to fully realize the market’s potential.