Malaysia Alcoholic Drinks Market Outlook to 2029

By Market Structure, By Product Types (Beer, Wine, Spirits, Others), By Consumer Demographics, By Distribution Channels (On-trade, Off-trade), and By Region

- Product Code: TDR0069

- Region: Asia

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “Malaysia Alcoholic Drinks Market Outlook to 2029 - By Market Structure, By Product Types (Beer, Wine, Spirits, Others), By Consumer Demographics, By Distribution Channels (On-trade, Off-trade), and By Region” provides a comprehensive analysis of the alcoholic drinks market in Malaysia. The report covers an overview of the industry, market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, consumer profiles, challenges, and competitive landscape. The report concludes with future market projections based on market size, product types, and regional distribution, along with success stories and key opportunities in the market.

Malaysia Alcoholic Drinks Market Overview and Size

The Malaysia alcoholic drinks market reached a valuation of MYR 15 Billion in 2023, driven by increasing consumer demand for diverse alcoholic beverages, a growing tourism sector, and rising disposable incomes. The market is characterized by major players such as Carlsberg Malaysia, Heineken Malaysia, Diageo, and Pernod Ricard. These companies are recognized for their wide range of product offerings, strategic distribution channels, and strong brand presence.

In 2023, Carlsberg Malaysia introduced a new line of craft beers aimed at tapping into the growing craft beer segment in urban areas. This initiative reflects the evolving preferences of Malaysian consumers, particularly in Kuala Lumpur and Penang, where premium and niche beverages are gaining popularity due to higher incomes and increased socialization trends.

Market Size for Malaysia Alcoholic Beverage Industry on the Basis of Revenue in USD Billion, 2018-2024

Source: TraceData Research Analysis

What Factors Are Leading to the Growth of Malaysia Alcoholic Drinks Market

Economic Factors: Rising disposable incomes and increasing urbanization have fueled the demand for alcoholic beverages, particularly among the middle and upper-income groups. In 2023, beer and spirits accounted for nearly 70% of the total alcoholic beverage sales in Malaysia.

Changing Consumer Preferences: Malaysia’s younger population, particularly millennials and Gen Z, are increasingly gravitating towards craft beers, premium spirits, and international wine brands. In 2023, the premium alcoholic drinks segment grew by 18%, indicating a shift towards high-end consumption.

Tourism and Hospitality: Malaysia's thriving tourism sector plays a pivotal role in the growth of the alcoholic drinks market. The influx of international tourists has boosted the demand for international spirits and wines, especially in hotels, bars, and restaurants.

Which Industry Challenges Have Impacted the Growth for Malaysia Alcoholic Drinks Market

Regulatory Restrictions: Strict regulations on the sale and consumption of alcohol, including high excise duties and restricted sales hours, pose challenges for market growth. In 2023, excise duties on alcoholic beverages in Malaysia were among the highest in Southeast Asia, limiting affordability and curbing consumer demand, particularly for lower-income groups.

Cultural and Religious Sensitivities: Malaysia’s significant Muslim population, where alcohol consumption is prohibited, limits the overall market potential. Approximately 60% of the population adheres to Islam, creating natural barriers to market expansion in certain regions. This challenge has led to a more concentrated demand in non-Muslim urban areas like Kuala Lumpur and Penang.

High Production and Import Costs: The cost of producing and importing alcoholic beverages has risen due to inflation and global supply chain disruptions. In 2023, these increased costs led to a price hike of nearly 10% across most alcoholic drink categories, impacting affordability and reducing consumption among price-sensitive consumers.

What are the Regulations and Initiatives which have Governed the Malaysia Alcoholic Drinks Market:

Excise Duties and Taxes: The Malaysian government imposes high excise duties and sales taxes on alcoholic beverages. In 2023, excise duties on alcohol were raised by 5%, which contributed to an increase in retail prices. These taxes are aimed at discouraging excessive alcohol consumption but have also impacted market affordability, especially for price-sensitive consumers.

Restrictions on Alcohol Sales: Alcohol sales in Malaysia are subject to strict regulations, including restrictions on sales hours, age limits (legal drinking age of 21), and designated locations for purchasing alcohol. In 2023, the enforcement of these restrictions remained stringent, particularly in regions with a majority Muslim population. Non-compliance can lead to hefty fines and license revocation for retailers.

Promotional Limitations: The government has set strict guidelines for alcohol advertising and promotion. In 2023, regulations continued to limit alcohol advertisements in mainstream media and public spaces, with a strong focus on ensuring that promotional content is not targeted towards minors or seen in predominantly Muslim areas.

Malaysia Alcoholic Drinks Market Segmentation

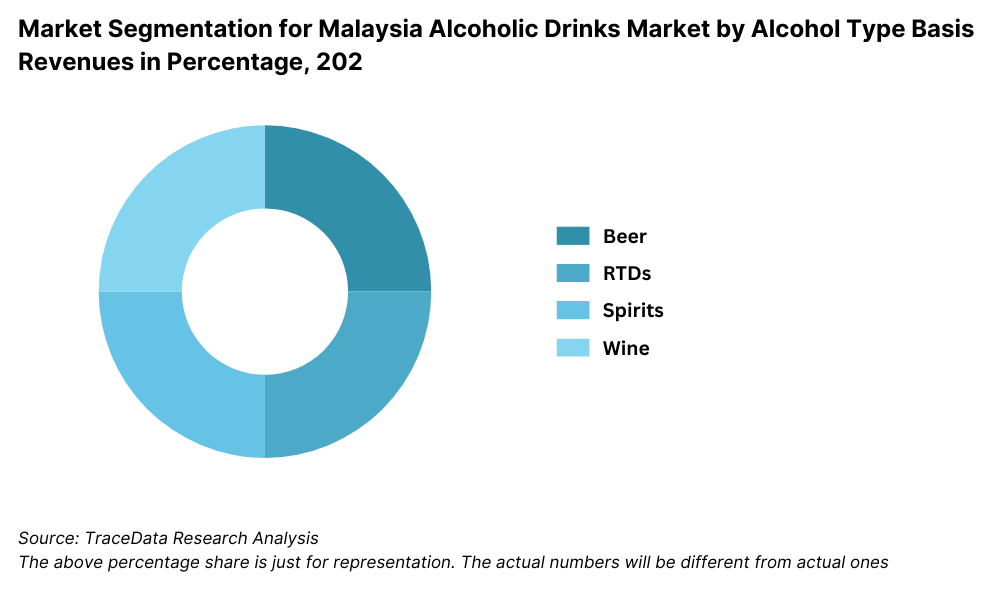

By Alcohol Type: Beer continues to dominate the alcoholic drinks market in Malaysia, accounting for the largest share of sales in 2023, driven by its affordability and widespread availability. Spirits, including whiskey and vodka, are gaining popularity, particularly among urban consumers, while wine consumption is steadily rising, especially in premium and imported segments.

By Price Segment: The alcoholic drinks market is segmented into economy, mid-range, and premium products. The economy segment captures a significant share due to its affordability and appeal among mass consumers. However, the premium segment has been experiencing faster growth, especially among higher-income groups and expatriates seeking international brands.

.png)

By Distribution Channel: Supermarkets and hypermarkets hold the largest market share due to their convenience and extensive range of products. On-trade sales, such as bars and restaurants, account for a substantial portion, particularly in urban areas. E-commerce platforms are growing rapidly, with online alcohol sales increasing by 20% in 2023 due to the convenience of home delivery services.

Competitive Landscape in Malaysia Alcoholic Drinks Market

The Malaysia alcoholic drinks market is relatively competitive, with a few major players holding a dominant share, while smaller local brewers and international brands are gaining ground. The expansion of e-commerce platforms and on-trade consumption in urban areas has further diversified the market. Key players include Carlsberg Malaysia, Heineken Malaysia, Diageo, Pernod Ricard, and smaller craft breweries.

| Company Name | Establishment Year | Headquarters |

|---|---|---|

| Heineken Malaysia Bhd | 1964 | Petaling Jaya, Malaysia |

| Carlsberg Brewery Malaysia Bhd | 1969 | Shah Alam, Selangor, Malaysia |

| Guinness Anchor Berhad (GAB) | 1989 | Petaling Jaya, Malaysia |

| Suntory Beverage & Food Malaysia | 2009 | Tokyo, Japan |

| Pernod Ricard Malaysia | 1975 | Paris, France |

| Asahi Group Holdings | 1889 | Tokyo, Japan |

| Diageo Malaysia | 1997 | London, United Kingdom |

| Bacardi-Martini Malaysia | 1862 | Hamilton, Bermuda |

| Moët Hennessy Diageo | 1987 | Paris, France |

| Pelican Winery (M) Sdn Bhd | 1998 | Kuala Lumpur, Malaysia |

Some of the recent competitor trends and key information about competitors include:

Carlsberg Malaysia: A leading player in the beer market, Carlsberg Malaysia recorded a 12% increase in sales in 2023, driven by the growing demand for its premium and craft beer offerings. The company launched new products catering to health-conscious consumers, such as low-calorie beers.

Heineken Malaysia: Heineken Malaysia saw a 10% growth in 2023, primarily from its premium and international beer portfolio. The company’s strong distribution network, combined with its digital marketing efforts, helped it maintain a leading position in urban markets.

Diageo: Known for its popular spirits brands like Johnnie Walker and Guinness, Diageo reported a 7% growth in spirits sales in 2023. The company continues to focus on premiumization and sustainability initiatives, targeting Malaysia’s affluent consumers and the hospitality sector.

Pernod Ricard: Pernod Ricard experienced a 9% growth in wine and spirits sales in 2023, driven by its strong presence in luxury wine and champagne segments. The company’s focus on e-commerce and digital campaigns has helped capture a growing online consumer base.

Malaysia Craft Brewers: Local craft breweries have been gaining popularity, particularly among younger consumers. In 2023, craft beer sales grew by 15%, with local brewers benefiting from the rising interest in unique and artisanal alcoholic beverages. These breweries often focus on innovative flavors and sustainable practices to attract niche markets.

What Lies Ahead for Malaysia Alcoholic Drinks Market?

The Malaysia alcoholic drinks market is projected to grow steadily through 2029, exhibiting a moderate CAGR during the forecast period. This growth is expected to be driven by rising disposable incomes, evolving consumer preferences, and the expansion of both retail and online distribution channels.

Premiumization of Alcoholic Beverages: As consumer spending power increases, there is a growing trend toward premium and international alcoholic brands. By 2029, premium alcoholic beverages, including craft beers, fine wines, and high-end spirits, are expected to capture a larger share of the market, particularly in urban areas.

Health-Conscious Offerings: The demand for low-alcohol and alcohol-free beverages is rising as health-conscious consumers seek healthier alternatives. Alcohol-free beer and low-calorie drinks are projected to grow in popularity, driven by a shift toward wellness-oriented consumption habits.

Growth of E-commerce Channels: Online sales of alcoholic beverages are expected to grow rapidly through 2029, as more consumers turn to digital platforms for convenience and variety. E-commerce will become a key driver of market growth, with online sales projected to account for up to 30% of total alcohol sales by 2029.

Sustainability Initiatives: There is an increasing focus on sustainability within the alcoholic drinks industry. By 2029, companies are expected to adopt more eco-friendly practices, such as using recyclable packaging, promoting carbon-neutral production processes, and reducing water usage. These initiatives will appeal to environmentally conscious consumers and could influence purchasing decisions.

Future Outlook and Projections for Malaysia Alcoholic Beverages Market on the Basis of Revenues in USD Billion, 2024-2029

Malaysia Alcoholic Drinks Market Segmentation

- By Alcohol Type:

- Beer

- Spirits (Whiskey, Vodka, Rum)

- Wine (Red, White, Sparkling)

- Cider

- Ready-to-Drink (RTD) Cocktails

- By Beer

- Lager

- Dark Beer and others

- By Beer

- Craft

- Standard Beer

- By RTDs

- Malt based RTDs

- Spirit Based RTDs

- Wine Based RTDs

- Non-Alcoholic RTDs and others

- By Spirits

- Brandy

- Dark Rum

- White Rum

- Whiskies

- Gin

- Vodka and others

- By Vodka

- Flavoured

- Non-Flavoured Vodka

- By Wine

- Fortified Wine

- Champagne

- Other Sparkling Wine

- Red Wine

- White Wine and others

- By Distribution Channel:

- On-Trade (Bars, Restaurants, Hotels)

- Off-Trade (Supermarkets, Hypermarkets, Convenience Stores)

- By Price Segment:

- Economy

- Mid-Range

- Premium

- Super Premium

- By Consumer Age:

- 18-24

- 25-34

- 35-54

- 55+

- By Region:

- Northern

- Southern

- Central

- Eastern

- Western

Players Mentioned in the Report:

- Carlsberg Brewery Malaysia Berhad

- Guinness Anchor Bhd.

- Heineken Malaysia Berhad

- Diageo Asia Pacific Pte Ltd.

- Kirin Brewery Company Limited (Malaysia)

- Anheuser-Busch InBev SA/NV (Malaysia)

- Thai Beverage Public Co. Ltd.

- Luen Heng F&B Sdn Bhd

- Pernod Ricard

- Malaysia Craft Brewers

Key Target Audience:

- Alcoholic Beverage Manufacturers

- Breweries

- Online Alcohol Marketplaces

- Hospitality and Tourism Industry

- Regulatory Bodies (e.g., Ministry of Domestic Trade and Consumer Affairs)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3. Ecosystem of Key Stakeholders in Malaysia Alcoholic Drinks Market

4.1. Value Chain Process-Role of Entities, Stakeholders, Gross Margins, and Challenges they Face

4.2. Business Model Canvas for Malaysia Alcoholic Drinks Market

4.3. Consumer Buying Decision Process

5.1. Market Overview and Genesis

5.2. Number of Breweries and Microbreweries, as on Date

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Type (Beer, Cider, RTDs, Spirits and Wine), 2018-2023

9.1.1. By Beer (Lager, Dark Beer and others), 2018-2023

9.1.1.1. By Lager (Domestic Premium and Imported Premium), 2018-2023

9.1.1.2. By Craft and Standard Beer, 2018-2023

9.1.1.3. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.2. By RTDs (Malt based RTDs, Spirit Based RTDs, Wine Based RTDs, Non-Alcoholic RTDs and others), 2018-2023

9.1.2.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.3. By Spirits (Brandy, Dark Rum, White Rum, Whiskies, Gin, Vodka and others), 2018-2023

9.1.3.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.3.2. By Flavoured and Non-Flavoured Vodka, 2018-2023

9.1.4. By Wine (Fortified Wine, Champagne, Other Sparkling Wine, Red Wine, White Wine and others), 2018-2023

9.1.4.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.2. By Off Trade and On Trade for Each Type of Alcoholic Beverages, 2023

9.2.1. By Distribution Channel for Off Trade, 2023

9.3. By Major States, 2023-2024P

10.1. Customer Landscape and Segment Analysis

10.2. Customer Journey and Decision-Making Process

10.3. Consumer Needs, Preferences, and Pain Points

10.4. Gap Analysis Framework

11.1. Trends and Developments in Malaysia Alcoholic Drinks Market

11.2. Growth Drivers for Malaysia Alcoholic Drinks Market

11.3. SWOT Analysis for Malaysia Alcoholic Drinks Market

11.4. Issues and Challenges for Malaysia Alcoholic Drinks Market

11.5. Government Regulations for Malaysia Alcoholic Drinks Market

14.1. Market Share of Key Players in Alcoholic Beverages Market, 2023

14.2. Market Share of Key Players in Beer Market, 2023

14.3. Market Share of Key Players in Wine Market, 2023

14.4. Market Share of Key Players in Spirits Market, 2023

14.5. Market Share of Key Players in RTDs Market, 2023

14.6. Benchmark of Key Competitors in Malaysia Alcoholic Drinks Market Basis 15-20 Operational and Financial Parameters

14.7. Strength and Weakness of Key Competitors

14.8. Operating Model Analysis Framework

14.9. Gartner Magic Quadrant for Market Positioning

14.10. Bowmans Strategic Clock for Competitive Advantage

15.1. Revenues, 2025-2029

15.2. Sales Volume, 2025-2029

16.1. By Type (Beer, Cider, RTDs, Spirits and Wine), 2025-2029

16.1.1. By Beer (Lager, Dark Beer and others), 2025-2029

16.1.1.1. By Lager (Domestic Premium and Imported Premium), 2025-2029

16.1.1.2. By Craft and Standard Beer, 2025-2029

16.1.1.3. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.2. By RTDs (Malt based RTDs, Spirit Based RTDs, Wine Based RTDs, Non-Alcoholic RTDs and others), 2025-2029

16.1.2.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.3. By Spirits (Brandy, Dark Rum, White Rum, Whiskies, Gin, Vodka and others), 2025-2029

16.1.3.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.3.2. By Flavoured and Non-Flavoured Vodka, 2025-2029

16.1.4. By Wine (Fortified Wine, Champagne, Other Sparkling Wine, Red Wine, White Wine and others), 2025-2029

16.1.4.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.2. By Off Trade and On Trade for Each Type of Alcoholic Beverages, 2025-2029

16.2.1. By Distribution Channel for Off Trade, 2025-2029

16.3. By Major States, 2025-2029

17.1. Strategic Recommendations

17.2. Opportunity Identification

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand and supply side entities for the Malaysia Alcoholic Drinks Market. Based on this ecosystem, we will shortlist 5-6 leading producers and distributors in the country by analyzing their financial performance, production capacity, and market share.

Sourcing information is conducted through industry articles, multiple secondary sources, and proprietary databases to perform detailed desk research on the market and collect industry-level data.

Step 2: Desk Research

Engage in comprehensive desk research by referencing diverse secondary and proprietary databases. This research process includes a thorough analysis of market trends, sales revenues, the number of players, pricing strategies, and consumer demand patterns. Additionally, company-level data is examined through press releases, annual reports, and financial statements, constructing a detailed understanding of market entities and competitive dynamics.

Step 3: Primary Research

Conduct in-depth interviews with C-level executives and stakeholders representing various companies in the Malaysia Alcoholic Drinks Market. The interviews are designed to validate market hypotheses, authenticate statistical data, and extract key operational and strategic insights from industry players. A bottom-up approach is used to evaluate sales volumes for each player, contributing to the overall market analysis.

As part of our validation, we carry out disguised interviews where we approach companies as potential customers. This method helps validate operational and financial details shared by executives and cross-checks it with secondary data. It also provides a deeper understanding of revenue streams, value chains, pricing strategies, and market dynamics.

Step 4: Sanity Check

- Conduct bottom-up and top-down analysis, along with market size modeling exercises, to ensure the accuracy of the data and the reliability of market projections. This process serves as a final check to validate the research findings and the overall market outlook.

FAQs

1. What is the potential for the Malaysia Alcoholic Drinks Market?

The Malaysia alcoholic drinks market is set for steady growth, with a projected market valuation of MYR 15 billion by 2029. This growth is driven by factors such as rising disposable incomes, increasing urbanization, and evolving consumer preferences towards premium and international alcoholic beverages. The expansion of e-commerce and on-trade sales further enhances the market's potential.

2. Who are the Key Players in the Malaysia Alcoholic Drinks Market?

Key players in the Malaysia alcoholic drinks market include Carlsberg Malaysia, Heineken Malaysia, Diageo, and Pernod Ricard. These companies dominate the market due to their strong brand presence, extensive product portfolios, and robust distribution networks. Local craft breweries are also gaining popularity, contributing to the market’s diversity.

3. What are the Growth Drivers for the Malaysia Alcoholic Drinks Market?

The primary growth drivers include increasing disposable incomes, the premiumization of alcohol consumption, and a growing trend toward online sales. Additionally, the rise of health-conscious offerings such as low-alcohol and alcohol-free beverages, along with expanding tourism, are key contributors to market growth.

4. What are the Challenges in the Malaysia Alcoholic Drinks Market?

The Malaysia alcoholic drinks market faces challenges such as high excise duties, regulatory restrictions on sales and advertising, and cultural sensitivities surrounding alcohol consumption. Additionally, the rising cost of production and distribution impacts pricing, which may deter price-sensitive consumers.