Malaysia Auto Finance Market Outlook to 2029

By Market Structure, By Banks and NBFCs, By Types of Vehicles Financed, By Loan Tenure, By Interest Rates, and By Region

- Product Code: TDR0128

- Region: Asia

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled "Malaysia Auto Finance Market Outlook to 2029 - By Market Structure, By Banks and NBFCs, By Types of Vehicles Financed, By Loan Tenure, By Interest Rates, and By Region." provides a comprehensive analysis of the auto finance market in Malaysia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on outstanding loan value, by market players, types of vehicles financed, regions, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Malaysia Auto Finance Market Overview and Size

The Malaysia auto finance market reached a valuation of MYR 140 Billion in 2023, driven by increasing vehicle ownership, rising disposable incomes, and favorable financing options. The market is characterized by major players such as Maybank, CIMB Bank, Public Bank, Bank Islam, and Toyota Capital Malaysia. These institutions are recognized for their competitive interest rates, flexible loan tenure, and extensive customer outreach.

In 2023, CIMB Bank introduced digital financing solutions aimed at streamlining the auto loan application process and improving customer experience. This initiative aligns with the growing digital adoption trend in Malaysia, providing a seamless and efficient financing journey for vehicle buyers. Kuala Lumpur and Selangor remain key markets due to their high vehicle ownership rates and strong economic activities.

Market Size for Malaysia Auto Finance Industry on the Basis of Credit Disbursed in USD Billion, 2018-2024

What Factors are Leading to the Growth of Malaysia Auto Finance Market:

Economic Factors: The stable economic growth and rising disposable incomes have increased consumers' ability to afford vehicle financing. In 2023, auto financing accounted for approximately 85% of total vehicle purchases in Malaysia, highlighting the reliance on structured financing solutions. Lower interest rates and attractive financing packages have further boosted loan adoption among consumers.

Growing Demand for Vehicles: The increasing demand for both new and used cars has directly contributed to the expansion of the auto finance market. In recent years, new vehicle sales in Malaysia grew by 9%, reflecting a strong consumer appetite for car ownership. Financial institutions have responded by offering more flexible repayment terms and higher loan-to-value ratios.

Digitalization: The rise of online banking and digital financing platforms has revolutionized the auto finance landscape, improving accessibility and transparency. In 2023, around 50% of auto loan applications in Malaysia were processed through digital channels, marking a significant shift towards fintech-driven financial solutions. These platforms offer real-time loan approvals, EMI calculators, and personalized financial recommendations, enhancing the overall loan procurement process.

Which Industry Challenges Have Impacted the Growth for Malaysia Auto Finance Market

Credit Risk and Default Rates: One of the significant challenges in the auto finance market is managing credit risk and minimizing default rates. According to industry data, approximately 8% of auto loan accounts were classified as non-performing in 2023. This scenario poses financial risks to lenders and can lead to tightened lending criteria, potentially limiting access to financing for lower credit score consumers.

Regulatory Compliance: Stringent regulations related to consumer financing, interest rate caps, and compliance requirements for financial institutions can create operational hurdles. In 2023, regulatory changes in the Malaysian financial sector introduced additional compliance requirements, impacting smaller non-banking financial companies (NBFCs) more significantly.

Market Competition: The auto finance market in Malaysia is highly competitive, with traditional banks, NBFCs, and emerging fintech players vying for market share. This competition can lead to reduced profit margins for financial institutions as they introduce more competitive interest rates and flexible loan products to attract customers.

What are the Regulations and Initiatives which have Governed the Market:

Consumer Credit Act: The Malaysian government has implemented regulations under the Consumer Credit Act, setting guidelines on interest rates, loan tenure, and transparency in loan agreements. In 2023, approximately 90% of auto finance providers adhered to these regulatory requirements, enhancing consumer protection and market stability.

Digital Finance Initiatives: The government has also promoted digital finance initiatives to streamline loan application processes and reduce approval times. In 2023, new digital guidelines were introduced to standardize e-KYC (Electronic Know Your Customer) processes across all financial institutions offering auto loans.

Support for Electric Vehicle Financing: To support Malaysia's sustainability goals, the government has introduced incentives for financing electric vehicles (EVs), including lower interest rates and tax benefits. These incentives are designed to increase the share of EVs in the financed vehicle segment, which reached 5% in 2023 and is projected to grow further in the coming years.

Malaysia Auto Finance Market Segmentation

By Market Structure: The auto finance market in Malaysia is segmented into banks, non-banking financial companies (NBFCs), and digital finance platforms. Banks hold the largest market share due to their established reputation, robust financial products, and widespread branch networks. NBFCs, while smaller in scale, offer competitive financing solutions, particularly for used vehicle financing. Digital finance platforms are emerging rapidly, providing quick and convenient loan approvals through technology-driven solutions.

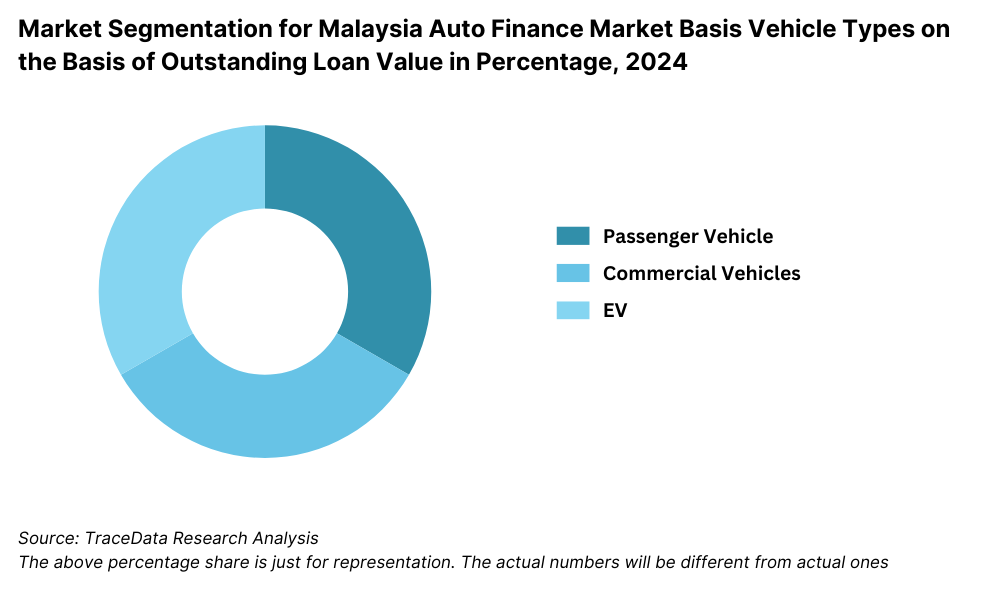

By Type of Vehicles Financed: Passenger vehicles dominate the auto finance market, accounting for a significant portion of loans disbursed in 2023. Financing for commercial vehicles is also growing, driven by the expansion of the logistics and e-commerce sectors. Electric vehicle (EV) financing is a niche but fast-growing segment, supported by government incentives and growing consumer interest in sustainability.

By Loan Tenure: Auto loans with a tenure of 5-7 years are the most popular, providing a balanced approach between manageable monthly payments and overall interest costs. Shorter tenures of 3-5 years are preferred by those looking to reduce interest expenses, while longer tenures of 7-9 years are opted by buyers needing lower monthly installments.

Competitive Landscape in Malaysia Auto Finance Market

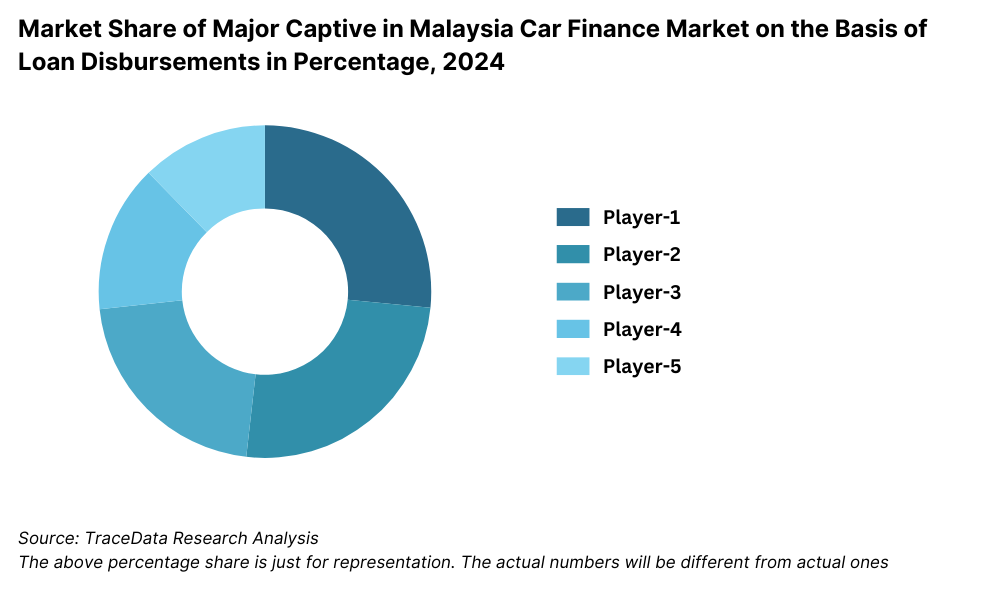

The Malaysia auto finance market is moderately competitive, with a mix of established banks, non-banking financial companies (NBFCs), and emerging digital finance platforms. Key players such as Maybank, CIMB Bank, Public Bank, Bank Islam, Toyota Capital Malaysia, AEON Credit Service, and MBSB Bank dominate the market, offering a range of financing products and services.

| Name | Founding Year | Original Headquarters |

|---|---|---|

| Toyota Capital Malaysia | 2001 | Kuala Lumpur, Malaysia |

| BMW Credit (BMW Group Financial Services) | 2007 | Munich, Germany |

| Mercedes-Benz Services Malaysia | 2012 | Stuttgart, Germany |

| Maybank Auto Finance | 1960 | Kuala Lumpur, Malaysia |

| CIMB Auto Finance | 2006 | Kuala Lumpur, Malaysia |

| Public Bank Hire Purchase | 1966 | Kuala Lumpur, Malaysia |

| AmBank Auto Financing | 1975 | Kuala Lumpur, Malaysia |

| Hong Leong Bank Auto Financing | 1905 | Kuala Lumpur, Malaysia |

| Affin Bank Auto Financing | 1975 | Kuala Lumpur, Malaysia |

| AEON Credit Service Malaysia | 1996 | Kuala Lumpur, Malaysia |

Some of the recent competitor trends and key information about competitors include:

Maybank: The largest player in the auto finance market, Maybank provided financing for over 100,000 vehicles in 2023, representing a 10% growth compared to the previous year. The bank's competitive interest rates and digital loan processing solutions have strengthened its market leadership.

CIMB Bank: Known for its innovative financing packages, CIMB Bank launched a 'Zero Down Payment' scheme in 2023, which boosted its loan disbursements by 15%. The initiative has attracted first-time buyers and increased market penetration.

Public Bank: Specializing in conventional and Islamic auto finance products, Public Bank achieved a 12% increase in financed vehicle volume in 2023. The bank's extensive dealer partnerships have been pivotal in maintaining its strong market position.

Bank Islam: As a leader in Sharia-compliant auto financing, Bank Islam introduced flexible repayment plans in 2023, resulting in a 20% rise in new loan approvals, particularly among younger consumers.

Toyota Capital Malaysia: Focused on financing Toyota vehicles, Toyota Capital Malaysia saw a 30% increase in financed sales in 2023. The company's targeted marketing campaigns and attractive promotional rates have contributed to this growth.

AEON Credit Service: Catering to the subprime segment, AEON Credit Service offered tailored financing solutions with higher approval rates for used vehicle purchases. The company recorded a 25% growth in financed transactions in 2023.

MBSB Bank: The relatively new entrant in the market, MBSB Bank, introduced digital-first auto finance solutions, capturing a 5% market share within two years of operation. The bank's focus on providing faster approval processes through digital channels has attracted tech-savvy consumers.

What Lies Ahead for Malaysia Auto Finance Market?

The Malaysia auto finance market is projected to experience steady growth by 2029, exhibiting a healthy CAGR during the forecast period. This growth is expected to be driven by increasing vehicle ownership, favorable economic conditions, and enhanced digital finance solutions.

Rise of Electric Vehicle Financing: As the Malaysian government continues to promote electric vehicles (EVs) through incentives and tax benefits, there is expected to be a growing demand for EV financing. Financial institutions are likely to introduce tailored loan products with lower interest rates and longer tenures to support the adoption of EVs.

Digital Transformation of Financing Services: The integration of advanced technologies such as AI, big data analytics, and digital lending platforms is anticipated to streamline the loan application and approval processes. These technologies will enhance credit assessment accuracy, reduce processing times, and improve customer experiences.

Focus on Green Financing: With increasing environmental awareness, banks and financial institutions may offer green financing solutions, including lower interest rates and preferential terms for financing environmentally friendly vehicles. These initiatives align with Malaysia's sustainability goals and are expected to attract eco-conscious consumers.

Expansion of Fintech Influence: The growing influence of fintech companies in the auto finance sector is expected to increase competition and drive innovation. Digital platforms offering flexible payment options, instant loan approvals, and transparent financial products are likely to gain market share, particularly among younger and tech-savvy consumers.

Future Outlook and Projections for Malaysia Car Finance Market on the Basis of Loan Disbursements in USD Billion, 2024-2029

Malaysia Auto Finance Market Segmentation

- By Market Structure:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Digital Finance Platforms

- Credit Unions

- Peer-to-Peer (P2P) Lending Platforms

- Captive Finance Companies

- Microfinance Institutions

- By Type of Vehicles Financed:

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Luxury Vehicles

- Used Vehicles

- By Loan Tenure:

- <3 years

- 3-5 years

- 5-7 years

- 7-9 years

- 9 years

- By Interest Rates:

- Fixed Interest Rate Loans

- Variable Interest Rate Loans

- Zero Interest Loans

- By Region:

- Northern

- Southern

- Central

- Western

- Eastern

Players Mentioned in the Report (Banks):

- Maybank

- Public Bank

- CIMB Bank

- Hong Leong Bank

- AmBank

- RHB Bank

- Affin Bank

- Bank Simpanan Nasional

Players Mentioned in the Report (NBFCs):

- AEON Credit Service

- MBSB Bank

- RCE Capital Berhad

- Malaysia Building Society Berhad (MBSB)

Players Mentioned in the Report (Captive):

- Toyota Capital Malaysia

- Honda Malaysia Resources

- BMW Credit (Malaysia) Sdn Bhd

- Mercedes-Benz Services Malaysia

Key Target Audience:

- Auto Finance Companies

- Banks and NBFCs

- Digital Finance Platforms

- Automotive Dealerships

- Regulatory Bodies (e.g., Bank Negara Malaysia)

- Fintech Companies

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Malaysia by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024P

9.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By Type of Vehicle (New, Used, Electric), 2023-2024P

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Malaysia Car Finance Market

11.2. Growth Drivers for Malaysia Car Finance Market

11.3. SWOT Analysis for Malaysia Car Finance Market

11.4. Issues and Challenges for Malaysia Car Finance Market

11.5. Government Regulations for Malaysia Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Malaysia Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Malaysia Car Finance Market, 2024

17.3. Market Share of Key Captive in Malaysia Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Malaysia Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New, Used, Electric), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, Above 8 years), 2025-2029

19.6. Recommendation

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Malaysia Auto Finance Market. Based on this ecosystem, we will shortlist leading 5-6 financial institutions and digital finance platforms in the country based on their financial performance, loan portfolio size, and market share.

Sourcing involves industry articles, multiple secondary, and proprietary databases to perform desk research and gather industry-level information.

Step 2: Desk Research

An exhaustive desk research process is conducted by referencing diverse secondary and proprietary databases. This involves a detailed analysis of the market, including aspects such as total loan disbursements, market share of financial institutions, interest rate trends, consumer financing preferences, and regulatory landscape.

The research process includes examining company-level data, utilizing sources such as press releases, annual reports, financial statements, and market research reports. This step aims to build a strong foundational understanding of both the auto finance market and the key players operating within it.

Step 3: Primary Research

Conduct in-depth interviews with C-level executives and other stakeholders from various auto finance institutions, digital finance platforms, and automotive dealerships in Malaysia. These interviews serve to validate market hypotheses, confirm statistical data, and obtain critical operational and financial insights from industry participants.

A bottom-to-top approach is employed to evaluate the market share and loan volumes of each player, which are then aggregated to understand the overall market.

Implement disguised interviews by approaching companies as potential customers to verify operational and financial data shared by company executives. This strategy helps validate information against secondary sources and provides insights into revenue streams, loan processing workflows, customer acquisition strategies, and competitive positioning.

Step 4: Sanity Check

- Perform both bottom-to-top and top-to-bottom analyses along with market size modeling exercises to ensure the accuracy and reliability of the research findings. This sanity check process is crucial to delivering credible and data-driven insights into the Malaysia Auto Finance Market.

FAQs

1. What is the potential for the Malaysia Auto Finance Market?

The Malaysia auto finance market is expected to witness significant growth, with the total outstanding loan value projected to exceed MYR 140 Billion by 2029. Key drivers include increasing vehicle ownership, favorable financing options, and the growing influence of digital finance solutions. The market's potential is also enhanced by government incentives for electric vehicle (EV) financing and the adoption of green finance practices.

2. Who are the Key Players in the Malaysia Auto Finance Market?

Prominent players in the Malaysia auto finance market include Maybank, CIMB Bank, Public Bank, Bank Islam, Toyota Capital Malaysia, AEON Credit Service, and MBSB Bank. These institutions hold a significant share of the market due to their robust financial products, competitive interest rates, and extensive customer outreach.

3. What are the Growth Drivers for the Malaysia Auto Finance Market?

The primary growth drivers include economic stability, rising disposable incomes, and an increasing preference for vehicle ownership. Digitalization within the financial sector has also enhanced the accessibility and convenience of obtaining auto loans. Additionally, government support for EV financing and sustainable finance initiatives contribute positively to market growth.

4. What are the Challenges in the Malaysia Auto Finance Market?

Challenges in the Malaysia auto finance market include managing credit risk and minimizing default rates. Regulatory compliance requirements can impose operational burdens, particularly on smaller non-banking financial companies (NBFCs). The competitive landscape, with banks, NBFCs, and fintech firms vying for market share, also impacts profit margins and market dynamics.