Malaysia Consumer Electronics Market Outlook to 2029

By Market Structure (Branded and Local), By Product Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), By Distribution Channel, By Consumer Demographics, and By Region

- Product Code: TDR0071

- Region: Asia

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “Malaysia Consumer Electronics Market Outlook to 2029 - By Market Structure (Branded and Local), By Product Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), By Distribution Channel, By Consumer Demographics, and By Region” provides a comprehensive analysis of the consumer electronics market in Malaysia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape, including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Consumer Electronics Market. The report concludes with future market projections based on sales revenue, product types, region, consumer preferences, and success case studies highlighting the major opportunities and cautions.

Malaysia Consumer Electronics Market Overview and Size

The Malaysia consumer electronics market reached a valuation of MYR 14 Billion in 2023, driven by the increasing demand for smart devices, rapid urbanization, and changing consumer preferences towards innovative technologies. The market is characterized by major players such as Samsung, Sony, LG Electronics, Panasonic, and Xiaomi. These companies are recognized for their extensive distribution networks, diverse product offerings, and customer-focused services.

In 2023, Samsung launched a new series of Smart TVs and home appliances to cater to the increasing demand for connected devices in Malaysia. This initiative aims to tap into the growing market for smart home solutions and provide a more integrated living experience. Kuala Lumpur and Penang are key markets due to their high population density and robust infrastructure for consumer electronics.

Market Size for Malaysia Consumer Electronics Industry on the Basis of Revenue, 2018-2023

Source: TraceData Research Analysis

What Factors are Leading to the Growth of the Malaysia Consumer Electronics Market?

Technological Advancements: The rapid pace of innovation and the introduction of cutting-edge technologies such as IoT, AI, and 5G have significantly boosted consumer interest in new electronic devices. In 2023, smart devices and connected home appliances accounted for approximately 45% of total consumer electronics sales in Malaysia, as they offer enhanced functionality and convenience for modern lifestyles.

Increasing Urbanization: With more than 75% of Malaysia's population living in urban areas, there is a heightened demand for high-tech consumer electronics that cater to the needs of city dwellers. Urban consumers are more likely to purchase smart home products, entertainment devices, and personal electronics that enhance their daily routines and provide a seamless living experience.

Rising Disposable Income: The growing middle class and increased disposable income levels have led to a rise in spending on premium and high-end consumer electronics. In recent years, the middle-income population in Malaysia has expanded by 15%, driving demand for advanced electronics such as high-definition TVs, smartwatches, and home automation systems. This demographic shift has positioned Malaysia as an attractive market for consumer electronics manufacturers.

Which Industry Challenges Have Impacted the Growth of the Malaysia Consumer Electronics Market?

Price Sensitivity: The high cost of advanced consumer electronics, especially premium products such as smart home devices and high-end entertainment systems, has posed a significant challenge for market growth. In 2023, approximately 40% of potential buyers indicated that high prices were a primary deterrent in their purchasing decisions, particularly among middle-income and budget-conscious consumers.

Supply Chain Disruptions: The global semiconductor shortage and logistical disruptions have resulted in limited product availability and increased lead times for several electronic items. In 2023, it was reported that around 25% of electronic products faced delays of up to 3 months, impacting sales and customer satisfaction. These disruptions have also led to increased production costs, which are often passed on to consumers.

Regulatory Compliance: Strict regulations concerning electronic waste management and safety standards have increased compliance costs for manufacturers and distributors. In 2023, it was reported that around 18% of imported electronics failed to meet the regulatory standards, leading to product rejections and additional costs for re-evaluation and certification. This has particularly affected smaller players and new entrants who lack the resources to quickly adapt to regulatory changes.

What are the Regulations and Initiatives that have Governed the Malaysia Consumer Electronics Market?

Product Safety and Certification Standards: The Malaysian government mandates strict safety and certification standards for all electronic products sold in the country. These standards ensure that products meet specific safety, performance, and environmental requirements. In 2023, approximately 85% of imported consumer electronics passed the certification process on their first attempt, indicating a high level of compliance among major manufacturers.

Import Restrictions on Electronic Goods: The government enforces regulations on the importation of electronic goods to prevent the influx of low-quality products and ensure adherence to local standards. All imported electronics must comply with the ASEAN safety and emissions criteria. In 2023, imports of non-compliant electronics decreased by 12% due to enhanced screening and enforcement of these regulations.

Government Incentives for Digital Transformation: To accelerate digital transformation, the Malaysian government has introduced various incentives, including tax rebates for companies investing in digital infrastructure and subsidies for the purchase of smart devices. These incentives are aimed at boosting the adoption of technology in households and businesses. In 2023, the number of households purchasing smart devices with government assistance grew by 15%, contributing to the overall growth of the consumer electronics market.

Malaysia Consumer Electronics Market Segmentation

By Product Type: Smartphones dominate the consumer electronics market in Malaysia due to their high penetration rate and frequent upgrade cycles. Consumers are increasingly opting for high-end models equipped with advanced features such as 5G connectivity, AI-enhanced cameras, and extended battery life. Laptops and tablets hold a significant share as remote working and online education trends continue to drive demand. Home appliances such as refrigerators, washing machines, and air conditioners are also popular, especially among urban households seeking energy-efficient and smart solutions.

By Distribution Channel: Online marketplaces and e-commerce platforms have emerged as leading distribution channels for consumer electronics in Malaysia, capturing a growing share of the market due to their convenience and competitive pricing. Organized retail stores, including chain electronics stores and supermarkets, remain popular among consumers seeking hands-on experience and immediate product availability. OEM outlets, offering direct purchases from manufacturers, appeal to brand-loyal customers looking for certified products and after-sales services.

By Consumer Demographics: Young adults aged 18-34 are the primary consumers of smartphones, personal electronics, and entertainment devices, driven by a strong interest in technology and digital lifestyle. Middle-aged consumers (35-54) show a preference for home appliances and smart home devices, seeking products that offer convenience and improved quality of life. Consumers aged 55 and above tend to invest in durable and essential electronics, such as refrigerators and televisions, prioritizing reliability and after-sales support.

Competitive Landscape in Malaysia Consumer Electronics Market

The Malaysia consumer electronics market is highly competitive, with several global and regional players dominating the industry. However, the expansion of online platforms and local brands has diversified the market, offering consumers more choices and personalized services. Major companies such as Samsung, Sony, LG Electronics, Panasonic, and Xiaomi have a strong presence in the market, leveraging their extensive distribution networks and established brand reputation to maintain their competitive edge.

Company Name | Segment | Establishment Year | Headquarters |

|---|---|---|---|

Samsung Electronics | Televisions, Mobile Devices, Home Appliances | 1938 | Suwon, South Korea |

Sony Corporation | Televisions, Imaging Devices, Audio | 1946 | Tokyo, Japan |

LG Electronics | Televisions, Home Appliances | 1958 | Seoul, South Korea |

Lenovo Group Ltd. | Computers and Peripherals | 1984 | Beijing, China |

HP Inc. | Computers and Peripherals | 1939 | Palo Alto, California, USA |

Canon Inc. | Imaging Devices | 1937 | Tokyo, Japan |

Dell Technologies | Computers and Peripherals | 1984 | Round Rock, Texas, USA |

Xiaomi Corp. | Mobile Devices, Smart TVs | 2010 | Beijing, China |

Sharp Corporation | Televisions, Home Appliances | 1912 | Osaka, Japan |

Pioneer Electronics | In-Car Entertainment | 1938 | Kawasaki, Kanagawa, Japan |

Senheng Electric (KL) Sdn Bhd | Multi-category Consumer Electronics Retailer | 1989 | Kuala Lumpur, Malaysia |

Some of the recent competitor trends and key information about competitors include:

Samsung: As a leading player in the consumer electronics market, Samsung recorded a 15% increase in revenue from its home appliance segment in 2023. The company's focus on developing smart and energy-efficient products, such as AI-powered refrigerators and washing machines, has strengthened its position in the premium electronics market.

Sony: Sony’s emphasis on high-end entertainment electronics, including its line of 4K and 8K televisions, contributed to a 12% growth in its consumer electronics division in 2023. The company has also capitalized on its reputation for audio quality with the launch of a new range of wireless headphones.

LG Electronics: Known for its innovative home appliance solutions, LG reported a 10% increase in sales in 2023, driven by the growing demand for smart home devices. The company has been actively promoting its energy-efficient products, aligning with the government’s push for sustainability.

Panasonic: Focusing on kitchen and home solutions, Panasonic saw an 8% increase in its home appliance division. The company’s range of multifunctional microwave ovens and air purifiers has been well received in the market, especially among urban consumers looking for compact and versatile solutions.

Xiaomi: Xiaomi’s aggressive pricing strategy and feature-packed smartphones have made it one of the top contenders in the Malaysian market. In 2023, Xiaomi recorded a 20% increase in smartphone sales, with strong demand from young consumers. The company’s expansion into smart home devices and wearables has further diversified its product portfolio.

What Lies Ahead for Malaysia Consumer Electronics Market?

The Malaysia consumer electronics market is expected to witness steady growth by 2029, exhibiting a strong CAGR during the forecast period. This growth is anticipated to be driven by technological advancements, rising urbanization, and increasing consumer confidence in the quality and durability of electronic products.

Adoption of Smart Home Technologies: As the Malaysian government and private sector continue to invest in smart city projects, there is an expected increase in the adoption of smart home technologies, including smart lighting, security systems, and home automation devices. This trend is supported by the rising preference for connected living and the integration of IoT technologies in everyday life.

Expansion of E-Commerce Channels: The continued growth of e-commerce platforms and online marketplaces is likely to transform the distribution landscape of the consumer electronics market. As more consumers turn to online channels for their purchases, companies are expected to invest in enhancing their digital presence and optimizing logistics for faster delivery and improved customer service.

Emergence of Sustainable Electronics: There is a growing trend towards sustainable practices in the consumer electronics market, driven by increased environmental awareness among consumers. Companies are introducing eco-friendly products made from recycled materials and focusing on energy-efficient solutions. These initiatives are expected to resonate well with environmentally conscious buyers and drive demand for sustainable electronics.

Shift Towards Premium and High-End Products: The expanding middle class and rising disposable income levels are projected to fuel demand for premium and high-end electronic products. This trend is particularly evident in categories such as high-definition televisions, smart home appliances, and personal electronics like smartwatches and fitness trackers. Consumers are willing to pay a premium for products that offer superior features and enhanced user experience.

Future Outlook and Projections for Malaysia Consumer Electronics Market on the Basis of Revenue in USD Billion, 2024-2029

Malaysia Consumer Electronics Market Segmentation

- By Market Structure:

- Organized Sector

- Unorganized Sector

- By Product Type:

- Computer and Peripherals

- In-Car Entertainment

- In-Home Consumer Electronics

- Television

- Headphones

- Imaging Devices

- By Computer and Peripherals

- Desktops

- Laptops

- Tablets

- Monitors

- Printers

- In-Car Entertainment:

- In-Car Navigation

- In-Car Speakers

- In-Dash Media Players

- In-Home Consumer Electronics:

- Audio Separates

- Digital Media Player Docks

- Hi-Fi System

- Home Cinema & Speaker System

- Speakers

- Others

- Television and Video Players:

- TV Types:

- Analog TV

- LCD

- OLED

- Plasma

- Other TVs

- Video Players:

- BD Players

- DVD Players

- Video Recorders

- TV Types:

- Headphones:

- Wireless Headbands

- Wireless Earphones

- TWS Earbuds

- Imaging Devices:

- Cameras

- Camcorders

- By Distribution Channel:

- Online Platforms (E-commerce)

- Offline Retail Stores

- Multi-brand Showrooms

- Exclusive Brand Outlets

- Wholesale Channels

- By Consumer Demographics:

- Age Group:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

- Income Group:

- Lower-Income

- Middle-Income

- Upper-Middle-Income

- High-Income

- Age Group:

Key Players Mentioned in the Report:

- Samsung Electronics

- Sony Corporation

- LG Electronics

- Apple Inc.

- Lenovo

- Dell Technologies

- Hewlett-Packard (HP)

- Acer

- Asus

- Canon Inc.

- Nikon Corporation

- Huawei Technologies Co., Ltd.

- Polytron

- Pioneer Electronics

- Sharp Corporation

- Hisense

- Xiaomi

- Vivo

- Oppo

- Realme

Key Target Audience:

- Electronics Retailers and Distributors

- Online E-commerce Platforms

- Consumer Electronics Manufacturers

- Technology Startups and Innovators

- Regulatory Bodies (e.g., Ministry of Communications and Multimedia)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Manufacturers and Suppliers

3.2. Distribution Channels

3.3. Retailers and E-commerce Platforms

3.4. Consumer Groups

4.1. Value Chain Process-Entity relationships, Margin Analysis, Distributor, Dealers, Traders and Retailers

4.2. Business Model Canvas for the Malaysia Consumer Electronics Market

5.1. Overview and Business Cycle

5.2. Household Penetration for Each Type of Consumer Electronics in Malaysia, 2018-2023

5.3. Replacement Cycle of Consumer Electronics by Each Category, 2018-2023

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Market Structure (Branded and Local Brands), 2023-2024P

9.2. By Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), 2018-2024

9.2.1. By Computer and Peripherals (Desktops, Laptops, Tablets, Monitors and Printers), 2018-2024

9.2.2. By In-Car Entertainment (In-Car Navigation, In-Car Speakers, In-Dash Media Players), 2018-2024

9.2.3. By In-Home Consumer Electronics (Audio Separates, Digital Media Player Docks, Hi-Fi System, Home Cinema & Speaker System, Speakers and others), 2018-2024

9.2.4. By Television and Video Players

9.2.4.1. By TV (Analog TV, LCD, OLED, Plasma, Other TVs), 2018-2024

9.2.4.2. By Video Players (BD Players, DVD Players and Video Recorders), 2018-2024

9.2.5. By Headphones (Wireless Headbands, Wireless Earphones and TWS Earbuds) 2018-2024

9.2.6. By Imaging Devices (Camers and Camcorders), 2018-2024

9.3. By Distribution Channel (MBOs, EBOs, Online and others), 2023-2024P

9.4. By Region, 2023-2024P

9.5. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2023-2024P

10.1. Consumer Landscape and Segment Analysis

10.2. Customer Journey and Decision-Making Process

10.3. Need, Desire, and Pain Point Analysis

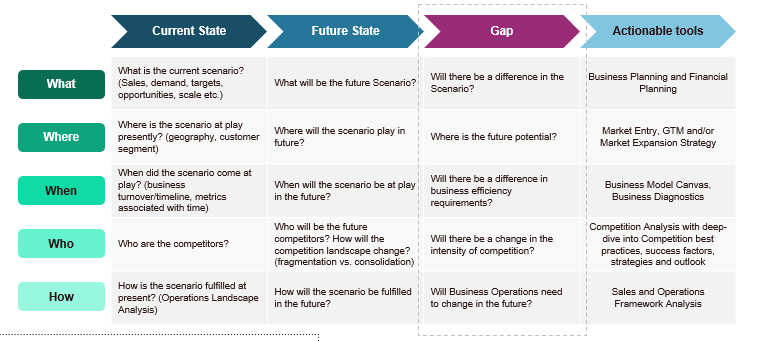

10.4. Gap Analysis Framework

10.5. By Income, Age and Gender Split, 2024

11.1. Trends and Developments in the Malaysia Consumer Electronics Market

11.2. Growth Drivers for Malaysia Consumer Electronics Market

11.3. SWOT Analysis for Malaysia Consumer Electronics Market

11.4. Issues and Challenges in the Malaysia Consumer Electronics Market

11.5. Government Regulations and Initiatives for Malaysia Consumer Electronics Market

12.1. Market Size and Future Potential for Online Consumer Electronics Market, 2018-2029

12.2. Business Model and Revenue Streams of Leading Online Platforms

12.3. Cross Comparison of Leading Online Consumer Electronics Platforms Based on Operational and Financial Parameters

13.1. Finance Penetration Rate and Average Ticket Size for Consumer Electronics, 2018-2029

13.2. Trends in Financing Options for Consumer Electronics

13.3. Popular Consumer Electronics Segments with Higher Finance Penetration Rates

13.4. Finance Split by Banks/NBFCs/Private Finance Companies, 2023-2024P

13.5. Average Loan Tenure for Consumer Electronics Financing in Malaysia

13.6. Finance Disbursement for Consumer Electronics in INR Crores, 2018-2024P

16.1. Market Share of Key Players in Malaysia Consumer Electronics Market, 2018-2024

16.2. Market Share of Key Players in Malaysia Computer and Peripherals Market, 2018-2024

16.3. Market Share of Key Players in Malaysia In-Car Entertainment Market, 2018-2024

16.4. Market Share of Key Players in Malaysia In-Home Consumer Electronics Market, 2018-2024

16.5. Market Share of Key Players in Malaysia Television Market, 2018-2024

16.6. Market Share of Key Players in Malaysia Headphones Market, 2024

16.7. Market Share of Key Players in Malaysia Imaging Devices Market, 2024

16.8. Benchmarking of Key Competitors in Malaysia Consumer Electronics Market including Operational and Financial Parameters

16.9. Heat Map Analysis for Major Players in Malaysia Consumer Electronics Market

16.10. Strengths and Weaknesses Analysis

16.11. Operating Model Analysis Framework

16.12. Gartner Magic Quadrant

16.13. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Sales Volume, 2025-2029

18.1. By Market Structure (Branded and Local Brands), 2025-2029

18.2. By Type (Computer and Peripherals, In-Car Entertainment, In-Home Consumer Electronics, Television, Headphones and Imaging Devices), 2025-2029

18.2.1. By Computer and Peripherals (Desktops, Laptops, Tablets, Monitors and Printers), 2025-2029

18.2.2. By In-Car Entertainment (In-Car Navigation, In-Car Speakers, In-Dash Media Players), 2025-2029

18.2.3. By In-Home Consumer Electronics (Audio Separates, Digital Media Player Docks, Hi-Fi System, Home Cinema & Speaker System, Speakers and others), 2025-2029

18.2.4. By Television and Video Players

18.2.4.1. By TV (Analog TV, LCD, OLED, Plasma, Other TVs), 2025-2029

18.2.4.2. By Video Players (BD Players, DVD Players and Video Recorders), 2025-2029

18.2.5. By Headphones (Wireless Headbands, Wireless Earphones and TWS Earbuds) 2025-2029

18.2.6. By Imaging Devices (Camers and Camcorders), 2025-2029

18.3. By Distribution Channel (MBOs, EBOs, Online and others), 2025-2029

18.4. By Region, 2025-2029

18.5. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2025-2029

18.6. Recommendations

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: Identify all demand-side and supply-side entities involved in the Malaysia Consumer Electronics Market. This includes manufacturers, distributors, retailers, e-commerce platforms, and end-consumers. The ecosystem mapping provides a comprehensive view of key stakeholders and their roles within the industry.

Shortlisting Key Players: Based on the mapped ecosystem, we shortlist leading 5-6 producers in the country by evaluating their financial performance, production capacity, product range, and market influence. This step helps in identifying major contributors to the market and establishes a foundation for further research.

Step 2: Desk Research

Secondary Data Sourcing: Conduct an in-depth desk research process using a variety of secondary sources, such as industry reports, market publications, press releases, and proprietary databases. This step involves aggregating industry-level data to analyze sales revenues, product pricing, distribution channels, and consumer behavior.

Company-Level Analysis: Supplement industry-level insights with detailed examinations of company-level data. Sources include annual reports, financial statements, and press releases. This analysis aims to understand each company's product portfolio, pricing strategy, and market positioning.

Step 3: Primary Research

Conducting In-Depth Interviews: Initiate a series of in-depth interviews with C-level executives and other stakeholders from various companies operating in the Malaysia Consumer Electronics Market. This interview process validates the market hypotheses, authenticates statistical data, and extracts valuable insights related to operational and financial strategies.

Validation Strategy: Use disguised interviews to approach companies as potential customers, which allows for authentic responses and validation of the data provided by executives. This information is cross-referenced with secondary data sources to ensure accuracy and reliability.

Step 4: Sanity Check

- Market Size Modeling: Perform top-down and bottom-up analysis to validate market size and growth projections. This involves aggregating volume and revenue data for each segment to ensure consistency with overall market trends.

FAQs

1. What is the potential for the Malaysia Consumer Electronics Market?

The Malaysia consumer electronics market is poised for substantial growth, reaching a valuation of MYR 20 Billion by 2029. This growth is driven by increasing demand for innovative and smart electronic products, rising disposable income, and expanding digital infrastructure.

2. Who are the Key Players in the Malaysia Consumer Electronics Market?

Key players include Samsung, Sony, LG Electronics, Panasonic, and Xiaomi. These companies dominate the market due to their extensive distribution networks, strong brand presence, and diverse product offerings.

3. What are the Growth Drivers for the Malaysia Consumer Electronics Market?

The primary growth drivers include technological advancements, increasing urbanization, and rising consumer confidence in electronic products. Additionally, government initiatives promoting digital transformation are expected to further boost market growth.

4. What are the Challenges in the Malaysia Consumer Electronics Market?

Challenges include price sensitivity, regulatory hurdles, and supply chain disruptions affecting product availability and delivery timelines. Addressing these issues will be crucial for sustained market growth.