Malaysia Dairy Food Products Market Outlook to 2029

By Market Structure, By Product Types, By Distribution Channels, By Consumer Demographics, and By Region

- Product Code: TDR0027

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled “Malaysia Dairy Food Products Market Outlook to 2029 - By Market Structure, By Product Types, By Distribution Channels, By Consumer Demographics, and By Region.” provides a comprehensive analysis of the dairy food products market in Malaysia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Dairy Food Products Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Malaysia Dairy Food Products Market Overview and Size

The Malaysia dairy food products market reached a valuation of MYR 5.5 Billion in 2023, driven by the increasing demand for healthy and convenient food options, rising health awareness, and a growing population with a preference for dairy-based products. The market is characterized by major players such as Fonterra, Nestlé Malaysia, Dutch Lady Milk Industries, and Marigold. These companies are recognized for their extensive distribution networks, diverse product offerings, and customer-focused marketing strategies.

In 2023, Dutch Lady Milk Industries launched a new line of fortified dairy beverages to cater to the health-conscious segment of the market. This initiative aims to tap into the growing demand for functional foods in Malaysia, offering products that provide additional health benefits beyond basic nutrition. Kuala Lumpur and Johor are key markets due to their high population density and strong retail infrastructure.

Market Size for Malaysia Dairy Food Products Industry on the Basis of Revenues in USD Billion, 2018-2024

Source: TraceData Research Analysis.

What Factors are Leading to the Growth of Malaysia Dairy Food Products Market:

Health and Wellness Trends: The increasing focus on health and wellness among Malaysian consumers has significantly boosted the demand for dairy products, particularly those fortified with vitamins, minerals, and probiotics. In 2023, fortified dairy products accounted for approximately 40% of total dairy sales in Malaysia, as consumers seek out products that support their overall health and well-being.

Urbanization and Changing Lifestyles: The growing urban population in Malaysia, along with changing lifestyles, has led to an increased demand for convenient and ready-to-consume dairy products. This trend is particularly evident in urban centers where busy lifestyles drive the consumption of products like yogurt, flavored milk, and cheese as quick meal options.

Rise of E-commerce: The rapid growth of e-commerce platforms has revolutionized the way consumers purchase dairy products, enhancing convenience and accessibility. In 2023, around 30% of dairy product sales in Malaysia were conducted online, reflecting a growing trend towards digital channels. These platforms offer a wide variety of products, price comparisons, and doorstep delivery, which have significantly boosted market growth.

Which Industry Challenges Have Impacted the Growth for Malaysia Dairy Food Products Market

Price Sensitivity: The Malaysian dairy market is highly price-sensitive, with consumers often opting for cheaper alternatives or private label brands. According to a recent industry survey, approximately 45% of consumers are influenced by price when purchasing dairy products. This issue has led to intense competition among brands, particularly in the mass-market segment.

Regulatory Compliance: Stringent regulations regarding food safety, labeling, and nutritional content can limit the introduction of new products and pose challenges for manufacturers. In 2023, it was reported that around 15% of new dairy products failed to meet the required standards, leading to delays in their market entry.

Supply Chain Disruptions: The dairy industry is highly dependent on a robust supply chain, from raw milk collection to distribution. Any disruption, such as logistical challenges or raw material shortages, can impact the availability of products on the market. In 2023, supply chain disruptions caused by global events led to a 10% decline in the availability of certain dairy products in Malaysia.

What are the Regulations and Initiatives which have Governed the Market:

Food Safety Regulations: The Malaysian government mandates strict food safety regulations, including requirements for pasteurization, labeling, and nutritional content. These regulations are enforced to ensure that dairy products are safe for consumption and meet health standards. In 2023, compliance with these regulations was high, with 90% of dairy products passing safety inspections on the first attempt.

Import Restrictions on Dairy Products: The government enforces regulations on the importation of dairy products to protect the local dairy industry and ensure that imported products meet Malaysian standards. In 2023, imports of dairy products increased by 5%, driven by rising demand for specialty and premium dairy products.

Government Support for Local Dairy Farmers: The Malaysian government has introduced various initiatives to support local dairy farmers, including subsidies, grants, and training programs. These initiatives are aimed at boosting local milk production and improving the quality of dairy products. In 2023, local milk production accounted for 30% of the total dairy consumption in Malaysia, a number expected to grow as these initiatives take effect.

Malaysia Dairy Food Products Market Segmentation

By Market Structure: The organized sector leads the Malaysia dairy food products market due to its extensive distribution networks, strict adherence to quality standards, and established brand reputation. These companies often provide a wide range of dairy products, including milk, yogurt, cheese, and butter, catering to the diverse needs of consumers. The unorganized sector, comprising local producers and small-scale dairy farms, plays a significant role in rural areas, offering fresh and locally sourced products. However, their market share is smaller due to limited distribution capabilities and lower brand recognition.

By Product Type: Milk is the dominant product type in the Malaysia dairy food products market, driven by its status as a staple food item and its widespread consumption across all demographics. Yogurt follows, gaining popularity due to its health benefits and convenience as a snack option. Cheese and butter also hold significant shares, with increasing demand for Western dietary influences and culinary uses. Other dairy products, including flavored milk and cream, cater to niche markets but are growing in popularity as consumer tastes diversify.

.png)

By Distribution Channel: Supermarkets and hypermarkets dominate the distribution of dairy products in Malaysia, offering consumers a wide variety of choices and the convenience of one-stop shopping. Convenience stores are also significant players, particularly for products like flavored milk and yogurt that are often purchased on-the-go. Online platforms are rapidly growing in importance, driven by the convenience of home delivery and the increasing digitalization of consumer shopping habits. Other channels, including specialty stores and direct sales from local farms, cater to specific consumer segments looking for niche or premium products.

By Consumer Demographics: The majority of dairy product consumers in Malaysia are in the 18-34 age group, reflecting the influence of younger, health-conscious consumers who are driving demand for products like yogurt, cheese, and functional dairy beverages. The 35-54 age group is also significant, with a preference for traditional dairy products like milk and butter. Consumers aged 55 and above tend to prefer products that are associated with health benefits, such as low-fat milk and fortified dairy products. Urban consumers dominate the market, given their higher purchasing power and access to a wider range of products, while rural consumers primarily rely on locally produced dairy items.

By Region: The Central region, including Kuala Lumpur and Selangor, holds the largest market share due to its dense population, higher income levels, and extensive retail infrastructure. The Northern region, known for its agricultural activities, follows with significant consumption of locally produced dairy products. The Southern region, including Johor, is also a key market, driven by its proximity to Singapore and a growing middle-class population. The Eastern and Western regions, while smaller in market size, are growing steadily due to urbanization and increased access to dairy products through expanding retail networks.

Competitive Landscape in Malaysia Dairy Food Products Market

The Malaysia dairy food products market is relatively concentrated, with a few major players dominating the space. However, the entrance of new firms and the expansion of online platforms such as HappyFresh and GrabMart have diversified the market, offering consumers more choices and services.

Name | Products | Founding Year |

Dutch Lady Milk Industries Bhd | Milk, Flavored Milk, Yogurt, Milk Powder | 1963 |

Nestlé Malaysia | Flavored Milk, Ice Cream, Milk Powder, Yogurt, Butter | 1912 |

Fonterra Brands Malaysia | Milk Powder, Cheese, Butter, Yogurt | 1956 |

FrieslandCampina Malaysia | Flavored Milk, Milk Powder, Cheese, Yogurt | 1871 |

Goodday Milk (Etika Group) | Flavored Milk, Fresh Milk, Ice Cream | 1968 |

Marigold (Malaysia Milk Sdn Bhd) | Milk, Flavored Milk, Yogurt, Ice Cream | 1969 |

Farm Fresh | Flavored Milk, Fresh Milk, Yogurt | 2010 |

Yeo Hiap Seng (Malaysia) Bhd | Flavored Milk, Ice Cream, Yogurt | 1957 |

Emborg (Asia) | Butter, Cheese, Milk Powder | 1947 |

Magnolia (Fraser & Neave Holdings Bhd) | Flavored Milk, Ice Cream, Milk Powder | 1883 |

Some of the recent competitor trends and key information about competitors include:

Fonterra: A leading dairy cooperative, Fonterra recorded a 10% increase in sales of its premium dairy products in 2023. The company’s focus on sustainability and innovation has resonated well with health-conscious consumers in Malaysia.

Nestlé Malaysia: Known for its diverse range of dairy products, Nestlé Malaysia saw a 15% increase in sales of fortified dairy products in 2023. The company's emphasis on health and wellness has been well-received by the market.

Dutch Lady Milk Industries: Dutch Lady has a strong presence in the Malaysian dairy market, with a 20% increase in sales of its fortified milk products in 2023. The company's focus on providing high-quality, nutritious products has made it a preferred choice among consumers.

Marigold: Specializing in dairy and soy-based products, Marigold saw a 12% increase in sales in 2023. The company’s innovative product offerings, such as lactose-free milk, have been particularly successful in catering to niche markets.

What Lies Ahead for Malaysia Dairy Food Products Market?

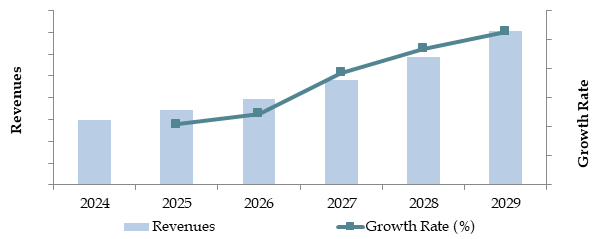

The Malaysia dairy food products market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be fueled by health trends, increasing urbanization, and rising consumer confidence in dairy products.

Focus on Premium and Functional Products: As consumer awareness of health and nutrition continues to grow, there is anticipated to be an increase in demand for premium and functional dairy products. This trend is supported by the growing middle class and their willingness to spend more on quality products that offer additional health benefits.

Integration of Technology: The integration of advanced technologies such as AI and big data analytics in supply chain management and consumer behavior analysis is expected to provide manufacturers with more accurate and efficient processes. This technological advancement will enhance product availability, boost consumer trust, and streamline the purchasing process.

Sustainability Initiatives: There is a rising trend towards sustainability within the dairy industry. This includes initiatives such as eco-friendly packaging, reducing carbon footprints in production processes, and promoting ethical sourcing. These practices are becoming increasingly important to environmentally conscious consumers and are expected to influence buying decisions.

Future Outlook and Projections for Malaysia Dairy Food Products Market on the Basis of Volume Sales in Units, 2024-2029

Source: TraceData Research Analysis

Malaysia Dairy Food Products Market Segmentation

By Market Structure:

Organized Sector

Unorganized Sector

By Product Types:

Milk

Yogurt

Cheese

Butter

Others

Product Type

Drinking Milk Product

Flavoured Milk Drinks

Dairy only Flavored Milk Drinks

Flavored Milk Drinks with Fruit Juices

Powdered Milk

UHT/Fresh/Liquid Milk

Shelf Stable Milk

Full Fat Shelf Stable Milk

Semi Skimmed Shelf Stable Milk

Fresh Milk

Full Fat Fresh Milk

Fat Free Fresh Milk

Semi Skimmed Fresh Milk

Milk Alternatives

Soy Drinks

Other Milk Alternatives (Almond Milk, Cashew Milk and Rest)

Condensed Milk Products

Plain Condensed Milk

Flavoured Condensed Milk

Yoghurt and Sour Milk Products

Yoghurt

Drinking Yoghurt

Plain Yoghurt

Flavoured Yoghurt

Sour Milk

Ice Cream and Frozen Desserts

Impulse Ice Cream by Type

Single Portion Dairy Ice-Cream

Single Portion Water Ice-Cream

Impulse Ice Cream by Format

Sticks

Cones

Others (Single Serving Cups, Family Pack Tubs, Ice-Cream Cakes and Rest)

Take Home Ice Cream

Bulk Dairy Ice Cream

Multi-Pack Dairy Ice Cream

Take-Home Water Ice Cream

Cheese

Processed Cheese

Spreadable Processed Cheese

Reconstituted Cheese

Cream Cheese

Other Processed Cheese

Unprocessed / Packaged Hard Cheese

Cheddar Cheese

Others (Mozzarella, Provolone, Parmesan, Emmental, Romano, Ricotta and Rest)

Cream

Fresh Whipped Cream

Fresh Half/ Single Cream

Long Life/ UHT Whipped Cream

Butter and Spreads

Butter

Margarine and Spreads

Coffee Whiteners

Product Form

Concentrated/ Thick liquid non dairy creamer

Powdered non dairy creamer

Liquid non dairy creamer

Fat Type

Medium Fat

Low / No Fat

High Fat

Application

Coffee

Tea

Baking Items

Other Applications (Drinks, Candy and Remaining Concentrated Beverages)

Distribution Channel

Hypermarkets

Supermarkets

Independent Small Grocers

Convenience stores

Other grocery retailers

Non store retailing

Health and beauty specialist retailers

By Consumer Demographics:

Age (18-34, 35-54, 55+)

Income Level

Urban vs. Rural

By Region:

Northern

Southern

Central

Western

Eastern

Players Mentioned in the Report:

Dutch Lady Milk Industries Bhd

Nestlé Malaysia

Fonterra Brands Malaysia

FrieslandCampina Malaysia

Goodday Milk (Etika Group)

Marigold (Malaysia Milk Sdn Bhd)

Farm Fresh

Yeo Hiap Seng (Malaysia) Bhd

Emborg (Asia)

Magnolia (Fraser & Neave Holdings Bhd)

Key Target Audience:

Dairy Product Manufacturers

Retailers and Distributors

E-commerce Platforms

Regulatory Bodies (e.g., Ministry of Health)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Margins, Operating Model, Stakeholders, and Challenges they face

4.2. Business Model Canvas for Malaysia Dairy Food Products Market

5.1. Milk Production and Consumption in Malaysia, 2018-2024

5.2. Number of Dairy Producers and Processors in Malaysia

8.1. Revenues, 2018-2024

9.1. By Product Type (Milk Powder, Flavoured Milk, Yogurt, Cheese, Butter, Ice Cream and Others), 2018-2024P

9.1.1. Milk Powder Segmentation

9.1.1.1. By Skimmed Milk Powder and Whole Milk Powder, 2018-2024P

9.1.1.2. By Distribution Channel, 2018-2024P

9.1.1.3. By Organized and Unorganized Sector, 2018-2024P

9.1.1.4. By Application (Nutritional Foods, Infant Formula, Confectionaries and others), 2018-2024P

9.1.2. Yoghurt Market Segmentation

9.1.2.1. By Flavoured, Plain and Drinking Yoghurt, 2018-2024P

9.1.2.2. By Distribution Channel, 2018-2024P

9.1.2.3. By Organized and Unorganized Sector, 2018-2024P

9.1.2.4. By Retailers and HORECAs, 2018-2024P

9.1.3. Cheese Market Segmentation

9.1.3.1. By Spreadable Cheese, Soft, Hard and Processed Cheese, 2018-2024P

9.1.3.2. By Distribution Channel, 2018-2024P

9.1.3.3. By Organized and Unorganized Sector, 2018-2024P

9.1.3.4. By Retailers and HORECAs, 2018-2024P

9.1.4. Butter Market Segmentation

9.1.4.1. By Cooking Fats, Butter, Margarine & Spreads, 2018-2024P

9.1.4.2. By Distribution Channel, 2018-2024P

9.1.4.3. By Organized and Unorganized Sector, 2018-2024P

9.1.4.4. By Retailers and HORECAs, 2018-2024P

9.1.5. Ice Cream Market Segmentation

9.1.5.1. By Take Home Ice Cream and Impulse Ice Cream, 2018-2024P

9.1.5.2. By Distribution Channel, 2018-2024P

9.1.5.3. By Organized and Unorganized Sector, 2018-2024P

10.1. Consumer Landscape and Cohort Analysis

10.2. Consumer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

10.5. By Consumer Demographics (Age, Income Level, Urban vs. Rural), 2023-2024P

11.1. Trends and Developments for Malaysia Dairy Food Products Market

11.2. Growth Drivers for Malaysia Dairy Food Products Market

11.3. SWOT Analysis for Malaysia Dairy Food Products Market

11.4. Issues and Challenges for Malaysia Dairy Food Products Market

11.5. Government Regulations for Malaysia Dairy Food Products Market

14.1. Market Share of Major Players in Malaysia Butter Market Basis Volume/Revenues, 2023

14.2. Market Share of Major Players in Malaysia Cheese Market Basis Volume/Revenues, 2023

14.3. Market Share of Major Players in Malaysia Ice Cream Market Basis Volume/Revenues, 2023

14.4. Market Share of Majo Players in Malaysia Flavoured Milk Market Basis Volume/Revenues, 2023

14.5. Market Share of Majo Players in Malaysia Yoghurt Market Basis Volume/Revenues, 2023

14.6. Benchmark of Key Competitors in Malaysia Dairy Food Products Market including Variables such as Company Overview, USP, Business Strategies, Sales and Marketing Strategy, Recent Development, Sourcing, Volume Sales, Production Capacity, Best Selling Products, Product SKUs and Pricing, Revenues, Production Plant with Locations, Major Clients and others

14.7. Strengths and Weaknesses

14.8. Operating Model Analysis Framework

14.9. Gartner Magic Quadrant

14.10. Bowmans Strategic Clock for Competitive Advantage

15.1. Revenues, 2025-2029

16.1. By Product Type (Milk Powder, Flavoured Milk, Yogurt, Cheese, Butter, Ice Cream and Others), 2025-2029

16.1.1. Milk Powder Segmentation

16.1.1.1. By Skimmed Milk Powder and Whole Milk Powder, 2025-2029

16.1.1.2. By Distribution Channel, 2025-2029

16.1.1.3. By Organized and Unorganized Sector, 2025-2029

16.1.1.4. By Application (Nutritional Foods, Infant Formula, Confectionaries and others), 2025-2029

16.1.2. Yoghurt Market Segmentation

16.1.2.1. By Flavoured, Plain and Drinking Yoghurt, 2025-2029

16.1.2.2. By Distribution Channel, 2025-2029

16.1.2.3. By Organized and Unorganized Sector, 2025-2029

16.1.2.4. By Retailers and HORECAs, 2025-2029

16.1.3. Cheese Market Segmentation

16.1.3.1. By Spreadable Cheese, Soft, Hard and Processed Cheese, 2025-2029

16.1.3.2. By Distribution Channel, 2025-2029

16.1.3.3. By Organized and Unorganized Sector, 2025-2029

16.1.3.4. By Retailers and HORECAs, 2025-2029

16.1.4. Butter Market Segmentation

16.1.4.1. By Cooking Fats, Butter, Margarine & Spreads, 2025-2029

16.1.4.2. By Distribution Channel, 2025-2029

16.1.4.3. By Organized and Unorganized Sector, 2025-2029

16.1.4.4. By Retailers and HORECAs, 2025-2029

16.1.5. Ice Cream Market Segmentation

16.1.5.1. By Take Home Ice Cream and Impulse Ice Cream, 2025-2029

16.1.5.2. By Distribution Channel, 2025-2029

16.1.5.3. By Organized and Unorganized Sector, 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Mapping the Ecosystem: Identify all the demand-side and supply-side entities in the Malaysia Dairy Food Products Market. Based on this ecosystem, we will shortlist leading 5-6 producers in the country based on their financial information, production capacity, and volume.

Sourcing: Industry articles, multiple secondary, and proprietary databases are used to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Exhaustive Desk Research: We engage in a thorough desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a detailed analysis of the market, aggregating industry-level insights. We delve into aspects like sales revenues, number of market players, price levels, demand, and other variables. This is supplemented with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

In-depth Interviews: We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Malaysia Dairy Food Products Market companies and end-users. The interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-up approach is undertaken to evaluate volume sales for each player, thereby aggregating the overall market.

Validation Strategy: Our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Analysis and Modeling: Bottom-up and top-down analyses along with market size modeling exercises are undertaken as part of the sanity check process. This ensures that the data collected and the projections made are consistent and accurate.

FAQs

01 What is the potential for the Malaysia Dairy Food Products Market?

The Malaysia Dairy Food Products Market is poised for substantial growth, reaching a valuation of MYR 5 Billion in 2023. This growth is driven by factors such as increasing health consciousness, rising demand for convenient and fortified dairy products, and the expansion of the digital retail landscape. The market's potential is further bolstered by government initiatives supporting local dairy production and sustainability.

02 Who are the Key Players in the Malaysia Dairy Food Products Market?

The Malaysia Dairy Food Products Market features several key players, including Fonterra, Nestlé Malaysia, Dutch Lady Milk Industries, and Marigold. These companies dominate the market due to their extensive distribution networks, strong brand presence, and innovative product offerings. Other notable players include smaller local producers who cater to niche markets.

03 What are the Growth Drivers for the Malaysia Dairy Food Products Market?

The primary growth drivers include the rising health and wellness trends, urbanization, and changing consumer lifestyles, which are increasing the demand for convenient and nutritious dairy products. Additionally, the growth of e-commerce platforms has made it easier for consumers to access a wide variety of dairy products, further enhancing market growth.

04 What are the Challenges in the Malaysia Dairy Food Products Market?

The Malaysia Dairy Food Products Market faces several challenges, including price sensitivity, regulatory compliance, and supply chain disruptions. The price sensitivity of consumers leads to intense competition among brands, while stringent food safety regulations can delay the introduction of new products. Additionally, supply chain disruptions can impact the availability of dairy products, posing significant challenges to market stability.