Malaysia Data Center Market Outlook to 2029

By Market Structure, By Providers, By Type of Services, By End-User Industries, By Tier-Level, and By Region

- Product Code: TDR0028

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled “Malaysia Data Center Market Outlook to 2029 - By Market Structure, By Providers, By Type of Services, By End-User Industries, By Tier-Level, and By Region” provides a comprehensive analysis of the data center market in Malaysia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape, including opportunities and bottlenecks, and company profiling of major players in the Malaysia Data Center Market. The report concludes with future market projections based on revenue, market structure, services, regions, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Malaysia Data Center Market Overview and Size

The Malaysia data center market reached a valuation of MYR 4.8 billion in 2023, driven by the increasing demand for cloud services, digital transformation initiatives across industries, and strong government support for tech investments. The market is characterized by major players such as Keppel Data Centres, Bridge Data Centres, AIMS Data Centre, TM One, and VADS. These companies are recognized for their state-of-the-art facilities, extensive service offerings, and customer-focused infrastructure solutions.

In 2023, TM One launched a new high-performance data center in Johor to meet the growing demand for secure and scalable data storage solutions among enterprises and government entities. This expansion aims to cater to Malaysia’s rapidly evolving digital economy while leveraging the strategic position of Johor as a data center hub. Kuala Lumpur and Johor are key markets due to their strategic locations, well-established connectivity infrastructure, and growing demand from sectors such as financial services, telecommunications, and e-commerce.

Market Size for Malaysia Data Center and Cloud Services Market on the Basis of Revenue in USD Billion, 2018-2023

Source: TraceData Research Analysis

What Factors are Leading to the Growth of the Malaysia Data Center Market:

Cloud Adoption and Digitalization: The rapid adoption of cloud computing and digitalization across industries has been a significant driver of the data center market in Malaysia. By 2023, over 60% of large enterprises in Malaysia had migrated to cloud-based solutions, contributing to the rising demand for reliable and secure data center services. This trend is especially prevalent in the financial services, telecommunications, and e-commerce sectors.

Government Support and Investment Incentives: The Malaysian government has introduced several initiatives to promote digital transformation, such as the MyDIGITAL blueprint, which aims to accelerate the digital economy. These policies have attracted substantial investments in data center infrastructure, with incentives including tax exemptions and subsidies for green and energy-efficient data centers. In 2023, government initiatives led to an 18% increase in data center investments.

Growing Demand for Edge Computing: The rise of edge computing, driven by the need for lower latency and faster data processing, is another key growth factor. By 2023, edge computing services accounted for 15% of the total data center market, and this share is expected to grow as industries like manufacturing, IoT, and healthcare increasingly adopt real-time data processing solutions.

Which Industry Challenges Have Impacted the Growth for Malaysia Data Center Market:

High Operational Costs: One of the biggest challenges facing the data center industry in Malaysia is the high operational cost, particularly related to energy consumption. Data centers require substantial amounts of electricity to power and cool servers, and energy costs accounted for approximately 40% of the total operational expenses in 2023. This issue is exacerbated by Malaysia’s relatively high electricity tariffs, which can put pressure on profit margins.

Regulatory Compliance: Stricter regulations concerning data privacy and localization have posed challenges for data center operators. Compliance with laws such as the Personal Data Protection Act (PDPA) requires significant investment in security infrastructure and data governance practices. In 2023, around 25% of smaller data centers faced difficulties in meeting these stringent requirements, limiting their ability to scale and compete with larger providers.

Skilled Workforce Shortage: The lack of skilled professionals in areas such as data center management, cybersecurity, and cloud architecture has been a major barrier to growth. A survey conducted in 2023 indicated that 35% of data center operators in Malaysia reported a talent gap, particularly in specialized roles. This shortage of skilled workers has slowed the expansion of existing facilities and delayed the development of new projects.

What are the Regulations and Initiatives which have Governed the Market:

Data Privacy Regulations: The Malaysian government enforces the Personal Data Protection Act (PDPA), which mandates that organizations handling personal data must implement robust security measures to protect against unauthorized access and data breaches. In 2023, over 80% of data centers had to upgrade their security infrastructure to comply with these regulations, driving increased investments in cybersecurity solutions.

Data Localization Requirements: Malaysia’s data localization laws require certain sensitive data, especially in sectors such as banking and government, to be stored within the country’s borders. This has fueled demand for domestic data centers, with 15% of new data center capacity in 2023 directly attributed to compliance with these localization requirements.

Green Data Center Incentives: To promote sustainability in the tech industry, the Malaysian government has introduced incentives for the construction and operation of green data centers. These initiatives include tax exemptions, subsidies, and grants for facilities that meet energy efficiency standards and utilize renewable energy sources. In 2023, green-certified data centers accounted for 20% of new projects, as more operators seek to take advantage of these benefits.

Digital Economy Framework (MyDIGITAL): Launched in 2021, the MyDIGITAL initiative aims to accelerate Malaysia’s digital transformation by encouraging investment in digital infrastructure, including data centers. As a result of this policy, foreign investment in the Malaysian data center market increased by 25% in 2023, with global cloud providers expanding their presence in the country.

Malaysia Data Center Market Segmentation

By Market Structure: Hyperscale data centers dominate the market due to their ability to provide scalable, cost-effective solutions for large enterprises and cloud providers. These facilities offer advanced infrastructure, high levels of security, and energy efficiency, making them the preferred choice for international companies looking to establish a presence in Southeast Asia. Co-location and managed services also hold significant market shares, catering to smaller businesses and organizations that require flexible data center solutions without the need for extensive capital investment.

%2C%202023.png)

By Provider Type: Keppel Data Centres leads the market with a strong presence in both hyperscale and co-location services, leveraging its vast global network and expertise in green data center technologies. TM One follows closely, with a strong focus on secure and compliant data storage solutions for government and financial institutions. Bridge Data Centres is known for its cutting-edge facilities, offering a range of managed services to support growing SMEs and startups.

By Tier-Level: Tier 3 data centers dominate the market due to their balance of performance and cost, offering high availability and redundancy, which is crucial for enterprises seeking reliability without the need for full-scale Tier 4 infrastructure. However, Tier 4 data centers are becoming more popular among industries with critical uptime requirements, such as financial services and healthcare.

Competitive Landscape in Malaysia Data Center Market

The Malaysia data center market is relatively concentrated, with a few major players dominating the space. However, the entrance of new firms and the expansion of hyperscale and co-location providers such as Keppel Data Centres, Bridge Data Centres, AIMS Data Centre, TM One, and VADS have diversified the market, offering businesses more choices and specialized services.

| Name | Founding Year | Headquarters |

| AIMS Data Centre | 1990 | Kuala Lumpur, Malaysia |

| TM ONE (Telekom Malaysia) | 1984 | Kuala Lumpur, Malaysia |

| NTT Ltd. (formerly Netmagic) | 1999 | Cyberjaya, Malaysia |

| VADS Berhad (Telekom Malaysia) | 1991 | Kuala Lumpur, Malaysia |

| Bridge Data Centres | 2017 | Kuala Lumpur, Malaysia |

| TIME dotCom | 1996 | Kuala Lumpur, Malaysia |

| Alibaba Cloud Malaysia | 2009 | Hangzhou, China (Operations in Malaysia) |

| Amazon Web Services (AWS) | 2006 | Seattle, USA (Data Centers in Kuala Lumpur) |

| Microsoft Azure Malaysia | 2010 | Redmond, USA (Operations in Malaysia) |

| Google Cloud Malaysia | 2008 | Mountain View, USA (Operations in Malaysia) |

Some of the recent competitor trends and key information about competitors include:

Keppel Data Centres: As one of the leading hyperscale providers in Southeast Asia, Keppel Data Centres invested MYR 500 million in expanding its operations in Malaysia in 2023. The company focuses on energy-efficient, green data centers, contributing to its leadership in the market.

Bridge Data Centres: Bridge Data Centres, known for its cutting-edge infrastructure, saw a 20% increase in revenue in 2023, driven by growing demand from SMEs and large enterprises transitioning to co-location services. Its emphasis on flexible and scalable solutions has attracted a diverse client base.

AIMS Data Centre: AIMS reported a 15% growth in demand for its managed services in 2023. The company is recognized for its high connectivity offerings and strong position in the telecommunications sector, catering to clients who prioritize low latency and high network reliability.

TM One: Specializing in secure and compliant data center solutions for government and financial institutions, TM One launched a new Tier 3 data center in Johor in 2023 to meet the rising demand for high-performance infrastructure. The company saw a 25% increase in data center service adoption from government agencies.

VADS: A subsidiary of Telekom Malaysia, VADS focuses on providing managed services and cloud infrastructure to enterprises across Malaysia. In 2023, VADS achieved a 10% increase in market share, particularly in the healthcare and education sectors, as digitalization continues to grow in these industries.

What Lies Ahead for the Malaysia Data Center Market?

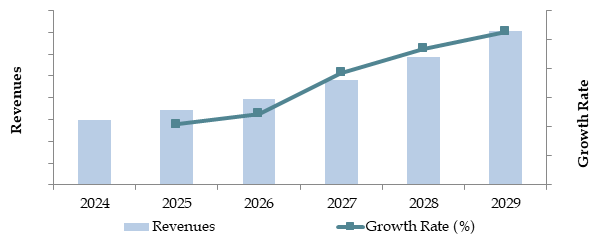

The Malaysia data center market is projected to grow steadily by 2029, exhibiting a strong CAGR of 11.2% during the forecast period. This growth is expected to be fueled by digital transformation across industries, government policies supporting the digital economy, and rising demand for cloud services and edge computing.

Shift Towards Green Data Centers: As sustainability becomes a priority, the market is expected to see a significant shift towards green and energy-efficient data centers. The Malaysian government’s green incentives, coupled with corporate sustainability goals, will drive investment in data centers powered by renewable energy and energy-efficient technologies. By 2029, it is projected that 40% of new data center capacity will be green-certified.

Increased Adoption of Edge Computing: The growing demand for low-latency services, particularly in industries like IoT, manufacturing, and autonomous vehicles, is expected to fuel the rise of edge data centers. These smaller, distributed facilities will provide real-time data processing closer to end-users, with edge computing projected to account for 25% of the market by 2029.

Expansion of Cloud Services: The integration of AI, big data analytics, and machine learning within cloud infrastructure is expected to continue growing, enabling data centers to offer more advanced and scalable solutions. This trend will lead to enhanced automation, predictive maintenance, and optimization of energy usage, helping providers reduce operational costs and improve service delivery.

Rising Demand for Hyperscale Data Centers: Hyperscale data centers are expected to dominate the landscape, catering to global cloud providers and large enterprises. With companies increasingly outsourcing their IT infrastructure to specialized facilities, hyperscale data centers will see a significant increase in capacity and service offerings. By 2029, hyperscale data centers could account for 60% of the market's total capacity.

Focus on Data Security and Compliance: With stricter data localization and privacy regulations being enforced, data centers will continue to invest in advanced security measures and ensure compliance with local and international standards. This trend is expected to attract more companies seeking compliant and secure data storage solutions, particularly in highly regulated industries such as finance and healthcare.

Future Outlook and Projections for Malaysia Data Center and Cloud Services Market on the Basis of Revenues in USD Million, 2024-2029

Source: TraceData Research Analysis

Malaysia Data Center Market Segmentation

By Market Structure:

Colocation Data Centers

Retail Co-Location

Wholesale Co-Location

Managed Service Providers

By Cloud Services:

Public Cloud

Private Cloud

Hybrid Cloud

By Data Center Infrastructure:

IT Infrastructure (Servers, Storage, Networking)

Power Management

Cooling Solutions

Security Solutions

By End-User Industry:

IT & Telecom

BFSI

Government

Healthcare

Retail

By Location

Kuala Lumpur

Petaling Jaya

Klang

Johor

Others

Key Players Mentioned in the Report:

AIMS Data Centre

TM ONE (Telekom Malaysia)

NTT Ltd. (formerly Netmagic)

VADS Berhad (Telekom Malaysia)

Bridge Data Centres

TIME dotCom

Alibaba Cloud Malaysia

Amazon Web Services (AWS)

Microsoft Azure Malaysia

Google Cloud Malaysia

Key Target Audience:

Data Center Operators

Cloud Service Providers

IT Infrastructure Companies

Regulatory Bodies

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Malaysia Data Center Market. Based on this ecosystem, we will shortlist the leading 5-6 providers in the country, focusing on their financial information, service offerings, and data center capacity.

Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research on the market, collating industry-level information regarding investment trends, technology adoption, and infrastructure development.

Step 2: Desk Research

We engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach allows us to conduct a thorough analysis of the market, aggregating insights related to revenue growth, market players, price trends, and demand patterns. We also delve into company-level data, examining press releases, annual reports, and financial statements. This analysis helps us construct a foundational understanding of the market dynamics and the key players involved.

Step 3: Primary Research

A series of in-depth interviews with C-level executives and other stakeholders representing various Malaysia Data Center Market companies and end-users are initiated. This process serves a dual purpose: to validate market hypotheses and authenticate statistical data while extracting valuable operational and financial insights. A bottom-to-top approach is used to evaluate data center capacity and utilization rates for each major provider, which is then aggregated to estimate the overall market size.

As part of our validation strategy, our team conducts disguised interviews, posing as potential clients to gain firsthand insights into operational and financial information shared by company executives. These interactions also help us gather detailed data on revenue streams, service offerings, value chain processes, and pricing strategies.

Step 4: Sanity Check

- A combination of bottom-to-top and top-to-bottom analysis is conducted, along with market size modeling exercises, to validate the accuracy of the research findings and ensure the reliability of the data.

FAQs

01 What is the potential for the Malaysia Data Center Market?

The Malaysia data center market is expected to experience substantial growth, reaching a valuation of MYR 9.6 billion by 2029. This growth is driven by factors such as the increasing adoption of cloud services, the digitalization of businesses, and government initiatives aimed at promoting the digital economy. The market's potential is further enhanced by the growing demand for edge computing and sustainable data center infrastructure.

02 Who are the Key Players in the Malaysia Data Center Market?

The Malaysia Data Center Market features several key players, including Keppel Data Centres, Bridge Data Centres, and AIMS Data Centre. These companies dominate the market due to their extensive infrastructure, strong market presence, and comprehensive service offerings. Other notable players include TM One and VADS, which also contribute significantly to the data center landscape.

03 What are the Growth Drivers for the Malaysia Data Center Market?

The primary growth drivers include the rapid adoption of cloud services, digital transformation across various industries, and increasing demand for secure and compliant data storage solutions. Additionally, government initiatives such as the MyDIGITAL blueprint, along with incentives for green and energy-efficient data centers, have created a favorable environment for market growth.

04 What are the Challenges in the Malaysia Data Center Market?

The Malaysia Data Center Market faces several challenges, including high operational costs, particularly related to energy consumption. Regulatory compliance with data privacy and localization laws also imposes significant costs, especially for smaller players. Furthermore, the shortage of skilled professionals in data center management and cybersecurity is a critical challenge, limiting the scalability of data center operations.