Malaysia Pharmaceuticals Market Outlook to 2030

By Product Type, By Therapeutic Area, By Dosage Form, By Distribution Channel, and By Region

- Product Code: TDR0384

- Region: Asia

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “Malaysia Pharmaceuticals Market Outlook to 2030 - By Product Type, By Therapeutic Area, By Dosage Form, By Distribution Channel, and By Region” provides a comprehensive analysis of the pharmaceuticals market in Malaysia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the pharmaceuticals market. The report concludes with future market projections based on therapeutic categories, dosage forms, distribution networks, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

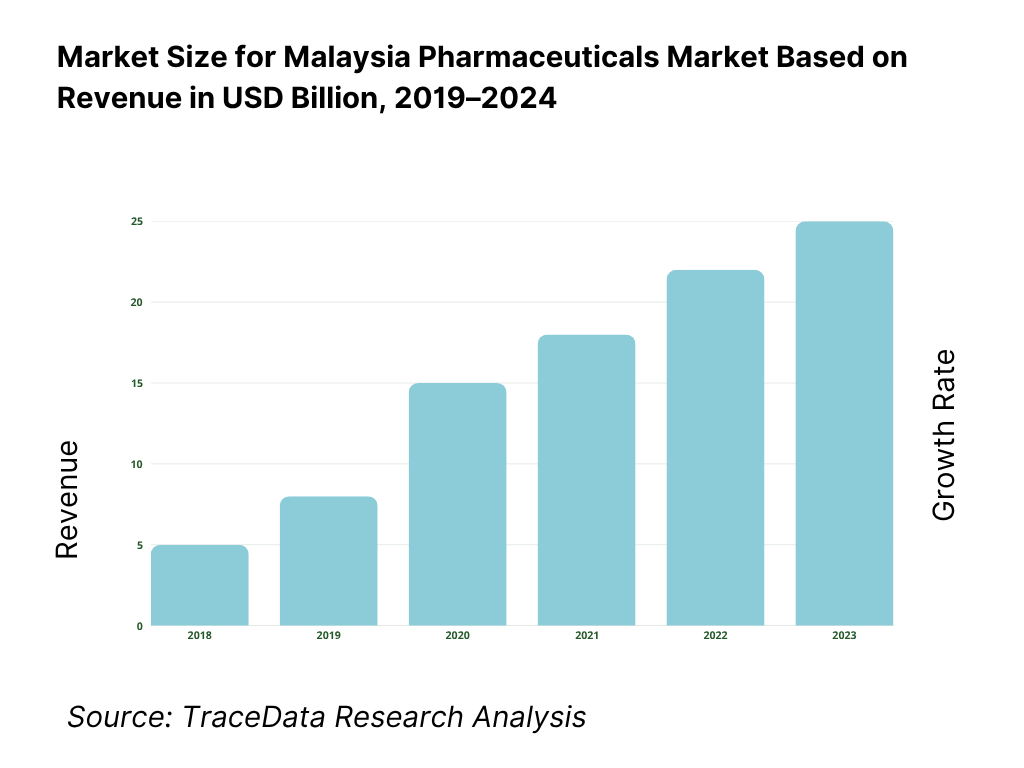

Malaysia Pharmaceuticals Market Overview and Size

The pharmaceuticals in dosage market in Malaysia is valued at USD 3.7561 billion in 2024. This size is driven largely by expanding chronic disease burden, rising per capita healthcare spend, government procurement scaling in public hospitals, and incremental uptake of specialty and biologic drugs. Export of medicinal and pharmaceutical products recorded USD 260.686 million in Malaysia in 2024, reflecting outward demand linkages.

The Malaysian pharmaceutical market is concentrated in major urban and industrial hubs like Kuala Lumpur (Selangor), Penang, Johor Bahru, and to some extent in East Malaysia (Sabah / Sarawak). These dominate because they host most of the clinical research centers, headquarters of pharmaceutical firms, key hospital systems, logistics nodes (airport / port connectivity), and regulatory / administrative infrastructure. Their advanced hospital networks and greater healthcare budgets further concentrate demand and distributor presence.

What Factors are Leading to the Growth of the Malaysia Pharmaceuticals Market:

Scale of healthcare utilization and population base fueling medicine demand: Malaysia’s population stood at 34.2 million in the latest official estimate, expanding the treated patient pool and prescription volumes across public and private channels. MOH reporting shows 1,362,564 private-hospital admissions and 4,062,272 private-hospital outpatient attendances, reflecting heavy throughput into prescription pathways that directly drive ethical and specialty drug consumption. On the public side, the system’s breadth—captured in MOH Health Facts—anchors recurring demand for chronic and acute therapies. Together, the size of the resident base and the volume of hospital interactions form a durable demand engine for pharmaceuticals.

Trade connectivity and import intensity ensuring broad molecule availability: Malaysia’s pharma supply is reinforced by deep import channels: US$2.4 billion in pharmaceutical imports were recorded, alongside US$471.43 million in exports, enabling access to originator and biosimilar pipelines and creating regional redistribution opportunities. The wider trade platform also matters: overall goods exports reached US$329.45 billion, underscoring logistics capacity (ports, air freight, 3PLs) that supports Good Distribution Practice-compliant movement of temperature-sensitive products. This import-export backbone shortens time-to-availability for new therapies and stabilizes inventories across hospitals and retail pharmacies.

System capacity and care access expanding prescription volumes: MOH facility statistics evidence a large care footprint that directly translates into prescription issuances. Government “Health Facts” report 148 MOH hospitals and special medical institutions with 45,167 official beds, plus 3,121 health clinics and 1,722 rural clinics, creating dense points of care for dispensing and referrals. This installed capacity, combined with high clinic visitation and hospital bed availability, expands the number of encounters where pharmaceuticals are initiated, switched, or continued—sustaining baseline demand across therapeutic classes from cardiometabolic to anti-infectives.

Which Industry Challenges Have Impacted the Growth of the Malaysia Pharmaceuticals Market:

Import dependency exposes the market to external supply shocks: Malaysia relied on US$2.4 billion worth of pharmaceutical imports against US$471.43 million of exports, indicating a structural exposure to global manufacturing disruptions, currency swings, and shipping bottlenecks. In a year of broader trade normalization, overall exports still tallied US$329.45 billion, showing high openness that, for medicines, can transmit upstream shortages quickly into hospital and pharmacy shelves. For procurement teams, this imbalance complicates safety-stock planning for cold-chain biologics and narrow-therapeutic-index drugs, raising continuity-of-care risks if substitution is limited.

High disease-management burden concentrates demand in resource-intensive areas: MOH Health Facts document heavy caseloads: private hospitals handled 1,362,564 admissions and 4,062,272 outpatient visits, while national communicable-disease surveillance recorded a dengue notification rate of 368.89 per 100,000 and tuberculosis notification rate of 80.23 per 100,000. These case volumes intensify demand for anti-infectives, vaccines, and supportive therapies, stressing formularies and budgets. For oncology and cardiometabolic diseases—top causes of mortality in MOH and private hospitals—the need for continuous, multi-drug regimens elevates supply complexity and exposes gaps in specialty distribution.

Geographic dispersion and service load complicate last-mile pharmaceutical delivery: MOH’s facility footprint shows 3,121 health clinics and 1,722 rural clinics under the public system, alongside 148 hospitals/special institutions with 45,167 beds. Servicing this dispersed network—particularly in Sabah and Sarawak—requires sustained cold-chain and stock-replenishment logistics that meet GDP standards across thousands of handoff points. High clinic volumes (e.g., millions of maternal and child health attendances reported in Health Facts) intensify pressure on inventory accuracy and reorder cycles, heightening the risk of localized stockouts without robust data integration and buffer stocks.

What are the Regulations and Initiatives which have Governed the Market:

Centralized product registration under NPRA/DCA with continuous decision cycles: All medicines are regulated under the Drug Control Authority via the NPRA, requiring registration before supply. NPRA publishes “New Products Approved” by DCA meeting number; in the recent cycle, approvals were issued across decision sets labeled DCA392 through DCA403, evidencing at least 12 formal decision tranches in that year. This cadence indicates ongoing throughput for new molecules and line extensions, shaping launch timing and formulary bids for public procurement and private hospitals. Stakeholders can verify approval status via MOH’s open “Approved Pharmaceutical Products” dataset.

Market conduct and pharmacovigilance anchored in national surveillance outputs: Regulatory oversight extends into post-marketing surveillance and mandatory health-system reporting. MOH Health Facts compile utilization and outcomes, including 1,362,564 private-hospital admissions, 4,062,272 private-hospital outpatient visits and tabulated principal causes of hospitalisation and mortality, which inform NPRA risk management decisions and safety communications. Such quantified outputs, with documented response rates and submission coverage, provide regulators and hospital PTCs with evidence to calibrate formulary restrictions, Risk Management Plans and reporting thresholds for adverse drug reactions.

Distribution licensing and GDP/GDPMD compliance across a high-volume network: The legal framework requires licensed wholesalers and healthcare facilities to meet GDP/GDPMD standards for storage and distribution. The MOH facility base—148 MOH hospitals/special institutions, 3,121 health clinics and 1,722 rural clinics—creates quantifiable compliance obligations for warehousing, cold-chain, and audit trails. Concurrently, Malaysia’s trade channels handle US$2.4 billion of pharmaceutical imports and US$471.43 million of exports, volumes that are subject to import permits and regulatory release controls at the border, linking licensing to physical flows of product.

Malaysia Pharmaceuticals Market Segmentation

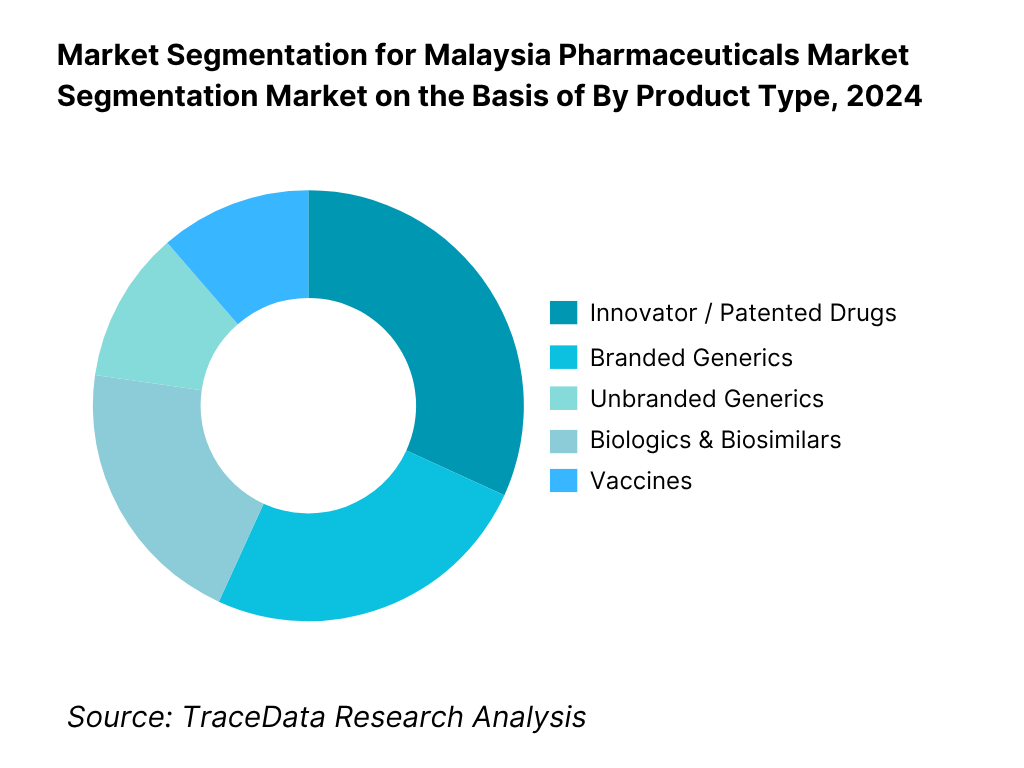

By Product Type: Malaysia pharmaceutical market is segmented into innovator/patented drugs, branded generics, unbranded generics, biologics & biosimilars, vaccines, and OTC/self-care. Among these, innovator/patented drugs tend to hold a leading share because global MNCs prioritize Malaysia as a moderately high-income Southeast Asian market, launching novel therapies earlier there. Also, government hospital tenders often require patented (or reference) medicines for certain specialty therapies. The branded generics and OTC/self-care segments are also substantial due to domestic manufacturer contributions and consumer access in community pharmacies. Biologics & biosimilars are growing but still limited by high cost and regulatory complexity, while vaccines – often procured via state programs – account for a moderate share. The predominance of innovators is sustained by strong marketing capability, hospital formulary access, and reliance on imported high-margin therapies.

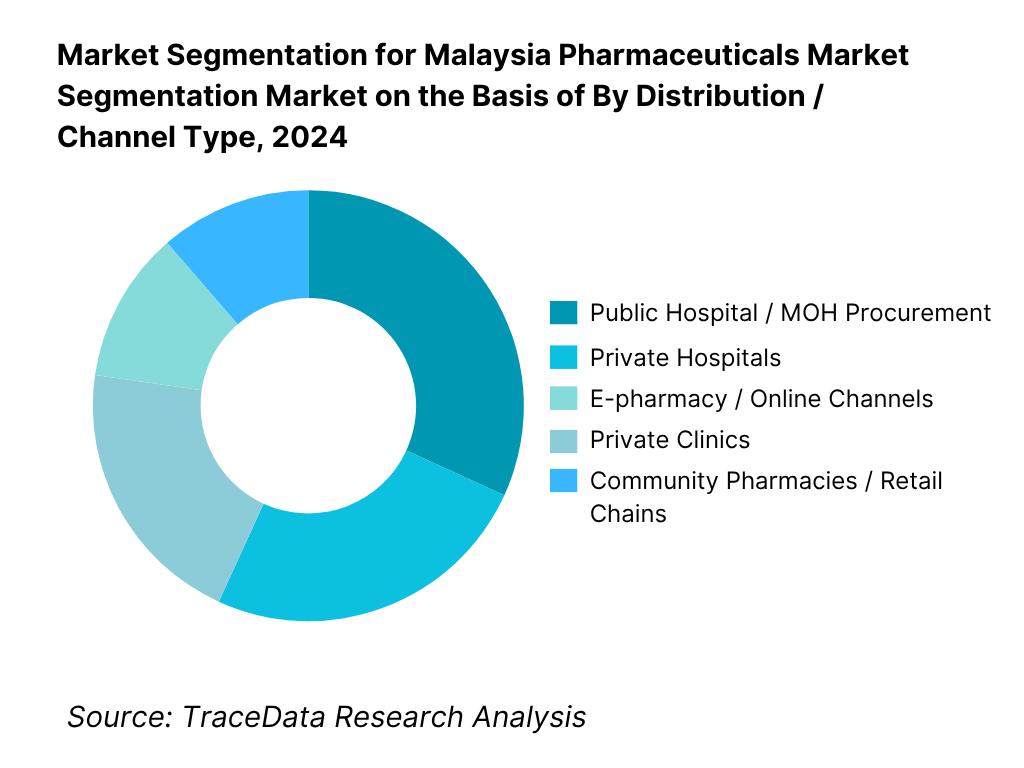

By Distribution / Channel Type: Malaysia’s pharmaceutical market is segmented into public hospital / MOH procurement, private hospitals, community pharmacies / retail chains, e-pharmacy/online, and private clinics. The public hospital channel dominates because the Ministry of Health remains a major buyer via national tenders and formulary procurement, covering a large share of in-patient and chronic care medicine supply. Community pharmacies / retail chains also command significant share due to broad geographic reach and high consumer footfall for prescriptions and self-care products. Private hospitals and clinics capture niche higher-margin segments, especially specialty drugs, but their smaller scale limits share. E-pharmacy / online is an emerging but smaller slice (circa ~5 %) given regulatory constraints and trust issues in medicine delivery. The dominance of public procurement reflects Malaysia’s dual health system approach and centralized budget capacity.

Competitive Landscape in Malaysia Pharmaceuticals Market

The Malaysia pharmaceutical market is characterized by a mix of domestic manufacturers and multinational entrants. A few large players dominate hospital tenders and retail distribution. Domestic firms often leverage local manufacturing, halal certification capabilities, and government linkages, while MNCs bring global pipelines and brand strength.

Name | Founding Year | Original Headquarters |

Pharmaniaga Berhad | 1994 | Selangor, Malaysia |

Duopharma Biotech Berhad | 1978 | Klang, Selangor, Malaysia |

Hovid Berhad | 1980 | Ipoh, Perak, Malaysia |

Y.S.P. Southeast Asia (M) Berhad | 1987 | Kuala Lumpur, Malaysia |

Kotra Pharma (M) Sdn Bhd | 1982 | Melaka, Malaysia |

Apex Healthcare Berhad (Xepa-SP) | 1962 | Melaka, Malaysia |

Sunward Pharmaceutical Sdn Bhd | 1966 | Johor Bahru, Malaysia |

Nova Laboratories (Malaysia) Sdn Bhd | 1989 | Selangor, Malaysia |

Pfizer Malaysia Sdn Bhd | 1959 | New York, USA |

GlaxoSmithKline Pharmaceutical Malaysia | 1958 | London, United Kingdom |

Novartis Corporation (Malaysia) Sdn Bhd | 1996 | Basel, Switzerland |

Sanofi-Aventis (Malaysia) Sdn Bhd | 1959 | Paris, France |

Roche (Malaysia) Sdn Bhd | 1972 | Basel, Switzerland |

AstraZeneca Sdn Bhd | 1999 | Cambridge, United Kingdom |

Merck Sharp & Dohme (MSD) Malaysia | 1965 | Rahway, New Jersey, USA |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Pharmaniaga Berhad: As Malaysia’s largest integrated pharmaceutical company, Pharmaniaga has strengthened its vaccine production capacity through collaboration with Sinovac and the Ministry of Health, supporting national immunization programs. In 2024, the company invested in digitalizing its logistics and supply-chain infrastructure to improve cold-chain reliability and traceability under Good Distribution Practice (GDP) standards. Pharmaniaga also announced plans to expand its halal pharmaceutical portfolio to enhance regional exports within ASEAN markets.

Duopharma Biotech Berhad: Duopharma Biotech recorded strong revenue growth in 2024 driven by increased biologics and insulin portfolio sales. The company expanded its partnership with Biocon Biologics to commercialize biosimilar insulin and monoclonal antibody therapies in Malaysia. Additionally, Duopharma introduced new halal-certified nutraceuticals and wellness products, reinforcing its positioning in both ethical and consumer health segments while aligning with Malaysia’s National Pharmaceutical Policy goals.

Hovid Berhad: Hovid has focused on rebuilding export competitiveness following its relisting on Bursa Malaysia, with a renewed emphasis on generic pharmaceuticals and OTC products. In 2024, the firm invested in advanced oral solid dosage manufacturing lines and quality assurance labs to align with updated NPRA and PIC/S GMP requirements. It continues to prioritize research in formulations with longer shelf life suitable for tropical storage conditions, catering to both domestic and regional demand.

Apex Healthcare Berhad (Xepa-SP): Apex Healthcare has diversified its portfolio with new therapeutic launches in pain management, respiratory care, and antibiotics. In 2024, the company’s subsidiary Xepa-Soul Pattinson (Xepa-SP) completed a major production facility upgrade to expand capacity for sterile manufacturing and export-oriented lines. Apex also reinforced its regional distribution network in Singapore and Indonesia, targeting export growth through ASEAN mutual recognition agreements.

Pfizer Malaysia Sdn Bhd: Pfizer Malaysia continued to play a pivotal role in the biopharmaceutical space by introducing new oncology and vaccine products to the local market. In 2024, Pfizer focused on expanding access to its pneumococcal and COVID-19 vaccines via partnerships with both private hospitals and MOH procurement. The company also launched community-level health awareness campaigns and supported digital doctor-patient engagement platforms to promote timely vaccination and treatment adherence.

What Lies Ahead for Malaysia Pharmaceuticals Market?

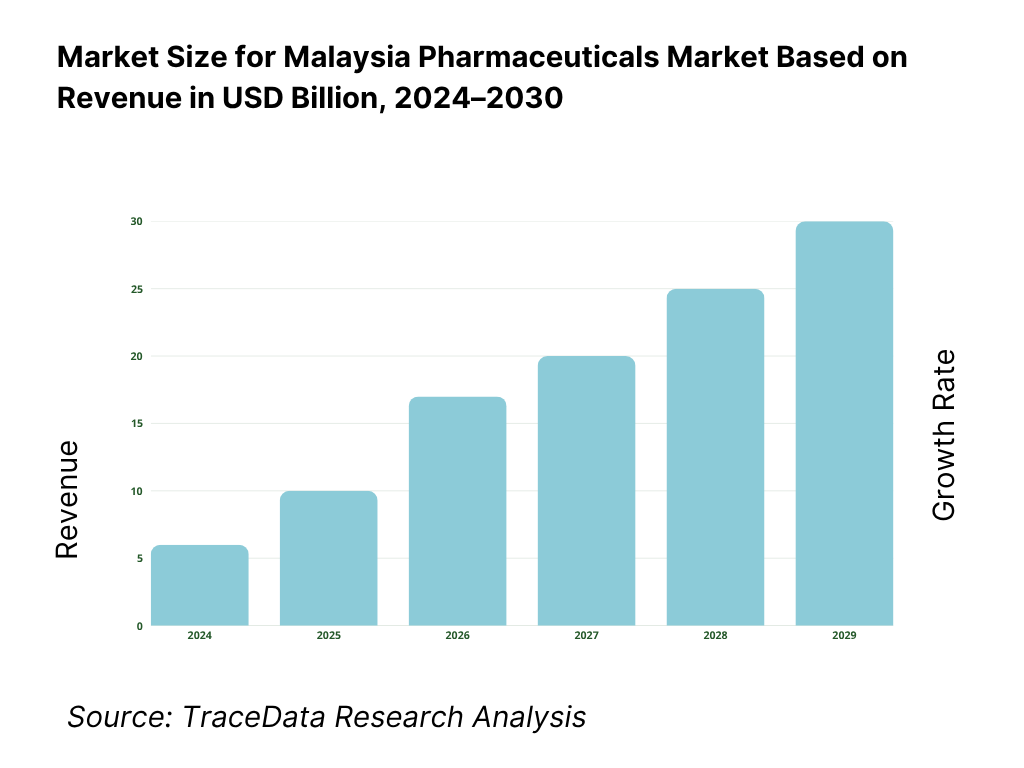

The Malaysia pharmaceuticals market is projected to continue its steady expansion through 2030, driven by sustained healthcare expenditure, local manufacturing investments, and government-led initiatives supporting the domestic life sciences ecosystem. The sector’s evolution will be propelled by Malaysia’s position as a regional hub for halal-certified medicines, the growing role of biologics and biosimilars, and the digital transformation of the healthcare delivery chain. As population health priorities evolve, the demand for affordable, high-quality, and compliant medicines will reinforce Malaysia’s position as one of Southeast Asia’s key pharmaceutical markets.

Rise of Biologics and Biosimilar Adoption: The future of Malaysia’s pharmaceutical industry will be shaped by the accelerated uptake of biologics and biosimilars across oncology, diabetes, and autoimmune therapies. With increasing prevalence of chronic diseases and a rising middle-class population, demand for advanced biologic therapies continues to climb. Local manufacturers like Duopharma Biotech have strengthened technology-transfer partnerships to produce biosimilar insulin and monoclonal antibodies locally, supported by the Ministry of Health’s framework for specialty drug inclusion. This transition toward biologics signifies Malaysia’s strategic move to reduce dependency on imports while improving long-term therapeutic affordability.

Strengthening Halal Pharmaceutical Leadership: Malaysia is poised to consolidate its leadership as the global hub for halal pharmaceuticals under the MS 2424:2019 standard. With over 80 GMP-licensed pharmaceutical plants and an established certification ecosystem led by JAKIM, the country serves as a preferred production base for Organization of Islamic Cooperation (OIC) markets. Manufacturers such as Pharmaniaga and Duopharma Biotech continue to expand halal-certified SKUs targeting export markets across the Middle East, Africa, and ASEAN. The convergence of compliance, manufacturing quality, and brand trust positions Malaysia to dominate the global halal medicine value chain.

Expansion of Domestic Manufacturing and R&D Infrastructure: The government’s New Industrial Master Plan (NIMP) 2030 and Pharmaceutical Industry Transformation Program (PITP) emphasize greater self-sufficiency in drug production. Malaysia currently records US$2.4 billion in annual pharmaceutical imports, highlighting ample opportunity for local substitution. Ongoing investments in sterile manufacturing, biologics fill-finish lines, and contract manufacturing organizations (CMOs) are expected to reduce dependency on imported formulations and APIs. Strategic tax incentives from the Malaysian Investment Development Authority (MIDA) are driving private-sector participation in R&D and GMP-certified facility expansion to strengthen Malaysia’s export competitiveness.

Digitization and E-Pharmacy Growth: The pharmaceutical retail and supply ecosystem in Malaysia is witnessing rapid digitization. With 33.7 million mobile subscriptions and internet penetration exceeding 97 % (MCMC 2024), e-pharmacy and telehealth services are integrating into mainstream distribution. Online dispensing platforms are improving last-mile access, particularly in semi-urban and rural regions where clinic density remains lower. Digital prescription verification, AI-driven adherence tools, and integrated logistics platforms are expected to redefine retail pharmacy efficiency and transparency, aligning Malaysia’s ecosystem with advanced e-pharma models seen in South Korea and Singapore.

Integration of AI and Regulatory Automation: Malaysia’s National Pharmaceutical Regulatory Agency (NPRA) is embracing digital transformation through the QUEST3+ electronic submission system, expediting product registration and lifecycle management. Artificial Intelligence (AI) and data analytics are being deployed in pharmacovigilance, quality-control, and adverse-event monitoring systems to ensure compliance with PIC/S standards. Predictive analytics and digital twin technologies in manufacturing are improving yield optimization and process consistency. This fusion of AI and automation across the regulatory and production chain will enhance transparency, reduce time-to-market, and strengthen Malaysia’s pharmaceutical reliability in global trade.

Regional Export Expansion and Trade Integration: Malaysia’s strategic trade linkages within ASEAN and bilateral free-trade agreements are unlocking new export corridors for finished dose formulations and halal-certified medicines. With total goods exports reaching US$329.45 billion (World Bank 2024) and pharmaceuticals contributing nearly US$471 million, Malaysia is positioned to leverage logistics excellence through Port Klang and Johor’s Pasir Gudang to expand into emerging Asian and Gulf markets. Government initiatives to streamline export documentation and mutual recognition agreements (MRAs) with regional regulators will further reduce barriers for Malaysian producers in highly regulated therapeutic segments.

Malaysia Pharmaceuticals Market Segmentation

By Product Type

Innovator / Patented Drugs

Branded Generics

Unbranded Generics

Biologics & Biosimilars

OTC & Self-Care Medicines

Vaccines

By Therapeutic Area

Cardiovascular

Anti-Infectives

Oncology

Central Nervous System (CNS)

Gastrointestinal & Metabolic Disorders

Respiratory

Dermatology & OTC Wellness

By Dosage Form

Solid Oral (Tablets/Capsules)

Injectables / Sterile Products

Topical / Dermatologicals

Liquids / Syrups / Suspensions

Inhalation & Nasal Preparations

By Distribution Channel

Public Hospitals (MOH / University / Military)

Private Hospitals

Community Pharmacies / Retail Chains

E-Pharmacy / Online Platforms

Private Clinics

By Region

Central Malaysia (Klang Valley, Selangor, Kuala Lumpur)

Northern Region (Penang, Kedah, Perlis)

Southern Region (Johor, Melaka, Negeri Sembilan)

East Coast (Pahang, Terengganu, Kelantan)

East Malaysia (Sabah, Sarawak, Labuan)

Players Mentioned in the Report:

Pharmaniaga Berhad

Duopharma Biotech Berhad

Hovid Berhad

Y.S.P. Southeast Asia (M) Berhad

Kotra Pharma (M) Sdn Bhd

Apex Healthcare / Xepa-SP

Sunward Pharmaceutical

Nova Laboratories

Pfizer Malaysia (subsidiary)

GlaxoSmithKline (GSK) Malaysia

Novartis Malaysia

Sanofi Malaysia

Roche Malaysia

AstraZeneca Malaysia

Merck Sharp & Dohme (MSD) Malaysia

Key Target Audience

Pharmaceutical manufacturers (local and MNCs)

Hospital group procurement divisions (MOH hospitals, private hospital chains)

Retail pharmacy chains and distribution networks

E-pharmacy operators / digital health pharmacies

Venture capital / private equity firms investing in biotech or pharma

Export promotion agencies / trade bodies (e.g. Malaysian Investment Development Authority)

Government and regulatory bodies (Ministry of Health Malaysia, NPRA)

Health insurers / TPAs and corporate healthcare purchasers

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis-Retail Boutique, Resort & Spa, Pharmacy/Para-pharma, E-commerce, Salon-Pro, Duty-Free, D2C (gross margin by channel %, footfall conversion %, basket size (MVR), replenishment cycle days, shrinkage %, SGA absorption, strengths/weaknesses matrix)

4.2. Revenue Streams for Maldives Beauty & Personal Care (sell-in vs sell-out mix, listing & visibility fees, exclusive resort contracts, salon services add-ons, subscription/refill, private label, promotional funding %)

4.3. Business Model Canvas (Maldives Context) (customer segments (tourist archetypes/residents), value propositions (reef-safe, halal/vegan, dermocosmetic), key partners (resorts/importers), cost structure (duty/freight/SGA), revenue model granularity, key resources & activities)

5.1. Freelancer Beauty Pros vs Employed Salon Staff (artist utilization %, average ticket (MVR), certification prevalence, commission structures, service-to-retail attachment rate)

5.2. Investment Model in Maldives BPC (store CAPEX per sqm, gondola/fixture ROI months, working capital turns, new-brand entry costs, resort concession fees)

5.3. Funneling Process: Private vs Government-Linked Procurement (pre-qualification norms, payment terms, compliance/labeling checks, delivery SLAs, evaluation weights)

5.4. Corporate/Institutional Beauty Budget Allocation by Company Size (resorts/spas/hospitality groups: budget per key, training spend per therapist, amenities cost per occupied room)

8.1. Revenues (Historic Period)

9.1. By Market Structure (Public Procurement, Private Sales, and Exports)

9.2. By Product Type (Innovator Rx, Branded Generics, Unbranded Generics, Biologics, Vaccines, OTC & Self-Care)

9.3. By Therapeutic Area (Cardiovascular, Oncology, Anti-Infectives, Respiratory, CNS, Gastrointestinal, Vaccines)

9.4. By Dosage Form (Solid Oral, Injectable, Inhalation, Topical, Liquid)

9.5. By Manufacturing Source (Locally Manufactured, Imported Finished Dose, Contract-Manufactured)

9.6. By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Private Clinics, E-Pharmacy)

9.7. By Payer Type (Public Budget, Private Insurance, Corporate Healthcare, Out-of-Pocket)

9.8. By Region (Central, Northern, Southern, East Coast, and East Malaysia)

10.1. Institutional and Retail Buyer Landscape

10.2. Procurement and Tender Decision Process (MOH, Public Hospitals, Universities)

10.3. Private Hospital and Pharmacy Buying Preferences

10.4. Prescription and Substitution Behavior

10.5. Gap Analysis Framework (Demand-Supply and Product-Mix Gaps)

11.1. Trends & Developments (reef-safe & clean beauty, dermocosmetics, minis/travel kits, AI shade-match, refillable formats, halal/vegan claims)

11.2. Growth Drivers (tourist inflows, premiumization, digital penetration, exclusive resort tie-ups, pharmacy professionalization)

11.3. SWOT (Maldives BPC) (supply dependence, logistics complexity, high-value tourist basket, niche brand curation)

11.4. Issues & Challenges (labeling/compliance, cold-chain for actives, inter-island freight, gray imports, staff training)

11.5. Regulatory Environment (ingredient restrictions, labeling norms, SPF/claims substantiation, customs/HS codes, MIRA/tax, product safety & recalls)

12.1. Market Size and Future Potential for Online Dispensing Platforms

12.2. Business Model and Revenue Streams-[B2C, Marketplace, Subscription, Telehealth Integration]

12.3. Delivery Models and Product Categories Offered-[Prescription Drugs, Wellness Products, Nutraceuticals]

15.1. Market Share of Key Players (Revenue Basis)

15.2. Benchmark of Key Competitors-[Company Overview, USP, Business Model, Manufacturing Capability, Pricing, Technology Adoption, Key Brands, Major Clients, Strategic Partnerships, Marketing Strategy, and Recent Developments]

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant-[Local vs MNC Innovators and Generics Players]

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues (Forecast Period)

17.1. By Market Structure (Public Procurement, Private Sales, and Exports)

17.2. By Product Type (Innovator, Generics, Biologics, Vaccines, OTC)

17.3. By Therapeutic Area (Cardiovascular, Oncology, Anti-Infectives, CNS, Vaccines, GI)

17.4. By Dosage Form (Solid Oral, Injectable, Inhalation, Topical, Liquid)

17.5. By Manufacturing Source (Local, Imported, Contract)

17.6. By Distribution Channel (Hospital, Retail, Clinic, E-Pharmacy)

17.7. By Payer Type (Public, Private, Corporate, Out-of-Pocket)

17.8. By Region (Central, Northern, Southern, East Coast, East Malaysia)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Malaysia Pharmaceuticals Market. On the demand side, we consider entities such as the Ministry of Health (MOH), National Pharmaceutical Regulatory Agency (NPRA), public and private hospitals, community pharmacies, and private clinics. On the supply side, we include local pharmaceutical manufacturers, multinational corporations (MNCs), importers, contract manufacturers, distributors, and third-party logistics providers. Based on this ecosystem, we will shortlist leading 5–6 pharmaceutical companies in the country such as Pharmaniaga Berhad, Duopharma Biotech Berhad, Hovid Berhad, Pfizer Malaysia, GlaxoSmithKline (GSK) Malaysia, and Apex Healthcare Berhad, based on their financial information, product portfolios, and market reach. Sourcing is conducted through industry articles, government databases (MOH, NPRA, MIDA, DOSM), and multiple proprietary and secondary databases to perform desk research around the market to collate industry-level information, including manufacturing capacity, product registrations, and trade data.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like import-export values, GMP-certified manufacturing facilities, public and private healthcare utilization, distribution channels, and regulatory structures. We supplement this with detailed examinations of company-level data, relying on press releases, annual reports, financial statements, NPRA licensing data, and Ministry of Health procurement documents. This process aims to construct a foundational understanding of both the market structure and the entities operating within it, establishing the baseline for size estimation, segmentation, and performance benchmarking across therapeutic areas.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, regulatory officials, hospital procurement heads, distributors, and pharmacists representing various Malaysia Pharmaceuticals Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions and product volumes for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate operational and financial information shared by company executives, corroborating this data against what is available in secondary sources such as NPRA records, MOH Health Facts, and UN Comtrade trade data. These interactions also provide us with a comprehensive understanding of manufacturing capacity, value chains, import dependencies, pricing structures, and distribution processes.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess the sanity of the process. The bottom-up model compiles company-level revenues, product volumes, and NPRA-approved product counts, while the top-down model aligns estimates with macro indicators such as total health expenditure (USD 22.5 billion, World Bank) and pharmaceutical import value (USD 2.4 billion, UN Comtrade). Both approaches are cross-verified to ensure consistency, with deviations maintained within an acceptable threshold. This step ensures the market estimations, segmentation structures, and competitive benchmarks are statistically robust, credible, and aligned with Malaysia’s current healthcare and economic landscape.

FAQs

01. What is the potential for the Malaysia Pharmaceuticals Market?

The Malaysia Pharmaceuticals Market demonstrates strong growth potential, valued at USD 3.76 billion according to ReportLinker’s dataset. The market’s expansion is driven by the country’s robust healthcare infrastructure, increasing prevalence of chronic diseases, and rising healthcare spending supported by the government’s MOH Health Budget allocation exceeding MYR 36 billion. Malaysia’s pharmaceutical potential is further reinforced by its positioning as a regional halal-pharma hub under the MS 2424:2019 standard, and by the ongoing digitalization of the healthcare ecosystem.

02. Who are the Key Players in the Malaysia Pharmaceuticals Market?

The Malaysia Pharmaceuticals Market features a mix of domestic manufacturers and multinational corporations. Key players include Pharmaniaga Berhad, Duopharma Biotech Berhad, and Hovid Berhad, recognized for their manufacturing capacity and halal-certified product portfolios. Multinational leaders such as Pfizer Malaysia, GlaxoSmithKline (GSK), Novartis, Roche, and AstraZeneca dominate the specialty and biologics segment. Together, these players drive innovation, contribute to public-hospital supply chains, and shape the country’s regulatory and export competitiveness.

03. What are the Growth Drivers for the Malaysia Pharmaceuticals Market?

Key growth drivers include a growing population of 34.2 million (Department of Statistics Malaysia) that underpins medicine demand, and consistent public-sector investment in healthcare—reflected in MYR 36 billion allocated to the Ministry of Health (MOH Budget 2024). Additionally, Malaysia’s trade openness—shown by US$ 2.4 billion in pharmaceutical imports and US$ 471 million in exports (UN Comtrade)—enables access to innovative therapies and supports regional re-exports. The government’s emphasis on halal-certified production, under the MS 2424 standard, and the New Industrial Master Plan 2030 (NIMP) incentives for local manufacturing, further accelerate the market’s expansion.

04. What are the Challenges in the Malaysia Pharmaceuticals Market?

The Malaysia Pharmaceuticals Market faces several challenges, including heavy reliance on imported finished products, which totaled US$ 2.4 billion, creating exposure to currency fluctuations and supply-chain disruptions. Regulatory timelines under the Drug Control Authority (DCA) and NPRA registration framework can extend product-launch lead times. Additionally, the domestic market’s fragmentation—with over 80 GMP-licensed manufacturers competing on similar therapeutic lines—pressures margins. Price-control proposals under the MOH’s Medicine Price Monitoring Mechanism and rising compliance costs for GDP/GMP audits also constrain profitability, particularly for smaller local manufacturers.