Maldives Beauty and Personal Care Market Outlook to 2030

By Category, By Distribution Channel, By Consumer Group, By Product Type, and By Region

- Product Code: TDR0386

- Region: Asia

- Published on: November 2025

- Total Pages: 80

Report Summary

The Report Title: “Maldives Beauty and Personal Care Market Outlook to 2030 – By Category, By Distribution Channel, By Consumer Group, By Product Type, and By Region” provides a comprehensive analysis of the beauty and personal care industry in the Maldives. It covers an overview and genesis of the sector, overall market size in terms of value, detailed market segmentation, emerging trends and developments, regulatory landscape, consumer-level profiling, issues and challenges, and a competitive landscape that includes competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the market. The report concludes with future market projections segmented by category, distribution channel, consumer group, product type, and region. It also incorporates cause-and-effect relationships and success case studies, highlighting major opportunities, constraints, and strategic considerations that will shape the Maldives Beauty and Personal Care Market through 2030.

Maldives Beauty and Personal Care Market Overview and Size

The Maldives Beauty & Personal Care market is best proxied by HS Chapter 33 imports because domestic manufacturing is negligible. Maldives Monetary Authority’s customs-sourced series shows HS-33 imports at USD 42.46 million in 2023 and USD 46.61 million in 2024, reflecting rising tourist footfall, premiumization in resort retail, and higher ASPs in sun-care and fragrance. These figures are official totals compiled from Maldives Customs and published by the central bank’s statistics portal, providing a robust, non-estimated baseline for market value.

Supply is concentrated from a few external hubs that feed the archipelago’s resort and retail channels. In beauty, perfumery (HS 330300) alone contributed USD 12.65 million in 2023 imports, with top origins UAE, Singapore, and France; beauty/make-up & skin care (HS 330499) added USD 12.13 million, led by India, UAE, and Singapore. On-the-ground, Greater Malé dominates due to warehousing, port access and national retail clustering, while high-ADR resort atolls (North/South Malé, Ari, Baa) anchor premium demand and gifting.

What Factors are Leading to the Growth of the Maldives Beauty and Personal Care Market:

Tourism-led consumption and resort retail intensity: The Maldives’ beauty and personal care demand is anchored in tourism volumes that far exceed the country’s population, creating outsized retail throughput in resorts, pharmacies, and airport duty-free. Official data show 2,046,615 tourist arrivals in 2024, against a national population of 515,132 residents, meaning visitor inflows are roughly four times the domestic headcount. An inflation backdrop averaging 1.40 on the all-items CPI helped preserve purchasing power for essential sun-care and premium minis in resort boutiques. Together, the scale of inbound travelers and stable prices sustain high-velocity beauty categories across atolls.

High digital reach and spending capacity enabling premiumization and e-commerce: Beauty discovery and replenishment benefit from Maldives’ advanced connectivity and relatively high income. Around 84.69 of the population use the internet, while mobile penetration stands at 142 subscriptions per 100 people. On the demand side, GDP per capita of 18,210 U.S. dollars supports premium skincare and fragrance purchasing by residents and expatriates. This combination of digital reach and income depth drives uptake of dermatologist-led regimens, online concierge delivery, and pre-travel ordering linked to resort stays, accelerating omnichannel beauty adoption across the islands.

Strengthening logistics and market access via multimodal initiatives: Distribution to a multi-island nation hinges on reliable intermodal links. In March 2024, Maldives Ports Limited launched a Sea-to-Air cargo transshipment service to speed high-value, time-sensitive goods, including temperature-sensitive personal care. Customs access is broad, with operations from 10 locations nationwide, improving clearance and reach into atolls. These logistics upgrades reduce lead-time risk for resort and pharmacy channels, lower stock-out frequency for sun-care and skincare, and enable faster new-product rotations in resort retail—strengthening the market’s responsiveness to global beauty trends.

Which Industry Challenges Have Impacted the Growth of the Maldives Beauty and Personal Care Market:

Geographic fragmentation raises last-mile cost and service complexity: Beauty distribution is stretched across dispersed population centers and resort islands. The total population of 515,132 residents is split across 211,908 in Malé, 236,911 in administrative islands, and 52,482 living or working on resort islands. Serving these nodes requires multi-stage shipping and island-level warehousing for minis, SPF, and after-sun products, with seasonality tied to tourist flows of over 2 million arrivals annually. The combination of small drop sizes and inter-atoll freight legs complicates planogram compliance and on-shelf availability for fast-moving beauty SKUs.

Fiscal and macro constraints can affect operating conditions and demand: While inflation averaged 1.40 in 2024, fiscal pressures remain elevated and can influence indirect costs such as utilities, logistics, and wages. A fiscal deficit of 12.3 of GDP was recorded, widening from 10.6 previously, as recurrent expenditure outpaced revenue. For beauty operators, these macro signals translate into tighter working capital cycles, import scheduling challenges, and potential policy adjustments that affect subsidy frameworks and freight rates—factors that directly impact product pricing and profitability in retail and resort channels.

Workforce structure and skills availability for professional beauty services: Labor composition affects the delivery of salon-professional and pharmacy-based beauty services. The employed base includes 171,130 Maldivians and 129,292 foreign workers, with 174,036 residing in atolls and 126,386 in Malé. Youth NEET stands at 10,414, indicating an emerging need for vocational training in aesthetic, retail, and dermo-counseling skills. For beauty retailers and resort spas, this workforce structure necessitates continuous staff development and certification programs to maintain service standards, enhance upselling in resort outlets, and improve product knowledge across touchpoints.

What are the Regulations and Initiatives which have Governed the Market:

Customs classification and tariff administration for HS-33 imports: Cosmetics and personal care products enter the Maldives under HS Chapter 33, governed by the 2024 National Tariff Schedule administered by Maldives Customs Service. Importers and exporters must register with Customs; since April 2019, a general import/export license from the Ministry of Economic Development is no longer required. Customs services operate from 10 locations nationwide, facilitating clearance into resorts and retail markets. Correct HS coding and documentation remain essential for importers to ensure compliance and avoid delays or reclassification disputes at entry points.

Health regulatory interface for borderline products and therapeutic claims: Products that make therapeutic claims or contain active medicinal ingredients fall under the oversight of the Maldives Food and Drug Authority (MFDA). The authority requires pre-authorization for registration samples and valid import and export certificates for consignment clearance. Beauty products such as medicated sunscreens, anti-acne formulations, or whitening treatments may need MFDA classification and documentation before customs release. Companies must ensure packaging and claims align with regulatory definitions to prevent delays in entry and distribution.

Quality, reliance, and GMP expectations in the therapeutic space affecting beauty-adjacent lines: MFDA enforces Good Manufacturing Practice (GMP) compliance for imported products, particularly those at the cosmetic-therapeutic boundary. All qualifying imports must carry a valid GMP certificate issued by the manufacturing country’s regulatory authority. The 2024 reliance guideline update further allows reliance on approvals from recognized international reference agencies, expediting access to quality-assured beauty-adjacent products. For multinational brands, adherence to GMP, proper dossier documentation, and evidence of regulatory recognition are critical to avoid clearance bottlenecks and ensure product marketability.

Maldives Beauty and Personal Care Market Segmentation

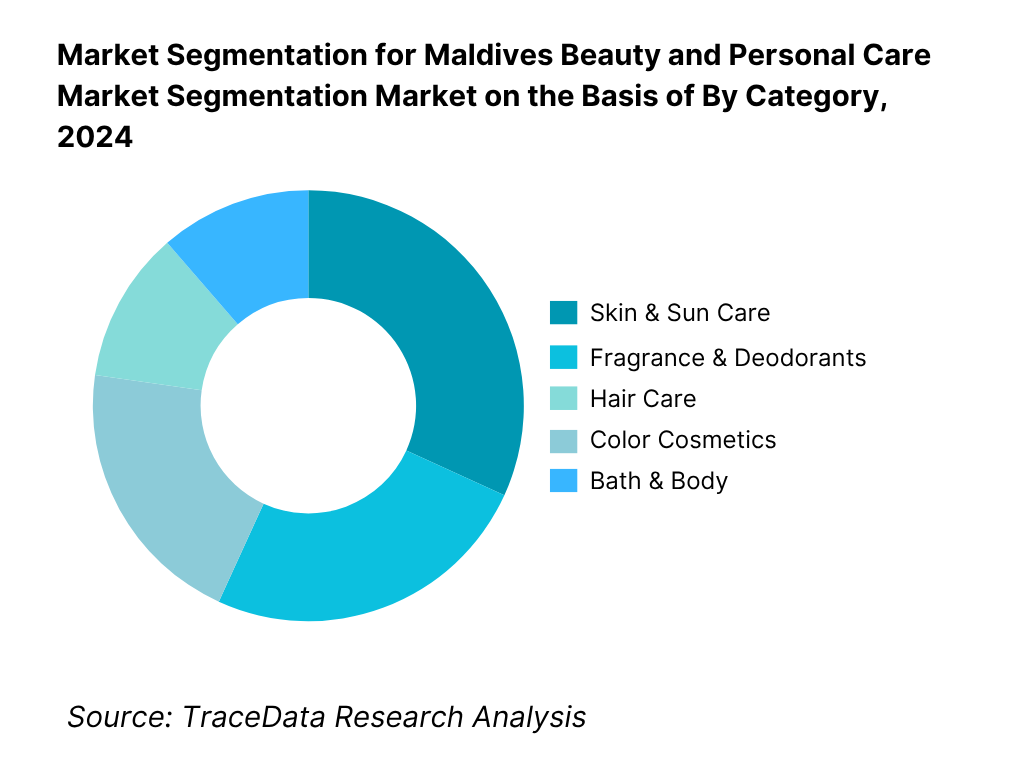

By Category: Maldives Beauty & Personal Care market is segmented into skin & sun care, fragrance & deodorants, hair care, color cosmetics, and bath & body. Skin & sun care presently leads share given year-round UV exposure, reef-safe positioning in resorts, and amenity packs for guests. Sunblocks, after-sun gels, and hydrating serums ride both tourist and resident baskets, supported by pharmacy counseling and resort spa cross-selling. Robust replenishment cycles, premium minis/travel kits, and dermocosmetic credibility help this segment capture the highest unit velocity and sustain higher ASPs versus mass bath lines, keeping it at the top of category mix.

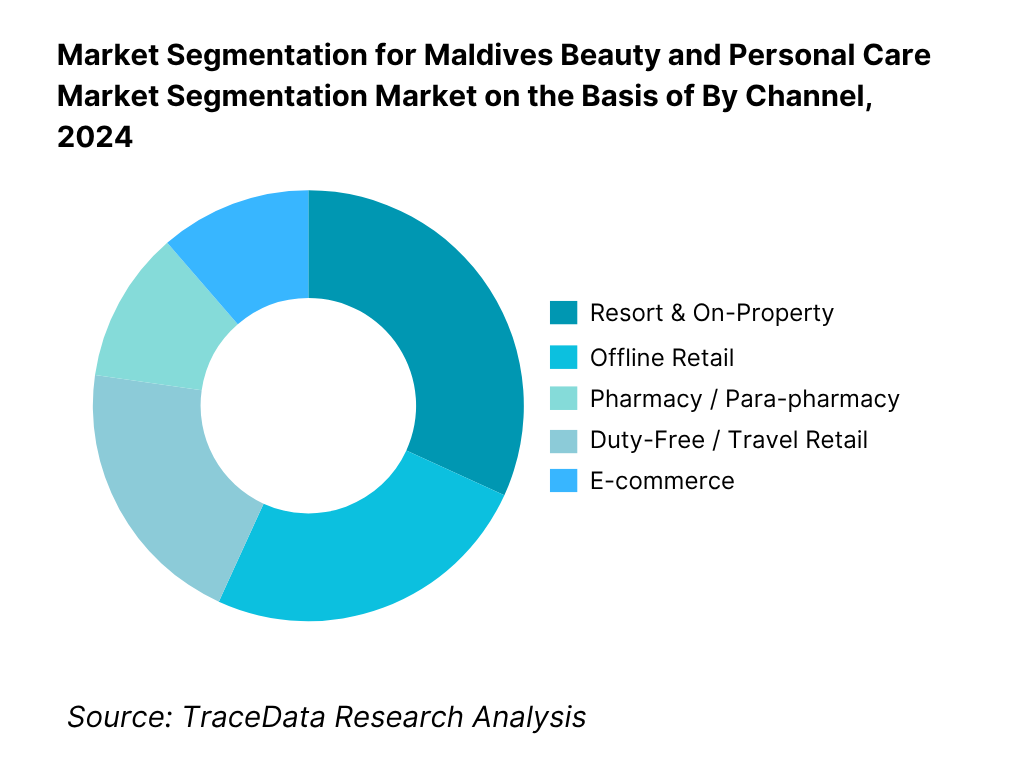

By Channel: Maldives Beauty & Personal Care market is segmented by resort & on-property, offline retail, pharmacy/para-pharmacy, e-commerce, salon-professional, and duty-free/travel retail. Resort & on-property dominates as high-spend visitors seek convenience, curated luxury sets, and reef-safe assortments bundled with spa experiences. Exclusive tie-ups, premium gifting, and travel-size formats boost conversion. Strong footfall adjacency to spas, attentive staff upselling, and limited price sensitivity underpin margins and sell-through, while minis and amenity programs create steady re-order cadence even during shoulder seasons.

Competitive Landscape in Maldives Beauty and Personal Care Market

The Maldives Beauty & Personal Care market is shaped by global multinationals working through local importers and resort distribution, alongside Asian beauty specialists with strong sun-care and hydration portfolios. Consolidation around a handful of brand-owner groups ensures bargaining power at key accounts (resorts, pharmacies), while origin hubs such as UAE, India and Singapore sustain agility in replenishment and price-pack architecture for minis and travel retail. Fragrance houses leverage gifting and duty-free adjacency; dermocosmetic lines scale via pharmacy counseling.

Name | Founding Year | Original Headquarters |

L’Oréal | 1909 | Clichy, France |

Unilever | 1929 | London, United Kingdom |

Estée Lauder Companies | 1946 | New York, United States |

Beiersdorf (NIVEA) | 1882 | Hamburg, Germany |

Shiseido Company | 1872 | Tokyo, Japan |

Amorepacific Corporation | 1945 | Seoul, South Korea |

Procter & Gamble (P&G) | 1837 | Cincinnati, United States |

Colgate-Palmolive Company | 1806 | New York, United States |

Johnson & Johnson | 1886 | New Brunswick, US |

Coty Inc. | 1904 | New York, United States |

Kao Corporation | 1887 | Tokyo, Japan |

Henkel AG & Co. | 1876 | Düsseldorf, Germany |

Revlon Inc. | 1932 | New York, United States |

The Body Shop | 1976 | Brighton, United Kingdom |

Himalaya Wellness Company | 1930 | Bengaluru, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

L’Oréal: A leading multinational in the Maldivian beauty landscape, L’Oréal has expanded its presence in the resort retail segment through its luxury brands such as Lancôme, Kiehl’s, and La Roche-Posay. In 2024, the company strengthened its reef-safe sun-care and dermocosmetic lines, aligning with resort sustainability mandates and increasing dermatology-linked skincare consultations across pharmacies.

Unilever: Unilever has reinforced its dominance in mass and masstige beauty categories with brands like Dove, Sunsilk, and Pond’s. The company introduced eco-friendly packaging and refill initiatives in collaboration with local distributors in 2024, aiming to reduce single-use plastics and support Maldives’ environmental goals while maintaining a strong hold in retail and pharmacy shelves.

Estée Lauder Companies: Targeting the luxury consumer segment, Estée Lauder expanded its footprint in duty-free and resort boutiques through Estée Lauder, MAC, and Clinique lines. In 2024, the brand emphasized personalized skincare consultations and mini-sized offerings to attract premium tourists, further solidifying its leadership in prestige cosmetics and skincare across high-end resort locations.

Beiersdorf (NIVEA): Beiersdorf has sustained a strong presence through its sun protection and skincare range, especially NIVEA Sun and NIVEA Men. In 2024, the company focused on promoting dermatologist-endorsed formulations and affordable travel kits, addressing both tourists and local consumers. It also intensified awareness campaigns around reef-safe sunscreen compliance in partnership with pharmacies and resorts.

Amorepacific: With brands such as Innisfree and Laneige, Amorepacific has expanded in the Maldives via resort concept stores and spa collaborations, leveraging its strength in hydration and natural-ingredient formulations. In 2024, it introduced eco-conscious refillable packaging and K-beauty-inspired routines for spa retail, tapping into rising tourist demand for Asian skincare innovations.

What Lies Ahead for Maldives Beauty and Personal Care Market?

The Maldives Beauty and Personal Care market is poised for steady expansion by 2030, reflecting the country’s strong tourism inflows, rising consumer sophistication, and the increasing adoption of sustainable and reef-safe beauty formulations. With total tourist arrivals recorded at 2,046,615 in 2024 (Maldives Monetary Authority), beauty retail and resort-driven personal care consumption continue to flourish. Growth is expected to be supported by evolving consumer preferences toward clean beauty, the digitalization of purchasing behaviors, and active government support for sustainability-led industries under the National Tourism and Environmental Frameworks.

Rise of Reef-Safe and Sustainable Beauty: The future of the Maldives Beauty and Personal Care market will be defined by the rise of reef-safe and eco-certified formulations. As the Maldives comprises 1,190 coral islands, beauty brands are shifting towards sunscreens and skincare products free of harmful ingredients like oxybenzone and octinoxate to align with national reef-protection mandates. The Ministry of Environment, Climate Change, and Technology continues to encourage eco-labelling initiatives and sustainable manufacturing practices. This pivot ensures brand compliance while catering to environmentally aware tourists who increasingly prefer resorts with eco-conscious product portfolios.

Expansion of Resort and Spa Retail Experiences: The Maldives’ luxury hospitality infrastructure, featuring 175 resorts and over 900 guesthouses, will remain central to future growth. Resorts are transforming into experiential retail hubs, offering curated skincare, fragrance, and spa product lines designed for high-value guests. Global players such as L’Oréal, Estée Lauder, and Shiseido are expected to strengthen collaborations with resort chains for exclusive in-room amenities, spa tie-ups, and customized after-sun recovery products. This retail evolution will continue to integrate beauty consumption with premium guest experiences, reinforcing brand positioning.

Digital and E-Commerce Integration Across Atolls: Digital transformation will shape the next phase of market development, supported by the Maldives’ 84.69% internet usage rate and 142 mobile subscriptions per 100 people. The expansion of mobile payment platforms and digital concierge services enables resorts and urban retailers to streamline cross-island delivery of beauty products. Brands are introducing virtual consultation tools and AR-powered shade matching to personalize experiences for both residents and tourists. These advances will bridge geographical gaps, improve last-mile access, and enhance convenience in a nation spread across numerous islands.

Growth in Pharmacy-Based Dermocosmetic Retail: Dermocosmetic and therapeutic skincare categories will see increasing traction as Greater Malé’s 211,908 residents seek medically endorsed personal care. Pharmacies are evolving into hybrid health-and-beauty outlets offering dermatologist-recommended skincare products. The Maldives Food and Drug Authority (MFDA) continues to regulate active-ingredient claims and import documentation, ensuring consumer safety and credibility. This regulatory reliability, combined with rising urban disposable incomes, positions pharmacy and para-pharmacy channels as growth frontiers for science-backed beauty solutions.

Leveraging Tourism as a Gateway for Brand Showcasing” Beauty companies will increasingly view the Maldives as a strategic brand showcase destination in Asia. With a GDP per capita of USD 18,210 and a tourist stay duration averaging 7.1 nights, the Maldives offers a concentrated luxury consumer base. Resorts act as live showrooms for global beauty brands through spa rituals and co-branded amenities. This exposure not only builds brand credibility among international travelers but also converts them into global consumers, reinforcing the Maldives’ role as an experiential beauty capital in the Indian Ocean.

Maldives Beauty and Personal Care Market Segmentation

By Category

Skin & Sun Care

Hair Care

Color Cosmetics

Fragrance & Deodorants

Bath & Body

By Distribution Channel

Resort & On-Property

Offline Retail

Pharmacy / Para-Pharmacy

E-Commerce

Duty-Free & Travel Retail

By Consumer Group

Tourists

Residents

Expatriate Workforce

Salon & Spa Professionals

Corporate / Institutional Buyers

By Product Type

Premium / Luxury

Mass / Conventional

Organic / Natural

Dermocosmetic / Therapeutic

Eco-Certified / Reef-Safe

By Region (Atoll Cluster)

Greater Malé

North Malé Atoll

South Malé Atoll

Ari / Alif Alif Atoll

Baa / Lhaviyani & Others

Players Mentioned in the Report:

L’Oréal

Unilever

Estée Lauder Companies

Beiersdorf (NIVEA, La Prairie)

Shiseido

Amorepacific (Laneige, innisfree)

Procter & Gamble (Olay, Pantene)

Colgate-Palmolive (personal care)

Johnson & Johnson (Neutrogena, Aveeno)

Coty (fragrances/color)

Kao Corporation

Henkel Beauty Care

Revlon

The Body Shop

Himalaya Wellness

Key Target Audience

Resort & hotel chain procurement heads (Ministry of Tourism interface)

Pharmacy & para-pharmacy chains’ merchandising leadership

National importers & multi-brand distributors (Maldives Customs Service compliant)

Duty-free and airport retail operators (Maldives Airports Company Ltd.)

Salon & spa group owners and professional academies

Investments and venture capitalist firms (consumer/beauty portfolios)

Government and regulatory bodies (Maldives Food and Drug Authority, Maldives Customs Service, Maldives Monetary Authority, Ministry of Tourism)

E-commerce marketplaces and last-mile logistics operators serving atolls

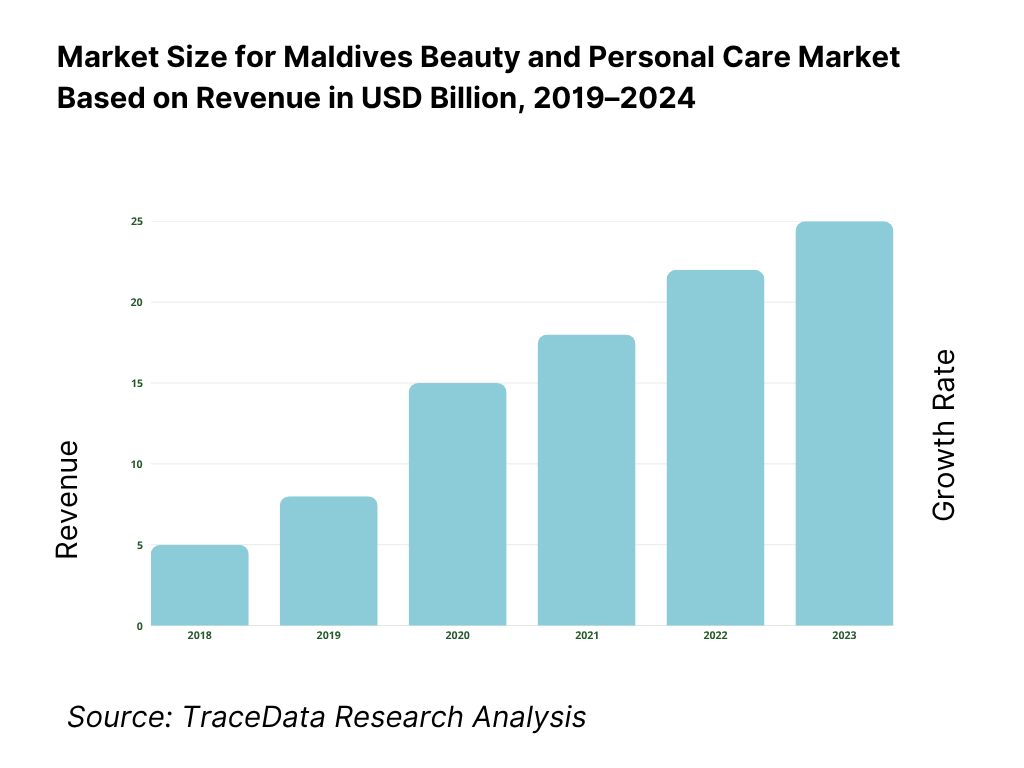

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Maldives Beauty and Personal Care Market. On the demand side, the ecosystem includes resort and hotel chains, pharmacies and para-pharmacies, duty-free operators, salons and spas, e-commerce platforms, and local as well as expatriate consumers. The supply side encompasses global manufacturers, authorized distributors, importers, brand subsidiaries, logistics providers, and government agencies such as the Maldives Food and Drug Authority (MFDA) and Maldives Customs Service. Based on this ecosystem, we will shortlist 5–6 leading beauty and personal care brands operating in the Maldives based on their financial information, resort presence, channel partnerships, and distributor networks. These include companies such as L’Oréal, Unilever, Estée Lauder, Beiersdorf, and Amorepacific. Sourcing is conducted through industry articles, government trade statistics, secondary publications, and proprietary databases to perform desk research around the market and collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects such as import revenues (HS Code 33 data), product category breakdowns, brand availability across atolls, resort retail penetration, and e-commerce development trends. We supplement this with detailed examinations of company-level data, relying on press releases, partnership announcements, sustainability disclosures, financial statements, and resort collaboration news. This process aims to construct a foundational understanding of both the market and the entities operating within it. Key sources include the Maldives Monetary Authority (MMA), Maldives Bureau of Statistics (MBS), Ministry of Tourism, and World Bank Open Data, ensuring reliable and transparent data validation.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Maldives Beauty and Personal Care Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide a comprehensive understanding of revenue streams, distribution margins, resort retail processes, price-pack architecture, logistics challenges, and product rotation cycles specific to the Maldives’ tourism-driven beauty ecosystem.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess the sanity of the process. The top-down model relies on customs-import statistics under HS Chapter 33, macroeconomic indicators such as tourist arrivals and per capita income, and resort-level retail consumption estimates. The bottom-up model integrates findings from primary research—covering resorts, pharmacies, e-commerce, and duty-free stores—to compute aggregate market revenues and category shares. Both models are reconciled to ensure logical coherence between macro-trade flows and micro-market dynamics. This cross-verification process ensures that the final market estimations are statistically valid, field-verified, and aligned with real-time consumption and distribution behavior observed across the Maldives Beauty and Personal Care Market.

FAQs

01 What is the potential for the Maldives Beauty and Personal Care Market?

The Maldives Beauty and Personal Care Market holds significant potential, valued at USD 42.46 million in 2023 as per Maldives Monetary Authority customs-based trade statistics. The market’s growth is supported by a combination of tourism-driven consumption, luxury resort retail expansion, and rising urban purchasing power. With 2,046,615 tourist arrivals and a population base of 515,132, the Maldives enjoys a unique per-capita retail intensity unmatched in the region. The sector’s potential is further strengthened by growing demand for reef-safe skincare, dermocosmetic formulations, and premium fragrance lines across resorts, pharmacies, and duty-free outlets.

02 Who are the Key Players in the Maldives Beauty and Personal Care Market?

The Maldives Beauty and Personal Care Market features several prominent players, including L’Oréal, Unilever, and Estée Lauder Companies, which lead through their diverse brand portfolios and strong resort retail partnerships. These global giants are complemented by established regional brands such as Beiersdorf (NIVEA) and Amorepacific, known for their sun-care and hydration products. Other active players include Shiseido, Procter & Gamble, and The Body Shop, each leveraging targeted product positioning, resort collaborations, and growing pharmacy presence to strengthen their foothold in the Maldives’ premium and masstige segments.

03 What are the Growth Drivers for the Maldives Beauty and Personal Care Market?

The primary growth drivers for the Maldives Beauty and Personal Care Market stem from its booming tourism sector, advanced digital infrastructure, and increasing consumer emphasis on sustainable and luxury skincare. With over 2.0 million tourists visiting annually (Ministry of Tourism, 2024) and a GDP per capita of USD 18,210, purchasing capacity for high-value beauty products is expanding. Additionally, 84.69% of the population now uses the internet, enabling e-commerce and cross-border digital beauty retail. Government policies promoting sustainability and reef-safe standards have also accelerated the adoption of eco-friendly formulations, making sustainability a commercial growth catalyst.

04 What are the Challenges in the Maldives Beauty and Personal Care Market?

The Maldives Beauty and Personal Care Market faces several challenges, notably high import dependency and logistical fragmentation across over 1,190 islands, which elevate transportation and inventory costs. Regulatory compliance, particularly under the Maldives Food and Drug Authority (MFDA) for product safety, labeling, and SPF claim validation, can delay market entry for new brands. Additionally, limited warehousing capacity outside Greater Malé and high inter-island freight costs constrain distribution scalability. Seasonal tourist fluctuations and grey-market imports also pose challenges to pricing consistency, brand protection, and sustained product availability across resort and local retail channels.