Mexico Auto Finance Market Outlook to 2029

By Market Structure, By Lender Type, By Vehicle Category (New vs Used), By Financing Channel (Online vs Offline), By Loan Tenure, and By Region

- Product Code: TDR0161

- Region: North America

- Published on: May 2025

- Total Pages: 80

Report Summary

The report titled “Mexico Auto Finance Market Outlook to 2029 – By Market Structure, By Lender Type, By Vehicle Category (New vs Used), By Financing Channel (Online vs Offline), By Loan Tenure, and By Region” provides a comprehensive analysis of the auto finance industry in Mexico. The report covers an overview and genesis of the industry, overall market size in terms of credit disbursed and loan outstanding, market segmentation; trends and developments, regulatory landscape, consumer profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Auto Finance Market. The report concludes with future market projections based on loan disbursed and outstanding, by lender types, vehicle segment, financing channels, cause and effect relationship, and success case studies highlighting major opportunities and risks.

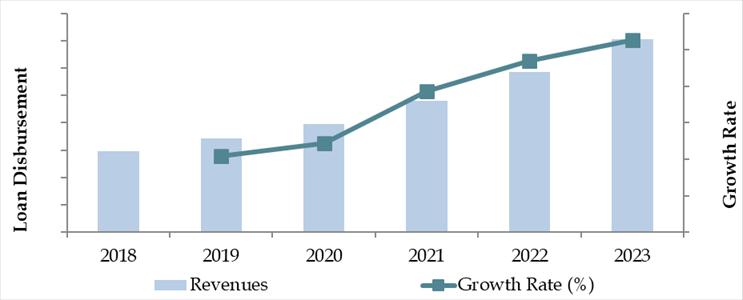

Mexico Auto Finance Market Overview and Size

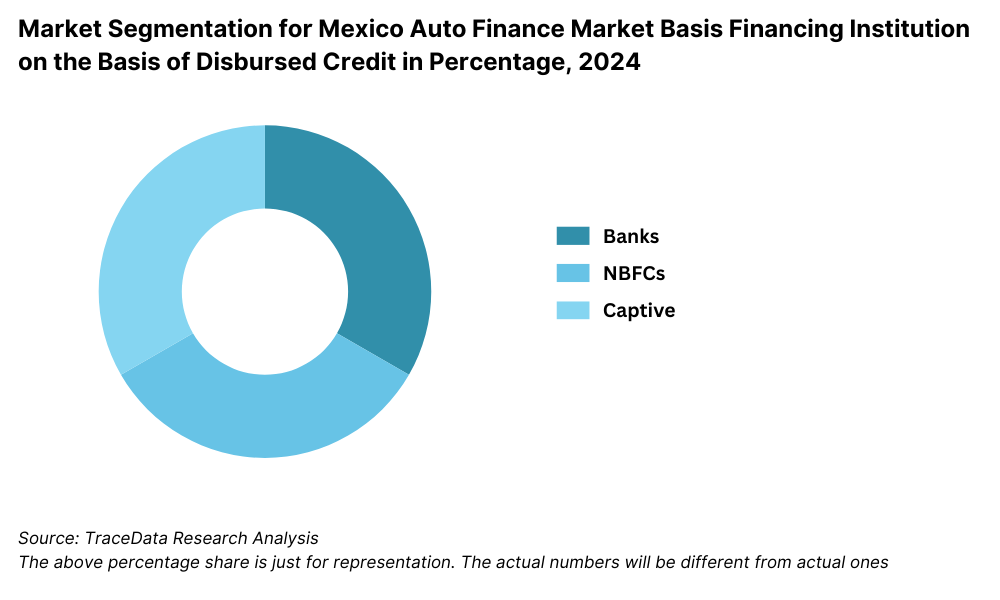

The Mexico auto finance market was valued at approximately MXN 320 Billion in credit disbursed in 2023, driven by increasing vehicle penetration, a growing appetite for personal and commercial mobility, and financial inclusion through non-bank lenders and fintechs. The market is dominated by banks such as BBVA, Santander, and HSBC Mexico; captive finance arms such as Nissan Renault Financial Services and GM Financial; and emerging NBFCs and fintech lenders.

In 2023, Santander México announced a new digital auto loan platform, allowing for pre-approved financing and seamless online document processing, targeting the growing urban digital population. Key auto finance markets include Mexico City, Monterrey, and Guadalajara, driven by higher income groups, robust vehicle sales, and a maturing banking ecosystem.

Market Size for Mexico Auto Finance Industry on the Basis of Credit Disbursed in USD Billion, 2018-2023

What Factors are Leading to the Growth of Mexico Auto Finance Market:

Economic Recovery & Urbanization: Post-COVID macroeconomic stabilization and the rise in urban migration are contributing to increased demand for personal vehicles, thus boosting auto finance. In 2023, urban centers contributed over 72% to vehicle finance volume.

Bank and NBFC Participation: Mexican banks have gradually relaxed their lending norms post-2021, while NBFCs and digital lenders are penetrating Tier-2 cities with alternative credit scoring methods. Over 40% of used car loans in 2023 were funded by NBFCs and fintechs.

Digital Financing Channels: Online auto loan applications accounted for 27% of total financed purchases in 2023, up from 12% in 2020. The adoption of e-KYC, API-based credit checks, and app-based loan management is streamlining access.

Which Industry Challenges Have Impacted the Growth for Mexico Auto Finance Market

High Interest Rates and Inflation Pressure: Mexico has experienced persistent inflationary pressures and benchmark interest rate hikes by Banco de México, resulting in higher borrowing costs. In 2023, the average auto loan interest rate stood at approximately 13.5%, discouraging both consumers and lenders. This has led to a 12–15% reduction in loan approvals for first-time borrowers compared to pre-pandemic levels.

Credit Access Disparity in Tier-2 and Rural Markets: Despite growing vehicle demand in smaller towns, access to auto finance remains highly concentrated in metropolitan areas. Over 65% of vehicle loans in 2023 were issued in just six major cities. This geographic imbalance is a key bottleneck, particularly affecting used vehicle buyers and informal income groups.

High Loan Delinquency Rates: Loan default rates have remained elevated, especially in the used car and NBFC segments. In 2023, non-performing asset (NPA) ratios for used vehicle loans touched 6.8%, compared to 2.9% for new vehicles. Lenders are now more cautious in extending credit to subprime borrowers, further slowing down loan disbursals.

What are the Regulations and Initiatives which have Governed the Market

Automotive Credit Reporting Regulations: The Mexican government, through the Comisión Nacional Bancaria y de Valores (CNBV), mandates thorough credit reporting and borrower profiling for all auto loans. In 2022, new compliance frameworks required digital lenders and fintechs to align with central credit bureaus to improve loan transparency and reduce fraud.

Used Vehicle Loan Guidelines: The regulatory framework differentiates between new and used vehicle loans, with stricter documentation and collateralization norms for used vehicles. In 2023, over 30% of loan applications for used cars were either rejected or delayed due to incomplete ownership documents or unclear vehicle histories.

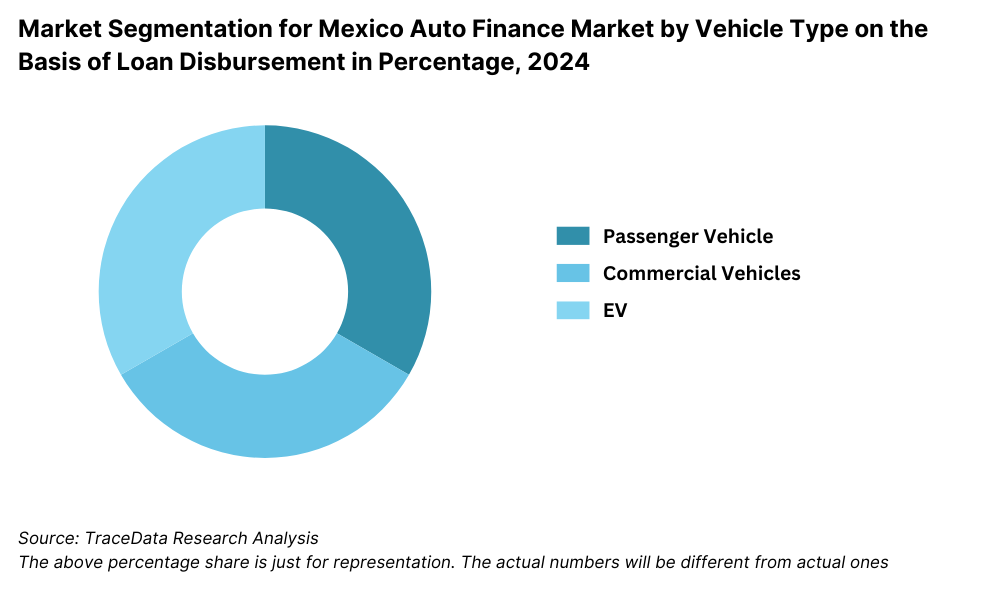

Green Mobility Financing Incentives: To support Mexico’s climate action roadmap, the Secretaría de Hacienda y Crédito Público (SHCP) launched preferential loan schemes in 2023 for electric and hybrid vehicle financing, offering subsidized interest rates and longer tenures. These initiatives are expected to increase EV auto loan penetration from 2.5% in 2023 to an estimated 6% by 2026.

Mexico Auto Finance Market Segmentation

By Market Structure: Banks continue to dominate Mexico’s auto finance ecosystem, leveraging their robust branch network, established brand trust, and access to low-cost capital. Major players like BBVA, Santander, and HSBC offer competitive loan packages with extended tenures and bundled insurance.

NBFCs and Digital Lenders are gaining traction, especially in financing used vehicles and in Tier-2/3 cities where traditional banks have limited reach. These lenders are popular among self-employed and informal segment borrowers due to quicker loan approvals and relaxed credit scoring. Captive Finance Companies, such as Nissan Renault Financial Services and GM Financial, hold a strong position in financing new cars, offering manufacturer-backed incentives like zero down payment and low-interest schemes.

By Vehicle Category: New Car Financing remains the largest segment, accounting for the majority of loans disbursed due to structured dealer tie-ups and strong OEM-financier integration. Used Car Financing, however, is growing rapidly and now accounts for a significant share—driven by the rising affordability of used vehicles, digital dealership platforms, and tailored loan offerings by NBFCs and fintechs. The average loan ticket size for used cars is 25–30% lower than for new vehicles.

By Financing Channel: Offline Channels such as dealerships and bank branches dominate the market, especially for first-time car buyers who prefer in-person verification and negotiations. Online Channels are rapidly expanding with the rise of digital-first fintech lenders and captive platforms. These platforms offer faster loan processing, real-time eligibility checks, and digital KYC. In 2023, around 27% of auto finance applications originated through online platforms.

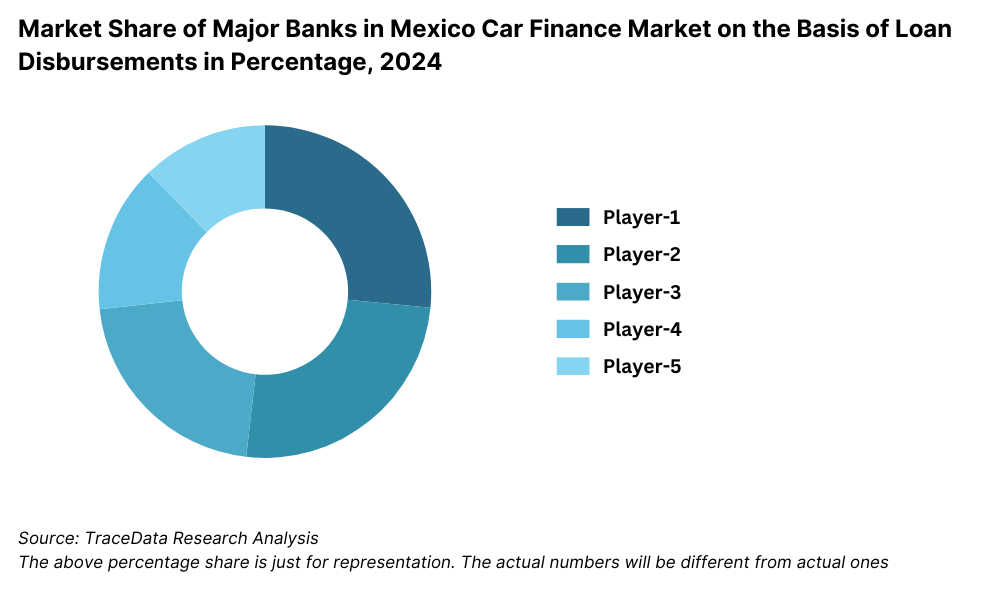

Competitive Landscape in Mexico Auto Finance Market

The Mexico auto finance market is moderately concentrated, with established banks, captive finance arms of automakers, and a growing base of non-banking financial companies (NBFCs) and fintech lenders. While traditional players such as BBVA, Santander, and HSBC maintain a stronghold through branch-based lending, newer entrants like Kueski, Creditea, and digital platforms of OEMs are disrupting the ecosystem with faster, digital-first loan offerings.

| Company Name | Founding Year | Original Headquarters |

| BBVA México | 1932 | Mexico City, Mexico |

| Banorte | 1899 | Monterrey, Mexico |

| Banco Azteca | 2002 | Mexico City, Mexico |

| HSBC México | 1941 | Mexico City, Mexico |

| BanBajío | 1994 | León, Guanajuato, Mexico |

| Banco Autofin México | 2006 | Mexico City, Mexico |

| Finanmadrid México | 2005 | Huixquilucan, Mexico |

| Grupo Famsa | 1970 | Monterrey, Mexico |

| GM Financial México | 1931 | Detroit, Michigan, USA |

| Nexu | 2015 | Mexico City, Mexico |

| Kuna | 2023 | Mexico City, Mexico |

| inDrive (with R2) | 2024 | Monterrey, Mexico |

Some of the recent competitor trends and key information about competitors include:

BBVA México: The market leader in vehicle financing, BBVA disbursed over MXN 65 billion in auto loans in 2023, with a focus on salaried employees and new vehicles. Their partnership network spans over 350 dealerships across the country.

Santander México: Known for its competitive rate structure and flexible loan terms, Santander launched a fully digital loan origination platform in 2023, reducing approval time to under 10 minutes. It also extended zero down-payment schemes for selected models in collaboration with top auto OEMs.

HSBC México: HSBC focuses primarily on prime customers, offering pre-approved loans and bundling with motor insurance. In 2023, the bank reported a 10% year-on-year growth in its auto loan portfolio driven by demand in Mexico City and Monterrey.

GM Financial México: The captive finance arm of General Motors, GM Financial accounted for over 20% of new Chevrolet and GMC vehicles sold in 2023. Their tailored loan and lease programs have been particularly effective in dealer-led promotions.

Nissan Renault Financial Services: One of the largest captive players in Mexico, the company financed approximately 38% of all new Nissan vehicles sold. Their loyalty-based refinancing schemes saw strong uptake among repeat buyers in 2023.

What Lies Ahead for Mexico Auto Finance Market?

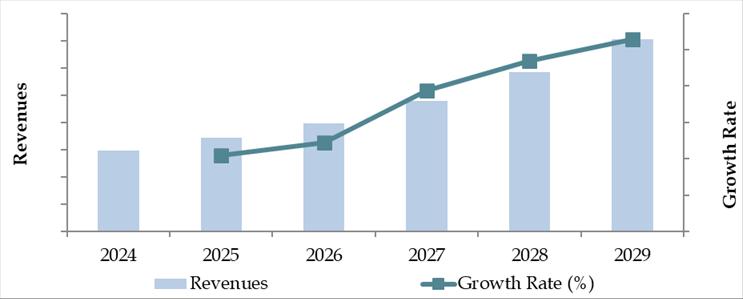

The Mexico auto finance market is projected to witness steady expansion through 2029, with an expected CAGR of 7.2% in credit disbursements during the forecast period. This growth will be driven by digital transformation in lending, rising vehicle ownership, and the increasing penetration of financing in Tier-2 and Tier-3 cities.

Rising Adoption of Electric and Hybrid Vehicle Financing: As the Mexican government promotes sustainable mobility, auto financing for electric and hybrid vehicles is expected to surge. Lenders are expected to introduce more green loan products with preferential terms such as lower interest rates and extended repayment tenures, supported by fiscal subsidies from the Secretaría de Hacienda.

Growth in Used Car Financing: The used car finance segment is likely to outpace new car loans in volume terms by 2026, fueled by affordability, increased resale transactions, and expanding partnerships between fintechs and digital dealerships. Flexible underwriting models and lower down payment options will be key growth enablers.

Fintech Disruption and AI-led Underwriting: The auto finance sector in Mexico is witnessing a shift from traditional risk assessment models to AI-powered underwriting and alternative credit scoring, particularly for underserved and informal economy segments. This will open up access to credit for millions of previously unbanked customers.

Expansion of Digital Loan Platforms: Digital lending platforms are expected to account for 40% of total auto loan originations by 2029, compared to 27% in 2023. The increasing consumer preference for end-to-end digital journeys, real-time approvals, and contactless disbursement will reshape customer acquisition and servicing models.

Future Outlook and Projections for Mexico Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Mexico Auto Finance Market Segmentation

- By Market Structure:

o Banks

o Captive Finance Companies

o NBFCs (Non-Banking Financial Companies)

o Fintech and Digital Lenders

o Credit Unions and Microfinance Institutions - By Vehicle Category:

o New Vehicles

o Used Vehicles

o Electric Vehicles (EVs)

o Hybrid Vehicles

o Commercial Vehicles - By Financing Channel:

o Online Platforms

o Offline (Bank Branches, Dealerships)

o OEM Digital Finance Portals

o Third-Party Aggregator Platforms - By Loan Tenure:

o Less than 2 years

o 2–4 years

o 4–6 years

o More than 6 years - By Loan Type:

o Fixed Rate Loans

o Variable Rate Loans

o Lease Financing

o Balloon Payment Loans - By Consumer Segment:

o Salaried Professionals

o Self-Employed and Informal Sector

o First-Time Vehicle Buyers

o Fleet Owners

o Ride-Sharing Drivers - By Region:

o Central Mexico (including Mexico City)

o Northern Mexico (Monterrey, Chihuahua, Saltillo)

o Western Mexico (Guadalajara, Jalisco)

o Southern Mexico (Oaxaca, Chiapas)

o Eastern Mexico (Veracruz, Puebla)

Players Mentioned in the Report (Banks):

- BBVA México

- Citibanamex

- Santander México

- Banorte

- HSBC México

- Scotiabank México

- Banco Inbursa

- CI Banco

- BanBajío

- Banco Azteca

- Banco del Bienestar

- Banco Multiva

- Banco Afirme

- Banco Famsa

- Banco Compartamos

Key Target Audience:

- Commercial and Retail Banks

- Automotive Captive Finance Companies

- Used and New Vehicle Dealerships

- Fintech Auto Loan Providers

- Regulatory Bodies (e.g., CNBV, SHCP)

- Online Vehicle Marketplaces

- Market Research and Analytics Firms

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Mexico by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Mexico Car Finance Market

11.2. Growth Drivers for Mexico Car Finance Market

11.3. SWOT Analysis for Mexico Car Finance Market

11.4. Issues and Challenges for Mexico Car Finance Market

11.5. Government Regulations for Mexico Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Mexico Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Mexico Car Finance Market, 2024

17.3. Market Share of Key Captive in Mexico Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Mexico Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Mexico Auto Finance Market. Basis this ecosystem, we will shortlist leading 5-6 producers in the country based upon their financial information, disbursement volume, customer base, and product offering.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the credit disbursed, number of active lenders, vehicle sales trends, interest rates, and loan tenure patterns. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, regulatory filings, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Mexico Auto Finance Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate credit disbursed for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, loan approval process, interest rate models, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Mexico Auto Finance Market?

The Mexico Auto Finance Market holds strong growth potential, reaching a credit disbursal value of approximately MXN 320 Billion in 2023. The market is expected to grow at a steady CAGR until 2029, driven by rising vehicle ownership, financial inclusion through non-traditional lenders, and the rapid adoption of digital loan origination platforms. Increasing affordability of vehicles and supportive regulatory frameworks are also fueling long-term growth.

2. Who are the Key Players in the Mexico Auto Finance Market?

The Mexico Auto Finance Market is dominated by major banks such as BBVA México, Santander México, and HSBC México, alongside captive finance arms like GM Financial México and Nissan Renault Financial Services. Emerging fintech players including Kueski, Creditea México, and Creditas are disrupting the market with digital-first loan offerings, particularly in the used vehicle and underserved borrower segments.

3. What are the Growth Drivers for the Mexico Auto Finance Market?

Key growth drivers include the expansion of digital lending platforms, increasing demand for vehicle ownership in Tier-2 and Tier-3 cities, and the government’s push for green mobility through subsidized EV financing. Additionally, alternative credit scoring models and faster loan approvals from fintech players are unlocking access for informal and first-time borrowers.

4. What are the Challenges in the Mexico Auto Finance Market?

The Mexico Auto Finance Market faces several challenges, including high interest rates, elevated delinquency levels in used car financing, and limited access to credit in rural and semi-urban regions. Regulatory bottlenecks, such as stringent documentation for used vehicle loans and rising compliance requirements for fintechs, can also slow market penetration and operational scalability.