Mexico Cold Chain Market Outlook to 2029

By Market Structure (Organized and Unorganized), By Type (Cold Storage and Cold Transportation), By End Users (Fruits and Vegetables, Dairy Products, Meat and Seafood, Pharmaceuticals, and Others), By Ownership (3PL and Captive)

- Product Code: TDR0292

- Region: North America

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Mexico Cold Chain Market Outlook to 2029 – By Market Structure (Organized and Unorganized), By Type (Cold Storage and Cold Transportation), By End Users (Fruits and Vegetables, Dairy Products, Meat and Seafood, Pharmaceuticals, and Others), By Ownership (3PL and Captive)” provides a comprehensive analysis of the cold chain market in Mexico. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on revenue, by segment, end user type, ownership model, and cause-effect relationship analysis, along with success case studies highlighting key opportunities and cautions.

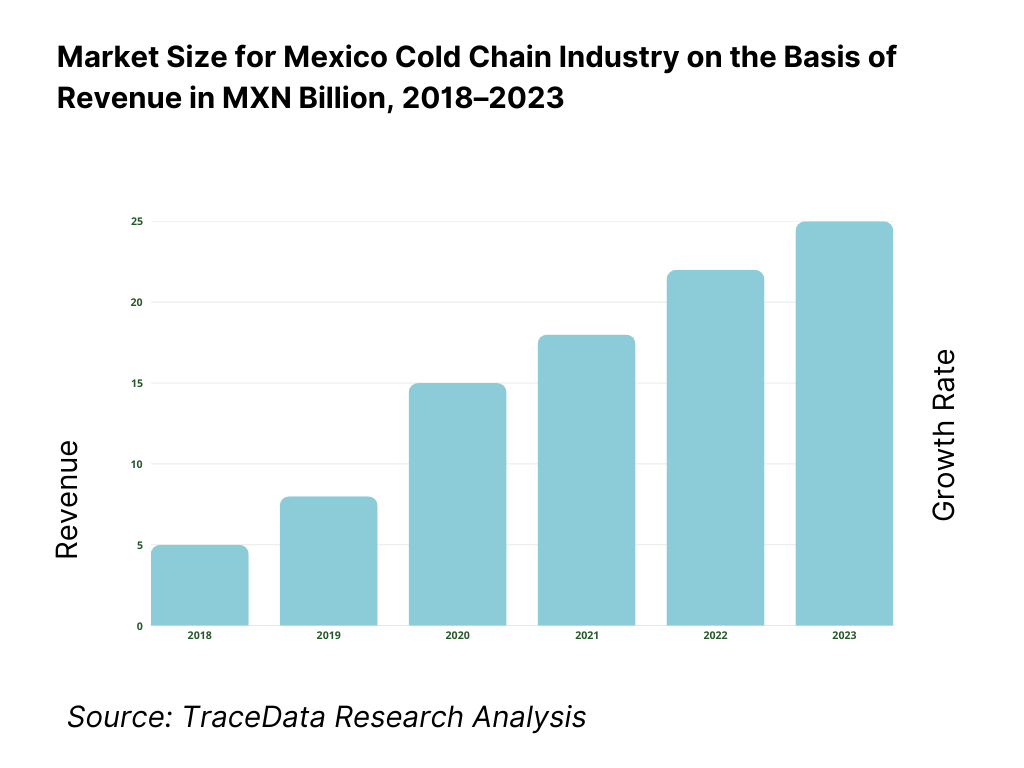

Mexico Cold Chain Market Overview and Size

The Mexico cold chain market reached a valuation of MXN 65 Billion in 2023, driven by the rising demand for temperature-sensitive food and pharmaceutical products, growing exports of fresh produce, and increasing adoption of organized storage and logistics infrastructure. The market is led by companies such as Frialsa, Emergent Cold Latin America, Grupo Alianza, and Qualianz. These players are recognized for their nationwide cold storage facilities, reliable cold transportation services, and end-to-end logistics solutions.

In 2023, Emergent Cold LatAm expanded its warehouse capacity in Jalisco, focusing on strategic locations for agri-food exports to the U.S. and Europe. Mexico City, Guadalajara, and Monterrey emerged as top cold chain hubs owing to high consumption volumes, industrial clustering, and connectivity to major ports and highways.

What Factors are Leading to the Growth of Mexico Cold Chain Market:

Export Growth in Agri-Food and Seafood: Mexico’s fresh produce exports—particularly avocados, berries, and tomatoes—have witnessed strong growth to the U.S. and Europe. In 2023, over 65% of exported agri-products required temperature-controlled handling, driving investment in cold logistics and storage facilities.

Rising Pharmaceutical and Vaccine Demand: The growth of the pharmaceutical sector and vaccine distribution, especially post-COVID, has fueled demand for reliable cold chain networks. In 2023, the pharma sector accounted for nearly 18% of the cold transportation segment’s revenue.

Urban Consumption and Modern Retail: The shift toward modern retail, online grocery delivery, and quick commerce in urban areas such as Mexico City and Monterrey has created new demand for last-mile cold logistics. Retailers now demand real-time temperature monitoring and micro-warehousing capabilities.

Which Industry Challenges Have Impacted the Growth for Mexico Cold Chain Market

Infrastructure Gaps in Remote Regions: One of the major challenges in Mexico’s cold chain sector is the lack of cold storage and last-mile temperature-controlled logistics in remote and rural areas. According to industry estimates, nearly 35% of fresh produce losses occur due to inadequate cold storage infrastructure, particularly in southern states such as Oaxaca and Chiapas. This results in significant post-harvest wastage and revenue loss for producers.

Energy Costs and Reliability: High electricity costs and inconsistent power supply continue to affect the operational efficiency of cold storage facilities. In 2023, energy expenses accounted for nearly 25% of total operational costs for cold chain providers, limiting their expansion capacity. Power outages also impact temperature-sensitive goods, posing a risk of spoilage.

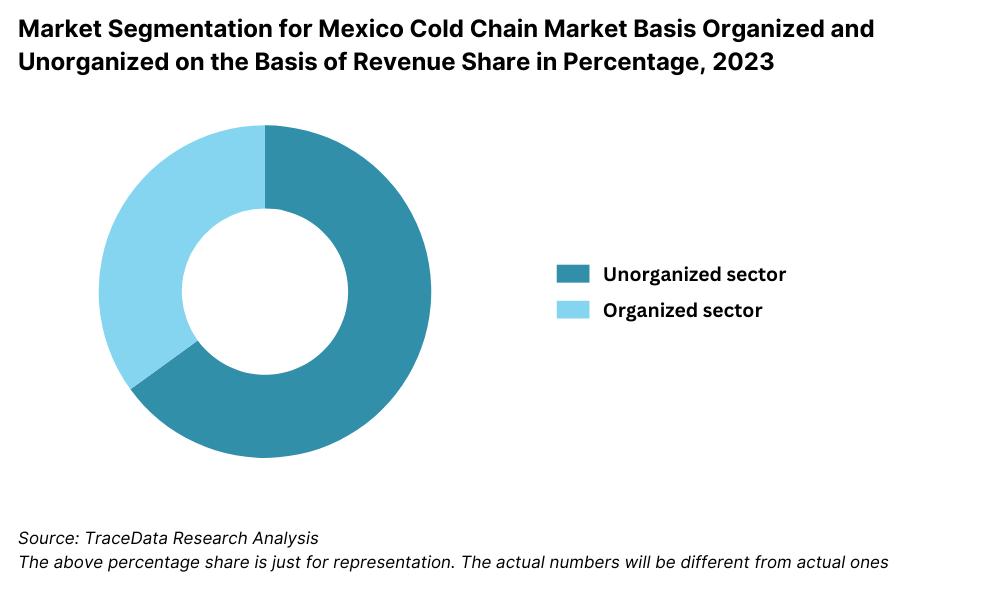

Fragmented and Unorganized Market: A large share of the cold chain market in Mexico remains dominated by small and unorganized players lacking modern equipment or real-time monitoring systems. In 2023, unorganized operators still accounted for approximately 48% of the market, which restricts overall efficiency, scalability, and service quality across the supply chain.

What are the Regulations and Initiatives which have Governed the Market

NOM-251-SSA1 Sanitary Practices Regulation: The Mexican government enforces the NOM-251 regulation which outlines hygiene and sanitary practices in handling and transportation of perishable goods. This mandates strict temperature controls, traceability, and periodic audits for cold chain operators, especially in food and pharma sectors. In 2023, over 70% of compliant facilities were concentrated in central and northern Mexico.

Tax Incentives and Infrastructure Support: To promote cold chain development, the Mexican government has included logistics and storage infrastructure under the “Zonas Económicas Especiales (ZEE)” and “Prologistics” programs. These offer tax exemptions and customs benefits to cold chain companies investing in designated growth zones such as Veracruz and Tabasco.

Support for Export-Oriented Agri Logistics: The Ministry of Agriculture and Rural Development (SADER) has partnered with private players to fund cold storage and reefer truck deployment for export corridors—especially avocados, berries, and seafood. In 2023, 22 new cold chain hubs were announced under this scheme, with funding support for up to 50% of project costs in priority zones.

Mexico Cold Chain Market Segmentation

By Market Structure: The organized cold chain segment is growing steadily, especially among large-scale exporters, pharma companies, and modern retailers due to better infrastructure, regulatory compliance, and real-time monitoring. These players often provide end-to-end solutions from storage to last-mile delivery. The unorganized segment, however, still plays a vital role in local and regional food distribution due to its low-cost services and wide penetration in Tier II and III cities, albeit with limited technological sophistication and compliance.

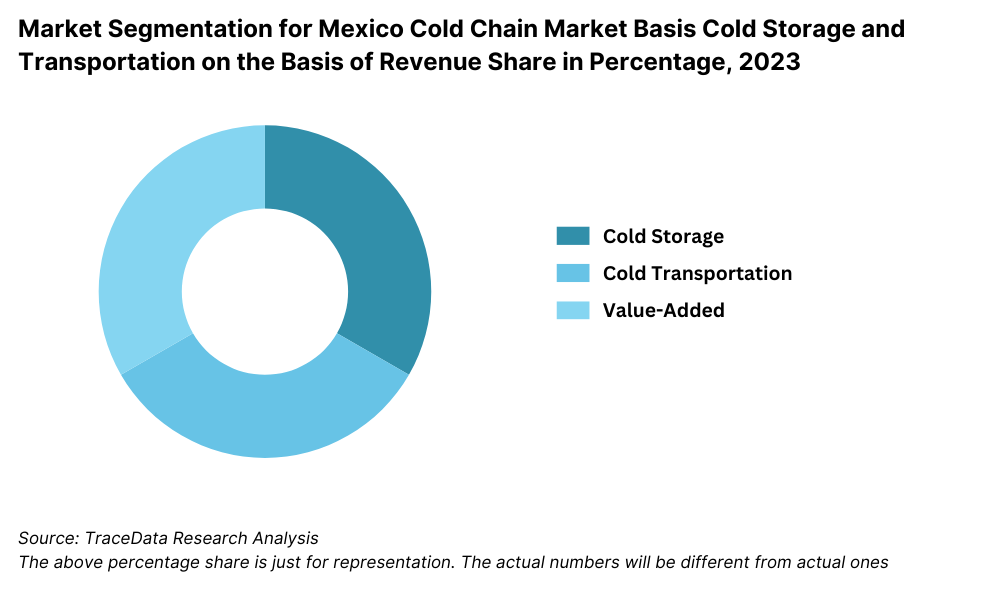

By Type: Cold storage holds the larger share of the market, especially for agri-produce, dairy, and seafood preservation across key producing states like Michoacán, Jalisco, and Veracruz. Cold transportation, on the other hand, is witnessing rapid growth due to the rise in online grocery delivery, pharmaceutical logistics, and cross-border food exports. With increasing investment in reefer trucks and IoT tracking systems, the transportation segment is expected to gain further traction.

By End User: The fruits and vegetables segment dominates the cold chain market due to Mexico’s strong agricultural export base. Dairy and meat products form the second-largest share due to rising domestic consumption and safety standards. Pharmaceuticals—especially biologics and vaccines—are an emerging end-user segment, with double-digit growth, driven by both public health programs and private pharma distribution.

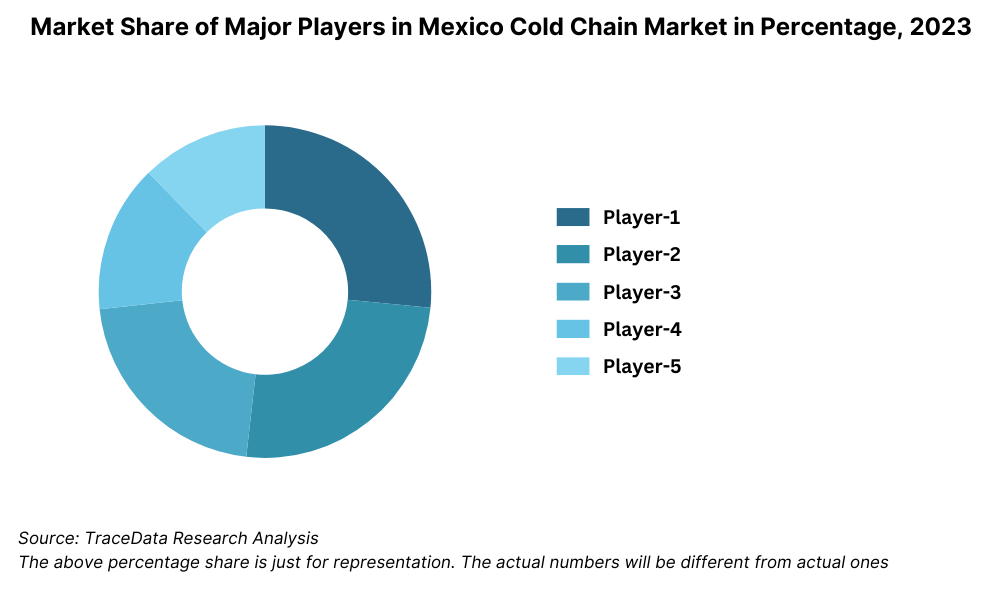

Competitive Landscape in Mexico Cold Chain Market

The Mexico cold chain market is moderately consolidated, with a mix of established domestic players and international logistics firms operating across cold storage and transportation segments. While large players such as Frialsa, Emergent Cold Latin America, and Grupo Alianza dominate the organized market, several regional players and cooperatives continue to serve unorganized and semi-urban markets. The market has also witnessed increased investment from foreign logistics companies aiming to strengthen end-to-end cold supply chains, especially for food exports and pharmaceuticals.

Company | Establishment Year | Headquarters |

Frialsa Frigoríficos | 1983 | Mexico City, Mexico |

Emergent Cold LatAm | 2021 (Mexico Entry) | Monterrey, Mexico |

Grupo Alianza | 1994 | Guadalajara, Mexico |

Qualianz | 2019 | Mexico City, Mexico |

Lineage Logistics (Mexico) | 2022 (via acquisition) | Nuevo León, Mexico |

Some of the recent competitor trends and key information about competitors include:

Frialsa Frigoríficos: One of Mexico’s largest cold storage operators, Frialsa runs over 25 facilities nationwide. In 2023, it expanded capacity in Sinaloa and Jalisco by 12%, catering to seafood and produce exporters. Their use of solar-powered warehouses and advanced WMS systems has made them a sustainability leader in the sector.

Emergent Cold LatAm: The company entered Mexico in 2021 and rapidly expanded through acquisitions. In 2023, it announced a major new distribution center in Jalisco to support agri-exports and regional food retailers. Their state-of-the-art infrastructure and compliance with FDA/USDA export protocols have made them a key player in international supply chains.

Grupo Alianza: A domestic logistics firm known for integrated refrigerated transportation and storage. In 2023, it focused on pharma and vaccine distribution in central Mexico, launching GPS-enabled reefer fleet services and gaining ISO 9001 and ISO 22000 certifications.

Qualianz: A fast-growing firm specializing in multi-temperature cold chain solutions for retail and food service clients. In 2023, the company launched its Smart Monitoring System (SMS) for real-time temperature tracking, leading to a 20% boost in client retention across urban markets.

Lineage Logistics (Mexico): A global cold chain powerhouse that entered the Mexican market through acquisitions in 2022. In 2023, it announced a strategic partnership with local producers in Baja California to streamline avocado and berry exports to the U.S. and Canada, supported by advanced automation and analytics tools.

What Lies Ahead for Mexico Cold Chain Market?

The Mexico cold chain market is projected to witness robust growth by 2029, registering a healthy CAGR during the forecast period. The expansion will be driven by increased exports of temperature-sensitive goods, pharmaceutical distribution needs, and modernization of logistics infrastructure across the country.

Expansion of Export-Oriented Cold Logistics: Mexico’s position as a leading exporter of fruits, vegetables, seafood, and meat to the U.S., Canada, and Europe is expected to fuel continued investment in cold storage hubs and cross-border cold transportation corridors. New trade agreements and infrastructure support under the USMCA are likely to further accelerate export-driven cold chain development.

Digitization and Smart Monitoring Adoption: The industry is moving towards digitized cold chain management, with increased adoption of IoT, real-time GPS tracking, and AI-based temperature monitoring. By 2029, these technologies are expected to become standard across organized players, reducing product spoilage and improving supply chain transparency.

Rise in Pharma and Vaccine Logistics: The post-pandemic focus on public health and pharmaceutical supply chains will continue to stimulate growth in specialized cold storage and transportation solutions. Demand for GxP-compliant (Good Distribution Practice) facilities and ISO-certified providers is likely to rise, especially in central and northern Mexico.

Investment in Green and Energy-Efficient Infrastructure: Sustainability will be a key theme going forward, with cold chain operators investing in solar-powered warehouses, energy-efficient refrigeration systems, and low-emission reefer trucks. These shifts align with Mexico’s national climate goals and increasing ESG expectations from global clients.

%2C%202023-2029.png)

Mexico Cold Chain Market Segmentation

• By Market Structure:

o Organized Sector

o Unorganized Sector

o 3PL (Third Party Logistics) Providers

o Captive In-House Logistics

• By Type:

o Cold Storage

o Cold Transportation

o Multi-Temperature Warehousing

o Reefer Trucking Services

• By End User:

o Fruits & Vegetables

o Dairy Products

o Meat & Seafood

o Pharmaceuticals & Vaccines

o Bakery & Confectionery

o Quick Service Restaurants (QSRs)

• By Ownership:

o Third-Party Logistics (3PL)

o Captive (Owned by Product Manufacturers/Retailers)

• By Temperature Range:

o Chilled (0–10°C)

o Frozen (Below 0°C)

o Deep Freeze (Below −20°C)

• By Region:

o Northern Mexico (Monterrey, Nuevo León, Coahuila)

o Central Mexico (Mexico City, Estado de México, Querétaro)

o Western Mexico (Jalisco, Michoacán)

o Southern Mexico (Oaxaca, Chiapas)

o Eastern Mexico (Veracruz, Tabasco, Campeche)

o Baja Peninsula (Baja California, Baja California Sur)

Players Mentioned in the Report:

• Frialsa Frigoríficos

• Emergent Cold LatAm

• Grupo Alianza

• Qualianz

• Lineage Logistics (Mexico)

• DHL Supply Chain Mexico

• Solistica

• Logística Fría

Key Target Audience:

• Cold Chain Logistics Providers

• Food Exporters and Importers

• Pharmaceutical Manufacturers and Distributors

• Retail and E-Commerce Companies

• Restaurant Chains and QSR Operators

• Government and Regulatory Bodies (e.g., SADER, COFEPRIS)

• Investment and Infrastructure Developers

• Technology Providers (IoT, WMS, GPS)

• Market Research and Consulting Firms

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Mexico Cold Chain Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges that they face

4.2. Revenue Streams for Mexico Cold Chain Market

4.3. Business Model Canvas for Mexico Cold Chain Market

4.4. Buying Decision Making Process (End Users: Retailers, Exporters, Pharma, etc.)

4.5. Supply Decision Making Process (Cold Storage Providers, 3PL, Transporters)

5. Market Structure

5.1. Cold Chain Infrastructure in Mexico, 2018-2024

5.2. Organized vs. Unorganized Cold Chain Penetration, 2018-2024

5.3. Government Spending and Support on Logistics and Cold Chain, 2024

5.4. Number of Cold Storage Facilities and Reefer Fleets by Region

6. Market Attractiveness for Mexico Cold Chain Market

7. Supply-Demand Gap Analysis

8. Market Size for Mexico Cold Chain Market Basis

8.1. Revenues, 2018-2024

8.2. Cold Storage and Transport Capacity, 2018-2024

9. Market Breakdown for Mexico Cold Chain Market Basis

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Type (Cold Storage and Cold Transportation), 2023-2024P

9.3. By End User (Fruits & Vegetables, Meat & Seafood, Dairy, Pharma, QSR, Others), 2023-2024P

9.4. By Ownership (3PL and Captive), 2023-2024P

9.5. By Region (North, Central, West, South, East, Baja), 2023-2024P

9.6. By Temperature Range (Chilled, Frozen, Deep Freeze), 2023-2024P

10. Demand Side Analysis for Mexico Cold Chain Market

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Needs, Desires, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Mexico Cold Chain Market

11.2. Growth Drivers for Mexico Cold Chain Market

11.3. SWOT Analysis for Mexico Cold Chain Market

11.4. Issues and Challenges for Mexico Cold Chain Market

11.5. Government Regulations and Incentives for Mexico Cold Chain Market

12. Snapshot on Online and Tech-enabled Cold Chain Platforms

12.1. Market Size and Future Potential of Tech-enabled 3PL Cold Chain, 2018-2029

12.2. Business Models and Revenue Streams (WMS, SaaS, Asset-light, etc.)

12.3. Cross Comparison of Leading Cold Chain Tech Providers (Infrastructure, Reach, Clients, USP)

13. Mexico Cold Chain Financing and Investment Landscape

13.1. Investment Trends and Key Infrastructure Projects, 2018-2029

13.2. Role of Development Banks and Government Schemes

13.3. Public-Private Partnerships and FDI Trends

13.4. Financing Gaps and Barriers for Cold Chain Operators

14. Opportunity Matrix for Mexico Cold Chain Market-Presented with the help of Radar Chart

15. PEAK Matrix Analysis for Mexico Cold Chain Market

16. Competitor Analysis for Mexico Cold Chain Market

16.1. Benchmark of Key Competitors in Mexico Cold Chain Market including variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Network Capacity, Automation Level, Client Base, Certifications, and Recent Developments

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Mexico Cold Chain Market Basis

17.1. Revenues, 2025-2029

17.2. Cold Storage and Transport Capacity, 2025-2029

18. Market Breakdown for Mexico Cold Chain Market Basis

18.1. By Market Structure (Organized and Unorganized Market), 2025-2029

18.2. By Type (Cold Storage and Cold Transportation), 2025-2029

18.3. By End User (Fruits & Vegetables, Meat & Seafood, Dairy, Pharma, QSR, Others), 2025-2029

18.4. By Ownership (3PL and Captive), 2025-2029

18.5. By Region (North, Central, West, South, East, Baja), 2025-2029

18.6. By Temperature Range (Chilled, Frozen, Deep Freeze), 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Mexico Cold Chain Market. Basis this ecosystem, we will shortlist leading 5-6 players in the country based upon their financial information, storage and transport capacity/volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the revenues, number of market players, service mix, pricing levels, demand patterns, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Mexico Cold Chain Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate storage and transportation volumes for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of service offerings, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Mexico Cold Chain Market?

The Mexico cold chain market holds significant potential, reaching a valuation of MXN 65 Billion in 2023. The market is set for strong growth driven by increasing exports of perishable goods, growing demand for temperature-sensitive pharmaceutical logistics, and modernization of cold storage and transportation infrastructure. The strategic geographic location of Mexico, along with evolving trade partnerships, further enhances its potential as a regional cold chain hub.

2. Who are the Key Players in the Mexico Cold Chain Market?

The Mexico Cold Chain Market features several key players, including Frialsa Frigoríficos, Emergent Cold LatAm, and Grupo Alianza. These companies lead the market with extensive cold storage networks, integrated logistics solutions, and strong presence in key agricultural and industrial regions. Other notable players include Qualianz, Lineage Logistics Mexico, and DHL Supply Chain Mexico.

3. What are the Growth Drivers for the Mexico Cold Chain Market?

Primary growth drivers include the expansion of agri-food and seafood exports, rising demand for vaccine and pharmaceutical logistics, and adoption of cold chain solutions by modern retail and QSR sectors. Government support through infrastructure programs and tax incentives, along with the growing role of 3PL providers, also contribute to sustained market expansion.

4. What are the Challenges in the Mexico Cold Chain Market?

The Mexico Cold Chain Market faces several challenges, including inadequate infrastructure in rural regions, high energy costs affecting cold storage profitability, and lack of real-time monitoring systems among unorganized players. Regulatory compliance and the need for specialized handling in pharma and food logistics also pose operational complexities for market participants.