Myanmar Cold Chain Market Outlook to 2029

By Market Type (Cold Storage and Cold Transportation), By End User (Fruits & Vegetables, Meat & Seafood, Dairy Products, Pharmaceuticals, and Others), By Temperature Type, By Region

- Product Code: TDR0296

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Myanmar Cold Chain Market Outlook to 2029 – By Market Type (Cold Storage and Cold Transportation), By End User (Fruits & Vegetables, Meat & Seafood, Dairy Products, Pharmaceuticals, and Others), By Temperature Type, By Region.” provides a comprehensive analysis of the cold chain logistics industry in Myanmar. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer-level insights, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and profiling of major players operating in Myanmar’s cold chain market. The report concludes with future market projections based on revenue, by service type, product segments, regions, and major use-cases highlighting key opportunities and risks.

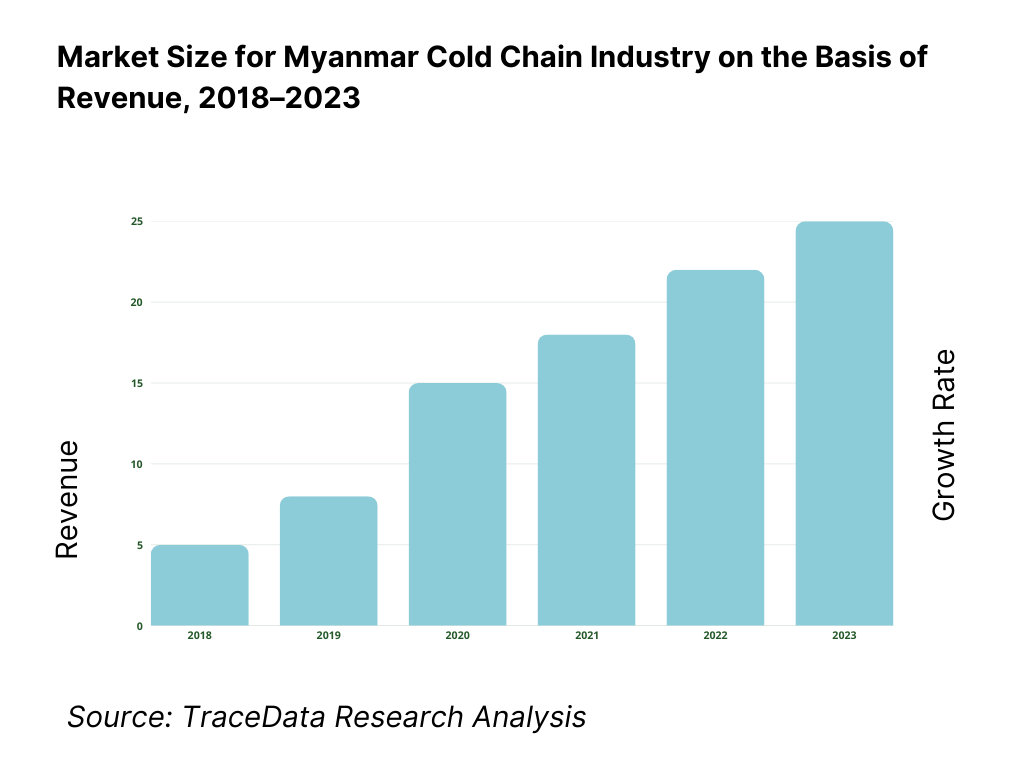

Myanmar Cold Chain Market Overview and Size

The Myanmar cold chain market reached a valuation of USD 1.75 billion in 2023, driven by rising demand for temperature-controlled storage and transportation of perishable goods such as meat, seafood, pharmaceuticals, and dairy products. As Myanmar’s economy gradually opens to international trade and urban consumption increases, cold chain infrastructure is becoming vital. Major players such as KOSPA, Premium Distribution, Kokula Logistics, and Yusen Logistics are recognized for their investments in cold storage capacity, last-mile cold transport networks, and integrated supply chain solutions.

In 2023, Premium Distribution expanded its temperature-controlled warehouse facilities near Yangon to accommodate increased demand from food retail and pharma sectors. Yangon and Mandalay serve as the primary cold chain hubs due to high urban consumption and strong connectivity.

What Factors are Leading to the Growth of Myanmar Cold Chain Market

Agriculture and Seafood Export Growth: Myanmar is a leading exporter of seafood and fresh produce in the region. In 2023, seafood exports alone accounted for over USD 750 million, necessitating reliable cold chain systems to maintain quality during transit, especially for shipments to China and Thailand.

Rising Demand for Processed and Packaged Foods: With a growing urban population and rising middle class, consumer preferences are shifting toward packaged, frozen, and ready-to-eat foods. The number of retail outlets with cold chain needs increased by 20% in 2023, fueling storage and distribution demand.

Pharmaceutical Distribution Needs: Cold chain compliance has become critical in pharmaceutical logistics, especially for vaccines and temperature-sensitive drugs. With initiatives by the Ministry of Health and international NGOs, the requirement for GDP-compliant cold storage and distribution systems has surged.

Which Industry Challenges Have Impacted the Growth for Myanmar Cold Chain Market

Insufficient Infrastructure and Power Reliability: One of the biggest constraints in Myanmar's cold chain development is the lack of modern storage and transport infrastructure, especially outside major cities. In 2023, it was estimated that nearly 60% of perishable goods in rural areas suffered spoilage due to inadequate cold storage or power outages. Frequent electricity cuts in regions like Shan and Ayeyarwady have further limited the operational efficiency of cold storage facilities.

High Capital and Operating Costs: Building and maintaining cold storage and refrigerated transport systems are capital-intensive. Many local logistics firms find it financially unviable to invest in temperature-controlled units. In 2023, operational costs for cold chain logistics were reported to be 25–30% higher than standard logistics, discouraging small and mid-sized players from entering the sector.

Limited Technical Expertise and Workforce Training: A skilled workforce is essential to ensure the consistent performance of cold chain systems. However, Myanmar faces a shortage of trained professionals in areas such as refrigeration system maintenance, temperature monitoring, and inventory control. This skill gap results in frequent breakdowns and inconsistent temperature maintenance, compromising product quality.

What are the Regulations and Initiatives which have Governed the Market

Cold Chain Guidelines by the Ministry of Commerce: The Myanmar Ministry of Commerce has issued advisory frameworks for the proper handling, transport, and storage of perishable goods. While currently non-mandatory, these guidelines aim to encourage best practices in temperature management. In 2023, over 40 cold chain operators voluntarily aligned with these standards to enhance reliability and secure contracts with global exporters.

Support from International Development Agencies: Organizations such as JICA, USAID, and GIZ have initiated capacity-building programs and grants to support cold chain infrastructure, particularly in agriculture and pharmaceuticals. For instance, USAID funded cold storage units in Mandalay and Mon in 2022–2023 to improve post-harvest handling for mango and fishery products.

National Logistics Master Plan (NLMP): As part of its broader infrastructure agenda, the Myanmar government included cold chain development under the National Logistics Master Plan (2023–2030). The plan emphasizes regional cold hubs, integrated transport corridors, and public-private partnerships to bridge infrastructure gaps and improve market connectivity.

Myanmar Cold Chain Market Segmentation

By Market Structure: The Myanmar cold chain market is largely dominated by unorganized local operators due to the fragmented logistics infrastructure and lower entry barriers in regional towns. These players provide basic cold storage or ad-hoc refrigerated delivery solutions, often catering to agriculture and small-scale retailers. However, organized players such as KOSPA, Premium Distribution, and Yusen Logistics are gaining market share by investing in large-scale, standardized cold warehouses and transport fleets. Their ability to serve pharmaceutical clients, international food brands, and large supermarkets has led to increased demand for organized cold chain services in Yangon and Mandalay.

%2C%202023.png)

By End User: Meat & Seafood is the dominant segment in Myanmar’s cold chain market, driven by the country’s strong seafood exports to China, Thailand, and the Middle East. This is followed by Fruits & Vegetables, especially in the delta and central plains regions, where fresh produce logistics require short-haul cold storage and transport. The pharmaceutical segment has seen sharp growth due to increased demand for vaccines, insulin, and biologics, especially post-COVID-19. Dairy products and frozen processed foods are also growing steadily with urban lifestyle shifts.

%2C%202023.png)

By Temperature Type: Chilled storage (0–5°C) holds a larger share in the Myanmar cold chain market, primarily used for fresh produce, dairy, and short-haul meat transport. However, the share of frozen (-18°C and below) storage and logistics is increasing due to exports of frozen fishery items and growth in frozen food retail. Organized players are now offering hybrid warehouses to meet the growing multi-temperature storage needs of clients.

Competitive Landscape in Myanmar Cold Chain Market

The Myanmar cold chain market is moderately consolidated, with a handful of organized players dominating in urban hubs such as Yangon and Mandalay, while a large number of smaller, unorganized operators serve regional markets. Over the last five years, companies have been gradually investing in integrated temperature-controlled storage and transportation solutions to meet rising demand from agriculture, food processing, and pharmaceuticals. Key players include KOSPA, Premium Distribution, Kokula Logistics, Yusen Logistics, and Japfa Comfeed.

Company | Establishment Year | Headquarters |

KOSPA Logistics | 2014 | Yangon, Myanmar |

Premium Distribution | 2012 | Yangon, Myanmar |

Kokula Logistics | 2015 | Mandalay, Myanmar |

Yusen Logistics Myanmar | 2014 | Yangon, Myanmar |

Japfa Comfeed Myanmar | 1999 | Yangon, Myanmar |

Some of the recent competitor trends and key information about competitors include:

KOSPA Logistics: A joint venture between Kokubu Group (Japan) and Yoma Strategic Holdings, KOSPA expanded its cold transport fleet by 30% in 2023 to cater to growing pharmaceutical and seafood export needs. It is recognized for maintaining high standards in temperature monitoring and distribution reliability.

Premium Distribution: One of Myanmar’s largest cold chain service providers, Premium Distribution added over 5,000 square meters of new cold storage space in 2023 in Yangon and began offering last-mile refrigerated delivery for frozen foods and dairy across major cities.

Kokula Logistics: Based in Mandalay, Kokula has developed strong regional capabilities in chilled and frozen food delivery. In 2023, it signed contracts with over 100 agro-processors in upper Myanmar and introduced a tracking system for temperature compliance.

Yusen Logistics Myanmar: Backed by the Japanese logistics conglomerate, Yusen offers end-to-end cold chain solutions including air and sea freight. The company grew its cold pharma logistics division by 20% in 2023, mainly due to rising vaccine transportation needs.

Japfa Comfeed Myanmar: Although primarily an agribusiness firm, Japfa operates its own cold logistics infrastructure to support its poultry and processed food supply chain. In 2023, it launched temperature-controlled delivery services to modern trade outlets in Naypyidaw and Bago.

What Lies Ahead for Myanmar Cold Chain Market?

The Myanmar cold chain market is projected to witness robust growth through 2029, driven by rising demand from agro-exports, food retail, and the pharmaceutical sector. The market is expected to register a CAGR of around 9–11%, with increasing investments in infrastructure, digital capabilities, and international trade compliance acting as key accelerators.

Expansion of Agro-Export Cold Chain Infrastructure: With Myanmar aiming to boost exports of seafood, fruits, and vegetables, significant investment is expected in building cold storage clusters near production zones and border trade points. Export-focused cold chain infrastructure near regions like Myawaddy, Muse, and Yangon Port will be vital to reduce spoilage and improve product quality for international buyers.

Integration of Cold Chain in E-Commerce Fulfillment: As online grocery and pharmaceutical delivery platforms grow, there will be a rising need for micro cold storage hubs and temperature-controlled last-mile delivery services. Urban centers like Yangon, Mandalay, and Naypyidaw are expected to see the emergence of tech-enabled refrigerated delivery platforms to serve B2C and B2B needs.

Adoption of Advanced Monitoring Technologies: The use of IoT-enabled sensors, temperature logging systems, and GPS fleet tracking is likely to expand, enhancing the transparency and reliability of cold chain operations. This will not only support regulatory compliance for pharmaceuticals but also help reduce operational losses.

Public-Private Partnerships and Development Aid: Strategic partnerships between government agencies and international development bodies are anticipated to play a pivotal role in closing the infrastructure gap. Programs led by JICA, USAID, and ADB will likely offer technical assistance, funding, and training initiatives for local players to improve cold chain efficiency.

%2C%202023-2029.png)

Myanmar Cold Chain Market Segmentation

• By Market Structure:

Cold Storage Facilities (Standalone and Integrated)

Cold Transportation (Refrigerated Trucks, Vans, and Containers)

Last-Mile Cold Delivery Providers

Multi-Temperature Warehouses

Organized Sector

Unorganized Sector

Third-Party Logistics (3PL) Cold Chain Providers

• By End User Industry:

Meat & Seafood

Fruits & Vegetables

Dairy Products

Pharmaceuticals

Frozen Processed Foods

Quick Service Restaurants (QSRs)

Retail Chains and Supermarkets

• By Temperature Type:

Chilled (0°C to 5°C)

Frozen (-18°C and below)

Ambient Controlled (15°C to 25°C, for pharma)

• By Type of Services:

Storage Services

Transportation Services

Integrated Cold Chain Solutions

Distribution and Fulfillment

Cross-Border Cold Logistics

• By Region:

Yangon

Mandalay

Bago

Ayeyarwady

Shan State

Sagaing

Tanintharyi

Players Mentioned in the Report

KOSPA Logistics

Premium Distribution

Kokula Logistics

Yusen Logistics Myanmar

Japfa Comfeed Myanmar

Pro 1 Global Logistics

Excel Logistic Group

Mingalarbar Logistics

Key Target Audience

Cold Storage Operators

Logistics and Transport Providers

Exporters and Agro-Processing Firms

Pharmaceutical and Vaccine Distributors

Development Agencies and Government Authorities

Retail Chains and Supermarkets

Restaurant Chains and Food Aggregators

Time Period

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Myanmar Cold Chain Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges Faced

4.2. Revenue Streams for Myanmar Cold Chain Market

4.3. Business Model Canvas for Myanmar Cold Chain Market

4.4. Buying Decision-Making Process for End Users

4.5. Supply Chain Decision-Making Process for Logistics Providers

5. Market Structure

5.1. Cold Chain Infrastructure by Type (Storage vs Transport), 2018-2024

5.2. Number of Cold Storage Warehouses and Refrigerated Vehicles in Myanmar, 2018-2024

5.3. Cold Chain Penetration by Industry (Food, Pharma, Retail), 2024

5.4. Investment Trends in Myanmar Cold Chain Sector, 2018-2024

6. Market Attractiveness for Myanmar Cold Chain Market

7. Supply-Demand Gap Analysis

8. Market Size for Myanmar Cold Chain Market Basis

8.1. Revenue, 2018-2024

8.2. Volume Capacity (Cubic Meters/Tons), 2018-2024

9. Market Breakdown for Myanmar Cold Chain Market Basis

9.1. By Market Structure (Organized vs Unorganized), 2023-2024P

9.2. By Temperature Type (Chilled vs Frozen), 2023-2024P

9.3. By End User Industry (Meat & Seafood, Dairy, Pharma, Fruits & Vegetables, Others), 2023-2024P

9.4. By Type of Service (Storage, Transport, Integrated), 2023-2024P

9.5. By Region (Yangon, Mandalay, Bago, etc.), 2023-2024P

10. Demand Side Analysis for Myanmar Cold Chain Market

10.1. Customer Landscape and Sectoral Demand Patterns

10.2. Industry Usage Journey and Cold Chain Needs

10.3. Pain Point Analysis and Service Expectations

10.4. Sector-Wise Gap Assessment Framework

11. Industry Analysis

11.1. Trends and Developments for Myanmar Cold Chain Market

11.2. Growth Drivers for Myanmar Cold Chain Market

11.3. SWOT Analysis for Myanmar Cold Chain Market

11.4. Issues and Challenges in the Cold Chain Sector

11.5. Regulatory Landscape and Government Initiatives

12. Snapshot on Tech Adoption in Cold Chain

12.1. Adoption of Temperature Monitoring, Fleet Tracking, and Warehouse Automation

12.2. Cold Chain Digitalization Trends and Impact on Efficiency

12.3. Cross Comparison of Major Players' Tech Integration

13. Myanmar Cold Chain Financing and Investment Trends

13.1. Investment Flow from Government and Donor Agencies

13.2. Cold Chain Project Financing Models and Risk Sharing

13.3. Financial Challenges for Small Logistics Firms

13.4. ROI Models in Cold Chain Warehousing and Transport

14. Opportunity Matrix for Myanmar Cold Chain Market-Presented via Radar Chart

15. PEAK Matrix Analysis for Myanmar Cold Chain Service Providers

16. Competitor Analysis for Myanmar Cold Chain Market

16.1. Benchmark of Key Players by Services, Capacity, Region, Clients, and Capabilities

16.2. Strengths and Weaknesses of Major Competitors

16.3. Cold Chain Operating Models Comparison

16.4. Bowman’s Strategic Clock for Competitive Advantage

16.5. Strategic Partnerships and Recent Developments

17. Future Market Size for Myanmar Cold Chain Market Basis

17.1. Revenue, 2025-2029

17.2. Storage and Transport Capacity (Tons/Cubic Meters), 2025-2029

18. Market Breakdown for Myanmar Cold Chain Market Basis

18.1. By Market Structure (Organized vs Unorganized), 2025-2029

18.2. By Temperature Type (Chilled vs Frozen), 2025-2029

18.3. By End User Industry (Meat, Dairy, Pharma, Produce, Others), 2025-2029

18.4. By Region (Yangon, Mandalay, etc.), 2025-2029

18.5. By Type of Service (Storage, Transport, Integrated), 2025-2029

18.6. Recommendations and Strategic Imperatives

18.7. Future Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side (food processors, exporters, pharma distributors, retailers) and supply-side (cold storage operators, 3PL firms, transporters, equipment providers) entities in the Myanmar Cold Chain Market. Based on this ecosystem, we shortlist the leading 5–6 organized players in the country based on their infrastructure size, fleet capacity, warehouse footprint, and key client verticals.

Sourcing is done through industry articles, international development agency reports, trade databases, and proprietary cold chain intelligence tools to collate reliable, market-level and company-specific insights.

Step 2: Desk Research

We conduct exhaustive desk research using secondary and proprietary sources, including cold chain industry publications, development finance institution reports (e.g., ADB, USAID), company websites, logistics association documents, and market databases.

Our analysis spans across parameters such as cold storage capacity (cubic meters), refrigerated fleet size, geographic distribution, pricing structures, and service models. In-depth reviews of annual reports, press releases, and news articles supplement our understanding of key players and trends.

Step 3: Primary Research

A series of in-depth telephonic and in-person interviews are conducted with cold chain operators, exporters, retailers, pharma firms, and government logistics stakeholders. These helps validate market size assumptions, assess capacity utilization, and gather ground-level insights on operational practices and pricing.

Our team also conducts disguised interactions with service providers under the identity of potential customers to understand rate cards, service levels, and geographic coverage. This helps corroborate financial and operational insights with real-time market behavior.

A bottom-up approach is used to aggregate individual operator capacities (in pallet positions or tons) and estimate market-wide volume and revenue figures.

Step 4: Sanity Check

Both bottom-up and top-down modeling exercises are undertaken for cross-verification of results.

A final sanity check is conducted by triangulating primary insights, desk data, and statistical modeling outcomes, ensuring that our market size estimates, segmentation, and forecasts are robust and defensible.

FAQs

1. What is the potential for the Myanmar Cold Chain Market?

The Myanmar cold chain market holds strong growth potential, with a valuation of USD USD 1.75 billion in 2023 and projected steady growth through 2029. Key drivers include rising demand for temperature-sensitive logistics across agriculture, seafood, pharmaceuticals, and modern food retail. As Myanmar integrates more closely with regional trade networks and urban consumption rises, the cold chain industry is expected to become a vital backbone for food security and export competitiveness.

2. Who are the Key Players in the Myanmar Cold Chain Market?

Key players in the Myanmar cold chain market include KOSPA Logistics, Premium Distribution, Kokula Logistics, Yusen Logistics Myanmar, and Japfa Comfeed Myanmar. These companies have emerged as leaders through investments in cold storage capacity, refrigerated transportation, and integrated distribution services. They serve clients across food processing, export, retail, and healthcare sectors.

3. What are the Growth Drivers for the Myanmar Cold Chain Market?

Growth in the Myanmar cold chain market is driven by increased agro-exports (especially seafood and fruits), demand for processed and frozen foods, expansion of pharmaceutical supply chains, and the growth of organized food retail in urban areas. Government infrastructure plans and support from international development agencies further catalyze market expansion. Technological advancements such as GPS tracking and temperature monitoring are also improving reliability and trust in cold logistics.

4. What are the Challenges in the Myanmar Cold Chain Market?

The industry faces several challenges, including insufficient infrastructure in rural areas, frequent power outages, high capital costs, and limited availability of trained professionals. The dominance of unorganized players also creates service inconsistencies. Regulatory gaps and the absence of formal cold chain standards can impact quality assurance and limit participation in high-value global export markets.