Myanmar Online Education Platforms Market Outlook to 2030

By Learning Type, By Delivery Mode, By Monetization Model, By Device Type, and By Region

- Product Code: TDR0389

- Region: Asia

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “Myanmar Online Education Platforms Market Outlook to 2030 - By Learning Type, By Delivery Mode, By Monetization Model, By Device Type, and By Region” provides a comprehensive analysis of the online education market in Myanmar. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the online education market. The report concludes with future market projections based on learner volumes, platform revenues, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions in the Myanmar Online Education Platforms Market.

Myanmar Online Education Platforms Market Overview and Size

The Myanmar online education / EdTech market is valued at USD X in 2024, the market is projected to grow strongly. The expansion is propelled by rising smartphone adoption, improving mobile broadband coverage, and youthful demographics increasingly demanding flexible learning alternatives. In 2024, the market continues to expand, closely tied to greater mobile penetration and donor-backed digital learning programs.

The leading hubs in this market are Yangon and Mandalay, which dominate platform penetration and content development. These cities host the majority of EdTech startups, infrastructure, and high-income learner segments. Many local content providers, platform operators, and fintech partnerships are based there, enabling better investor access, internet backbone connectivity, and logistic support.

What Factors are Leading to the Growth of the Myanmar Online Education Platforms Market:

Dense mobile access and working-age learner base enables scale for online delivery: Myanmar’s mobile reach remains expansive, with 121.028 mobile subscriptions per 100 people and a working-age population of 37,275,361 individuals forming the backbone of its digital learning audience. Macroeconomic capacity underpins digital spending, with the nation’s GDP recorded at USD 74,079.8 million in current prices. A total population of approximately 54.9 million creates a wide learner base spanning K-12, TVET, and adult upskilling. Together, high SIM density, a strong working-age segment, and solid macro output drive scalable opportunities for mobile-first and low-data online education solutions.

Urban concentration and telecom-payment rails ease acquisition and retention: Urban hubs like Yangon and Mandalay anchor much of Myanmar’s digital infrastructure and consumer activity, enabling easier platform reach and engagement. The country’s 37.27 million working-age adults concentrate primarily in these regions, which also enjoy greater internet coverage and smartphone access. The Union Taxation Law (2024) imposes MMK 20,000 per SIM and a 15% commercial tax on internet services, illustrating the economic significance of telecom usage. This interconnected telecom-fintech ecosystem allows micro-payments and sponsored data packs that facilitate flexible subscription and course payments across user demographics.

Youth–employment dynamics and resilient connectivity trends support upskilling: Myanmar’s youth-heavy labor force and digital rebound underpin the sustainability of its online education ecosystem. Mobile density stabilized at 121.028 per 100 people in 2023 after temporary dips during pandemic disruptions, indicating steady digital participation. A population of 54.9 million and GDP of USD 74,079.8 million sustain the long-term need for digital upskilling in IT, languages, and vocational fields. This consistent connectivity resilience creates fertile conditions for asynchronous and hybrid education platforms to expand in both corporate and grassroots segments.

Which Industry Challenges Have Impacted the Growth of the Myanmar Online Education Platforms Market:

Connectivity and power constraints add cost-to-serve and require offline design: Despite the high mobile penetration rate of 121.028 per 100 people, quality and reliability differ widely between urban and rural areas. Internet costs are also elevated due to the MMK 20,000 SIM tax and 15% levy on internet services, increasing total cost-to-serve for platforms and learners alike. With GDP at USD 74,079.8 million, disposable income remains limited in many provinces, making affordability a challenge. As a result, platforms must invest in offline learning packs, lightweight apps, and downloadable content to ensure inclusivity across variable network and power conditions.

Fragmented education data and uneven institutional capacity slow scale-up: Myanmar’s education administration continues to modernize, but the absence of consolidated national data slows decision-making and digital adoption. A working-age population of 37.27 million and overall population near 54.9 million amplify the cost of such inefficiencies, especially for vendors attempting to integrate with schools, universities, and NGOs. Without unified databases on teachers, students, and institutions, platforms face higher acquisition costs, redundant onboarding processes, and inconsistent performance tracking—ultimately impeding rapid scaling of digital learning infrastructure.

Macroeconomic shocks complicate household budgets and institutional spending: Frequent climate events and economic disruptions continue to strain education budgets and digital adoption. Even with GDP at USD 74,079.8 million and a working-age base exceeding 37 million, disposable household income remains volatile, especially outside major cities. These economic fluctuations affect enrollment consistency, donor disbursements, and institutional procurement cycles. To counter this, EdTech platforms increasingly rely on installment-based pricing through mobile wallets and donor-backed programs to stabilize revenue streams amid fluctuating consumer purchasing power.

What are the Regulations and Initiatives which have Governed the Market:

Private Education Law mandates registration and governance for private providers: The Private Education Law (enacted May 2023) requires private educational entities—including primary, secondary, tertiary, and TVET providers—to formally register with central education authorities. This framework ensures regulatory oversight and institutional quality compliance. For EdTech providers partnering with private schools or offering certification-linked programs, adherence to registration standards is mandatory. The policy particularly impacts operators expanding in major hubs such as Yangon and Mandalay, which together represent the bulk of the 37.27 million working-age population driving education demand.

Union Taxation Law sets explicit telecom levies affecting EdTech delivery costs: The Union Taxation Law (2024) stipulates a one-time MMK 20,000 SIM levy and a 15% commercial tax on internet services, directly influencing the affordability of online learning. These levies shape the cost structure for data-heavy platforms and determine the viability of zero-rated education bundles. With GDP at USD 74,079.8 million and 121.028 mobile lines per 100 people, taxation on connectivity becomes a defining factor in how online education platforms structure their pricing, partnerships, and user acquisition strategies.

No comprehensive data-protection statute; obligations scattered with penalties: Myanmar lacks a unified data protection law, with compliance governed by fragmented statutes such as the Telecommunications Law and various security regulations. Non-compliance may result in fines or 1–3 years of imprisonment, depending on the provision enforced. This fragmented legal framework complicates operations for EdTech providers managing student data, payment records, and assessment results. In a country of 54.9 million people, the absence of a single, standardized privacy law elevates compliance risk and operational costs for platforms expanding across multiple states and user groups.

Myanmar Online Education Platforms Market Segmentation

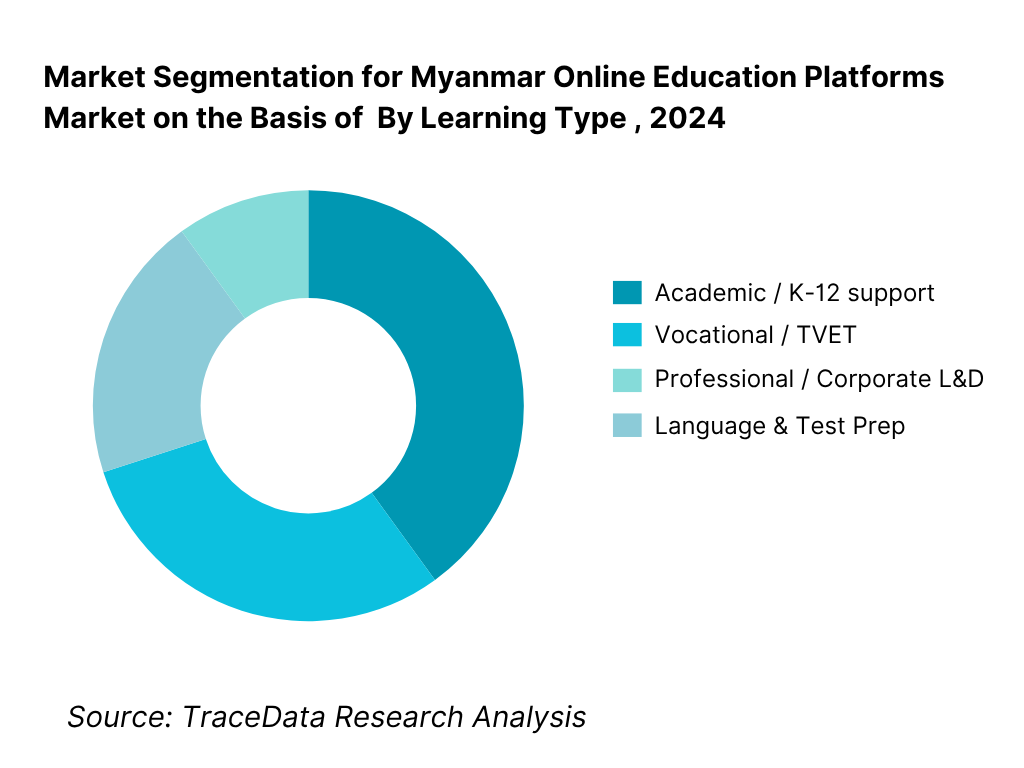

By Learning Type: In 2024, the Academic / K-12 support subsegment commands the largest share, due to strong demand from school students for supplementary classes, exam preparation, and bridging learning gaps. Many parents and students seek help with school curricula, especially in urban areas where competition for college entrance is fierce. Local platforms and tutoring ecosystems have evolved around K-12 needs, making this segment better monetized and frequently promoted.

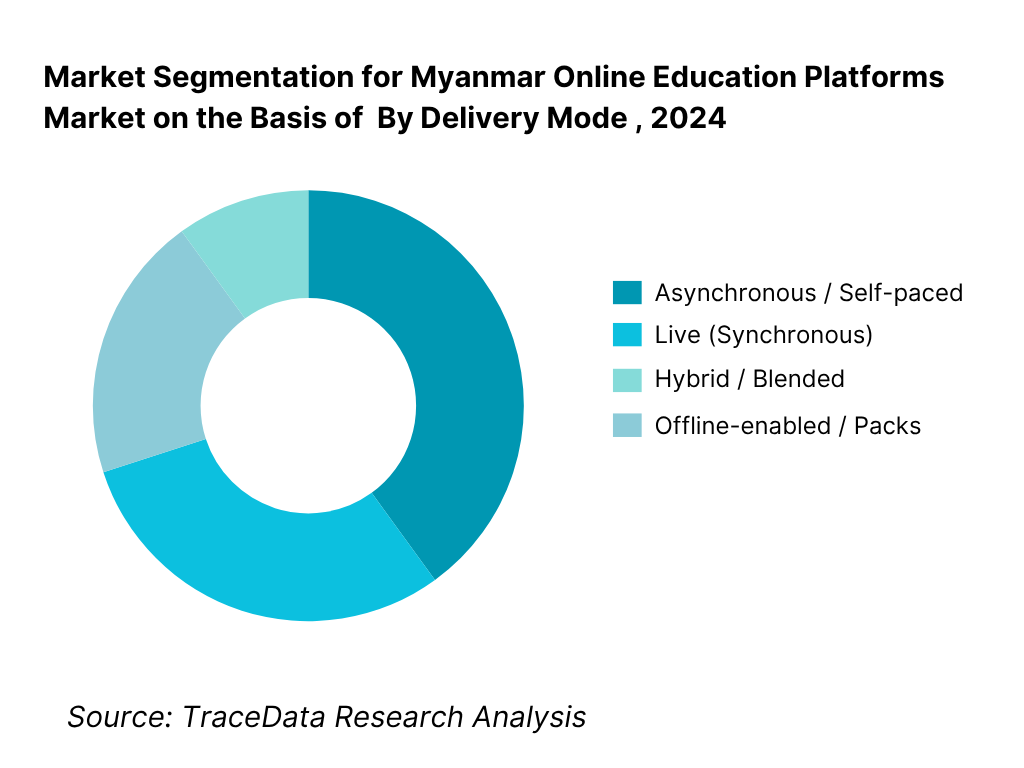

By Delivery Mode: In 2024, Asynchronous / Self-paced is the dominant sub-segment. Many learners prefer flexibility to consume courses at their convenience due to erratic schedules, intermittent connectivity, or device constraints. Platforms offering recorded video modules, quizzes, and downloadable content cater better to learners in lower-bandwidth regions. Moreover, asynchronous models simplify scaling and cost amortization for platforms.

Competitive Landscape in Myanmar Online Education Platforms Market

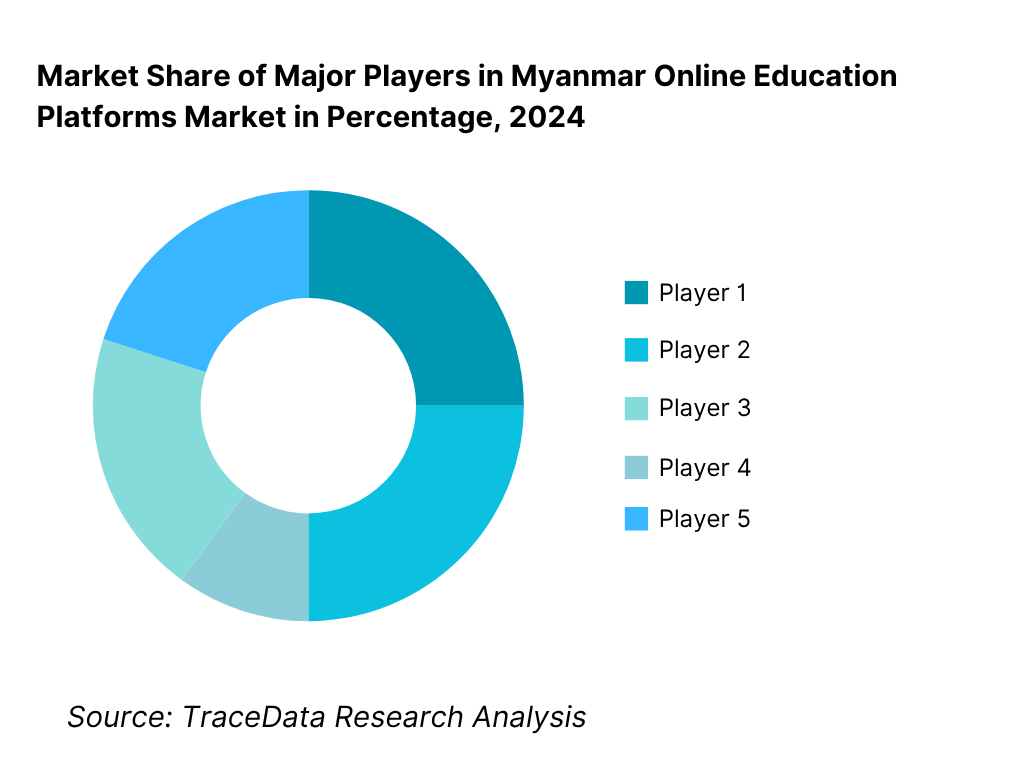

The Myanmar EdTech space is characterized by a mix of local startups and small regional players, with fragmentation and nascent consolidation. While no single player has monopolistic dominance, a few stand out in terms of reach, content library, or partnerships.

Name | Founding Year | Original Headquarters |

360Ed | 2018 | Yangon, Myanmar |

Waso Learn | 2019 | Mandalay, Myanmar |

SAYA | 2020 | Yangon, Myanmar |

ConceptX | 2017 | Yangon, Myanmar |

DedaaBox | 2021 | Yangon, Myanmar |

MyanLearn | 2019 | Yangon, Myanmar |

MPT e-Learning | 2016 | Yangon, Myanmar |

DynEd Myanmar | 2015 | Yangon, Myanmar |

GandaWin Learn | 2018 | Yangon, Myanmar |

HostMyanmar LMS | 2014 | Yangon, Myanmar |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

360Ed: A pioneering EdTech startup from Yangon, 360Ed has expanded its immersive AR-based learning portfolio, adding science and math modules aligned with Myanmar’s basic education curriculum. The company partnered with telecom operators to distribute low-data learning packs across regions with limited internet access. In 2023, it recorded a strong surge in usage among K-12 students, driven by its offline-enabled applications and bilingual (Burmese–English) interface.

Waso Learn: Focusing on upskilling for rural learners and teachers, Waso Learn introduced localized content in multiple ethnic languages, including Shan and Karen. The platform integrated with Wave Money for seamless micro-payments and launched community-based digital classrooms in Mandalay and Bago. Its emphasis on teacher training and NGO partnerships made it a preferred partner for donor-funded literacy programs in 2023.

SAYA: SAYA has gained traction among working professionals and college students by expanding its catalog of self-paced business and IT courses. The company recently introduced a hybrid learning feature, allowing learners to attend recorded sessions offline while joining live doubt-clearing classes during connectivity windows. In 2023, SAYA reported consistent enrollment growth through corporate L&D partnerships and content syndication with local universities.

ConceptX: ConceptX has reinforced its position in the technical and vocational education segment by introducing new certification pathways in digital skills, entrepreneurship, and hospitality management. The firm collaborated with multiple NGOs to deploy its platform in underserved areas and launched affordable subscription tiers priced below MMK 10,000 per month. Its B2B partnerships with small enterprises for workforce training highlight its growing foothold in the vocational upskilling domain.

DedaaBox: Operating with an “offline-first” architecture, DedaaBox has become one of the most adaptive learning platforms in Myanmar’s low-connectivity zones. In 2023, the company introduced device-light learning kits distributed through schools and TVET centers in Shan and Kayin states. DedaaBox also partnered with UNICEF Myanmar to provide digital content for early-grade learning. Its strong focus on inclusivity and content localization makes it a frontrunner among socially driven EdTech innovators.

What Lies Ahead for Myanmar Online Education Platforms Market?

The Myanmar online education platforms market is expected to maintain strong forward momentum through the remainder of the decade, underpinned by expanding digital connectivity, donor-funded education digitization, and an increasingly youthful, mobile-first population. Continuous improvements in network reliability and the integration of fintech payment rails (Wave Money, KBZ Pay) are set to support greater learner participation across K-12, vocational, and corporate upskilling segments.

Rise of Mobile-First and Offline-Enabled Learning Models: The future of Myanmar’s EdTech sector will be characterized by “offline-enabled digitalization”—a hybrid system allowing learners to download lessons or use zero-rated data packs provided by telecoms. As power interruptions and bandwidth variation remain key barriers, the success of offline-first architectures will define platform competitiveness. Companies that optimize for low-data streaming and asynchronous engagement will lead nationwide adoption.

Localization and Vernacular Content Expansion: A defining shift will be toward localized learning in Burmese and ethnic languages such as Shan, Karen, and Mon. With over 54.9 million residents and pronounced regional diversity, vernacular adaptation ensures accessibility across socio-linguistic lines. Government and NGO initiatives supporting curriculum digitization in multiple languages will open opportunities for content partnerships and regional expansion.

Integration of FinTech-Driven Micro-Payments: FinTech ecosystems like KBZ Pay and Wave Money, processing billions in monthly transaction volume, will power affordable course payments, installment models, and subscription renewals. These rails will enable users in lower-income brackets to participate in structured online programs. Telecom-FinTech collaboration will thus anchor Myanmar’s EdTech scalability and inclusion.

Expansion of Vocational and Corporate Training Channels: With a working-age population exceeding 37 million (World Bank 2024), enterprises and TVET centers will increasingly rely on online and blended platforms to deliver compliance, hospitality, and digital-skills training. Sector-focused platforms in tourism, manufacturing, and banking are expected to develop new certifications recognized by domestic employers and donor projects, extending EdTech beyond academic domains.

Leveraging AI, Analytics, and Adaptive Learning Engines: The coming years will see local platforms integrating AI for learning-path recommendations, automated grading, and translation. Predictive analytics will allow providers to track learner progress even in offline environments once synchronization resumes. These technologies, coupled with government digital-transformation initiatives, will transform Myanmar’s online education sector into a measurable, data-driven learning ecosystem.

Myanmar Online Education Platforms Market Segmentation

By Learning Type

Academic / K–12 Support

Vocational / TVET Training

Professional & Corporate L&D

Language & Test Preparation

Adult Continuing Education

By Delivery Mode

Asynchronous / Self-Paced Learning

Live (Synchronous) Classes

Hybrid / Blended Learning

Offline-Enabled / Downloadable Learning

By Monetization Model

Freemium Access

Subscription-Based

Pay-Per-Course

B2B / Institutional Contracts

Donor / NGO-Funded Programs

By Device Type

Android Smartphones

iOS Devices

Laptops / Desktops

Tablets

By Region

Yangon

Mandalay

Nay Pyi Taw

Bago / Ayeyarwady

Shan / Kayin / Other States

Players Mentioned in the Report:

360Ed

Waso Learn

SAYA

ConceptX

DedaaBox

MyanLearn

MPT e-Learning

DynEd Myanmar

GandaWin Learn

HostMyanmar LMS

Thabyay eLearning

AEI Yangon

Little Stars

Edemy

GoMyanLearn

Key Target Audience

Telecom & Mobile Operators (e.g. MPT, Ooredoo, ATOM)

Digital Wallet / FinTech Providers (e.g. KBZPay, Wave Money)

NGOs & International Development Agencies (e.g., UNICEF Myanmar, USAID Education Programs)

Government & Regulatory Bodies (Ministry of Education Myanmar, Department of Innovation & Digital Economy)

EdTech Venture Capital & Investment Firms

Corporate HR & Training Departments (Large Myanmar, ASEAN corporates entering Myanmar)

Vocational Training Providers & TVET Centers

Mobile Device OEMs / Smartphone Brands targeting Myanmar educational users

Time Period:

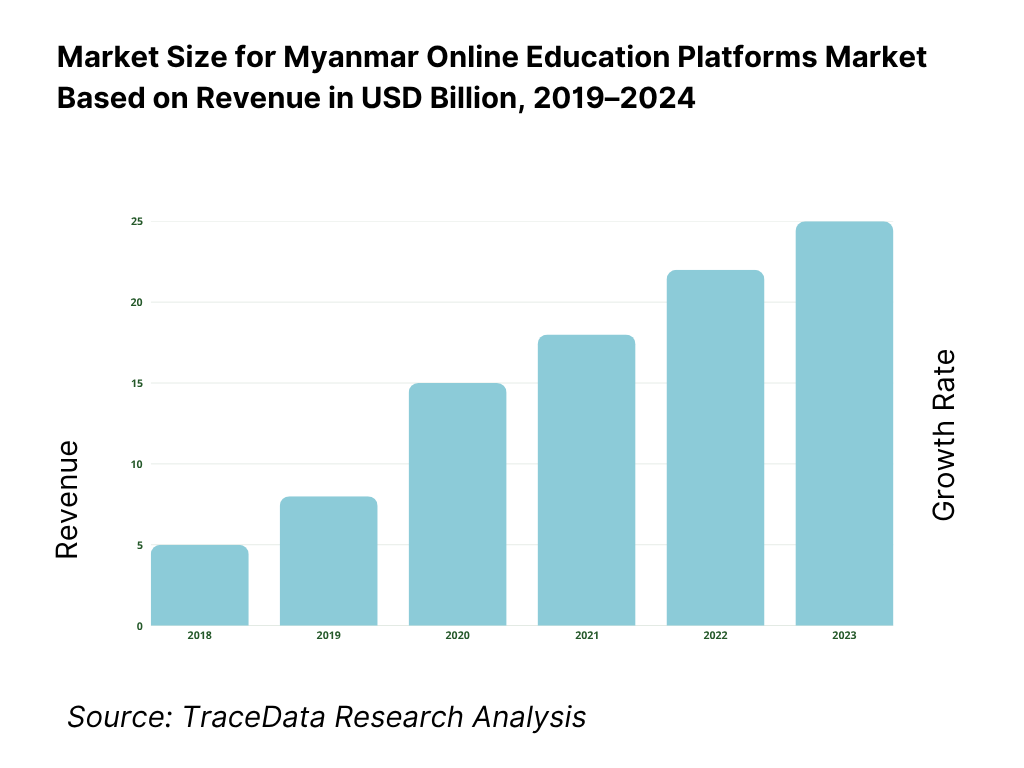

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Online Learning Platforms-Live, Asynchronous, Hybrid, Offline-Enabled, and Self-Paced

4.2. Revenue Streams for Myanmar Online Education Platforms Market

4.3. Business Model Canvas for Myanmar Online Education Platforms Market

5.1. Freelance Tutors vs. Full-Time Educators in Platform Ecosystems

5.2. Investment Model in Myanmar Online Education Platforms Market

5.3. Comparative Analysis of Learner Funneling-Private vs Government Portals

5.4. Education Budget Allocation by Institution & Sector (Public, Private, NGO)

8.1. Revenues, 2019-2024

8.2. Learner Enrollment Volume & Paid Subscription Trends

8.3. Institutional Adoption Curve

9.1. Market Structure (In-House vs Aggregator), 2023-2024P

9.2. Learning Type (Academic, Vocational, Professional, Corporate, Language), 2023-2024P

9.3. Industry Verticals (Education, Banking, Hospitality, Healthcare, Retail), 2023-2024P

9.4. Institution Type (K-12, HEIs, Training Centers, Corporate, NGO-Run), 2023-2024P

9.5. Learner Profile (Students, Employees, Entrepreneurs, Teachers), 2023-2024P

9.6. Mode of Learning (Live, Asynchronous, Hybrid, Offline-Enabled), 2023-2024P

9.7. Course Customization (Open Access vs Customized Programs), 2023-2024P

9.8. By Region (Yangon, Mandalay, Nay Pyi Taw, Bago, Shan, Ayeyarwady), 2023-2024P

10.1. Learner & Institutional Client Cohort Analysis

10.2. Decision-Making & Purchase Journey

10.3. Program Effectiveness & ROI Measurement Framework

10.4. Skill Gap & Accessibility Framework

11.1. Trends & Developments

11.2. Growth Drivers

11.3. SWOT Analysis

11.4. Issues & Challenges

11.5. Government Regulations

12.1. Market Size & Future Potential (2018-2030)

12.2. Business Model & Revenue Streams

12.3. Delivery Models & Types of Courses Offered

15.1. Market Share of Key Players (2024)

15.2. Benchmark of Key Competitors

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant Equivalent

15.5. Bowman’s Strategic Clock

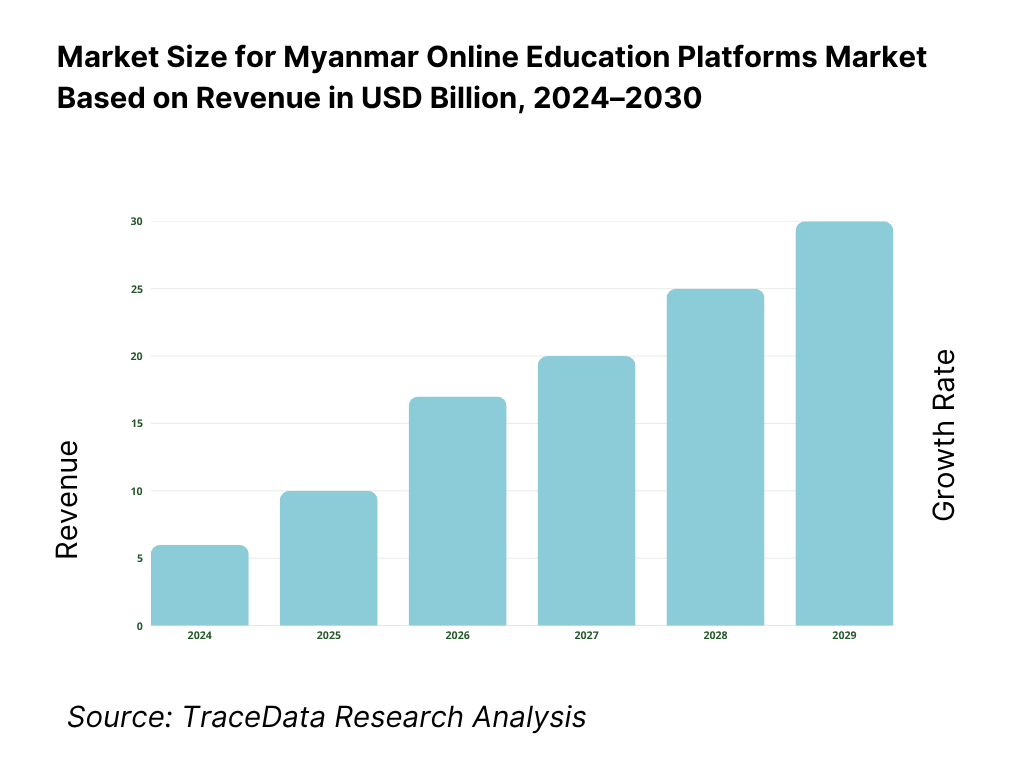

16.1. Revenues, 2025-2030

17.1. By Market Structure, 2025-2030

17.2. By Learning Type, 2025-2030

17.3. By Industry Verticals, 2025-2030

17.4. By Institution Type, 2025-2030

17.5. By Learner Profile, 2025-2030

17.6. By Mode of Learning, 2025-2030

17.7. By Course Customization, 2025-2030

17.8. By Region (Yangon, Mandalay, Nay Pyi Taw, Bago, Shan, Ayeyarwady), 2025-2030

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Myanmar Online Education Platforms Market. Based on this ecosystem, we will shortlist leading 5–6 online learning providers in the country based on their user base, course offerings, technology enablement, and partnership network. Sourcing is conducted through industry articles, multilateral reports (World Bank, UNESCO, ADB), and proprietary databases to perform desk research around the market to collate industry-level information. On the demand side, the focus remains on K–12 learners, university students, TVET trainees, and corporate professionals, while the supply side encompasses EdTech platforms, telecom providers, payment gateways, and content partners enabling online learning in Myanmar.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like platform revenues, number of active learners, pricing structures, mobile-data affordability, and digital literacy indicators. We supplement this with detailed examinations of company-level data, relying on sources like press releases, platform announcements, funding disclosures, and media statements. Additional datasets from the Ministry of Education, World Bank digital access reports, and UNESCO education statistics are integrated to create a holistic view of the market ecosystem. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, founders, and program heads representing various Myanmar Online Education Platform companies and associated stakeholders such as NGOs, telecom partners, and educational institutions. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue models, content delivery processes, pricing mechanisms, partnerships with telecoms and payment providers, and value-chain dependencies unique to the Myanmar EdTech environment.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess the sanity of the process. This validation step includes comparing bottom-up data (aggregated from platform-level financials and user metrics) with top-down macroeconomic indicators such as Myanmar’s GDP (USD 74,079.8 million, World Bank 2024) and working-age population (37,275,361 individuals, World Bank 2024). Through triangulation, our model ensures consistency between platform-level performance and country-level digital adoption statistics, thereby producing an accurate and credible market assessment for the Myanmar Online Education Platforms Market.

FAQs

01 What is the Potential for the Myanmar Online Education Platforms Market?

The Myanmar Online Education Platforms Market holds significant potential, with strong foundations in mobile connectivity and a growing digital learning appetite across urban and rural regions. According to the World Bank, Myanmar recorded a GDP of USD 74,079.8 million in 2024 and a total population of 54.9 million, creating a wide addressable base for digital learning. The expansion of telecom and fintech infrastructure, supported by NGOs and international donors, continues to boost access to education platforms, especially in the K-12, vocational, and professional upskilling segments.

02 Who are the Key Players in the Myanmar Online Education Platforms Market?

The Myanmar Online Education Platforms Market features several prominent local and regional players, including 360Ed, Waso Learn, and SAYA, which have established strong learner bases through localized and offline-enabled platforms. Other notable participants such as ConceptX, DedaaBox, and MyanLearn are driving inclusion by offering courses in Burmese and ethnic languages while partnering with NGOs and telecom providers. International entrants like DynEd Myanmar and corporate initiatives such as MPT e-Learning further expand content diversity and institutional reach within the market.

03 What are the Growth Drivers for the Myanmar Online Education Platforms Market?

The primary growth drivers include high mobile penetration and digital accessibility, with 121.028 mobile subscriptions per 100 people enabling broad reach for online learning. A working-age population of 37,275,361 people sustains continuous demand for upskilling and vocational training. Additionally, donor-funded education digitization and telecom-fintech partnerships are making learning affordable and accessible through zero-rated data and micro-payments, accelerating nationwide adoption of online education platforms.

04 What are the Challenges in the Myanmar Online Education Platforms Market?

The Myanmar Online Education Platforms Market faces several challenges, including uneven internet quality and power reliability, which hinder consistent access to online learning. Regulatory ambiguity around data privacy and digital education accreditation increases compliance costs for providers. Moreover, income disparities within a GDP per capita context of roughly USD 1,339 limit paid subscription adoption in rural and low-income segments, compelling platforms to rely on freemium models and donor partnerships for sustainable growth.