Myanmar Telemedicine Market Outlook to 2030

By Care Model, By Modality, By Clinical Specialty, By Payer/Channel, By Provider Type, and By Region

- Product Code: TDR0390

- Region: Asia

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “Myanmar Telemedicine Market Outlook to 2030 - By Care Model, By Modality, By Clinical Specialty, By Payer/Channel, By Provider Type, and By Region” provides a comprehensive analysis of the telemedicine market in Myanmar. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the telemedicine market. The report concludes with future market projections based on consultation volumes, clinical service lines, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

Myanmar Telemedicine Market Overview and Size

The Myanmar telemedicine space sits within a region where telehealth transacts USD 8.07 billion and a globe at USD 83.62 billion / USD 94.14 billion, pointing to deep supply-side and consumer pull that spill over through telco bundles, hospital apps, and NGO programs. Locally, activity is evidenced by platforms such as MyanCare (hundreds of thousands of installs; 700+ doctors stated) and HEAL by Pun Hlaing (hospital-anchored app), operating atop national population 54,133,798 and broad mobile access. This mix—regional capital/know-how plus domestic digital rails—underpins Myanmar’s addressable teleconsult volume and pharmacy/diagnostics linkages.

Utilization concentrates around Yangon and Mandalay and in hospital networks because these corridors bundle private providers, diagnostics, and pharmacy delivery, and host the apps (e.g., HEAL) most capable of synchronous consults and e-prescription workflows. Telco channels (MPT, ATOM, Mytel, Ooredoo) create nationwide discovery and subsidized access, while NGO/charity tele-clinics (e.g., Telekyanmar) extend reach into conflict-affected and rural townships via store-and-forward models. The dominance stems from provider density, reliable bandwidth, and integrated last-mile fulfillment rather than an explicit share cap.

What Factors are Leading to the Growth of the Myanmar Telemedicine Market:

Ubiquitous mobile access and large rural addressable base: Myanmar’s digital infrastructure enables telemedicine reach at a national scale. The country had 65,516,900 active mobile cellular subscriptions in 2023, exceeding the total population, ensuring widespread access to mobile devices for chat and voice-based consultations. Although fixed broadband connectivity remains limited, with 1,514,830 connections recorded in 2023, it still supports essential video consultations and e-prescription workflows. A total population of 54,500,091 in 2024, including 36,803,911 rural residents, represents a massive addressable base for remote healthcare. Meanwhile, an urban population of 17,696,180 provides concentrated hubs for hospital-linked telemedicine platforms and diagnostic ecosystems, balancing both rural outreach and urban specialization.

Economic capacity for health and digital services despite headwinds: Myanmar’s macroeconomic base remains sufficient to sustain healthcare digitization, with a GDP of USD 64.94 billion in 2024 supporting telecom, device, and service expenditures. Despite ongoing socioeconomic challenges, households continue to rely on digital channels for essential services. With a population of 54,500,091, even modest per-capita healthcare spending translates into large-scale adoption of low-cost teleconsultations, medication deliveries, and remote monitoring services. Demand is geographically polarized—Yangon and Mandalay drive urban adoption, while rural areas, with 36,803,911 people, rely primarily on low-bandwidth chat and voice consultations. Together, this mix fuels steady national growth in telemedicine utilization.

National telecom footprint and SIM-registration regime supporting digital health distribution: Myanmar’s telecom backbone serves as the foundation for scalable digital health delivery. Nationwide Telecommunications Licences issued by the Posts and Telecommunications Department ensure consistent coverage through leading operators such as ATOM, Ooredoo, MPT, and Mytel. SIM registration and KYC verification enable the use of authenticated patient IDs, facilitating secure health enrollments and targeted mobile-health programs. With 121.028 mobile subscriptions per 100 people in 2023, operator-led channels, including USSD, mobile apps, and zero-rated data bundles, offer reliable access for both urban and rural populations. This telecom-enabled regulatory framework ensures predictable connectivity for healthcare delivery nationwide.

Which Industry Challenges Have Impacted the Growth of the Myanmar Telemedicine Market:

Thin fixed connectivity and security infrastructure for clinical-grade telehealth: Myanmar’s fixed broadband penetration remains low, with only 1,514,830 connections recorded in 2023, limiting the viability of high-definition video consultations and connected medical devices. Security infrastructure is also underdeveloped, with just 23.6 secure internet servers per million people in 2024, constraining the country’s ability to handle sensitive patient data securely. These infrastructure gaps compel telemedicine providers to rely heavily on low-data chat and voice models, delaying the rollout of remote diagnostic equipment and chronic-disease management tools that require stable high-speed internet access.

Humanitarian displacement and poverty pressures that disrupt care continuity: While telemedicine demand rises in areas with limited physical access, widespread humanitarian displacement—affecting over 3,000,000 people—undermines care continuity. Persistent fuel shortages, transport restrictions, and security challenges further disrupt health-service logistics, particularly in rural and conflict-affected regions. Poverty pressures and mobility constraints make it difficult for displaced populations to maintain digital connectivity or consistent follow-ups. As a result, telemedicine providers face obstacles in sustaining chronic-care adherence and ensuring patient retention across fragmented and unstable regions.

Population distribution and coverage gaps that bias modality choices: Myanmar’s population of approximately 51,316,756 people is unevenly distributed, with 36,803,911 living in rural areas and 17,696,180 in urban centers. This demographic spread creates stark differences in healthcare access and telemedicine usage. Urban areas such as Yangon and Mandalay favor video-based consultations and integrated diagnostics, while rural townships rely on chat, SMS, and voice-based models due to bandwidth and infrastructure limitations. Telemedicine providers must design hybrid, bandwidth-flexible solutions that cater to these contrasting user environments to achieve balanced market coverage and scalability.

What are the Regulations and Initiatives which have Governed the Market:

Nationwide telecom licensing under PTD enabling operator-delivered health access: The Posts and Telecommunications Department oversees long-term Nationwide Telecommunications Licences that form the regulatory backbone of Myanmar’s telehealth expansion. These licences grant mobile operators the authority to provide all telecommunication services through to 2029, ensuring consistent service delivery across the country. Telecom operators use these licences to partner with hospitals, NGOs, and telemedicine startups to deploy zero-rated health apps, SMS triage systems, and hotline-based services, particularly in bandwidth-constrained townships.

SIM-registration/KYC enforcement that supports authenticated patient onboarding: Myanmar’s mandatory SIM-registration and verification process ensures that each mobile connection is tied to a verified user identity. Telecom providers enforce USSD-based registration and verification for MPT, ATOM, Ooredoo, and Mytel customers, enabling reliable patient identification for teleconsultation platforms. This mechanism supports secure onboarding, continuity of care, and effective communication for prescription delivery and appointment follow-ups. KYC compliance also minimizes fraud and improves the traceability of patient records across digital healthcare systems.

Cybersecurity law with explicit data-retention and fine provisions shaping platform compliance: Myanmar’s newly implemented Cybersecurity Law mandates a minimum of three years of user data retention and imposes fines ranging from 1,000,000 to 10,000,000 kyats for non-compliance. The law also introduces potential imprisonment for unauthorized digital activity, emphasizing stricter governance over personal and health data. For telemedicine providers, these regulations necessitate stronger data-management systems, local hosting arrangements, and enhanced audit trails for clinical information. Compliance with these cybersecurity standards will be crucial to building public trust and attracting foreign investment into Myanmar’s growing digital health ecosystem.

Myanmar Telemedicine Market Segmentation

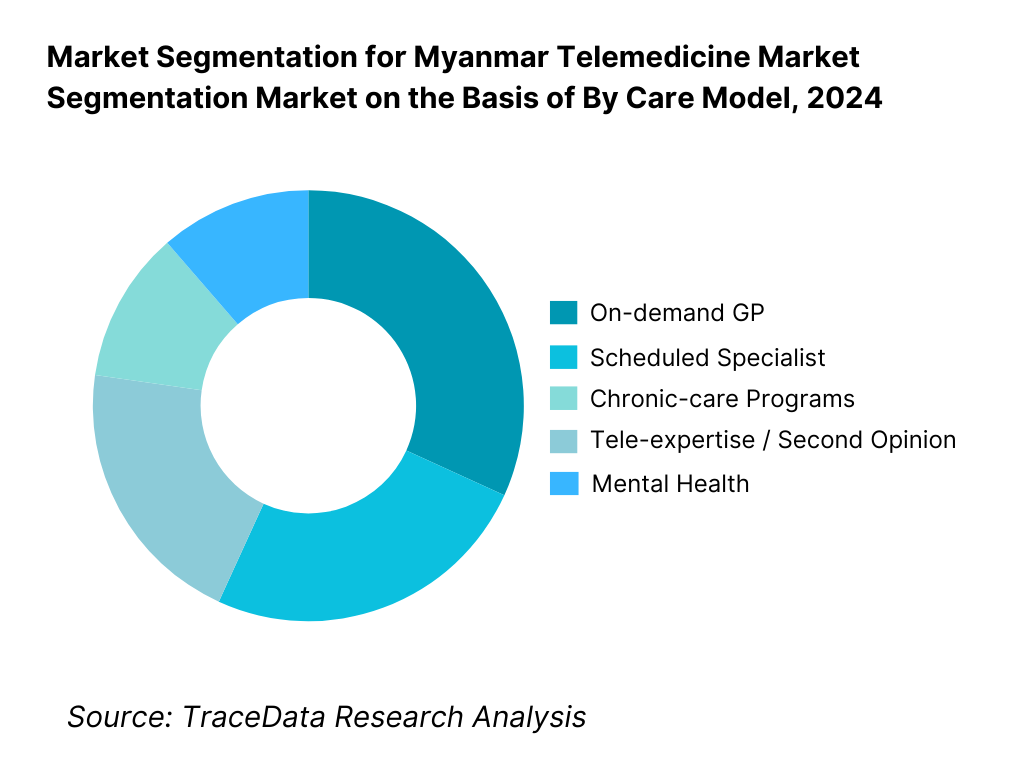

By Care Model: Myanmar telemedicine market is segmented by care model into on-demand GP, scheduled specialist, chronic-care programs, tele-expertise/second opinion, and mental health. Recently, on-demand GP commands the largest share under this segmentation, driven by its low ticket size, immediate symptom relief, and strong fit with telco-bundled chat/voice funnels. Hospital-linked apps such as HEAL and consumer platforms like MyanCare use 24/7 triage, short wait times, and Burmese/English chat to compress activation friction, while NGOs widen reach via asynchronous case handling for common ailments. The result is higher consult frequency per user, sustained even when video bandwidth is volatile.

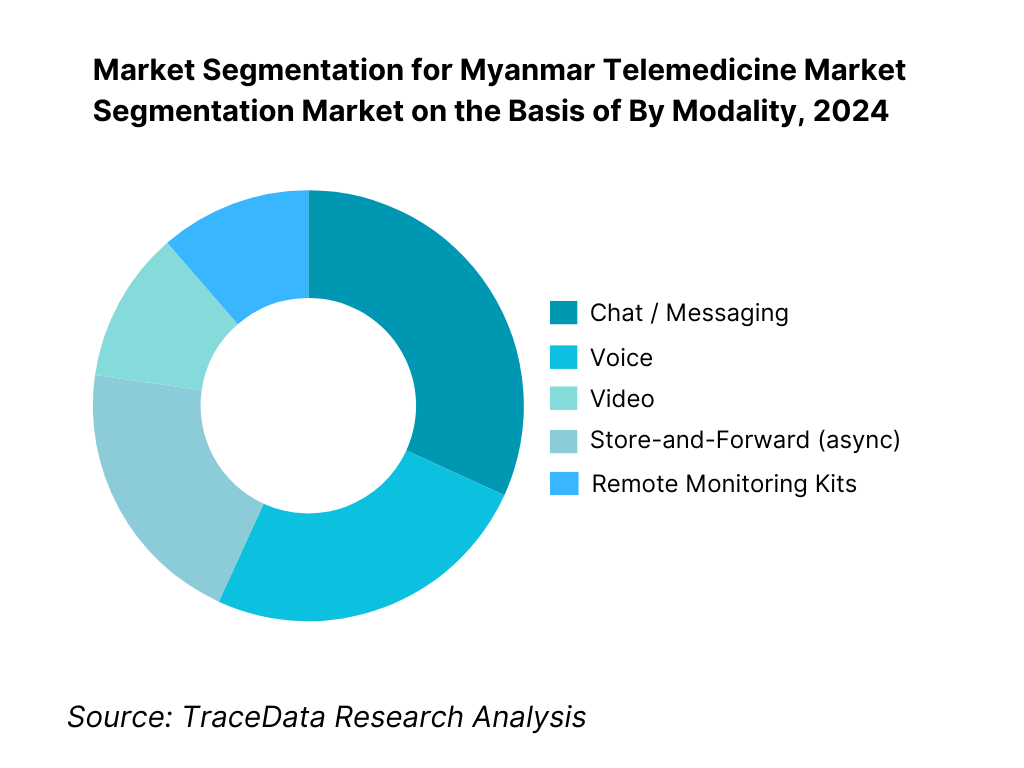

By Modality: Myanmar telemedicine market is segmented by modality into chat/messaging, voice, video, store-and-forward, and remote monitoring. Chat/messaging leads due to low bandwidth needs, multilingual text support, and pay-per-day/weekly packs that fit household budgets. Operator tie-ins and hospital apps use text triage and e-Rx as the first line, escalating to voice/video only when clinically required. In rural and peri-urban areas, messaging integrates better with intermittent data and lets clinicians handle higher daily consult counts, sustaining short median connect times and robust asynchronous follow-ups.

Competitive Landscape in Myanmar Telemedicine Market

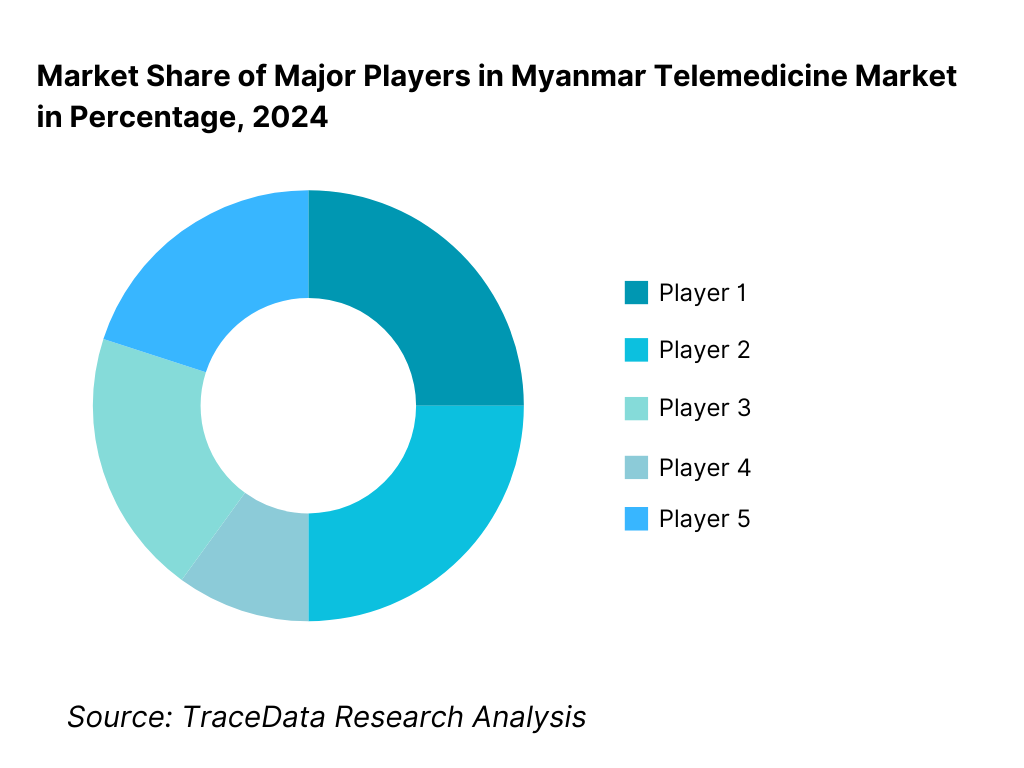

The Myanmar telemedicine market skews toward platform-plus-provider ecosystems, anchored by hospital apps, independent platforms, and telco access channels. Visible actors include HEAL by Pun Hlaing, MyanCare, and content-led communities such as OnDoctor, with telcos acting as both distribution and subsidy rails; NGO/charity tele-clinics fill public-health gaps. This consolidation highlights the influence of hospital brands, telco reach, and NGO funding in shaping patient acquisition, clinician liquidity, and fulfillment.

Name | Founding Year | Original Headquarters |

MyanCare | 2018 | Yangon, Myanmar |

HEAL (Pun Hlaing Hospitals) | 2020 | Yangon, Myanmar |

OnDoctor | 2016 | Yangon, Myanmar |

MPT Health (with MyanCare) | 2021 | Yangon, Myanmar |

ATOM Myanmar | 2022 | Yangon, Myanmar |

Ooredoo Myanmar | 2013 | Yangon, Myanmar |

Mytel (telehealth-enabled services) | 2018 | Nay Pyi Taw, Myanmar |

Parami General Hospital | 2004 | Yangon, Myanmar |

Hello Health Group Myanmar | 2015 | Bangkok, Thailand |

Koe Koe Tech | 2013 | Yangon, Myanmar |

Z-waka | 2019 | Singapore, Singapore |

My-Medicine | 2020 | Yangon, Myanmar |

CareMe | 2019 | Yangon, Myanmar |

Yat Chain You | 2020 | Yangon, Myanmar |

Telekyanmar Online Clinics | 2022 | Yangon, Myanmar |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

MyanCare: One of Myanmar’s earliest and most recognizable telemedicine platforms, MyanCare expanded its doctor network to over 700 practitioners and surpassed 300,000 app downloads in 2024. It integrated online prescription services and partnered with local pharmacies to ensure same-day delivery across major cities, strengthening its position as a go-to virtual healthcare provider for general and specialist consultations.

HEAL by Pun Hlaing Hospitals: Backed by the Yoma Group, HEAL has deepened its integration with the Pun Hlaing hospital network, enabling seamless teleconsultation-to-diagnostics workflows. In 2024, it launched a bilingual (Burmese-English) app interface and added remote lab result access for patients, improving continuity of care and hospital-driven digital engagement.

OnDoctor: Initially focused on digital health education and wellness content, OnDoctor has transitioned into active online consultation and remote health monitoring. During 2024, the company strengthened its chronic disease management segment and launched new health awareness campaigns across social platforms, expanding its reach among younger digital users.

Telekyanmar Clinics: This non-profit initiative recorded strong traction in underserved rural regions by operating hybrid tele-clinic models. Supported by volunteer doctors, Telekyanmar launched a remote follow-up system for maternal and child health services in 2024, aligning with humanitarian health priorities and extending reach beyond Yangon and Mandalay corridors.

My-Medicine: A rapidly growing digital health startup, My-Medicine expanded its service portfolio by integrating real-time chat consultations with e-pharmacy deliveries. In 2024, it partnered with several diagnostic labs for doorstep sample collection, positioning itself as one of Myanmar’s first end-to-end telehealth and fulfillment platforms.

What Lies Ahead for Myanmar Telemedicine Market?

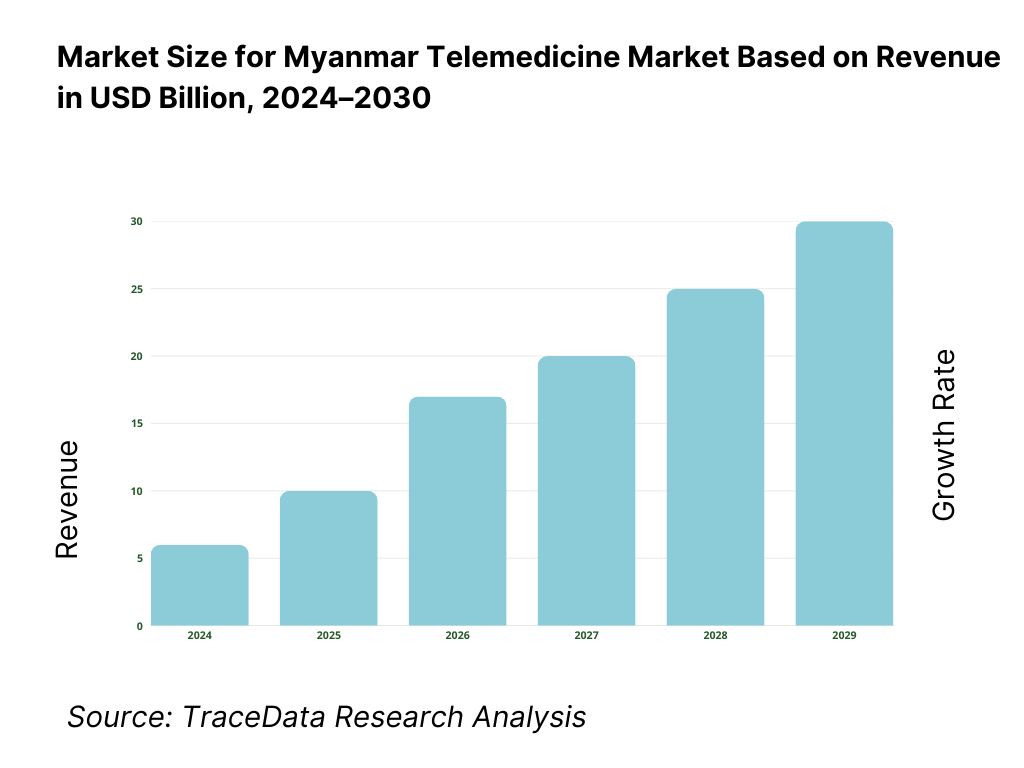

The Myanmar Telemedicine Market is anticipated to advance steadily over the next few years, driven by the nation’s expanding digital connectivity, private sector participation, and donor-backed healthcare digitization programs. Economic stabilization, with Myanmar’s GDP standing at USD 64.94 billion in 2024, provides a strong financial base for continued technology adoption across healthcare delivery chains. The market’s next phase will rely on expanding clinical coverage beyond Yangon and Mandalay, while improving regulatory clarity for electronic prescriptions and cross-border data management.

Rise of Multi-Modal Telehealth Models: The future of telemedicine in Myanmar will likely revolve around multi-modal delivery—combining chat, voice, and store-and-forward methods to overcome inconsistent bandwidth. With 65,516,900 mobile cellular subscriptions recorded in 2023, operators are poised to leverage lightweight, data-efficient consultation platforms that function in both low and high bandwidth environments. Hybrid care models will integrate hospital-linked video sessions in urban hubs with asynchronous rural case reviews managed by NGO-supported clinics, ensuring nationwide accessibility and technology adaptability.

Focus on Integrated Care and Diagnostic Ecosystems: Myanmar’s healthcare digitization journey is progressing toward deeper integration of teleconsultation, e-prescription, diagnostics, and pharmacy delivery systems. With an urban population of 17,696,180 forming dense consumption hubs, hospital networks are expected to digitize patient pathways through in-house mobile apps and partnered pharmacy networks. Meanwhile, the rural population of 36,803,911 remains underserved, creating opportunities for tele-diagnostic vans, mobile laboratory units, and store-and-forward radiology systems. Integrated care pathways are expected to define future adoption, reducing diagnostic turnaround times and improving treatment adherence across the healthcare continuum.

Expansion of NGO and Donor-Linked Health Digitalization Programs: Development partnerships continue to anchor Myanmar’s digital healthcare infrastructure. Donor-funded initiatives sustain hundreds of public health projects, including maternal and child health tracking, immunization monitoring, and teleconsultation support networks. These NGO collaborations are expected to grow further, improving digital literacy, data collection, and patient outreach across remote and conflict-affected areas. As humanitarian and health digitization programs converge, the national telemedicine ecosystem is projected to evolve toward inclusive care delivery models that seamlessly serve both displaced and rural populations.

Leveraging AI and Health Analytics for Population Health Management: Artificial intelligence and analytics are expected to become central to Myanmar’s telehealth systems, enhancing triage accuracy, prescription verification, and chronic disease management. With a population of 54,500,091 people in 2024, the country provides a rich dataset to build predictive models that assist clinicians in managing high patient volumes. Predictive analytics for maternal and child health, spearheaded by health-tech innovators, will improve early detection and optimize resource distribution across regions. Over time, AI-powered tools are expected to play a critical role in strengthening clinical decision-making and scaling remote healthcare operations efficiently.

Strengthening Regulatory Clarity and Data Protection Enforcement: Sustained growth of Myanmar’s telemedicine market depends on maturing digital governance and consistent enforcement of cybersecurity regulations. The Cybersecurity Law enacted in 2024 mandates three-year data retention and financial penalties between 1,000,000 and 10,000,000 kyats for non-compliance, compelling operators to formalize data hosting and processing standards. As these frameworks stabilize, both domestic and international investors are likely to gain confidence in supporting cloud-based and cross-border telehealth systems. Strengthened governance will ensure safer data flows, improved accountability, and enhanced investor participation across Myanmar’s emerging digital health infrastructure.

Myanmar Telemedicine Market Segmentation

By Care Model

On-demand GP consults

Scheduled specialist consults (cardio, neuro, ortho, etc.)

Chronic-care programs (diabetes, hypertension, COPD/TB follow-up)

Tele-expertise & second opinions (hub-and-spoke referrals)

Mental health & counseling (psychology/psychiatry)

By Modality

Chat / messaging (in-app, web chat)

Voice call (app/call-center)

Video consult (hospital and platform)

Store-and-forward (asynchronous case review, teleradiology/telederm)

Remote patient monitoring kits (glucometers, BP cuffs, pulse-ox, ECG patches)

By Clinical Specialty

Internal medicine / family medicine

Pediatrics & neonatology

OB-GYN & reproductive health

Dermatology & wound care

Psychiatry & behavioral health

Infectious diseases / respiratory (including TB follow-up)

By Payer / Channel

Self-pay retail (B2C)

Employer benefits & corporate panels (B2B2C)

NGO / donor-funded programs (public health & humanitarian)

Insurer / TPA-linked pathways

Telco-bundled health packs (zero/low-data access)

By Provider Type

Hospital-led apps (integrated with OPD, labs, pharmacy)

Independent telehealth platforms (multi-clinic networks)

Public-sector / township health units using tele-referral

NGO / charity tele-clinics (mobile or community sites)

Hybrid O2O networks (online triage with offline partner centers)

Players Mentioned in the Report:

HEAL by Pun Hlaing (Pun Hlaing Hospitals)

MyanCare

OnDoctor

MPT (health hotlines / bundles with platforms)

ATOM (formerly Telenor)

Ooredoo Myanmar

Mytel

Parami General Hospital

Hello Health Group Myanmar

Koe Koe Tech

Z-waka

My-Medicine

CareMe

Yat Chain You

Telekyanmar Online Clinics

Key Target Audience

Private hospital groups (e.g., Pun Hlaing; Victoria; Parami)

Mobile network operators & ISPs (MPT, ATOM, Ooredoo, Mytel)

Diagnostics & e-pharmacy chains (national labs, hospital pharmacies)

Employers & corporate benefit administrators (B2B health programs)

Health insurers and TPAs (benefit design, tele-triage)

Investments and venture capitalist firms (impact funds; regional strategics)

Government & regulatory bodies

International development & donor agencies (WHO; UNICEF; UNDP; Global Fund)

Time Period:

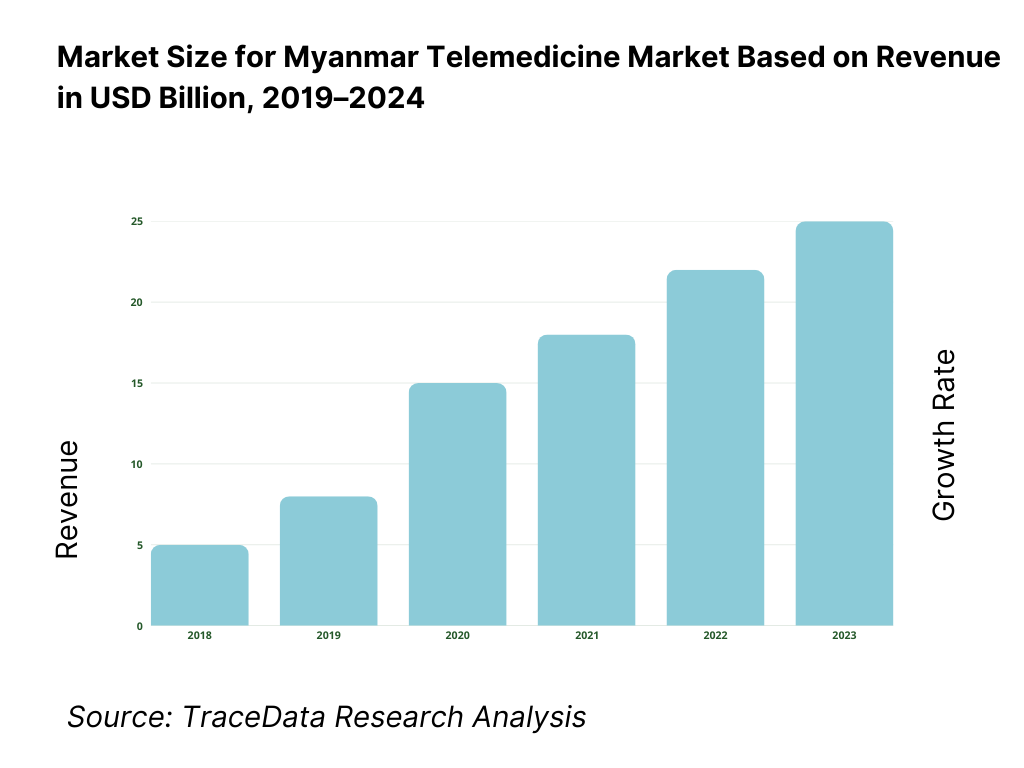

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Telemedicine in Myanmar (Video, Voice, Chat, Store-and-Forward, Remote Monitoring)

4.2. Revenue Streams for Myanmar Telemedicine Market

4.3. Business Model Canvas for Myanmar Telemedicine Market

5.1. Freelance Doctors vs Full-Time Doctors (Network Scale, Availability, Quality Control, Margins)

5.2. Investment Model in Myanmar Telemedicine Market (Foreign, Impact, Local Angel, Donor-Driven)

5.3. Comparative Analysis of Private vs Government Telemedicine Initiatives (Funding, Technology, Reach, Quality Metrics)

5.4. Healthcare Budget Allocation by Organization Type (Private Hospitals, NGOs, Government Health Units)

8.1. Total Revenues (In USD Million)

8.2. Number of Consultations and User Base

8.3. Platform and Operator-Level Revenue Shares

8.4. Per Capita Digital Health Spending

9.1. By Care Model (On-Demand GP, Scheduled Specialist, Chronic Care, Mental Health, Tele-Expertise)

9.2. By Modality (Chat, Video, Voice, Store-and-Forward, Remote Monitoring)

9.3. By Clinical Specialty (Internal Medicine, Pediatrics, OB-GYN, Dermatology, Psychiatry, Others)

9.4. By Payer Type (Self-Pay, Employer Benefits, NGO/Donor Programs, Insurance, Telco Bundles)

9.5. By Provider Type (Hospital-Led, Platform-Led, NGO Clinics, Hybrid Networks)

9.6. By Region (Yangon, Mandalay, Dry Zone, Delta/Coastal, Border Regions)

10.1. Patient Cohort Analysis and Usage Patterns

10.2. Decision-Making Process for Telemedicine Adoption

10.3. Patient Satisfaction and Perceived Effectiveness

10.4. ROI Analysis for Hospitals and NGOs

10.5. Accessibility vs Affordability Gap

11.1. Trends and Developments in Myanmar Telemedicine Market

11.2. Growth Drivers (Connectivity, NGO Programs, Private Hospital Digitalization, Diaspora Demand, Health Awareness)

11.3. SWOT Analysis

11.4. Issues and Challenges (Regulatory Ambiguity, Low Digital Literacy, Trust, Data Security)

11.5. Government Regulations and Policy Roadmap (E-Health Strategy, Data Protection Draft, MoH Guidelines)

12.1. Market Size and Future Potential

12.2. Dominant Business Models (Operator Partnership, Hospital Integration, NGO/Donor Support)

12.3. Delivery Models and Service Types

15.1. Market Share of Key Players (Basis Revenue and Consult Volume)

15.2. Benchmark of Key Competitors (Company Overview, USP, Business Model, No. of Doctors, Pricing, Platform Features, Technology Stack, Service Coverage, Key Clients, Strategic Partnerships, Marketing Strategy & Recent Developments)

15.3. Operating Model Analysis Framework (B2C, B2B2C, B2G)

15.4. Gartner Magic Quadrant Positioning (Leaders, Challengers, Visionaries, Niche Players)

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Projected Revenues (In USD Million)

16.2. Projected Consultation Volumes and User Base

16.3. Key Growth Catalysts (Digital Penetration, Policy Enablement, Private Investment, NGO Continuity)

17.1. By Care Model

17.2. By Modality

17.3. By Clinical Specialty

17.4. By Payer Type

17.5. By Provider Type

17.6. By Region

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Myanmar Telemedicine Market. Based on this ecosystem, we will shortlist the leading 5–6 telemedicine and digital healthcare providers in the country based on their operational presence, user base, partnerships, and digital infrastructure readiness. Sourcing is conducted through industry articles, government portals (Ministry of Health, Posts and Telecommunications Department), and multiple secondary and proprietary databases to perform desk research around the market to collate country-level healthcare and digital connectivity information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a detailed analysis of the market, aggregating sector-level insights. We examine aspects like the number of licensed healthcare facilities, internet connectivity density, mobile operator penetration, and digital health initiatives. We supplement this with detailed evaluations of company-level data, relying on sources such as press releases, hospital announcements, operator partnership disclosures, NGO reports, and regulatory filings. This process aims to construct a foundational understanding of both telemedicine platforms (supply side) and patient adoption behaviors (demand side) in Myanmar.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, medical directors, and digital platform heads representing various Myanmar telemedicine and healthcare organizations. This interview process serves a multi-faceted purpose: to validate key assumptions, authenticate service metrics, and extract valuable operational insights from these stakeholders. A bottom-to-top approach is undertaken to evaluate virtual consultation volumes and platform revenues, aggregating this data to form a reliable country-level perspective. As part of our validation strategy, our team executes disguised interviews, approaching each company under the guise of potential clients. This enables validation of operational, partnership, and pricing data, corroborating these findings with information obtained from secondary databases. These interactions also provide a comprehensive understanding of care models, patient demographics, doctor network sizes, pricing systems, service utilization, and data protection mechanisms that define the Myanmar Telemedicine ecosystem.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process. Triangulation between telecom subscriber data, population health indicators, and hospital telehealth utilization ensures balanced estimation. Cross-verification of findings with publicly available data from the Ministry of Health, World Bank, and IMF guarantees accuracy and alignment with macroeconomic and demographic realities. This step concludes with a refined and validated representation of the Myanmar Telemedicine Market structure, ecosystem, and opportunity potential.

FAQs

01 What is the potential for the Myanmar Telemedicine Market?

The Myanmar Telemedicine Market holds strong potential owing to the country’s growing digital foundation and rising healthcare accessibility needs. Myanmar’s economy stood at USD 64.94 billion in 2024, providing a macroeconomic base for digital service expansion. With 65,516,900 active mobile subscriptions and an urban population of 17,696,180, the structural ecosystem for mobile health services is already extensive. The market’s potential is strengthened by increasing adoption of online consultations in major cities and NGO-led digital health programs extending virtual care into rural regions.

02 Who are the Key Players in the Myanmar Telemedicine Market?

The Myanmar Telemedicine Market features a blend of hospital-led apps, independent platforms, and telecom-linked digital health services. Major players include HEAL by Pun Hlaing Hospitals, MyanCare, and OnDoctor, which dominate urban virtual consultation activity through large doctor networks and hospital-backed trust. Other notable participants such as Telekyanmar, My-Medicine, Z-waka, and Koe Koe Tech cater to NGO-driven or rural telehealth segments. Telecom operators—MPT, ATOM, Mytel, and Ooredoo—play an essential role by offering subsidized data packs and app partnerships that enable nationwide healthcare access and digital inclusion.

03 What are the Growth Drivers for the Myanmar Telemedicine Market?

Growth in the Myanmar Telemedicine Market is supported by structural and technological enablers. With 65,516,900 mobile subscriptions and 1,514,830 fixed-broadband connections recorded in 2023, mobile coverage has become nearly universal, underpinning video and chat-based consultations. Expanding digital payments and telecom penetration are enabling greater rural healthcare outreach, while a population of 54,500,091 people ensures a large addressable base. Supportive NGO programs, hospital digitization, and an emerging data protection framework are converging to expand sustainable telehealth adoption across both private and humanitarian sectors.

04 What are the Challenges in the Myanmar Telemedicine Market?

The Myanmar Telemedicine Market faces structural and infrastructural challenges that constrain rapid scaling. The country has only 1,514,830 fixed-broadband subscriptions as of 2023, limiting high-resolution video consultations, while secure internet servers number just 23.6 per million people in 2024, underscoring weak cybersecurity readiness. Political instability and internal displacement—over 3,000,000 people reported displaced—further hinder continuity of care, especially in remote areas. Inconsistent regulations for e-prescriptions and cross-border data flows also pose challenges to private and NGO telehealth operators.