Netherlands Consumer Appliances Market Outlook to 2029

By Market Structure (Branded and Local), By Product Type (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators, Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances

- Product Code: TDR0073

- Region: Asia

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “Netherlands Consumer Appliances Market Outlook to 2029 - By Market Structure (Branded and Local), By Product Type (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators, Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), By Distribution Channel, By Consumer Demographics, and By Region” provides a comprehensive analysis of the consumer appliances market in the Netherlands. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Consumer Appliances Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Netherlands Consumer Appliances Market Overview and Size

The Netherlands consumer appliances market reached a valuation of EUR 7.5 Billion in 2023, driven by the increasing demand for energy-efficient appliances, growing disposable income, and changing consumer preferences towards smart home solutions. The market is characterized by major players such as Philips, Siemens, Bosch, Whirlpool, and Samsung. These companies are recognized for their innovative product offerings, strong distribution networks, and customer-focused services.

In 2023, Samsung introduced a new line of smart kitchen appliances, aiming to enhance energy efficiency and integrate AI-driven features to appeal to the growing tech-savvy customer base in the Netherlands. Amsterdam and Rotterdam are key markets due to their high population density and robust economic infrastructure.

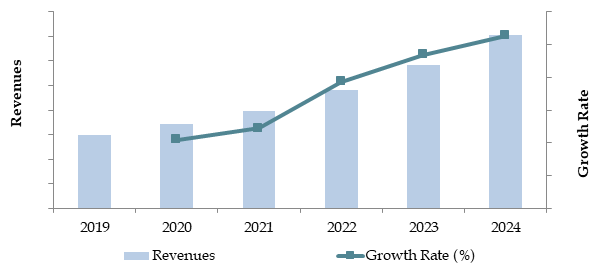

Market Size for Netherlands Consumer Appliances Market Based on Revenues in USD Billion, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of the Netherlands Consumer Appliances Market?

Economic Growth and Rising Disposable Income: The steady economic growth in the Netherlands, coupled with increasing disposable income, has significantly boosted consumer spending on home appliances. In 2023, consumer appliances represented approximately 60% of total electronics sales in the Netherlands, driven by a strong preference for high-quality, durable, and energy-efficient products.

Shift Towards Smart Appliances: The adoption of smart home technology is transforming the consumer appliances market in the Netherlands. Smart appliances, equipped with advanced features such as remote control, voice activation, and energy monitoring, have seen a 25% increase in sales from 2022 to 2023. This trend is fueled by the growing tech-savvy population and the integration of smart technology in household devices.

Energy Efficiency and Sustainability: Increasing environmental awareness and stringent government regulations are driving the demand for energy-efficient appliances. In 2023, around 45% of consumer appliances sold in the Netherlands were labeled with energy efficiency ratings of A+ or higher. Government incentives and subsidies for purchasing energy-efficient appliances have further contributed to this trend, encouraging consumers to replace older models with newer, more sustainable options.

Which Industry Challenges Have Impacted the Growth of the Netherlands Consumer Appliances Market?

Supply Chain Disruptions: The Netherlands consumer appliances market has faced significant disruptions due to global supply chain constraints. Shortages of essential components such as semiconductors, delays in raw material supply, and increased shipping costs have led to production delays and increased appliance prices. In 2023, it was reported that around 18% of appliance orders were delayed due to these supply chain issues, affecting consumer satisfaction and sales volumes.

High Competition and Price Sensitivity: Intense competition among local and international players has resulted in a highly price-sensitive market. The presence of well-established brands, coupled with the entry of new players offering competitive pricing, has put pressure on profit margins. Smaller local manufacturers and retailers, in particular, struggle to compete with larger companies on both price and innovation, leading to market consolidation.

Stringent Energy Efficiency Regulations: The Netherlands has stringent energy efficiency regulations that require all appliances sold in the market to meet specific standards. In 2023, approximately 12% of appliances offered in the market failed to meet these standards, resulting in product recalls and additional compliance costs for manufacturers. This regulatory burden can be particularly challenging for new entrants and smaller firms, limiting their ability to compete.

What are the Regulations and Initiatives that Have Governed the Market?

Energy Efficiency Regulations: The Dutch government mandates stringent energy efficiency standards for all consumer appliances sold in the market. These regulations focus on reducing energy consumption and minimizing the environmental impact of household appliances. In 2022, approximately 85% of consumer appliances met the required energy efficiency standards, reflecting a high level of compliance among manufacturers and retailers.

E-Waste Management Regulations: The Netherlands has established comprehensive regulations for the disposal and recycling of electronic waste (e-waste) to promote sustainability. Companies are required to adhere to guidelines for the collection, recycling, and disposal of old appliances. In 2023, compliance levels for e-waste management among appliance retailers reached 78%, indicating progress but also highlighting room for improvement in handling and reporting e-waste.

Government Incentives for Energy-Efficient Appliances: To encourage the adoption of energy-efficient consumer appliances, the Dutch government offers various incentives, such as tax rebates and subsidies. These incentives are aimed at promoting sustainable consumption patterns and reducing overall energy usage. In 2023, sales of energy-efficient appliances increased by 12% due to these incentives, showing a positive impact on market growth.

Netherlands Consumer Appliances Market Segmentation

By Market Structure: Large-scale retailers dominate the market due to their extensive distribution networks, strong brand partnerships, and comprehensive product offerings. These retailers provide a wide range of consumer appliances, from basic models to premium, smart-enabled products, catering to diverse customer preferences. Online marketplaces are rapidly gaining traction, holding a significant share of the market as consumers increasingly prefer the convenience and variety offered by digital channels. Independent specialty stores also contribute to the market, particularly in niche product categories like luxury kitchen appliances and specialized home care equipment.

By Product Category: Kitchen appliances, such as refrigerators, ovens, and dishwashers, accounted for the largest share of the market in 2023, driven by high consumer demand for multi-functional and energy-efficient solutions. Laundry appliances, including washing machines and dryers, are the second-largest segment, reflecting the need for reliable and time-saving products. The air conditioning segment is also growing steadily, supported by rising temperatures and an increased focus on indoor air quality.

By Distribution Channel: Online channels account for approximately 55% of total appliance sales, supported by the growing e-commerce ecosystem in the Netherlands and changing consumer shopping behaviors. Consumers prefer online platforms for the convenience, wide product selection, and access to customer reviews. Offline retail channels, including department stores and specialty appliance stores, still hold a significant share, particularly for high-involvement purchases where consumers value in-store demonstrations and personalized service.

Competitive Landscape in the Netherlands Consumer Appliances Market

The Netherlands consumer appliances market is relatively consolidated, with a few major players dominating the space. However, the emergence of new firms and the expansion of online platforms such as Coolblue, MediaMarkt, and Bol.com have diversified the market, offering consumers a wider range of products and services.

Company Name | Segment | Establishment Year | Headquarters |

|---|---|---|---|

Philips | Small appliances, Personal care, Kitchen appliances, Vacuum cleaners | 1891 | Eindhoven, Netherlands |

Bosch | Dishwashers, Refrigerators, Washing machines, Cooking appliances | 1886 | Gerlingen, Germany |

Miele | Dishwashers, Refrigerators, Cooking appliances, Laundry equipment | 1899 | Gütersloh, Germany |

Samsung Electronics | Refrigerators, Washing machines, Microwaves, Cooking appliances | 1938 | Suwon, South Korea |

Siemens | Refrigerators, Dishwashers, Cooking appliances, Laundry equipment | 1847 | Munich, Germany |

AEG | Dishwashers, Washing machines, Cooking appliances, Refrigerators | 1887 | Stockholm, Sweden |

Whirlpool | Washing machines, Dishwashers, Refrigerators, Microwaves | 1911 | Benton Harbor, Michigan, USA |

LG Electronics | Refrigerators, Washing machines, Microwaves, Air conditioners | 1958 | Seoul, South Korea |

Electrolux | Dishwashers, Washing machines, Cooking appliances, Refrigerators | 1919 | Stockholm, Sweden |

Blokker | Small appliances, Kitchen appliances, Personal care | 1896 | Amsterdam, Netherlands |

Some of the recent competitor trends and key information about competitors include:

Philips: As a leading manufacturer in the Netherlands, Philips generated EUR 2.1 Billion in appliance sales in 2023, marking a 10% increase in revenue. The company’s strong emphasis on sustainability and product innovation has reinforced its market position. Philips is also expanding its presence in the smart home segment with a new line of connected kitchen appliances.

Siemens: Siemens reported a 12% growth in sales of high-end kitchen appliances in 2023. The brand's focus on premium and energy-efficient products has been well received by consumers seeking durability and long-term savings. Siemens is also investing in AI-driven technologies to enhance user experience.

Bosch: Known for its reliable and energy-efficient products, Bosch experienced a 15% growth in sales of home appliances in 2023. The company’s strategy of integrating smart technology into its product range has positioned it as a key player in the growing smart home market.

Samsung: Samsung saw a 20% increase in smart appliance sales in 2023, driven by strong demand for its connected kitchen and laundry solutions. The company's emphasis on advanced features, such as AI-powered functions and IoT integration, has appealed to the tech-savvy Dutch consumer base.

Coolblue: As one of the largest online retailers in the Netherlands, Coolblue recorded over EUR 1 Billion in appliance sales in 2023, reflecting a 15% growth. The platform’s strong focus on customer service, detailed product information, and fast delivery have made it a preferred choice for online shoppers.

MediaMarkt: MediaMarkt saw a 10% increase in consumer appliance sales in 2023, supported by its omnichannel strategy that combines a robust online presence with extensive in-store experiences. The company has been investing heavily in its digital infrastructure to enhance the online shopping experience and integrate it seamlessly with its physical stores.

Bol.com: Bol.com, one of the largest e-commerce platforms in the Netherlands, experienced a 20% growth in appliance sales in 2023. Its focus on providing a wide range of product options, competitive pricing, and extensive customer reviews has made it a leading player in the online consumer appliances market.

What Lies Ahead for the Netherlands Consumer Appliances Market?

The Netherlands consumer appliances market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be fueled by rising disposable incomes, increasing urbanization, and consumer preferences shifting towards smart and energy-efficient appliances.

Shift Towards Smart Home Appliances: As consumers in the Netherlands continue to embrace smart home technology, there is expected to be a significant increase in the demand for smart appliances. This trend is supported by advancements in AI and IoT technology, making smart appliances more accessible and affordable. In 2023, smart appliances accounted for 30% of total appliance sales, a number anticipated to grow as the smart home ecosystem expands.

Increased Focus on Energy Efficiency: With the Dutch government’s continued emphasis on reducing energy consumption and promoting sustainable practices, the demand for energy-efficient appliances is expected to rise. Government initiatives, such as tax rebates and subsidies for energy-efficient products, will further drive this trend. The market is projected to see a 20% increase in sales of energy-efficient appliances by 2029, supported by consumer awareness and favorable regulations.

Expansion of Online Retail Channels: The growth of e-commerce and online retail channels is expected to play a key role in shaping the market landscape. As more consumers prefer the convenience of online shopping, major retailers are likely to expand their digital offerings and invest in improving the online shopping experience. By 2029, it is expected that online channels will account for over 60% of total appliance sales.

Rising Demand for Multi-Functional and Compact Appliances: With increasing urbanization and smaller living spaces, there will be a growing demand for multi-functional and compact appliances that cater to the needs of modern households. Products such as combination microwave-ovens, washer-dryer units, and compact dishwashers are expected to see strong growth, particularly in urban areas like Amsterdam and Rotterdam.

Emphasis on Sustainable and Eco-Friendly Products: Sustainability will remain a key focus for the market, with an expected rise in the demand for appliances made from recycled materials and those offering eco-friendly features. Manufacturers are likely to increase investment in R&D to develop innovative, sustainable products that meet the needs of environmentally conscious consumers. This shift is anticipated to result in a 15% increase in sales of eco-friendly appliances by 2029.

Future Outlook and Projections for Netherlands Consumer Appliances Market on the Basis of Revenues in USD Billion, 2024-2029

Netherlands Consumer Appliances Market Segmentation

- By Market Structure:

- Organized Sector

- Unorganized Sector

- By Product Type:

- Major Appliances

- Small Appliances

- By Major Appliances

- Dishwashers

- Washing Machines

- Cooking Appliances

- Microwaves

- Freezers

- Refrigerators

- Washing Machines:

- Semi Automatic

- Automatic Washing Machines

- Cooking Appliances:

- Built-In Hobs

- Ovens

- Cooker Hoods

- Cookers

- Freezers:

- Built-In

- Freestanding

- Small Appliances

- Air Treatment Products

- Food Preparation Appliances

- Heating Appliances

- Irons

- Personal Care Appliances

- Small Cooking Appliances

- Vacuum Cleaners and Small Appliances:

- By Distribution Channel:

- Online Platforms (E-commerce)

- Offline Retail Stores

- Multi-brand Showrooms

- Exclusive Brand Outlets

- Wholesale Channels

- By Consumer Demographics:

- Age Group:

- 18-24

- 25-34

- 35-44

- 45-54

- 55+

- Income Group:

- Lower-Income

- Middle-Income

- Upper-Middle-Income

- High-Income

- Age Group:

Players Mentioned in the Report:

Bosch

Siemens

Samsung Electronics

LG Electronics

Whirlpool Corporation

Miele

AEG (Electrolux)

Philips

Indesit

Beko

Key Target Audience:

Consumer Appliance Manufacturers

Online and Offline Retailers

Regulatory Bodies (e.g., Ministry of Economic Affairs and Climate Policy)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges Faced

4.2. Revenue Streams for the Netherlands Consumer Appliances Market

4.3. Business Model Canvas for the Netherlands Consumer Appliances Market

4.4. Buying Decision-Making Process

4.5. Supply Decision-Making Process

5.1. New Appliance Sales in the Netherlands, 2018-2024

5.2. Replacement vs. New Sales Ratio in the Netherlands, 2018-2024

5.3. Spend on Home Appliances in the Netherlands, 2024

5.4. Number of Consumer Appliance Deaers in the Netherlands by Region

8.1. Revenues, 2018-2024

9.1. By Market Structure (Branded and Local Brands), 2023-2024P

9.2. By Type (Major and Small Appliances), 2018-2024

9.2.1. By Major Appliances (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators), 2018-2024

9.2.1.1. By Washing Machines (Semi-Automatic and Automatic Washing Machines), 2018-2024

9.2.1.2. By Cooking Appliances (Built-In Hobs, Ovens, Cooker Hoods and Cookers), 2018-2024

9.2.1.3. By Freezers (Built-In and Freestanding), 2018-2024

9.2.1.4. By Refrigerator (Built-In and Freestanding), 2018-2024

9.2.2. By Small Appliances (Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), 2018-2024

9.3. By Average Price Range, 2023-2024P

9.4. By Distribution Channel (MBOs, EBOs, Online and others), 2023-2024P

9.5. By Region (Northern, Southern, Western, Eastern, Central), 2023-2024P

9.6. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments in the Netherlands Consumer Appliances Market

11.2. Growth Drivers for the Netherlands Consumer Appliances Market

11.3. SWOT Analysis for the Netherlands Consumer Appliances Market

11.4. Issues and Challenges for the Netherlands Consumer Appliances Market

11.5. Government Regulations for the Netherlands Consumer Appliances Market

12.1. Market Size and Future Potential for Online Consumer Appliances Market, 2018-2029

12.2. Business Model and Revenue Streams for Major Marketplace and Company Websites

12.3. Cross-Comparison of Leading Online Consumer Appliance Companies Based on Operational and Financial Parameters

13.1. Finance Penetration Rate and Average Down Payment for Consumer Appliances, 2018-2029

13.2. Trends in Finance Penetration Rates Over the Years and Contributing Factors

13.3. Appliance Segments with Higher Finance Penetration

13.4. Finance Split by Banks/NBFCs/Private Finance Companies and Captive Entities, 2023-2024P

13.5. Average Finance Tenure for Consumer Appliances in the Netherlands

13.6. Finance Disbursement for Consumer Appliances in the Netherlands, 2018-2024P

16.1. Market Share of Key Players in India Consumer Electronics Market, 2018-2024

16.1.1. Market Share of Key Players in India Washing Machine Market, 2018-2024

16.1.2. Market Share of Key Players in India Cooking Appliances Market, 2018-2024

16.1.3. Market Share of Key Players in India Refrigerator Market, 2018-2024

16.1.4. Market Share of Key Players in India Television Market, 2018-2024

16.2. Benchmarking of Key Competitors in India Consumer Electronics Market including Operational and Financial Parameters

16.3. Heat Map Analysis for Major Players in India Consumer Electronics Market

16.4. Strengths and Weaknesses Analysis

16.5. Operating Model Analysis Framework

19.1. Revenues, 2025-2029

20.1. By Market Structure (Branded and Local Brands), 2025-2029

20.2. By Type (Major and Small Appliances), 2025-2029

20.2.1. By Major Appliances (Dishwashers, Washing Machines, Cooking Appliances, Microwaves, Freezers, Refrigerators), 2025-2029

20.2.1.1. By Washing Machines (Semi-Automatic and Automatic Washing Machines), 2025-2029

20.2.1.2. By Cooking Appliances (Built-In Hobs, Ovens, Cooker Hoods and Cookers), 2025-2029

20.2.1.3. By Freezers (Built-In and Freestanding), 2025-2029

20.2.1.4. By Refrigerator (Built-In and Freestanding), 2025-2029

20.2.2. By Small Appliances (Air Treatment Products, Food Preparation Appliances, Heating Appliances, Irons, Personal Care Appliances, Small Cooking Appliances, Vacuum Cleaners and Small Appliances), 2025-2029

20.3. By Average Price Range, 2025-2029

20.4. By Distribution Channel (MBOs, EBOs, Online and others), 2025-2029

20.5. By Region (Northern, Southern, Western, Eastern, Central), 2025-2029

20.6. By Technology Adoption (Smart, AI-Enabled, IoT-Enabled, and Non-Smart), 2025-2029

20.7. Recommendation

20.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the Ecosystem and Identify Entities: We map the ecosystem and identify all the demand-side and supply-side entities involved in the Netherlands Consumer Appliances Market. Based on this ecosystem analysis, we shortlist the leading 5-6 manufacturers in the country based on their financial performance, production capacity/volume, and market presence.

Data Sourcing: Sourcing is carried out through a combination of industry articles, multiple secondary sources, and proprietary databases. This approach enables us to collate industry-level information and establish a comprehensive understanding of the market.

Step 2: Desk Research

Comprehensive Desk Research: We engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables a thorough analysis of the market, aggregating industry-level insights such as sales revenues, number of market players, price levels, and demand trends.

Company-Level Data Analysis: We supplement our desk research with detailed examinations of company-level data, utilizing sources like press releases, annual reports, financial statements, and other relevant documents. This enables us to construct a foundational understanding of both the overall market and the specific entities operating within it.

Step 3: Primary Research

In-Depth Interviews: We conduct a series of in-depth interviews with C-level executives and other key stakeholders representing various Netherlands Consumer Appliances Market companies and end-users. This interview process serves multiple purposes: validating market hypotheses, authenticating statistical data, and extracting valuable operational and financial insights from these industry representatives.

Disguised Interviews: As part of our validation strategy, our team undertakes disguised interviews, approaching companies under the guise of potential customers. This method enables us to validate the operational and financial information shared by company executives and cross-check it against available secondary data. These interactions also provide a detailed understanding of revenue streams, value chains, processes, pricing strategies, and other operational factors.

Step 4: Sanity Check

- Sanity Check and Market Modeling: We perform bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, to conduct a sanity check. This ensures that the collected data is consistent, reliable, and accurately represents the market dynamics. This step is crucial to validate our findings and provide accurate market forecasts and projections.

FAQs

1. What is the potential for the Netherlands Consumer Appliances Market?

The Netherlands consumer appliances market is poised for steady growth, reaching a valuation of EUR 7.5 Billion in 2023. This growth is driven by factors such as rising disposable incomes, increasing demand for energy-efficient and smart appliances, and a strong preference for innovative home solutions. The market's potential is further enhanced by a robust e-commerce infrastructure, which facilitates greater access to a wide range of appliances.

2. Who are the Key Players in the Netherlands Consumer Appliances Market?

The Netherlands Consumer Appliances Market is dominated by major players such as Philips, Siemens, Bosch, and Samsung. These companies hold a significant market share due to their extensive product portfolios, strong distribution networks, and a focus on product innovation. Other notable players include Coolblue, Media Mark3t, and Bol.com, which are major online and offline retail platforms.

3. What are the Growth Drivers for the Netherlands Consumer Appliances Market?

The primary growth drivers include rising consumer interest in smart home technology, increasing urbanization, and a shift towards energy-efficient products. Government initiatives that provide subsidies and tax incentives for energy-efficient appliances further support market growth. Additionally, the growing adoption of e-coemerce and online retail channels has made it easier for consumers to explore and purchase a wide range of appliances.

4. What are the Challenges in the Netherlands Consumer Appliances Market?

The Netherlands Consumer Appliances Market faces several challenges, including supply chain disruptions, high competition among established and new players, and stringent energy efficiency regulations. Compliance with e-waste management regulations also poses a challenge, especially for smaller retailers and manufacturers. Moreover, the limited adoption of smart appliances among older consumers restricts the growth of this segment, as many in this demographic are hesitant to adopt new technology due to perceived complexity and high costs.