Netherlands Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Service Mix, By End Users, By Type of Warehousing, By Region

- Product Code: TDR0298

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Netherlands Logistics and Warehousing Market Outlook to 2029 - By Market Structure, By Service Mix, By End Users, By Type of Warehousing, By Region” provides a comprehensive analysis of the logistics and warehousing industry in the Netherlands. The report covers the overview and genesis of the sector, overall market size in terms of revenue, segmentation by service lines and client types, trends and developments, regulatory environment, customer-level profiling, key challenges, and a comparative landscape including competition scenario, cross comparisons, market opportunities and constraints, and profiles of major industry players. The report concludes with market projections up to 2029 based on service revenue, growth drivers, regional demand, cause-effect linkages, and strategic success case studies.

Netherlands Logistics and Warehousing Market Overview and Size

The Netherlands logistics and warehousing market reached a valuation of EUR 85 Billion in 2023, driven by its strategic location as a gateway to Europe, strong port and airport infrastructure (notably Port of Rotterdam and Schiphol Airport), and advanced multimodal transport systems. The industry is supported by leading logistics providers such as DHL, Kuehne + Nagel, DB Schenker, DSV, and CEVA Logistics, along with a robust ecosystem of SMEs and regional players specializing in warehousing, freight forwarding, and last-mile delivery.

In 2023, the market saw notable growth in e-commerce logistics and temperature-controlled warehousing, largely due to rising online retail activity and increasing demand for pharmaceuticals and perishable goods. Amsterdam, Rotterdam, and Eindhoven remain key hubs due to their connectivity, population density, and logistics infrastructure.

%2C%202018%E2%80%932023.png)

What Factors are Leading to the Growth of Netherlands Logistics and Warehousing Market:

Strategic Geographic Location: The Netherlands is widely regarded as the "Gateway to Europe" due to its central location, excellent connectivity, and efficient port and airport systems. Rotterdam handles over 14 million TEUs annually, making it the largest port in Europe. This has made the Netherlands a hub for re-export and distribution across the EU.

Boom in E-commerce: The rapid rise in e-commerce activity, with over 15% annual growth in online retail since 2020, has driven demand for efficient fulfillment centers, last-mile delivery solutions, and returns management. E-commerce logistics accounted for an estimated 22% of warehousing demand in 2023.

Sustainability Initiatives: There is a strong push for green logistics in the Netherlands. Companies are investing in electric fleets, warehouse solarization, and multimodal transport to reduce emissions. The government offers incentives and grants for sustainable logistics solutions, fostering long-term sector resilience.

Which Industry Challenges Have Impacted the Growth for Netherlands Logistics and Warehousing Market

Rising Real Estate Costs: The increasing cost of industrial land and warehouse rentals, particularly in urban hubs like Amsterdam and Rotterdam, poses a significant challenge. In 2023, average warehouse rents rose by nearly 12% YoY, making it difficult for small and mid-sized logistics providers to maintain profit margins. This has forced many companies to shift to peripheral locations, which increases last-mile delivery costs and turnaround times.

Labor Shortages: There is a chronic shortage of skilled labor in the Dutch logistics sector, especially in warehousing and distribution. As of 2023, over 20,000 logistics vacancies remained unfilled nationwide. The problem is exacerbated by an aging workforce and low attraction among younger workers for manual warehouse roles, even with increasing automation.

Sustainability Compliance Pressure: While green logistics is a major opportunity, the financial and operational burden of transitioning to electric fleets, carbon-neutral warehouses, and multimodal solutions has strained many SMEs. Meeting environmental compliance under the EU Green Deal has increased average operational costs by 8–10% for mid-sized logistics providers.

What are the Regulations and Initiatives which have Governed the Market

EU Mobility Package Compliance: The Netherlands adheres to the EU Mobility Package, which mandates stricter rules on driver working hours, cabotage restrictions, and rest periods. These rules, fully implemented by 2022, have increased compliance costs for Dutch freight operators and reduced flexibility in cross-border operations.

CO₂ Emissions Standards for Logistics: The Dutch government, aligned with EU directives, requires large logistics operators to publish CO₂ reduction targets and implement emissions tracking for fleets. By 2023, over 60% of top logistics firms were required to disclose their carbon footprints, with mandated reductions coming into effect by 2025.

National Logistics Program (2020–2025): The Netherlands launched this initiative to improve infrastructure, digitization, and sustainability in logistics. It includes funding for electric vehicle charging networks, data-sharing platforms for freight optimization, and smart warehousing pilots. Over EUR 400 million was allocated under this initiative by 2023, supporting over 250 logistics innovation projects nationwide.

Netherlands Logistics and Warehousing Market Segmentation

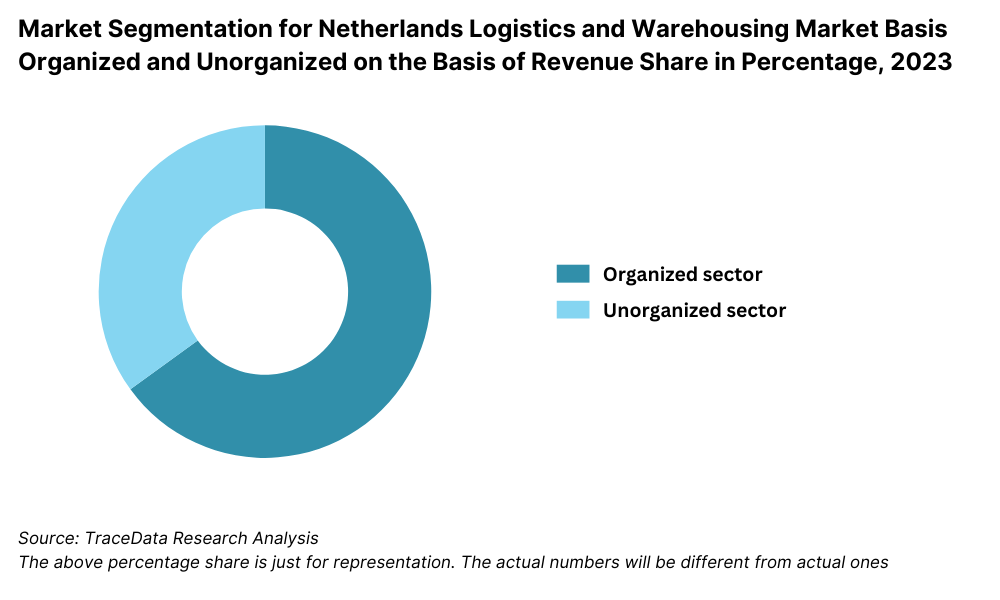

By Market Structure: Organized players dominate the Netherlands logistics and warehousing market due to their strong infrastructure, compliance with EU standards, and integrated multimodal services. Companies such as DHL, Kuehne + Nagel, DB Schenker, and DSV have built trust through technology integration, real-time tracking, and sustainability practices. Their ability to handle international freight, customs, warehousing, and last-mile delivery positions them strongly across verticals. Unorganized players, including regional and family-run logistics firms, still hold a relevant share in rural and niche markets. These firms offer cost-effective services and flexibility but may lack in terms of scalability, automation, and regulatory compliance.

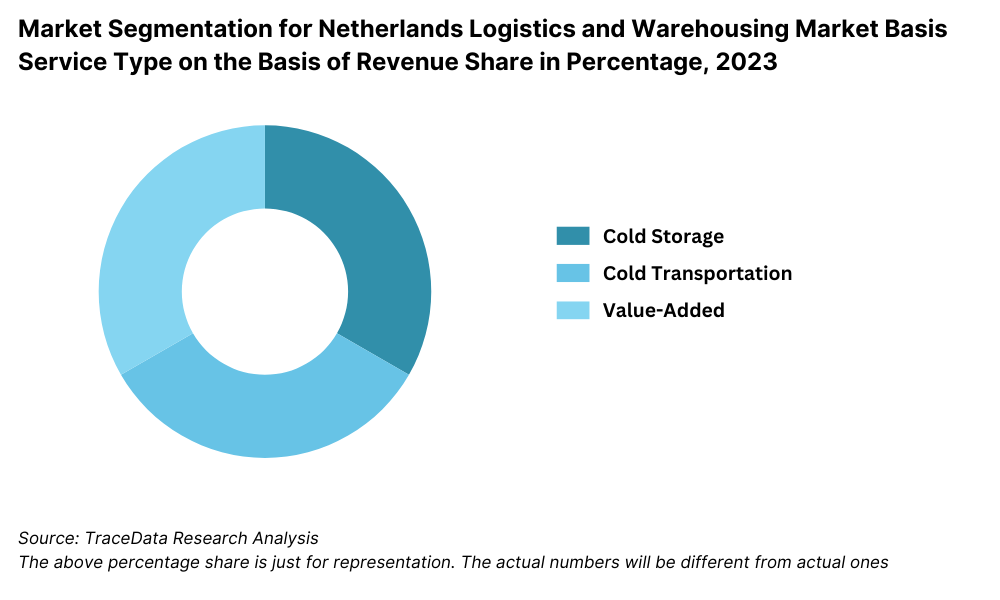

By Service Type: Warehousing services hold the largest share of the logistics market, fueled by demand from sectors like retail, FMCG, and pharmaceuticals. Fulfillment centers and temperature-controlled warehouses are witnessing increased investments. Freight forwarding services, including road, rail, sea, and air, contribute significantly due to the Netherlands' role as a trade hub via the Port of Rotterdam and Schiphol Airport. Last-mile delivery is rapidly expanding with e-commerce penetration and growing consumer expectations for same-day or next-day delivery.

By End User: Retail and e-commerce are the largest end users, driven by the demand for fast delivery and reverse logistics. The food and beverage sector follows closely, relying on cold storage and efficient distribution systems. Pharmaceutical and healthcare logistics have grown due to strict compliance and temperature-controlled requirements. Automotive, electronics, and industrial goods also represent notable shares of warehousing and transportation demand.

Competitive Landscape in Netherlands Logistics and Warehousing Market

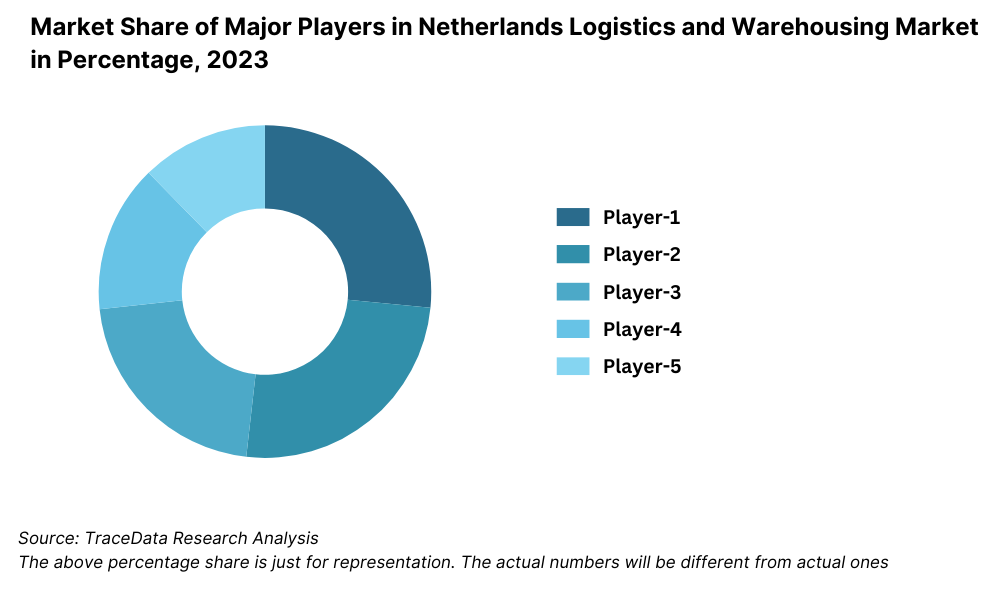

The Netherlands logistics and warehousing market is moderately consolidated, with a mix of global logistics giants and specialized domestic players shaping the competitive landscape. The presence of international 3PLs and freight forwarders such as DHL, Kuehne + Nagel, DB Schenker, DSV, and CEVA Logistics ensures robust infrastructure, while smaller regional firms continue to support localized and niche logistics operations.

Company | Establishment Year | Headquarters |

DHL Supply Chain | 1969 | Bonn, Germany (Netherlands hub in Eindhoven) |

Kuehne + Nagel | 1890 | Schindellegi, Switzerland (Netherlands HQ in Rotterdam) |

DB Schenker | 1872 | Essen, Germany (Dutch office in Tilburg) |

DSV | 1976 | Hedehusene, Denmark (Netherlands branch in Venlo) |

CEVA Logistics | 2006 | Marseille, France (Dutch office in Hoofddorp) |

Rhenus Logistics | 1912 | Holzwickede, Germany (Netherlands HQ in Amsterdam) |

Neele-Vat Logistics | 1973 | Rotterdam, Netherlands |

Mainfreight | 1978 | Auckland, New Zealand (Netherlands office in ‘s-Heerenberg) |

Some of the recent competitor trends and key information about competitors include:

DHL Supply Chain: A dominant player in the Netherlands, DHL expanded its Eindhoven hub with a new 25,000 sqm warehouse facility in 2023 to support e-commerce fulfillment. The company also invested in electric delivery fleets to enhance sustainability across urban logistics routes.

Kuehne + Nagel: Leveraging the strategic position of the Port of Rotterdam, Kuehne + Nagel increased its sea freight operations by 18% in 2023. The firm is increasingly focused on pharma and cold chain logistics through its KN PharmaChain service offering.

DB Schenker: DB Schenker added automation to its Tilburg warehouse in 2023, with AI-powered picking systems and robotic inventory management. The move is part of its push to enhance same-day and next-day logistics capabilities across the Benelux.

DSV: DSV Netherlands witnessed a 20% YoY growth in e-commerce logistics volume. The company launched a smart warehousing solution integrated with IoT-based real-time monitoring and temperature control for food and pharma clients.

CEVA Logistics: CEVA introduced a green warehousing initiative in 2023 at its Hoofddorp facility, using solar panels, energy-efficient lighting, and electric forklifts, in alignment with the company’s global Net Zero targets.

Neele-Vat Logistics: A major Dutch player, Neele-Vat expanded its Rotterdam operations by opening a new cross-dock center to cater to increased container flows. The firm is heavily involved in petrochemical and industrial goods logistics.

Rhenus Logistics: Rhenus continued expanding its presence in the Netherlands with new multi-client warehousing in Amsterdam and Almere. The company also focused on digital freight brokerage through its Rhenus Freight Procurement platform.

Mainfreight: Operating a strong regional logistics network from its ‘s-Heerenberg location, Mainfreight Netherlands has seen steady growth in contract logistics. The company has prioritized sustainability and local hiring to reinforce its community-based operations model.

What Lies Ahead for Netherlands Logistics and Warehousing Market?

The Netherlands logistics and warehousing market is projected to grow steadily by 2029, exhibiting a healthy CAGR during the forecast period. This growth is expected to be driven by the country’s role as a key European trade hub, continued e-commerce expansion, and increasing investments in automation and green logistics solutions.

Expansion of E-commerce Logistics: With online retail continuing to grow at a double-digit rate, demand for last-mile delivery, micro-fulfillment centers, and automated sorting facilities is expected to surge. Logistics providers are likely to invest heavily in urban distribution hubs and real-time delivery optimization to meet consumer expectations for speed and convenience.

Sustainability and Green Logistics: The Netherlands is expected to lead Europe in green logistics adoption. Growth in electric vehicle fleets, solar-powered warehouses, and modal shift initiatives (road-to-rail and inland waterways) will contribute significantly to emissions reduction goals. Regulatory incentives and the EU Green Deal targets will further accelerate this trend.

Digital Transformation and Automation: Technologies such as AI-based warehouse management systems, IoT-enabled fleet tracking, and robotic process automation are anticipated to become standard across medium and large-scale logistics providers. These advancements will improve inventory accuracy, reduce human error, and enable predictive logistics.

Growth of Cold Chain and Pharma Logistics: Rising demand for temperature-sensitive goods including vaccines, biologics, and perishable foods will spur investments in cold storage infrastructure. The Netherlands’ strong compliance with EU GDP (Good Distribution Practice) regulations positions it favorably to become a major pharma logistics hub for continental Europe.

%2C%202023-2029.png)

Netherlands Logistics and Warehousing Market Segmentation

• By Market Structure:

o Organized Sector

o Unorganized Sector

o Third-Party Logistics (3PL) Providers

o Freight Forwarders

o Contract Logistics Providers

o Integrated Logistics Players

o Local Independent Operators

• By Service Type:

o Warehousing

o Freight Forwarding

o Customs Clearance

o Last-Mile Delivery

o Inventory Management

o Value-Added Services (Labeling, Packaging, Kitting)

o Cold Chain Logistics

• By End User:

o Retail and E-commerce

o Food and Beverage

o Pharmaceuticals and Healthcare

o Automotive and Spare Parts

o Industrial Goods and Machinery

o Electronics and Appliances

o Agricultural and Perishables

• By Type of Warehousing:

o General Warehousing

o Bonded Warehousing

o Cold Storage Warehousing

o Automated Warehousing

o Fulfillment Centers

o Multi-client Warehouses

o Dedicated Warehouses

• By Region:

o North Holland (Amsterdam, Haarlem)

o South Holland (Rotterdam, The Hague)

o North Brabant (Eindhoven, Tilburg)

o Limburg (Venlo, Maastricht)

o Gelderland (Nijmegen, Arnhem)

o Flevoland and Others

Players Mentioned in the Report:

• DHL Supply Chain

• Kuehne + Nagel

• DB Schenker

• DSV

• CEVA Logistics

• Rhenus Logistics

• Neele-Vat Logistics

• Mainfreight

Key Target Audience:

• Third-Party Logistics Providers

• Freight Forwarding Companies

• Retail and E-commerce Firms

• Warehouse Infrastructure Developers

• Government Agencies and Trade Authorities

• Cold Chain Service Providers

• Pharmaceutical and Food Logistics Firms

• Research and Policy Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Netherlands Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Netherlands Logistics and Warehousing Market

4.3. Business Model Canvas for Netherlands Logistics and Warehousing Market

4.4. Buying Decision Making Process (Logistics Buyers/Clients)

4.5. Service Provider Decision Making Process

5. Market Structure

5.1. Logistics Industry Performance in Netherlands, 2018-2024

5.2. Warehousing Space Occupancy and Utilization Rate, 2018-2024

5.3. Freight Movement Volume by Mode (Road, Rail, Air, Sea), 2018-2024

5.4. Number of Logistics and Warehousing Providers in Netherlands by Region

6. Market Attractiveness for Netherlands Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for Netherlands Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Warehousing Space (Million Sq. Meters), 2018-2024

9. Market Breakdown for Netherlands Logistics and Warehousing Market Basis

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Service Type (Warehousing, Freight Forwarding, Customs Clearance, Last-Mile, Value-Added), 2023-2024P

9.3. By Region (North Holland, South Holland, North Brabant, Limburg, Gelderland, Others), 2023-2024P

9.4. By End-User Industry (Retail & E-commerce, Food & Beverage, Pharma, Automotive, Electronics), 2023-2024P

9.5. By Type of Warehousing (General, Cold Chain, Bonded, Automated), 2023-2024P

10. Demand Side Analysis for Netherlands Logistics and Warehousing Market

10.1. Client Landscape and Sector-Wise Requirements

10.2. Logistics Outsourcing Trends and Buyer Preferences

10.3. Need, Desire, and Pain Point Analysis

10.4. Service Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Netherlands Logistics and Warehousing Market

11.2. Growth Drivers for Netherlands Logistics and Warehousing Market

11.3. SWOT Analysis for Netherlands Logistics and Warehousing Market

11.4. Issues and Challenges for Netherlands Logistics and Warehousing Market

11.5. Government Policies and Regulations for Netherlands Logistics and Warehousing Market

12. Snapshot on E-commerce and Cold Chain Logistics in Netherlands

12.1. Market Size and Growth of E-commerce Fulfillment and Last-Mile Delivery, 2018-2029

12.2. Evolution of Cold Chain Logistics and Future Potential

12.3. Cross Comparison of Key E-commerce Logistics and Cold Chain Providers

13. Logistics and Warehousing Technology Landscape

13.1. Digital Adoption in Logistics (WMS, TMS, IoT, Automation)

13.2. Investment Trends in Green and Smart Warehousing

13.3. Cold Chain Monitoring Technologies

13.4. Future of Autonomous and AI-Driven Logistics in the Netherlands

14. Opportunity Matrix for Netherlands Logistics and Warehousing Market-Radar Chart Representation

15. PEAK Matrix Analysis for Netherlands Logistics and Warehousing Market

16. Competitor Analysis for Netherlands Logistics and Warehousing Market

16.1. Benchmark of Key Competitors Based on Business Model, Strengths, Operations, Innovation, and Coverage

16.2. Strength and Weakness Profile

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant Placement (Indicative)

16.5. Bowman’s Strategic Clock for Competitive Positioning

17. Future Market Size for Netherlands Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Warehousing Space (Million Sq. Meters), 2025-2029

18. Market Breakdown for Netherlands Logistics and Warehousing Market Basis

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Service Type (Warehousing, Freight Forwarding, Customs, Last-Mile), 2025-2029

18.3. By Region, 2025-2029

18.4. By End-User Industry, 2025-2029

18.5. By Type of Warehousing (General, Cold, Bonded, Automated), 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Netherlands Logistics and Warehousing Market. Based on this ecosystem, we shortlist the leading 5–6 logistics service providers in the country by evaluating their financial strength, scale of operations, warehousing capacity, and freight movement volume.

Sourcing is done through industry articles, multiple secondary and proprietary databases to perform desk research around the market and collate sector-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This enables us to conduct a comprehensive analysis of the logistics and warehousing sector, aggregating data on total market size, revenue trends, regional distribution hubs, industry dynamics, and service line breakdowns.

We examine press releases, government trade reports, company filings, transportation studies, logistics indices, and annual reports to develop a baseline understanding of both market- and company-level performance indicators.

Step 3: Primary Research

We initiate a series of in-depth interviews with logistics heads, operations managers, warehouse planners, and government/regulatory stakeholders from the Netherlands logistics and warehousing market. These interviews help validate market assumptions, collect financial and operational metrics, and understand key success drivers across verticals.

As part of our validation strategy, our team undertakes disguised interviews with logistics providers under the guise of potential clients. This method allows us to cross-verify information shared by senior executives regarding pricing, warehouse types, process automation, operational capacity, and service offerings.

Step 4: Sanity Check

Both bottom-up (aggregating revenue/space/service data from individual players) and top-down (benchmarking national logistics trends and trade volumes) approaches are used to triangulate data and confirm consistency.

The market size modeling and growth forecasting undergo a final round of validation by comparing calculated results with regional benchmarks, policy impact scenarios, and global logistics trendlines.

FAQs

1. What is the potential for the Netherlands Logistics and Warehousing Market?

The Netherlands logistics and warehousing market holds significant potential, reaching a valuation of EUR 85 Billion in 2023. Its strategic location as the “Gateway to Europe,” coupled with world-class infrastructure such as the Port of Rotterdam and Schiphol Airport, positions the country as a central node for European and global trade. The growing need for e-commerce logistics, sustainable supply chain solutions, and cold chain capabilities further amplifies the sector’s growth potential through 2029.

2. Who are the Key Players in the Netherlands Logistics and Warehousing Market?

The Netherlands Logistics and Warehousing Market is led by global and regional players such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, DSV, CEVA Logistics, Rhenus Logistics, Neele-Vat Logistics, and Mainfreight. These companies dominate the space due to their integrated service offerings, widespread infrastructure, compliance with EU standards, and investments in technology and sustainability.

3. What are the Growth Drivers for the Netherlands Logistics and Warehousing Market?

Major growth drivers include the rise of e-commerce, increasing demand for green logistics, adoption of automation and digital tools, and the Netherlands’ strategic positioning as a logistics gateway for continental Europe. Additionally, strong governmental initiatives under the National Logistics Program, and rising cold chain requirements in pharma and food sectors, continue to support long-term sector expansion.

4. What are the Challenges in the Netherlands Logistics and Warehousing Market?

The market faces several challenges such as rising warehousing and real estate costs in prime regions, labor shortages across logistics functions, and growing regulatory pressure to adopt sustainable practices. Smaller logistics firms also face hurdles in digital transformation and compliance with EU-level emissions and operational standards, which could impact their competitiveness over the forecast period.