Nigeria Alcoholic Drinks Market Outlook to 2029

By Market Structure, By Manufacturers, By Types of Alcohol, By Consumer Age Groups, By Distribution Channels, and By Region

- Product Code: TDR0112

- Region: Africa

- Published on: January 2025

- Total Pages: 80

Report Summary

The report titled “Nigeria Alcoholic Drinks Market Outlook to 2029 - By Market Structure, By Manufacturers, By Types of Alcohol, By Consumer Age Groups, By Distribution Channels, and By Region” provides a comprehensive analysis of the alcoholic drinks market in Nigeria. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and a comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the alcoholic drinks market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationships, and success case studies highlighting major opportunities and potential risks.

Nigeria Alcoholic Drinks Market Overview and Size

The Nigeria alcoholic drinks market reached a valuation of NGN 500 billion in 2023, driven by increasing urbanization, growing disposable incomes, and changing consumer lifestyles that favor social drinking. The market is dominated by key players such as Nigerian Breweries, Guinness Nigeria, International Breweries, and other regional manufacturers. These companies are recognized for their extensive distribution networks, diverse product portfolios, and aggressive marketing strategies.

In 2023, Nigerian Breweries launched new premium brands to cater to the evolving tastes of consumers seeking high-quality alcoholic beverages. This initiative targets the growing middle and upper-class segments and reflects the trend towards premiumization within the market. Lagos, Abuja, and Port Harcourt are key markets due to their large population densities and vibrant nightlife cultures, which drive demand for alcoholic beverages.

Market Size for Nigeria Alcoholic Beverage Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors are Leading to the Growth of Nigeria Alcoholic Drinks Market:

Economic Factors: Rising disposable incomes, especially among the middle class, have boosted the demand for alcoholic beverages. The consumption of alcoholic drinks is increasingly viewed as a symbol of social status in Nigeria. In 2023, alcoholic drinks accounted for approximately 60% of total beverage sales in Nigeria, as consumers spend more on premium and international brands.

Growing Urban Population: Rapid urbanization in Nigeria has led to a shift in lifestyle, with more consumers participating in social drinking at bars, clubs, and events. The urban population in Nigeria grew by 20% between 2018 and 2023, significantly contributing to the growth of the alcoholic drinks market.

Expanding Distribution Channels: The rise of modern retail chains and e-commerce platforms has enhanced the availability of alcoholic beverages across Nigeria. In 2023, over 30% of alcoholic drink sales were made through modern retail channels such as supermarkets and online stores, reflecting a shift from traditional open markets. These channels offer a more extensive range of products and price points, which has broadened consumer access to a variety of alcoholic drinks.

Which Industry Challenges Have Impacted the Growth of the Nigeria Alcoholic Drinks Market

Regulatory and Taxation Issues: One of the most significant challenges faced by the alcoholic drinks industry in Nigeria is the heavy taxation imposed on alcoholic products. In recent years, excise duties on beer, spirits, and wine have risen sharply, leading to higher prices for consumers. In 2023, it was reported that tax hikes contributed to a 15% decrease in alcohol consumption, particularly among low-income consumers. Strict advertising and marketing regulations also limit the ability of companies to promote their products, especially in certain regions with conservative social norms.

Quality and Counterfeit Products: The proliferation of counterfeit alcoholic products remains a serious issue in the Nigerian market. According to industry reports, approximately 30% of alcoholic beverages in Nigeria may be adulterated or fake, leading to health risks for consumers and damaging the reputation of legitimate brands. This issue is further compounded by weak enforcement of quality control standards, which has eroded consumer trust and slowed market growth.

Distribution Challenges and Infrastructure: Nigeria’s underdeveloped infrastructure poses logistical challenges for the distribution of alcoholic beverages, particularly to rural areas. Poor road networks and unreliable transportation systems contribute to higher distribution costs and inefficiencies. For smaller producers, this can be a significant barrier to expanding their reach, while larger companies also face increased operational expenses.

What are the Regulations and Initiatives that have Governed the Nigeria Alcoholic Drinks Market

Excise Duties and Taxation Policies: The Nigerian government imposes excise duties on alcoholic beverages, which vary by product type (beer, spirits, and wine). In 2023, the excise duty on spirits was increased by 20%, while beer and wine also faced incremental tax increases. These policies are intended to regulate alcohol consumption, but they have also contributed to higher retail prices, which has impacted demand, especially in price-sensitive segments of the population.

Alcohol Licensing Laws: The Nigerian government strictly regulates the sale and distribution of alcoholic beverages through licensing requirements. All manufacturers, distributors, and retailers are required to obtain a license before engaging in the sale of alcohol. These laws are designed to curb the illegal sale of alcohol, ensure quality control, and reduce the availability of counterfeit products. In 2022, the government revoked over 100 licenses due to non-compliance with the set standards.

Health and Safety Campaigns: To promote responsible drinking, the Nigerian government, in collaboration with the National Agency for Food and Drug Administration and Control (NAFDAC), has launched public health campaigns aimed at reducing excessive alcohol consumption. These initiatives include stricter advertising rules, mandatory health warnings on alcoholic drink labels, and awareness programs in schools and workplaces. In 2023, these efforts were intensified, with fines introduced for companies that fail to adhere to the guidelines.

Nigeria Alcoholic Drinks Market Segmentation

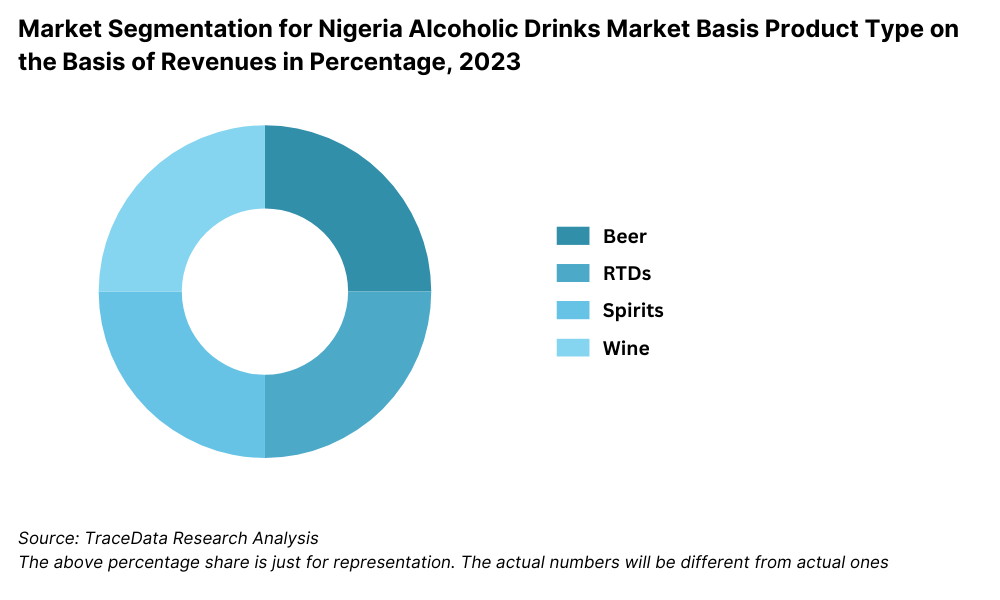

By Product Type: Beer is the leading product category in the Nigerian alcoholic drinks market, driven by the high consumption rate among the younger population and the lower price point compared to spirits and wines. Nigerian Breweries and International Breweries are key players in this segment. Spirits, including gin and whiskey, are popular among middle to high-income consumers, while wine, both locally produced and imported, is gaining traction among affluent urban residents due to the growing trend of wine appreciation and lifestyle shifts.

Market Segmentation for Nigeria Alcoholic Drinks Market Basis Product Type on the Basis of Revenues in Percentage, 2023

By Consumer Age Group: The 18-35 age group represents the largest consumer base for alcoholic drinks in Nigeria, primarily favoring beer and low-cost spirits. This segment is influenced by socializing culture and urbanization trends. The 35-50 age group, however, leans more towards premium spirits and wines, seeking high-quality products for personal consumption or gifting purposes.

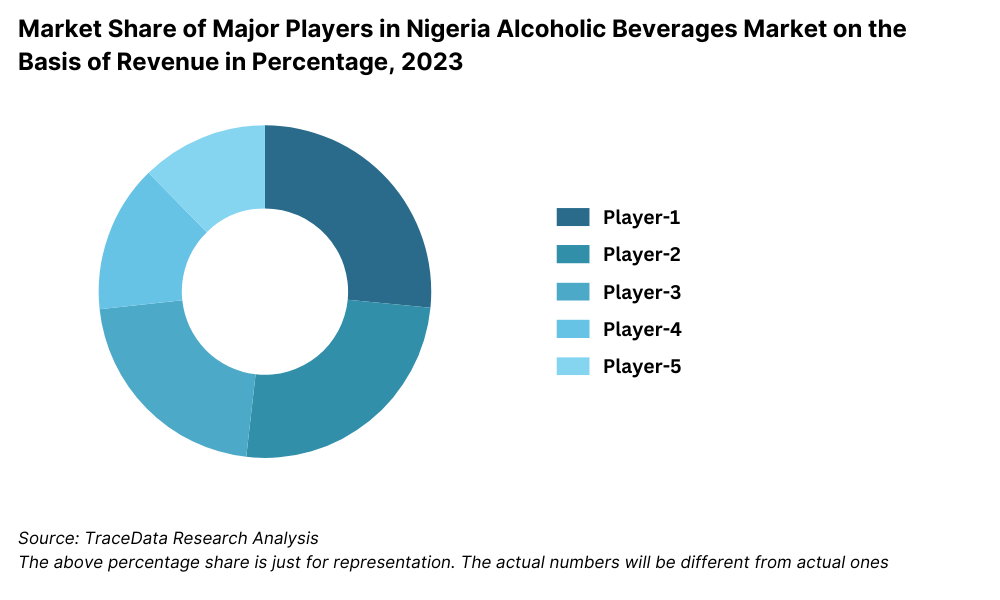

Competitive Landscape in Nigeria Alcoholic Drinks Market

The Nigeria alcoholic drinks market is highly competitive, with a mix of both local and international players. Local brewers dominate the beer segment, while international brands lead in premium spirits and wines. The rise of online distribution platforms and direct-to-consumer sales has diversified the market, offering consumers greater access to a wide range of alcoholic beverages. Key players in the market include Nigerian Breweries, Guinness Nigeria, International Breweries, and other emerging local brands.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Nigerian Breweries | 1946 | Lagos, Nigeria |

Guinness Nigeria | 1962 | Lagos, Nigeria |

International Breweries | 1971 | Lagos, Nigeria |

AB InBev | 2008 (Nigeria entry) | Leuven, Belgium |

Diageo | 1997 | London, United Kingdom |

Pernod Ricard Nigeria | 2018 | Lagos, Nigeria |

Intercontinental Distillers | 1984 | Ogun State, Nigeria |

Grand Oak Limited | 2006 | Lagos, Nigeria |

Kasapreko | 1989 | Accra, Ghana |

Distell Group | 1925 | Stellenbosch, South Africa |

Some of the recent competitor trends and key information about competitors include:

Nigerian Breweries: As the largest brewing company in Nigeria, Nigerian Breweries recorded a 12% increase in sales in 2023, driven by the launch of new premium beer brands and innovative marketing campaigns targeted at the youth demographic. The company continues to expand its product portfolio, catering to both lower and higher-income consumers with a mix of affordable and premium products.

Guinness Nigeria: Known for its iconic stout and other beverage products, Guinness Nigeria saw a 10% increase in sales in 2023, primarily due to the growing demand for premium spirits. The company has also focused on expanding its distribution channels, particularly in rural and semi-urban areas, to capture a wider audience.

International Breweries: A subsidiary of AB InBev, International Breweries reported a 15% growth in 2023, bolstered by its strong presence in the affordable beer segment. The company’s aggressive pricing strategy and local production capacity have made it a formidable competitor in Nigeria’s beer market.

Grand Oak: Specializing in spirits and wines, Grand Oak saw an 8% rise in sales in 2023, primarily driven by increased consumer interest in locally produced spirits like gin and brandy. The company’s focus on affordable alcoholic beverages has helped it maintain a steady market share, particularly in low-income segments.

Distell International: As a major importer of premium wines and spirits, Distell International reported a 20% increase in premium spirit sales in Nigeria in 2023. The company’s focus on luxury brands and lifestyle marketing has appealed to Nigeria’s growing middle and upper class.

SABMiller (Nigerian Branch): SABMiller, which focuses on both beer and soft drinks in Nigeria, has experienced a 7% growth in 2023, driven by strong demand for its lager beers. The company continues to focus on expanding its footprint through increased production capacity and distribution in rural areas.

Market Share of Major Players in Nigeria Alcoholic Beverages Market on the Basis of Revenue in Percentage, 2023

What Lies Ahead for Nigeria Alcoholic Drinks Market?

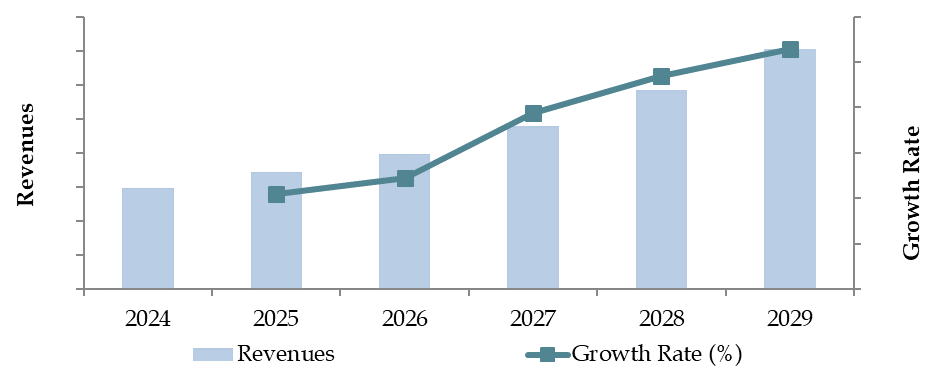

The Nigeria alcoholic drinks market is projected to grow steadily by 2029, demonstrating a healthy compound annual growth rate (CAGR) during the forecast period. This growth is expected to be driven by urbanization, rising disposable incomes, and evolving consumer preferences towards premium alcoholic beverages.

Increased Demand for Premium Products: As Nigeria’s middle class continues to expand, there is expected to be a significant shift towards premium alcoholic beverages, including higher-end spirits and wines. Consumers are becoming more discerning, seeking quality and premium experiences, which is likely to fuel growth in this segment, particularly in urban areas like Lagos, Abuja, and Port Harcourt.

Growth of E-commerce and Direct-to-Consumer Sales: With the increasing penetration of the internet and mobile devices, more consumers are expected to purchase alcoholic beverages online. E-commerce platforms and direct-to-consumer channels will play a key role in expanding market reach, allowing consumers to conveniently access a wider variety of products. In 2023, online alcohol sales represented a small but growing percentage of total sales, and this trend is expected to accelerate.

Expanding Role of Craft and Local Beverages: The rise of locally brewed craft beverages, including specialty beers and traditional drinks like palm wine, is expected to gain traction. Local producers are capitalizing on growing consumer interest in authentic and artisanal products, creating opportunities for niche markets within the broader alcoholic drinks industry.

Focus on Responsible Drinking Initiatives: As part of broader efforts to curb excessive alcohol consumption, there will likely be an increase in public health initiatives and corporate responsibility campaigns focused on promoting responsible drinking. These programs are expected to impact consumer behavior, especially among younger age groups, encouraging moderate alcohol consumption and creating more balanced market dynamics.

Future Outlook and Projections for Nigeria Alcoholic Beverages Market on the Basis of Revenues in USD Billion, 2024-2029

Nigeria Alcoholic Drinks Market Segmentation

- By Alcohol Type:

- Beer

- Spirits (Whiskey, Vodka, Rum)

- Wine (Red, White, Sparkling)

- Cider

- Ready-to-Drink (RTD) Cocktails

- By Beer

- Lager

- Dark Beer and others

- By Beer

- Craft

- Standard Beer

- By RTDs

- Malt based RTDs

- Spirit Based RTDs

- Wine Based RTDs

- Non-Alcoholic RTDs and others

- By Spirits

- Brandy

- Dark Rum

- White Rum

- Whiskies

- Gin

- Vodka and others

- By Vodka

- Flavoured

- Non-Flavoured Vodka

- By Wine

- Fortified Wine

- Champagne

- Other Sparkling Wine

- Red Wine

- White Wine and others

- By Distribution Channel:

- On-Trade (Bars, Restaurants, Hotels)

- Off-Trade (Supermarkets, Hypermarkets, Convenience Stores)

- By Price Segment:

- Economy

- Mid-Range

- Premium

- Super Premium

- By Consumer Age:

- 18-24

- 25-34

- 35-54

- 55+

- By Region:

- Northern Nigeria

- Southern Nigeria

- Eastern Nigeria

- Western Nigeria

- Central Nigeria

Players Mentioned in the Report:

- Nigerian Breweries Plc

- Guinness Nigeria Plc

- International Breweries Plc

- Intercontinental Distillers Ltd

- Nigeria Distilleries Ltd

- Grand Oak Ltd

- Pernod Ricard Nigeria Ltd

- Euro Global Foods and Distilleries Ltd

- Stellar Beverages Ltd

- Champion Breweries PLC

Key Target Audience:

- Alcoholic Beverage Producers

- Bars, Pubs, and Restaurants

- Retailers (Supermarkets, Hypermarkets, and Convenience Stores)

- E-commerce Alcohol Platforms

- Regulatory Bodies (e.g., NAFDAC, Federal Ministry of Health)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, Gross Margins, and Challenges they Face

4.2. Business Model Canvas for Nigeria Alcoholic Drinks Market

4.3. Consumer Buying Decision Process

5.1. Market Overview and Genesis

5.2. Number of Breweries and Microbreweries, as on Date

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Type (Beer, Cider, RTDs, Spirits and Wine), 2018-2023

9.1.1. By Beer (Lager, Dark Beer and others), 2018-2023

9.1.1.1. By Lager (Domestic Premium and Imported Premium), 2018-2023

9.1.1.2. By Craft and Standard Beer, 2018-2023

9.1.1.3. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.2. By RTDs (Malt based RTDs, Spirit Based RTDs, Wine Based RTDs, Non-Alcoholic RTDs and others), 2018-2023

9.1.2.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.3. By Spirits (Brandy, Dark Rum, White Rum, Whiskies, Gin, Vodka and others), 2018-2023

9.1.3.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.3.2. By Flavoured and Non-Flavoured Vodka, 2018-2023

9.1.4. By Wine (Fortified Wine, Champagne, Other Sparkling Wine, Red Wine, White Wine and others), 2018-2023

9.1.4.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.2. By Off Trade and On Trade for Each Type of Alcoholic Beverages, 2023

9.2.1. By Distribution Channel for Off Trade, 2023

9.3. By Region, 2023-2024P

10.1. Customer Landscape and Segment Analysis

10.2. Customer Journey and Decision-Making Process

10.3. Consumer Needs, Preferences, and Pain Points

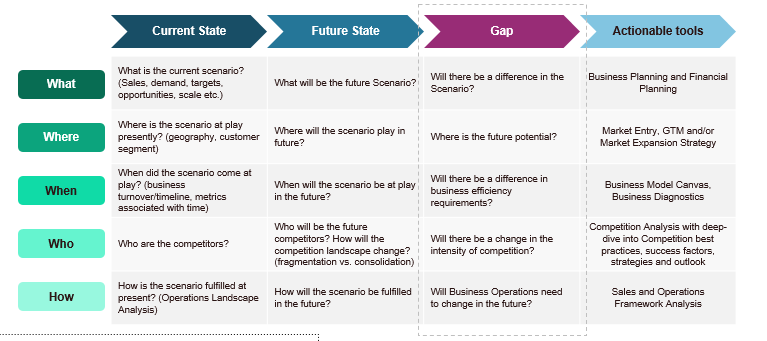

10.4. Gap Analysis Framework

11.1. Trends and Developments in Nigeria Alcoholic Drinks Market

11.2. Growth Drivers for Nigeria Alcoholic Drinks Market

11.3. SWOT Analysis for Nigeria Alcoholic Drinks Market

11.4. Issues and Challenges for Nigeria Alcoholic Drinks Market

11.5. Government Regulations for Nigeria Alcoholic Drinks Market

14.1. Market Share of Key Players in Alcoholic Beverages Market, 2023

14.2. Market Share of Key Players in Beer Market, 2023

14.3. Market Share of Key Players in Wine Market, 2023

14.4. Market Share of Key Players in Spirits Market, 2023

14.5. Market Share of Key Players in RTDs Market, 2023

14.6. Benchmark of Key Competitors in Nigeria Alcoholic Drinks Market Basis 15-20 Operational and Financial Parameters

14.7. Strength and Weakness of Key Competitors

14.8. Operating Model Analysis Framework

14.9. Gartner Magic Quadrant for Market Positioning

14.10. Bowmans Strategic Clock for Competitive Advantage

15.1. Revenues, 2025-2029

15.2. Sales Volume, 2025-2029

16.1. By Type (Beer, Cider, RTDs, Spirits and Wine), 2025-2029

16.1.1. By Beer (Lager, Dark Beer and others), 2025-2029

16.1.1.1. By Lager (Domestic Premium and Imported Premium), 2025-2029

16.1.1.2. By Craft and Standard Beer, 2025-2029

16.1.1.3. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.2. By RTDs (Malt based RTDs, Spirit Based RTDs, Wine Based RTDs, Non-Alcoholic RTDs and others), 2025-2029

16.1.2.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.3. By Spirits (Brandy, Dark Rum, White Rum, Whiskies, Gin, Vodka and others), 2025-2029

16.1.3.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.3.2. By Flavoured and Non-Flavoured Vodka, 2025-2029

16.1.4. By Wine (Fortified Wine, Champagne, Other Sparkling Wine, Red Wine, White Wine and others), 2025-2029

16.1.4.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.2. By Off Trade and On Trade for Each Type of Alcoholic Beverages, 2025-2029

16.2.1. By Distribution Channel for Off Trade, 2025-2029

16.3. By Region, 2025-2029

17.1. Strategic Recommendation

17.2. Opportunity Identification

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Nigeria Alcoholic Drinks Market. Based on this ecosystem, we will shortlist the leading 5-6 producers in the country by evaluating their financial information, production capacity/volume, and market presence.

Sourcing is done through industry articles, government reports, multiple secondary sources, and proprietary databases to perform extensive desk research and gather industry-level information about the market, including key trends, challenges, and opportunities.

Step 2: Desk Research

We engage in an exhaustive desk research process by referencing various secondary and proprietary databases. This approach allows for a thorough analysis of the market, aggregating insights into aspects such as sales revenue, major market players, product categories, pricing levels, and consumer demand. We further supplement this with a detailed examination of company-level data from sources like press releases, annual reports, financial statements, and industry publications. The goal of this step is to build a foundational understanding of the Nigeria Alcoholic Drinks Market and the businesses operating within it.

Step 3: Primary Research

In this stage, we conduct a series of in-depth interviews with C-level executives, production managers, distributors, and other key stakeholders within the Nigeria Alcoholic Drinks Market. These interviews aim to validate market hypotheses, authenticate statistical data, and gather valuable insights about the financial and operational aspects of the industry. A bottom-up approach is used to assess sales volumes for each player, which is then aggregated to determine the overall market size.

Additionally, our team performs disguised interviews by approaching companies as potential buyers or clients. This allows for the verification of operational and financial information provided by company executives and ensures that it aligns with the data collected from secondary research sources. These interactions also help us gain a detailed understanding of revenue streams, distribution channels, pricing strategies, and other market dynamics.

Step 4: Sanity Check

- To ensure the reliability of the findings, a comprehensive bottom-up and top-down analysis is conducted. Market size modeling exercises are performed to assess and verify the validity of the data collected, followed by a sanity check to confirm the accuracy and consistency of the overall research process and findings.

FAQs

1. What is the potential for the Nigeria Alcoholic Drinks Market?

The Nigeria alcoholic drinks market is poised for significant growth, projected to reach a valuation of NGN 500 billion by 2029. This growth is driven by factors such as urbanization, rising disposable incomes, and changing consumer preferences toward premium alcoholic beverages. Additionally, the expanding middle class and the rise of e-commerce platforms for alcohol sales further enhance the market's potential.

2. Who are the Key Players in the Nigeria Alcoholic Drinks Market?

The Nigeria alcoholic drinks market features several key players, including Nigerian Breweries, Guinness Nigeria, and International Breweries. These companies dominate the market due to their extensive production capacity, strong brand presence, and broad distribution networks. Other notable players include Grand Oak and Distell International, which cater to niche segments in spirits and wine.

3. What are the Growth Drivers for the Nigeria Alcoholic Drinks Market?

The primary growth drivers include rising urbanization, increasing disposable incomes, and the growing demand for premium alcoholic beverages among the middle and upper classes. Additionally, the expansion of online distribution channels and the rising popularity of locally brewed craft beverages are contributing to market growth. Government initiatives aimed at boosting local production are also expected to play a role in driving the market forward.

4. What are the Challenges in the Nigeria Alcoholic Drinks Market?

The Nigeria alcoholic drinks market faces several challenges, including regulatory and taxation issues that increase costs for producers and consumers. Quality control issues, particularly the prevalence of counterfeit products, pose significant risks to consumer trust. Additionally, distribution challenges, such as poor infrastructure and high logistics costs, limit the reach of products in rural areas. Fluctuations in the Nigerian economy and inflation also impact consumer spending power, affecting market growth.