Nigeria Auto Finance Market Outlook to 2029

By Market Structure, By Vehicle Category, By Lender Type (Bank, NBFC, Captive), By Financing Type (New vs. Used), By Loan Tenure, and By Region

- Product Code: TDR0155

- Region: Africa

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Nigeria Auto Finance Market Outlook to 2029 – By Market Structure, By Vehicle Category, By Lender Type (Bank, NBFC, Captive), By Financing Type (New vs. Used), By Loan Tenure, and By Region” provides a comprehensive analysis of the auto finance industry in Nigeria. The report covers the genesis and evolution of the market, market size by credit disbursed and loan outstanding, segmentation by financing structure and vehicle category, major trends and developments, regulatory landscape, customer behavior and borrower profiles, challenges and bottlenecks, and competitive landscape. The report concludes with market projections until 2029 based on key drivers, economic variables, and emerging opportunities, including case studies highlighting success factors and market risks.

Nigeria Auto Finance Market Overview and Size

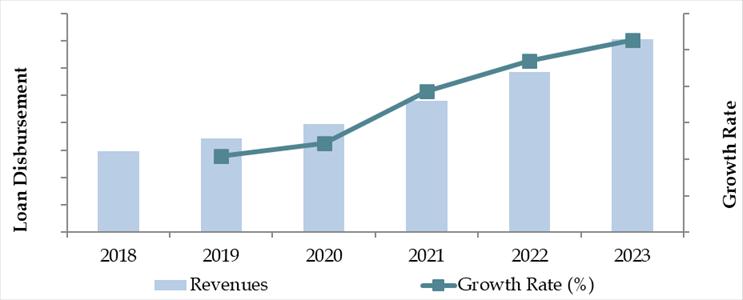

The Nigeria Auto Finance Market reached a credit disbursement value of NGN 420 Billion in 2023, driven by increasing demand for vehicle ownership amid rising urbanization, a growing working-class population, and the emergence of fintech-enabled lending models. The auto finance industry in Nigeria is relatively nascent but rapidly evolving, with players such as Sterling Bank, First Bank, Access Bank, Autochek, and Cars45 offering structured vehicle loan products.

In 2023, Autochek expanded its loan origination platform by partnering with microfinance banks and vehicle dealers across Lagos and Abuja, enabling faster credit processing and digital approvals. These developments have been pivotal in addressing the market’s pain points around credit access and documentation.

Market Size for Nigeria Auto Finance Market on the Basis of Credit Disbursed (in NGN Billion), 2018–2023

What Factors Are Leading to the Growth of Nigeria Auto Finance Market:

Urbanization and Mobility Needs: With over 50% of Nigeria’s population now living in urban areas, there has been a rising need for personal mobility. Vehicle financing offers a gateway for first-time buyers to access ownership, especially in cities like Lagos, Abuja, and Port Harcourt.

Digital Lending & Fintech Models: Companies like Autochek and Cars45 have digitized the auto loan process by integrating banks and credit providers into their platforms. In 2023, approximately 35% of used car purchases in urban Nigeria were financed through digital lending apps or aggregator platforms.

Rising Middle Class and Financial Inclusion: Nigeria’s growing middle-income population has led to increased demand for structured loan products. Financial inclusion programs by the Central Bank of Nigeria (CBN) and the introduction of credit scoring mechanisms through bureaus such as CRC Credit Bureau have enabled more consumers to access vehicle loans.

Which Industry Challenges Have Impacted the Growth of Nigeria Auto Finance Market

Limited Credit Penetration and High Interest Rates: One of the key barriers to auto finance adoption in Nigeria is the low penetration of formal credit and high interest rates. According to a 2023 industry survey, only 18–22% of vehicle purchases were financed through structured loans, with the majority relying on personal savings or informal borrowing. Average interest rates on auto loans in Nigeria range between 22–28% per annum, significantly dampening affordability and uptake.

Informal Vehicle Markets and Poor Documentation: Nigeria’s vehicle market remains largely informal, with over 60% of used vehicle sales occurring through unregulated dealers or individual sellers. This limits the ability of finance companies to verify ownership history, perform accurate valuation, or repossess vehicles in the event of default. As a result, financing institutions are exposed to higher risk, which discourages lending.

Depreciating Naira and Import Dependency: The sharp depreciation of the Nigerian Naira has led to a rise in imported vehicle prices, increasing both loan sizes and monthly EMI obligations. This price volatility, coupled with limited availability of affordable locally-assembled cars, has constrained vehicle affordability. In 2023 alone, the average cost of imported used vehicles rose by 17–20% year-on-year.

What are the Regulations and Initiatives Which Have Governed the Market

Central Bank’s Financial Inclusion Framework: The Central Bank of Nigeria (CBN) has introduced several initiatives under its Financial Inclusion Strategy to expand access to credit. These include the promotion of digital lending, expansion of credit bureaus, and micro-lending guidelines. As of 2023, over 50 financial institutions were listed under the CBN-approved digital lenders list, enabling structured vehicle loan disbursements.

Automotive Policy for Local Assembly (NAIDP): Under the Nigeria Automotive Industry Development Plan (NAIDP), the government provides tax waivers, import duty reductions, and licensing incentives to encourage local vehicle assembly. This indirectly supports the auto finance market by potentially reducing car prices in the long term, thereby increasing affordability and reducing loan default risks.

Vehicle Registration and Loan Verification System: In 2022, a pilot integration between the FRSC Vehicle Registration Platform and selected lenders was initiated to verify financed vehicle ownership and aid in repossession tracking. This initiative aims to improve transparency, reduce fraud, and provide lenders with better recourse in cases of delinquency.

Nigeria Auto Finance Market Segmentation

By Market Structure: The Nigerian auto finance market is primarily dominated by unorganized and semi-formal lenders, including dealership-linked informal credit and individual financing arrangements. These players are more flexible with documentation and faster in approvals but often lack transparency and regulatory oversight. However, organized players—including commercial banks, microfinance institutions, and digital lenders—are steadily gaining ground due to structured repayment plans, lower default risks, and growing adoption of credit scoring. The emergence of fintech platforms like Autochek has accelerated this shift toward formal lending by digitizing loan processing.

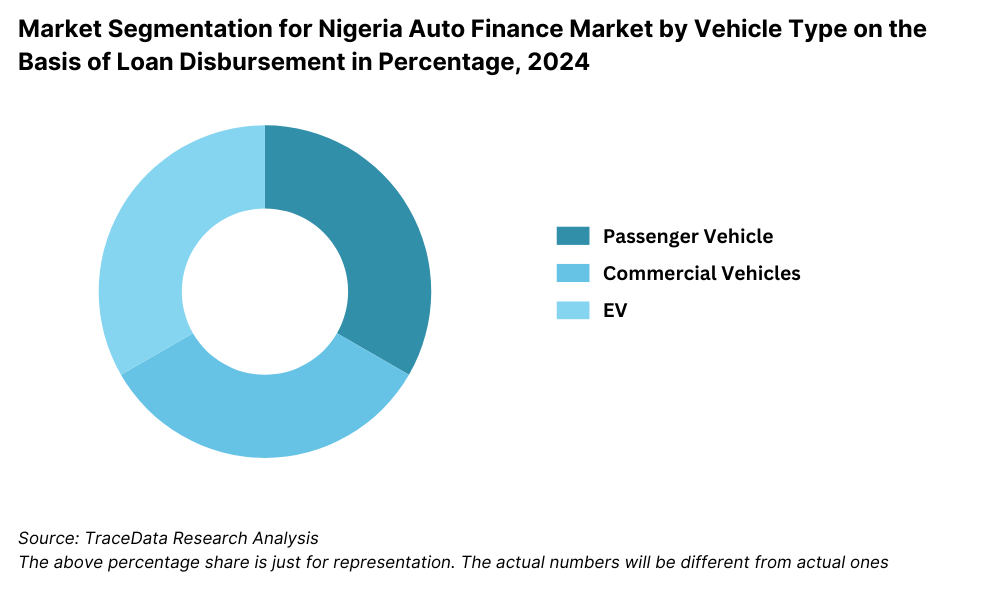

By Vehicle Category (New vs. Used): The Nigerian auto finance market is skewed towards used vehicles, which account for a larger share of financed vehicles due to affordability and wider availability. New vehicles, while aspirational, remain cost-prohibitive for a large portion of the population. Financial institutions have started offering shorter-term loans (12–24 months) for used imports to reduce default risk and appeal to mid-income consumers.

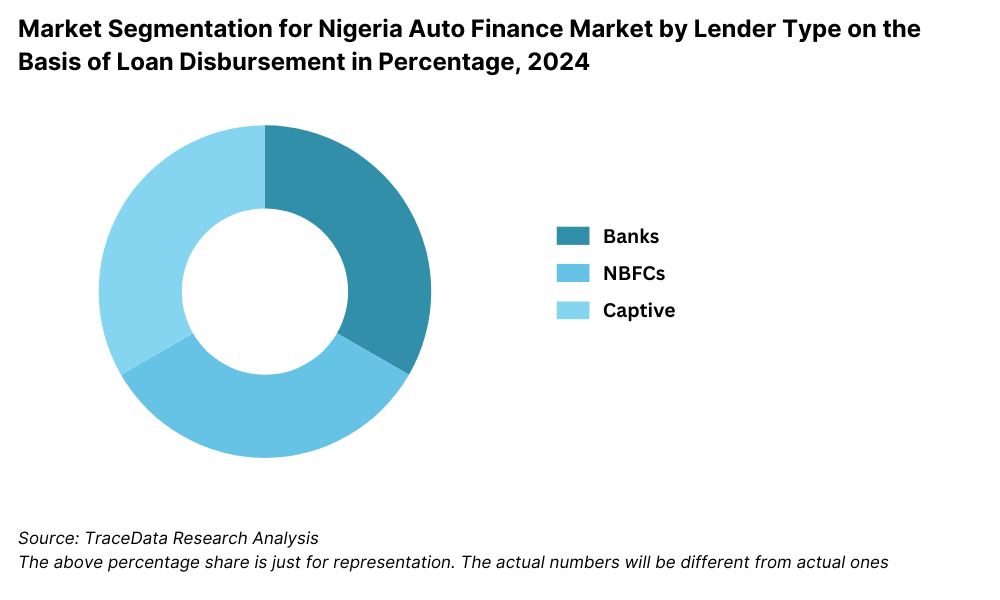

By Lender Type: Banks dominate the organized lending landscape, offering structured vehicle loans with relatively low interest rates but stricter eligibility requirements. Non-Banking Financial Companies (NBFCs) and Microfinance Banks have increased their market share by targeting underbanked and low-income consumers with flexible repayment options. Captive finance arms are limited due to the small number of OEMs with direct presence in Nigeria.

Competitive Landscape in Nigeria Auto Finance Market

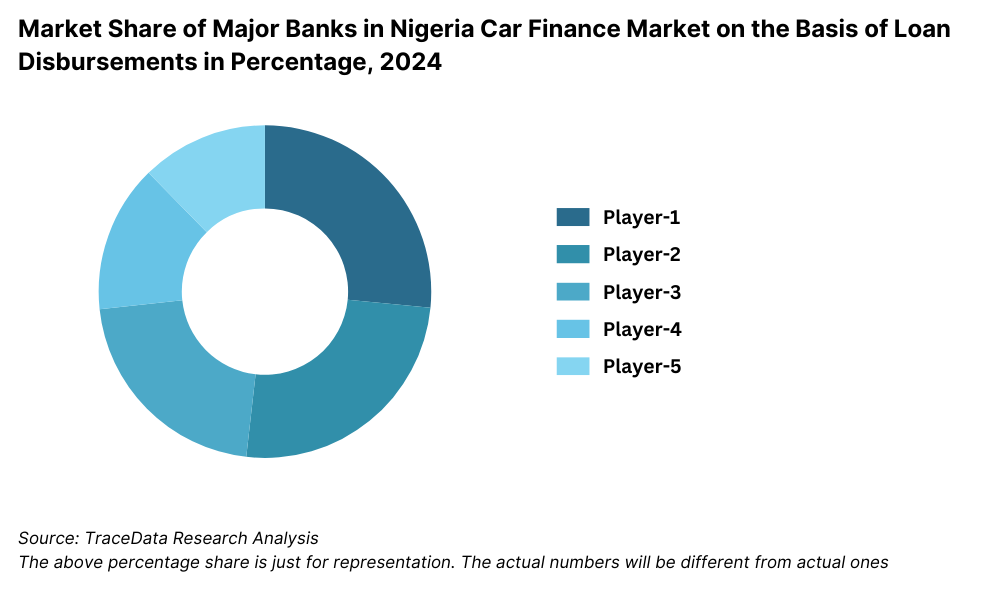

The Nigeria auto finance market is moderately fragmented, with a mix of traditional banks, microfinance institutions, fintech platforms, and a few OEM-linked financiers. While traditional banks dominate formal lending, fintech players such as Autochek and Cars45 are transforming the market by offering tech-driven, streamlined loan services. Increasing smartphone penetration and digital banking have further enabled the rise of these platforms.

| Company Name | Founding Year | Original Headquarters |

| First Bank of Nigeria | 1894 | Lagos, Nigeria |

| Access Bank | 1989 | Lagos, Nigeria |

| Stanbic IBTC Bank | 1989 | Lagos, Nigeria |

| First City Monument Bank (FCMB) | 1982 | Lagos, Nigeria |

| United Bank for Africa (UBA) | 1949 | Lagos, Nigeria |

| Wema Bank | 1945 | Lagos, Nigeria |

| Polaris Bank | 2018 | Lagos, Nigeria |

| Fina Trust Microfinance Bank | 2009 | Lagos, Nigeria |

| Creditville Limited | 2013 | Lagos, Nigeria |

| Opticom Finance Limited | 2004 | Lagos, Nigeria |

| Rosabon Financial Services | 1993 | Lagos, Nigeria |

| Autochek | 2020 | Lagos, Nigeria |

| Betacar | 2019 | Lagos, Nigeria |

| Moove | 2020 | Lagos, Nigeria |

| Altdrive (Alternative Bank) | 2021 | Lagos, Nigeria |

| NOLT Finance | 2018 | Lagos, Nigeria |

| Fincred Nigeria | 2015 | Lagos, Nigeria |

Some of the recent competitor trends and key information about competitors include:

Access Bank Auto Loans: One of Nigeria’s largest commercial banks, Access Bank reported a 12% year-on-year increase in auto loan disbursement volumes in 2023. The bank's offerings include flexible repayment plans and partnerships with select dealerships for pre-approved financing.

First Bank Auto Loans: As one of Nigeria’s oldest financial institutions, First Bank provides auto loans to both salary earners and SMEs. In 2023, the bank launched a vehicle financing scheme with embedded insurance, reducing risk and increasing adoption by 18% over the previous year.

Autochek: A leading auto-tech platform, Autochek has revolutionized the loan origination process in Nigeria. Through partnerships with over 70 lenders and 1,000 dealers, Autochek facilitated more than NGN 20 Billion in auto financing in 2023. Its digital-first approach includes instant loan pre-qualification and integrated vehicle listings.

Cars45: Initially focused on car inspections and auctions, Cars45 has diversified into financing through dealer partnerships and trade-in programs. In 2023, Cars45 reported a 30% increase in financing-linked transactions, with growth largely driven by Lagos, Abuja, and Ibadan.

Page Financials: Known for personal and auto loans to mid-income professionals, Page Financials saw strong traction in 2023 through its mobile-first approach. It offers 100% vehicle financing with approvals within 6 hours, and is expanding its customer base beyond Tier-1 cities.

What Lies Ahead for Nigeria Auto Finance Market?

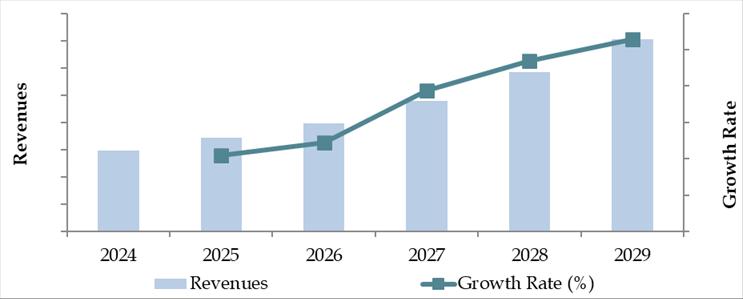

The Nigeria auto finance market is projected to witness sustained growth through 2029, driven by the increasing demand for vehicle ownership, rapid urbanization, fintech-led financial inclusion, and favorable regulatory developments. The market is expected to expand at a healthy CAGR over the forecast period as structured lending gains traction across both new and used vehicle segments.

Expansion of Fintech Lending Platforms: The rise of digital-first platforms like Autochek, Carbon, and FairMoney is expected to reshape the lending landscape. These platforms are likely to deepen their market penetration by expanding partnerships with microfinance institutions and integrating advanced credit scoring technologies. Faster disbursal, minimal paperwork, and mobile-based applications will drive higher adoption, especially among first-time borrowers.

Increased Focus on Used Vehicle Financing: Given the dominance of used vehicles in the Nigerian auto ecosystem, lenders are expected to tailor more loan products specifically for used imports. Shorter tenures, vehicle inspection tie-ups, and bundled insurance-finance offerings will become more common, helping to reduce default risk and broaden consumer access.

Emergence of Asset-Backed Loan Products: Structured asset-backed lending is likely to grow as lenders look to mitigate risk and reach underbanked segments. Initiatives like vehicle collateral registration systems and integration with credit bureaus will allow lenders to manage loan recovery more effectively.

OEM and Dealer-Driven Financing Models: As global OEMs and local assemblers expand their presence under the Nigeria Automotive Industry Development Plan (NAIDP), captive and dealer-led financing programs are expected to emerge. These models will offer bundled solutions with better interest rates, boosting new vehicle uptake and supporting local manufacturing objectives.

Future Outlook and Projections for Nigeria Car Finance Market Size on the Basis of Loan Disbursements in USD Billion, 2024-2029

Nigeria Auto Finance Market Segmentation

By Market Structure:

Banks

Non-Banking Financial Companies (NBFCs)

Microfinance Institutions (MFIs)

Digital Lending Platforms / Fintechs

Captive Finance Arms

Organized Financing Channels

Unorganized / Informal Lending Channels

By Vehicle Category:

New Vehicles

Used Vehicles

Locally Assembled Vehicles

Imported (Tokunbo) Vehicles

By Loan Tenure:

Less than 12 Months

12–24 Months

25–36 Months

Above 36 Months

By Financing Type:

Full Financing (Up to 100%)

Partial Financing (Down Payment Required)

Salary-Linked Auto Loans

Asset-Backed Auto Loans

By Consumer Profile:

Salaried Professionals

SMEs and Business Owners

Government Employees

Informal Sector Workers

First-Time Borrowers

By Region:

Lagos

Abuja (FCT)

Port Harcourt

Kano

Ibadan

Eastern Corridor (Onitsha, Enugu, Aba)

Northern Belt (Kaduna, Jos, Maiduguri)

Players Mentioned in the Report (Banks):

- Access Bank

- First Bank of Nigeria

- Stanbic IBTC Bank

- Union Bank of Nigeria

- Wema Bank

- First City Monument Bank (FCMB)

- Sterling Bank

- United Bank for Africa (UBA)

- Zenith Bank

- Guaranty Trust Bank (GTBank)

- Fidelity Bank

- Ecobank Nigeria

- Polaris Bank

- Keystone Bank

- Unity Bank

Players Mentioned in the Report (NBFCs):

- Rosabon Financial Services

- Zedvance Finance

- Page Financials

- TFS Finance

- Credit Direct

- MIM Finance Company

- Newedge Finance

- WSTC Financial Services

- SFS Capital

- Altdrive

- CredPal

- MenaCred

- Riby

- Crowdyvest

- Aladdin Digital Bank

- Kuda

Players Mentioned in the Report (Captive):

- Toyota Financial Services Nigeria

- Volkswagen Financial Services Nigeria

- Hyundai Capital Nigeria

- Stellantis Financial Services Nigeria

- Dana Motors Finance

- Coscharis Mobility

- CFAO Motors Finance

Key Target Audience:

Commercial Banks and NBFCs

Online Auto Financing Platforms

Used and New Vehicle Dealers

Fintech Lending Startups

Automotive OEMs and Local Assemblers

Regulatory Bodies (e.g., Central Bank of Nigeria, NAIDP)

Development Finance Institutions

Credit Bureaus

Research and Policy Institutions

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

5.1. New Car and Used Car Sales in Nigeria by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024

9.2. By Vehicle Type (Passenger, Commercial and EV), 2023-2024

9.3. By Region, 2023-2024

9.4. By Type of Vehicle (New and Used), 2023-2024

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Nigeria Car Finance Market

11.2. Growth Drivers for Nigeria Car Finance Market

11.3. SWOT Analysis for Nigeria Car Finance Market

11.4. Issues and Challenges for Nigeria Car Finance Market

11.5. Government Regulations for Nigeria Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Nigeria Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Nigeria Car Finance Market, 2024

17.3. Market Share of Key Captive in Nigeria Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Nigeria Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Vehicle Type (Passenger, Commercial and EV), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New and Used), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

We began by mapping the complete ecosystem for the Nigeria Auto Finance Market, identifying both demand-side and supply-side entities. This includes commercial banks, NBFCs, fintech lenders, vehicle dealerships, OEMs, credit bureaus, and end consumers.

Based on this ecosystem, we shortlisted key players across segments (banks, fintechs, and microfinance institutions) using parameters such as loan book size, disbursement volume, technology integration, and customer reach.

Initial insights were sourced through multiple secondary sources, including industry portals, news articles, regulatory filings, and proprietary market intelligence databases.

Step 2: Desk Research

An extensive secondary research process was conducted using a combination of public databases, syndicated industry reports, regulatory data from institutions such as the Central Bank of Nigeria (CBN), and international databases including IMF and World Bank.

This enabled a granular understanding of the market structure, total credit disbursed, lending models, consumer demographics, and interest rate ranges.

Company-level information such as loan schemes, product pricing, annual reports (where available), financial statements, and investor presentations were also examined to benchmark key players’ market shares and strategies.

Step 3: Primary Research

A series of structured interviews were conducted with senior stakeholders from banks, NBFCs, auto dealerships, and digital lending platforms. These interviews were aimed at validating market assumptions, obtaining real-time loan data, interest rate brackets, credit approval processes, NPA trends, and recovery mechanisms.

A bottom-up approach was followed to estimate loan disbursement at the individual entity level, which was then aggregated to derive the market size.

As part of the data triangulation process, mystery shopping techniques were also deployed. Our researchers posed as prospective vehicle buyers to collect firsthand information on documentation requirements, EMIs, approval timelines, and down payment norms from lenders and dealerships.

Step 4: Sanity Check

The market estimates derived from both bottom-up (player-level) and top-down (macro-level economic and vehicle registration trends) models were reconciled through iterative triangulation.

- Statistical models, historical trend analysis, and expert validation were used to finalize CAGR projections and market segmentation for the 2024–2029 forecast period.

FAQs

1. What is the potential for the Nigeria Auto Finance Market?

The Nigeria auto finance market presents substantial growth potential, with credit disbursement reaching approximately NGN 420 Billion in 2023. Factors such as rapid urbanization, rising vehicle ownership aspirations, and the growing fintech ecosystem are expected to fuel steady growth through 2029. The increasing adoption of digital lending platforms and expanding financial inclusion are pivotal in unlocking the underserved auto financing segment.

2. Who are the Key Players in the Nigeria Auto Finance Market?

Key players in the Nigeria auto finance landscape include Access Bank, First Bank Nigeria, Autochek, Cars45, and Page Financials. These players hold significant market share due to their innovative financing solutions, partnerships with dealerships, and ability to reach both urban and semi-urban consumers. Emerging fintechs such as FairMoney and Carbon are also gaining traction with mobile-first lending approaches.

3. What are the Growth Drivers for the Nigeria Auto Finance Market?

The main growth drivers include the dominance of used vehicle sales, increasing smartphone and internet penetration, and a growing working-class population. Additionally, the Nigerian government’s push for local vehicle assembly under the NAIDP, the rise of digital credit scoring, and expanding fintech lending models are catalyzing the formalization of vehicle financing services.

4. What are the Challenges in the Nigeria Auto Finance Market?

Challenges include high interest rates, foreign exchange volatility, and low formal credit penetration, especially in rural areas. The predominance of informal vehicle markets and lack of verifiable ownership documentation create obstacles for lenders. Regulatory complexities and limited data infrastructure also hamper efficient risk assessment and loan recovery, especially for used vehicle financing.