Nigeria Logistics and warehousing Market Outlook to 2029

By Market Structure (Integrated vs Contract Logistics), By Mode of Transport (Road, Rail, Air, and Sea), By End Users (Retail, Manufacturing, Oil & Gas, FMCG, Agriculture, E-commerce), By Type of Warehousing (General, Cold Chain, ICDs, Bonded, Open Yards)

- Product Code: TDR0299

- Region: Africa

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Nigeria Logistics and Warehousing Market Outlook to 2029 – By Market Structure (Integrated vs Contract Logistics), By Mode of Transport (Road, Rail, Air, and Sea), By End Users (Retail, Manufacturing, Oil & Gas, FMCG, Agriculture, E-commerce), By Type of Warehousing (General, Cold Chain, ICDs, Bonded, Open Yards), and By Region” provides a comprehensive analysis of the logistics and warehousing industry in Nigeria. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, key trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including cross comparisons, opportunities, and bottlenecks. The report concludes with future market projections based on revenue and volume, analysis by segments, regions, and end-user industries, as well as success case studies illustrating major opportunities and areas of caution.

Nigeria Logistics and Warehousing Market Overview and Size

The Nigerian logistics and warehousing market reached an estimated valuation of NGN 5.2 trillion in 2023, driven by rising domestic consumption, infrastructural investment, expanding retail and e-commerce sectors, and regional trade under the AfCFTA framework. The market features key players such as DHL, GIG Logistics, Red Star Express, Kobo360, and Speedaf, which are recognized for their pan-Nigerian networks, integration of technology, and diversified logistics solutions.

In 2023, Kobo360 expanded its operations in the northern corridor and launched new AI-powered fleet optimization tools to reduce cost per delivery and enhance shipment visibility. Lagos, Ogun, Rivers, and the FCT are key logistical hubs due to their industrial bases, port access, and warehousing clusters.

%2C%202018%E2%80%932023.png)

What Factors are Leading to the Growth of Nigeria Logistics and Warehousing Market:

Rising Demand from E-commerce and Retail: The exponential growth in online shopping, with platforms like Jumia, Konga, and PayPorte scaling up last-mile networks, has pushed the need for faster and more reliable logistics and warehousing services. In 2023, the e-commerce sector contributed nearly 18% of total logistics revenues in urban centers.

Government Infrastructure Initiatives: Federal investments in dry ports, road rehabilitation (e.g., Apapa-Oworonshoki Expressway), and new rail corridors have helped decongest ports and stimulate inland logistics connectivity. The Inland Container Depot (ICD) in Kaduna and the Lekki Deep Sea Port are expected to be major catalysts by 2026.

Technology-Driven Logistics Solutions: Startups and incumbents alike are digitizing the supply chain with tracking solutions, real-time dashboards, and automated warehousing. For instance, GIG Logistics’ integration of IoT-based package monitoring has increased delivery accuracy and reduced theft.

Which Industry Challenges Have Impacted the Growth for Nigeria Logistics and Warehousing Market

Poor Transport Infrastructure and Congestion: One of the most pressing challenges in Nigeria’s logistics ecosystem is the state of physical infrastructure. In 2023, over 40% of logistics delays were attributed to poor road conditions, especially along major trade corridors such as Lagos-Ibadan and Port Harcourt-Aba routes. Port congestion, particularly at Apapa and Tin Can Island Ports, has led to turnaround times of up to 18 days, increasing demurrage costs by 25% over the past two years.

Security and Cargo Theft: Security issues such as highway robbery and warehouse break-ins have negatively impacted logistics operations, particularly in the North-West and North-East regions. According to industry estimates, cargo theft and loss accounted for nearly NGN 35 billion in financial losses in 2023 alone, affecting both local and cross-border logistics reliability.

Regulatory Complexity and Border Delays: Fragmented regulatory processes involving multiple agencies (Customs, SON, NAFDAC) have led to high compliance costs and bureaucratic delays. At Nigeria’s land borders, clearance times still average 3–5 days, reducing the efficiency of regional trade. Inconsistent enforcement and limited digitization of customs procedures further slow down throughput.

What are the Regulations and Initiatives which have Governed the Market

National Logistics Policy Implementation: The Federal Ministry of Transportation launched the National Freight and Logistics Policy (NFLP) in 2023 to coordinate infrastructure, customs processes, and private sector participation across Nigeria’s logistics value chain. The policy aims to reduce logistics costs as a percentage of GDP from 23% in 2023 to below 15% by 2029.

Inland Dry Ports (IDPs) Regulation and Expansion: The Nigerian Shippers' Council and Nigerian Railway Corporation are jointly regulating IDPs in Kaduna, Kano, and Funtua to promote hinterland connectivity. As of 2023, three IDPs were operational with standardized customs clearance processes, cutting lead times for northern manufacturers by 30–35%.

NESREA and NAFDAC Oversight for Warehousing Compliance: General and cold chain warehouses must comply with environmental and health storage regulations set by NESREA and NAFDAC. These include requirements for waste disposal, temperature control, and pest management. In 2023, compliance inspections increased by 22% year-on-year, driven by growing pharmaceutical and food storage demand.

Nigeria Logistics and Warehousing Market Segmentation

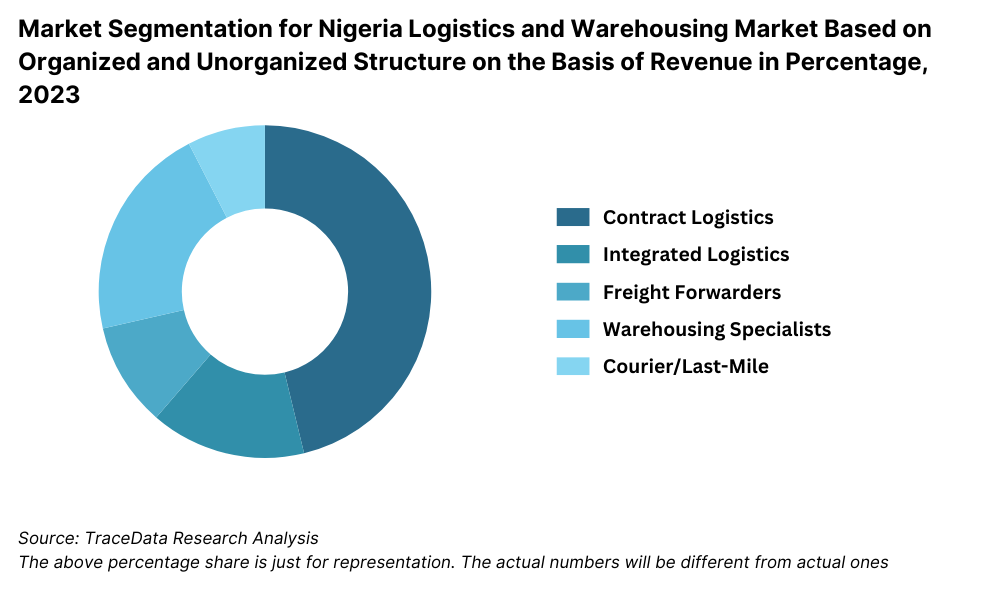

By Market Structure: Contract logistics dominates the market due to its ability to provide cost-efficient, scalable, and tech-enabled solutions across diverse industries such as FMCG, manufacturing, and e-commerce. Many Nigerian businesses prefer outsourcing their logistics operations to experienced 3PL players like GIG Logistics, Red Star Express, and Speedaf, which offer value-added services such as real-time tracking, reverse logistics, and customized warehousing. Integrated logistics players are also gaining traction, especially among large corporations requiring unified control over supply chains. These providers offer seamless multimodal solutions that combine warehousing, transportation, and clearance services under a single contract to optimize operations.

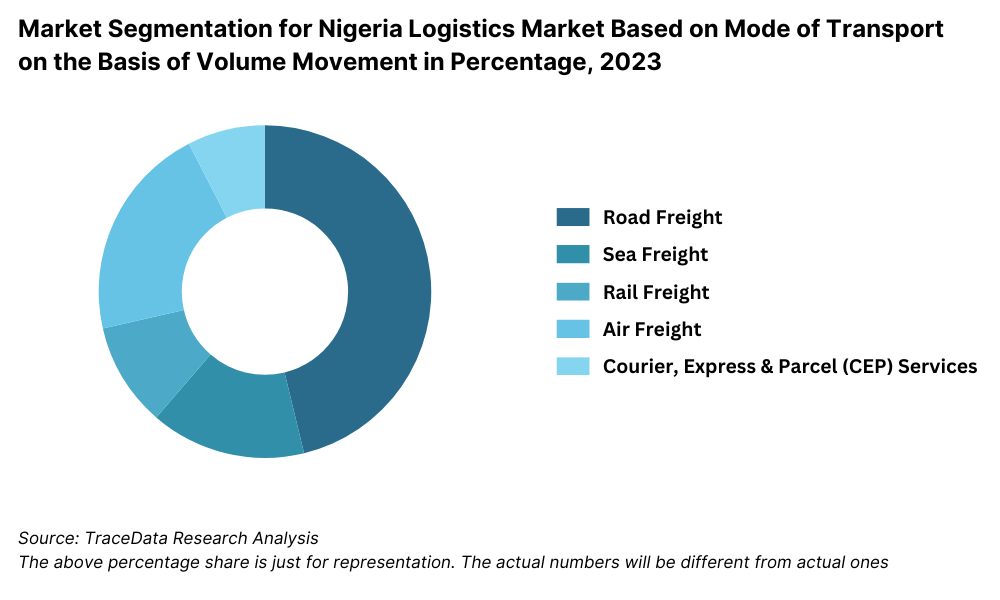

By Mode of Transport: Road transportation is the backbone of logistics in Nigeria, contributing the largest share due to its extensive reach and flexibility. It is essential for last-mile delivery and rural access despite infrastructure challenges. Sea freight follows, driven by Nigeria’s import-export activity through ports in Lagos and Port Harcourt. Rail logistics is growing due to recent investments in the standard gauge network, especially the Lagos-Ibadan and Abuja-Kaduna lines. Air freight, though limited by volume, is critical for high-value and time-sensitive goods, serving industries such as pharmaceuticals and e-commerce.

By Type of Warehousing: General warehouses occupy the major share of Nigeria’s warehousing market, catering to dry goods and industrial storage needs. These facilities are widespread in industrial zones such as Lagos, Ogun, and Kano. Cold chain warehouses are emerging rapidly due to increased demand from the pharmaceutical, perishable food, and dairy sectors. Inland Container Depots (ICDs) and bonded warehouses are crucial for customs clearance and bulk storage, helping decongest Nigeria’s sea ports. Open yards are primarily used in the construction and oil & gas sectors, particularly for heavy or non-sensitive materials.

Competitive Landscape in Nigeria Logistics and Warehousing Market

The Nigeria logistics and warehousing market is moderately consolidated, with a few key players leading in road freight, express delivery, and tech-driven logistics. However, the landscape is evolving rapidly with the emergence of startups and digital freight platforms. Companies such as GIG Logistics, Red Star Express, DHL Nigeria, Kobo360, Speedaf, and Sendbox are notable players offering diverse services from courier and freight forwarding to smart warehousing and last-mile delivery.

Company | Establishment Year | Headquarters |

GIG Logistics | 2012 | Lagos, Nigeria |

Red Star Express | 1992 | Lagos, Nigeria |

DHL Nigeria | 1979 | Lagos, Nigeria |

Kobo360 | 2017 | Lagos, Nigeria |

Speedaf | 2019 | Lagos, Nigeria |

Sendbox | 2018 | Lagos, Nigeria |

Some of the recent competitor trends and key information about competitors include:

GIG Logistics: One of Nigeria’s leading last-mile and express logistics providers, GIGL operates over 100 service centers and recently expanded into Ghana and Kenya. In 2023, the company introduced AI-powered delivery optimization, resulting in a 20% reduction in delivery times and a 15% drop in operational costs.

Red Star Express: A franchisee of FedEx in Nigeria, Red Star specializes in express parcel delivery, warehousing, and e-commerce logistics. In 2023, the company invested NGN 2.5 billion in expanding its warehouse footprint in Lagos and Abuja, enabling greater B2B fulfillment capabilities.

DHL Nigeria: A legacy multinational in the Nigerian logistics space, DHL operates a strong air freight and express network across all 36 states. In 2023, DHL saw a 12% increase in international shipment volumes and expanded cold chain capabilities to serve pharma and medical sectors.

Kobo360: A tech-enabled freight management platform connecting shippers to transporters, Kobo360 managed over 500,000 deliveries across Nigeria and West Africa in 2023. The company recently integrated blockchain for supply chain transparency and raised funding for cross-border logistics expansion under AfCFTA.

Speedaf: Backed by Chinese investors, Speedaf focuses on e-commerce parcel delivery, leveraging a growing warehouse and hub network across urban Nigeria. In 2023, it recorded a 40% increase in B2C volumes and launched 12-hour intra-city delivery service in Lagos and Ibadan.

Sendbox: Targeted at small businesses, Sendbox offers digital fulfillment and cross-border shipping solutions. The company handled over 350,000 parcels in 2023, with major clients in fashion and beauty segments. Its plug-and-play logistics platform is gaining traction among Instagram and Jumia sellers.

What Lies Ahead for Nigeria Logistics and Warehousing Market?

The Nigeria logistics and warehousing market is projected to grow steadily by 2029, registering a strong CAGR over the forecast period. This growth will be driven by increased domestic consumption, e-commerce expansion, infrastructure investments, and regional trade opportunities under AfCFTA.

Expansion of E-commerce Logistics: With Nigeria’s e-commerce market expected to reach over USD 10 billion by 2029, logistics players will increasingly focus on last-mile delivery innovation, warehousing automation, and regional fulfillment centers. Fast and flexible delivery options will become a critical differentiator, especially in urban centers such as Lagos, Abuja, and Port Harcourt.

Digitization and Smart Logistics: The adoption of AI, IoT, and big data analytics is expected to revolutionize supply chain operations. These technologies will enhance shipment visibility, predictive maintenance, warehouse automation, and route optimization. By 2029, over 50% of organized logistics providers are expected to implement end-to-end digital dashboards for client transparency.

Growth of Cold Chain Infrastructure: The demand for temperature-controlled logistics is projected to rise significantly, especially in the agriculture, pharmaceutical, and dairy sectors. Investments in reefer trucks, solar-powered cold storage, and rural distribution networks will be key to minimizing post-harvest losses and ensuring medicine integrity.

Integration with Continental Trade Corridors: Nigeria’s strategic position within West Africa and participation in the AfCFTA will position it as a logistics gateway for the region. Development of trans-African corridors, such as the Lagos-Abidjan highway and Kano-Katsina-Maradi railway, will support regional freight volumes and stimulate cross-border warehousing needs.

%2C%202023-2029.png)

Nigeria Logistics and Warehousing Market Segmentation

• By Market Structure:

o Contract Logistics

o Integrated Logistics Providers

o Freight Forwarders

o Courier & Express Delivery Services

o Organized Sector

o Unorganized Sector

o Last-Mile Delivery Operators

• By Mode of Transport:

o Road

o Rail

o Sea

o Air

o Multimodal Transport

• By Type of Warehousing:

o General Warehouses

o Cold Chain Warehouses

o Inland Container Depots (ICDs)

o Bonded Warehouses

o Open Yard Storage

o Fulfillment Centers

o Automated Warehouses

• By End User Industry:

o FMCG

o Retail and E-commerce

o Manufacturing

o Oil and Gas

o Agriculture

o Pharmaceuticals

o Construction

• By Region:

o South West (Lagos, Ogun)

o South South (Rivers, Delta)

o North Central (Abuja, Kogi, Niger)

o North West (Kano, Kaduna)

o South East (Anambra, Abia)

o North East (Borno, Bauchi)

Players Mentioned in the Report:

• GIG Logistics

• Red Star Express

• DHL Nigeria

• Kobo360

• Speedaf Nigeria

• Sendbox

• ABC Transport

• Nigerian Railway Corporation

• UPS Nigeria

• TSL Logistics

Key Target Audience:

• Logistics Service Providers

• Warehousing Infrastructure Companies

• E-commerce Platforms

• Manufacturing and FMCG Companies

• Agricultural Exporters and Aggregators

• Government and Regulatory Bodies (e.g., Nigerian Shippers' Council, Federal Ministry of Transportation)

• Technology Providers and Supply Chain Startups

• Industry Associations (e.g., NAGAFF, NPA)

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Nigeria Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges That They Face

4.2. Revenue Streams for Nigeria Logistics and Warehousing Market

4.3. Business Model Canvas for Nigeria Logistics and Warehousing Market

4.4. Logistics Partner Selection Decision Making Process

4.5. Warehousing and Infrastructure Investment Decision Making Process

5. Market Structure

5.1. Overview of Nigeria’s Logistics and Warehousing Sector, 2018-2024

5.2. Share of Logistics Spend as a Percentage of Nigeria’s GDP, 2018-2024

5.3. Government Expenditure on Infrastructure and Transport, 2018-2024

5.4. Number of Registered Logistics Companies by Region in Nigeria

6. Market Attractiveness for Nigeria Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for Nigeria Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Volume of Goods Handled, 2018-2024

9. Market Breakdown for Nigeria Logistics and Warehousing Market Basis

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Mode of Transport (Road, Rail, Sea, Air), 2023-2024P

9.3. By Type of Warehouse (General, Cold Chain, ICDs, Bonded, Open Yard), 2023-2024P

9.4. By Region (South West, South South, North Central, etc.), 2023-2024P

9.5. By End User Industry (FMCG, E-commerce, Manufacturing, Agriculture, Oil & Gas, etc.), 2023-2024P

9.6. By Level of Automation and Digitization, 2023-2024P

10. Demand Side Analysis for Nigeria Logistics and Warehousing Market

10.1. Customer Landscape and Industry-wise Logistics Needs

10.2. Client Journey and Service Provider Evaluation Criteria

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments in Nigeria Logistics and Warehousing Market

11.2. Growth Drivers for Nigeria Logistics and Warehousing Market

11.3. SWOT Analysis for Nigeria Logistics and Warehousing Market

11.4. Issues and Challenges for Nigeria Logistics and Warehousing Market

11.5. Government Policies and Regulations for Logistics and Warehousing Sector

12. Snapshot on Digital Logistics Platforms in Nigeria

12.1. Market Size and Future Potential for Digital Logistics Market, 2018-2029

12.2. Business Model and Revenue Streams for Digital Freight and Fulfillment Platforms

12.3. Cross Comparison of Key Players (Company Overview, Volume Handled, Fleet Size, Automation Tools, Pricing)

13. Warehousing Infrastructure and Investment Landscape

13.1. Investment Trends and PE/VC Activity, 2018-2024

13.2. Warehouse Development Patterns by Region and Industry

13.3. Warehousing Real Estate Trends and Lease Rates

13.4. Warehouse Space Distribution by Grade (A/B/C)

13.5. Cold Chain Warehousing Trends and Technology Adoption

13.6. Warehouse Automation and Emerging Tech

14. Opportunity Matrix for Nigeria Logistics and Warehousing Market-Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for Nigeria Logistics and Warehousing Market

16. Competitor Analysis for Nigeria Logistics and Warehousing Market

16.1. Benchmark of Key Competitors Including Company Overview, Fleet and Warehouse Capacity, Business Strategy, USP, Strengths, Weaknesses, Service Footprint, Pricing Model, and Value-Added Services

16.2. Strength and Weakness Matrix

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant Positioning

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Nigeria Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Volume of Goods Handled, 2025-2029

18. Market Breakdown for Nigeria Logistics and Warehousing Market Basis

18.1. By Market Structure (Organized and Unorganized Market), 2025-2029

18.2. By Mode of Transport (Road, Rail, Sea, Air), 2025-2029

18.3. By Type of Warehouse (General, Cold Chain, ICDs, Bonded, Open Yard), 2025-2029

18.4. By Region (South West, South South, North Central, etc.), 2025-2029

18.5. By End User Industry (FMCG, E-commerce, Manufacturing, Agriculture, Oil & Gas, etc.), 2025-2029

18.6. By Level of Automation and Digitization, 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Nigeria Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5–6 logistics and warehousing service providers in the country based upon their operational scale, infrastructure base, technological capabilities, and geographic coverage.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like logistics volumes, warehousing capacity, mode of transport share, infrastructure status, pricing levels, and service penetration. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, investment announcements, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Nigeria Logistics and Warehousing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate logistics volumes and warehousing space for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, service pricing, operational processes, capacity utilization, and technology integration.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Nigeria Logistics and Warehousing Market?

The Nigeria logistics and warehousing market holds significant growth potential, with a valuation of NGN 5.2 trillion in 2023. The sector is poised for expansion due to increasing demand for efficient supply chain solutions across FMCG, e-commerce, agriculture, and manufacturing sectors. Infrastructure upgrades, policy support under AfCFTA, and a growing digital ecosystem are further strengthening Nigeria’s role as a logistics hub for West Africa.

2. Who are the Key Players in the Nigeria Logistics and Warehousing Market?

The Nigeria Logistics and Warehousing Market includes major players such as GIG Logistics, Red Star Express, DHL Nigeria, and Kobo360. These companies lead due to their strong distribution networks, tech-enabled service models, and ability to serve diverse industries. Other prominent players include Speedaf, Sendbox, and TSL Logistics, which cater to niche segments such as last-mile delivery, SME logistics, and cold chain services.

3. What are the Growth Drivers for the Nigeria Logistics and Warehousing Market?

Key growth drivers include the rapid expansion of the e-commerce sector, government investments in infrastructure (rail, ports, ICDs), and Nigeria’s strategic location in the West African trade corridor. Technological advancements such as real-time tracking, automation, and digital freight matching platforms are also transforming the market landscape. Additionally, demand from sectors like agriculture and pharmaceuticals is boosting the need for specialized logistics and warehousing solutions.

4. What are the Challenges in the Nigeria Logistics and Warehousing Market?

The market faces several challenges, including poor road infrastructure, port congestion, and security risks such as cargo theft. Regulatory bottlenecks and fragmented customs procedures add to operational inefficiencies. High fuel costs and foreign exchange volatility also increase the cost of logistics services. Furthermore, the shortage of skilled logistics professionals and limited cold chain capacity continue to hinder seamless operations across the value chain.