North America Intraocular Lens (IOL) Market Outlook to 2030

By Market Structure, By Optic Type, By Material, By Toricity Level, By Delivery System, By End-User Setting, and By Country & Sub-Region

- Product Code: TDR0338

- Region: North America

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “North America Intraocular Lens (IOL) Market Outlook to 2030 - By Market Structure, By Optic Type, By Material, By Toricity Level, By Delivery System, By End-User Setting, and By Country & Sub-Region” provides a comprehensive analysis of the intraocular lens market in North America. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the intraocular lens market. The report concludes with future market projections based on procedure volumes, product classes, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

North America Intraocular Lens Market Overview and Size

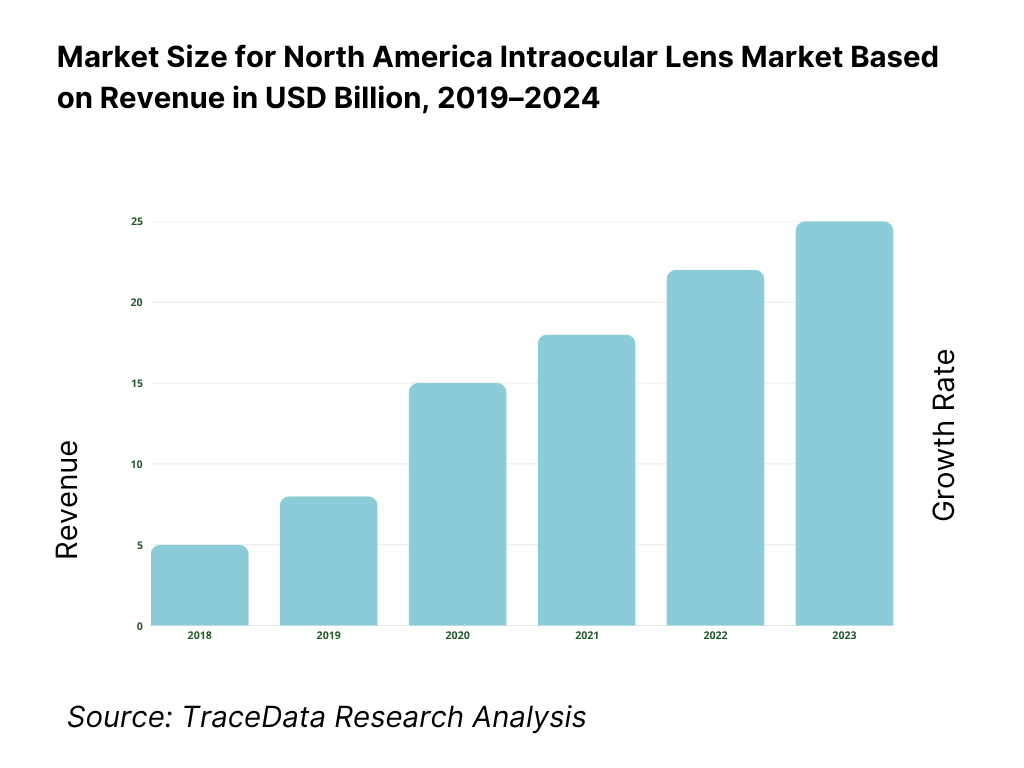

The market is valued at USD 1.53 billion, based on a five-year historical analysis of regional revenues. The latest publicly reported regional figure shows USD 1.53 billion in the current period, underscoring steady procedure volumes and strong adoption of premium designs in select centers. Growth is being driven by high cataract prevalence, continued expansion of ambulatory surgery centers, and payer coverage of conventional monofocal IOLs that keeps the base of reimbursed procedures robust.

The United States dominates due to very high surgical volumes (about 3.7–4.0 million cataract operations annually), deep ASC penetration, and Medicare coverage of conventional IOLs, which anchors baseline demand; Canada follows, with universal coverage and monitored wait-time benchmarks (e.g., 112 days national guideline) shaping capacity and scheduling. Large metro clusters in California, Texas, Florida and the Northeast concentrate ophthalmic surgery infrastructure and premium IOL counseling programs.

What Factors are Leading to the Growth of the North America Intraocular Lens Market:

Rapidly aging population (North America IOL demand is cataract-driven): Across North America, the at-risk cohort for cataract surgery keeps expanding. In the United States, the population aged 65+ reached 61.2 million, while Canada counted 7,820,121 people 65+ and Mexico recorded 10,794,162 older adults. These three figures reflect demographic momentum that directly lifts surgical volume for age-related lens opacities, the main clinical indication for intraocular lenses. A larger senior base also correlates with higher utilization of post-cataract refractive solutions (e.g., toric and EDOF IOLs) because presbyopia and astigmatism are more common with age, reinforcing steady device pull-through across hospital outpatient departments and ambulatory surgery centers.

Coverage and surgical throughput (financing and capacity underwrite procedures): Public payers and national health systems that cover cataract extraction underpin IOL volumes. In the U.S., 67,059,354 people were enrolled in Medicare, the program that pays for cataract surgery with lens implantation; capacity is supported by 6,308 Medicare-certified ASCs. Canada performed 2,330,200 surgeries in the most recent fiscal year across all specialties, with cataract consistently among the highest-volume day surgeries. In Mexico, the health ministry reports 760,000 people living with cataract-related vision loss and 47,600 new cases annually—quantifying an explicit, system-recognized surgical need that sustains IOL demand.

Metabolic disease burden (diabetes elevates cataract incidence and surgical complexity): Diabetes accelerates cataract formation, increases surgical caseload, and shapes lens selection for eyes with diabetic retinopathy or macular disease. In the U.S., 38.4 million people have diabetes; Canada reports 3.7 million with diagnosed diabetes; Mexico’s ENSANUT measured 14.6 million adults with diagnosed or undiagnosed diabetes. These very large patient pools translate into more pre-operative screenings, tighter peri-operative control, and a higher likelihood of cataract surgery at earlier ages, sustaining procedure pipelines for monofocal, toric, and advanced-technology IOLs across tertiary centers and high-throughput surgical hubs.

Which Industry Challenges Have Impacted the Growth of the North America Intraocular Lens Market:

Surgical wait times and backlog (capacity strain in publicly funded systems): Canada’s national benchmark for cataract surgery is 112 days from specialist consult to treatment. Mid-year data showed median waits lengthening by 7 days, even as systemwide surgeries totaled 2,330,200—illustrating throughput pressure on ophthalmology operating lists. In Mexico, the ministry identifies 760,000 people requiring cataract intervention, a quantified backlog that strains regional surgical campaigns. Even in the U.S., OR block availability depends on ASC capacity, which—though extensive at 6,308 centers—can be locally constrained by staffing and anesthesia coverage. Persistent wait-time pressure can defer IOL procedures and complicate case mix with denser cataracts.

Clinical complexity from comorbidities (more intensive peri-operative care): Large diabetic populations heighten cataract surgical complexity, necessitating additional imaging, anti-VEGF coordination, and post-op monitoring—absorbing clinic and OR resources. The U.S. has 38.4 million people with diabetes; Canada counts 3.7 million; Mexico reports 14.6 million adults affected. Higher rates of diabetic retinopathy and macular edema in these cohorts make IOL selection and refractive targeting more nuanced, while non-ocular comorbidities extend pre-admission workups. These burdens contribute to longer clinical pathways and can reduce daily surgical throughput—an operational challenge for ophthalmology service lines intent on maintaining high-volume IOL programs.

Household affordability headwinds for premium lenses (elective add-ons face budget limits): While standard monofocal IOLs are publicly/insurance covered, premium lens adoption is sensitive to household budgets. U.S. median household income was 74,580 dollars; Canada’s median family after-tax income registered 60,800 dollars; Mexico’s households reported average quarterly current income of 63,695 pesos. These macro income levels, alongside inflation and out-of-pocket trade-offs, can temper demand for presbyopia-correcting, toric, or light-adjustable lenses that frequently involve patient-pay elements beyond standard coverage. Result: clinics must segment offers and financing paths carefully to convert refractive upgrades without suppressing overall surgical flow.

What are the Regulations and Initiatives which have Governed the Market:

FDA classification & review timelines (PMA pathway governs IOLs): Intraocular lenses are explicitly regulated as Class III devices under 21 CFR 886.3600, requiring PMA. Under MDUFA V performance goals, FDA’s average Total Time to Decision target of 290 days applies to original PMAs, shaping launch plans and evidence packages for monofocal, toric, multifocal/EDOF and LAL devices. FDA also recognizes IOL-specific consensus standards such as ISO 11979-10 for phakic IOL clinical investigations, which sponsors routinely cite in submissions and post-approval studies.

Health Canada medical device licensing (Class III review standard): Most IOLs are licensed as Class III medical devices by Health Canada. The Therapeutic Products Directorate lists a 75-day service standard for Class III medical device license reviews, which informs timeline commitments with Canadian distributors and hospital value-analysis committees. Provincial surgical programs then procure within public frameworks while adhering to national device regulations and labeling requirements. For market planning, the federal service standard anchors clinical evidence timing and local economic evaluations prior to provincial formulary or bulk-buy adoption in cataract pathways.

COFEPRIS sanitary registration (RIS timelines for devices): COFEPRIS regulates IOLs under the Reglamento de Insumos para la Salud, which stipulates decision timelines; for higher-risk devices, the resolution window is commonly 60 business days following complete dossier submission. Post-approval, establishments that import or distribute surgical devices must hold appropriate sanitary authorizations and comply with labeling in Spanish. These statutory timeframes guide project milestones for multinational IOL suppliers seeking registration updates for toric, multifocal, or accommodative indications and align with national public-health campaigns addressing cataract blindness.

North America Intraocular Lens Market Segmentation

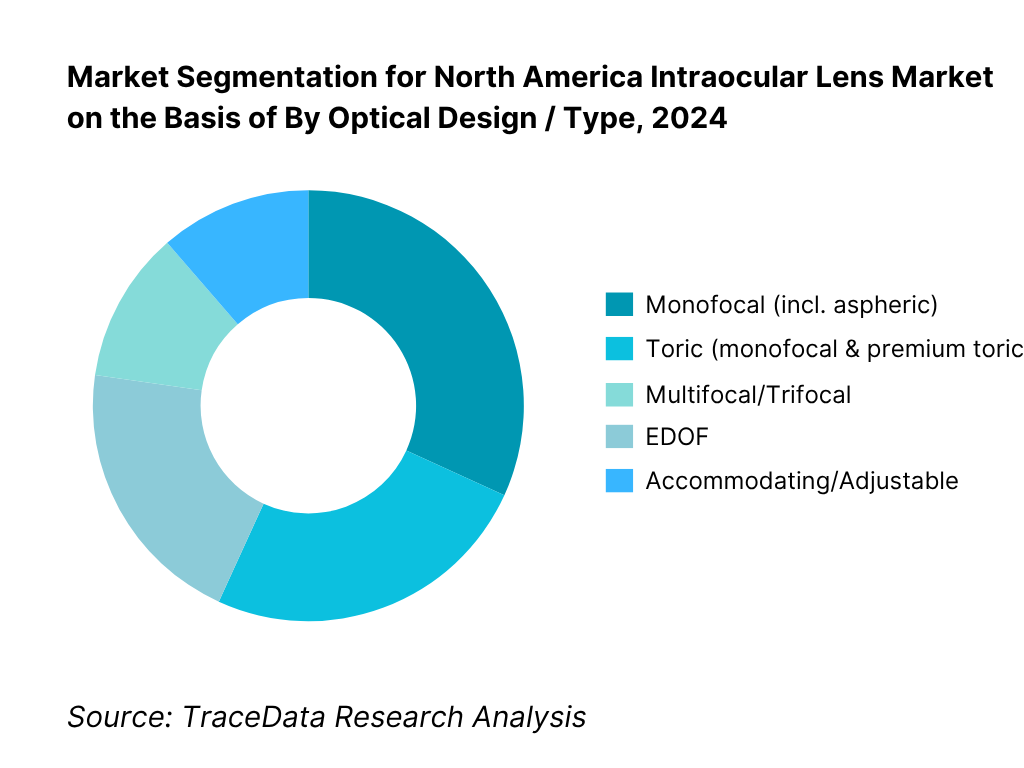

By Optical Design / Type: The North America intraocular lens market is segmented by type into monofocal, toric, multifocal/trifocal, EDOF, accommodating/adjustable, and phakic IOLs. Monofocal lenses hold the dominant share because they are covered under Medicare and most commercial plans for cataract surgery, aligning with surgeon workflow and patient affordability; toric monofocals add astigmatism correction without shifting reimbursement fundamentals. Premium presbyopia-correcting IOLs (multifocal/trifocal and EDOF) grow rapidly where centers have strong counseling and financing, but adoption remains capped by out-of-pocket costs and patient selection criteria. Adjustable and phakic IOL niches expand off a small base via technology-led differentiation and targeted indications.

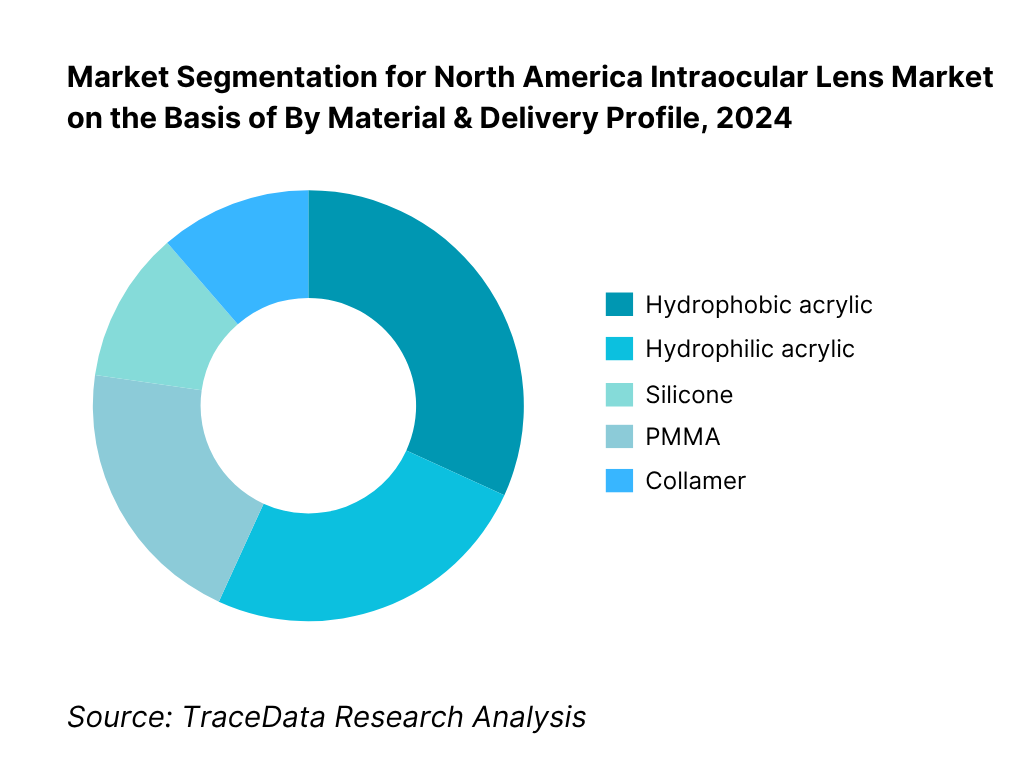

By Material & Delivery Profile: The market is segmented by material into hydrophobic acrylic, hydrophilic acrylic, silicone, PMMA and collamer. Hydrophobic acrylic dominates due to its high refractive index, low water content, optical clarity, and compatibility with small-incision, preloaded delivery systems, which shorten OR time and enhance consistency. Hydrophilic acrylic maintains a role in specific surgical preferences and complex cases. Silicone persists in legacy portfolios and certain surgeon preferences, while PMMA is mostly reserved for special indications. Collamer use is largely tied to phakic indications and select refractive programs.

Competitive Landscape in North America Intraocular Lens Market

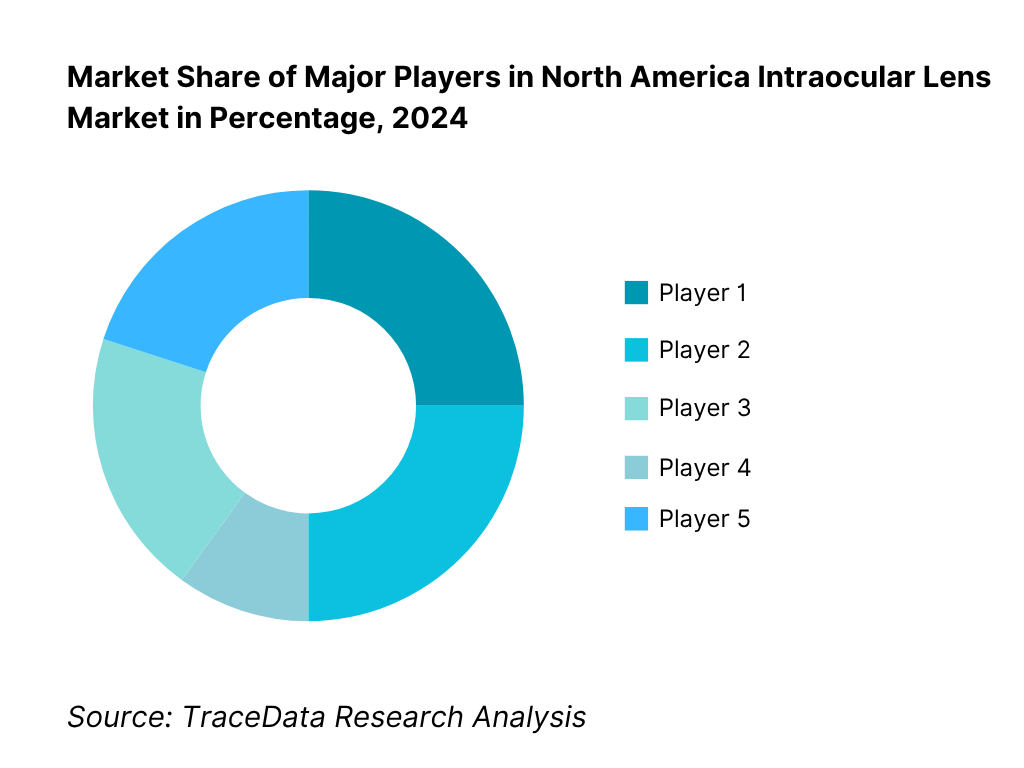

The North America IOL market is led by diversified multinationals with deep surgical ecosystems and broad ranges spanning monofocal, toric and presbyopia-correcting designs. Alcon and Johnson & Johnson Vision anchor the premium and monofocal segments through extensive surgeon education and ASC integration; Bausch + Lomb, Carl Zeiss Meditec and HOYA Surgical Optics round out the top tier with strong channel partnerships and selective innovations across materials, preloaded systems and toric ranges.

Name | Founding Year | Original Headquarters |

Alcon | 1945 | Fort Worth, Texas, USA |

Johnson & Johnson Vision | 1976 | Santa Ana, California, USA |

Bausch + Lomb | 1853 | Rochester, New York, USA |

Carl Zeiss Meditec | 2002 | Jena, Germany |

HOYA Surgical Optics | 1987 | Singapore, Singapore |

Rayner | 1910 | London, United Kingdom |

STAAR Surgical | 1982 | Monrovia, California, USA |

Lenstec | 1993 | St. Petersburg, Florida, USA |

RxSight | 1997 | Aliso Viejo, California, USA |

Ophtec | 1983 | Groningen, Netherlands |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Alcon: Introduced the next-gen Clareon PanOptix Pro presbyopia-correcting IOL, citing 94% light utilization and half the light scatter vs Clareon PanOptix, and spotlighted Vivity as the most-implanted EDOF IOL worldwide in recent launches and conference updates. These moves reinforce Alcon’s premium mix strategy alongside its broad Clareon collection and preloaded delivery systems, keeping surgeons engaged across ASC and HOPD settings.

Johnson & Johnson Vision: Rolled out the TECNIS Odyssey “full-range” IOL platform, with company-reported outcomes such as 93% of patients free from glasses at all distances and improved small-print readability vs a leading trifocal. While initially launched outside the U.S., Odyssey signals an advancing presbyopia roadmap that complements ongoing momentum with TECNIS Eyhance / Eyhance Toric II and the Simplicity delivery system in North American practices.

Bausch + Lomb: Managed a voluntary U.S. recall of select enVista models (Aspire™, Envy™, and certain monofocals) and subsequently announced a return to full production and U.S. market supply. The sequence underscores active quality-system vigilance and the company’s intent to normalize inventory for cataract programs while continuing to support presbyopia and small-aperture options within its broader portfolio.

RxSight: Continued commercialization of its Light Adjustable Lens (LAL) platform, reporting $40.2 million revenue in Q4 2024 (up 41% YoY) as the installed base expanded with LAL+; however, mid-2025 guidance was revised, with preliminary Q2 revenue of ~$33.6 million and a reset to the commercial approach to bolster practice success. The dynamics highlight both the category’s differentiation and the execution intensity required in premium IOL adoption.

Rayner: Closed recruitment in its U.S. IDE study for RayOne EMV Toric (June 2024), a step toward potential U.S. commercialization of its “enhanced monovision” toric design. The program widens surgeon choice in range-of-vision strategies for astigmatic patients and underscores ongoing competitive innovation in premium optics for the North American market.

What Lies Ahead for North America Intraocular Lens Market?

Over the next five years, North America’s IOL market should see steady, procedure-anchored expansion. Cataract surgery remains one of the highest-volume operations in the region and is reimbursed for a conventional IOL under Medicare in the U.S., sustaining the core base of demand across ASCs and hospital outpatient departments. Momentum on the premium side is reinforced by continuous product refreshes (non-diffractive EDOF, enhanced-monofocal, small-aperture, light-adjustable) and a healthy cadence of FDA decisions and label updates that keep surgeons engaged with newer optics and delivery systems.

Rise of hybrid-optic strategies: Premium mix is shifting from “single-technology bets” to hybrid approaches that blend non-diffractive EDOF, enhanced-monofocal, toric correction and mini-monovision protocols to dial in range of vision while managing dysphotopsia. A notable proof point is Alcon’s non-diffractive EDOF platform, which surpassed the one-million global implant milestone—signaling broad surgeon comfort with wavefront-shaping optics now common in North American practices. At the same time, J&J’s TECNIS Eyhance line continues to see iterative FDA supplements (including Simplicity and Toric II delivery updates), illustrating how “enhanced-monofocal” designs are maturing as everyday upgrades. Expect continued surgeon experimentation with mix-and-match lens strategies tailored to patient tasks.

Sharper focus on outcome-based value: Reimbursement still anchors monofocal volumes, but provider competition is increasingly decided on functional-vision outcomes, refractive precision, OR efficiency and patient-reported measures—not just on list prices. Medicare’s clear statement that it covers a conventional IOL when implanted during cataract surgery secures baseline flow, while premium conversions hinge on practices’ ability to demonstrate fewer enhancements, stable toric alignment and smoother chair-time. Image-guided alignment, intra-op aberrometry and preloaded injectors will keep spreading because they compress variability and throughput friction—key in a U.S. setting performing ~3.7–4.0 million cataract procedures annually and in Canadian systems that operate under a 112-day benchmark for access.

Expansion of indication-specific solutions: Pipeline breadth now targets previously underserved scenarios—irregular corneas, post-refractive eyes and complex astigmatism. The FDA approval of the IC-8 Apthera small-aperture IOL introduced pinhole-based EDOF for eyes where diffractive optics may be less predictable; meanwhile RxSight’s LAL+ commercial launch extended post-operative adjustability, letting surgeons fine-tune refraction in vivo. Together with continuing toric range extensions across families, these options let clinics increase candidacy and confidence in premium upgrades, widening the practical addressable pool without compromising safety or workflow.

Digital planning, data science and service-model innovation.: The next leg of differentiation will come from tighter integration of diagnostics, planning software and surgical platforms—using biometry data and modern formulas alongside image-guided alignment to reduce residual cylinder and refractive surprises. Professional guidance on coding and billing for premium lenses is also becoming more standardized, enabling practices to operationalize counseling and patient-pay workflows more consistently. Expect vendors to lean harder into connected planning suites, outcome registries, and training ecosystems that shorten learning curves and stabilize results across diverse surgeon cohorts and facility types.

North America Intraocular Lens Market Segmentation

By Optical Design / Type

Monofocal (spherical, aspheric, enhanced-monofocal)

Presbyopia-correcting: EDOF (non-diffractive, diffractive), Multifocal/Trifocal

Accommodating / Light-Adjustable

Small-aperture (pinhole)

Phakic IOLs (adjacent refractive segment)

By Toricity (Astigmatism Correction)

Non-toric

Toric

By Material

Hydrophobic acrylic (glistening-resistant, high RI variants)

Hydrophilic acrylic (heparin-surface-modified options)

Silicone

PMMA

Collamer (phakic)

By Optical/Design Features

Aberration profile

Filters

Edge design

By Delivery System / Injector

Preloaded, single-use injector systems

Manual-load injectors (single-use / reusable)

Micro-incision compatibility (≤2.2 mm; sub-2.0 mm platforms)

Players Mentioned in the Report:

Key Target Audience

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

1. Executive Summary (key highlights: cataract surgery volumes, premium IOL conversion, ASP index, payer mix, ASC penetration, innovation cadence, supply status, leading players)

2. Research Methodology (top-down cataract volume triangulation, bottom-up SKU/ASP build, primary interviews with surgeons/ASC admins/distributors, secondary sources, assumptions & exclusions)

3. Ecosystem of Key Stakeholders in North America IOL Market (ophthalmic surgeons, ASCs/HOPDs, distributors & IDNs/GPOs, manufacturers/OEMs, payers-Medicare/Commercial/Provincial/IMSS, regulators-FDA/Health Canada/COFEPRIS, pre-op diagnostics vendors, patient advocacy groups)

4. Value Chain Analysis (polymer suppliers → molding/lathe cut → optic/haptic finishing → sterilization/packaging → distribution → OR insertion → post-op care & enhancements)

4.1 Care Delivery Model Analysis-ASC, Hospital Outpatient, Private Clinic, Academic Center, Tele-preop (margins by setting, surgeon preference, strengths/weaknesses, throughput & chair-time metrics)

4.2 Revenue Streams for IOL Market (standard reimbursed IOLs, premium/patient-pay upgrades-toric/EDOF/multifocal/small-aperture/light-adjustable, injectors & disposables bundles, rebates/volume tiers, training & digital planning add-ons)

4.3 Business Model Canvas for IOL Manufacturers & Providers (key partners, key activities, value propositions, channels, customer segments, cost structure, revenue structure)

5. Market Structure (standard reimbursed vs premium patient-pay segments; direct vs distributor sales; contract/GPO dynamics; consignment models)

5.1 Independent Surgeons vs Employed/IDN Surgeons (case mix, premium conversion, device choice latitude, contracting constraints)

5.2 Investment Model in IOL Market (phaco/femto capex, injector/ancillary kits, inventory carrying cost, training center capex, ROI horizons)

5.3 Comparative Analysis of the Patient-Acquisition Funnel-Private/Patient-Pay vs Public Payer (referral sources, eligibility & counseling, conversion levers, billing workflows across U.S./Canada/Mexico)

5.4 IOL Procurement & Premium-Upgrade Budget Allocation by Facility Size (high-volume ASC, medium center, small clinic; allocation shares & thresholds)

6. Market Attractiveness for North America IOL Market (growth/profit pools by optic class & setting, entry barriers, regulatory friction, competitive intensity, switching costs)

7. Supply-Demand Gap Analysis (cataract backlog vs OR capacity, surgeon density, premium inventory availability, sterilization & logistics constraints)

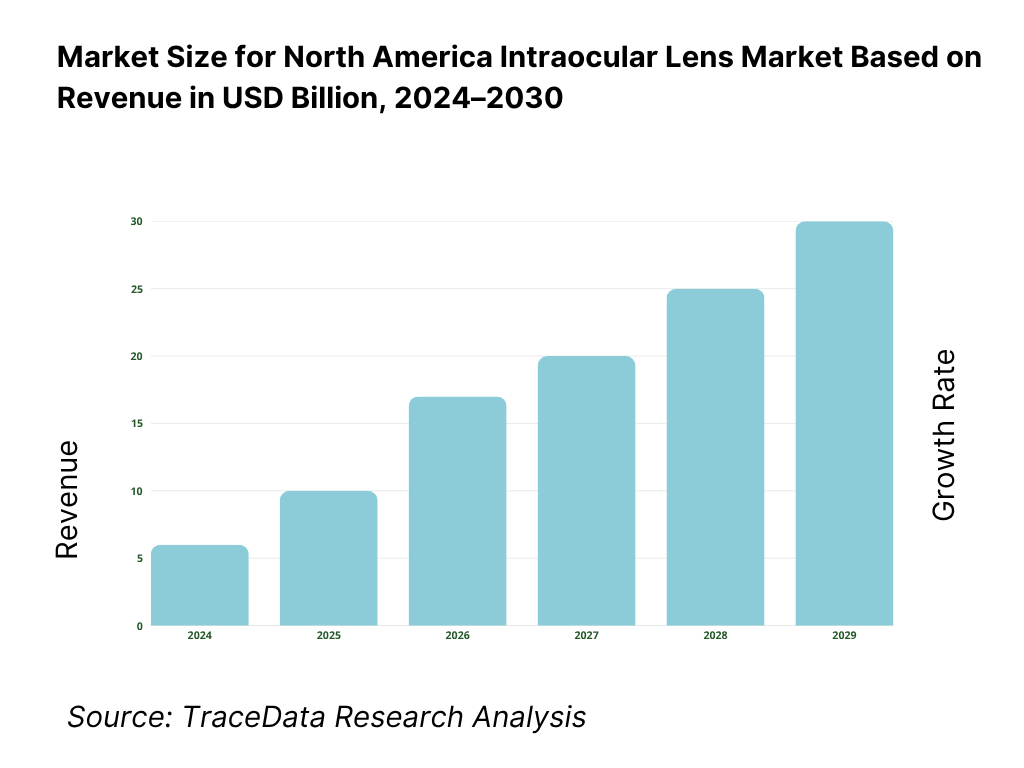

8. Market Size for North America IOL Market Basis

8.1 Revenues (Historical to Current Base Period)

9. Market Breakdown for North America IOL Market Basis

9.1 By Market Structure (standard reimbursed IOLs vs premium/patient-pay IOLs)

9.2 By Optic Type (monofocal, enhanced monofocal, EDOF, multifocal/trifocal, accommodating)

9.3 By Patient/Procedure Profile (age-related cataract, refractive lens exchange, post-refractive cornea, combined cataract+glaucoma, pediatric/aphakia)

9.4 By Facility Size (high-volume ASCs, medium centers, small clinics)

9.5 By Surgeon Cohort (refractive cataract specialists, high-volume cataract surgeons, general ophthalmologists, supervised residents/fellows)

9.6 By Surgical Technique/Platform (phaco only, femto-assisted, MIGS combo, intra-op aberrometry guidance)

9.7 By Procurement Model (GPO/IDN contracted, direct-to-facility, consignment, bundled with ancillaries)

9.8 By Country & Sub-Region (U.S.-Northeast/Midwest/South/West; Canada-Atlantic/Quebec/Ontario/Prairies/B.C.; Mexico-North/Central/West/Southeast)

10. Demand-Side Analysis for North America IOL Market

10.1 Provider Landscape & Cohort Analysis (ASC ownership patterns, chain vs independent, academic hubs)

10.2 Decision-Making Process (surgeon preferences, committee approvals, payer policy alignment, patient counseling for premium upgrades)

10.3 Program Effectiveness & ROI Analysis (visual outcome KPIs-UDVA/UIVA/UNVA distributions, enhancement rates, premium conversion ROI, OR throughput)

10.4 Gap Analysis Framework (capability gaps in diagnostics, counseling, inventory, post-op touchpoints)

11. Industry Analysis

11.1 Trends & Developments (non-diffractive EDOF, wavefront shaping, preloaded standardization, small-incision optics, post-op adjustability, data-driven formulas)

11.2 Growth Drivers (aging demographics, ASC penetration, patient-pay acceptance, toric under-correction opportunity, technology refresh cycles)

11.3 SWOT Analysis (product pipelines, KOL networks, regulatory stance, channel depth)

11.4 Issues & Challenges (dysphotopsia management, rotational stability, pricing pressure, recall risks, coding/coverage nuances)

11.5 Regulatory & Reimbursement (FDA/Health Canada approvals, CMS coverage & patient-shared billing, provincial payer nuances, UDI/MDR reporting)

12. Snapshot on Digital Surgical Planning & Online Patient-Education Ecosystem

12.1 Market Size & Future Potential (Digital Planning/Tele-ophthalmology Adjacent to IOL)

12.2 Business Model & Revenue Streams (software licenses, per-case fees, device tie-ins, education subscriptions)

12.3 Delivery Models & Module Types Offered (IOL calculation, toric alignment planners, chair-side education, remote consent tools)

13. Opportunity Matrix for North America IOL Market-Radar Chart (white-space by optic class, setting, country/sub-region, procurement model, surgeon cohort)

14. PEAK Matrix Analysis for North America IOL Market (leaders, major contenders, aspirants-capabilities vs market impact)

15. Competitor Analysis for North America IOL Market

15.1 Market Share of Key Players (Basis Revenues-Current Period)

15.2 Benchmark of Key Competitors (company overview, USP, strategy, portfolio breadth, SKU counts, pricing by class, technology platform, best-selling SKUs, major IDN/GPO clients, tie-ups, marketing playbook, recent developments)

15.3 Operating Model Analysis Framework (manufacturing footprint, sterilization & packaging, inventory/consignment practices, training centers)

15.4 Gartner-Style Quadrant View (vision vs execution; premium innovation vs scale)

15.5 Bowman’s Strategic Clock for Competitive Advantage (price/value positioning across standard & premium ranges)

16. Future Market Size for North America IOL Market Basis

16.1 Revenues (Forecast Horizon: Base, Upside, Downside Scenarios)

17. Market Breakdown for North America IOL Market Basis (Forecast)

17.1 By Market Structure (standard reimbursed vs premium/patient-pay)

17.2 By Optic Type (monofocal, enhanced monofocal, EDOF, multifocal/trifocal, accommodating)

17.3 By Patient/Procedure Profile (age-related cataract, refractive lens exchange, post-refractive, combined cataract+glaucoma, pediatric/aphakia)

17.4 By Facility Size (high-volume ASC, medium center, small clinic)

17.5 By Surgeon Cohort (refractive cataract specialists, high-volume cataract surgeons, general ophthalmologists, trainees-supervised)

17.6 By Surgical Technique/Platform (phaco only, femto-assisted, MIGS combo, intra-op aberrometry)

17.7 By Procurement Model (GPO/IDN, direct, consignment, bundled)

17.8 By Country & Sub-Region (U.S., Canada, Mexico with sub-regional splits)

18. Market Analysts’ Recommendations

19. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the North America Intraocular Lens (IOL) Market. Based on this ecosystem, we will shortlist leading 5–6 IOL providers in the region based on their financial information, market reach, and client base. Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the market revenues, number of IOL providers, pricing structures, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various North America Intraocular Lens (IOL) Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, pricing, and other factors.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process.

FAQs

01 What is the potential for the North America Intraocular Lens (IOL) Market?

The North America Intraocular Lens (IOL) market shows strong potential anchored by consistently high cataract surgery volumes, entrenched reimbursement for conventional monofocal lenses, and expanding adoption of premium optics such as toric, EDOF, trifocal, small-aperture, and light-adjustable IOLs. Robust ASC infrastructure, mature surgeon training ecosystems, and continuous product refresh cycles (including preloaded delivery systems and image-guided alignment) further support penetration. Together, these dynamics create a durable, procedure-led market with attractive upsell pathways into presbyopia-correcting and astigmatism-correcting segments across the U.S., Canada, and Mexico.

02 Who are the Key Players in the North America Intraocular Lens (IOL) Market?

The competitive field is led by multi-platform ophthalmic companies with broad portfolios and deep surgeon education programs, notably Alcon, Johnson & Johnson Vision, Bausch + Lomb, Carl Zeiss Meditec, and HOYA Surgical Optics. Important challengers and specialists include Rayner, RxSight (light-adjustable IOL), Lenstec, Teleon Surgical, Ophtec, HumanOptics, SIFI, VSY Biotechnology, Sav-IOL, and STAAR Surgical (adjacent phakic ICL category). Their differentiation spans optics design, preloaded injectors, toric ranges, clinical evidence depth, channel partnerships, and integrated diagnostic-to-surgery ecosystems.

03 What are the Growth Drivers for the North America Intraocular Lens (IOL) Market?

Growth is propelled by demographic aging that expands the surgical pool; widespread reimbursement for standard monofocal IOLs that anchors baseline procedures; and steady innovation in premium optics that improves functional vision and expands candidacy (e.g., non-diffractive EDOF, advanced toric stability, small-aperture designs, and post-op adjustability). Additional impetus comes from ASC penetration that boosts throughput, improved biometry and image-guided alignment reducing refractive surprises, and increasingly standardized patient-pay pathways that make premium upgrades more accessible for suitable candidates.

04 What are the Challenges in the North America Intraocular Lens (IOL) Market?

Key challenges include capacity and access constraints in publicly funded systems and localized staffing bottlenecks that can elongate wait times; clinical complexity from comorbidities (e.g., diabetes and retinal disease) that raise pre-/post-op resource needs and complicate IOL selection; and variability in patient-pay affordability for premium lenses, requiring careful counseling, financing options, and expectation setting. Additionally, rigorous Class III regulatory processes, vigilance around dysphotopsia and rotational stability, and supply chain/sterility discipline demand sustained investment from manufacturers and providers alike.