Norway Cold Chain Market Outlook to 2029

By Market Structure, By Storage and Transportation Modes, By End-User Industries (Pharmaceuticals, Food & Beverage, Chemicals, etc.), By Temperature Range, and By Region

- Product Code: TDR0300

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Norway Cold Chain Market Outlook to 2029 – By Market Structure, By Storage and Transportation Modes, By End-User Industries (Pharmaceuticals, Food & Beverage, Chemicals, etc.), By Temperature Range, and By Region” provides a comprehensive analysis of the cold chain industry in Norway. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Norway Cold Chain Market Overview and Size

The Norway cold chain market was valued at NOK 8.5 billion in 2023, driven by the growing need for temperature-sensitive storage and transportation solutions in industries such as pharmaceuticals, seafood exports, and frozen food. The market is characterized by key players such as Bring Frigo, Thermo-Transit, Nor Lines, DB Schenker, and DHL Supply Chain. These companies are known for their robust infrastructure, advanced cold storage capabilities, and compliance with European and Norwegian temperature control regulations.

In 2023, Bring Frigo expanded its cold storage facilities near Oslo to meet growing demand from e-commerce grocery and healthcare clients. The cities of Oslo, Bergen, and Trondheim emerged as critical cold chain hubs due to their logistics connectivity, population density, and access to major food production and healthcare facilities.

What Factors are Leading to the Growth of the Norway Cold Chain Market:

Export-Oriented Seafood Sector: Norway’s position as one of the world’s top exporters of fresh and frozen seafood has significantly boosted investments in cold chain infrastructure. In 2023, seafood alone accounted for over 50% of cold chain volume in Norway, necessitating highly specialized temperature control systems, particularly for salmon and cod exports to Asia and Europe.

Pharmaceutical Demand: With the rise in biologics and vaccine logistics post-COVID-19, pharmaceutical cold chain logistics have grown considerably. In 2023, over 70% of pharmaceutical transport in Norway required cold chain compliance. Strict EU Good Distribution Practices (GDP) further strengthens the demand for certified providers.

Sustainability & Regulation: Norway’s environmental policies and push for carbon-neutral logistics have driven companies to invest in energy-efficient cold storage units and electric refrigerated trucks. In 2023, about 25% of newly procured cold chain vehicles in the country were electric, supported by government grants and carbon tax incentives.

Which Industry Challenges Have Impacted the Growth for Norway Cold Chain Market

High Operating Costs and Energy Consumption: One of the key challenges facing Norway’s cold chain industry is the high energy cost associated with refrigeration and storage, especially in remote and sub-Arctic areas. Electricity accounts for nearly 40–50% of cold storage operational expenditure, and despite Norway’s access to renewable energy, energy efficiency remains a concern. This has impacted the profitability of small-scale logistics providers and deterred new entrants.

Geographical and Climatic Complexity: Norway’s rugged terrain, fjords, and long winter months present logistical challenges for cold chain transportation. According to industry estimates, around 30% of temperature-sensitive deliveries experience delays due to difficult terrain or harsh weather conditions, especially in the northern and inland regions. This reduces the reliability of just-in-time deliveries for sectors such as pharmaceuticals and fresh seafood.

Workforce Shortages and Skill Gaps: The cold chain sector requires specialized handling of temperature-sensitive goods, but a shortage of trained technicians, drivers, and warehouse operators continues to affect service quality. As of 2023, around 18% of cold chain companies in Norway reported difficulty hiring qualified cold storage operators and vehicle handlers, particularly for GDP- and HACCP-compliant operations.

What are the Regulations and Initiatives which have Governed the Market

GDP Compliance for Pharmaceutical Logistics: The Norwegian Medicines Agency mandates that all pharmaceutical cold chain logistics must comply with the EU’s Good Distribution Practice (GDP) guidelines. This includes monitoring temperature throughout the supply chain, maintaining validated storage equipment, and ensuring staff training. By 2023, over 85% of pharma cold chain operators in Norway had obtained GDP certification.

Norwegian Climate Action Plan & Electrification Incentives: Under its 2021–2030 Climate Action Plan, Norway has implemented aggressive targets to reduce emissions in the transport and logistics sector. Cold chain operators are incentivized to shift toward electric refrigerated trucks through subsidies covering up to 50% of vehicle procurement costs. As of 2023, about 12% of Norway’s cold chain transport fleet was electric or hybrid.

Import Controls for Food Safety: The Norwegian Food Safety Authority (Mattilsynet) enforces strict checks for imported perishable goods, requiring cold chain certification for all seafood, dairy, and meat imports. This includes traceability, temperature logging, and sanitary compliance. In 2023, nearly 95% of food importers utilized certified cold chain logistics providers to meet import regulations.

Norway Cold Chain Market Segmentation

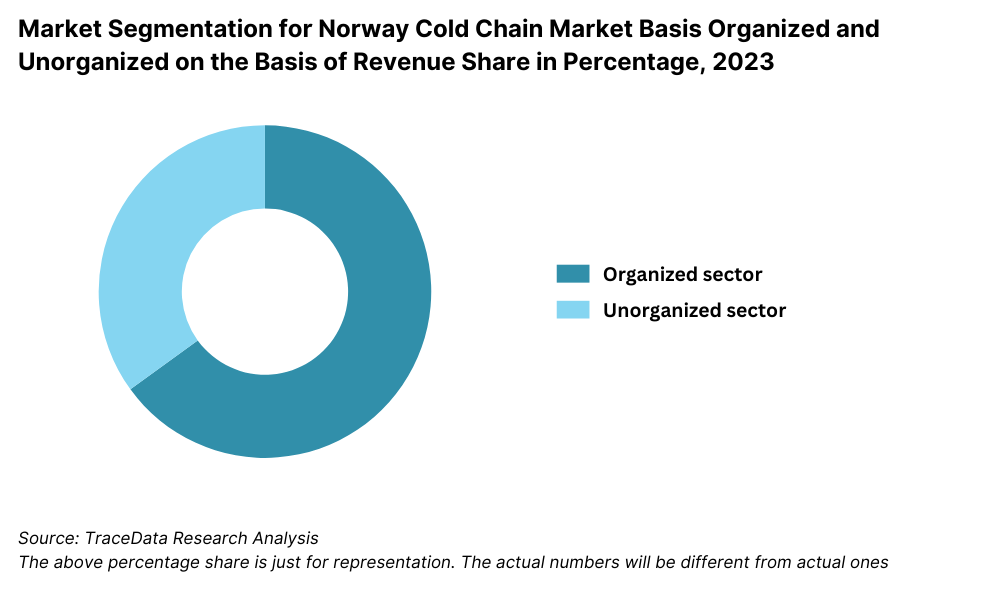

By Market Structure: The organized segment dominates Norway’s cold chain market, primarily driven by established logistics companies and third-party providers with GDP- and HACCP-compliant infrastructure. These players ensure regulatory adherence, real-time temperature monitoring, and consistent service levels—especially important in pharmaceuticals and high-value food exports. The unorganized sector, including small-scale operators and regional fleets, plays a relatively smaller role, mainly serving local food producers and rural areas, but faces challenges in scaling up due to compliance costs and limited digital adoption.

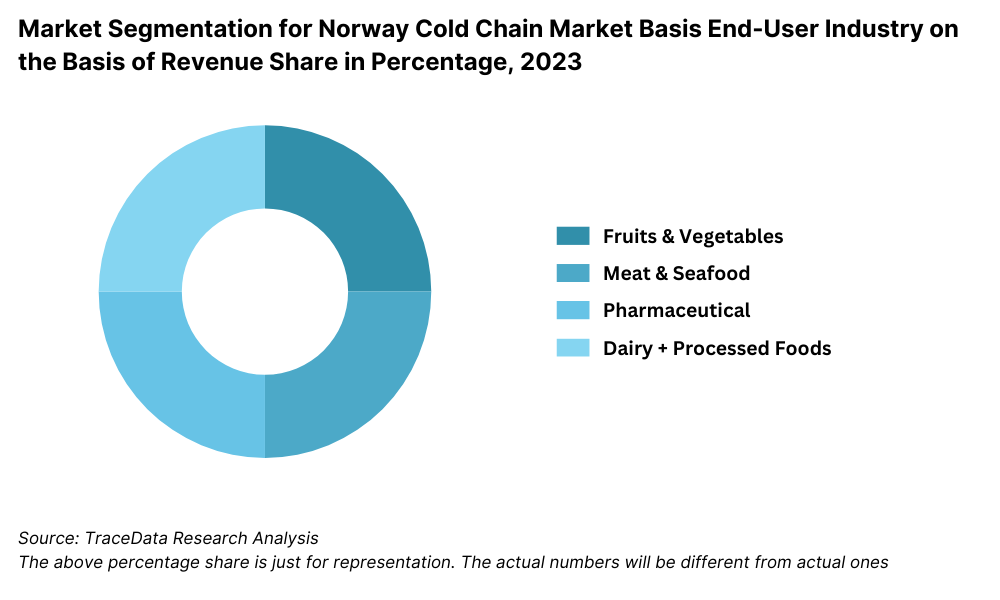

By End-User Industry: The seafood industry holds the largest share of the cold chain demand due to Norway’s status as a global leader in salmon exports. These products require precise cold storage from harvest to international delivery. Pharmaceuticals form the second-largest segment, driven by increasing demand for biologics, vaccines, and temperature-sensitive medicines. The food & beverage sector, including dairy, frozen foods, and fresh produce, is also a major contributor, supported by rising consumer demand for ready-to-eat and perishable grocery products.

By Temperature Range: The cold (0°C to 8°C) category dominates due to its applicability across pharmaceuticals, dairy, and seafood. Frozen storage (-18°C and below) is the second-largest segment, primarily used for processed meat, frozen bakery items, and export-bound seafood. Ultra-cold segments (below -60°C), while niche, are increasingly relevant for specialty pharmaceuticals and research use, especially after the pandemic.

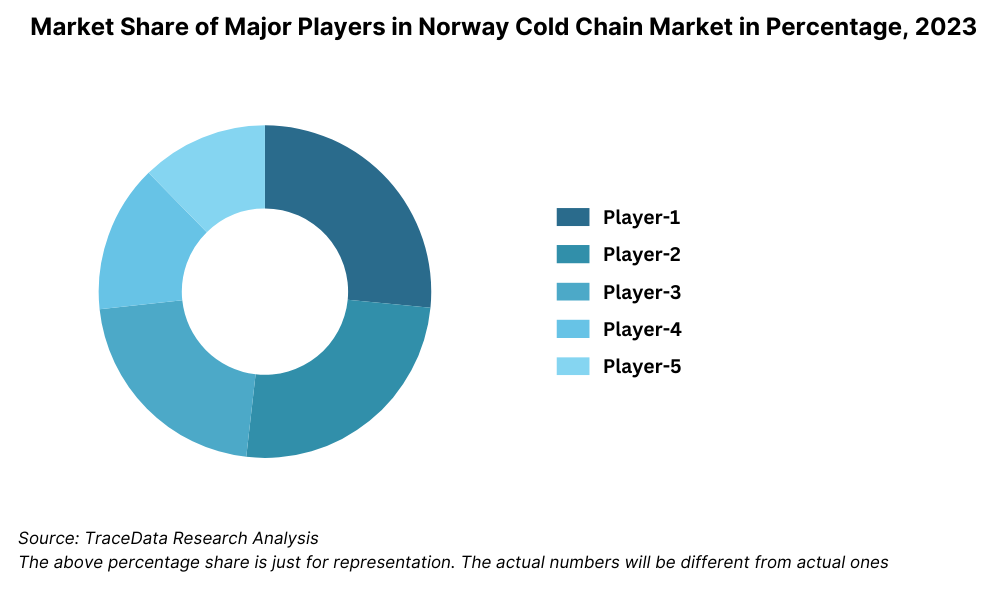

Competitive Landscape in Norway Cold Chain Market

The Norway cold chain market is moderately concentrated, with a mix of established international logistics players and specialized domestic cold chain providers. While legacy firms like Bring Frigo and DB Schenker dominate large-scale and pharma-oriented operations, the entry of niche regional players and investment in cold logistics digitization has added more diversity and efficiency to the market.

Company | Establishment Year | Headquarters |

Bring Frigo | 2002 | Oslo, Norway |

Thermo-Transit | 1987 | Stjørdal, Norway |

Nor Lines | 1984 | Tromsø, Norway |

DB Schenker Norway | 1872 (global) | Oslo, Norway |

DHL Supply Chain | 1969 (global) | Oslo, Norway |

Some of the recent competitor trends and key information about competitors include:

Bring Frigo: Norway’s leading cold logistics provider, Bring Frigo expanded its Oslo-region cold storage capacity by 25% in 2023 to support rising demand from pharma and seafood sectors. It also introduced AI-powered temperature monitoring systems for its reefer fleet to enhance compliance and reduce energy consumption.

Thermo-Transit: Known for its pan-Nordic reach, Thermo-Transit saw a 12% increase in refrigerated cross-border shipments to Germany and the Netherlands in 2023. The company upgraded its mobile tracking system, allowing real-time temperature and humidity checks for perishable food exports.

Nor Lines: A key cold logistics player in coastal Norway, Nor Lines operates hybrid vessels with cold chain capabilities, facilitating sustainable seafood exports. In 2023, the company signed a strategic partnership with Norwegian salmon exporters, boosting outbound logistics volume by 18%.

DB Schenker Norway: Leveraging its global pharmaceutical logistics expertise, DB Schenker reported a 20% increase in pharma cold chain contracts in Norway in 2023. The firm invested in GDP-certified temperature-controlled warehouses in Stavanger and Bergen, aimed at meeting EU regulatory standards.

DHL Supply Chain: DHL continued scaling its cold chain footprint in Norway by launching its “CoolSolutions” service for frozen and chilled food delivery. In 2023, DHL handled over 9,000 temperature-sensitive shipments, and is now piloting electric refrigerated trucks for Oslo-based intra-city deliveries.

What Lies Ahead for Norway Cold Chain Market?

The Norway cold chain market is projected to grow steadily through 2029, supported by rising demand in pharmaceutical logistics, expansion of seafood exports, and digital transformation across logistics operations. The market is expected to exhibit a moderate to strong CAGR during the forecast period, backed by regulatory compliance requirements, electrification initiatives, and the continued rise in e-grocery demand.

Expansion of Pharmaceutical and Biotech Cold Logistics: As Norway strengthens its role in the European biotech and pharmaceutical supply chain, the demand for ultra-cold and highly controlled logistics is set to rise. Growth in biologics, specialty vaccines, and personalized medicine will drive demand for GDP-compliant storage and temperature-controlled distribution channels.

Electrification and Green Logistics: With Norway aiming to become carbon-neutral by 2030, cold chain providers are expected to increase investment in electric refrigerated trucks, solar-powered cold storage, and AI-based energy optimization systems. These green logistics solutions will not only reduce emissions but also attract clients with strong ESG mandates.

Growth of Seafood Export Infrastructure: Norway’s salmon exports are forecasted to reach record levels by 2029, necessitating further development of port-based cold storage hubs and reefer vessel capacity. Emerging export markets in Asia and the Middle East will push logistics players to build more resilient and scalable cold chain networks.

Digital Transformation and Automation: The adoption of IoT-enabled sensors, real-time shipment tracking, and automated storage systems is expected to increase significantly. These technologies will enhance traceability, reduce spoilage, and improve compliance across food and pharma logistics. By 2029, over 60% of organized cold chain providers are expected to offer fully integrated digital visibility platforms to their clients.

%2C%202023-2029.png)

Norway Cold Chain Market Segmentation

• By Market Structure:

o Organized Logistics Providers

o Unorganized/Regional Cold Chain Operators

o Third-Party Logistics (3PL) Providers

o Integrated Supply Chain Companies

o Port-Linked Cold Storage Facilities

o On-Site Cold Rooms (Food Processing, Pharma Plants)

• By End-User Industry:

o Seafood and Aquaculture

o Pharmaceuticals and Biotechnology

o Dairy and Frozen Foods

o Fruits and Vegetables

o Meat and Poultry

o Chemicals and Industrial Applications

• By Temperature Range:

o Chilled (0°C to +8°C)

o Frozen (-18°C and below)

o Ultra-Cold (-60°C and below)

o Ambient-Controlled Logistics (15°C to 25°C)

• By Transportation Mode:

o Road Refrigerated Transport

o Reefer Shipping Vessels

o Cold Chain Air Freight

o Intermodal Rail with Cold Containers

• By Storage Type:

o Centralized Cold Warehouses

o Multi-Temperature Warehouses

o Last-Mile Cold Hubs

o Mobile Refrigerated Units

• By Region:

o Eastern Norway (Oslo, Akershus, Østfold)

o Western Norway (Bergen, Rogaland)

o Northern Norway (Troms, Finnmark, Nordland)

o Central Norway (Trøndelag)

o Southern Norway (Agder region)

Players Mentioned in the Report:

• Bring Frigo

• Thermo-Transit

• Nor Lines

• DB Schenker Norway

• DHL Supply Chain

• Greencarrier

• Posten Norge

• Airsped Logistics

Key Target Audience:

• Cold Chain Logistics Companies

• Pharmaceutical Distributors and Manufacturers

• Seafood Exporters

• E-Grocery and Food Retailers

• Government and Regulatory Bodies (e.g., Norwegian Food Safety Authority, Norwegian Medicines Agency)

• Technology Providers (IoT, Temperature Monitoring, WMS)

• Infrastructure Investors

• Research and Development Institutions

Time Period:

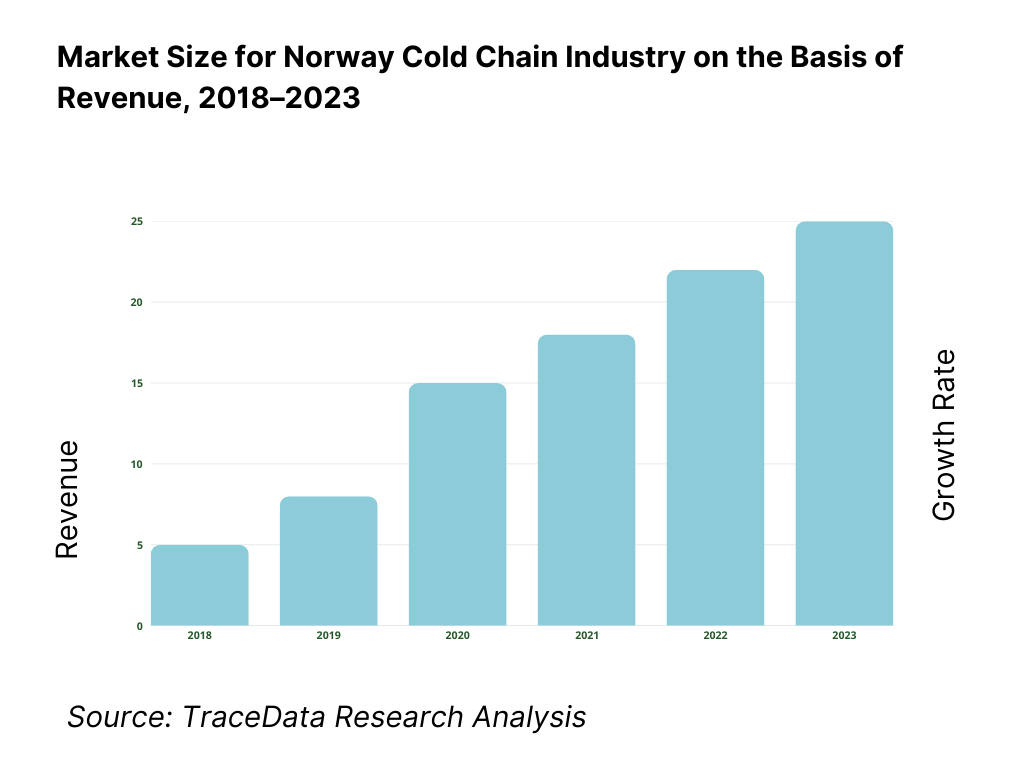

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Norway Cold Chain Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Norway Cold Chain Market

4.3. Business Model Canvas for Norway Cold Chain Market

4.4. Procurement Decision-Making Process (Cold Storage and Logistics Services)

4.5. Supply Chain Decision-Making Process (Logistics Partners, Modes, Route Planning)

5. Market Structure

5.1. Cold Chain Infrastructure Overview in Norway

5.2. Cold Chain Investment Trends, 2018-2024

5.3. Cold Storage Capacity vs. Demand by Region, 2024

5.4. Number of Cold Chain Logistics Providers by Region

6. Market Attractiveness for Norway Cold Chain Market

7. Supply-Demand Gap Analysis

8. Market Size for Norway Cold Chain Market Basis

8.1. Revenues, 2018-2024

8.2. Capacity (Cubic Meters / Pallets), 2018-2024

9. Market Breakdown for Norway Cold Chain Market Basis

9.1. By Market Structure (Organized vs. Unorganized), 2023-2024P

9.2. By End-User Industry (Seafood, Pharma, Food, etc.), 2023-2024P

9.3. By Temperature Range (Chilled, Frozen, Ultra-Cold), 2023-2024P

9.4. By Transportation Mode (Road, Reefer Vessels, Air, Rail), 2023-2024P

9.5. By Storage Type (Centralized Warehouses, Micro-Hubs, etc.), 2023-2024P

9.6. By Region (Eastern, Western, Northern, Southern, Central), 2023-2024P

10. Demand Side Analysis for Norway Cold Chain Market

10.1. Client Landscape and Segment Profiling

10.2. Industry-Specific Logistics Needs

10.3. Pain Points and Service Gaps

10.4. Evaluation Criteria for Logistics Providers

11. Industry Analysis

11.1. Trends and Developments in Norway Cold Chain Market

11.2. Growth Drivers for Norway Cold Chain Market

11.3. SWOT Analysis for Norway Cold Chain Market

11.4. Issues and Challenges in Norway Cold Chain Market

11.5. Government Regulations and Sustainability Policies

12. Snapshot on E-Grocery and Online Cold Chain Demand

12.1. Market Size and Future Potential for E-Grocery Deliveries

12.2. Fulfillment Models and Delivery Structures

12.3. Comparison of Cold Chain Usage by Online Grocery Companies

13. Norway Cold Chain Financing and Investment Landscape

13.1. Cold Storage Facility CAPEX Benchmarks

13.2. Government Subsidies and Green Infrastructure Funds

13.3. Financing Split by Bank, Private Equity, Public-Private

13.4. Incentives for Electrification and Solar Cooling

13.5. Cost of Operations Benchmark by Type and Region

14. Opportunity Matrix for Norway Cold Chain Market-Presented Using Radar Chart

15. PEAK Matrix for Cold Chain Service Providers in Norway

16. Competitor Analysis for Norway Cold Chain Market

16.1. Benchmark of Key Competitors by Company Overview, USP, Services, Compliance Certifications, Client Segments, Fleet Size, Storage Capacity, and Geographic Coverage

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Norway Cold Chain Market Basis

17.1. Revenues, 2025-2029

17.2. Storage Capacity, 2025-2029

18. Market Breakdown for Norway Cold Chain Market Basis

18.1. By Market Structure (Organized vs. Unorganized), 2025-2029

18.2. By End-User Industry, 2025-2029

18.3. By Temperature Range, 2025-2029

18.4. By Transportation Mode, 2025-2029

18.5. By Storage Type, 2025-2029

18.6. By Region, 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Norway Cold Chain Market. On the supply side, this includes cold storage providers, refrigerated transport operators, logistics integrators, and infrastructure players. On the demand side, key entities include seafood exporters, pharmaceutical manufacturers, frozen food distributors, and e-grocery platforms. Based on this mapping, we shortlist the leading 5–6 players across segments using filters such as operational scale, compliance certifications (GDP, HACCP), service portfolio, and customer base.

Sourcing is made through industry articles, government publications, trade association reports (e.g., Mattilsynet, Norsk Industri), and multiple secondary and proprietary databases to perform desk research around the market and collate industry-level insights.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This includes analyzing market reports, whitepapers, company filings, industry presentations, port traffic data, and energy usage statistics. This approach enables us to gather and validate insights on market revenue, cold storage capacity, transport fleet size, price benchmarks, regulatory landscape, and operational trends.

Additionally, company-level analysis is conducted using public filings, press releases, annual reports, and procurement disclosures to assess strategic moves, capacity additions, investments, partnerships, and customer contracts.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and operations managers representing various Norway Cold Chain Market participants—both from logistics providers and end-user industries (e.g., seafood processors, pharma manufacturers, online grocers). The objective is to validate desk research insights, authenticate statistical trends, and extract granular data around pricing, utilization rates, delivery timelines, and compliance costs.

As part of our validation strategy, we conduct disguised interviews with selected companies, posing as potential clients to evaluate service scope, rate cards, fleet availability, and quality assurance protocols. These interactions help confirm internal estimates and assess operational practices firsthand. Bottom-up analysis is used to estimate total market revenue based on capacity, throughput, and pricing at the company level.

Step 4: Sanity Check

- Both bottom-up and top-down modeling exercises are undertaken to ensure data consistency and perform a sanity check on revenue and volume estimates. Assumptions are validated across industry benchmarks and triangulated between supply-side capacity and demand-side shipment volumes.

FAQs

1. What is the potential for the Norway Cold Chain Market?

The Norway cold chain market holds strong growth potential, reaching a valuation of NOK 8.5 billion in 2023. This potential is driven by Norway’s position as a leading seafood exporter, increasing demand for temperature-sensitive pharmaceuticals, and the growth of e-grocery and online food services. The market is further supported by regulatory enforcement, sustainability goals, and investments in electrification and digital infrastructure.

2. Who are the Key Players in the Norway Cold Chain Market?

The Norway cold chain market is led by several key players, including Bring Frigo, Thermo-Transit, and Nor Lines. These companies have established themselves through their nationwide logistics networks, GDP/HACCP-compliant infrastructure, and specialization in seafood and pharma logistics. Other prominent players include DB Schenker Norway, DHL Supply Chain, and Greencarrier.

3. What are the Growth Drivers for the Norway Cold Chain Market?

Major growth drivers include the rising export volumes of Norwegian seafood, the increasing importance of cold storage for pharmaceutical and biotech products, and the government’s push toward carbon-neutral and sustainable logistics. Additionally, technological advancements such as IoT tracking, digital temperature logs, and automation are expected to streamline operations and increase efficiency across the value chain.

4. What are the Challenges in the Norway Cold Chain Market?

Key challenges in the Norway cold chain market include high operational and energy costs, especially in remote and sub-Arctic areas; geographic and climatic constraints affecting last-mile delivery; and a shortage of trained cold logistics professionals. Compliance with GDP and HACCP regulations also imposes cost pressures, particularly on small and mid-sized operators seeking to modernize their infrastructure.