Norway Logistics and warehousing Market Outlook to 2029

By Market Structure, By End-User Industries, By Mode of Transport, By Type of Warehousing, By Region, and By Ownership Models

- Product Code: TDR0301

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Norway Logistics and Warehousing Market Outlook to 2029 – By Market Structure, By End-User Industries, By Mode of Transport, By Type of Warehousing, By Region, and By Ownership Models” provides a comprehensive analysis of the logistics and warehousing industry in Norway. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the logistics and warehousing market. The report concludes with future market projections based on revenue, by segments, modes, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and risks.

Norway Logistics and Warehousing Market Overview and Size

The Norway logistics and warehousing market reached an estimated valuation of NOK 426 billion in 2023, driven by rising cross-border trade, expansion of e-commerce, and increased demand for cold chain and automated warehousing solutions. The market is characterized by the presence of key players such as Posten Bring, DB Schenker, DSV, DHL, ColliCare, and Greencarrier, offering a mix of freight forwarding, contract logistics, and storage services.

In 2023, Posten Bring announced an expansion of its automation infrastructure by launching a new distribution hub outside Oslo equipped with robotics and AI-driven inventory management systems. Oslo, Bergen, and Stavanger are among the most critical logistics hubs due to port accessibility and strategic proximity to Sweden and EU markets.

%2C%202018%E2%80%932023.png)

What Factors are Leading to the Growth of Norway Logistics and Warehousing Market

Growth of E-commerce and Retail Distribution: The rapid growth of online shopping and omni-channel retailing in Norway has led to higher demand for last-mile logistics and real-time inventory warehousing. In 2023, e-commerce accounted for 17% of total retail sales, creating a surge in demand for urban fulfillment centers and smart logistics technologies.

Cross-Border Trade and EU Integration: Despite not being an EU member, Norway enjoys robust trade with European countries through EEA agreements. In 2023, over 75% of Norway’s imports and exports were tied to EU countries, driving demand for efficient freight forwarding and customs-cleared warehousing operations near ports and border towns.

Sustainability and Green Logistics Push: Norway has set aggressive climate goals and is incentivizing low-emission freight and warehousing. In 2023, over 30% of warehouse facilities used renewable energy, and electric vehicle (EV) fleets became the standard for several last-mile delivery providers in urban centers.

Which Industry Challenges Have Impacted the Growth for Norway Logistics and Warehousing Market

High Operational Costs and Labor Shortages: Norway's high wage structure and limited availability of skilled logistics personnel have posed significant cost pressures. According to a 2023 industry report, labor accounts for nearly 35% of total logistics operational costs. Additionally, logistics companies face a shortage of qualified warehouse staff and truck drivers, which delays delivery timelines and increases outsourcing dependencies.

Infrastructure Constraints in Remote Areas: While urban logistics infrastructure is well-developed, several remote and northern regions of Norway face limited access to high-capacity roads, rail connectivity, and temperature-controlled warehouses. In 2023, it was estimated that over 18% of logistics delays in Norway were due to underdeveloped infrastructure in sparsely populated areas.

Complex Cross-Border Compliance Requirements: Despite being part of the European Economic Area (EEA), Norway must still comply with customs clearance and documentation procedures for trade with EU nations. These non-tariff barriers slow down transit times. In 2023, nearly 22% of cross-border freight shipments experienced documentation-related delays, especially during peak import-export seasons.

What are the Regulations and Initiatives Which Have Governed the Market

National Freight Transport Plan (NTP): The Norwegian government’s 2022–2033 National Transport Plan includes dedicated investments worth NOK 150 billion for modernizing freight corridors and enhancing multi-modal logistics. The plan emphasizes increasing rail freight share to reduce road congestion and emissions. As of 2023, rail accounted for 17% of freight tonnage, a number projected to rise steadily.

Mandatory Cold Chain Protocols for Pharmaceuticals and Seafood: Given Norway’s leadership in seafood exports and pharma trade, the government enforces strict cold chain logistics compliance. Regulations require end-to-end temperature tracking, with fines imposed for deviations. In 2023, over 92% of cold chain shipments met full compliance standards, up from 85% in 2021.

Green Logistics Incentives: To promote environmental sustainability, the Norwegian government offers tax reductions and subsidies for companies investing in electric trucks, hydrogen-powered forklifts, and green-certified warehouses. In 2023, 35% of new warehousing projects applied for green building certification under the BREEAM-NOR framework.

Norway Logistics and Warehousing Market Segmentation

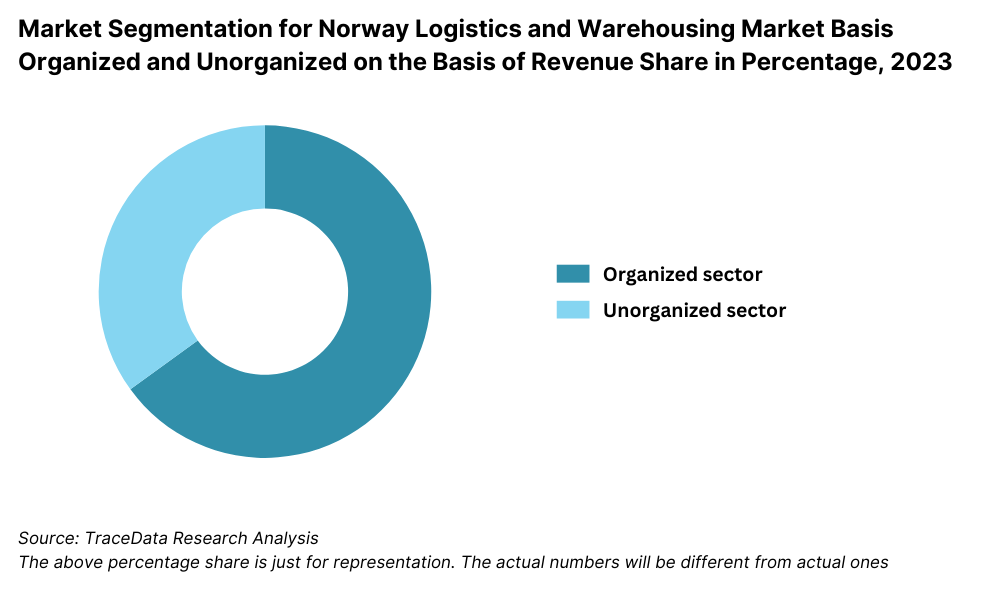

By Market Structure: Organized players dominate the market due to their ability to offer integrated logistics solutions, compliance with international standards, and access to modern infrastructure. These companies typically invest in automation, fleet management systems, and green logistics initiatives, which appeal to large clients with cross-border operations. Unorganized players continue to operate in regional pockets, often catering to local SMEs through flexible, low-cost services. However, their limited scalability, lack of digital integration, and regulatory challenges restrict their market share.

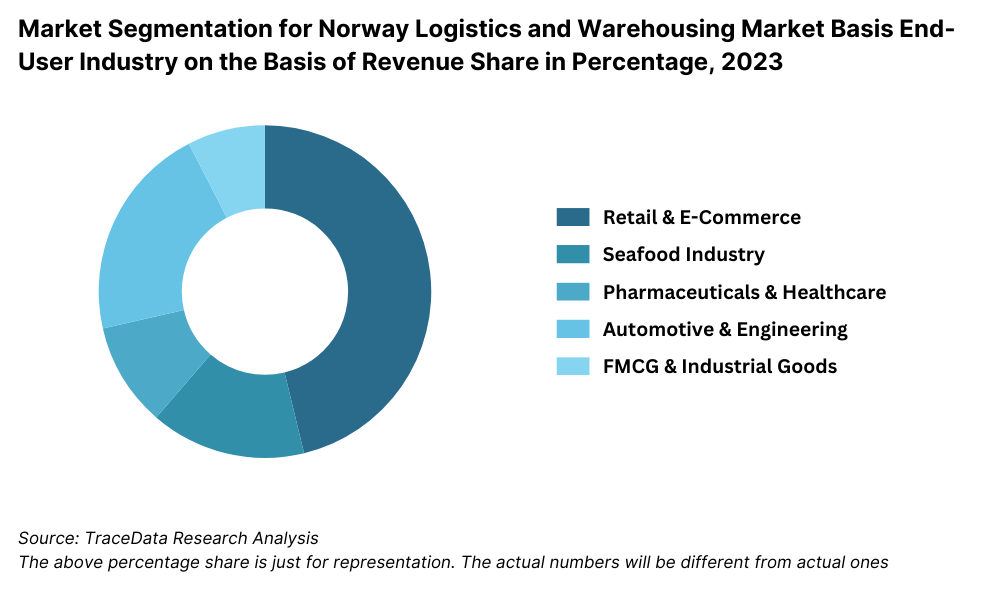

By End-User Industry: Retail and e-commerce are the leading end-users due to Norway’s increasing online shopping activity and demand for fast delivery services. These sectors rely heavily on warehousing and last-mile fulfillment. The seafood industry also contributes significantly, given Norway’s global leadership in fish exports which requires highly specialized cold chain logistics. Pharmaceuticals and healthcare follow due to the rise in biotech exports and strict compliance standards. Automotive and engineering sectors use logistics services for both domestic distribution and international trade.

By Mode of Transport: Road transport dominates due to Norway’s expansive road network and the country’s dependency on truck-based last-mile connectivity. Sea freight holds a significant share given Norway’s strong port infrastructure and maritime trade with the EU and UK. Air freight, though small, is vital for time-sensitive and high-value products like pharmaceuticals. Rail logistics is gaining ground, particularly for sustainability-focused clients and long-haul movements between industrial zones and ports.

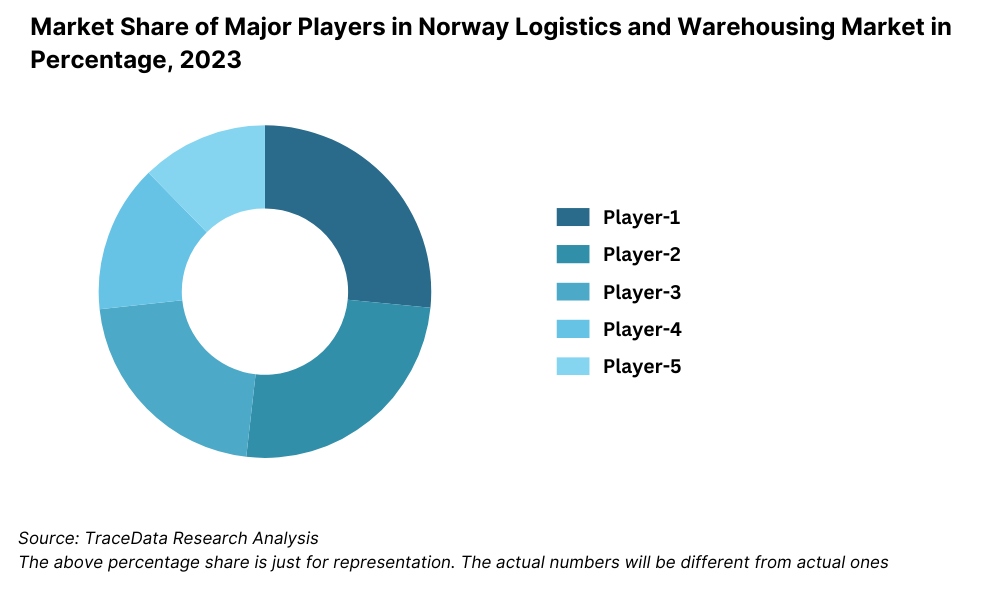

Competitive Landscape in Norway Logistics and Warehousing Market

The Norway logistics and warehousing market is moderately concentrated, with a mix of large global players and specialized regional operators. Established players such as Posten Bring, DB Schenker, DSV, DHL, ColliCare, Greencarrier, and PostNord dominate the organized segment, offering integrated supply chain solutions across transport, warehousing, and last-mile delivery. The increasing presence of tech-enabled logistics startups and green logistics firms has added more diversity to the competitive ecosystem, especially in urban logistics and sustainable operations.

Company | Establishment Year | Headquarters |

Posten Bring | 2002 (rebranded) | Oslo, Norway |

DB Schenker | 1872 | Essen, Germany (Norway office in Oslo) |

DSV | 1976 | Hedehusene, Denmark (Norway office in Langhus) |

DHL | 1969 | Bonn, Germany (Norway office in Oslo) |

ColliCare | 2007 | Vestby, Norway |

Greencarrier | 2000 | Gothenburg, Sweden (Norway office in Oslo) |

PostNord | 2009 | Solna, Sweden (Norway office in Oslo) |

Some of the recent competitor trends and key information about competitors include:

Posten Bring: As Norway’s national postal and logistics company, Posten Bring handled over 80 million parcels in 2023, marking a 12% increase in B2C deliveries driven by e-commerce growth. The company continues to invest in AI-powered warehouse automation and electric vehicle fleets, with a goal of being fossil-free by 2030.

DB Schenker: A major logistics provider in Norway, DB Schenker operates multi-modal hubs across Oslo, Bergen, and Trondheim. In 2023, the company launched a new temperature-controlled logistics corridor to serve the seafood export industry, increasing its cold chain market share by 18%.

DSV: DSV reported double-digit growth in its warehousing services in 2023, following the opening of a new 30,000 sqm distribution center in Langhus. The company focuses on cross-docking, contract logistics, and freight forwarding across Scandinavia, with tailored offerings for the retail and industrial sectors.

DHL: Known for its global reach and digital solutions, DHL Express Norway expanded its green logistics program in 2023 by adding 20 new electric delivery vans in Oslo. The firm saw a 25% rise in e-commerce parcel volume, particularly from fashion and electronics segments.

ColliCare: A Norwegian logistics innovator, ColliCare has carved out a niche in multi-modal transport and tech-enabled warehousing. In 2023, the company piloted automated inventory drones in its Vestby warehouse and recorded a 30% improvement in stock accuracy.

Greencarrier: Focusing on environmentally responsible logistics, Greencarrier offers sea and rail-based logistics solutions with lower emissions. The company reported a 20% increase in sustainable transport contracts in 2023, largely from Norwegian manufacturers and exporters seeking green logistics options.

PostNord: PostNord Norway continues to grow in the parcel delivery and e-commerce warehousing segment. In 2023, it partnered with major Nordic retailers to roll out urban micro-warehousing for same-day delivery services in Oslo and Bergen, registering a 28% increase in express delivery volume.

What Lies Ahead for Norway Logistics and Warehousing Market?

The Norway logistics and warehousing market is projected to grow steadily by 2029, demonstrating a healthy CAGR over the forecast period. This growth will be supported by expanding e-commerce, increasing trade integration with Europe, green logistics initiatives, and rapid technological adoption across supply chains.

Expansion of E-commerce Fulfillment Centers: With the continued rise in online shopping, Norway is expected to witness a sharp increase in the demand for last-mile fulfillment centers and regional distribution hubs. E-commerce is projected to contribute nearly 25% of total warehousing demand by 2029, especially in urban clusters like Oslo, Bergen, and Trondheim.

Green Logistics and Decarbonization Targets: Norway’s climate policies are expected to significantly shape the future of the logistics sector. The transition towards electric and hydrogen-powered fleets, along with solar-powered warehousing, will become industry norms. Government-backed incentives will further accelerate the shift, especially among mid- and large-scale logistics players.

Rise in Automation and Smart Warehousing: The adoption of robotics, IoT sensors, AI-based inventory management, and predictive logistics platforms will enhance supply chain efficiency and reduce reliance on manual labor. By 2029, automated warehousing solutions are expected to handle up to 40% of all processed volumes in Norway’s top logistics parks.

Growth in Cold Chain and Pharma Logistics: Due to Norway's strategic role in seafood exports and the expanding pharmaceutical industry, cold chain logistics will see rapid expansion. Warehouses equipped with end-to-end temperature monitoring systems will be in high demand, particularly in coastal areas and near key ports.

%2C%202023-2029.png)

Norway Logistics and Warehousing Market Segmentation

• By Market Structure:

Organized Sector

Unorganized Sector

3PL (Third Party Logistics) Providers

Freight Forwarders

Contract Logistics Providers

Last-Mile Delivery Providers

Warehousing Operators

Port-Based Logistics Operators

• By End-User Industry:

Retail and E-commerce

Seafood and Fisheries

Pharmaceuticals and Healthcare

Automotive and Machinery

FMCG and Consumer Goods

Industrial and Construction

Oil and Gas

Agriculture and Food Processing

• By Mode of Transport:

Road Freight

Sea Freight

Rail Freight

Air Freight

Multi-modal Logistics

• By Type of Warehousing:

General Warehousing

Cold Storage Warehousing

Bonded Warehousing

Automated/Smart Warehousing

Urban Fulfillment Centers

Open Yard Storage

• By Ownership Model:

Owned Warehouses

Rented Warehouses

Leased Contracted Warehouses

Shared (Multi-Client) Warehouses

• By Region:

Eastern Norway (Oslo, Akershus)

Western Norway (Bergen, Stavanger)

Central Norway (Trondheim)

Northern Norway (Tromsø, Bodø)

Southern Norway (Kristiansand)

Players Mentioned in the Report:

Posten Bring

DB Schenker

DSV

DHL

ColliCare

Greencarrier

PostNord

Key Target Audience:

Logistics Service Providers

Warehousing Infrastructure Developers

Freight Forwarding Companies

E-commerce and Retail Enterprises

Industrial Manufacturers and Exporters

Government Transport and Infrastructure Bodies

Cold Chain Logistics Operators

Trade & Port Authorities

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Norway Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Norway Logistics and Warehousing Market

4.3. Business Model Canvas for Norway Logistics and Warehousing Market

4.4. Logistics Partner Selection Process (Demand Side)

4.5. Service Design Process (Supply Side)

5. Market Structure

5.1. Road, Rail, Air, and Sea Freight Overview in Norway, 2018-2024

5.2. Logistics Spend as % of GDP, Norway vs EU Benchmarks, 2018-2024

5.3. Warehousing Footprint by Region in Norway, 2023-2024

5.4. Number of Logistics and Warehouse Operators by Region, 2023

6. Market Attractiveness for Norway Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for Norway Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Freight Volume (in million tonnes), 2018-2024

9. Market Breakdown for Norway Logistics and Warehousing Market Basis

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Mode of Transport (Road, Rail, Air, Sea), 2023-2024P

9.3. By Type of Warehousing (Cold Chain, Bonded, General, Automated), 2023-2024P

9.4. By Ownership Model (Owned, Rented, Leased, Shared), 2023-2024P

9.5. By Region (Eastern, Western, Central, Northern, Southern), 2023-2024P

9.6. By End-User Industry (Retail, Pharma, Seafood, FMCG, Automotive), 2023-2024P

10. Demand Side Analysis for Norway Logistics and Warehousing Market

10.1. Customer Landscape and Logistics Outsourcing Trends

10.2. Buyer Journey and Logistics Selection Criteria

10.3. Need, Expectation, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for Norway Logistics and Warehousing Market

11.2. Growth Drivers for Norway Logistics and Warehousing Market

11.3. SWOT Analysis for Norway Logistics and Warehousing Market

11.4. Issues and Challenges for Norway Logistics and Warehousing Market

11.5. Government Policies and Regulatory Environment

12. Snapshot on Cold Chain and E-commerce Warehousing

12.1. Market Size and Future Potential for Cold Chain and E-com Warehousing, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross-Comparison of Key Players in Cold Chain and Urban Fulfillment Warehousing

13. Norway Logistics Financing Landscape

13.1. Infrastructure Investment Trends and Public-Private Partnerships

13.2. Impact of Green Incentives and Government Subsidies

13.3. Emerging Financing Models for SME Logistics Operators

13.4. Warehouse Leasing and Investment Trends

14. Opportunity Matrix for Norway Logistics and Warehousing Market-Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for Norway Logistics and Warehousing Market

16. Competitor Analysis for Norway Logistics and Warehousing Market

16.1. Benchmark of Key Competitors Including Overview, USP, Strategy, Warehousing Capacity, Fleet Size, Automation Levels, and Recent Developments

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Norway Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Freight Volume, 2025-2029

18. Market Breakdown for Norway Logistics and Warehousing Market Basis

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Mode of Transport (Road, Rail, Air, Sea), 2025-2029

18.3. By Type of Warehousing (Cold Chain, Bonded, General, Automated), 2025-2029

18.4. By Ownership Model (Owned, Rented, Leased, Shared), 2025-2029

18.5. By Region (Eastern, Western, Central, Northern, Southern), 2025-2029

18.6. By End-User Industry (Retail, Pharma, Seafood, FMCG, Automotive), 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Norway Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5–6 logistics players and warehouse operators in the country based on their financial information, warehousing footprint, operational fleet size, and sectoral specialization.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like revenue size, warehousing capacity, number of players, volume of goods transported, mode of transport preferences, and pricing benchmarks.

We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, investor presentations, customs/trade reports, port traffic data, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, warehouse managers, supply chain heads, and freight specialists representing various logistics and warehousing companies as well as end-user industries in Norway. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate warehousing area, average throughput, and freight volume for each player, thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach logistics firms and warehousing operators under the guise of potential clients. This approach enables us to validate the operational and pricing information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of service offerings, capacity utilization, process structure, and technological capabilities.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process. Multiple iterations of volume and revenue validation are carried out to ensure consistency across segments, regions, and industry verticals.

FAQs

1. What is the potential for the Norway Logistics and Warehousing Market?

The Norway logistics and warehousing market is poised for sustained growth, reaching an estimated valuation of NOK 426 billion in 2023. This growth is driven by increasing cross-border trade, the rapid expansion of e-commerce, and the rising demand for specialized services such as cold chain and automated warehousing. Norway's strong connectivity with EU markets, combined with green logistics initiatives and digital infrastructure, further enhances the long-term potential of the industry.

2. Who are the Key Players in the Norway Logistics and Warehousing Market?

The Norway logistics and warehousing market is led by key players including Posten Bring, DB Schenker, DHL, DSV, ColliCare, and Greencarrier. These companies have strong operational footprints, modern infrastructure, and a growing focus on sustainable logistics. Other players such as PostNord and local tech-enabled providers are also gaining traction in last-mile and specialized warehousing segments.

3. What are the Growth Drivers for the Norway Logistics and Warehousing Market?

Key growth drivers include the rise of e-commerce, which is fueling demand for last-mile delivery and urban fulfillment centers. The increasing need for cold storage solutions in seafood and pharmaceuticals, along with investments in automation and green logistics, are further pushing the market forward. In addition, Norway’s integration with EU trade systems and investments under the National Transport Plan are supporting long-term infrastructure development.

4. What are the Challenges in the Norway Logistics and Warehousing Market?

Challenges in the market include high operational costs due to labor shortages and Norway’s high-wage economy. Limited infrastructure in remote regions, cross-border compliance complexity, and the capital-intensive shift to sustainable practices also present barriers to growth. Small and mid-sized logistics providers often struggle to meet rising compliance and digitalization demands, impacting their ability to scale.