Oman Auto Finance Market Outlook to 2029

By Market Structure, By Financiers, By Types of Vehicles Financed, By Loan Tenures, By Consumer Demographics, and By Regions

- Product Code: TDR0135

- Region: Middle East

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled "Oman Auto Finance Market Outlook to 2029 – By Market Structure, By Financiers, By Types of Vehicles Financed, By Loan Tenures, By Consumer Demographics, and By Regions" provides a comprehensive analysis of the auto finance market in Oman. The report covers an overview and genesis of the industry, overall market size in terms of loan disbursals, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, as well as a comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the auto finance market. The report concludes with future market projections based on loan disbursals, market segments, region, cause-and-effect relationships, and success case studies highlighting the major opportunities and challenges.

Oman Auto Finance Market Overview and Size

The Oman auto finance market reached a valuation of OMR 1.8 billion in 2023, fueled by a growing economy, rising vehicle ownership aspirations, and increasing demand for convenient financing options. The market is characterized by key players such as Oman Arab Bank, Bank Muscat, National Bank of Oman, and Alizz Islamic Bank. These financial institutions are recognized for their diverse auto loan products, attractive interest rates, and strong customer service networks.

In 2023, Oman Arab Bank introduced a new digital loan application platform to simplify the financing process and cater to tech-savvy consumers. This initiative aims to strengthen their position in the competitive auto finance market by providing a faster and more convenient loan approval process. Muscat and Salalah stand out as key regions due to their higher population densities, economic activity, and robust demand for new and used vehicles.

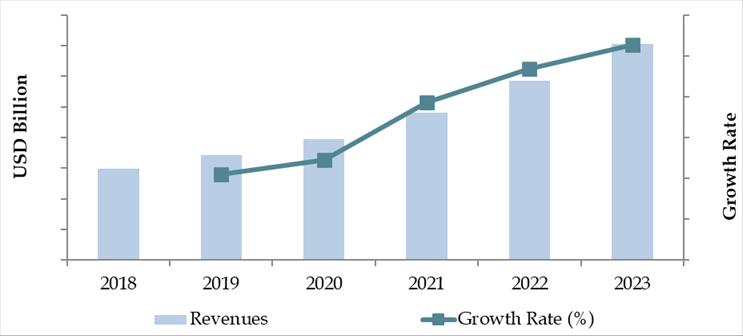

Market Size for Oman Auto Finance Industry Based on Loan Disbursement in USD Billion, 2018-2023

What Factors are Leading to the Growth of Oman Auto Finance Market:

Economic Growth: Oman’s economic diversification efforts and increased spending on infrastructure have improved consumer confidence and purchasing power. In 2023, the market saw a 10% increase in auto loan disbursals as more consumers sought vehicle ownership. The stable economy and favorable credit conditions have been pivotal in driving this growth.

Young Demographic: A younger, car-savvy population is emerging as a key driver of demand for auto financing in Oman. Approximately 65% of the population is under the age of 30, and this segment has shown a preference for car ownership to enhance mobility. The rise in first-time car buyers among younger consumers has increased demand for affordable financing options and competitive interest rates.

Digital Transformation: The adoption of online banking and digital loan application platforms has streamlined the loan approval process, making auto financing more accessible. In 2023, over 35% of auto loan applications in Oman were submitted digitally. Financial institutions have responded to this shift by enhancing their digital offerings, enabling faster approvals and better customer experiences.

Which Industry Challenges Have Impacted the Growth for Oman Auto Finance Market

High Interest Rates: Elevated interest rates on auto loans have deterred some potential borrowers. According to industry estimates, around 28% of consumers are discouraged from financing due to perceived high monthly payments. This has particularly impacted first-time buyers and low-income individuals, slowing down market expansion.

Limited Credit History of Borrowers: A significant portion of the target market—especially younger consumers—lacks an established credit history. In 2023, approximately 33% of auto loan applications were declined due to insufficient credit records, highlighting the need for more inclusive lending criteria.

Dependence on Conventional Financing Models: The limited availability of innovative or alternative financing options restricts consumer choice. Many prospective borrowers express a desire for flexible payment plans or Sharia-compliant products. This unmet demand has created a gap, making it harder to attract and retain customers.

What are the Regulations and Initiatives which have Governed the Market:

Central Bank Lending Guidelines: The Central Bank of Oman has implemented stricter loan-to-value (LTV) limits and caps on debt service ratios. In 2023, these guidelines led to a slight reduction in loan approvals, as around 15% of applicants did not meet the revised criteria. However, they aim to maintain financial stability and reduce defaults in the long run.

Consumer Protection Laws: To ensure transparency and fairness, the government has introduced consumer protection laws that require lenders to disclose all fees, terms, and conditions upfront. In 2023, compliance rates among major banks reached 90%, building consumer trust and confidence in the financing process.

Digital Transformation Initiatives: The Omani government’s push for digitalization in the banking sector has encouraged auto lenders to adopt online application portals and e-contracts. This initiative aims to improve accessibility and streamline loan processing. In 2023, digital loan applications accounted for 30% of total auto finance transactions, with that share expected to grow significantly in the coming years.

Oman Auto Finance Market Segmentation

By Loan Type: Conventional loans dominate the market due to their widespread availability, simpler application process, and established trust among customers. Banks and financial institutions offering conventional loans often have more extensive networks, allowing them to reach a broader customer base. Islamic (Sharia-compliant) financing options hold a significant share because they provide interest-free alternatives and appeal to the culturally rooted consumer base. The added transparency and ethical considerations of Islamic finance attract a growing number of customers.

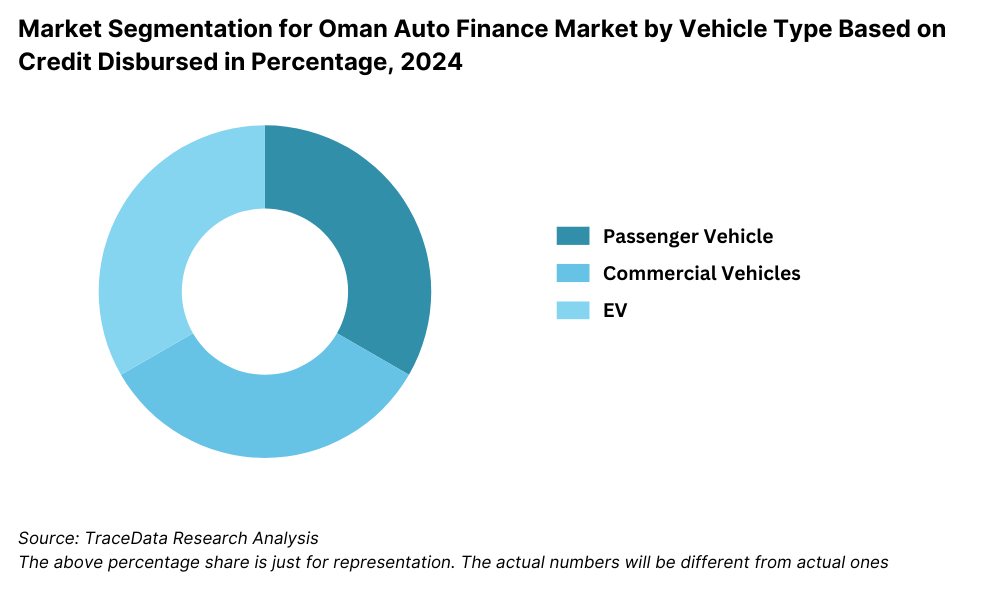

By Vehicle Type: Passenger vehicles are the leading segment within the Oman auto finance market due to the high demand for personal transportation among middle-income groups and families. These vehicles’ affordability, fuel efficiency, and availability in various models drive their popularity. Commercial vehicles follow closely, fueled by Oman’s growing logistics and construction sectors. As businesses seek to expand operations, financing for trucks, vans, and heavy equipment continues to rise steadily.

Market Segmentation for Oman Auto Finance Market by Vehicle Type Based on Credit Disbursed in Percentage, 2024

By Tenure Length: Loans with tenures of three to five years are the most popular, offering a manageable balance between monthly payment amounts and total interest paid. This term length is particularly attractive to middle-income earners who seek a feasible repayment plan without committing to long-term debt. Shorter-term loans of one to three years are also significant, as they appeal to consumers who prioritize minimizing interest expenses and paying off loans quickly.

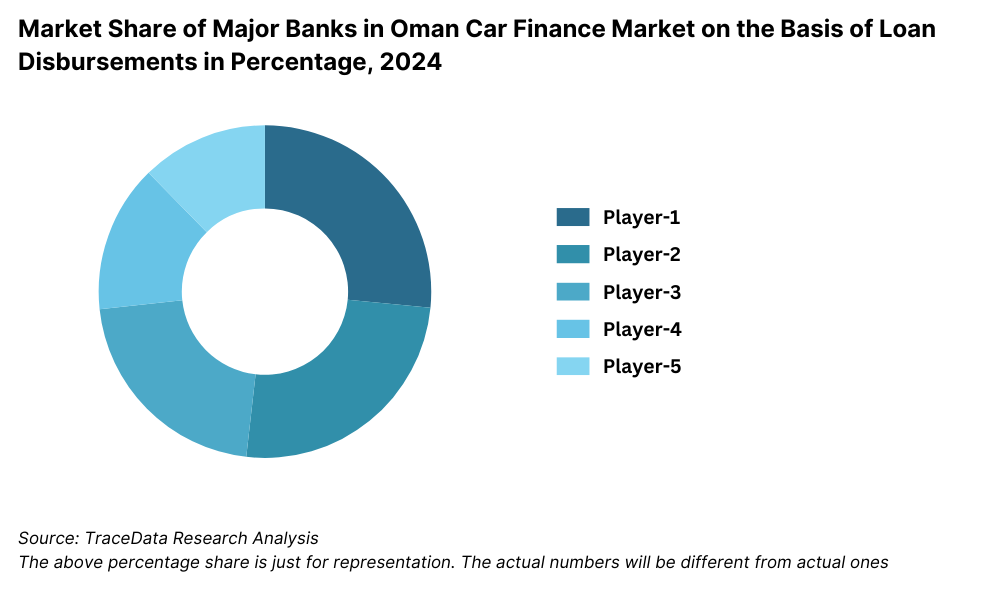

Competitive Landscape in Oman Auto Finance Market

The Oman auto finance market is relatively concentrated, with a few major players dominating the space. However, the entrance of newer banks and the expansion of digital platforms such as Oman Arab Bank, Bank Muscat, National Bank of Oman, Alizz Islamic Bank, Sohar International, and Bank Dhofar have diversified the market, offering consumers more choices and services.

Name | Founding Year | Original Headquarters |

|---|---|---|

Bank Muscat Auto Loan | 1982 | Muscat, Oman |

National Bank of Oman (NBO) Auto Finance | 1973 | Muscat, Oman |

Bank Dhofar Auto Loan | 1990 | Muscat, Oman |

Ahli Bank Oman Auto Finance | 2007 | Muscat, Oman |

Oman Arab Bank Auto Loan | 1984 | Muscat, Oman |

HSBC Oman Auto Finance | 1948 | London, UK |

Sohar International Bank Auto Loan | 2007 | Muscat, Oman |

Al Omaniya Financial Services | 1997 | Muscat, Oman |

Toyota Financial Services Oman | 1982 | Toyota City, Japan |

National Finance Company (NFC) Auto Loan | 1987 | Muscat, Oman |

Some of the recent competitor trends and key information about competitors include:

Oman Arab Bank: Oman Arab Bank introduced a new digital platform for auto loans in 2023, reducing the average loan approval time by 30%. The streamlined process has led to a significant increase in customer satisfaction and a higher number of approved applications.

Bank Muscat: A leader in the industry, Bank Muscat saw a 20% rise in auto loan disbursals in 2023. Its competitive interest rates and tailored financing options have made it a preferred choice for customers seeking reliable financing solutions.

National Bank of Oman: National Bank of Oman experienced a 15% growth in its Islamic auto finance segment in 2023. The bank’s emphasis on transparent terms and customer-centric policies has solidified its reputation as a trustworthy lender.

Alizz Islamic Bank: Specializing in Sharia-compliant financing, Alizz Islamic Bank expanded its reach through partnerships with major car dealerships. This initiative resulted in a 25% increase in auto loan applications, particularly among younger consumers.

Sohar International: Sohar International reported a 10% growth in auto loan disbursals in 2023, driven by its targeted campaigns for electric and hybrid vehicles. The bank’s focus on sustainable financing options has attracted environmentally conscious buyers.

Bank Dhofar: Bank Dhofar launched a promotional campaign in 2023 offering zero processing fees for auto loans. This move helped the bank capture a larger share of the market, increasing its loan approvals by 18% compared to the previous year.

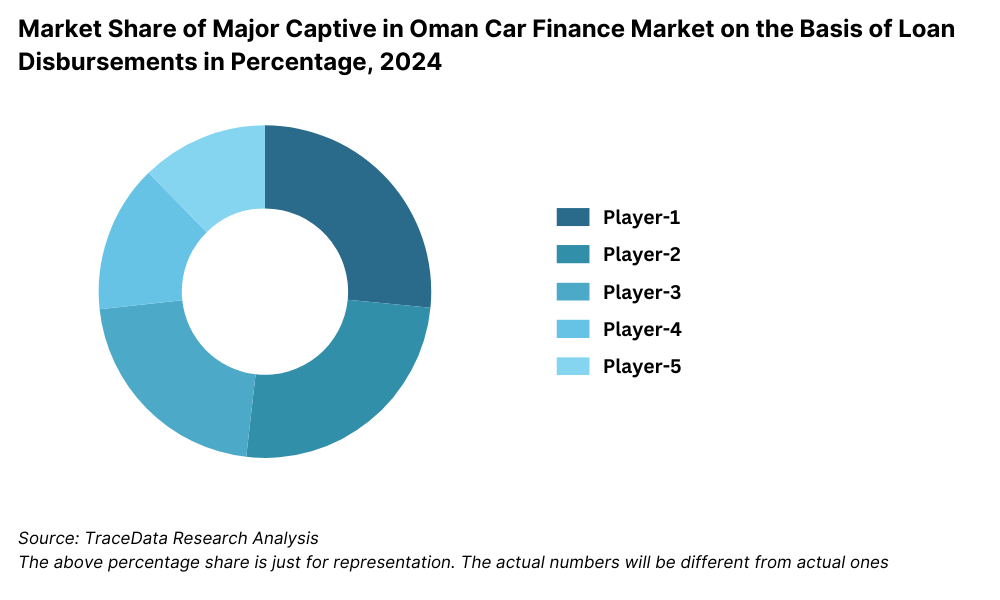

Market Share of Major Banks in Oman Car Finance Market on the Basis of Loan Disbursements in Percentage, 2024

What Lies Ahead for Oman Auto Finance Market?

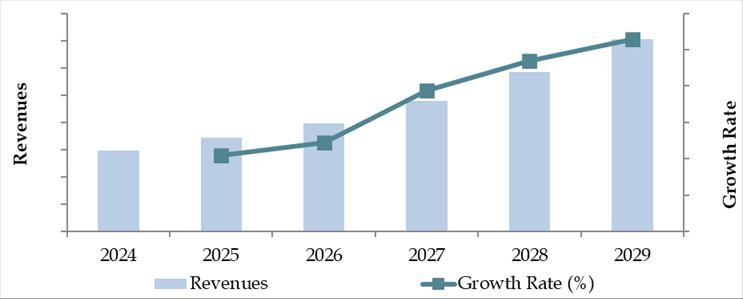

The Oman auto finance market is projected to grow steadily by 2029, driven by economic development, increased vehicle ownership aspirations, and enhanced digitalization efforts.

Adoption of Digital Financing Platforms: With ongoing digital transformation initiatives, more banks are expected to launch user-friendly online loan application platforms. These innovations will streamline the application process, offer personalized loan options, and improve approval times, thus attracting a wider audience of tech-savvy borrowers.

Sharia-Compliant Financing Growth: The demand for Islamic financing options is anticipated to grow further as financial institutions continue to expand their Sharia-compliant product offerings. This trend will be supported by rising consumer preference for interest-free financial solutions and greater product awareness among younger demographics.

Support for Electric and Hybrid Vehicles: As Oman looks towards sustainability, there is likely to be a gradual increase in auto financing solutions tailored to electric and hybrid vehicles. Government incentives, tax breaks, and public awareness campaigns are expected to promote the adoption of green transportation options, creating new opportunities for financiers.

Increased Competition and Market Diversification: As more regional and international banks enter the Omani market, competition will intensify, leading to more attractive loan terms, competitive interest rates, and innovative financial products. This diversity will empower consumers to choose from a wider range of tailored financing options, fostering further market growth.

Focus on Customer Experience: Financial institutions are expected to enhance customer service through improved digital communication channels, flexible repayment plans, and comprehensive post-loan support. This customer-centric approach will help build trust and loyalty, ensuring sustained market expansion.

Future Outlook and Projections for Malaysia Car Finance Market on the Basis of Loan Disbursements in USD Billion, 2024-2029

Oman Auto Finance Market Segmentation

• By Loan Type:

o Conventional Loans

o Islamic Financing

o Fleet Financing

o Leasing

o Personal Loans for Auto Purchases

• By Vehicle Type:

o Passenger Cars

o Commercial Vehicles

o Electric Vehicles (EVs)

o Hybrid Vehicles

o Used Vehicles

• By Tenure Length:

o 1-3 Years

o 3-5 Years

o 5+ Years

• By Consumer Profile:

o First-Time Buyers

o Repeat Buyers

o Corporate Clients

• By Region:

o Muscat

o Salalah

o Sohar

o Nizwa

o Sur

o Duqm

Players Mentioned in the Report (Banks):

- Ahli Bank

- Bank Nizwa

- Alizz Islamic Bank

- National Bank of Oman

- Bank of Baroda Oman

- Bank Dhofar

- Ahli Islamic Oman

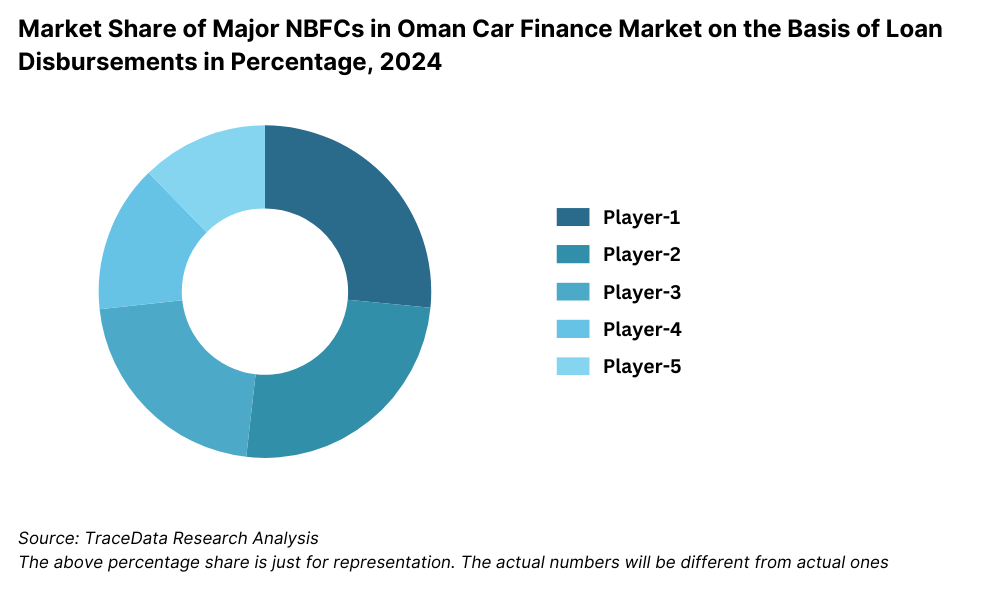

Players Mentioned in the Report (NBFCs):

- National Finance

- Al Omaniya Financial Services

- United Finance Company

- Taageer Finance

- Muscat Finance

Players Mentioned in the Report (Captive):

- Toyota Financial Services Oman

- Mercedes-Benz Finance Oman

- Nissan Finance Oman

- Ford Credit Oman

- Honda Finance Oman

- BMW Financial Services Oman

Key Target Audience:

• Commercial Banks

• Islamic Financial Institutions

• Auto Dealerships

• Online Auto Financing Platforms

• Regulatory Authorities (e.g., Central Bank of Oman)

• Research and Development Institutions

Time Period:

• Historical Period: 2018-2023

• Base Year: 2024

• Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Oman by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024P

9.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By Type of Vehicle (New, Used, Electric), 2023-2024P

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Oman Car Finance Market

11.2. Growth Drivers for Oman Car Finance Market

11.3. SWOT Analysis for Oman Car Finance Market

11.4. Issues and Challenges for Oman Car Finance Market

11.5. Government Regulations for Oman Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Oman Car Finance Market, 2024

17.2. Market Share of Key NBFCs in Oman Car Finance Market, 2024

17.3. Market Share of Key Captive in Oman Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Oman Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New, Used, Electric), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, Above 8 years), 2025-2029

19.6. Recommendations

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Oman Auto Finance Market. Based on this ecosystem, we will shortlist leading 5-6 financiers in the country based on their financial data, loan portfolio, and market share.

Sourcing is conducted through industry publications, multiple secondary and proprietary databases to perform desk research and gather industry-level data.

Step 2: Desk Research

Subsequently, we conduct exhaustive desk research by referencing diverse secondary and proprietary databases. This approach allows us to analyze the market in depth, consolidating industry-level insights. We examine factors such as total loan disbursals, number of market players, interest rate trends, demand, and other variables. We complement this by reviewing company-level data, using sources such as press releases, annual reports, financial statements, and similar documents. This process establishes a robust understanding of the market landscape and the entities operating within it.

Step 3: Primary Research

We conduct a series of in-depth interviews with C-level executives and other stakeholders from various Oman Auto Finance companies, automotive dealerships, and end-users. The purpose of these interviews is to validate market hypotheses, verify statistical data, and obtain valuable operational and financial insights from these industry representatives. A bottom-to-top approach is employed to evaluate the market share and loan volumes of each player, thereby constructing a comprehensive market outlook.

As part of our validation process, we perform disguised interviews by approaching companies as potential customers. This strategy helps validate the operational and financial information provided by company representatives, corroborating it against data from secondary sources. These interactions also offer detailed insights into revenue streams, value chains, processes, pricing strategies, and more.

Step 4: Sanity Check

- A combination of bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is performed to ensure a thorough sanity check process.

FAQs

1. What is the potential for the Oman Auto Finance Market?

The Oman auto finance market is poised for significant growth, with loan disbursals reaching an estimated OMR 1.8 billion in 2023. This growth is driven by a stable economic environment, increasing vehicle ownership aspirations, and the adoption of digital financing platforms. The market's potential is further supported by rising demand for both conventional and Sharia-compliant financing options.

2. Who are the Key Players in the Oman Auto Finance Market?

The Oman Auto Finance Market features several key players, including Oman Arab Bank, Bank Muscat, and National Bank of Oman. These institutions dominate the market due to their comprehensive product offerings, strong distribution networks, and competitive interest rates. Other notable players include Alizz Islamic Bank, Sohar International, and Bank Dhofar.

3. What are the Growth Drivers for the Oman Auto Finance Market?

The primary growth drivers include economic diversification efforts, increasing disposable incomes, and the growing number of first-time car buyers. The rise of digital platforms has also streamlined the loan application process, boosting consumer accessibility. Additionally, government support for sustainable transportation, including financing for electric and hybrid vehicles, contributes to the market’s expansion.

4. What are the Challenges in the Oman Auto Finance Market?

The Oman Auto Finance Market faces several challenges, including high interest rates that deter certain borrowers, limited credit histories among younger customers, and a reliance on traditional financing models. Regulatory requirements and slow adoption of alternative financing solutions also present barriers to market growth. Furthermore, competition among financial institutions may lead to price wars and margin pressures, complicating profitability in the long term.