Oman Smart Wearables Market Outlook to 2030

By Product Type, By Connectivity, By Price Band, By End User, By Sales Channel, and By Region

- Product Code: TDR0394

- Region: Middle East

- Published on: December 2025

- Total Pages: 80

Report Summary

The report titled “Oman Smart Wearables Market Outlook to 2030 - By Product Type, By Connectivity, By Price Band, By End User, By Sales Channel, and By Region” provides a comprehensive analysis of the smart wearables market in Oman. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the smart wearables market. The report concludes with future market projections based on device volumes, product categories, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

Oman Smart Wearables Market Overview and Size

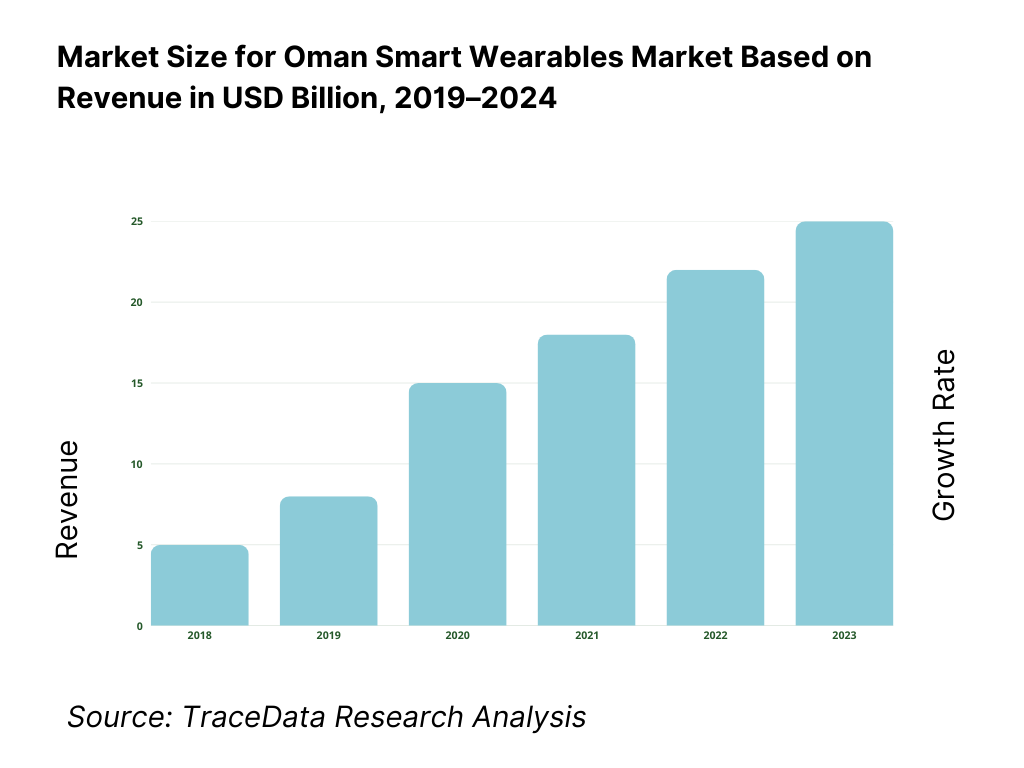

The Oman smart wearables market is valued at USD 52 million, based on a five-year historical analysis. Demand is underpinned by cellular-enabled Apple Watch availability at Omantel (ticket prices OMR 349–366) and broad eSIM support, indicating healthy premium ASPs and attach to mobile tariffs. Continued device approvals by the Telecommunications Regulatory Authority reinforce steady in-market supply. Recent global tracker updates also indicate rising upgrade activity in wristwear.

Muscat dominates sales due to concentrated electronics retail, higher post-paid penetration, and the presence of operator flagships; adjacent hubs like Sohar (Al Batinah) and Salalah (Dhofar) follow on the back of affluent consumer bases and tourism-linked footfall. These corridors host the widest assortment of premium wristwear and faster after-sales turn-around via authorized centers. Population clustering in Muscat (within a national base of ~5.3 million) supports better channel throughput and more frequent device refresh cycles.

What Factors are Leading to the Growth of the Oman Smart Wearables Market:

Dense digital connectivity and rising device addressability: Oman’s wearables market growth is anchored by its extensive digital infrastructure, which enables seamless data synchronization, fitness tracking, and eSIM utilization. The country has 7,240,909 total mobile subscriptions, 5,821,865 active mobile-broadband lines, and 577,713 fixed internet connections, reflecting widespread network access. The presence of 1,863,307 postpaid lines provides a strong foundation for operator-led smartwatch bundling and connected service plans. Furthermore, with 95 individuals using the internet per 100 people, the environment for app-based health, productivity, and communication ecosystems is highly conducive to wearable technology adoption.

Solid macro consumption capacity supporting discretionary tech: Oman’s macroeconomic strength provides the purchasing power necessary for sustained adoption of smart wearables. The country’s household final consumption expenditure stands at USD 40,068,920,676, demonstrating strong consumer spending potential on discretionary items such as electronics and fitness devices. Supported by a GDP of USD 104.35 billion, the economy offers stable conditions for retail and telecom sectors to expand wearable portfolios. With a resident population exceeding 5.2 million, the addressable base for mid-to-premium devices remains large, particularly among urban professionals with high smartphone penetration and digital payment accessibility.

Urban concentration and organized retail/after-sales corridors: Wearable penetration is driven by Oman’s urban-centered demographics, where service and retail infrastructure are highly concentrated. The nation’s urban population forms the main consumer hub, supported by 571,662 fixed broadband lines that enable seamless device updates and cloud-based syncing. The country’s 7,240,909 mobile lines ensure a broad connectivity backbone for wearable users across Muscat, Sohar, and Salalah. High network reliability and established modern trade stores improve the retail experience, while dedicated service centers in key governorates reduce maintenance barriers, facilitating repeat purchases and premium wearable upgrades.

Which Industry Challenges Have Impacted the Growth of the Oman Smart Wearables Market:

Small national scale outside the capital limits depth for niche SKUs: Despite its high digital readiness, Oman’s limited population of approximately 5.2 million concentrates demand within a few key cities, particularly Muscat. While 5,821,865 mobile-broadband and 577,713 fixed-internet lines ensure good coverage, after-sales service networks remain uneven beyond the capital. For global brands offering specialized wearables such as sports, diving, or medical-grade devices, smaller regional demand volumes make inventory allocation and warranty logistics challenging. This restricts SKU diversity and raises costs for localized support outside major metropolitan centers.

Import reliance exposes wearables to external shocks and logistics lags: Oman’s smart wearables market is fully dependent on imports, making it sensitive to supply chain disruptions. The country’s imports of goods and services total USD 47,411,799,185, with USD 38,573,001,760 attributed to physical goods. These inflows include electronics, components, and accessories vital for the market’s stability. Any international shipping or customs delays directly affect retail stock and launch timing for new devices. Seasonal fluctuations in logistics throughput can therefore extend product lead times and increase retail costs for consumers and distributors alike.

Ensuring network and data compliance as usage intensifies: As connected devices proliferate, ensuring compliance with network and data-handling requirements has become more complex. Oman has 1,863,307 postpaid mobile lines—the primary base for eSIM-enabled watches—and 577,713 fixed-internet subscriptions supporting cloud analytics. With 95 individuals online per 100 inhabitants, data transfer volumes are increasing across wearable ecosystems. OEMs and operators must therefore align with regulations covering lawful interception, SIM/eSIM registration, and data privacy to maintain operational integrity. Compliance with these obligations directly impacts time-to-market for connected and medical-grade wearable models.

What are the Regulations and Initiatives which have Governed the Market:

Device type-approval mandated by the Telecommunications Regulatory Authority: All smart wearables containing wireless transmitters require type-approval from Oman’s Telecommunications Regulatory Authority before distribution. This process ensures adherence to frequency, safety, and Specific Absorption Rate (SAR) standards. Given the high network density—7,240,909 mobile lines and 5,821,865 broadband lines—the TRA’s approval framework is critical in maintaining spectrum efficiency and device safety. Type-approval and labeling compliance are prerequisites for import clearance and operator bundling, particularly for cellular-enabled smartwatch models entering the Oman market.

eSIM activation and numbering resources governed via licensed operators: Cellular smartwatch services rely on eSIM provisioning managed exclusively by licensed telecom operators. With 1,863,307 postpaid lines forming the primary consumer base, operators control numbering resources, KYC processes, and lawful interception capabilities. Additionally, Oman’s high digital participation—95 internet users per 100 people—requires robust network oversight to manage secure device connectivity. Operators must ensure transparent auditing and SIM registration for each eSIM activation, maintaining compliance with national telecom and data regulations while enabling new LTE wearable launches.

Customs and import compliance intersect with electronics inflows: As Oman’s wearables market is import-driven, customs procedures play a major role in market accessibility. The country’s trade volume—USD 47,411,799,185 in goods and services imports, including USD 38,573,001,760 in merchandise goods—necessitates detailed customs declarations and alignment with electronic equipment standards. Each shipment must conform to TRA-approved documentation and product labeling requirements for import clearance. Proper coordination between OEMs, importers, and customs authorities ensures timely product availability, minimizing stock shortages and maintaining consistent market supply for retailers and distributors.

Oman Smart Wearables Market Segmentation

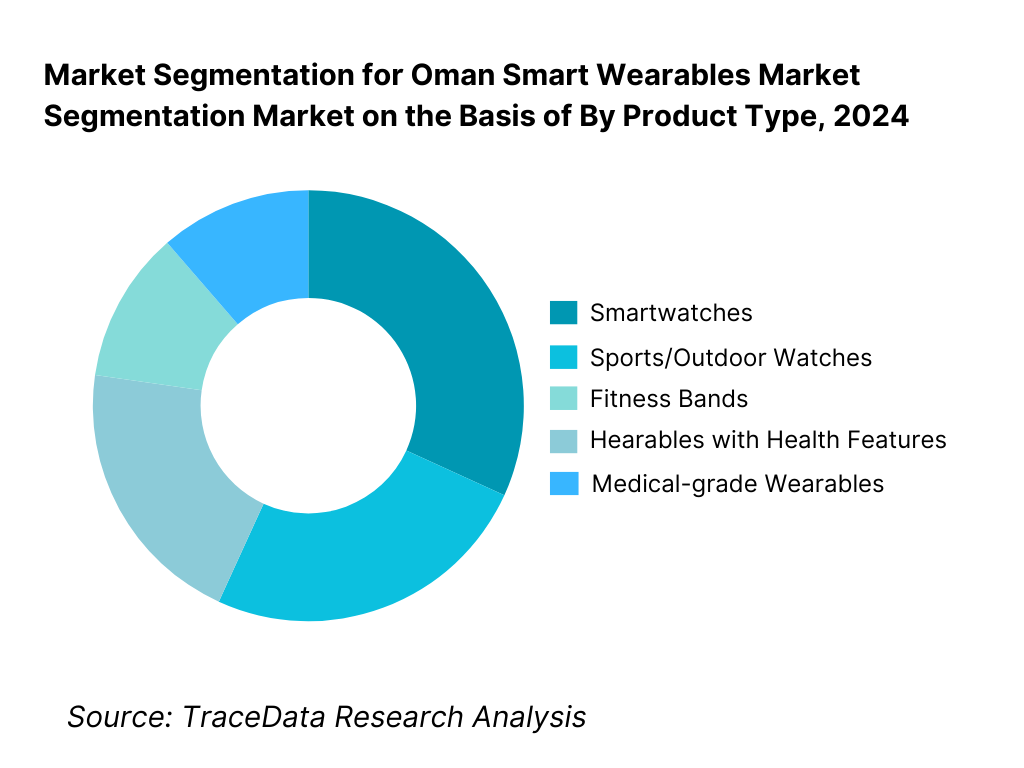

By Product Type: Oman smart wearables market is segmented by product type into smartwatches, sports/outdoor watches, fitness bands, hearables with health features, and medical-grade wearables. Recently, smartwatches have a dominant market share in Oman under the segmentation product type, it is due to their tight integration with operator eSIM services, premium retail presence in Muscat, and stronger app ecosystems. Branded cellular models promoted by Omantel and a steady cadence of launches from Apple, Samsung and Huawei reinforce higher willingness to pay, longer usage and elevated accessory attachment.

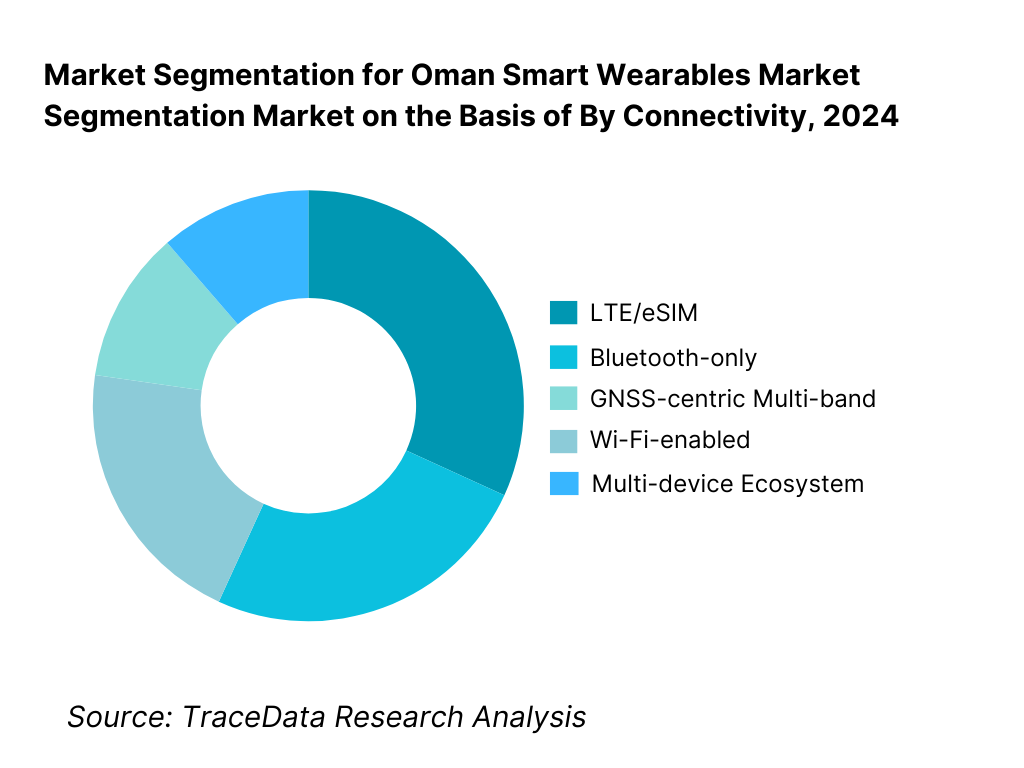

By Connectivity: Oman smart wearables market is segmented by connectivity into Bluetooth-only, LTE/eSIM, GNSS-centric multi-band, Wi-Fi-enabled, and multi-device ecosystems. Recently, LTE/eSIM has a dominant market share in Oman under the segmentation connectivity type, it is due to operator enablement for Apple Watch cellular, simplified eSIM onboarding, and marketing of “leave-your-phone” use-cases. Telco financing and bundling increase affordability, while desert/outdoor usage encourages GNSS-capable devices for endurance activities; however, cellular convenience remains the primary purchase driver.

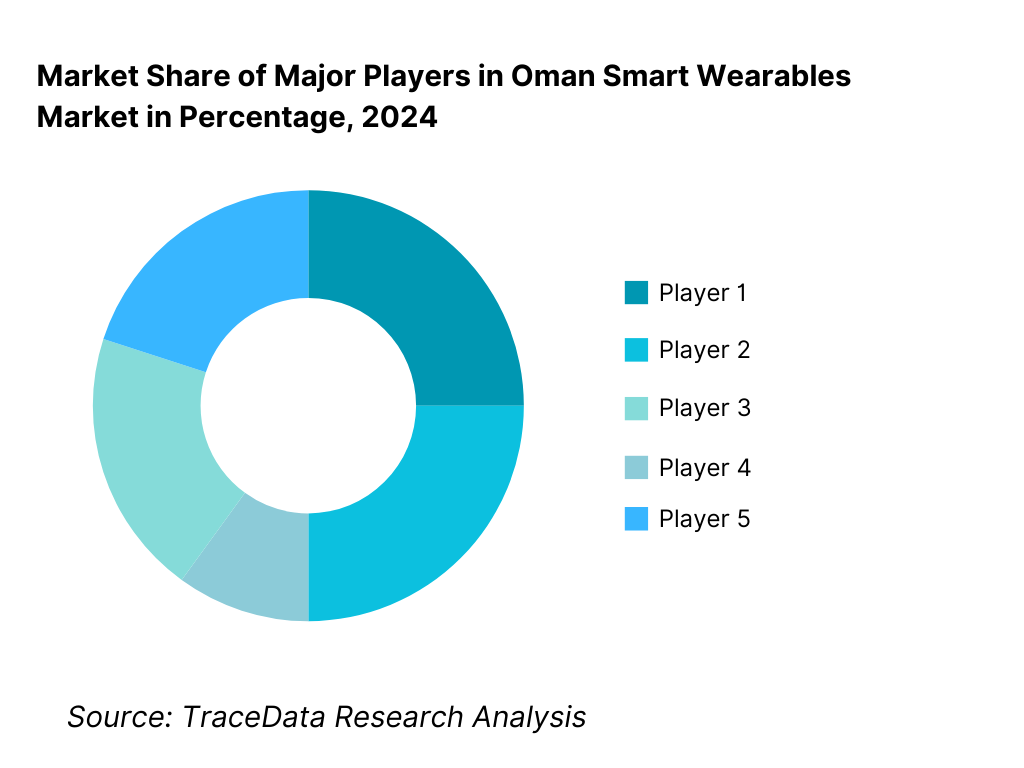

Competitive Landscape in Oman Smart Wearables Market

The Oman smart wearables market is shaped by a mix of global brands—Apple, Samsung, Huawei, Garmin, and Fitbit (Google)—with distribution routed through operator channels and modern trade in Muscat. Apple Watch cellular plans and steady type-approval throughput give incumbents a scale edge, while value brands address price-sensitive cohorts online. Overall, telco-brand partnerships and after-sales coverage in Muscat sustain high stickiness for leading players.

Name | Founding Year | Original Headquarters |

Apple | 1976 | Cupertino, USA |

Samsung | 1938 | Seoul, South Korea |

Huawei | 1987 | Shenzhen, China |

Garmin | 1989 | Olathe, USA |

Fitbit (Google) | 2007 | San Francisco, USA |

Xiaomi | 2010 | Beijing, China |

Amazfit (Zepp Health) | 2010 | Hefei, China |

HONOR | 2013 | Shenzhen, China |

OPPO | 2004 | Dongguan, China |

realme | 2018 | Shenzhen, China |

OnePlus | 2013 | Shenzhen, China |

Withings | 2008 | Issy-les-Moulineaux, France |

Polar | 1977 | Kempele, Finland |

Suunto | 1936 | Helsinki, Finland |

Mobvoi (TicWatch) | 2012 | Beijing, China |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Apple: Apple continues to dominate the premium smartwatch segment in Oman, supported by the launch of its Ultra line with extended battery life and advanced diving and endurance tracking features. Omantel’s active support for Apple Watch cellular connectivity has strengthened Apple’s foothold in Muscat’s premium wearable category, while regular software updates focusing on ECG and safety features have driven customer retention among health-conscious users.

Samsung: Samsung has consolidated its position through its Galaxy Watch series, particularly models integrating blood pressure and ECG functions. The brand’s diverse pricing strategy—ranging from entry Galaxy Fit trackers to flagship LTE-enabled watches—has allowed it to capture both premium and mass segments. Local retail tie-ups and visible placements in hypermarkets such as Lulu and Carrefour have also enhanced brand visibility across Oman’s main governorates.

Huawei: Huawei has expanded its wearables lineup in Oman with its Watch GT and Watch 4 series, focusing on robust design and long battery endurance. The company’s in-house HarmonyOS ecosystem and compatibility with both Android and iOS have made it appealing to cross-platform users. Huawei’s growing retail presence in Muscat City Centre and partnerships with Carrefour and e-commerce platforms are helping it counter the restrictions on Google ecosystem integration.

Garmin: Garmin continues to lead the sports and outdoor performance segment, driven by its Fenix, Forerunner, and Epix lines. These devices cater to Oman’s expanding community of runners, cyclists, and outdoor enthusiasts in mountainous and desert terrains. Garmin’s superior GPS accuracy, 10ATM water resistance, and rugged builds make it the preferred brand for endurance athletes and professionals seeking advanced performance analytics.

Fitbit (Google): Fitbit has maintained its niche among lifestyle and wellness users, bolstered by Google integration and new algorithmic health insights. The Sense and Versa lines remain popular for SpO₂ tracking, stress management, and heart rate monitoring. Fitbit’s cloud-based analytics and affordable pricing have strengthened its reach among mid-income urban consumers, while the migration into the Google Wear OS ecosystem aims to unify app and feature experiences across smart devices.

What Lies Ahead for Oman Smart Wearables Market?

The Oman smart wearables market is poised for sustained expansion toward the end of the decade, reflecting steady consumer uptake across connected devices and deeper integration with the country’s digital economy. This evolution will be supported by Oman’s strong connectivity infrastructure, a young, tech-aware population, and government-led digital transformation efforts under Oman Vision 2040, which emphasize e-governance, health digitization, and smart-city readiness.

Rise of Cellular-Enabled and Hybrid Ecosystem Devices: The coming years will see a pronounced shift toward LTE/eSIM-enabled wearables and cross-device ecosystems integrating smartwatches, hearables, and fitness accessories. Over 7.24 million mobile lines and 5.82 million mobile-broadband connections provide the technical foundation for these devices to operate seamlessly. Hybrid models—combining offline fitness tracking with always-connected functions—will appeal to Oman’s urban professionals seeking convenience, health insights, and productivity integration.

Focus on Preventive Health and Remote Monitoring Integration: Wearables will increasingly interface with Oman’s healthcare modernization initiatives. The Ministry of Health’s Digital Transformation Program supports telehealth, AI-based diagnostics, and connected patient systems, encouraging hospitals and insurers to leverage continuous monitoring data. With a population base exceeding 5.2 million residents, the shift toward wellness and chronic-disease management will amplify demand for medical-grade wearables offering SpO₂, ECG, and blood-pressure analytics.

Expansion of Value-Tier and Outdoor-Focused Wearables: As Oman continues to diversify its economy, with national output recorded at USD 104.35 billion, consumer spending on mid-tier devices is expected to broaden beyond Muscat. The growth of domestic tourism, rising fitness participation, and new coastal/outdoor infrastructure will fuel purchases of rugged, GPS-enabled watches and durable trackers suited for Oman’s terrain and climate. This segment will benefit from expanding retail penetration and logistics capacity linked to USD 47.4 billion worth of goods and services imports, ensuring continued availability of global wearables brands.

Leveraging AI and Data Analytics for Personalized Experience: Future market differentiation will revolve around AI-driven health analytics and adaptive learning within wearable software. With 95 internet users per 100 people, Oman’s digitally fluent population forms an ideal testing ground for cloud-linked, AI-enhanced user experiences. Personalized recommendations, real-time feedback, and voice-assistant integration will enhance engagement, boost retention, and expand monetization opportunities for both OEMs and telecom operators bundling wearable-as-a-service models.

Oman Smart Wearables Market Segmentation

By Product Type

Smartwatches (cellular & Bluetooth)

Sports/Outdoor GPS Watches (endurance/trekking/diving)

Fitness Bands/Trackers

Hearables with Health Features (TWS/neckbands with HR/SpO₂)

Medical-grade Wearables (ECG/BP/clinical RPM devices)

Kids/Senior Safety Wearables (locator watches, SOS)

By Connectivity

LTE/eSIM (standalone calling/data)

Bluetooth-only (phone-tethered)

GNSS-centric Multi-Band (L1/L5 for outdoor accuracy)

Wi-Fi Enabled (OTA sync/apps)

Multi-device Ecosystems (watch + buds + scale integrations)

By Price Band (OMR)

Entry (≤ OMR 40)

Mid (OMR 41–120)

Premium (OMR 121–250)

Ultra-Premium (≥ OMR 251)

Enterprise/Medical (contracted procurement)

By End User

Consumers (urban/expat, wellness & lifestyle)

Corporate Wellness Programs (HR/benefits-driven)

Healthcare Providers (hospital/clinic RPM use)

Sports & Fitness Chains/Academies

Education/Public Sector & Safety (students, first responders)

By Sales Channel

Operator Stores & Online (Omantel/Ooredoo bundles, financing)

Modern Electronics Retail (multi-brand chains)

Pure-play E-commerce/Marketplaces

Hypermarkets/Value Retail

Specialty/Sports Retail & Dive Shops

Travel Retail (airport/duty-paid)

Players Mentioned in the Report:

Apple

Samsung

Huawei

Garmin

Fitbit (Google)

Xiaomi

Amazfit (Zepp Health)

HONOR

OPPO

Realme

OnePlus

Withings

Polar

Suunto

Mobvoi (TicWatch)

Key Target Audience

Telecom operators (Omantel, Ooredoo Oman)

Large electronics retailers & distributors (authorized brand partners)

Health insurers (corporate wellness & RPM programs)

Hospitals and digital health units (Ministry of Health Oman – eHealth / digital)

Sports & fitness chains (multi-club operators, outdoor clubs)

Payment networks & issuer banks (wearable payments programs)

Investments and venture capitalist firms (hardware, RPM startups, middleware)

Government and regulatory bodies

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for Smart Wearables-Online, Omni-channel Retail, Operator Bundles or Direct-to-Consumer-(Margins, Preference, Strength & Weakness)

4.2 Revenue Streams for Oman Smart Wearables Market (device sales, wearable subscription/connected ARPU, services, healthcare tie-ups)

4.3 Business Model Canvas for Oman Smart Wearables Market (Key partners, Value proposition, Customer segments, Channels, Revenue streams, Cost structure)

5.1 Global/Regional Brand Presence vs Local Value Brands (premium vs value segmentation, operator OEM partnerships)

5.2 Investment Model in Oman Smart Wearables Market (capex for retail displays, service centres, marketing campaigns, bundled subsidies)

5.3 Comparative Analysis of the Funnelling Process by Private vs Government (public sector procurement of wearables, corporate wellness adoption)

5.4 Wearable Device Budget Allocation by Consumer Segment, Company Size (Large enterprises, SMEs)

8.1 Revenues, Historical (unit volume, average selling price, total value)

9.1 By Product Type (smartwatches, fitness bands, hearables, medical-grade wearables, children/teen wearables)

9.2 By Connectivity Type (Bluetooth only; LTE/eSIM; GNSS-enabled; multi-device ecosystem)

9.3 By Price Band (entry; mid-range; premium; ultra-premium)

9.4 By End-User Segment (consumer; corporate wellness; healthcare providers; sports/fitness clubs)

9.5 By Sales Channel (operator retail stores & online; modern electronics retail; pure-play e-commerce; syndicate/travel retail)

9.6 By Region within Oman (Muscat region; Al Batinah; Dhofar; Al Dakhiliyah; Musandam/Al Buraimi)

9.7 By Age/Demographic Group (18-24; 25-34; 35-44; 45+)

9.8 By Application (health & wellness tracking; sports/outdoor; kids/education; payment/NFC use)

10.1 Consumer Cohorts and Adoption Profile (age, income, expat vs Omani, male vs female)

10.2 Consumer Purchase Drivers & Decision-Making Process (connectivity, health features, brand, pricing, operator bundle)

10.3 Usage Behaviour & ROI Analysis (active wearable users, length of use, upgrade cycle, ARPU uplift for connected watches)

10.4 Gap Analysis Framework (features desired vs available, service/after-sales gap, connectivity/data ecosystem gap)

11.1 Trends & Developments in Oman Smart Wearables Market (Arabic UI localisation, rugged IP rating for desert conditions, satellite messaging readiness)

11.2 Growth Drivers for Oman Smart Wearables Market (health-wellness momentum, digital economy push, operator eSIM rollout, gym/club penetration)

11.3 SWOT Analysis for Oman Smart Wearables Market

11.4 Issues & Challenges for Oman Smart Wearables Market (high import cost, limited local service network, battery performance in high temperatures, data privacy/regulation)

11.5 Regulatory & Compliance Framework (type-approval via TRA, MoH medical-device registration, customs duty/import, data-localisation if applicable)

12.1 Market Size & Future Potential for Online Channel (unit volume, value, share of total, forecast)

12.2 Business Model & Revenue Streams in Online Wearables (D2C, marketplace, operator direct-online, subscription models)

12.3 Delivery Models & Types of Products Offered Online (exclusive online SKUs, live-stream sales, flash promotions)

15.1 Market Share of Key Players in Oman Smart Wearables Market (by revenues, unit shipments, 2024/2025)

15.2 Benchmark of Key Competitors-Variables such as Company Overview, USP, Business Strategies, Business Model, Number of Service Outlets in Oman, Warranty Support, Pricing by Type of Wearable, Technology Used, Best-Selling Models, Major Clients and Partnerships, Marketing Strategy, Recent Developments

15.3 Operating Model Analysis Framework (distribution vs direct, operator bundle vs open market, after-sales service network)

15.4 Strategic Positioning Framework for Competitive Advantage (e.g., Bowman’s Strategic Clock)

15.5 Emerging Vendor Landscape & Innovation Challenge

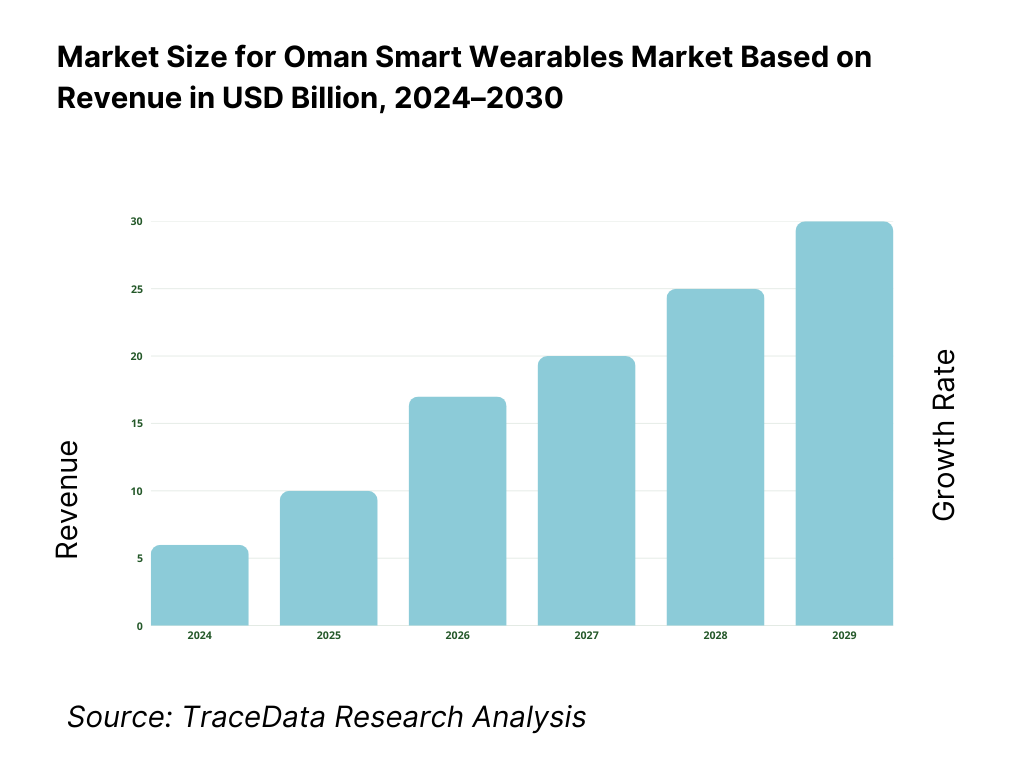

16.1 Revenues, Forecast (2025-2030)

17.1 By Product Type (smartwatches; fitness bands; hearables; children wearables; medical-grade)

17.2 By Connectivity Type (Bluetooth only; LTE/eSIM; GNSS/multi-device)

17.3 By Price Band (entry; mid; premium; ultra premium)

17.4 By End-User Segment (consumer; corporate wellness; healthcare providers; sports/outdoor)

17.5 By Sales Channel (operator stores/online; modern trade; online marketplaces; travel retail)

17.6 By Region Within Oman (Muscat; Al Batinah; Dhofar; Al Dakhiliyah; Musandam/Al Buraimi)

17.7 By Age/Demographic Group (18-24; 25-34; 35-44; 45+)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Oman Smart Wearables Market. Based on this ecosystem, we will shortlist the leading 5–6 wearable brands and operators in the country based on their distribution reach, operator tie-ups, product breadth, and after-sales infrastructure. Sourcing is conducted through official regulator data (TRA Oman type-approval listings, Ministry of Health Oman circulars), government statistics (NCSI Oman telecom data), operator portals (Omantel, Ooredoo), OEM annual reports, and multiple secondary and proprietary databases to perform desk research around the market and collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like sell-in and sell-through volumes, active SKUs, LTE/eSIM penetration, and channel distribution. We supplement this with detailed examinations of company-level data, relying on press releases, financial statements, regulatory disclosures, and customs/import records. This process aims to construct a foundational understanding of both the market and the entities operating within it, validating the operational base against NCSI Oman telecom indicators (7.24 million mobile lines and 5.82 million mobile broadband subscriptions).

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and operational heads representing various Oman Smart Wearables Market entities and ecosystem participants, including telecom operators, distributors, and authorized retailers. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate retail sell-through, operator bundle revenues, and product rotation per channel. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to verify the accuracy of operational and service-related claims, corroborating this data against secondary databases and TRA regulatory filings. These interactions also provide a comprehensive understanding of the value chain, pricing models, eSIM activation process, and warranty management.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process. All brand-level and channel-level estimates are reconciled with official indicators published by NCSI Oman (mobile and broadband connections) and IMF macroeconomic tables to ensure the estimates remain grounded in official baselines. Variance reconciliation, sensitivity tests on eSIM activation, and replacement cycle assumptions are performed to validate the consistency of the final Oman market model before concluding the analysis.

FAQs

01. What is the potential for the Oman Smart Wearables Market?

The Oman Smart Wearables Market holds significant growth potential, with expanding adoption driven by strong digital infrastructure and a growing technology-conscious population. The market is valued at USD 52 million, based on historical trends and retail data triangulated with Oman’s connectivity base of 7,240,909 mobile subscriptions and 5,821,865 active mobile-broadband lines. Rising interest in health, fitness, and lifestyle tracking, combined with operator-backed eSIM enablement, positions Oman as a key GCC growth node for premium and mid-tier wearable devices.

02. Who are the Key Players in the Oman Smart Wearables Market?

The Oman Smart Wearables Market is dominated by a mix of global and regional brands that have established strong distribution and operator tie-ups. The leading players include Apple, Samsung, Huawei, Garmin, and Fitbit (Google) — all of which maintain authorized presence through Omantel and major electronics retailers. Other prominent competitors such as Xiaomi, Amazfit, HONOR, OPPO, realme, OnePlus, Withings, Polar, Suunto, and Mobvoi cater to mid-range and niche consumer segments. Their success in Oman is attributed to wide device compatibility, Arabic UI support, and locally available after-sales services.

03. What are the Growth Drivers for the Oman Smart Wearables Market?

Three primary factors drive growth in the Oman Smart Wearables Market. First, strong connectivity infrastructure underpins continuous device usage—7.24 million mobile and 5.82 million broadband connections provide a reliable digital backbone. Second, Oman’s macroeconomic resilience, reflected in a GDP of USD 104.35 billion, supports consumer electronics spending and enables premium brand adoption. Third, healthcare digitization and wellness trends, backed by the Ministry of Health’s digital initiatives, are accelerating the uptake of medical-grade wearables for continuous monitoring and preventive care, particularly in urban centers such as Muscat and Sohar.

04. What are the Challenges in the Oman Smart Wearables Market?

The Oman Smart Wearables Market faces several structural challenges that could temper its expansion. The country’s compact population base of 5.2 million residents limits scale outside Muscat, leading to inventory and service concentration in urban centers. Heavy import dependence, with total goods and services imports of USD 47.41 billion, exposes OEMs to logistics and tariff delays. Additionally, regulatory processes under the Telecommunications Regulatory Authority (TRA) for type-approval and SAR compliance lengthen product launches, especially for LTE/eSIM and medical-grade models. These constraints collectively shape how quickly new wearables can penetrate Oman’s growing digital consumer base.