Oman Telemedicine Market Outlook to 2030

By Clinical Service Type, By Delivery Mode, By End-User Sector, By Deployment Model, and By Region

- Product Code: TDR0340

- Region: Middle East

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Oman Telemedicine Market Outlook to 2030 – By Clinical Service Type, By Delivery Mode, By End-User Sector, By Deployment Model, and By Region” provides a comprehensive analysis of the telemedicine market in Oman. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Oman telemedicine market. The report concludes with future market projections based on consult volumes, clinical service types, delivery models, end-user categories, and regional adoption patterns, alongside cause-and-effect relationships and success case studies highlighting the major opportunities and cautions within the market.

Oman Telemedicine Market Overview and Size

The Oman telemedicine landscape is embedded within a fast-scaling GCC context where telemedicine is valued at USD 1.98 billion and USD 2.22 billion currently across the bloc, driven by payer adoption, post-pandemic clinical normalization, and 5G/broadband rollouts that lower latency for video and RPM use cases. These figures are from Market Research Future’s GCC analyses. Global momentum further supports local growth, with worldwide telehealth at USD 83.62 billion and USD 94.14 billion in consecutive latest readings, highlighting sustained demand for virtual care that spills over to Oman’s providers and platforms.

Within the region, Saudi Arabia and the UAE dominate due to larger healthcare budgets, aggressive digital-health investment, and dense provider networks; Alpen Capital notes they account for the bulk of regional current health expenditure, which translates into faster platform uptake, richer specialty catalogs, and broader payer coverage. Oman’s runway is strengthened by high internet usage (about 4.58 million users) and national e-health efforts (e.g., Shifa app enabling remote consultations), positioning Muscat and Al Batinah as natural adoption hubs thanks to provider density and data-center access.

What Factors are Leading to the Growth of the Oman Telemedicine Market:

Nationwide digital connectivity and device access enabling scale: Oman’s user base for app-driven care is supported by 6,506,137 mobile subscriptions and 5,338,230 mobile-broadband subscriptions in Q1-2024, alongside 5,445,595 mobile-internet subscriptions and 689,975 fixed-broadband lines, according to the national regulator. In Q2-2024, mobile lines remained above 6,228,827 and fixed-broadband lines above 704,589, providing the bandwidth and reach for video consults, e-prescriptions and remote follow-ups across governorates. With a resident population indicator of 5,321,000, these access points materially lower virtual-care friction and underpin provider workflows (triage, scheduling, eRx) in Muscat and beyond.

Health-system scale and case throughput requiring virtual pathways: The Ministry of Health’s latest Health Facts 2023 reports 92 hospitals and 7,691 hospital beds nationwide, up from prior years, reflecting continued capacity expansion that still needs demand-management via tele-triage and virtual follow-ups. Oman News Agency further notes MoH plans for 9 new hospitals adding 1,799 beds across governorates, reinforcing the need for digital coordination to smooth referrals and reduce avoidable travel. These facility and bed counts translate into heavy outpatient load that benefits from remote primary-care check-ins, specialist pre-op reviews and RPM-supported chronic care.

Geography and population distribution make virtual access economically practical: Oman’s land area spans 309,500 km², with population indicators around 5,321,000, producing long travel arcs between interior wilayats and tertiary centers in Muscat. This spatial context increases time and logistics costs for routine follow-ups, chronic NCD checks, and post-discharge monitoring—precisely the use-cases where teleconsultation and store-and-forward thrive. The government’s Shifa platform adds remote consultation capability inside the national system, letting clinicians and patients exchange records, reports and appointment slots digitally, which raises utilization of virtual visits where in-person care is not clinically necessary.

Which Industry Challenges Have Impacted the Growth of the Oman Telemedicine Market:

Clinical workforce pressure relative to care demand: World Bank indicators show 2.058 physicians per 1,000 population in 2022 for Oman, implying constrained clinician minutes for rapidly growing follow-up loads in NCD and primary-care pathways. At the same time, MoH infrastructure tallied 92 hospitals and 7,691 beds in 2023, with Oman News Agency signaling 1,799 additional beds under construction across 9 facilities. Telemedicine can redistribute visits, but staffing intensity—especially specialist availability outside Muscat—remains a bottleneck for after-hours coverage and complex cases requiring escalation.

Coverage gaps and last-mile bandwidth variability outside urban cores: Regulatory open-data shows 5,445,595 mobile-internet lines and 689,975 fixed-broadband lines in Q1-2024, with 704,589 fixed-broadband lines in Q2-2024. While these baselines are strong in Muscat and coastal hubs, providers still report modality switching (audio vs. video) in interior districts where fixed lines are sparse relative to mobile connections. For tele-diagnostics and high-resolution video in dermatology or rehab, sustained uplink is critical; bandwidth variability forces asynchronous workflows and lengthens turnaround for image-dependent consults.

Data-protection compliance and governance obligations: Oman’s Personal Data Protection Law—Royal Decree 6/2022 establishes binding requirements for processing health data, with 2024 Executive Regulations from MTCIT adding operational conditions such as permits before certain processing activities. These instruments affect all tele-health actors that handle identifiable patient records, cross-border data transfers and cloud hosting choices. Compliance steps sit alongside integration into national apps like Shifa, creating dual obligations for data controllers and processors across provider groups and platform vendors operating in Sultanate jurisdiction.

What are the Regulations and Initiatives which have Governed the Market:

Personal Data Protection Law (Royal Decree 6/2022) and 2024 Executive Regulation: Royal Decree 6/2022 promulgates Oman’s PDPL, published in the Official Gazette and enforced after a one-year interval. The MTCIT Executive Regulation notice in Feb-2024 underscores obligations such as obtaining a permit before certain personal-data processing, which directly covers patient health records in teleconsultation platforms and RPM services. Controllers and processors must align hosting, access rights, and cross-border flows with these instruments to avoid violations while integrating with clinical systems.

Ministry of Health governance over licensed institutions and digital pathways: MoH Health Facts 2023 lists 92 hospitals and 7,691 beds across the Sultanate, reflecting the scope of institutions subject to clinical governance and licensing. The Shifa platform—maintained by MoH—supports remote consultations, access to records and e-services, bringing virtual care within ministerial oversight for documentation, referrals and medication management. Telemedicine providers embedding into this fabric must observe MoH workflows and policies for clinical safety, record integrity and audit.

Telecommunications regulatory environment underpinning service quality: TRA open-data shows 6,506,137 mobile lines, 5,338,230 mobile-broadband lines, 5,445,595 mobile-internet lines and 689,975 fixed-broadband lines in Q1-2024 (and 704,589 fixed lines in Q2-2024). These numbers frame the connectivity baseline that telemedicine platforms must design for—codec selection, session fallback to audio, and QoS monitoring. Providers contracting with telcos for dedicated links or edge resources must ensure compliance with TRA guidance while preserving clinical quality for video consults and secure transmission of DICOM images and eRx data.

Oman Telemedicine Market Segmentation

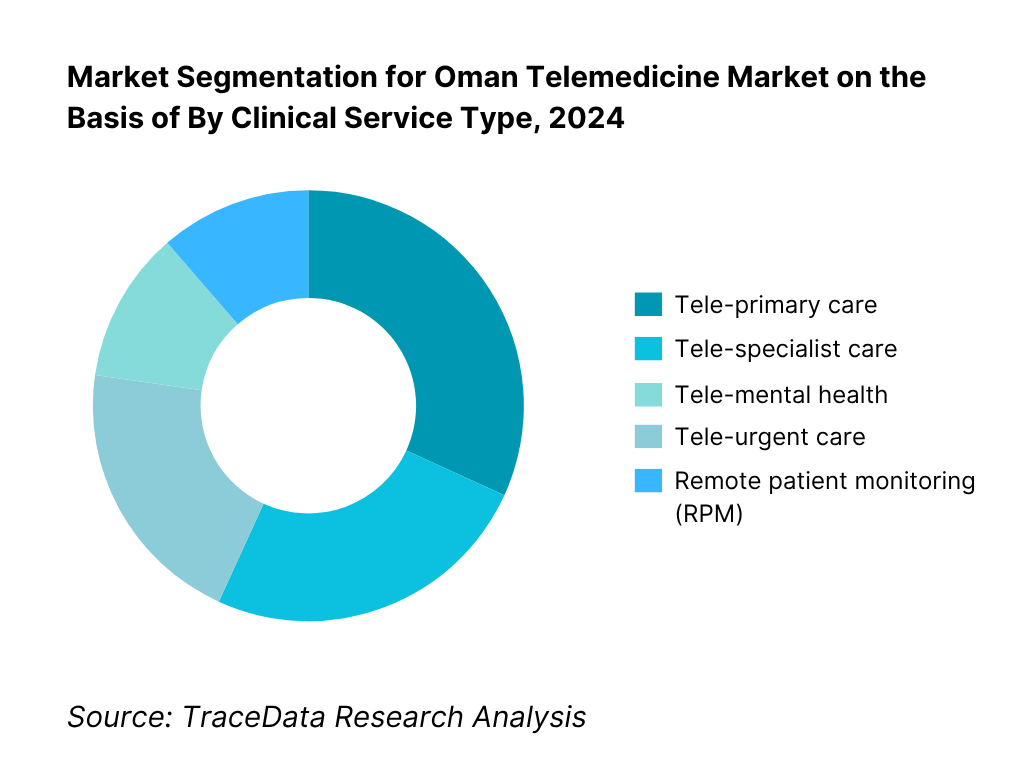

By Clinical Service Type: Oman Telemedicine Market is segmented by clinical service type into tele-primary care, tele-specialist care, tele-urgent care, tele-mental health, and remote patient monitoring. Tele-primary care presently holds a dominant share in Oman under this segmentation; it is propelled by nationwide PHC footprints, the Shifa ecosystem’s workflow integration (appointments, eRx), and strong patient familiarity with primary-care pathways. The model reduces travel for routine follow-ups, triage, and chronic maintenance visits, which aligns with local care-seeking behavior and MOH capacity management. Expansion of Arabic-first UX, payer acceptance for low-acuity video consults, and PHC SOPs sustaining virtual follow-ups reinforce this dominance.

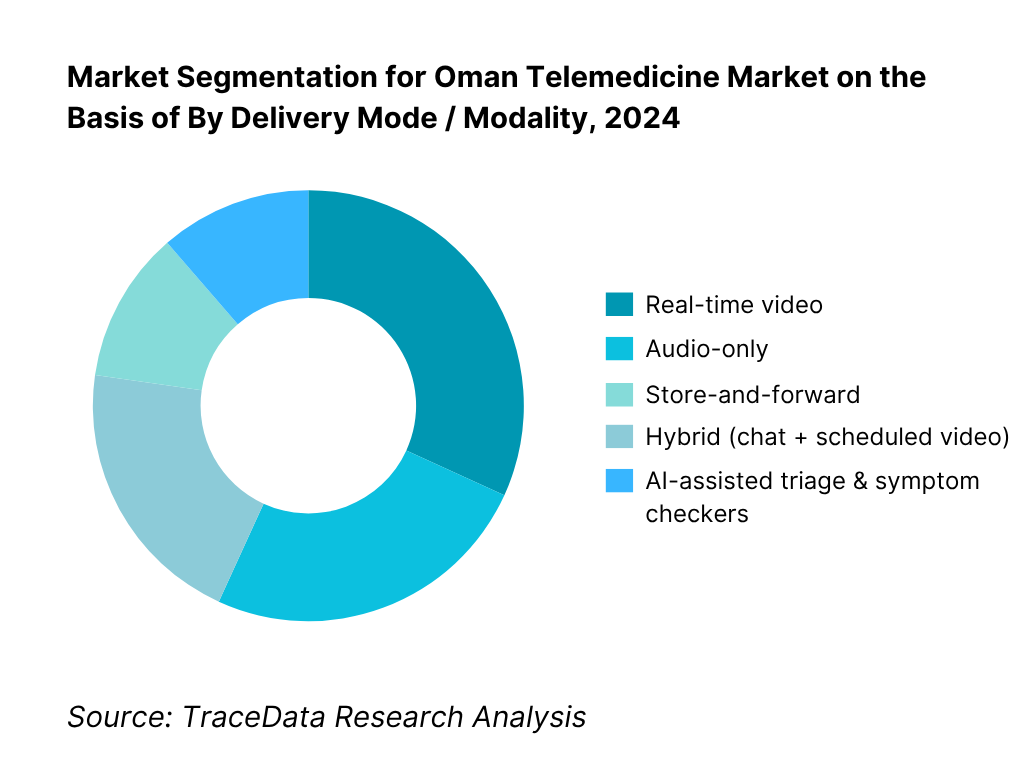

By Delivery Mode / Modality: Oman Telemedicine Market is segmented by delivery mode into real-time video, audio-only, store-and-forward, hybrid, and AI-assisted triage. Real-time video leads the share today because it aligns with clinical and cultural expectations for face-to-face interaction, supports documentation standards in Shifa and private EHRs, and is widely enabled by broadband/4G coverage in key governorates. It also simplifies e-prescribing and referral hand-offs during the same encounter. Audio-only retains a niche where bandwidth is constrained and for repeat follow-ups; hybrid models are accelerating as providers add chat history and quick image exchange before/after the video slot.

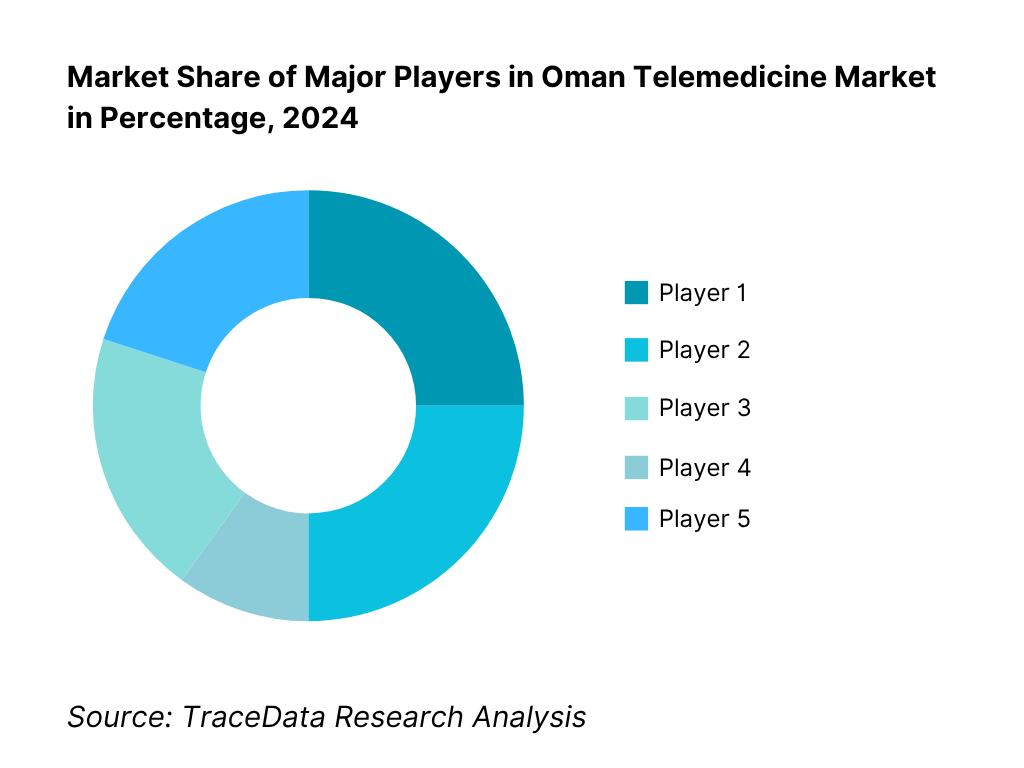

Competitive Landscape in Oman Telemedicine Market

The Oman telemedicine competitive field blends public-sector virtual clinics, private hospital platforms, and regional aggregators. A few large provider groups and MOH-linked services set standards on integration, clinical governance, and Arabic UX, while regional platforms add consumer-grade booking and multi-specialty breadth. This consolidation highlights the significant influence of these key companies on pricing, integration expectations, and payer negotiations.

Name | Founding Year | Original Headquarters |

MOH Shifa Tele-clinics | N/A | Muscat, Oman |

Muscat Private Hospital (Virtual Clinics) | 2000 | Muscat, Oman |

Badr Al Samaa Telemedicine | 2002 | Muscat, Oman |

Burjeel Oman eConsult (VPS/Burjeel) | 2007 | Abu Dhabi, UAE |

KIMS Oman Hospital Virtual Care | 2002 | Thiruvananthapuram, India |

Starcare Oman Telemedicine | 2011 | Muscat, Oman |

Sultan Qaboos University Hospital | 1986 | Muscat, Oman |

Aster Oman Telehealth | 1987 | Kochi, India |

Altibbi | 2011 | Amman, Jordan |

Okadoc | 2017 | Dubai, UAE |

Vezeeta | 2012 | Cairo, Egypt |

Philips Telehealth (Middle East) | 1891 | Amsterdam, Netherlands |

Oracle Health / Cerner Middle East | 1979 | Kansas City, USA |

GE HealthCare Virtual Care (ME) | 1892 | Chicago, USA |

Cura (GCC) | 2016 | Riyadh, Saudi Arabia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

MOH Shifa Tele-clinics: The Ministry of Health expanded its Shifa platform in 2024 to include e-prescription and remote consultation services across multiple governorates. This move strengthened access to primary healthcare in remote wilayats, making Shifa a central digital health backbone in Oman.

Badr Al Samaa Telemedicine: Badr Al Samaa Hospitals reported a surge in online consultations in 2024, especially in general practice and pediatrics. The group also integrated tele-pharmacy services, enabling patients to get medicines delivered post-consultation, thereby improving patient convenience.

Burjeel Oman eConsult: Burjeel Oman launched tele-cardiology and tele-orthopedic services in 2024, enhancing its specialty portfolio. These offerings cater to the rising demand for specialist care, particularly for chronic conditions like cardiovascular disease, which is highly prevalent in Oman.

Altibbi: The regional digital health player Altibbi expanded its Arabic-first teleconsultation services in Oman in 2024, focusing on mental health and women’s health. The platform has also started piloting AI-driven triage tools to optimize consultation flow.

Okadoc: Okadoc partnered with private hospitals in Muscat in 2024 to streamline appointment booking and virtual follow-ups. Its integration of calendar-based video consults has improved clinician scheduling efficiency, supporting both in-house and outsourced service models.

What Lies Ahead for Oman Telemedicine Market?

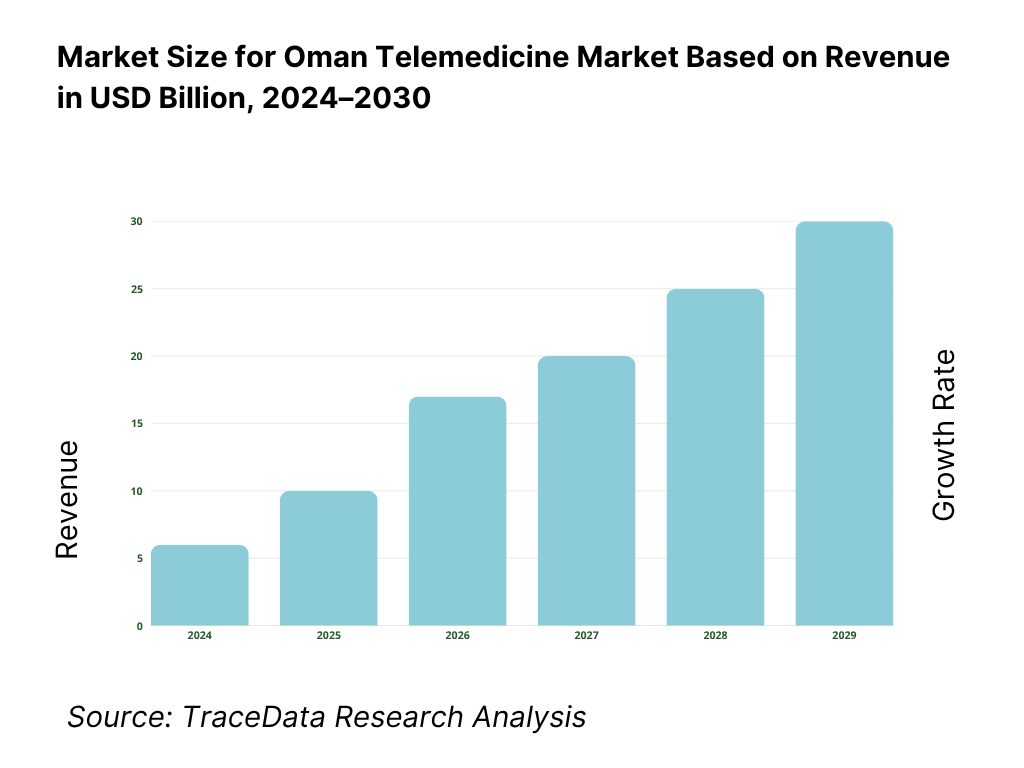

The Oman telemedicine market is expected to expand steadily toward the end of the decade, supported by the government’s Vision 2040 healthcare agenda, the growing demand for chronic disease management solutions, and the increasing adoption of digital health platforms such as the Shifa app. Rising internet penetration, with more than 5.3 million mobile-broadband subscriptions in 2024, and continued investment in health infrastructure are set to accelerate virtual care adoption across both public and private providers.

Rise of Hybrid Care Models: The future of Oman’s telemedicine market will see a marked shift toward hybrid models that blend virtual consultations with in-person visits. This approach allows providers to handle follow-ups and minor ailments remotely while still maintaining the physical capacity for complex cases, particularly in tertiary hospitals. Hybrid models will optimize resource utilization and improve patient convenience in geographically dispersed regions.

Focus on Outcome-Based Telehealth Programs: Healthcare stakeholders in Oman are increasingly moving toward outcome-driven digital programs. Chronic conditions like diabetes and hypertension, which are prevalent across the country, will see telemedicine tied to measurable clinical indicators such as reduced readmissions and improved medication adherence. This ensures that digital investments align with broader national health objectives and contribute to better population health outcomes.

Expansion of Specialty Tele-Services: There will be growing demand for specialty-focused virtual care, particularly in tele-cardiology, tele-dermatology, and tele-mental health. With 92 hospitals and 7,691 hospital beds recorded in 2023, pressure on physical infrastructure creates opportunities for specialty consults to be moved online, improving access for patients in interior governorates. These services will bridge gaps between urban centers and rural populations.

Leveraging AI and Remote Monitoring: Artificial intelligence and connected devices are expected to play a larger role in Oman’s telemedicine future. AI-assisted triage tools, already piloted by regional players like Altibbi, will streamline patient routing, while remote patient monitoring devices will become integral for NCD management. This combination of data-driven insights and IoT connectivity will enhance clinical efficiency, improve patient engagement, and strengthen healthcare ROI.

Oman Telemedicine Market Segmentation

By Clinical Service Type

Tele-primary care

Tele-specialist care (cardiology, dermatology, psychiatry, pediatrics)

Tele-urgent care

Tele-mental health

Remote Patient Monitoring (RPM)

By Delivery Mode

Real-time video

Audio-only consultations

Store-and-forward (asynchronous uploads, teleradiology, telepathology)

Hybrid (chat + scheduled video)

AI-assisted triage & symptom checkers

By End-User Sector

Public PHCs (Ministry of Health)

Public hospitals & tertiary centers

Private hospitals

Private clinics and SMEs

Employers/Corporate health programs

By Deployment Model

Cloud-based platforms

On-premise/hospital-hosted systems

Mobile app-first models

Web portal models

Integrated EHR modules

By Region (Governorate)

Muscat

Al Batinah North & South

Dhofar

Ad Dakhiliyah

Ad Dhahirah & Interior/remote wilayats

Players Mentioned in the Report:

MOH Shifa Tele-clinics

Muscat Private Hospital (Virtual Clinics)

Badr Al Samaa Telemedicine

Burjeel Oman eConsult

KIMS Oman Hospital Virtual Care

Starcare Oman Telemedicine

Sultan Qaboos University Hospital (Tele-clinics)

Aster Oman Telehealth

Altibbi (operating in Oman)

Okadoc (operating in Oman)

Vezeeta (operating in Oman)

Philips Telehealth (Middle East)

Oracle Health/Cerner ME (tele-modules with EHR)

GE HealthCare Virtual Care (ME)

Cura (GCC platform)

Key Target Audience

Government & Regulatory Bodies

Public Provider Networks (PHCs and tertiary hospitals seeking virtual-care scaling)

Private Hospital Groups & Clinic Chains

Insurance Companies & Third-Party Administrators

Employers / Corporate Health Buyers

Telecom Operators & Data-Center Providers (QoS, 5G edge, data-residency services)

Medical Device & RPM Vendors (glucometers, BP cuffs, wearables, gateways)

Investments and Venture Capitalist Firms

Time Period:

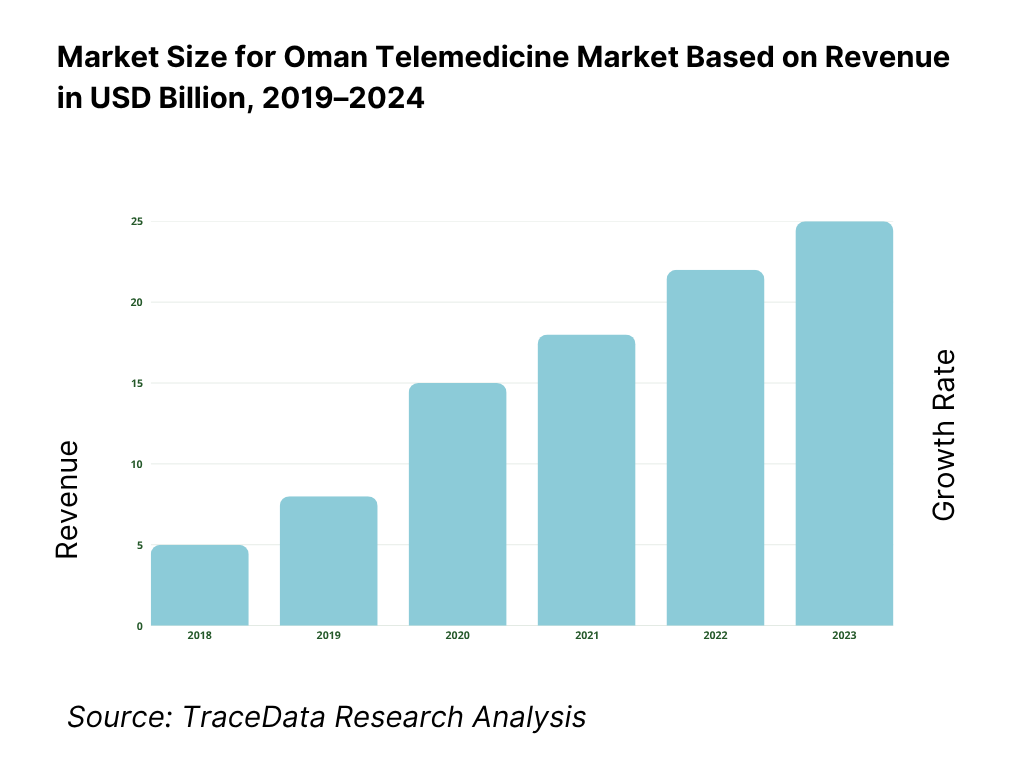

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis-Online, Blended, In-Person, Self-Paced ([gross margin bands by model; clinician utilization; no-show rates; average handle time; patient NPS; clinical risk categories; regulatory burden; Arabic/English UX readiness; strengths/weaknesses by specialty])

4.2. Revenue Streams for Oman Telemedicine Market ([B2C per-consult; B2B subscription (employers/insurers); capitated chronic care bundles (NCD RPM); eRx referral commissions (where permitted); tele-diagnostics reads; white-label SaaS to providers; API fees/integration; remote triage/AI add-ons])

4.3. Business Model Canvas for Oman Telemedicine Market ([customer segments; value propositions (Arabic UX, MOH integration, data residency); channels (apps/portals/IVR); key partners (PHCs, private hospitals, pharmacies, telcos); key activities (clinical ops, compliance, QA); resources (licensed clinicians, data center); cost structure (clinician payouts, infra, CAC); revenue model])

5.1. Freelance Clinicians vs Full-Time Clinicians ([panel composition; credentialing; shift economics; SLA adherence; malpractice & indemnity handling; productivity per FTE])

5.2. Investment Model in Oman Telemedicine Market ([capex: platform build vs SaaS; opex: clinician payouts, cloud, support; PPP & grants; JV structures; localization & data-residency costs; breakeven horizons])

5.3. Comparative Analysis of Funneling Process-Private vs Public ([patient acquisition funnels; referral pathways; PHC triage SOPs; eRx and lab integration steps; authorization with payers; discharge & follow-up loops])

5.4. Telemedicine Budget Allocation by Provider Size ([large systems vs mid-size clinics vs stand-alone practices; % IT vs clinical ops vs marketing; RPM device procurement share])

8.1. Revenues (in OMR/USD; total and by core solution buckets)

9.1. By Market Structure (In-House vs Outsourced/Platform) ([share by revenue & consult volume; integration level with EHR; SLA/quality metrics])

9.2. By Clinical Service Type (Tele-specialist, Tele-primary, Tele-urgent, Tele-mental health, Tele-dermatology) ([consult mix; ASPs; revisit rates; clinical outcomes proxies])

9.3. By End-User Sector (Public PHCs, Public Hospitals, Private Hospitals, Private Clinics, Employer Programs) ([adoption index; reimbursement coverage; contract lengths; renewal rates])

9.4. By Provider Size (Large Systems, Mid-Tier Networks, SMEs/Clinics, Solo Practices) ([panel size; consult capacity; IT maturity])

9.5. By Clinician Seniority (Consultants, Specialists, GPs, Allied Health, Nurses/Coaches) ([mix; payout ratios; supervision models])

9.6. By Mode of Care (Real-Time Video, Audio-Only, Store-and-Forward, Hybrid, Asynchronous chat/AI-triage) ([utilization; clinical suitability; medico-legal risk])

9.7. By Program Type (Open Market B2C vs Customized Enterprise/Insurer Programs) ([pricing; churn; outcomes guarantees])

9.8. By Region/Governorate (Muscat, Al Batinah, Dhofar, Ad Dakhiliyah, Ad Dhahirah/Interior & Remote) ([coverage; consults per 1,000 pop.; network readiness])

10.1. Client Landscape & Cohort Analysis ([public vs private purchasers; employer segments by headcount; high-utilization patient cohorts: NCDs, maternal-child, expat workers])

10.2. Decision-Making Process ([clinical governance; CIO/CMO sign-offs; payer pre-authorization; vendor due-diligence criteria: data residency, Al Shifa integration, Arabic UX])

10.3. Program Effectiveness & ROI ([ER diversion; readmission reduction; adherence; productivity gains; avoided travel; QALY proxies; cost per outcome])

10.4. Gap Analysis Framework ([as-is vs to-be capability map across specialties, governorates, and IT stack])

11.1. Trends & Developments ([5G-enabled tele-exam kits; AI triage; eRx expansion; PHC SOP updates; mental-health normalization; hospital-at-home pilots])

11.2. Growth Drivers ([Vision 2040 alignment; NCD burden; insurer adoption; broadband penetration; Arabic localization; PPP momentum])

11.3. SWOT Analysis ([Strengths, Weaknesses, Opportunities, Threats-Oman context])

11.4. Issues & Challenges ([data privacy; clinician licensing; reimbursement ambiguity; digital divide; cultural acceptance; cyber-risk])

11.5. Government Regulations ([telemedicine licensing, TRC data rules, cross-border consult limits, ePrescription norms, medical liability])

12.1. Market Size & Future Potential-Online Segment

12.2. Business Model & Revenue Streams ([B2C vs B2B; per-consult vs subscription; RPM bundles; payer contracts])

12.3. Delivery Models & Specialties Offered ([top specialties by online share; language availability; access hours; SLA])

15.1. Market Share of Key Players (Revenue Basis)

15.2. Benchmark of Key Competitors ([overview; USP; strategy; business model; clinician network size; revenue bands; pricing by service; tech stack; best-selling services; marquee clients; strategic tie-ups; marketing; recent developments])

15.3. Operating Model Analysis Framework ([clinical operations; QA; scheduling; triage; escalation; eRx; referrals; analytics])

15.4. Gartner-Style Quadrant Mapping ([vision vs execution for Oman context])

15.5. Bowman’s Strategic Clock ([price/value positioning of leading providers])

16.1. Revenues (total; by solution type, deployment, service line, region; scenario analysis)

17.1. By Market Structure (In-House vs Outsourced/Platform) ([share shifts; provider integration roadmaps])

17.2. By Clinical Service Type (Tele-specialist, Tele-primary, Tele-urgent, Tele-mental health, Tele-dermatology) ([growth outlook; margin sustainability; outcome KPIs])

17.3. By End-User Sector (Public PHCs, Public Hospitals, Private Hospitals, Private Clinics, Employer Programs) ([budget trends; renewal propensity])

17.4. By Provider Size (Large Systems, Mid-Tier Networks, SMEs/Clinics, Solo Practices) ([IT maturity curve; compliance uplift])

17.5. By Clinician Seniority (Consultants, Specialists, GPs, Allied Health, Nurses/Coaches) ([workforce planning; supervision models])

17.6. By Mode of Care (Real-Time Video, Audio-Only, Store-and-Forward, Hybrid, Asynchronous chat/AI-triage) ([cost-to-serve; risk management])

17.7. By Program Type (Open Market B2C vs Customized Enterprise/Insurer Programs) ([pricing evolution; outcomes guarantees])

17.8. By Region/Governorate (Muscat, Al Batinah, Dhofar, Ad Dakhiliyah, Ad Dhahirah/Interior & Remote) ([capacity additions; access indices])

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the Oman Telemedicine Market, covering both demand-side and supply-side entities. On the demand side, this includes public healthcare providers under the Ministry of Health, private hospital groups, insurance companies, employers offering corporate health benefits, and patients seeking remote consultations. On the supply side, we identify platform vendors, telecom operators, device/RPM manufacturers, and cloud/data hosting partners. Based on this ecosystem, we shortlist 5–6 leading telemedicine providers in Oman by analyzing their financial indicators (where available), service reach, specialty coverage, and integration with national systems like the Shifa app. Data sourcing for this stage leverages ministry publications, TRA statistics, Oman News Agency updates, and proprietary healthcare databases to collate industry-level information.

Step 2: Desk Research

We conduct an exhaustive desk research process by referencing multiple secondary and proprietary databases. This stage involves reviewing market-level insights such as the number of licensed hospitals (92) and hospital beds (7,691), bandwidth penetration figures (over 5.3 million mobile broadband subscriptions), and the digital footprint of patients and providers. Company-level data is compiled through hospital annual reports, press releases, MOH initiatives, and financial disclosures of regional platforms like Altibbi, Okadoc, and Vezeeta. Particular attention is paid to pricing structures (subscription vs. per-consult), integration levels with eRx, and patient adoption metrics. This process establishes a strong baseline understanding of Oman’s telemedicine market dynamics and competitive landscape.

Step 3: Primary Research

We conduct structured, in-depth interviews with C-level executives, CIOs, CMOs, and clinicians from both public and private healthcare systems in Oman. These interviews validate market hypotheses, authenticate secondary data, and provide operational insights into telemedicine adoption challenges and opportunities. A bottom-to-top approach is employed to estimate revenue contributions by individual providers, which are then aggregated for overall market assessment. As part of our methodology, disguised interviews are sometimes undertaken, where our team approaches companies as potential clients to validate operational and financial metrics. This enables cross-verification of data points such as the share of remote consultations, integration with RPM, and insurer tie-ups, while also clarifying workflows, processes, and pricing strategies across providers.

Step 4: Sanity Check

Finally, we apply a top-to-bottom and bottom-to-top triangulation to ensure consistency of the market model. This involves aligning provider-level consult data with macro indicators such as telecom subscription counts, hospital outpatient volumes, and population indicators (5.32 million in 2024). Sensitivity checks are run against multiple scenarios, and integration is cross-validated with government policy announcements and infrastructure expansions (such as the rollout of 9 new hospitals adding 1,799 beds). This stage ensures the robustness and accuracy of the Oman Telemedicine Market sizing, forecasts, and segmentation outputs.

FAQs

01 What is the potential for the Oman Telemedicine Market?

The Oman Telemedicine Market holds strong potential, supported by the Ministry of Health’s digital health initiatives, the widespread use of the Shifa app, and the rapid expansion of internet and mobile broadband subscriptions, which surpassed 5.3 million in 2024. With 92 hospitals and 7,691 beds nationwide, alongside plans for 9 new hospitals adding 1,799 beds, virtual care solutions are increasingly essential to manage patient loads efficiently. These dynamics make Oman well-positioned to scale telemedicine as a sustainable pillar of healthcare delivery.

02 Who are the Key Players in the Oman Telemedicine Market?

The Oman Telemedicine Market features several leading players, including MOH Shifa Tele-clinics, Badr Al Samaa Telemedicine, Burjeel Oman eConsult, and KIMS Oman Virtual Care. These providers dominate due to their strong integration with national healthcare systems, wide patient reach, and adoption of multi-specialty tele-services. Other notable players expanding access across the Sultanate include Starcare Oman Telemedicine, Aster Oman Telehealth, Sultan Qaboos University Hospital’s Tele-clinics, and regional platforms such as Altibbi, Okadoc, and Vezeeta.

03 What are the Growth Drivers for the Oman Telemedicine Market?

Growth is driven by macro factors, including Oman’s 5.32 million population spread across 309,500 km², making virtual consultations critical to bridging geographic gaps. The rapid uptake of 6.5 million mobile subscriptions and 704,589 fixed broadband lines in 2024 underpins digital adoption. The Ministry of Health’s investment in national digital platforms, combined with rising NCD prevalence requiring continuous monitoring, strengthens the demand for telemedicine. Regional momentum in GCC healthcare digitalization further amplifies this market’s growth trajectory.

04 What are the Challenges in the Oman Telemedicine Market?

Challenges include clinical workforce constraints, with only 2.058 physicians per 1,000 people in 2022, limiting capacity for scaling specialist tele-services. Connectivity disparities between Muscat and remote wilayats affect video consult quality, despite 5.44 million mobile-internet lines in 2024. Additionally, regulatory compliance under Royal Decree 6/2022 (Personal Data Protection Law) and its 2024 executive regulations creates new governance requirements for platforms handling sensitive health data. These challenges require coordinated solutions across infrastructure, policy, and workforce training.