Oman Used Car Market Outlook to 2030

By Sales Channel (OEM CPO, Organized Multi-brand, Online Marketplaces, Unorganized/C2C), By Vehicle Type (SUV, Sedan, Hatchback, Pickup, Luxury/Performance, LCV), By Powertrain (Petrol, Diesel, Hybrid, PHEV, BEV)

- Product Code: TDR0341

- Region: Middle East

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Oman Used Car Market Outlook to 2030 - By Sales Channel (OEM CPO, Organized Multi-brand, Online Marketplaces, Unorganized/C2C), By Vehicle Type (SUV, Sedan, Hatchback, Pickup, Luxury/Performance, LCV), By Powertrain (Petrol, Diesel, Hybrid, PHEV, BEV), By Vehicle Age (≤3 Years, 4–6 Years, 7–10 Years, >10 Years), By Price Band (≤ OMR 3k, OMR 3–6k, OMR 6–10k, OMR 10–20k, ≥ OMR 20k), and By Region (Muscat, Dhofar, Al Batinah, Al Dakhiliyah, Al Sharqiyah, Al Dhahirah/Al Buraimi)” provides a comprehensive analysis of the used car market in Oman. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the used car market. The report concludes with future market projections based on transaction volumes, financing products, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

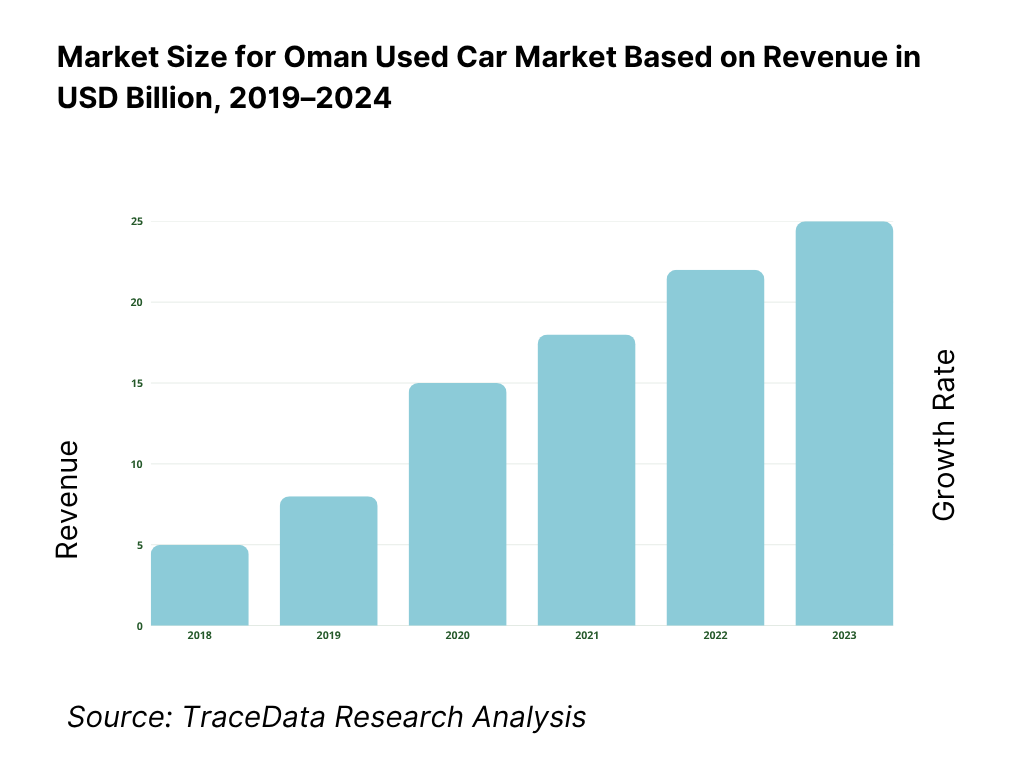

Oman Used Car Market Overview and Size

The Oman Used Car Market reached a valuation of around 450 million Omani Rials (equivalent to approximately USD 1.17 billion, using OMR 1 ≈ USD 2.6) in 2024, up from lower levels in prior years. This level was supported by a 5.8% rise in total vehicle registrations between 2023 and 2024, with used cars comprising roughly 65% of those registrations, as reported by Oman’s National Centre for Statistics and Information (NCSI) and the Oman Chamber of Commerce and Industry. The growth reflects affordability pressures from elevated new-car prices and VAT/duty at 5%, leading many buyers to opt for pre-owned vehicles. In 2024, continued demand for value, combined with relatively stable financing terms in the banking sector, further underpinned this market, with early indications pointing to maintained momentum in volume and value.

The used car market in Muscat Governorate dominates due to its status as Oman’s economic and population centre, with the most developed road networks, extensive dealership infrastructure, and higher levels of disposable income. The NCSI data shows that Muscat experienced a growth in automobile registrations by around 3.8% year-on-year in 2023, helping solidify its lead. Meanwhile Sohar and the adjoining North Al Batinah Governorate are emerging strongly, fueled by robust urban development and industrial activity tied to the Sohar Port and Free Zone. Vehicle registrations there rose by approximately 6.8% mid-2024 year over year, reflecting the influx of resident expats and local workforce needs. Furthermore, Sohar’s geographic advantage near import entry points offers competitive pricing and faster inventory turnover, helping it rise as a significant secondary hub.

What Factors are Leading to the Growth of the Oman Used Car Market:

Expanding vehicle base and active renewals supporting replacement demand: Oman’s vehicle stock continues to deepen, creating a steady replacement cycle that feeds used-car listings and transactions. The National Centre for Statistics and Information (NCSI) reports 1,667,393 vehicles registered at end-2023, rising to 1,704,873 by end-June 2024 and 1,711,702 by end-July 2024; private registrations account for over a million units, while commercial and fleet categories add recurring defleet supply into the secondary market. A larger rolling parc also increases the pool of trade-ins entering dealer lots and online marketplaces, especially in Muscat and North Al Batinah where registrations are concentrated. This tangible expansion in the parc—combined with continued annual renewals—underpins inventory depth, model variety, and price stratification across segments (SUVs, sedans, pickups), enabling dealers to match buyer budgets more efficiently and accelerate unit turns.

Bank credit depth enabling retail auto finance and dealer working capital: Availability of bank credit sustains retail purchases of pre-owned vehicles and funds dealer inventory cycles and reconditioning. The Central Bank of Oman’s Monthly Statistical Bulletin shows private-sector credit outstanding at OMR 20.3 billion at end-March 2024 (the same level also reported for April), reflecting ample liquidity for consumer and SME lending, including auto loans and dealer working capital lines. A liquid banking system helps shorten approval times, widen eligibility, and improve attach rates for protection products (warranty/insurance), which, in turn, raises buyer confidence in used-car purchases. IMF’s 2024 Article IV review further characterizes the banking sector as sound, with strong capital and liquidity buffers—conditions that are conducive to financing bigger-ticket household durables like vehicles.

Population scale with rising non-oil economic activity sustaining mobility needs: World Bank data places Oman’s population at 5,300,000 in 2024, forming a sizable base of drivers across national and expatriate cohorts. Parallel to this, Oman’s non-oil value added reached OMR 27.87 billion by end-2024, as documented by official statistics, indicating broad activity in services, construction, logistics, and tourism that depend on vehicle mobility and employee commuting. A growing urban workforce amplifies demand for reliable, budget-fit transport, often addressed by late-model used vehicles rather than new. The combination of a multi-million population, diversified non-oil output in the tens of billions of rials, and a maturing retail infrastructure (dealers, finance, insurance) anchors resilient baseline demand for pre-owned cars across governorates.

Which Industry Challenges Have Impacted the Growth of the Oman Used Car Market:

Import-reliant ecosystem amid customs/tariff regime and external supply frictions: Oman’s merchandise imports totaled USD 38.7 billion in 2023 (WTO tariff profile), underscoring a structurally import-reliant economy where vehicles and parts flow through border channels and port logistics. While GCC frameworks facilitate some intra-regional movement, motor vehicles fall under HS Chapter 87 (e.g., HS 8703/870350), and imported units must clear customs and meet conformity requirements before resale. Any disruption in source markets, shipping lanes, or documentation processes slows replenishment of popular trims and model-years, tightening dealer inventories. The import footprint—quantified in tens of billions of dollars—means currency swings and freight changes can ripple into stocking decisions, reconditioning timelines, and the breadth of listings on marketplaces.

Inspection and compliance bottlenecks for older or commercial vehicles: Royal Oman Police (ROP) requirements stipulate technical inspection for specific vehicle categories—including 10-year-old private vehicles, commercial vehicles, buses, trucks, pickup trucks, taxis, and driving school cars—during registration or renewal. These thresholds place operational friction on dealer intake of older vehicles and on sellers of commercial units, as each unit must pass inspection before transfer. Capacity constraints at inspection centers or documentation issues can stretch processing times and delay listings going live, affecting turnover and cash cycles. Clarity on who must inspect, and when, is spelled out by ROP service pages and traffic law updates that enumerate the categories and age conditions.

Small market scale limits depth of niche segments and variant availability: With a population of 5,300,000 in 2024, Oman’s market scale naturally caps the variety of low-volume trims, niche powertrains, or rare body styles across used-car lots. Even with a sizeable parc of 1,667,393 vehicles at end-2023, thin liquidity in specific models can widen search times for buyers needing certain configurations (e.g., advanced ADAS packages, long-bed pickups, or particular luxury options). Dealers consequently face inventory mix challenges—holding costs rise if units sit while the right match surfaces. The market’s numeric constraints—millions of residents, but not tens of millions—mean product-market fit must be engineered through targeted sourcing and trade-in capture rather than relying on abundant secondary supply.

What are the Regulations and Initiatives which have Governed the Market:

Vehicle inspection and renewal thresholds defined by ROP rules: The Royal Oman Police details conditions for vehicle registration renewal and technical inspection, explicitly covering 10-year-old private vehicles, commercial vehicles, buses, trucks, and pickup trucks. These numeric thresholds determine when a unit must be inspected before transfer or renewal, directly influencing dealer intake strategies (older units require pre-sale remediation) and timelines for C2C transfers. ROP has also communicated operational decisions that allow extending the validity of operating licences beyond one year for private vehicles under specified provisions, which affects renewal cadence and planning for owners and dealers.

Formal controls for technical inspection providers via official decision: In 2024, ROP issued Decision 88/2024 setting controls for providing vehicle technical inspection services, codifying requirements for inspection centers and personnel. The decision number anchors compliance obligations for private operators and standardizes processes around equipment, qualifications, and reporting—important for the integrity of used-vehicle condition assessment and for consistent buyer protection. Dealers and marketplaces relying on third-party inspections must align their SOPs to these controls, ensuring every vehicle presented for sale and ownership transfer is supported with compliant documentation recognized by licensing authorities.

Tax framework applicable to automotive transactions anchored by Royal Decree: Value Added Tax was established by Royal Decree 121/2020, creating the legal basis for VAT on supplies within Oman, including automotive sales and services except where specifically exempt or zero-rated. While the statute sets the standard rate in law, the operational takeaway for the used-car channel is the requirement to register, invoice, and account for VAT per the Executive Regulations, with implications for dealer cash flows and advertised prices. Import regimes intersect with HS Chapter 87, and national tariff schedules are administered under customs law and WTO-conforming bindings—dealers importing used units must comply with the applicable tariff line rules.

Oman Used Car Market Segmentation

By Vehicle Type: Oman Used Car market is segmented by vehicle type into hatchbacks, sedans, SUVs, pickup trucks, and luxury/performance vehicles. SUVs have a dominant market share, in 2023 reflecting around 45% of total market value, driven by their off-road capability, ground clearance suited to arid and rugged terrain, class appeal, and suitability for family and commercial use alike. The popularity of SUVs is bolstered by import flows of late-model ex-rental and fleet SUVs from GCC countries, available duty-free if under two years old. These factors combined mean SUVs capture both value-conscious and status-oriented buyers, outpacing sedans and hatchbacks, which are also present but attract different buyer segments focused more on fuel economy or city usability.

.png)

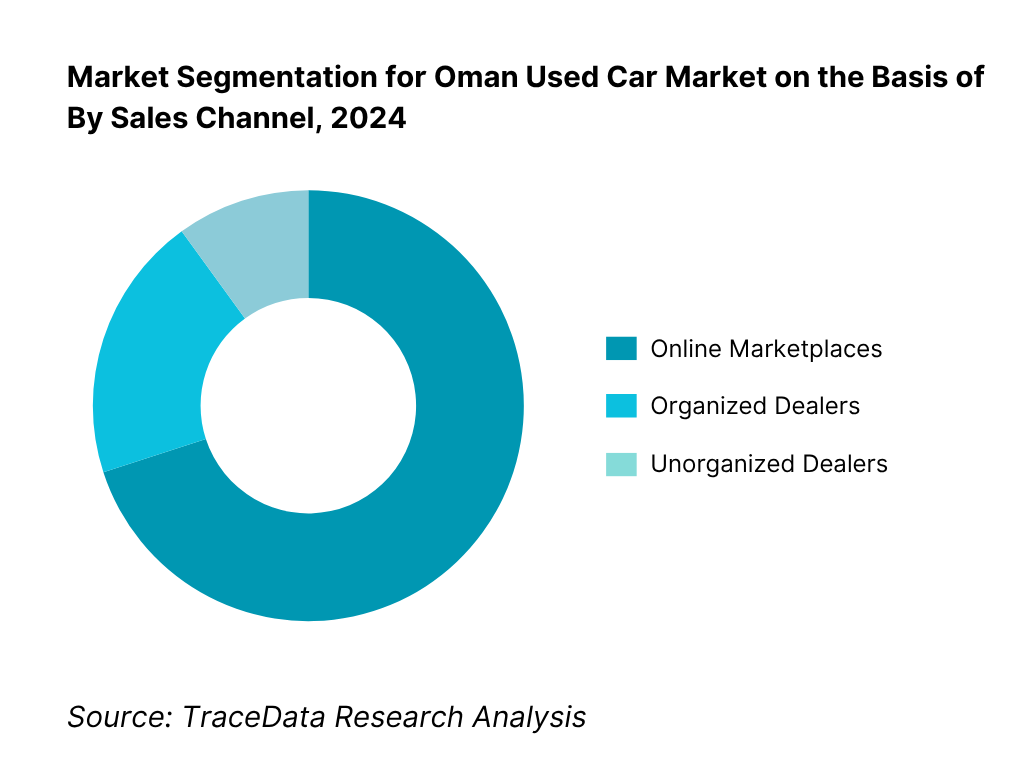

By Sales Channel: Oman Used Car market is segmented into online marketplaces, organized dealers (multi-brand and OEM CPO programs), and unorganized sales (street-lot dealers, peer-to-peer private sales). In 2024, online marketplaces captured approximately 68.5% of the market share, dominating transactions due to wide digital penetration, transparency with AI-driven pricing tools, home delivery/test-drive services, and escrow/payment integration. Organized dealers are growing rapidly through trust building, financing packages, warranties, and leveraging brand power; unorganized dealers remain significant but face pressure from regulation and digitalization.

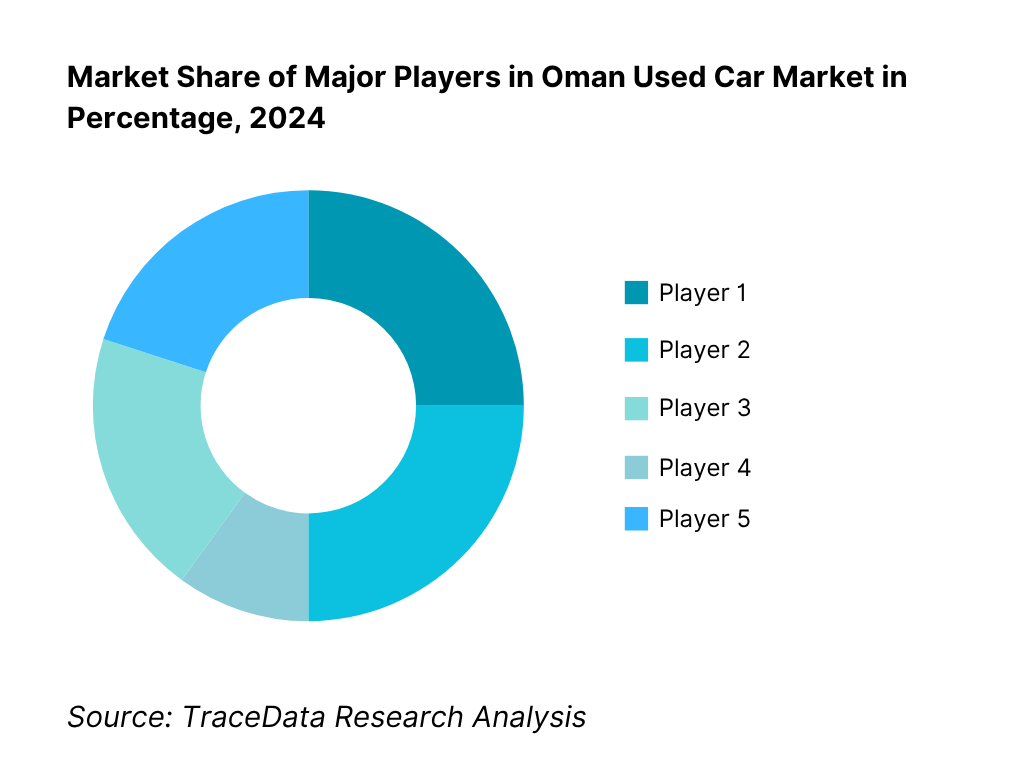

Competitive Landscape in Oman Used Car Market

The Oman Used Car Market features a blend of established online marketplaces and traditional dealer networks. Platforms such as YallaMotor, OpenSooq, and Dubizzle dominate online listings and transactions, benefiting from high internet/mobile penetration and shifting consumer trust to digital channels. Traditional players like Best Cars (Saud Bahwan) and MHD Used Cars (MHD LLC) maintain strength through physical footprint and OEM associations. Competition is shaped by ability to offer certified pre-owned programs, finance tie-ups, vehicle inspection and warranty packages, and ease of online-to-offline customer experience.

Name | Founding Year | Original Headquarters |

Dubizzle Oman (OLX) | 2005 | Muscat, Oman |

YallaMotor Oman | 2015 | Muscat, Oman |

Omanicar | 2010 | Muscat, Oman |

OpenSooq Oman | 2008 | Amman, Jordan |

Best Cars (Saud Bahwan Group) | 1965 | Muscat, Oman |

Popular Pre-Owned Cars | 1969 | Muscat, Oman |

MHD Used Cars (MHD LLC) | 1974 | Muscat, Oman |

Zubair Automotive – Pre-Owned | 1967 | Muscat, Oman |

Zawawi Trading Company – Mercedes- | 1972 | Muscat, Oman |

Al-Jenaibi International Automobiles | 2001 | Muscat, Oman |

OTE Group | 1991 | Muscat, Oman |

Towell Auto Centre | 1972 | Muscat, Oman |

General Automotive Company | 1973 | Muscat, Oman |

Bahwan Motors – Pre-Owned | 2004 | Muscat, Oman |

Kavak Oman | 2023 | Muscat, Oman |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Dubizzle Oman (OLX): As one of the leading online automotive marketplaces in Oman, Dubizzle enhanced its platform in 2024 by integrating instant car valuation tools and expanding its escrow payment system. This move significantly boosted trust and transparency, helping it attract more private sellers and buyers seeking secure online transactions.

YallaMotor Oman: YallaMotor strengthened its partnership network with authorized dealerships in 2024, enabling seamless lead generation and faster car financing approvals. By combining online listings with offline dealer engagement, it has positioned itself as a trusted hybrid channel for both individual and fleet buyers.

Best Cars (Saud Bahwan Group): Leveraging its strong Toyota and Lexus dealership ties, Best Cars expanded its Certified Pre-Owned (CPO) program in 2024. The initiative focused on rigorous inspection standards and extended warranties, catering to Oman’s growing middle-income buyers who seek reliability and assurance in used car purchases.

MHD Used Cars (MHD LLC): In 2024, MHD Used Cars introduced Islamic finance options for pre-owned Nissan and Infiniti vehicles. This attracted a wider consumer base, particularly younger Omani nationals, by offering more affordable financing packages that align with local cultural and regulatory expectations.

Kavak Oman: Entering the market in late 2024, Kavak brought a disruptive digital-first approach by offering 240-point inspections, doorstep delivery, and a 7-day return policy. Its aggressive customer acquisition campaigns and buy-back guarantee models are reshaping consumer expectations, raising competition levels in the organized used car space.

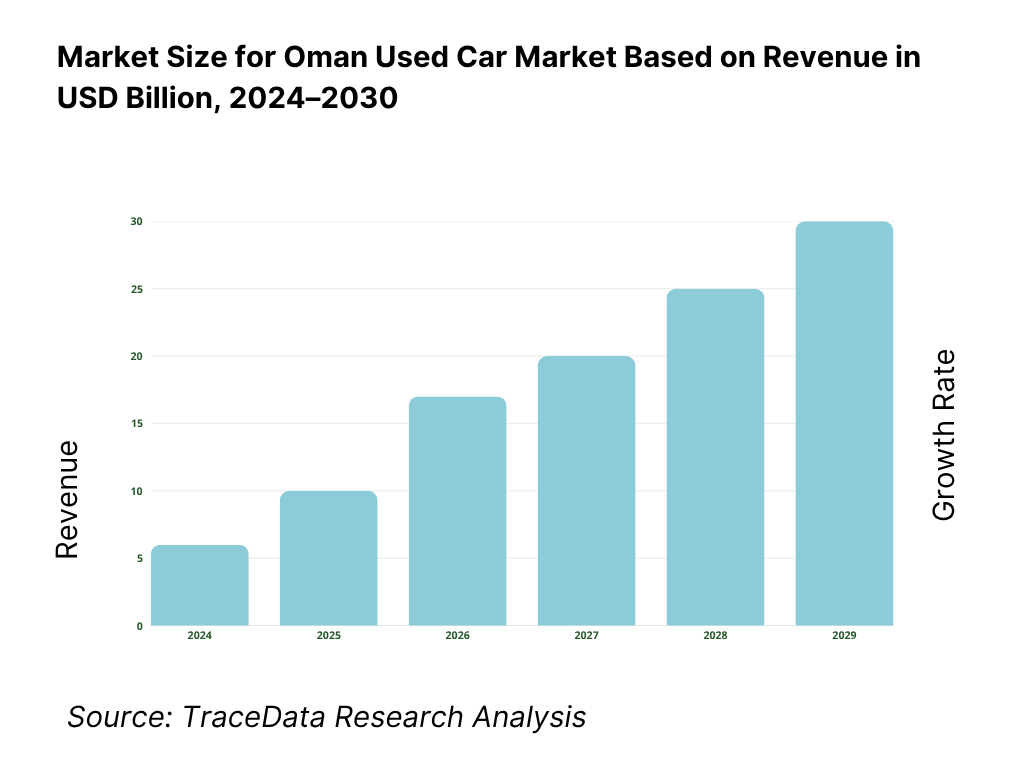

What Lies Ahead for Oman Used Car Market?

The Oman used car market is anticipated to maintain steady growth through the end of the decade, supported by rising demand for affordable mobility, expanding digital marketplaces, and the availability of financing options from both conventional banks and Islamic financial institutions. Growth momentum will be further reinforced by Oman’s expanding vehicle parc, urban population concentration in Muscat and Sohar, and the increasing consumer acceptance of certified pre-owned (CPO) programs that provide warranties and inspection-backed trust.

Rise of Online-to-Offline Marketplaces: The future of Oman’s used car ecosystem will see deeper integration between digital platforms and physical dealerships. Consumers are expected to benefit from seamless experiences such as instant car valuations, doorstep test drives, and digital payments, making transactions faster and more transparent.

Expansion of Certified Pre-Owned Programs: Organized dealers are set to broaden their certified pre-owned offerings, emphasizing multi-point inspections, extended warranties, and buy-back guarantees. These initiatives will attract middle-income and first-time buyers who prioritize reliability and lower risk in vehicle ownership.

Increasing Demand in Secondary Cities: While Muscat remains the dominant hub, growth is likely to accelerate in Sohar, Nizwa, and Salalah due to industrial expansion, rising household incomes, and better logistics connectivity. Dealers expanding into these regions will capture underserved demand and gain competitive advantage.

Adoption of Electric and Hybrid Vehicles in Used Market: With Oman investing in charging infrastructure and setting regulatory standards for low-emission mobility, pre-owned hybrid and electric cars are expected to emerge as a niche growth segment. Buyers looking for fuel savings and sustainability will gradually shape new demand pools in the secondary market.

Leveraging AI and Analytics for Pricing and Inventory: Dealers and platforms will increasingly adopt AI-driven dynamic pricing engines and predictive analytics to optimize inventory turnover. These technologies will help manage reconditioning costs, reduce days-to-sell, and improve buyer satisfaction through accurate valuations and tailored recommendations.

Oman Used Car Market Segmentation

By Vehicle Type (In Value %)

SUVs

Sedans

Hatchbacks

Pickup Trucks

Luxury & Performance Cars

Light Commercial Vehicles (LCVs)

By Fuel / Powertrain (In Value %)

Petrol Vehicles

Diesel Vehicles

Hybrid Vehicles

Plug-in Hybrid Vehicles (PHEV)

Battery Electric Vehicles (BEV)

By Vehicle Age (In Value %)

Up to 3 Years

4–6 Years

7–10 Years

Above 10 Years

By Price Band (In Value %)

≤ OMR 3,000

OMR 3,001 – 6,000

OMR 6,001 – 10,000

OMR 10,001 – 20,000

≥ OMR 20,001

By Sales Channel (In Value %)

OEM Certified Pre-Owned (CPO) Dealers

Multi-Brand Organized Dealers

Online Marketplaces / Classifieds

Unorganized Roadside Dealers

Consumer-to-Consumer (C2C)

By Ownership History (In Value %)

First-Owner Vehicles

Second-Owner Vehicles

Fleet & Ex-Rental Vehicles

Corporate & Government Disposals

By Region (In Value %)

Muscat

Dhofar (Salalah)

Al Batinah North & South (Sohar as hub)

Al Dakhiliyah (Nizwa)

Al Sharqiyah North & South

Al Dhahirah & Al Buraimi

Players Mentioned in the Report:

Key Target Audience

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for Used Cars in Oman-Offline Showrooms, Online Marketplaces, Hybrid Retail, Auctions, Consumer-to-Consumer [margins, buyer preference, strengths & weaknesses]

4.2 Revenue Streams for Oman Used Car Market [vehicle sales, warranties, financing commissions, insurance tie-ups, reconditioning fees, listing/ad revenue]

4.3 Business Model Canvas for Oman Used Car Market [CPO model, marketplace model, dealer aggregator model, buy-sell model]

5.1 Freelance Brokers vs. Authorized Dealers [trust, transparency, margins]

5.2 Investment Model in Oman Used Car Market [dealer working capital, inventory financing, marketplace VC funding, PE-backed consolidators]

5.3 Comparative Analysis of Funnelling Process-Organized vs. Unorganized Dealers in Oman [lead generation, inspection, sale closure, post-sale service]

5.4 Used Car Budget Allocation by Omani Households & Expat Buyers [by income brackets, financing penetration, upfront cash vs. installment preference]

8.1 Revenues (Historical Market Size, Growth Rate, Key Milestones)

9.1 By Market Structure (Organized Dealers, OEM CPO, Unorganized Dealers, Online Marketplaces, Auctions)

9.2 By Vehicle Type (SUV, Sedan, Hatchback, Pickup, Luxury/Performance, LCVs)

9.3 By Fuel/Powertrain (Petrol, Diesel, Hybrid, Plug-in Hybrid, Battery Electric)

9.4 By Vehicle Age (≤3 years, 4-6 years, 7-10 years, >10 years)

9.5 By Price Band (≤ OMR 3k, OMR 3k-6k, OMR 6k-10k, OMR 10k-20k, ≥ OMR 20k)

9.6 By Mileage Band (≤50k km, 50-100k km, 100-150k km, 150-200k km, >200k km)

9.7 By Ownership History (First Owner, Multiple Owners, Fleet/Ex-rental, Corporate/Government disposals)

9.8 By Region (Muscat, Dhofar, Al Batinah, Al Dakhiliyah, Al Sharqiyah, Al Dhahirah/Al Buraimi)

10.1 Buyer Cohort Landscape [Omani nationals, expats, corporate fleets]

10.2 Decision-Making Process for Vehicle Purchase [price, mileage, financing, warranty, brand origin]

10.3 Used Car Purchase ROI & Affordability Analysis [residual value, maintenance, insurance]

10.4 Gap Analysis Framework [demand for SUVs vs. supply, EV readiness vs. infrastructure]

11.1 Trends and Developments [online-to-offline integration, digital escrow/payments, instant offers, EV adoption]

11.2 Growth Drivers [expat churn, urbanization in Muscat, finance penetration, SUV preference]

11.3 SWOT Analysis [strengths, weaknesses, opportunities, threats]

11.4 Issues and Challenges [grey imports, odometer fraud, financing of older vehicles, warranty gaps]

11.5 Government Regulations [ROP inspection & title transfer, customs/import rules, VAT & duties, insurance mandates]

12.1 Market Size and Future Potential for Online Used Car Platforms in Oman

12.2 Business Models and Revenue Streams [subscription listings, transaction fees, value-added services]

12.3 Delivery Models and Services Offered [inspection, warranty, financing, doorstep delivery]

15.1 Market Share of Key Players in Oman Used Car Market [by revenues, by channel]

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Model, Dealer Network, Revenues, Pricing, Technology Used, Warranty/Inspection, Finance/Insurance Tie-Ups, Strategic Partnerships, Clients, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework [inventory vs. platform, dealer-led vs. asset-light]

15.4 Gartner Magic Quadrant (Applied to Used Car Platforms in Oman)

15.5 Bowman’s Strategic Clock for Competitive Advantage

16.1 Revenues (Forecast Projections)

17.1 By Market Structure (Organized Dealers, OEM CPO, Online Marketplaces, Unorganized Dealers, Auctions)

17.2 By Vehicle Type (SUV, Sedan, Pickup, Hatchback, Luxury/Performance, LCVs)

17.3 By Powertrain (Petrol, Diesel, Hybrid, BEV/PHEV)

17.4 By Vehicle Age (≤3 years, 4-6 years, 7-10 years, >10 years)

17.5 By Price Band (≤ OMR 3k, OMR 3k-6k, OMR 6k-10k, OMR 10k-20k, ≥ OMR 20k)

17.6 By Mileage Band

17.7 By Ownership History

17.8 By Region

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire Oman Used Car Market ecosystem to capture all demand-side and supply-side entities. On the demand side, this includes Omani nationals, expatriate residents, corporate fleet buyers, and rental/leasing companies. On the supply side, we map OEM-certified pre-owned programs, multi-brand dealers, online marketplaces, fleet disposals, auction houses, and importers. Based on this ecosystem, we shortlist 5–6 leading players in Oman—such as Dubizzle Oman, YallaMotor, Best Cars (Saud Bahwan Group), MHD Used Cars, Zubair Automotive, and Kavak—using criteria including financial disclosures, market reach, branch networks, and customer base. Sourcing is conducted through government portals (NCSI, ROP), trade associations, industry news, and proprietary databases to collate accurate industry-level information.

Step 2: Desk Research

Next, we conduct exhaustive desk research by leveraging secondary and proprietary databases. This step allows us to examine the Oman Used Car Market holistically, covering parameters such as registered vehicle stock, number of active dealers, financing penetration, inspection compliance requirements, and consumer demand trends. At the company level, we analyze publicly available disclosures—such as press releases, annual reports from automotive groups, financial statements, and official dealer announcements. This process creates a robust baseline understanding of the market’s size, structure, and the operational models of entities ranging from traditional dealerships to online marketplaces.

Step 3: Primary Research

We engage in structured interviews with executives and stakeholders across Oman’s used car ecosystem, including dealer principals, marketplace operators, bank auto-loan managers, and insurance underwriters. These interactions validate desk research hypotheses, confirm statistical data, and provide granular insights into pricing practices, residual value dynamics, reconditioning processes, and sales cycle times. To enhance accuracy, disguised interviews are conducted where our team poses as potential buyers or partners to test actual dealer practices and service standards. This approach corroborates operational and financial details against secondary sources and offers a deeper understanding of revenue streams, supply channels, and financing/insurance linkages.

Step 4: Sanity Check

Finally, we perform both bottom-up and top-down analyses to validate overall market size and segmentation. The bottom-up approach aggregates dealer and platform revenues, trade-in volumes, and fleet disposal contributions. The top-down approach cross-references macro indicators such as total registered vehicles (NCSI), import flows (WTO tariff data under HS 87), and population/urban mobility demand (World Bank). Through iterative modeling exercises, we reconcile both perspectives to ensure accuracy and consistency. This dual validation framework guarantees that the market sizing and growth analysis are realistic, credible, and reflective of Oman’s economic and regulatory environment.

FAQs

01 What is the Potential for the Oman Used Car Market?

The Oman Used Car Market holds strong potential, with the total registered vehicle base reaching 1,667,393 units at the end of 2024 and increasing to 1,711,702 units by mid-2024, according to the National Centre for Statistics and Information. Demand is reinforced by Oman’s population of 5.3 million people and the affordability gap between new and pre-owned cars. Growing reliance on digital platforms and certified pre-owned (CPO) programs further strengthens the sector’s future, positioning it as a resilient channel for affordable mobility.

02 Who are the Key Players in the Oman Used Car Market?

The Oman Used Car Market features a mix of online marketplaces, OEM dealer-backed CPO programs, and multi-brand operators. Major players include Dubizzle Oman (OLX), YallaMotor Oman, Omanicar, OpenSooq Oman, and Kavak Oman. On the dealership side, leaders include Best Cars (Saud Bahwan Group), MHD Used Cars (MHD LLC), Zubair Automotive, Zawawi Trading Company – Mercedes-Benz Certified, and Al-Jenaibi International Automobiles – BMW Approved Used. These companies dominate due to their strong brand reputation, wide distribution networks, digital capabilities, and trusted after-sales offerings.

03 What are the Growth Drivers for the Oman Used Car Market?

Growth is supported by Oman’s expanding vehicle parc and rising non-oil economic activity. The registered vehicle base surpassed 1.7 million units by 2024, ensuring steady replacement cycles feeding into the secondary market. Oman’s non-oil GDP value added stood at OMR 27.87 billion in 2024, highlighting the mobility needs of industries such as logistics, construction, and services. The banking sector also supports demand, with private-sector credit outstanding at OMR 20.3 billion in 2024, enabling auto financing and dealer liquidity—key enablers for used car purchases.

04 What are the Challenges in the Oman Used Car Market?

The Oman Used Car Market faces challenges rooted in regulatory, supply, and structural constraints. The market is import-dependent, with Oman’s merchandise imports valued at USD 38.7 billion in 2023, exposing dealers to global supply chain fluctuations. Regulatory requirements from the Royal Oman Police mandate technical inspections for 10-year-old private vehicles and all commercial categories, adding compliance costs and delays. Finally, Oman’s relatively small population base of 5.3 million limits the scale of niche model segments, affecting inventory variety and liquidity for certain trims.