Pakistan Cold Chain Market Outlook to 2029

By Market Structure, By Product Type, By End Users, By Mode of Transport, By Temperature Range, and By Region

- Product Code: TDR0302

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Pakistan Cold Chain Market Outlook to 2029 – By Market Structure, By Product Type, By End Users, By Mode of Transport, By Temperature Range, and By Region” provides a comprehensive analysis of the cold chain industry in Pakistan. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on sales revenue, segmented by service type, product category, end-user industry, temperature zones, region, and success case studies highlighting major opportunities and cautions.

Pakistan Cold Chain Market Overview and Size

The Pakistan cold chain market reached a valuation of PKR 88 Billion in 2023, driven by the growing demand for perishable food products, increasing pharmaceutical needs, and a rise in organized retail and exports. The market is dominated by key players such as TCS Logistics, Agility Pakistan, Rana Cold Storage, and Pakistan Cold Chain Association (PCCA). These organizations are known for their established cold storage facilities, refrigerated transport services, and strategic regional presence.

In 2023, Agility Pakistan expanded its temperature-controlled warehousing footprint in Karachi and Lahore to support growing demand from the pharmaceutical and food sectors. Sindh and Punjab remain the largest regional contributors due to their high concentration of agriculture, urban centers, and pharmaceutical hubs.

%2C%202018%E2%80%932023.png)

What Factors are Leading to the Growth of Pakistan Cold Chain Market:

Rising Perishable Exports: Exports of perishable commodities such as mangoes, meat, and seafood have been rising steadily. In 2023, Pakistan exported over USD 800 million worth of perishable products, necessitating an efficient cold chain network to preserve quality during transit.

Growth in Pharmaceutical Sector: The pharmaceutical industry, which demands stringent temperature control for storage and distribution of vaccines and medicines, grew by 11% YoY in 2023. Increased vaccine distribution and imports of biologics have accelerated cold chain infrastructure investments.

Urbanization and Organized Retail: The shift towards modern retail formats and increasing consumption of frozen and processed foods in urban centers like Karachi, Lahore, and Islamabad has created a strong demand for cold logistics services, including last-mile delivery with temperature control.

Which Industry Challenges Have Impacted the Growth for Pakistan Cold Chain Market

Lack of Infrastructure in Remote Areas: A major barrier to cold chain growth is the limited presence of temperature-controlled storage and transport facilities in rural and semi-urban areas. According to industry estimates, nearly 45% of perishable produce in Pakistan is wasted annually due to inadequate cold storage and logistics. This significantly impacts farmers and exporters, leading to revenue losses across the value chain.

High Energy Costs and Power Outages: Cold storage facilities rely heavily on uninterrupted power supply, which remains a challenge in Pakistan. Frequent power outages and high electricity tariffs inflate operating costs. In 2023, energy expenses accounted for over 30% of total operational costs in cold storage businesses, making it economically unviable for smaller players to scale.

Fragmented Industry and Lack of Standardization: The cold chain industry in Pakistan is highly fragmented, with a majority of operators being small, unorganized players. A lack of standard operating procedures (SOPs), poor hygiene protocols, and absence of traceability systems pose quality risks. As of 2023, only 25% of cold chain operators were reported to comply with international quality certifications like ISO 22000 or HACCP.

What are the Regulations and Initiatives which have Governed the Market:

Pakistan Horticulture Development and Export Company (PHDEC): Under the Ministry of Commerce, PHDEC supports cold chain development for improving post-harvest management. Initiatives include technical assistance for cold storage design and the introduction of pilot cold chain corridors. In 2023, PHDEC facilitated over 25 feasibility studies for modern cold storage units across Punjab and Sindh.

Tax Incentives for Cold Chain Development: The government has offered customs duty exemptions on the import of reefer trucks, refrigeration units, and temperature control equipment. These fiscal incentives have helped reduce setup costs by up to 18% for new market entrants since 2021.

National Logistics Policy 2021: As part of Pakistan’s broader logistics development roadmap, cold chain enhancement was identified as a priority. The policy emphasizes intermodal connectivity, real-time monitoring systems, and the development of temperature-controlled logistics parks. Pilot projects have been launched in Karachi and Multan with private sector collaboration.

Pakistan Cold Chain Market Segmentation

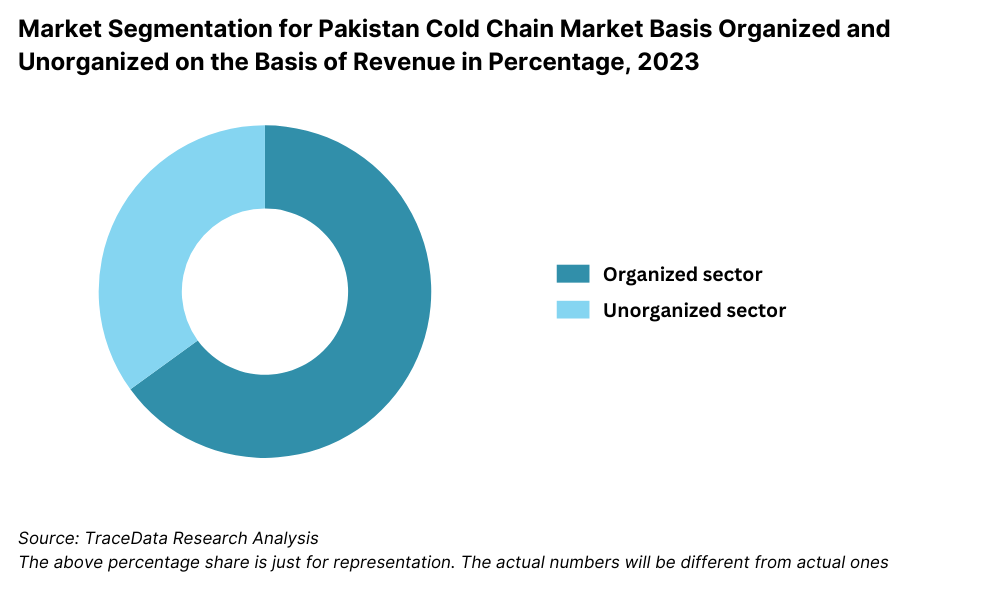

By Market Structure: The market is primarily dominated by unorganized players, including small-scale cold storage facilities and independent reefer transporters that operate locally. These players cater to regional demand, especially from small retailers and farmers, due to their cost-effectiveness and flexible services. However, the organized segment, led by integrated cold chain logistics providers, is rapidly gaining ground, driven by growing demand from pharma exporters, multinational food companies, and large-format retail chains. Organized players offer end-to-end temperature-controlled logistics, quality assurance, real-time tracking, and regulatory compliance, making them increasingly preferred for high-value and sensitive goods.

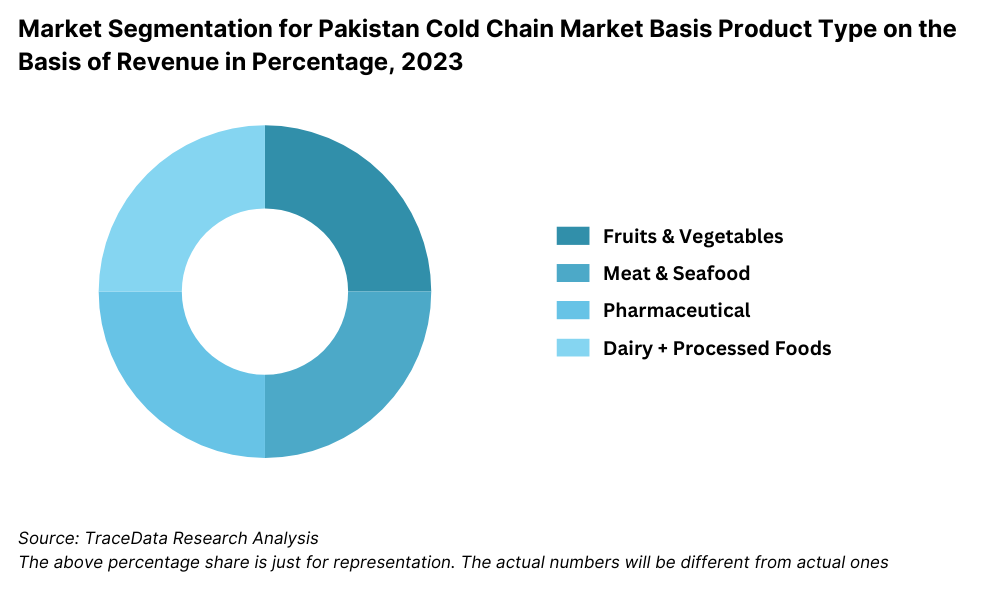

By Product Type: Fruits & vegetables form the largest segment in the cold chain market, driven by Pakistan’s high production volumes and strong export potential, especially for mangoes, kinnow, and onions. Meat & seafood follow closely due to rising domestic consumption, halal-certified exports, and the need for stringent temperature control. Pharmaceuticals have emerged as a fast-growing segment, with increasing demand for biologics, vaccines, and temperature-sensitive medications.

By End User Industry: Agriculture and horticulture remain the primary end-users of cold chain services in Pakistan, accounting for the majority of volume handled. The pharmaceutical sector is the second-largest, fueled by regulatory requirements and expansion of vaccine distribution networks. Foodservice and retail, especially modern trade and QSR chains, are also driving cold logistics growth with increasing demand for frozen and processed food products.

Competitive Landscape in Pakistan Cold Chain Market

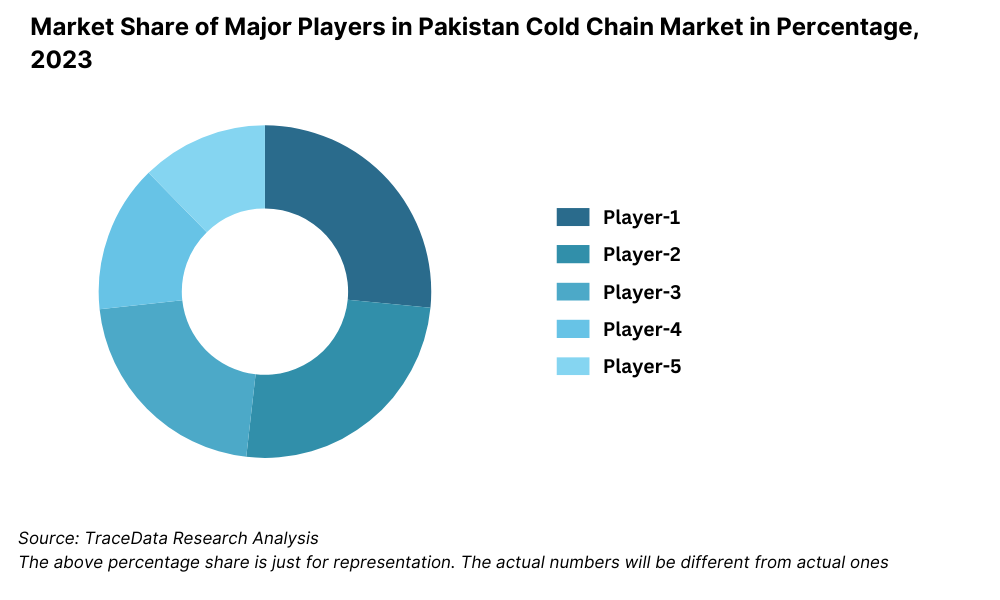

The Pakistan cold chain market is moderately fragmented, with a mix of traditional logistics operators and emerging specialized cold chain companies. However, increasing investments in cold storage infrastructure and the growing role of e-commerce and export-oriented sectors have attracted new entrants. Key players include TCS Logistics, Agility Pakistan, Rana Cold Storage, The Cold Chain Solution, and Pakistan Cold Chain Association (PCCA), all contributing to a more robust and structured competitive environment.

Company | Establishment Year | Headquarters |

TCS Logistics | 1983 | Karachi, Pakistan |

Agility Pakistan | 2006 | Karachi, Pakistan |

Rana Cold Storage | 1998 | Lahore, Pakistan |

The Cold Chain Solution | 2015 | Islamabad, Pakistan |

Pakistan Cold Chain Association (PCCA) | 2014 | Lahore, Pakistan |

Some of the recent competitor trends and key information about competitors include:

TCS Logistics: As one of the oldest logistics firms in Pakistan, TCS has integrated cold chain capabilities for pharma and food products. In 2023, it expanded its temperature-controlled fleet by 20% and launched real-time temperature monitoring systems to enhance transparency and control.

Agility Pakistan: A subsidiary of global logistics giant Agility, the company added over 80,000 sq. ft. of cold storage space in 2023 across Karachi and Lahore. Its advanced warehouse management system and pharma-compliant logistics network have made it a preferred choice for multinationals.

Rana Cold Storage: Focused primarily on agricultural produce, Rana Cold Storage services major fruit and vegetable exporters. In 2023, the company introduced a solar-powered cold storage unit in Multan, aiming to reduce energy costs and ensure sustainability in rural logistics.

The Cold Chain Solution: This tech-enabled cold logistics startup has gained traction in the processed food and dairy segments. It operates on an asset-light model and reported a 40% increase in client onboarding in 2023, primarily from FMCG firms expanding into Tier-II cities.

Pakistan Cold Chain Association (PCCA): As an industry body, PCCA plays a key role in standard-setting, advocacy, and knowledge-sharing. In 2023, PCCA launched a Cold Chain Skill Development Program in collaboration with the Technical Education and Vocational Training Authority (TEVTA), aiming to build skilled manpower for the sector.

What Lies Ahead for Pakistan Cold Chain Market?

The Pakistan cold chain market is projected to witness sustained growth through 2029, driven by rising demand for perishable goods, increasing pharmaceutical logistics needs, and the expansion of export-focused industries. The market is expected to grow at a steady CAGR over the forecast period, supported by public-private investments, digitization, and growing awareness of post-harvest losses.

Expansion of Cold Chain in Agri-Export Corridors: As Pakistan strengthens its position in global exports of fruits and vegetables, particularly to the Middle East and China, the development of integrated cold chain corridors is expected to be prioritized. These corridors will support faster, safer, and more temperature-compliant transportation from farms to ports, reducing post-harvest losses by an estimated 15–20% by 2029.

Rising Role of Pharma Cold Chain: With the pharmaceutical sector expected to grow steadily, demand for temperature-controlled logistics—especially for vaccines, biologics, and temperature-sensitive drugs—will significantly increase. The implementation of Good Distribution Practices (GDP) is likely to become mandatory, leading to modernization of infrastructure and higher compliance standards.

Technology Adoption and Digital Monitoring: IoT sensors, GPS-based fleet tracking, and AI-powered inventory management are anticipated to become mainstream in cold chain operations. By 2029, over 60% of organized cold storage facilities are projected to have real-time monitoring and predictive maintenance systems in place, improving efficiency and reducing spoilage.

Increased Government and Donor Interventions: Cold chain is being recognized as critical to food security and public health. Development finance institutions and government agencies are expected to roll out dedicated schemes and public-private partnerships (PPPs) to co-fund cold infrastructure in underserved areas, particularly in Balochistan and Khyber Pakhtunkhwa.

%2C%202023-2029.png)

Pakistan Cold Chain Market Segmentation

• By Market Structure:

o Cold Storage Facilities

o Reefer Transportation Services

o Integrated Cold Chain Logistics Providers

o Standalone Operators

o Organized Sector

o Unorganized Sector

o Third-Party Logistics (3PL) Cold Chain Providers

• By Product Type:

o Fruits and Vegetables

o Meat and Seafood

o Dairy Products

o Pharmaceuticals

o Frozen Processed Foods

o Bakery and Confectionery Items

• By Temperature Range:

o Chilled (0°C to 8°C)

o Frozen (-18°C and below)

o Ambient Controlled (15°C to 25°C)

• By Mode of Transport:

o Reefer Trucks

o Refrigerated Rail Wagons

o Air Cargo

o Cold Chain Marine Containers

• By End User Industry:

o Agriculture and Horticulture

o Food Processing Companies

o Retail and E-Commerce

o Pharmaceuticals and Healthcare

o Hospitality and Catering

o Exporters and Traders

• By Region:

o Punjab

o Sindh

o Khyber Pakhtunkhwa

o Balochistan

o Gilgit-Baltistan

o Islamabad Capital Territory

Players Mentioned in the Report:

• TCS Logistics

• Agility Pakistan

• Rana Cold Storage

• The Cold Chain Solution

• Pakistan Cold Chain Association (PCCA)

• METRO Cold Chain

• Daewoo Express Cargo Cold Chain

• PEL Cold Chain Solutions

Key Target Audience:

• Cold Chain Logistics Companies

• Food and Agri Exporters

• Pharmaceutical Manufacturers and Distributors

• Government Agencies (e.g., Ministry of National Food Security & Research)

• Multilateral Agencies and Donor Institutions

• Industry Associations and Regulatory Authorities

• Cold Storage Equipment Manufacturers

• Technology Providers (IoT, Sensors, Tracking Solutions)

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Pakistan Cold Chain Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges

4.2. Revenue Streams for Pakistan Cold Chain Market

4.3. Business Model Canvas for Pakistan Cold Chain Market

4.4. Product Movement and Temperature Compliance Flow

4.5. Service Procurement Decision Process (B2B Perspective)

5. Market Structure

5.1. Growth in Agricultural and Pharmaceutical Output, 2018-2024

5.2. Cold Storage Penetration vs Post-Harvest Loss Rates

5.3. Cold Logistics Infrastructure Availability by Region, 2024

5.4. Number of Cold Chain Operators in Pakistan by Province

6. Market Attractiveness for Pakistan Cold Chain Market

7. Supply-Demand Gap Analysis

8. Market Size for Pakistan Cold Chain Market Basis

8.1. Revenues, 2018-2024

8.2. Cold Storage Capacity and Reefer Fleet Size, 2018-2024

9. Market Breakdown for Pakistan Cold Chain Market Basis

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By Product Type (Fruits, Vegetables, Meat, Pharma, etc.), 2023-2024P

9.3. By Temperature Range (Chilled, Frozen, Ambient Controlled), 2023-2024P

9.4. By Mode of Transport (Truck, Rail, Marine, Air), 2023-2024P

9.5. By End-User Industry (Agri, Food Processing, Pharma, Retail), 2023-2024P

9.6. By Region (Punjab, Sindh, KP, Balochistan, Others), 2023-2024P

10. Demand Side Analysis for Pakistan Cold Chain Market

10.1. Customer Landscape and Industry Cohort Analysis

10.2. Stakeholder Journey-Exporters, Processors, Retail Chains

10.3. Needs, Challenges, and Value Perception Analysis

10.4. Cold Chain Readiness Gap Framework

11. Industry Analysis

11.1. Trends and Developments for Pakistan Cold Chain Market

11.2. Growth Drivers for Pakistan Cold Chain Market

11.3. SWOT Analysis for Pakistan Cold Chain Market

11.4. Issues and Challenges for Pakistan Cold Chain Market

11.5. Government Regulations and Incentives

12. Snapshot on Pharmaceutical Cold Chain Logistics

12.1. Market Size and Potential for Pharma Cold Chain, 2018-2029

12.2. Compliance Guidelines and Regulatory Framework

12.3. Digital Tools for Pharma Logistics (IoT, Blockchain, etc.)

12.4. Benchmarking of Pharma Cold Chain Providers in Pakistan

13. Financing and Investment in Cold Chain Sector

13.1. Cost Economics and Investment Requirements

13.2. Role of DFIs, PPP Models, and Government Schemes

13.3. Financing Barriers for Small and Medium Cold Chain Operators

13.4. Private Sector Case Examples and ROI Analysis

14. Opportunity Matrix for Pakistan Cold Chain Market-Presented via Radar Chart

15. PEAK Matrix Analysis for Pakistan Cold Chain Market

16. Competitor Analysis for Pakistan Cold Chain Market

16.1. Benchmark of Key Competitors-Infrastructure, Coverage, Capabilities

16.2. Strengths and Weaknesses

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant Positioning

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Pakistan Cold Chain Market Basis

17.1. Revenues, 2025-2029

17.2. Cold Storage and Fleet Capacity Expansion Forecast, 2025-2029

18. Market Breakdown for Pakistan Cold Chain Market Basis

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By Product Type, 2025-2029

18.3. By Temperature Range, 2025-2029

18.4. By Mode of Transport, 2025-2029

18.5. By End-User Industry, 2025-2029

18.6. By Region, 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Pakistan Cold Chain Market. On the supply side, this includes cold storage facility operators, reefer transporters, logistics integrators, and equipment providers. On the demand side, sectors like agriculture, pharmaceuticals, food processing, and retail are covered.

Sourcing is made through industry reports, trade publications, proprietary databases, government releases, and export-import data to perform comprehensive desk research. From this mapping, leading 5–6 service providers are shortlisted based on their infrastructure footprint, client portfolios, and revenue scale.

Step 2: Desk Research

We conduct an in-depth desk research process by referencing multiple secondary and proprietary sources. These include platforms such as Statista, TradeMap, Pakistan Bureau of Statistics, PSQCA, industry whitepapers, and association reports (e.g., PCCA).

Key data points analyzed include cold storage capacity (in MT), reefer fleet size, distribution coverage, pricing per pallet/km, regional infrastructure gaps, and export commodity volumes. Company-level insights are derived from press releases, tenders, annual reports, case studies, and media coverage to build a foundational market view.

Step 3: Primary Research

We initiate a series of in-depth interviews with stakeholders across the Pakistan Cold Chain ecosystem—cold storage operators, logistics providers, exporters, large-scale farmers, pharmaceutical distributors, and government officials. These interviews validate hypotheses, test assumptions, and provide insights into revenue models, price points, challenges, and growth drivers.

A bottom-up approach is used to estimate market size, starting from operational metrics (e.g., utilization rate, capacity per player, km covered per reefer unit).

Our disguised interviews (conducted under the pretense of being prospective clients) allow for validation of financial data, operational benchmarks, and pricing structures. These help triangulate findings with secondary data and ensure data integrity.

Step 4: Sanity Check

Top-down and bottom-up modeling approaches are used to ensure logical coherence between micro-level player data and macro-level market indicators.

These sanity checks cross-reference GDP-linked cold logistics demand growth, historical infrastructure expansion rates, and average cold storage costs to refine and validate overall market sizing and projections.

FAQs

1. What is the potential for the Pakistan Cold Chain Market?

The Pakistan cold chain market holds significant potential, reaching a valuation of PKR 88 Billion in 2023. This growth is supported by the rising demand for perishable food products, increasing pharmaceutical needs, and the rapid development of export-oriented agri and seafood sectors. The market is expected to expand steadily through 2029, bolstered by government incentives, technological upgrades, and increasing investments in cold storage infrastructure.

2. Who are the Key Players in the Pakistan Cold Chain Market?

The Pakistan Cold Chain Market includes several notable players such as TCS Logistics, Agility Pakistan, and Rana Cold Storage. These companies maintain a strong market presence through large-scale storage infrastructure, reefer fleet capacity, and established networks across urban and semi-urban centers. Other emerging players include The Cold Chain Solution and METRO Cold Chain, along with industry support from the Pakistan Cold Chain Association (PCCA).

3. What are the Growth Drivers for the Pakistan Cold Chain Market?

Key growth drivers include increasing exports of perishable goods like mangoes and seafood, the growing pharmaceutical industry requiring temperature-sensitive logistics, and the rise in consumption of processed and frozen foods in urban regions. Technological adoption such as real-time tracking and predictive maintenance, along with government support in the form of tax incentives and logistics policy reforms, are also contributing significantly to market expansion.

4. What are the Challenges in the Pakistan Cold Chain Market?

The market faces several challenges, including inadequate infrastructure in rural areas, high energy costs, fragmented operations, and lack of standardization. Limited access to financing for infrastructure development and insufficient skilled manpower are also significant barriers. These challenges impact operational efficiency and hinder the scalability of cold chain services across the country.