Peru Cold Chain Market Outlook to 2029

By Service Type (Cold Storage, Cold Transportation), By Temperature Range, By End-User Industry (Dairy Products, Pharmaceuticals, Meat and Seafood, Fruits and Vegetables, Others), and By Region

- Product Code: TDR0303

- Region: Central and South America

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Peru Cold Chain Market Outlook to 2029 - By Service Type (Cold Storage, Cold Transportation), By Temperature Range, By End-User Industry (Dairy Products, Pharmaceuticals, Meat and Seafood, Fruits and Vegetables, Others), and By Region” provides a comprehensive analysis of the cold chain industry in Peru. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; key trends and developments, regulatory landscape, customer-level profiling, major challenges, and a comparative landscape including competition scenario, cross comparisons, opportunities and bottlenecks, and profiling of major players in the Cold Chain Market. The report concludes with future market projections based on revenue, service segments, region, cause-and-effect relationships, and case studies highlighting the major opportunities and risks.

Peru Cold Chain Market Overview and Size

The Peru cold chain market reached a valuation of PEN 1.1 billion in 2023, driven by increased demand for temperature-controlled logistics due to growing consumption of perishable goods, expansion of organized retail, and the rise in pharmaceutical exports. The market features key players such as Ransa Comercial, Linea, TASA Logistics, Frio Aéreo, and Andes Cold Storage. These companies are known for their cold storage infrastructure, transport capabilities, and focus on compliance with international standards.

In 2023, Ransa expanded its refrigerated warehouse capacity in Lima and Callao, targeting pharmaceutical and seafood exports. This move aligns with Peru’s broader effort to modernize its logistics infrastructure and improve cold chain connectivity across ports and highland regions.

%2C%202018%E2%80%932023.png)

What Factors are Leading to the Growth of the Peru Cold Chain Market:

Agro-Export Growth: Peru’s agricultural exports, especially fruits such as avocados, blueberries, and grapes, have grown significantly, with cold chain services playing a vital role. In 2023, agro-exports accounted for over USD 10 Billion, a major portion of which required temperature-controlled handling and transit.

Rising Pharmaceutical Demand: The pharmaceutical sector, particularly vaccine storage and biologics, is increasingly relying on cold chain logistics. The COVID-19 pandemic has accelerated infrastructure upgrades, with over 20% of cold chain investments in 2023 dedicated to healthcare logistics.

Urbanization and Organized Retail: With rising urban population and increased penetration of supermarkets, demand for frozen and chilled foods is growing. In Lima alone, frozen food consumption rose by 18% in 2023, driven by convenience-seeking consumers and improvements in last-mile cold logistics.

Which Industry Challenges Have Impacted the Growth for Peru Cold Chain Market

Fragmented Infrastructure and High Operating Costs: Despite growing demand, the cold chain sector in Peru remains fragmented, with limited penetration beyond urban areas. Approximately 60% of cold storage facilities are concentrated in Lima and Callao, creating logistical bottlenecks for producers in rural and highland regions. Additionally, operating costs—including energy consumption and fuel prices—remain high, reducing profit margins and discouraging private investment in remote regions.

Lack of Skilled Workforce and Technical Know-How: Operating and maintaining cold chain systems require specialized technical expertise. However, the sector faces a talent shortage, with over 45% of operators reporting difficulties in hiring trained refrigeration technicians and logistics professionals. This gap has led to inefficiencies and compromised quality standards, especially in small and medium-sized enterprises.

Limited Cold Chain Integration for SMEs: Small and medium-sized agri-producers and exporters often lack access to reliable cold chain services. A 2023 survey revealed that nearly 40% of SMEs in the agro-export segment experienced post-harvest losses due to inadequate cold storage or unreliable transportation, limiting their ability to meet export-grade standards and fulfill international contracts.

What are the Regulations and Initiatives which have Governed the Market:

SENASA Cold Chain Compliance for Agro-Exports: The National Agrarian Health Service (SENASA) mandates cold chain certification for perishable agricultural exports such as fruits, vegetables, and seafood. In 2023, over 70% of fresh produce exports underwent mandatory pre-shipment cold chain checks, ensuring compliance with international phytosanitary norms.

DIGEMID Guidelines for Pharmaceutical Logistics: The Peruvian Directorate General of Medicines (DIGEMID) has enforced strict temperature control and documentation standards for the storage and transport of temperature-sensitive medicines and vaccines. By end-2023, pharmaceutical companies had to comply with Good Storage and Distribution Practices (GSDP), increasing demand for certified cold storage facilities.

Government-Backed Agro-Logistics Investment Programs: The Ministry of Transport and Communications, in coordination with ProInversión, has launched several public-private partnership (PPP) initiatives aimed at improving cold chain infrastructure in export corridors. Notably, in 2023, a PEN 120 million project was approved to establish cold hubs near Paita and Callao ports to reduce cargo spoilage and facilitate direct exports to North America and Europe.

Peru Cold Chain Market Segmentation

By Service Type: Cold Storage continues to dominate the market, accounting for a major share due to increased demand for warehousing of fruits, seafood, and pharmaceutical products. Cold storage facilities are crucial in maintaining product quality before distribution, especially in export-driven sectors like avocados and blueberries. Cold Transportation is gaining momentum with the expansion of temperature-sensitive goods distribution networks across Peru. The rise of multi-temperature reefer trucks and demand for last-mile cold delivery—especially in urban centers like Lima, Arequipa, and Trujillo—is driving this segment’s growth.

%20on%20the%20Basis%20of%20Revenue%20Share%20in%20Percentage%2C%202023.png)

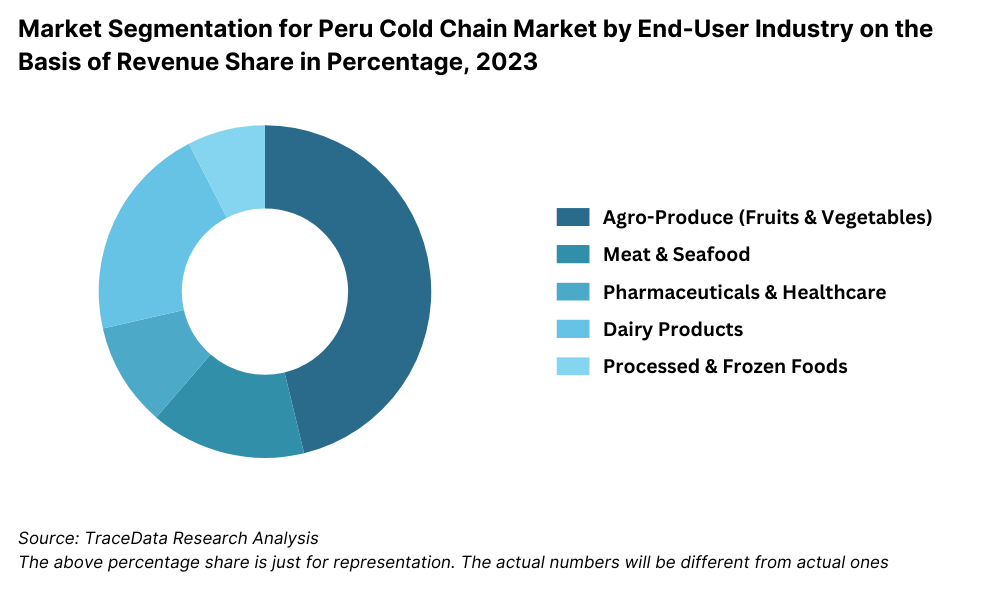

By End-User Industry: The Agro-Produce segment (fruits and vegetables) holds the largest share, supported by strong export volumes and compliance with cold chain protocols set by international buyers. The Meat and Seafood segment is the second-largest, fueled by both domestic consumption and international trade. Pharmaceuticals are a fast-growing segment, particularly after the COVID-19 pandemic, with the government and private players investing in temperature-controlled logistics for vaccine distribution and biologics.

By Temperature Range: Chilled (0°C to 8°C) is the most commonly used temperature band for dairy, fresh produce, and meat products. Frozen (-18°C and below) accounts for a significant portion, particularly for seafood and frozen processed foods. Ultra-low temperature logistics (below -20°C), while still niche, is growing steadily in the pharmaceutical segment for biologics and specialized drugs.

Competitive Landscape in Peru Cold Chain Market

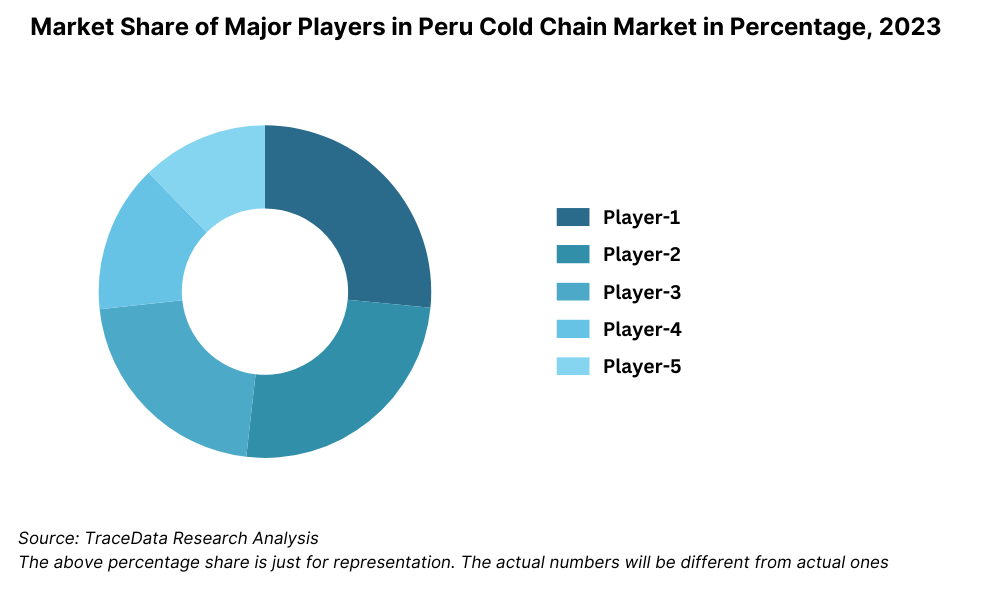

The Peru cold chain market is moderately concentrated, with a mix of well-established logistics companies and emerging regional players. While national giants like Ransa and TASA dominate due to their integrated logistics networks, several niche cold logistics providers such as Andes Cold, Frio Aéreo, and Linea are also gaining traction by focusing on specific industry verticals like agro-exports and pharmaceuticals.

Company | Establishment Year | Headquarters |

Ransa Comercial | 1939 | Lima, Peru |

TASA Logistics | 2002 | Callao, Peru |

Frio Aéreo | 2000 | Lima (Jorge Chávez Airport) |

Linea | 1992 | Lima, Peru |

Andes Cold Storage | 2011 | Arequipa, Peru |

Some of the recent competitor trends and key information about competitors include:

Ransa Comercial: One of the largest integrated logistics providers in Peru, Ransa expanded its cold storage capacity by 20% in 2023, particularly in Lima and Callao. The company also invested in IoT-based temperature monitoring systems to improve traceability and reduce spoilage rates, especially for the pharmaceutical and seafood segments.

TASA Logistics: A subsidiary of the largest fishmeal exporter in the world, TASA has scaled its cold chain division to serve domestic and export clients. In 2023, it launched a new fleet of reefer trucks and reported a 28% increase in seafood shipments, largely driven by exports to Asia and Europe.

Frio Aéreo: Operating out of Jorge Chávez International Airport, Frio Aéreo specializes in air-freight cold logistics for high-value perishables like asparagus, mangoes, and berries. The company handled over 40,000 metric tons of chilled exports in 2023, up 18% YoY, and expanded its cold chamber capacity to meet growing agro-export demand.

Linea: Focused on nationwide distribution, Linea has built a strong presence in chilled and frozen transport, particularly for processed foods and dairy. In 2023, it introduced route optimization software that reduced delivery times by 12% and helped cut cold chain disruptions across remote highland areas.

Andes Cold Storage: A rising player in the southern region of Peru, Andes Cold invested in solar-powered cold storage solutions in Arequipa in 2023, targeting sustainable storage for small agro-exporters. Their decentralized hub-and-spoke model has been instrumental in reducing post-harvest losses in less-connected regions.

What Lies Ahead for Peru Cold Chain Market?

The Peru cold chain market is projected to witness sustained growth through 2029, with a healthy CAGR driven by increasing agro-exports, rising pharmaceutical needs, and infrastructure development across storage and transport segments. The market is poised to play a crucial role in enhancing Peru’s global trade competitiveness and domestic food security.

Expansion of Agro-Export-Oriented Cold Chain: With Peru's strategic focus on agricultural exports like blueberries, grapes, avocados, and mangoes, investments in pre-cooling, packhouse logistics, and port-based cold storage facilities are expected to increase. Exporters are increasingly adopting end-to-end cold chain solutions to meet international quality standards and minimize post-harvest losses.

Pharmaceutical Cold Chain Modernization: As Peru expands its healthcare logistics capabilities, especially for vaccines, biologics, and temperature-sensitive drugs, the demand for GSDP-compliant facilities and temperature-validated transport systems will grow. By 2029, the pharmaceutical segment is expected to be one of the fastest-growing cold chain end-users.

Technology-Driven Efficiency Gains: The integration of IoT sensors, GPS-tracked reefer vehicles, and cloud-based monitoring systems will enhance visibility and real-time temperature control. These innovations are expected to reduce wastage, improve route optimization, and increase compliance with global standards—critical for both exports and domestic perishables distribution.

Emergence of Regional Cold Hubs: Secondary cities such as Arequipa, Trujillo, and Piura are emerging as regional cold chain hubs, reducing dependency on Lima and easing pressure on central logistics corridors. This decentralization will enable better access for small and medium-sized agri-producers and help balance national cold chain capacity.

%2C%202023-2029.png)

Peru Cold Chain Market Segmentation

By Service Type:

Cold Storage

Cold Transportation

Integrated Cold Chain Solutions

Reefer Container Services

Last-Mile Cold Delivery

By Temperature Range:

Chilled (0°C to 8°C)

Frozen (-18°C and below)

Ultra-Low Temperature (below -20°C)

Ambient Controlled (15°C to 25°C)

By End-User Industry:

Fruits and Vegetables

Meat and Seafood

Dairy Products

Pharmaceuticals and Biologics

Processed Foods

Quick Service Restaurants (QSRs)

Retail and Supermarkets

By Type of Transport:

Road-Based Reefer Trucks

Air Freight Cold Chain

Sea Freight Reefer Containers

Rail-Based Cold Chain (Emerging)

By Ownership Model:

3PL Cold Chain Providers

Captive Cold Chains (Owned by Producers/Exporters)

Cooperative Cold Chains (SME/Farmer Collectives)

By Region:

Lima & Callao

Northern Coastal (Piura, Tumbes, La Libertad)

Southern Highlands (Arequipa, Cusco, Puno)

Central Sierra (Junín, Huancayo)

Eastern Amazon (Iquitos, Loreto)

Players Mentioned in the Report:

Ransa Comercial

TASA Logistics

Frio Aéreo

Linea

Andes Cold Storage

Transportes Perales

Agroindustria S.A.

Soluciones Frigoríficas del Sur (SFS)

Key Target Audience:

Cold Chain Logistics Providers

Agro-Exporters and Farming Cooperatives

Pharmaceutical Distributors

Food Processing Companies

Supermarkets and QSR Chains

International Trade Agencies

Government Regulatory Bodies (SENASA, DIGEMID, MTC)

Investment Promotion Agencies (ProInversión)

Technology and Cold Chain Equipment Vendors

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Peru Cold Chain Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Peru Cold Chain Market

4.3. Business Model Canvas for Peru Cold Chain Market

4.4. Cold Chain Decision-Making Process-Demand Side

4.5. Cold Chain Decision-Making Process-Supply Side

5. Market Structure

5.1. Agro-Export Supply Chain Volumes in Peru, 2018-2024

5.2. Cold Chain Penetration Rate in Key Export Corridors, 2018-2024

5.3. Pharmaceutical Cold Storage Capacity in Peru, 2024

5.4. Number of Cold Chain Operators by Region in Peru

6. Market Attractiveness for Peru Cold Chain Market

7. Supply-Demand Gap Analysis

8. Market Size for Peru Cold Chain Market Basis

8.1. Revenues, 2018-2024

8.2. Volume of Cold Storage & Reefer Movement, 2018-2024

9. Market Breakdown for Peru Cold Chain Market Basis

9.1. By Service Type (Cold Storage vs Cold Transport), 2023-2024P

9.2. By Temperature Range (Chilled, Frozen, ULT, Ambient), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By End-User Industry (Fruits, Seafood, Pharma, Dairy, etc.), 2023-2024P

9.5. By Ownership Type (3PL, Captive, Cooperative), 2023-2024P

10. Demand Side Analysis for Peru Cold Chain Market

10.1. Customer Landscape and Usage Patterns

10.2. Exporter & Distributor Journey and Decision-Making

10.3. Pain Points and Value Gaps

10.4. Cold Chain Readiness Assessment by Sector

11. Industry Analysis

11.1. Trends and Developments for Peru Cold Chain Market

11.2. Growth Drivers for Peru Cold Chain Market

11.3. SWOT Analysis for Peru Cold Chain Market

11.4. Issues and Challenges for Peru Cold Chain Market

11.5. Government Regulations for Peru Cold Chain Market

12. Snapshot on Online & Tech-Driven Cold Chain Platforms

12.1. Adoption of IoT and Monitoring Systems, 2018-2029

12.2. Business Model and Efficiency Enhancements

12.3. Cross-Comparison of Cold Chain Tech Providers

13. Peru Cold Chain Financing Landscape

13.1. Investment Trends and Infrastructure Financing, 2018-2029

13.2. PPP and Government-Backed Cold Chain Programs

13.3. SME Accessibility to Cold Chain Financing

13.4. Role of International Donor Agencies & Development Banks

14. Opportunity Matrix for Peru Cold Chain Market-Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for Peru Cold Chain Market

16. Competitor Analysis for Peru Cold Chain Market

16.1. Benchmark of Key Cold Chain Operators in Peru (Company Overview, USP, Services, Coverage, Storage/Truck Capacity, Certifications, Revenue, etc.)

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Peru Cold Chain Market Basis

17.1. Revenues, 2025-2029

17.2. Volume of Cold Storage and Transportation, 2025-2029

18. Market Breakdown for Peru Cold Chain Market Basis

18.1. By Service Type (Cold Storage vs Cold Transport), 2025-2029

18.2. By Temperature Range (Chilled, Frozen, ULT, Ambient), 2025-2029

18.3. By Region, 2025-2029

18.4. By End-User Industry (Fruits, Seafood, Pharma, Dairy, etc.), 2025-2029

18.5. By Ownership Type (3PL, Captive, Cooperative), 2025-2029

18.6. By Type of Transport (Air, Sea, Road, Rail), 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Peru Cold Chain Market. Based on this ecosystem, we shortlist the leading 5–6 players in the country based on their operational scale, facility capacity, fleet size, and service portfolio.

Sourcing is conducted through industry reports, government publications, logistics portals, and proprietary databases to perform comprehensive desk research and build a foundational understanding of the cold chain ecosystem in Peru.

Step 2: Desk Research

An exhaustive desk research process is conducted using diverse secondary and proprietary sources. This includes data aggregation on revenue size, transport infrastructure, cold storage penetration, demand by sector, temperature control requirements, and technology adoption.

We supplement this with analysis of company-level information by referencing press releases, annual reports, licensing data from DIGEMID and SENASA, and sector-specific publications. This helps us map service offerings, regional distribution, investment activities, and pricing strategies across the cold chain value chain.

Step 3: Primary Research

A series of in-depth interviews are initiated with logistics experts, cold chain operators, exporters, agribusinesses, and pharmaceutical distributors across Peru. These discussions are aimed at validating hypotheses, triangulating revenue estimates, and gathering insights on operational models and key challenges.

Our team also conducts disguised interviews by approaching service providers under the guise of potential customers. This step allows us to validate claims related to capacity, uptime, route coverage, pricing structures, and technology use—comparing firsthand responses with secondary research findings.

Step 4: Sanity Check

Both bottom-up and top-down modeling approaches are applied to cross-validate the Peru cold chain market size.

This includes using volume-based demand estimates (e.g., agro-export tonnage, vaccine distribution volume) and translating them into revenue using industry-specific per-unit pricing. Reverse modeling from major player revenues and industry benchmarks is also applied to check for consistency and ensure data reliability.

FAQs

1. What is the potential for the Peru Cold Chain Market?

The Peru cold chain market is positioned for robust growth through 2029, with a projected CAGR driven by rising agro-exports, expanding pharmaceutical needs, and growing demand for temperature-sensitive logistics. The market reached a valuation of PEN 1.1 billion in 2023 and is expected to grow steadily as cold infrastructure development expands beyond Lima and into emerging regional hubs like Arequipa, Piura, and Trujillo.

2. Who are the Key Players in the Peru Cold Chain Market?

Key players in the Peru cold chain market include Ransa Comercial, TASA Logistics, Frio Aéreo, Linea, and Andes Cold Storage. These companies have established a strong presence through integrated service offerings, investments in cold infrastructure, and compliance with international cold chain and safety regulations. Regional players like Soluciones Frigoríficas del Sur are also gaining traction in specific highland and southern corridors.

3. What are the Growth Drivers for the Peru Cold Chain Market?

Major growth drivers include the surge in agricultural exports—especially fruits and vegetables—requiring reliable cold storage and transport; increased demand for pharmaceutical cold logistics post-COVID-19; and regulatory mandates from agencies like SENASA and DIGEMID. Additionally, technology adoption (IoT sensors, GPS tracking) and government-backed infrastructure projects are accelerating market expansion.

4. What are the Challenges in the Peru Cold Chain Market?

Key challenges include fragmented infrastructure with limited rural cold storage access, high energy and operational costs, and a shortage of skilled cold chain technicians. Additionally, small and medium agro-exporters often lack access to affordable cold logistics solutions, which limits their global competitiveness. Compliance with evolving food safety and pharmaceutical transport regulations also presents operational hurdles for less-equipped players.