Philippines Auto Finance Market Outlook to 2029

By Market Structure, By Key Lenders, By Vehicle Type, By Loan Tenure, By Consumer Profile, and By Region

- Product Code: TDR0124

- Region: Asia

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “Philippines Auto Finance Market Outlook to 2029 - By Market Structure, By Key Lenders, By Vehicle Type, By Loan Tenure, By Consumer Profile, and By Region” provides a comprehensive analysis of the auto finance market in the Philippines. It covers an overview and genesis of the industry, overall market size in terms of loan disbursement and outstanding credit, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and a competitive landscape including competition scenario, cross-comparison, opportunities, bottlenecks, and company profiling of major players in the auto finance market. The report concludes with future market projections based on loan disbursement trends, key lenders, vehicle segments, and success case studies highlighting major opportunities and risks.

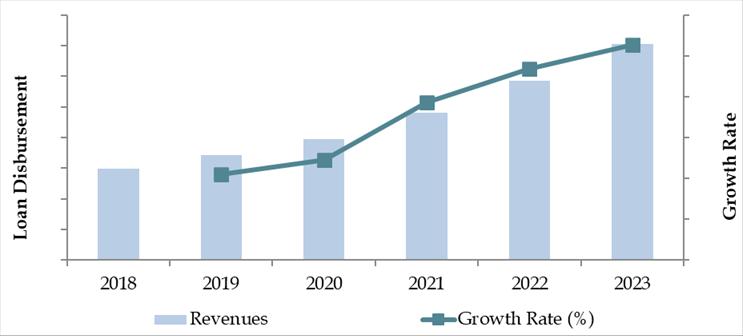

Philippines Auto Finance Market Overview and Size

The Philippines auto finance market reached a valuation of PHP 650 billion in 2023, driven by increasing vehicle demand, rising disposable income, and the expansion of digital lending solutions. The market is characterized by major players such as BDO Unibank, Metrobank, Bank of the Philippine Islands (BPI), Security Bank, and Toyota Financial Services. These institutions have established extensive loan distribution networks, competitive interest rate offerings, and customer-centric financing solutions.

In 2023, Toyota Financial Services introduced a digital auto loan application platform, enhancing convenience and accessibility for customers. This initiative reflects the growing trend towards digital transformation in the Philippines' financial sector. Metro Manila and Cebu remain key markets due to their high vehicle ownership rates and economic activity.

Market Size for Philippines Auto Finance Industry on the Basis of Loan Disbursement in USD Billion, 2018-2023

What Factors are Leading to the Growth of the Philippines Auto Finance Market?

Economic Growth and Increasing Vehicle Demand: The growing economy and rising middle-class income levels are driving demand for new and used vehicles, directly influencing the growth of auto financing. In 2023, auto loan disbursements increased by 12%, as more consumers sought financing to purchase personal and commercial vehicles. The rapid expansion of ride-hailing and logistics services has further fueled this trend.

Rising Preference for Used Car Financing: Used car financing is gaining popularity as consumers look for cost-effective vehicle options. The second-hand vehicle market in the Philippines grew by 18% in 2023, with banks and lending institutions expanding their financing options for pre-owned cars. Interest rates on used car loans have remained competitive, making this a viable alternative for budget-conscious buyers.

Digitalization of Auto Loan Processing: The rise of digital banking and online loan applications has significantly streamlined the auto finance process. In 2023, around 45% of auto loans were processed digitally, reflecting a shift towards a more efficient, paperless system. Financial institutions have leveraged AI-driven credit scoring and online verification, reducing processing time and improving loan approval rates.

Which Industry Challenges Have Impacted the Growth of the Philippines Auto Finance Market?

High Interest Rates and Loan Approval Criteria: The high cost of borrowing remains a significant challenge for the auto finance industry. Compared to neighboring countries, interest rates on auto loans in the Philippines are higher, making financing less accessible to middle and lower-income consumers. In 2023, around 42% of loan applicants faced difficulties in securing approvals due to stringent credit scoring and income verification requirements. This issue has limited the market’s growth, particularly for first-time car buyers and self-employed individuals.

Rising Non-Performing Loans (NPLs): The increasing number of delinquent auto loans has posed risks for financial institutions. In 2023, the NPL ratio in auto financing increased by 8.5%, signaling financial distress among borrowers. The used car financing segment has been more vulnerable to defaults due to faster vehicle depreciation and limited resale potential, which has made lenders more cautious about approving loans.

Limited Financing for Electric Vehicles (EVs): Despite government incentives for electric vehicles, only 5% of total auto loans in 2023 were allocated for EV purchases. Financial institutions remain hesitant to provide EV loans due to higher vehicle costs, lack of widespread charging infrastructure, and uncertainty over resale value. The lack of financing options has slowed the adoption of electric vehicles in the country.

What are the Regulations and Initiatives Which Have Governed the Market?

Central Bank Regulations on Auto Loans: The Bangko Sentral ng Pilipinas (BSP) sets guidelines for auto financing, including interest rate policies, borrower eligibility requirements, and loan-to-value (LTV) ratios. In 2023, BSP introduced new consumer protection measures to ensure transparency in loan terms and prevent predatory lending practices. These regulations aim to create a more stable and consumer-friendly auto financing market.

Tax Incentives for Electric Vehicle Financing: The Philippine government introduced tax incentives in 2023 to encourage EV adoption. Under this initiative, electric vehicle buyers receive reduced interest rates and partial tax exemptions on auto loans. However, the impact remains limited as banks are still reluctant to finance EVs due to market uncertainties.

Expansion of Digital Lending Platforms: To increase access to auto financing, the government has promoted digital lending initiatives, allowing banks and fintech firms to streamline loan application processes. In 2023, around 45% of auto loans were processed through digital platforms, reflecting a shift towards online banking and AI-driven credit assessments. This initiative has improved loan accessibility, particularly for young professionals and first-time borrowers.

Philippines Auto Finance Market Segmentation

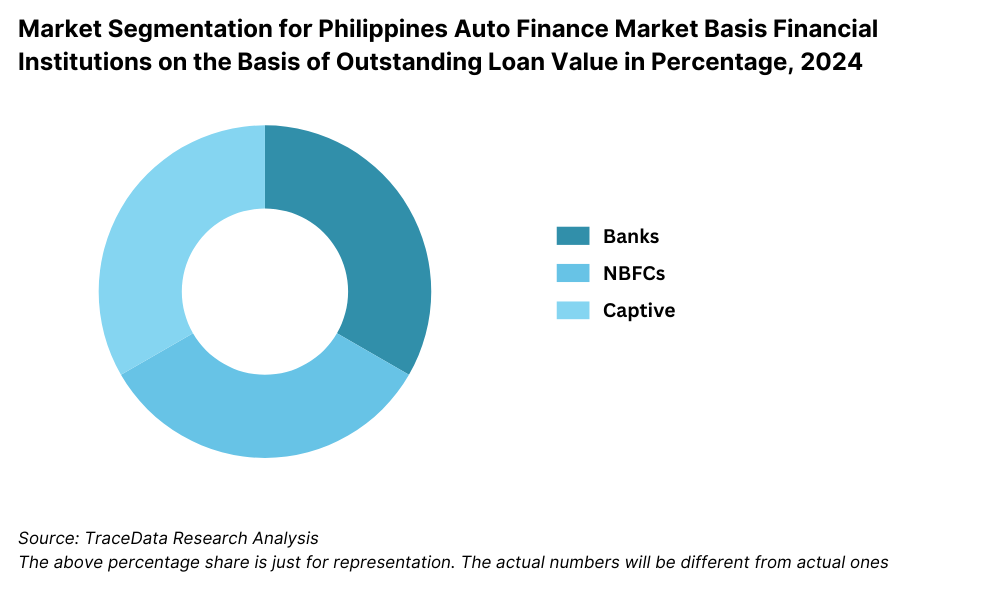

By Market Structure: Banks and Traditional Lenders dominate the market due to their established credibility, lower interest rates, and extensive branch networks. Major players such as BDO Unibank, Metrobank, and BPI lead this segment by offering competitive financing solutions, structured repayment terms, and comprehensive loan options. Non-Banking Financial Institutions (NBFIs) have gained traction, catering to consumers who may not qualify for traditional bank loans. Companies like Toyota Financial Services, Home Credit, and fintech startups offer flexible financing options, often with faster approval times and digital-first processes.

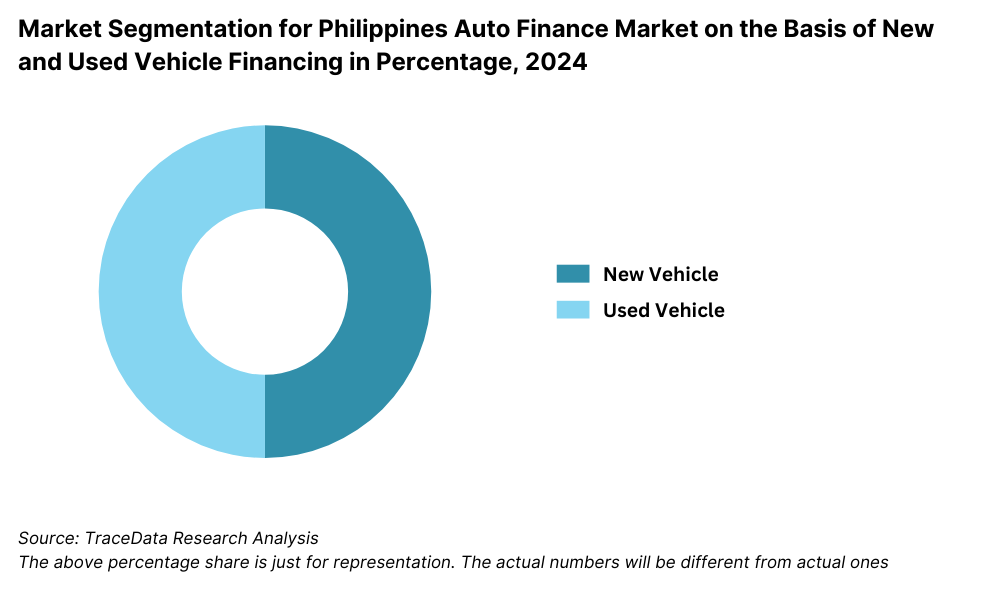

By Vehicle Type: New Car Financing dominates the market as most banks and financial institutions prefer lending for brand-new vehicles due to their lower risk and higher resale value. In 2023, over 70% of total auto loans were for new vehicles, primarily from brands like Toyota, Mitsubishi, and Honda. Used Car Financing is growing steadily, accounting for a significant portion of the market. Many consumers opt for used cars due to their affordability, and financial institutions have expanded their loan offerings to cover pre-owned vehicles, with slightly higher interest rates due to depreciation risks.

By Loan Tenure: 3-5 Years Loan Tenure is the most preferred, as it provides a balance between manageable monthly payments and overall interest costs. Over 60% of borrowers in 2023 opted for this loan tenure due to affordability and favorable bank terms. 1-3 Years Loan Tenure appeals to consumers with higher disposable income who want to minimize interest payments. These loans typically come with lower interest rates but require higher monthly repayments.

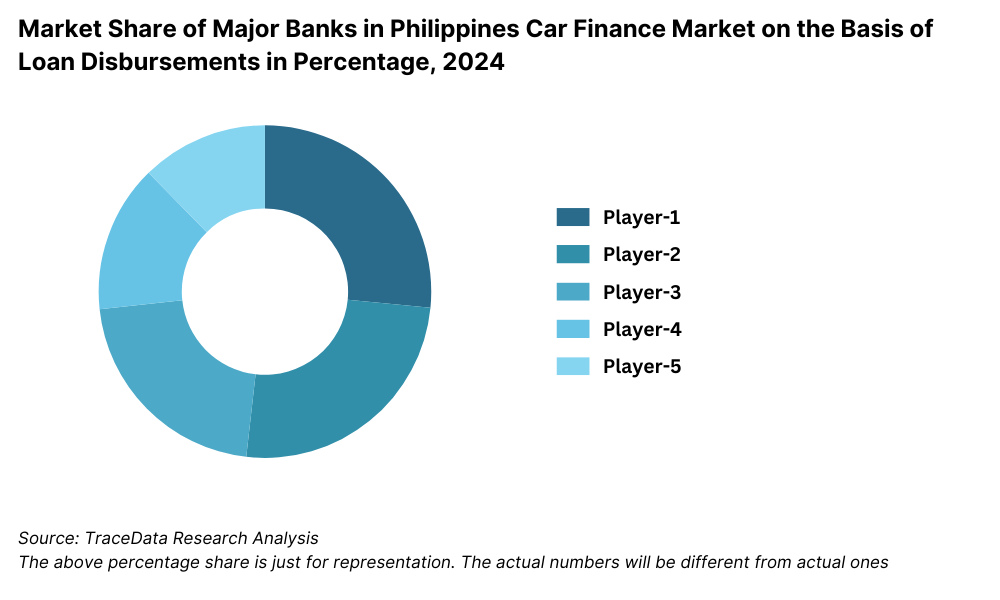

Competitive Landscape in the Philippines Auto Finance Market

The Philippines auto finance market is dominated by a few major banks and financial institutions, but the increasing role of non-banking financial institutions (NBFIs) and digital lenders has diversified the landscape. Traditional banks such as BDO Unibank, Metrobank, and BPI remain the largest auto loan providers, while Toyota Financial Services, Security Bank, and fintech startups are expanding their presence by offering innovative financing solutions.

Key Players in the Philippines Auto Finance Market

| Name | Founding Year | Original Headquarters |

|---|---|---|

| BDO Unibank Auto Loan | 1968 | Manila, Philippines |

| Metrobank Auto Loan | 1962 | Manila, Philippines |

| BPI Auto Loan (Bank of the Philippine Islands) | 1851 | Manila, Philippines |

| RCBC Auto Loan (Rizal Commercial Banking Corporation) | 1960 | Manila, Philippines |

| Security Bank Auto Loan | 1951 | Manila, Philippines |

| PSBank Auto Loan (Philippine Savings Bank) | 1960 | Manila, Philippines |

| EastWest Bank Auto Loan | 1994 | Manila, Philippines |

| Maybank Auto Loan Philippines | 1960 | Kuala Lumpur, Malaysia |

| Toyota Financial Services Philippines | 1982 | Toyota City, Japan |

| BDO Leasing & Finance, Inc. | 2007 | Manila, Philippines |

Some of the recent competitor trends and key information about competitors include:

BDO Unibank: As the largest auto loan provider in the Philippines, BDO processed over PHP 180 billion worth of auto loans in 2023, reflecting a 12% increase from the previous year. The bank’s flexible financing terms and strong dealership partnerships have solidified its market leadership.

Metrobank: A key player in auto financing, Metrobank saw a 10% rise in loan disbursements in 2023, particularly in the used car financing segment. The bank has introduced customized loan programs for SMEs and ride-hailing drivers, expanding its customer base.

BPI Auto Loan: BPI remains a top lender with an emphasis on digital loan processing, allowing for faster approvals and competitive interest rates. In 2023, over 60% of its auto loans were processed digitally, showcasing its shift toward a more tech-driven approach.

Security Bank: Known for its low-interest auto loan offerings, Security Bank reported a 15% increase in car loan applications in 2023. The bank’s partnerships with major car dealerships have provided customers with exclusive financing deals.

Toyota Financial Services: Specializing in Toyota car loans, the company experienced a 20% growth in financed Toyota vehicle sales in 2023. Its in-house financing offers lower interest rates for Toyota buyers, making it a preferred option for brand-loyal customers.

EastWest Bank: With a strong focus on the middle-class segment, EastWest Bank saw a 30% increase in loan disbursements for entry-level sedans and SUVs in 2023. Its aggressive marketing campaigns and branch network expansion have contributed to its success.

Home Credit Philippines: A leading non-banking lender, Home Credit entered the auto financing space in 2022, targeting low-income and first-time car buyers. The company reported a 25% increase in auto loan approvals in 2023, leveraging AI-driven credit scoring for faster loan decisions

What Lies Ahead for the Philippines Auto Finance Market?

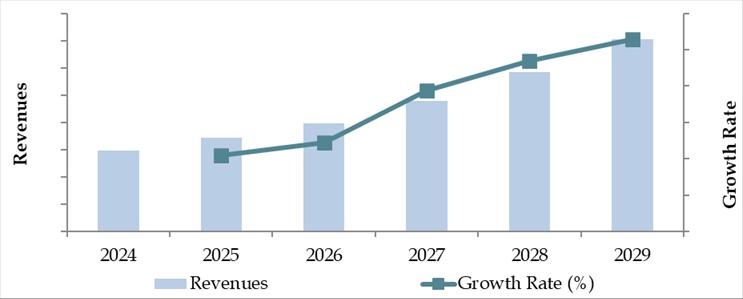

The Philippines auto finance market is projected to grow steadily by 2029, exhibiting a CAGR of approximately 9% during the forecast period. This growth will be driven by rising vehicle ownership, increasing financial inclusion, and the expansion of digital lending solutions.

Increase in Digital Auto Loan Processing: The shift towards online loan applications will continue to gain momentum. By 2029, over 70% of auto loan applications are expected to be processed digitally, leveraging AI-driven credit assessments and automated approval systems. This trend will enhance accessibility, particularly for young professionals and self-employed individuals.

Growth in Electric Vehicle (EV) Financing: As the Philippine government pushes for sustainable transportation initiatives, the demand for electric and hybrid vehicles will rise. Financial institutions are expected to introduce specialized loan products for EV financing, including lower interest rates, tax incentives, and extended repayment terms. By 2029, EV financing is projected to account for at least 10% of total auto loans, up from just 5% in 2023.

Expansion of Auto Loans for Ride-Hailing and Logistics Services: The ride-hailing and delivery sectors, including platforms like Grab and Lalamove, are driving a new wave of vehicle financing demand. Banks and non-banking financial institutions (NBFIs) are expected to roll out customized loan programs tailored for gig economy workers, enabling more Filipinos to finance vehicles for income-generating activities.

Rising Popularity of Used Car Financing: As the market for second-hand vehicles grows, auto loan offerings for pre-owned cars will become more accessible. By 2029, used car financing is expected to account for over 40% of total auto loans, with banks and digital lenders providing more flexible terms to cater to budget-conscious buyers.

Future Outlook and Projections for Philippines Car Finance Market on the Basis of Loan Disbursements in USD Billion, 2024-2029

Philippines Auto Finance Market Segmentation

- By Market Structure:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Digital Finance Platforms

- Credit Unions

- Peer-to-Peer (P2P) Lending Platforms

- Captive Finance Companies

- Microfinance Institutions

- By Type of Vehicles Financed:

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Luxury Vehicles

- Used Vehicles

- By Loan Tenure:

- <3 years

- 3-5 years

- 5-7 years

- 7-9 years

- 9 years

- By Interest Rates:

- Fixed Interest Rate Loans

- Variable Interest Rate Loans

- Zero Interest Loans

- By Region:

- Metro Manila

- Luzon (excluding NCR)

- Visayas

- Mindanao

By Financing Type:

Bank Loans

Leasing and Rent-to-Own Financing

Balloon Payment Financing

Zero Down Payment Financing

Players Mentioned in the Report (Banks):

- BDO Unibank

- Bank of the Philippine Islands (BPI)

- Metrobank

- Philippine National Bank (PNB)

- EastWest Bank

- Rizal Commercial Banking Corporation (RCBC)

- Security Bank

- UnionBank of the Philippines

- Maybank Philippines

- Robinsons Bank

Players Mentioned in the Report (NBFCs):

- Asialink Finance Corporation

- JACCS Finance Philippines Corporation

- Orico Auto Finance Philippines Inc.

- South Asialink Finance Corporation

- Unistar Credit and Finance Corporation

- Radio Wealth Finance Company

- Home Credit Philippines

Players Mentioned in the Report (Captive):

- Toyota Financial Services Philippines Corporation (TFSPH)

- Mitsubishi Motors Philippines Finance

- Nissan Finance

- Ford Credit Philippines

- Honda Cars Finance

- Hyundai Asia Resources Inc. Finance

Key Target Audience:

Banks and Financial Institutions

Automotive Financing Companies

Car Dealerships and OEMs

Fintech and Digital Lending Platforms

Regulatory Bodies (e.g., Bangko Sentral ng Pilipinas, Department of Trade and Industry)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges they face.

4.2. Relationship and Engagement Model between Banks-Dealers, NBFCs-Dealers and Captive-Dealers-Commission Sharing Model, Flat Fee Model and Revenue streams

4.3. Supply Decision-Making Process

5.1. New Car and Used Car Sales in Philippines by type of vehicle, 2018-2024

8.1. Credit Disbursed, 2018-2024

8.2. Outstanding Loan, 2018-2024

9.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2023-2024P

9.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2023-2024P

9.3. By Region, 2023-2024P

9.4. By Type of Vehicle (New, Used, Electric), 2023-2024P

9.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, above 8 years), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Philippines Car Finance Market

11.2. Growth Drivers for Philippines Car Finance Market

11.3. SWOT Analysis for Philippines Car Finance Market

11.4. Issues and Challenges for Philippines Car Finance Market

11.5. Government Regulations for Philippines Car Finance Market

12.1. Market Size and Future Potential for Online Car Financing Aggregators, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Digital Car Finance Companies Based on Company Overview, Revenue Streams, Loan Disbursements/Number of Leads Generated, Operating Cities, Number of Branches, and Other Variables

13.1. Finance Penetration Rate and Average Down Payment for New and Used Cars, 2018-2029

13.2. How Finance Penetration Rates are Changing Over the Years with Reasons

13.3. Type of Car Segment for which Finance Penetration is Higher

17.1. Market Share of Key Banks in Philippines Car Finance Market, 2024

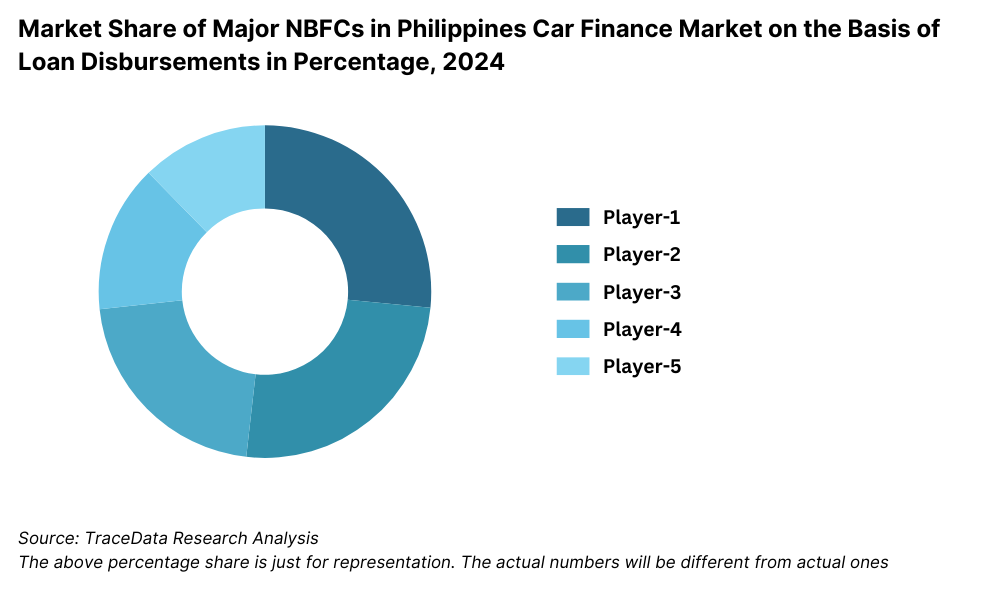

17.2. Market Share of Key NBFCs in Philippines Car Finance Market, 2024

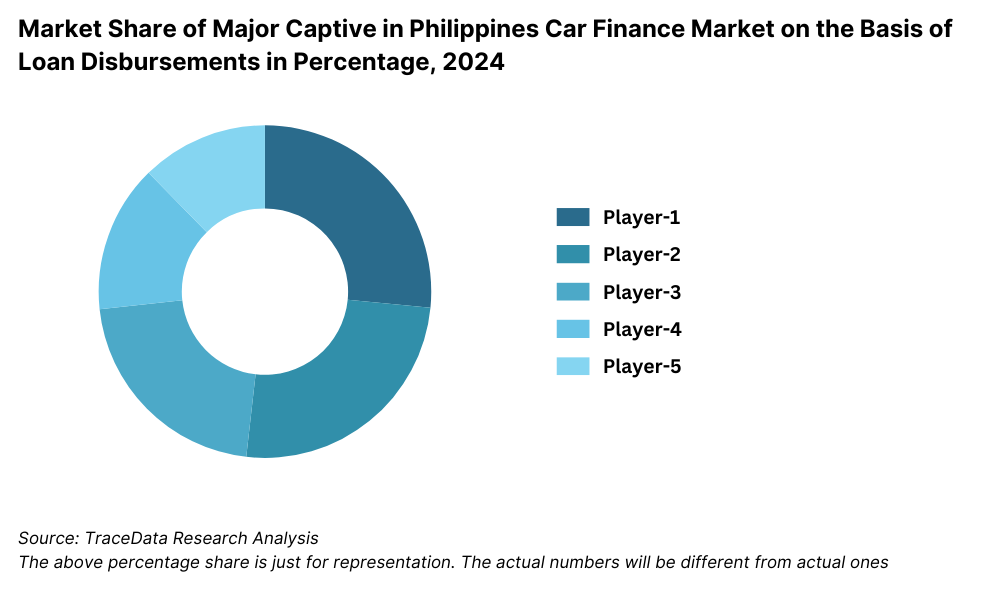

17.3. Market Share of Key Captive in Philippines Car Finance Market, 2024

17.4. Benchmark of Key Competitors in Philippines Car Finance Market, including Variables such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Number of Branches, Product Features, Interest Rate, NPA, Loan Disbursed, Outstanding Loans, Tie-Ups and others

17.5. Strengths and Weaknesses

17.6. Operating Model Analysis Framework

17.7. Gartner Magic Quadrant

17.8. Bowmans Strategic Clock for Competitive Advantage

18.1. Credit Disbursed, 2025-2029

18.2. Outstanding Loan, 2025-2029

19.1. By Market Structure (Bank-Owned, Multi-Finance, and Captive Companies), 2025-2029

19.2. By Financing Options (Traditional Loans, Leasing, Multi-Finance Loans), 2025-2029

19.3. By Region, 2025-2029

19.4. By Type of Vehicle (New, Used, Electric), 2025-2029

19.5. By Average Loan Tenure (0-2 years, 3-5 years, 6-8 years, Above 8 years), 2025-2029

19.6. Recommendation

19.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities for the Philippines Auto Finance Market. Basis this ecosystem, we will shortlist leading 5-6 financial institutions in the country based upon their loan disbursement volumes, interest rates, market share, and financial performance.

Sourcing is made through industry reports, financial databases, government records, and proprietary sources to perform desk research around the market and collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like loan disbursement volumes, interest rates, financing options, market players, borrower demographics, and overall market trends.

We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and regulatory filings. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, loan officers, fintech representatives, dealership managers, and other stakeholders representing various Philippines Auto Finance Market companies and end-users.

This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom-to-top approach is undertaken to evaluate loan volumes for each player, thereby aggregating to the overall market size.

As part of our validation strategy, our team executes disguised interviews, wherein we approach each company under the guise of potential borrowers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of interest rates, loan terms, approval processes, and financing models.

Step 4: Sanity Check

- Bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Philippines Auto Finance Market?

The Philippines auto finance market is poised for substantial growth, reaching a valuation of PHP 650 billion in 2023. This expansion is driven by increasing vehicle ownership, rising demand for accessible financing, and the growing adoption of digital lending solutions. The market's potential is further strengthened by government initiatives promoting financial inclusion and electric vehicle (EV) financing, making auto loans more accessible to a wider consumer base.

2. Who are the Key Players in the Philippines Auto Finance Market?

The Philippines Auto Finance Market features several key players, including BDO Unibank, Metrobank, and Bank of the Philippine Islands (BPI). These institutions dominate the market due to their strong banking networks, competitive loan products, and partnerships with major car dealerships. Other notable players include Security Bank, EastWest Bank, Toyota Financial Services, Home Credit Philippines, and fintech lenders like BillEase Auto Loan, which are gaining market share by offering fast, flexible, and digital-first financing solutions.

3. What are the Growth Drivers for the Philippines Auto Finance Market?

The primary growth drivers include economic factors, such as the increasing vehicle ownership demand and rising disposable income, which are fueling the need for auto financing. The expansion of digital lending platforms, offering AI-driven credit assessments and online applications, has made auto loans more accessible. Additionally, government initiatives promoting financial inclusion and electric vehicle (EV) financing are encouraging more consumers to explore auto loan options, further driving the growth of the Philippines Auto Finance Market.

4. What are the Challenges in the Philippines Auto Finance Market?

The Philippines Auto Finance Market faces several challenges, including high interest rates and strict loan approval criteria, which make financing less accessible for first-time buyers and freelancers. Rising non-performing loans (NPLs) have led financial institutions to tighten credit approval processes, reducing loan accessibility. Additionally, limited EV financing options remain a hurdle, as banks are hesitant to offer loans for electric vehicles due to their high upfront costs and uncertain resale values. Unequal access to auto financing in rural areas further limits market growth, with consumers outside urban centers facing higher interest rates and fewer financing options.